As a mortgage operations manager, articulating your complex project management skills and leadership experience in a concise resume can often prove challenging. Our guide provides targeted strategies to streamline this information, ensuring your resume demonstrates the impact of your expertise effectively to potential employers.

- Mortgage operations manager resumes that are tailored to the role are more likely to catch recruiters' attention.

- Most sought-out mortgage operations manager skills that should make your resume.

- Styling the layout of your professional resume: take a page from mortgage operations manager resume examples.

How to write about your mortgage operations manager achievements in various resume sections (e.g. summary, experience, and education).

- Safety Manager Resume Example

- Construction General Manager Resume Example

- Supply Chain Business Analyst Resume Example

- Hotel Operations Manager Resume Example

- Fitness General Manager Resume Example

- Business Process Manager Resume Example

- Library Director Resume Example

- Business Relationship Manager Resume Example

- Branch Operations Manager Resume Example

- Director of Business Development Resume Example

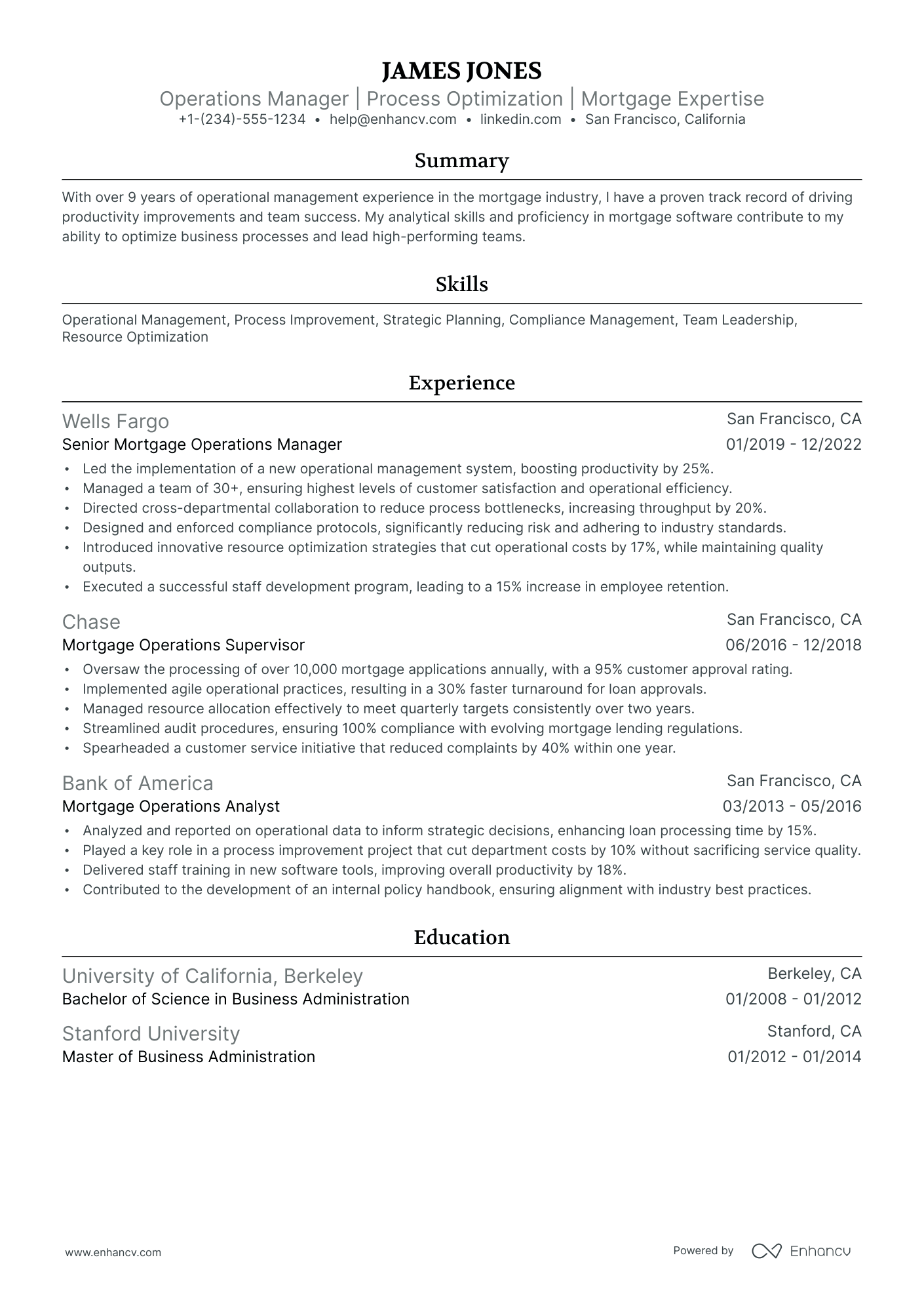

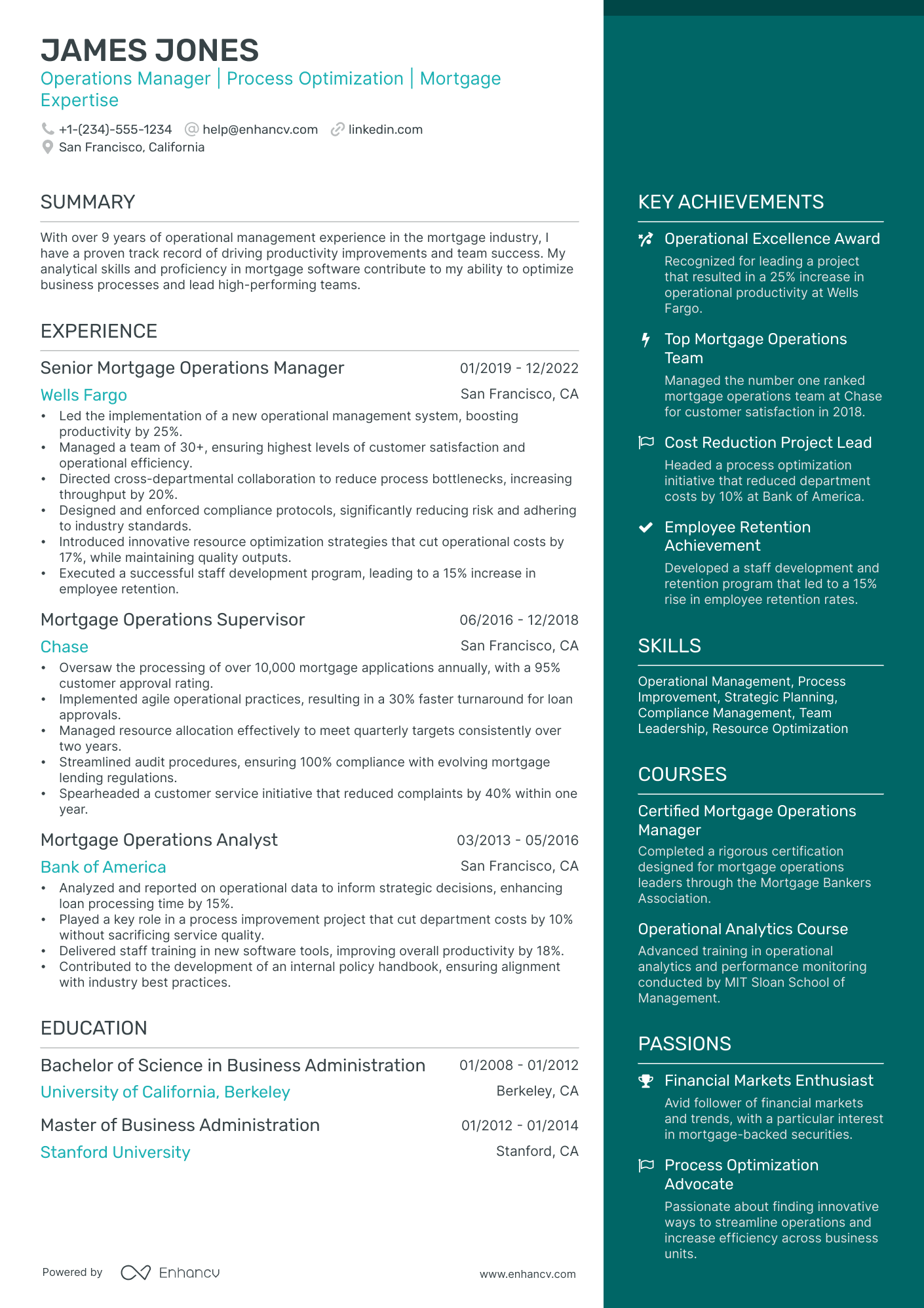

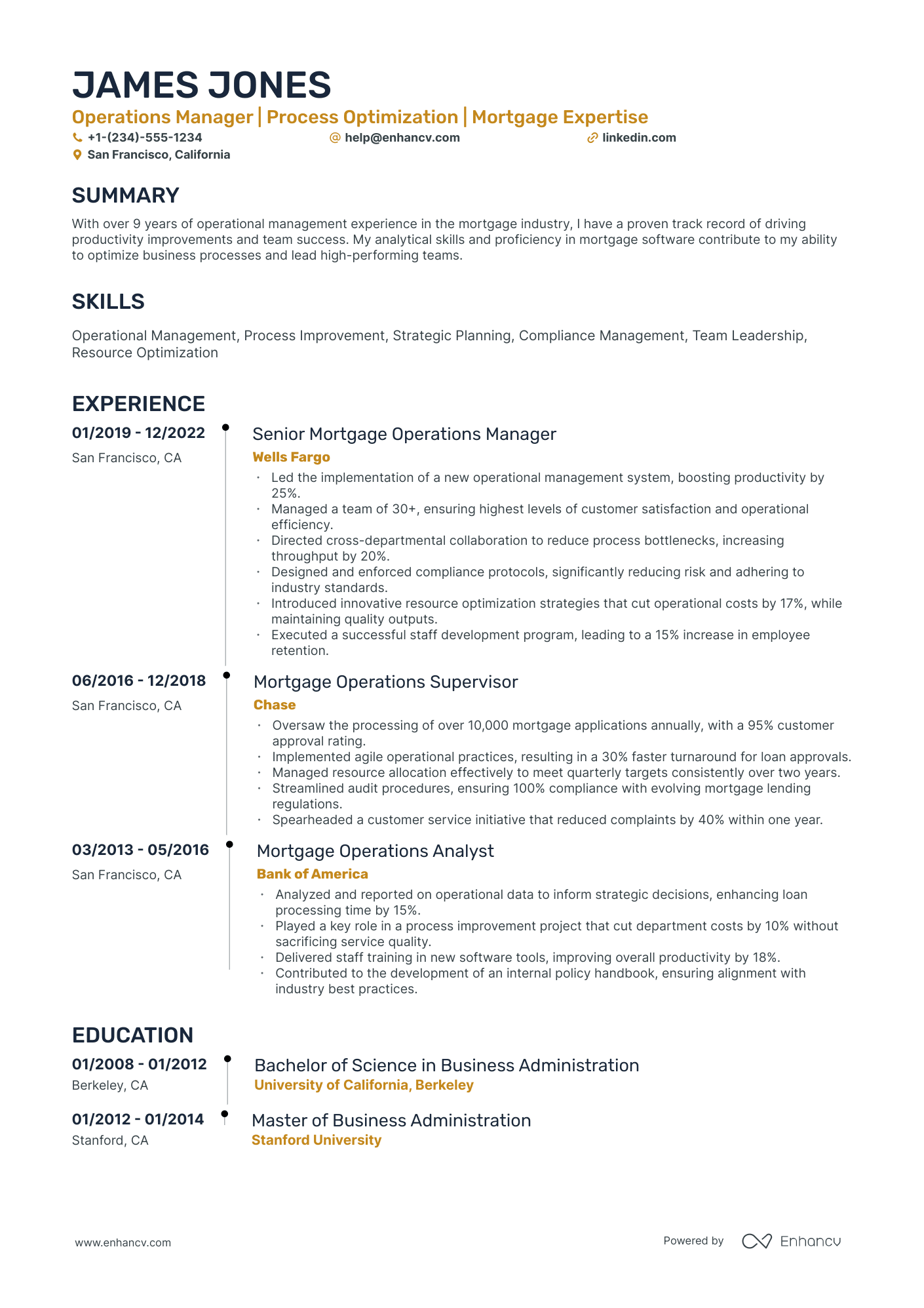

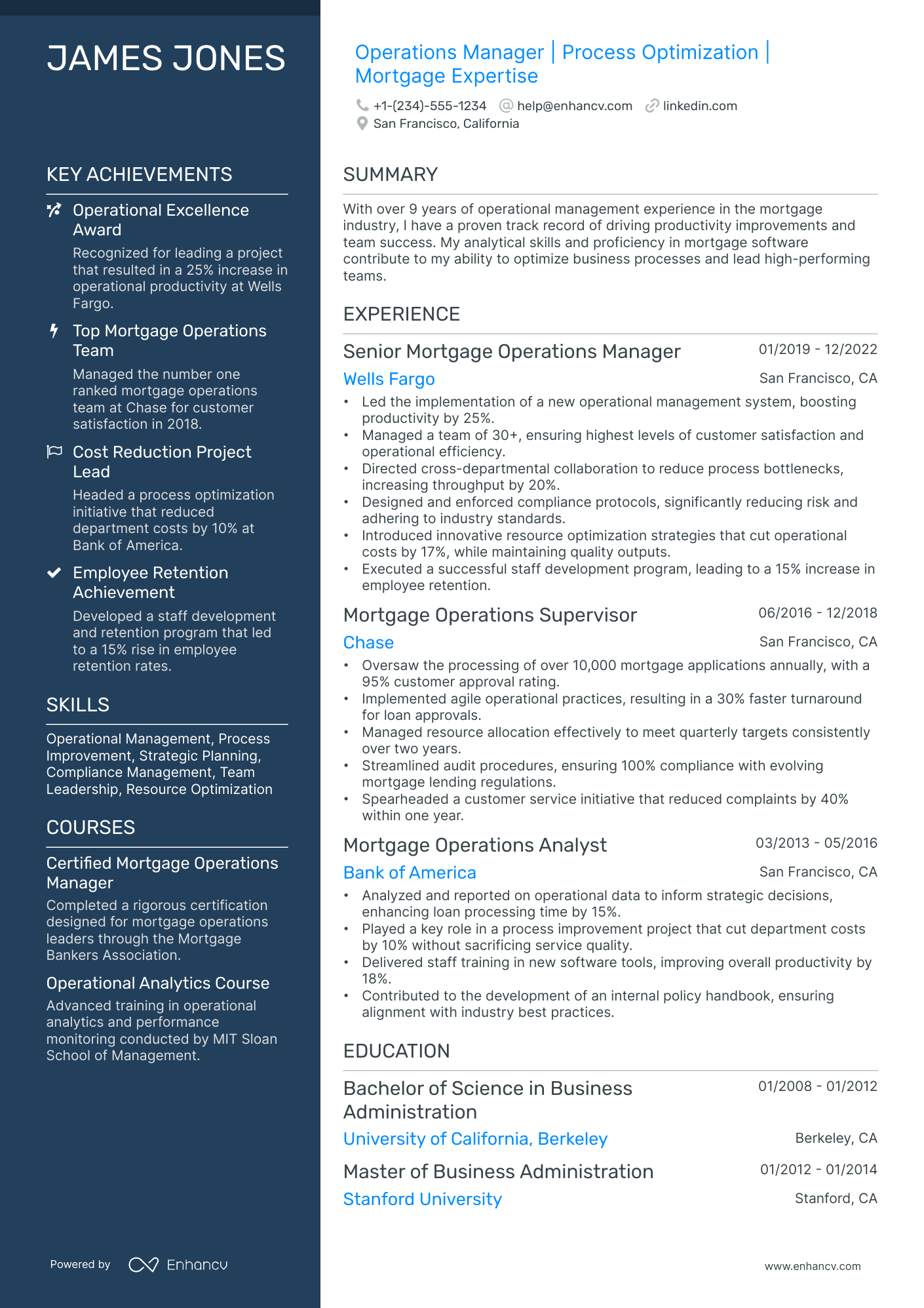

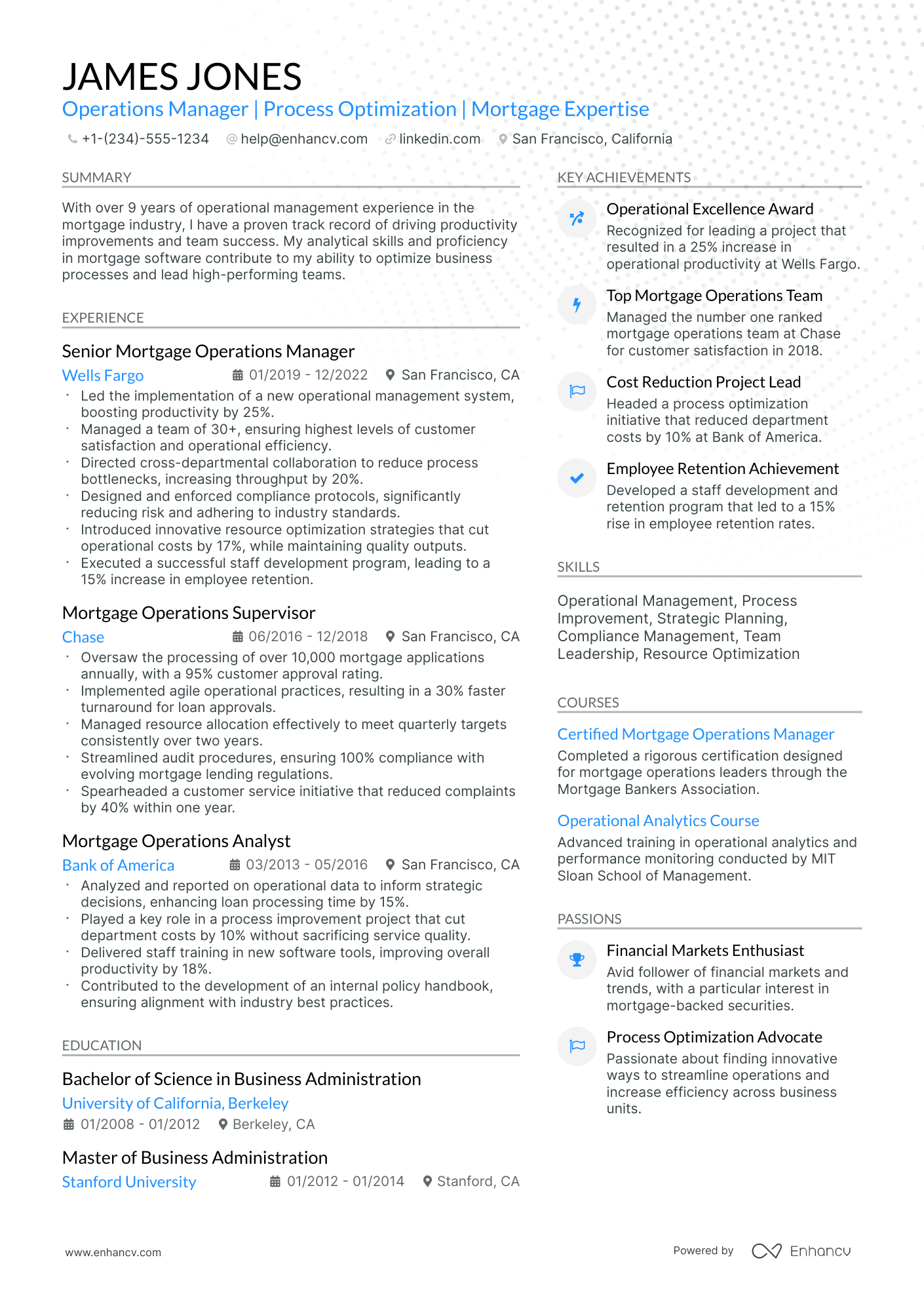

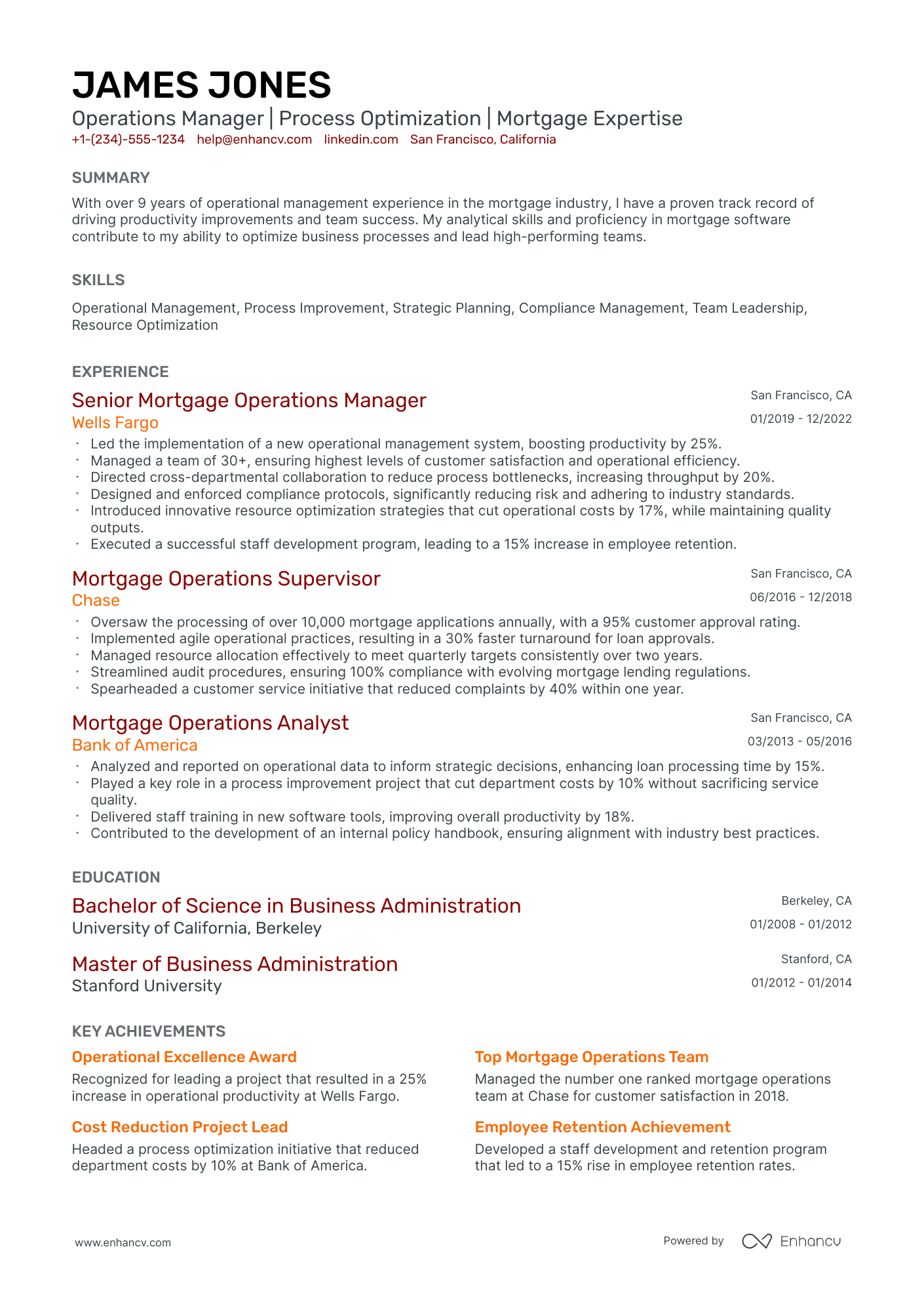

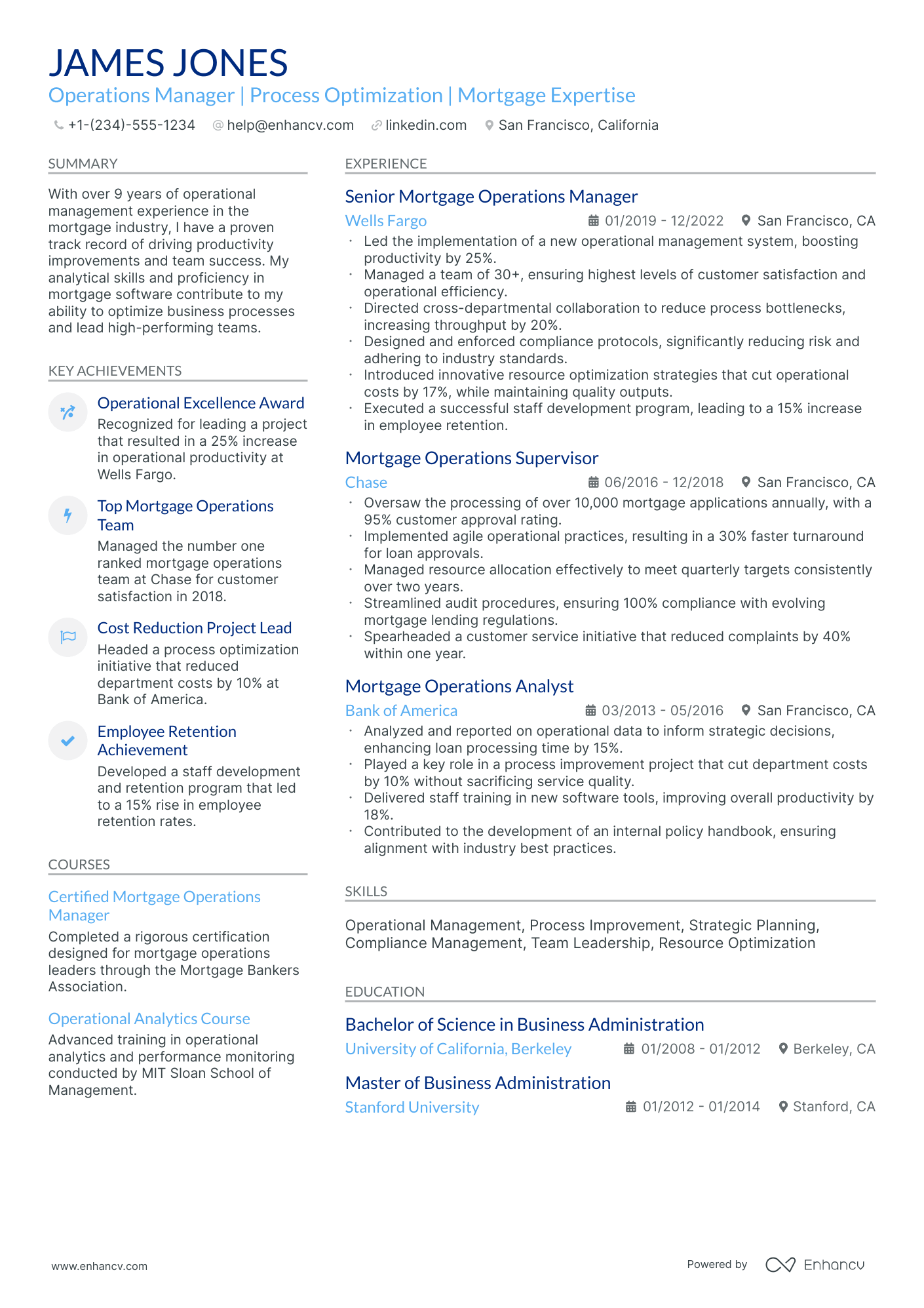

mortgage operations manager resume format made simple

You don't need to go over the top when it comes to creativity in your mortgage operations manager resume format .

What recruiters care about more is the legibility of your mortgage operations manager resume, alongside the relevancy of your application to the role.

That's why we're presenting you with four simple steps that could help your professional presentation check all the right boxes:

- The reverse-chronological resume format is the one for you, if you happen to have plenty of relevant (and recent) professional experience you'd like to showcase. This format follows a pretty succinct logic and puts the focus on your experience.

- Keep your header simple with your contact details; a headline that details the role you're applying for or your current job; and a link to your portfolio.

