Many tax director resume drafts fail because they read like compliance checklists and bury leadership impact behind dense responsibilities. That approach gets filtered by ATS screening and missed in rapid recruiter scans, especially when senior candidates compete closely.

A strong resume shows what you changed, not what you used. Knowing how to make your resume stand out means you should highlight audit exposure reduced, effective tax rate improved, cash tax savings delivered, penalties avoided, filings completed on time across entities, and controls strengthened.

Key takeaways

- Anchor every resume bullet to a measurable outcome like savings, audit results, or cycle-time reductions.

- Use reverse-chronological format to show progressive leadership—avoid hybrid or functional layouts entirely.

- Tailor each resume to the job posting's specific tools, frameworks, and compliance scope.

- Lead your summary with strategic impact, team scope, and decision-making authority—not vague descriptors.

- Demonstrate skills through quantified experience bullets, not just a standalone skills list.

- Use AI to sharpen clarity and add metrics, but stop before it inflates or invents claims.

- Enhancv can help you turn vague duties into focused, recruiter-ready bullets faster.

Job market snapshot for tax directors

We analyzed 334 recent tax director job ads across major US job boards. These numbers help you understand top companies hiring, employer expectations, employment type trends at a glance.

What level of experience employers are looking for tax directors

| Years of Experience | Percentage found in job ads |

|---|---|

| 3–4 years | 0.6% (2) |

| 5–6 years | 31.1% (104) |

| 7–8 years | 54.2% (181) |

| 9–10 years | 2.4% (8) |

| 10+ years | 4.2% (14) |

| Not specified | 9.3% (31) |

Tax director ads by area of specialization (industry)

| Industry (Area) | Percentage found in job ads |

|---|---|

| Finance & Banking | 97.9% (327) |

Top companies hiring tax directors

| Company | Percentage found in job ads |

|---|---|

| PwC | 83.8% (280) |

| Baker Tilly Virchow Krause, LLP | 4.8% (16) |

Role overview stats

These tables show the most common responsibilities and employment types for tax director roles. Use them to align your resume with what employers expect and to understand how the role is structured across the market.

Day-to-day activities and top responsibilities for a tax director

| Responsibility | Percentage found in job ads |

|---|---|

| Tax compliance | 56.3% (188) |

| Automation | 32.0% (107) |

| Digitization | 31.1% (104) |

| Tax planning | 29.9% (100) |

| Accounting | 22.2% (74) |

| Project management | 20.1% (67) |

| Asc740 | 18.9% (63) |

| Tax strategy | 18.9% (63) |

| Fatca | 18.6% (62) |

| Fbar | 18.6% (62) |

| Microsoft excel | 18.6% (62) |

| Microsoft powerpoint | 18.6% (62) |

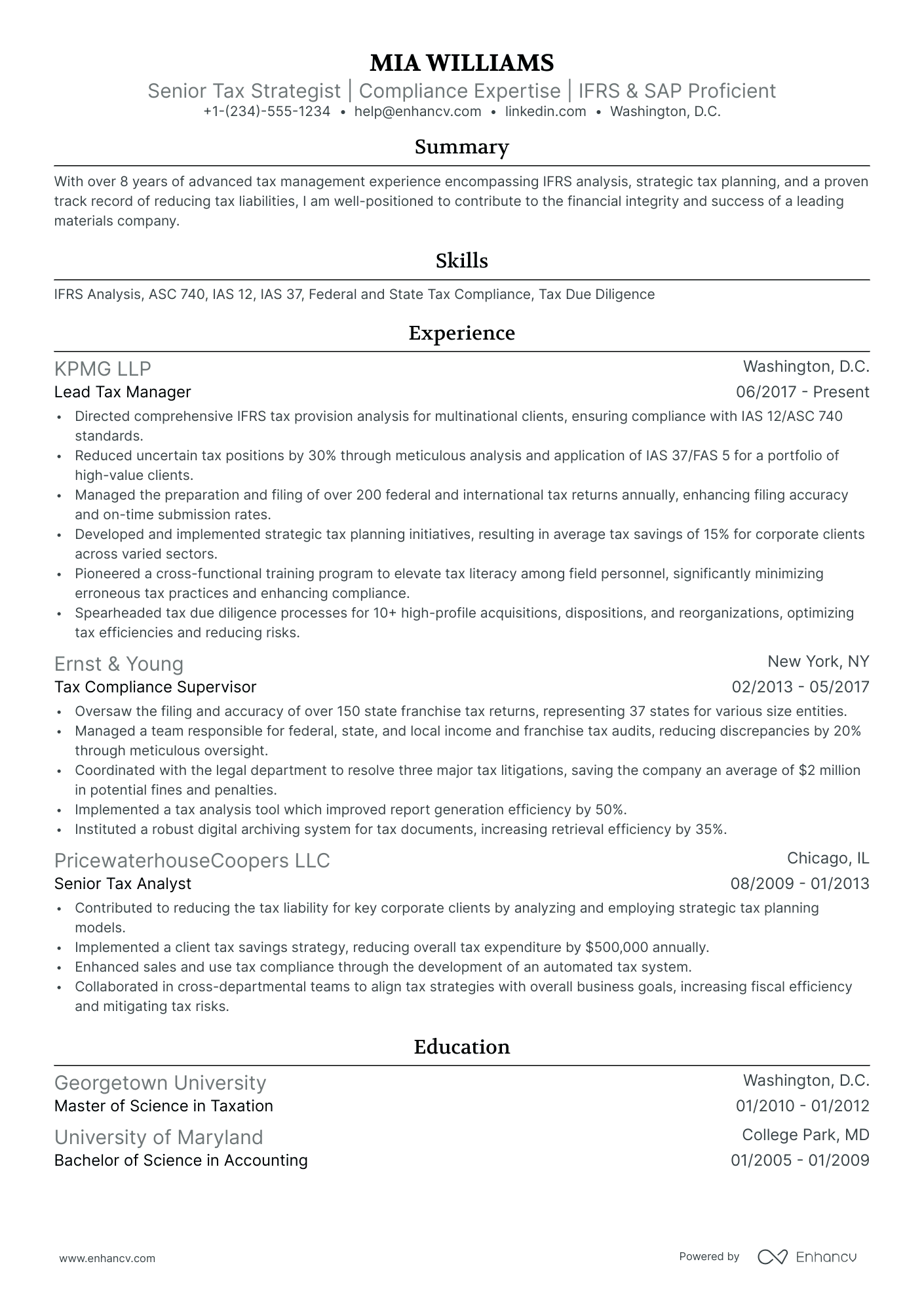

How to format a tax director resume

Recruiters evaluating tax director candidates prioritize evidence of progressive leadership, strategic oversight of tax functions, and measurable business impact across compliance, planning, and risk management. A well-chosen resume format ensures these signals—scope of authority, decision ownership, and quantified outcomes—are immediately visible rather than buried beneath formatting choices that obscure career trajectory.

I have significant experience in this role—which format should I use?

Use a reverse-chronological format—it's the strongest choice for a tax director resume because it foregrounds your leadership progression and expanding scope of responsibility. Do:

- Lead each role entry with your span of control: team size, jurisdictions managed, entity count, and reporting line (e.g., VP of Tax or CFO).

- Highlight domain expertise in areas recruiters scan for—transfer pricing, ASC 740/IAS 12 provision, federal and multistate compliance, M&A tax due diligence, and ERP platforms like SAP, Oracle, or OneSource.

- Anchor every bullet to a measurable outcome that ties your decision-making directly to business impact—cost savings, audit results, effective tax rate reductions, or process cycle-time improvements.

Why hybrid and functional resumes don't work for senior roles

Hybrid formats fragment your leadership narrative by pulling key competencies out of their role context, making it harder for recruiters and hiring committees to trace how your authority, team scope, and strategic impact grew over time. Functional formats go further in the wrong direction—they strip accountability from outcomes entirely, leaving reviewers unable to determine where, when, or under what organizational conditions you delivered results, which is exactly what decision-makers need to verify at the director level. Avoid both formats entirely when applying for tax director or equivalent senior positions, as they raise immediate red flags about gaps, stalled progression, or inflated responsibility claims.

- Edge-case exception: A functional resume is only acceptable if you're transitioning into a tax director role from a closely related senior position (e.g., VP of finance or external tax advisory partner) with no prior in-house tax leadership title—and even then, every listed skill must be tied to a specific project, engagement, or outcome that demonstrates director-level decision ownership.

With your layout and structure in place, the next step is deciding which sections to include so each one reinforces your qualifications as a tax director.

What sections should go on a tax director resume

Recruiters expect a tax director resume to show senior-level leadership in tax strategy, compliance, and risk management, backed by measurable results. Understanding what to put on a resume at this level is critical for making the right impression.

Use this structure for maximum clarity:

- Header

- Summary

- Experience

- Skills

- Projects

- Education

- Certifications

- Optional sections: Awards, Publications, Languages

Strong experience bullets should emphasize quantified tax savings, audit outcomes, compliance performance, team and budget scope, and enterprise-wide impact across jurisdictions.

Is your resume good enough?

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

Once you’ve organized your resume with the right core components, the next step is to write an experience section that fits that structure and highlights your impact.