- Ensure your resume reaches an up-to-two-page limit, only if you happen to be applying for a more senior role or you have over a decade of relevant experience.

- Save your mortgage operations manager resume as a PDF to retain its structure and presentation.

Upload & Check Your Resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

PRO TIP

Listing your relevant degrees or certificates on your mortgage operations manager resume is a win-win situation. Not only does it hint at your technical capabilities in the industry, but an array of soft skills, like perseverance, adaptability, and motivation.

Mortgage operations manager resume sections to answer recruiters' checklists:

- Header to help recruiters quickly allocate your contact details and have a glimpse over your most recent portfolio of work

- Summary or objective to provide an overview of your career highlights, dreams, and goals

- Experience to align with job requirements and showcase your measurable impact and accomplishments

- Skills section/-s to pinpoint your full breadth of expertise and talents as a candidate for the mortgage operations manager role

- Education and certifications sections to potentially fill in any gaps in your experience and show your commitment to the industry

What recruiters want to see on your resume:

- Demonstrated experience in managing and streamlining mortgage loan processing, underwriting, and closing procedures.

- Strong knowledge of federal and state mortgage lending regulations and compliance standards.

- Proven ability to improve operational efficiency and reduce turnaround times for loan approvals.

- Experience with mortgage software systems and the ability to integrate new technologies to enhance mortgage operations.

- Leadership skills evidenced by successful team management, training, and development in a mortgage operations environment.

The mortgage operations manager resume experience section: a roadmap to your expertise

The resume experience section provides you with an opportunity to tell your professional narrative.

Recruiters, reading between the lines of your resume, use the experience section to better understand your unique skill set, accomplishments, and what unique value you bring about.

Discover five quick steps on how to write your experience section:

- Curate only relevant experience items to the role and include the company, description, and dates; all followed by up to six bullets per experience item;

- Each experience item should feature tangible results of your actions - if you can include a number or percent, this will further highlight your aptitude;

- If you've received any managerial or customer feedback, use short excerpts of it as further social proof of your technical or people skills;

- Make sure you're using the appropriate verb tense when listing your responsibilities;

- Within the description for each role, you could summarize your most noteworthy and relevant achievements.

Now, take note of how a real-world mortgage operations manager professional received opportunities at industry leaders with these resume experience sections:

- Directed the mortgage processing and closing departments, overseeing a team of 15 loan processors and 5 closers, enhancing loan processing times by 25%.

- Implemented new loan origination software that streamlined operations, which reduced paperwork by 40% and improved overall customer satisfaction.

- Played a key role in executing a risk management strategy that led to a 15% reduction in loan defaults and a 10% increase in successfully closed loans.

- Managed a portfolio of mortgage products, enhancing the bank's mortgage offerings by tailoring them to market needs, resulting in a 20% increase in year-over-year sales.

- Led the digitization project for mortgage applications, cutting down processing time from 30 days to 15 days.

- Coordinated with compliance officers to ensure all mortgage operations met regulatory standards, preventing any compliance issues during my tenure.

- Developed and maintained key performance indicators for mortgage processing and underwriting teams, increasing productivity by 30%.

- Oversaw the introduction of automated underwriting systems, which led to a 50% decrease in manual errors.

- Negotiated with external service providers to improve the speed and cost-effectiveness of property appraisals and title searches.

- Spearheaded a customer service initiative for mortgage clients, which was recognized with an industry award for outstanding customer satisfaction.

- Introduced cross-training programs, resulting in a more versatile workforce able to handle a 35% increase in loan applications during peak times.