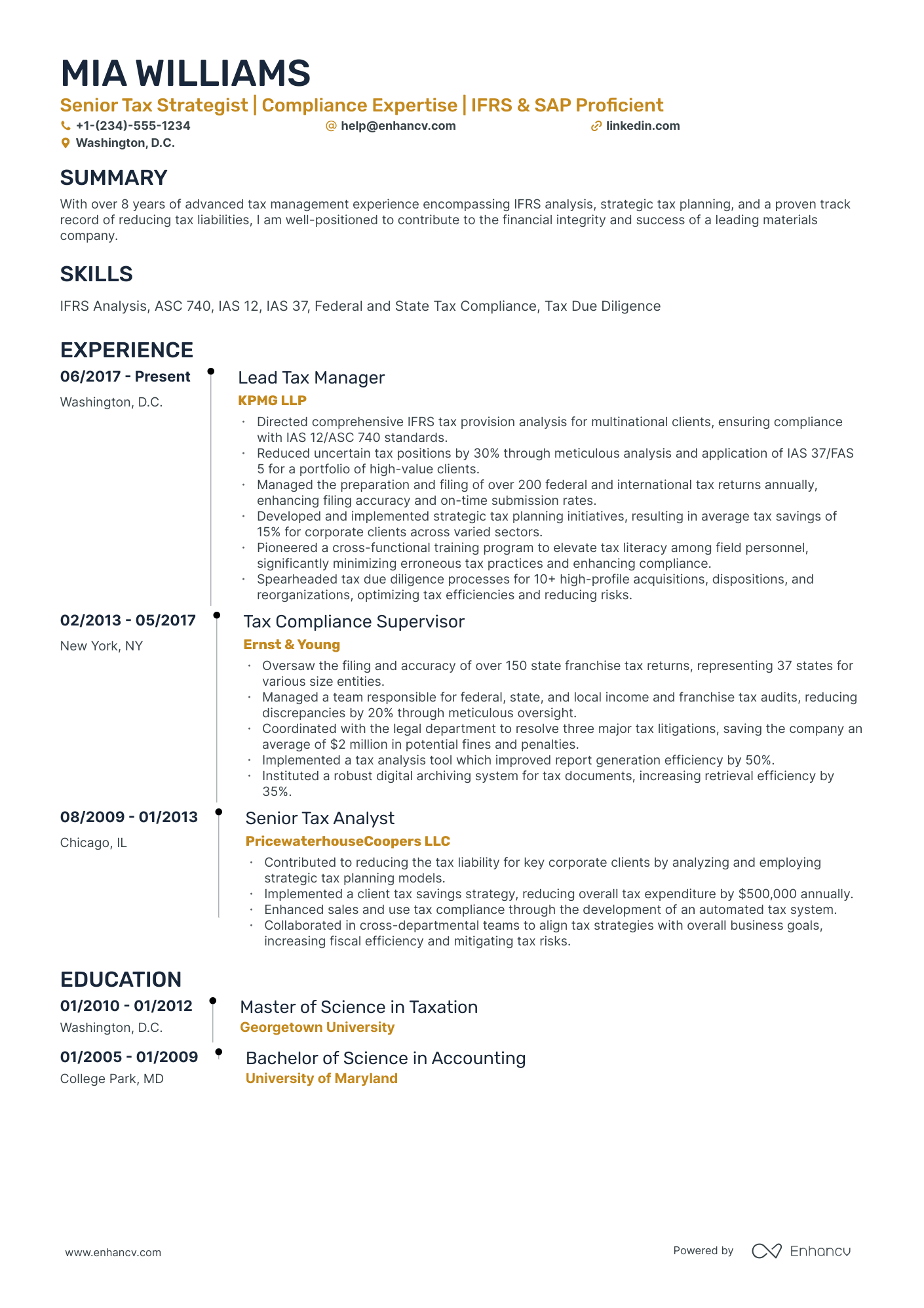

How to write your tax director resume experience

The experience section is where you prove you've delivered meaningful results as a tax director—through the compliance frameworks you've implemented, the tax planning strategies you've executed, and the measurable savings or efficiencies you've driven. Hiring managers prioritize demonstrated impact over descriptive task lists, so every bullet should connect your work to a tangible outcome.

Each entry should include:

- Job title

- Company and location (or remote)

- Dates of employment (month and year)

Three to five concise bullet points showing what you owned, how you executed, and what outcomes you delivered:

- Ownership scope: the tax functions, jurisdictions, filing processes, entity structures, or teams you were directly accountable for as a tax director.

- Execution approach: the tax software, ERP systems, regulatory frameworks, research methodologies, or planning strategies you used to drive decisions and deliver compliant, optimized outcomes.

- Value improved: changes to effective tax rates, audit readiness, compliance accuracy, reporting cycle times, risk exposure, or process efficiency resulting from your leadership.

- Collaboration context: how you partnered with finance, legal, treasury, external auditors, regulatory bodies, or C-suite executives to align tax strategy with broader business objectives.

- Impact delivered: outcomes expressed through reduced liabilities, successful audit defenses, realized savings, improved filing accuracy, or enterprise-wide tax transformation—framed as results rather than activity.

Experience bullet formula

A tax director experience example

✅ Right example - modern, quantified, specific.

Tax Director

NorthBridge SaaS | Austin, TX

2021–Present

B2B subscription software company with 1,200 employees and multi-entity operations across the United States, Canada, and the European Union.

- Led global tax provision and reporting under ASC 740 using OneSource Tax Provision and Workiva; cut close cycle from twelve to eight business days and reduced audit adjustments by 35%.

- Implemented indirect tax automation with Avalara and NetSuite, partnering with engineering and billing to fix taxability mapping across 9,000+ stock keeping units; reduced sales tax errors by 60% and lowered notice volume by 45%.

- Restructured transfer pricing documentation and intercompany agreements with external advisors and finance leadership; supported expansion into three new countries and reduced effective tax rate by 1.8 points year over year.

- Directed federal and state income tax compliance in OneSource Income Tax, standardizing entity data and e-filing workflows; improved on-time filing rate to 99% and avoided $750,000 in penalties and interest.

- Built a tax risk dashboard in Power BI using data from NetSuite and Workiva, aligning with internal audit and legal; increased issue detection speed by 50% and improved control testing pass rate from 88% to 97%.

Now that you've seen how a strong experience section comes together, let's look at how to adapt yours to match the specific role you're targeting.

How to tailor your tax director resume experience

Recruiters evaluate your tax director resume through applicant tracking systems and manual review, so tailoring your resume to the job description is essential. Tailoring ensures the specific skills, tools, and qualifications the employer prioritizes appear clearly throughout your experience section.

Ways to tailor your tax director experience:

- Match tax software and ERP systems named in the job description.

- Mirror the exact compliance frameworks or tax codes referenced.

- Use the employer's terminology for reporting standards and methodologies.

- Reflect specific KPIs or success metrics the posting highlights.

- Include industry experience relevant to the company's sector.

- Emphasize multistate or international tax scope when the role requires it.

- Highlight cross-functional collaboration models the job description references.

- Align your leadership scope with the team structure they describe.

Tailoring means connecting your real accomplishments to what the employer values—not forcing keywords where they don't belong.

Resume tailoring examples for tax director

| Job description excerpt | Untailored | Tailored |

|---|---|---|

| Lead federal and multi-state tax compliance for a $2B+ manufacturing company using OneSource and ensure timely filing of all corporate returns. | Handled tax compliance duties and prepared returns for the company. | Directed federal and multi-state tax compliance for a $2.4B manufacturing organization, leveraging Thomson Reuters OneSource to file 150+ corporate returns annually with zero late filings. |

| Manage transfer pricing documentation and intercompany agreements across 12 international jurisdictions in coordination with Big Four advisors. | Worked on international tax issues and helped with documentation. | Managed transfer pricing documentation and intercompany agreements across 14 jurisdictions, coordinating with Deloitte and EY advisors to maintain arm's-length compliance and reduce foreign audit exposure by 30%. |

| Oversee ASC 740 income tax provision process, including quarterly and year-end reporting, and present tax positions to the audit committee. | Assisted with tax provisions and supported the reporting process. | Oversaw the end-to-end ASC 740 provision process for quarterly and year-end reporting, identifying $6M in deferred tax asset adjustments and presenting uncertain tax positions directly to the audit committee. |

Once you’ve aligned your experience with the role’s priorities, the next step is to quantify your tax director achievements so hiring teams can see the measurable impact behind that fit.

How to quantify your tax director achievements

Quantifying your achievements proves you reduce risk, improve compliance, and protect cash. Focus on audit outcomes, close-cycle time, effective tax rate impact, penalties avoided, and process efficiency across filings, provisions, and controversy management.

Quantifying examples for tax director

| Metric | Example |

|---|---|

| Compliance accuracy | "Improved federal and state filing accuracy to 99.6% across 180 entities by adding a return review checklist and standard workpapers in OneSource." |

| Close cycle time | "Cut provision close from 10 days to seven by automating book-to-tax adjustments in Alteryx and standardizing SAP extracts." |

| Audit risk reduction | "Resolved an Internal Revenue Service exam with zero material adjustments and reduced open audit years from five to two through issue tracking and documentation controls." |

| Cash tax savings | "Delivered $4.2M in annual cash tax savings by restructuring intercompany royalties and securing two state nexus rulings with external counsel." |

| Penalties avoided | "Avoided $1.1M in late-payment penalties by redesigning estimated tax calendars, adding approval workflows, and monitoring payments for 12 jurisdictions." |

Turn vague job duties into measurable, recruiter-ready resume bullets in seconds with Enhancv's Bullet Point Generator.