- Designed and led a successful project to restructure the mortgage servicing platform, enhancing operational efficiency by 20%.

- Identified opportunities for process improvement in mortgage loan originations, achieving a 15% cost saving in operational expenses.

- Championed a mortgage loan process re-engineering effort that reduced loan closing times by an average of 7 days.

- Managed relationships with external auditing firms to ensure compliance with federal and state regulations, resulting in zero non-compliance findings.

- Restructured the mortgage underwriting department to better align with dynamic market conditions, facilitating a 10% growth in market share.

- Implemented a comprehensive training program for new mortgage operations staff, raising the department's efficiency by 25% within six months.

- Pioneered the use of data analytics to forecast loan default risk, which reduced the rate of bad loans by 5%.

- Increased loan processing capacity by 40% through strategic workforce planning and the implementation of Agile methodologies.

- Negotiated vendor contracts that resulted in a 20% reduction of operational costs for third-party mortgage processing services.

- Launched a successful borrower outreach program that improved loan retention rates by 8% amidst a competitive market.

- Launched an initiative to revamp the loan servicing software that improved payment processing times and customer interaction channels.

- Reduced closing cycle time by 10 days on average through the optimization of workflow processes and the integration of electronic document management systems.

- Fostered an organizational culture focused on continuous improvement, enabling the mortgage operations team to exceed customer SLAs consistently.

- Established a centralized hub for all mortgage-related inquiries, significantly improving response times by 50% and boosting customer satisfaction ratings.

- Orchestrated the transition to a new compliance tracking system, ensuring full adherence to constantly evolving regulatory requirements.

- Enhanced inter-departmental communication protocols contributing to a 20% decrease in operational inefficiencies and bottlenecks.

- Oversaw the integration of AI-driven predictive analytics into mortgage loan processing, resulting in a 10% improvement in credit decision accuracy.

- Managed a successful pilot project to test the viability of blockchain technology for mortgage recording, setting the stage for industry innovation.

- Cultivated a high-performance team culture that embraced digital transformation, which led to a 30% increase in productivity.

Quantifying impact on your resume

- Highlight the percentage reduction in loan processing time achieved under your management to demonstrate efficiency improvements.

- Document the dollar amount of mortgages processed annually to give a sense of the scale at which you operate.

- Specify the number of staff you've trained or managed, to illustrate leadership and team development capabilities.

- State the reduction in error rates or default rates for mortgages to underscore the quality of operations.

- Showcase the increase in customer satisfaction scores to reflect improved client relations and service quality.

- Include the number of compliance or regulatory audits passed to prove adherence to industry standards.

- Mention the growth percentage of the mortgage portfolio to display success in expanding business operations.

- Quantify the cost savings realized through process improvements or technology implementations you drove.

Action verbs for your mortgage operations manager resume

Experience section for candidates with zero-to-none experience

While you may have less professional experience in the field, that doesn't mean you should leave this section of your resume empty or blank.

Consider these four strategies on how to substitute the lack of experience with:

- Volunteer roles - as part of the community, you've probably gained valuable people (and sometimes even technological capabilities) that could answer the job requirements

- Research projects - while in your university days, you may have been part of some cutting-edge project to benefit the field. Curate this within your experience section as a substitute for real-world experience

- Internships - while you may consider that that summer internship in New York was solely mandatory to your degree, make sure to include it as part of your experience, if it's relevant to the role

- Irrelevant previous jobs - instead of detailing the technologies you've learned, think about the transferable skills you've gained.

Recommended reads:

PRO TIP

If you happen to have plenty of certificates, select the ones that are most applicable and sought-after across the industry. Organize them by relevance to the role you're applying for.

Featuring your hard skills and soft skills on your mortgage operations manager resume

The skills section of your mortgage operations manager resume needs to your various capabilities that align with the job requirements. List hard skills (or technical skills) to showcase to potential employers that you're perfectly apt at dealing with technological innovations and niche software. Meanwhile, your soft skills need to detail how you'd thrive within your new, potential environment with personal skills (e.g. resilience, negotiation, organization, etc.) Your mortgage operations manager resume skills section needs to include both types of skills to promote how you're both technical and cultural fit. Here's how to create your bespoke mortgage operations manager skills section to help you stand out:

- Focus on skill requirements that are listed toward the top of the job advert.

- Include niche skills that you've worked hard to obtain.

- Select specific soft skills that match the company (or the department) culture.

- Cover some of the basic job requirements by including important skills for the mortgage operations manager role - ones you haven't been able to list through the rest of your resume.

Get inspired with our mortgage operations manager sample skill list to list some of the most prominent hard and soft skills across the field.

Top skills for your mortgage operations manager resume:

Loan origination software

Mortgage underwriting systems

Customer relationship management (CRM) systems

Document management systems

Data analysis tools

Compliance management software

Microsoft Excel

Automated underwriting systems

Loan servicing platforms

Reporting and analytics tools

Leadership

Communication

Problem-solving

Time management

Attention to detail

Negotiation

Team collaboration

Adaptability

Customer service orientation

Conflict resolution

PRO TIP

List your educational qualifications and certifications in reverse chronological order.

Mortgage operations manager-specific certifications and education for your resume

Place emphasis on your resume education section . It can suggest a plethora of skills and experiences that are apt for the role.

- Feature only higher-level qualifications, with details about the institution and tenure.

- If your degree is in progress, state your projected graduation date.