With strong, well-crafted bullet points in place, the next step is making sure your resume highlights the right mix of hard and soft skills that tax director roles demand.

How to list your hard and soft skills on a tax director resume

Your skills section shows you can lead tax strategy and compliance, and recruiters and an ATS (applicant tracking system) scan them to match you to the job—aim for a hard-skills-heavy mix with a smaller set of leadership and stakeholder skills. Tax director roles require a blend of:

- Product strategy and discovery skills.

- Data, analytics, and experimentation skills.

- Delivery, execution, and go-to-market discipline.

- Soft skills.

Your skills section should be:

- Scannable (bullet-style grouping).

- Relevant to the job post.

- Backed by proof in experience bullets.

- Updated with current tools.

Place your skills section:

- Above experience if you're junior or switching careers.

- Below experience if you're mid/senior with strong achievements.

Hard skills

Your hard skills should reflect the technical tax expertise hiring managers prioritize:

- ASC 740 tax accounting

- Corporate tax provision, true-ups

- Federal, state, local compliance

- International tax, transfer pricing

- Tax planning, structuring, modeling

- Mergers and acquisitions tax due diligence

- Tax audits, controversy management

- Sales and use tax

- Payroll tax oversight

- SAP, Oracle, Workday

- Alteryx, Power BI, Excel

- OneSource, Corptax, CCH Axcess

Soft skills

Complement your technical expertise with soft skills that demonstrate leadership and stakeholder management:

- Lead cross-functional tax governance

- Translate tax impact for executives

- Negotiate with auditors and advisors

- Prioritize risks and remediation plans

- Drive calendar-based execution

- Build and coach tax teams

- Challenge assumptions with data

- Influence finance and legal partners

- Set clear policies and controls

- Manage deadlines under scrutiny

- Align stakeholders on tradeoffs

- Own outcomes and accountability

How to show your tax director skills in context

Skills shouldn't live only in a dedicated skills list. Explore how resume skills work best when demonstrated through real accomplishments.

They should be demonstrated in:

- Your summary (high-level professional identity)

- Your experience (proof through outcomes)

Here's what strong, context-driven examples look like in practice.

Summary example

Tax director with 14 years of experience leading federal and multistate compliance for mid-market companies. Skilled in ASC 740 provisions, OneSource, and cross-functional leadership. Reduced effective tax rate by 3.2% through strategic credits and incentive planning.

- Signals senior-level expertise immediately

- Names industry-standard tools directly

- Quantifies a clear financial outcome

- Highlights cross-functional leadership ability

Experience example

Tax Director

Redfield Manufacturing | Charlotte, NC

March 2019–Present

- Led quarterly ASC 740 provisions using OneSource, cutting close timelines by 30% across eight entities.

- Partnered with FP&A and legal teams to implement R&D credit strategies, generating $2.1M in annual savings.

- Redesigned the transfer pricing framework with external advisors, reducing audit exposure by 45% over three years.

- Every bullet includes a measurable result.

- Skills surface naturally through real accomplishments.

Once you’ve demonstrated your tax director capabilities through specific outcomes and responsibilities, the next step is adapting that approach to a tax director resume when you don’t have direct experience.

How do I write a tax director resume with no experience

Even without full-time experience, you can demonstrate readiness through transferable projects and structured exposure. Our guide on writing a resume without work experience covers strategies that apply here:

- Big Four tax internship rotations

- Corporate tax co-op assignments

- Volunteer nonprofit tax compliance

- Graduate tax clinic engagements

- University tax research assistantship

- IRS VITA program leadership

- State tax audit shadowing

Focus on:

- ASC 740 provision exposure

- Entity returns and compliance scope

- Audit support and documentation

- Process improvements with measurable results

Resume format tip for entry-level tax director

Use a combination resume format because it highlights tax director-ready skills and projects before limited work history. Do:

- Lead with a "Tax director-ready" summary and target role.

- Add a "Relevant tax projects" section above experience.

- Quantify scope: entities, returns, hours, dollar ranges.

- List tools: Excel, Alteryx, OneSource, Workiva.

- Map bullets to tax director responsibilities: provision, compliance, audit.

- Led an IRS VITA site workflow using Excel trackers and standardized review checklists, reducing return rework by 22% across 180 filings.

Even without direct experience, your educational background can demonstrate the foundational knowledge and credentials that qualify you for a tax director role.

How to list your education on a tax director resume

Your education section helps hiring teams confirm you have the academic foundation for a tax director role. It validates expertise in taxation, accounting, and financial strategy quickly.

Include:

- Degree name

- Institution

- Location

- Graduation year

- Relevant coursework (for juniors or entry-level candidates)

- Honors & GPA (if 3.5 or higher)

List only the graduation year. Avoid including specific months or days.

Here's a strong education entry tailored for a tax director resume.

Example education entry

Master of Science in Taxation

Georgetown University, Washington, D.C.

Graduated 2014

GPA: 3.8/4.0

- Relevant Coursework: Corporate Tax Strategy, International Tax Law, Mergers & Acquisitions Tax Planning, Partnership Taxation

- Honors: Beta Gamma Sigma Honor Society, Dean's List (all semesters)

How to list your certifications on a tax director resume

Certifications on a resume show a tax director's commitment to continuous learning, proficiency with tax tools and standards, and alignment with current regulatory and industry expectations.

Include:

- Certificate name

- Issuing organization

- Year

- Optional: credential ID or URL

- Place certifications below education when they are older, less relevant, or supplemental to your core tax director qualifications.

- Place certifications above education when they are recent, highly relevant, or required for the tax director roles you target.

Best certifications for your tax director resume

Certified Public Accountant (CPA) Enrolled Agent (EA) Chartered Financial Analyst (CFA) Chartered Global Management Accountant (CGMA) Certified Management Accountant (CMA) Certified Internal Auditor (CIA) Certified Fraud Examiner (CFE)

Once you’ve positioned your credentials where hiring teams can quickly verify them, use your tax director resume summary to connect those qualifications to the value you deliver.