- Think about excluding degrees that don't fit the job's context.

- Elaborate on your education if it accentuates your accomplishments in a research-driven setting.

On the other hand, showcasing your unique and applicable industry know-how can be a literal walk in the park, even if you don't have a lot of work experience.

Include your accreditation in the certification and education sections as so:

- Important industry certificates should be listed towards the top of your resume in a separate section

- If your accreditation is really noteworthy, you could include it in the top one-third of your resume following your name or in the header, summary, or objective

- Potentially include details about your certificates or degrees (within the description) to show further alignment to the role with the skills you've attained

- The more recent your professional certificate is, the more prominence it should have within your certification sections. This shows recruiters you have recent knowledge and expertise

At the end of the day, both the education and certification sections hint at the initial and continuous progress you've made in the field.

And, honestly - that's important for any company.

Below, discover some of the most recent and popular mortgage operations manager certificates to make your resume even more prominent in the applicant pool:

The top 5 certifications for your mortgage operations manager resume:

- Certified Mortgage Banker (CMB) - Mortgage Bankers Association (MBA)

- Residential Certified Mortgage Servicer (RCMS) - Mortgage Bankers Association (MBA)

- Certified Residential Underwriter (CRU) - Mortgage Bankers Association (MBA)

- School of Mortgage Banking (SOMB) Certificate - Mortgage Bankers Association (MBA)

- Accredited Mortgage Professional (AMP) - Mortgage Bankers Association (MBA)

PRO TIP

If you happen to have some basic certificates, don't invest too much of your mortgage operations manager resume real estate in them. Instead, list them within the skills section or as part of your relevant experience. This way you'd ensure you meet all job requirements while dedicating your certificates to only the most in-demand certification across the industry.

Recommended reads:

Adding a summary or objective to your mortgage operations manager resume

One of the most crucial elements of your professional presentation is your resume's top one-third. This most often includes:

- Either a resume summary - your career highlights at a glance. Select the summary if you have plenty of relevant experience (and achievements), you'd like recruiters to remember about your application.

- Or, a resume objective - to showcase your determination for growth. The perfect choice for candidates with less experience, who are looking to grow their career in the field.

If you want to go above and beyond with your mortgage operations manager resume summary or resume objective, make sure to answer precisely why recruiters need to hire you. What is the additional value you'd provide to the company or organization? Now here are examples from real-life mortgage operations manager professionals, whose resumes have helped them land their dream jobs:

Resume summaries for a mortgage operations manager job

- With over 10 years of dedicated experience in mortgage processing and operations management, this expert has consistently optimized loan procedures for financial institutions in the Midwest. Technologically proficient in the latest mortgage CRM software, they have achieved a 30% efficiency increase in loan processing, substantiating their capability to enhance operational workflows.

- After a successful 8-year tenure as a financial analyst within the automotive sector, this professional pivoted to mortgage operations management, bringing rigorous analytical skills and a strong grasp of regulatory compliance. They facilitated a cross-departmental initiative that yielded a 20% reduction in operational costs, demonstrating transferable skills and adaptability.

- Seasoned professional from the healthcare management field with over 12 years of progressive experience, now seeking to transfer a rich background in process optimization to the mortgage industry. They've been instrumental in implementing electronic records systems that resulted in a 40% increase in patient processing speed, highlighting their capacity for system enhancements and keen focus on meticulous compliance norms.

- Aiming to put an exceptional record of managing complex projects and leading high-performance teams to use in the mortgage operations sphere. Adept in modern project management methodologies, this enthusiastic strategy-focused leader is deeply committed to achieving operational excellence and strives to effectuate robust process improvements.

- As a recent finance graduate with an ardent desire for advancement in mortgage operations management, this candidate is eager to apply their solid educational foundation in finance and intern experience with loan processing to deliver meticulous and efficient operational support. Their objective is to cultivate a career by integrating strong analytical skills and a passion for financial services excellence.

- Determined to leverage a deep enthusiasm for the financial industry, this individual is newly stepping into the mortgage operations domain, with the aim to implement their fresh perspective and quick-learning abilities. They aspire to apply their intern experience in financial planning and their strong interpersonal skills to contribute to the efficiency and precision of mortgage processing tasks.

Showcasing your personality with these four mortgage operations manager resume sections

Enhance your mortgage operations manager expertise with additional resume sections that spotlight both your professional skills and personal traits. Choose options that not only present you in a professional light but also reveal why colleagues enjoy working with you:

- My time - a pie chart infographic detailing your daily personal and professional priorities, showcasing a blend of hard and soft skills;

- Hobbies and interests - share your engagement in sports, fandoms, or other interests, whether in your local community or during personal time;

- Quotes - what motivates and inspires you as a professional;

- Books - indicating your reading and comprehension skills, a definite plus for employers, particularly when your reading interests align with your professional field.

Key takeaways

- Your mortgage operations manager resume is formatted professionally and creates an easy-to-read (and -understand) experience for recruiters;

- You have included all pertinent sections (header, summary/objective, experience, skills, certifications) within your mortgage operations manager resume;

- Instead of just listing your responsibilities, you've qualified them with skills and the results of your actions;

- Within your mortgage operations manager resume, you've taken the time to align specific job requirements with your unique expertise, showcasing the value you can provide as a professional;

- Technologies and personal skills are featured across different sections of your mortgage operations manager resume to achieve the perfect balance.