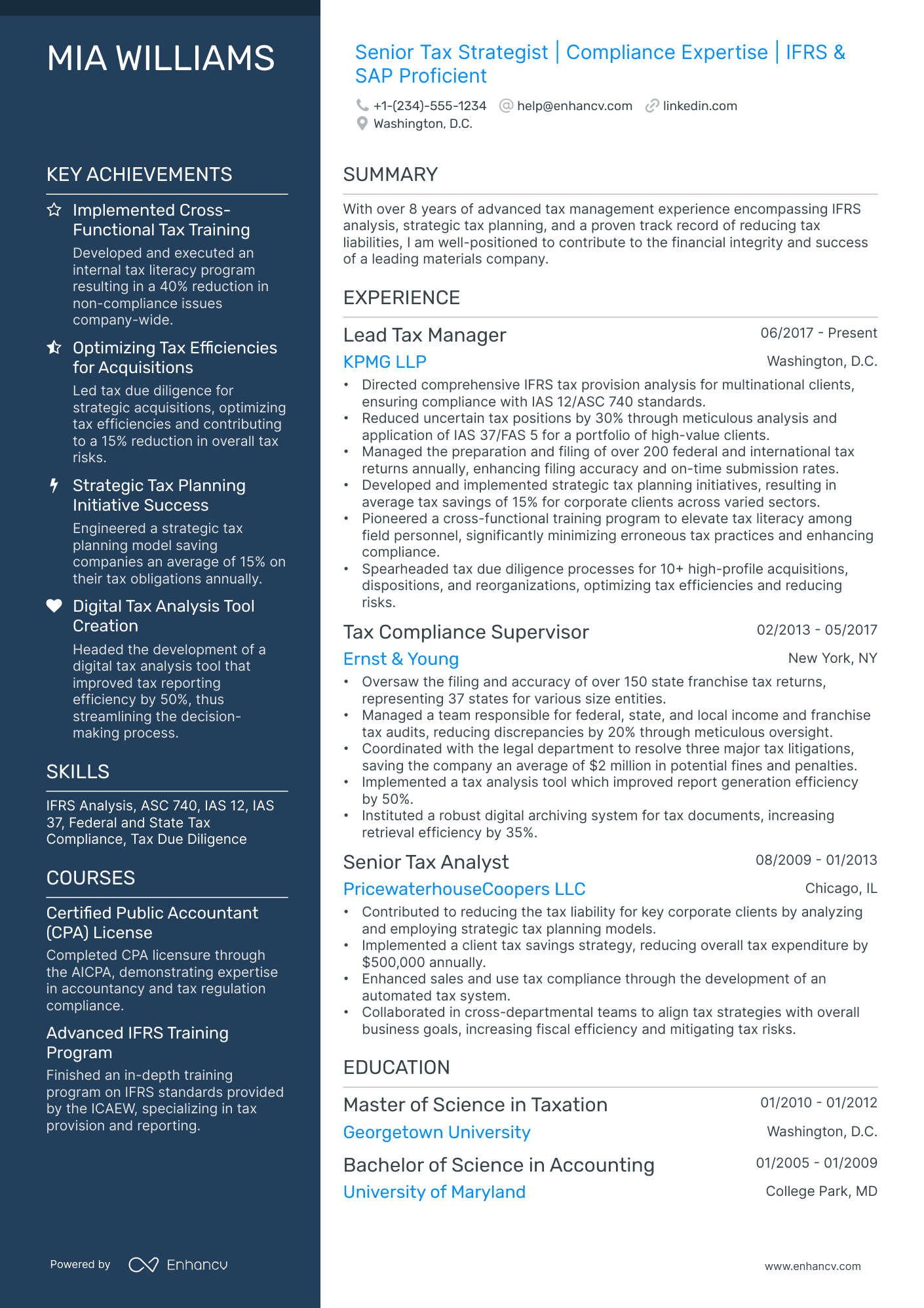

How to write your tax director resume summary

Your resume summary is the first thing a recruiter reads, so it must immediately signal executive-level tax expertise. A strong opening positions you as a strategic leader, not just a technical contributor.

Keep it to three to four lines, with:

- Your title and total years of progressive tax leadership experience.

- Domain focus such as corporate tax, international compliance, or multistate reporting.

- Core proficiencies like ASC 740, transfer pricing, tax provision software, or ERP platforms.

- One or two measurable achievements such as audit savings, effective tax rate reductions, or team growth.

- Soft skills tied to real outcomes like cross-functional collaboration that streamlined quarterly close cycles.

PRO TIP

At the director level, lead with strategic impact, organizational scope, and decision-making authority. Highlight how you've shaped tax policy, managed risk, or driven savings across business units. Avoid vague descriptors like "results-oriented" or "passionate tax professional." Recruiters want evidence of ownership, not enthusiasm.

Example summary for a tax director

Tax director with 12 years leading corporate and international tax strategy across Fortune 500 organizations. Reduced effective tax rate by 3.2% through restructured transfer pricing. Oversee a 15-member team managing $800M in annual tax provisions.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Now that your summary is crafted to spotlight your tax leadership expertise, make sure the header framing it presents your contact details clearly and professionally.

What to include in a tax director resume header

A resume header is the top section with your identity and contact details, and it drives visibility, credibility, and recruiter screening for a tax director role.

Essential resume header elements

- Full name

- Tailored job title and headline

- Location

- Phone number

- Professional email

- GitHub link

- Portfolio link

A LinkedIn link helps recruiters verify experience quickly and supports screening.

Do not include a photo on a tax director resume unless the role is explicitly front-facing or appearance-dependent.

Keep the header to two lines, match your tax director title to the posting, and use links that open to complete, current profiles.

Example

Tax director resume header

Jordan M. Parker

Tax Director | Corporate Tax Compliance, Provision, and IRS Audit Leadership

Chicago, IL

(312) 555-01XX your.name@enhancv.com github.com/yourname yourwebsite.com linkedin.com/in/yourname

Once your contact details and key identifiers are set at the top, round out your application with additional sections that reinforce your qualifications and credibility.

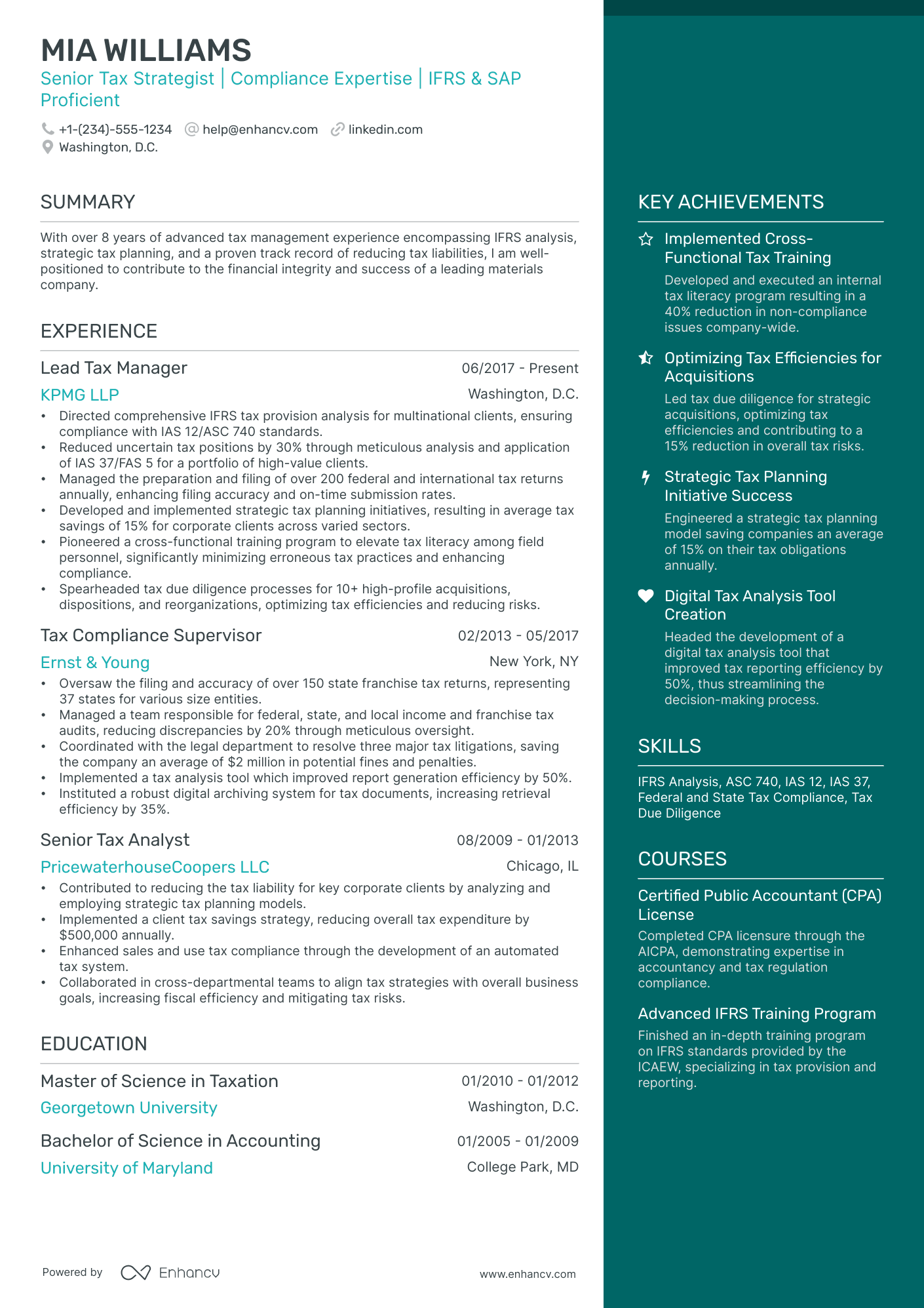

Additional sections for tax director resumes

Extra resume sections help you stand out when your core qualifications match other candidates—especially for senior tax leadership roles where specialized credibility matters.

Consider adding these sections to strengthen your tax director resume:

- Languages

- Professional affiliations (e.g., Tax Executives Institute, AICPA)

- Publications and thought leadership

- Speaking engagements and conference presentations

- Certifications and licenses (CPA, EA, LL.M. in Taxation)

- Board memberships or advisory roles

- Awards and industry recognition

Once you've strengthened your resume with targeted additional sections, pairing it with a well-crafted cover letter can further set your application apart.

Do tax director resumes need a cover letter

A cover letter isn't required for a tax director, but it helps in competitive searches and formal hiring processes. If you're unsure what a cover letter is or when to use one, it can make a difference when the hiring team expects a clear story beyond the resume.

Use a cover letter to add context the resume can't:

- Explain role and team fit: Connect your leadership style to the tax director scope, reporting lines, and how the function partners with finance and legal.

- Highlight one or two outcomes: Pick a major audit, controversy matter, restructuring, or process change, and quantify impact on risk, cash, or cycle time.

- Show business context: Reference the company's products, customers, revenue model, and footprint, and tie them to sales tax, income tax, or transfer pricing exposure.

- Address transitions: Clarify a move across industries, from public accounting to in-house, or from domestic to global work, with a direct skills bridge.

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Even when you decide a cover letter won’t add value to your tax director application, using AI to improve your tax director resume helps you strengthen the document that hiring teams review first.

Using AI to improve your tax director resume

AI can sharpen your resume's clarity, structure, and impact. It helps refine language and highlight results. But overuse dulls authenticity. Once your content reads clearly and aligns with the role, step away from AI. For practical starting points, explore these ChatGPT resume writing prompts tailored for resume improvement.

Here are 10 practical prompts you can copy and paste to strengthen specific sections of your tax director resume:

Strengthen summary impact

Quantify experience bullets

Sharpen skills relevance

Tighten action verbs

Refine project descriptions

Align certifications section

Clarify education details

Remove redundant phrasing

Improve scope statements

Tailor for specific postings

Conclusion

A strong tax director resume shows measurable outcomes, role-specific skills, and a clear structure. It highlights tax planning, compliance oversight, audit leadership, and cross-functional partnership, tied to savings, risk reduction, and on-time filings.

Keep your resume easy to scan, with consistent headings and focused bullets. This approach signals readiness for today’s hiring market and near-future demands, and it helps employers trust your judgment and execution.