Many treasury analyst resume drafts fail because they list tasks without quantifying liquidity impact, risk controls, or cash forecasting accuracy. That omission hurts when an applicant tracking system screens for results and recruiters scan fast in a crowded market. If you're unsure where to begin, learning how to write a resume from the ground up can help you avoid these common pitfalls.

A strong resume shows what you improved and how it moved the business. You should highlight reduced borrowing costs, improved forecast variance, accelerated cash positioning, strengthened bank fee controls, supported debt covenant reporting, and safeguarded liquidity across entities.

Key takeaways

- Quantify every treasury accomplishment with metrics like forecast accuracy, fee savings, or cycle time.

- Use reverse-chronological format for experienced analysts and hybrid format for career changers.

- Mirror each job posting's exact tools, systems, and terminology in your experience bullets.

- Lead bullets with ownership scope, execution method, and measurable business outcome.

- Place skills above experience if you're junior—below experience if you're mid-level or senior.

- Anchor your summary in specific tools, domain focus, and one or two concrete results.

- Use Enhancv to turn vague treasury duties into sharp, results-driven resume bullets faster.

Job market snapshot for treasury analysts

We analyzed 137 recent treasury analyst job ads across major US job boards. These numbers help you understand employer expectations, employment type trends, salary landscape at a glance.

What level of experience employers are looking for treasury analysts

| Years of Experience | Percentage found in job ads |

|---|---|

| 1–2 years | 12.4% (17) |

| 3–4 years | 15.3% (21) |

| 5–6 years | 8.0% (11) |

| 7–8 years | 2.9% (4) |

| 10+ years | 3.6% (5) |

| Not specified | 56.2% (77) |

Treasury analyst ads by area of specialization (industry)

| Industry (Area) | Percentage found in job ads |

|---|---|

| Finance & Banking | 85.4% (117) |

Top companies hiring treasury analysts

| Company | Percentage found in job ads |

|---|---|

| Fulton Financial Corporation | 8.8% (12) |

Role overview stats

These tables show the most common responsibilities and employment types for treasury analyst roles. Use them to align your resume with what employers expect and to understand how the role is structured across the market.

Day-to-day activities and top responsibilities for a treasury analyst

| Responsibility | Percentage found in job ads |

|---|---|

| Excel | 33.6% (46) |

| Cash management | 16.8% (23) |

| Microsoft excel | 15.3% (21) |

| Liquidity management | 14.6% (20) |

| Accounting | 13.9% (19) |

| Microsoft office | 12.4% (17) |

| Financial modeling | 11.7% (16) |

| Financial analysis | 10.2% (14) |

| Kyriba | 10.2% (14) |

| Analytical skills | 9.5% (13) |

| Forecasting | 9.5% (13) |

| Powerpoint | 9.5% (13) |

Type of employment (remote vs on-site vs hybrid)

| Employment type | Percentage found in job ads |

|---|---|

| On-site | 51.8% (71) |

| Hybrid | 36.5% (50) |

| Remote | 11.7% (16) |

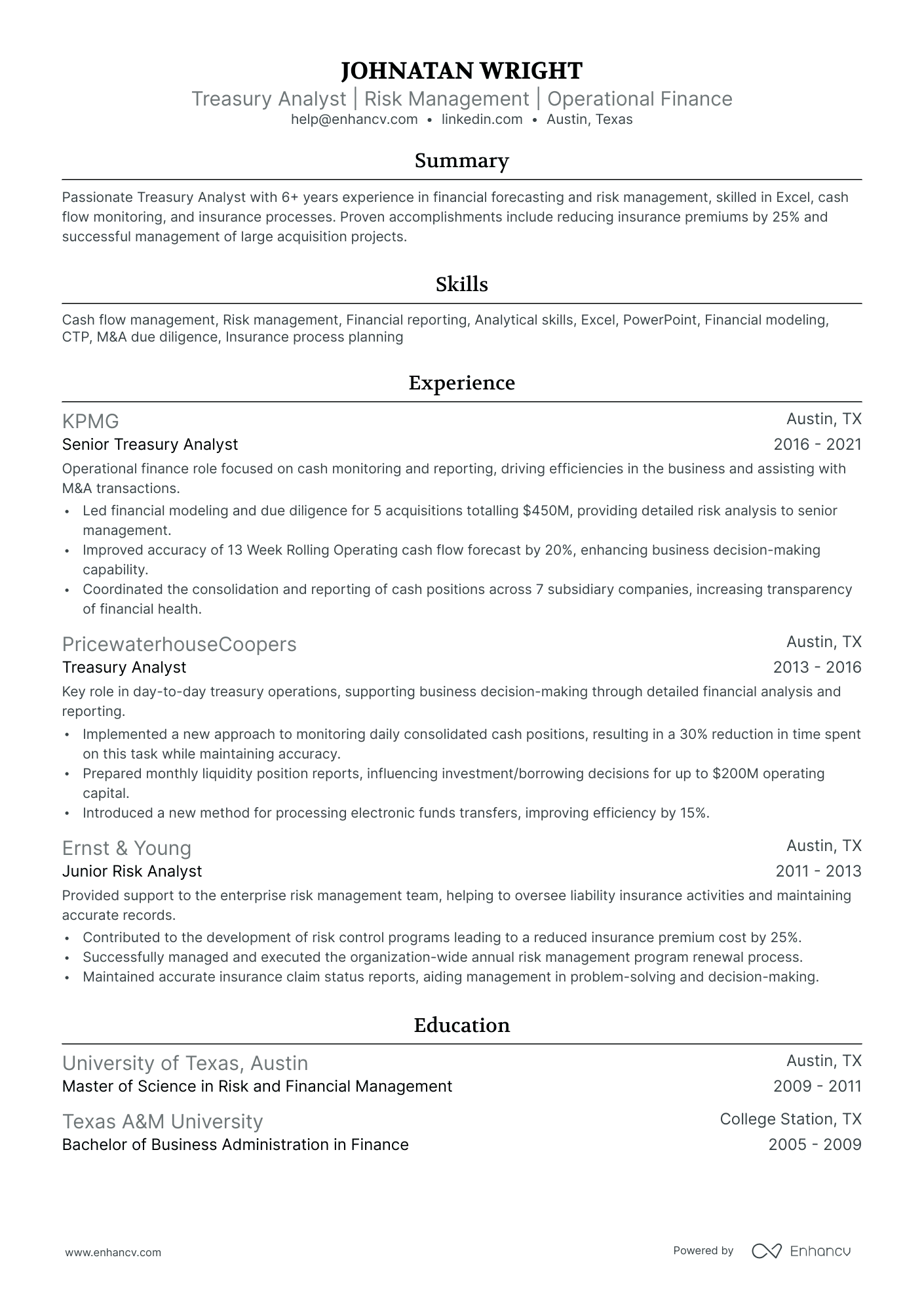

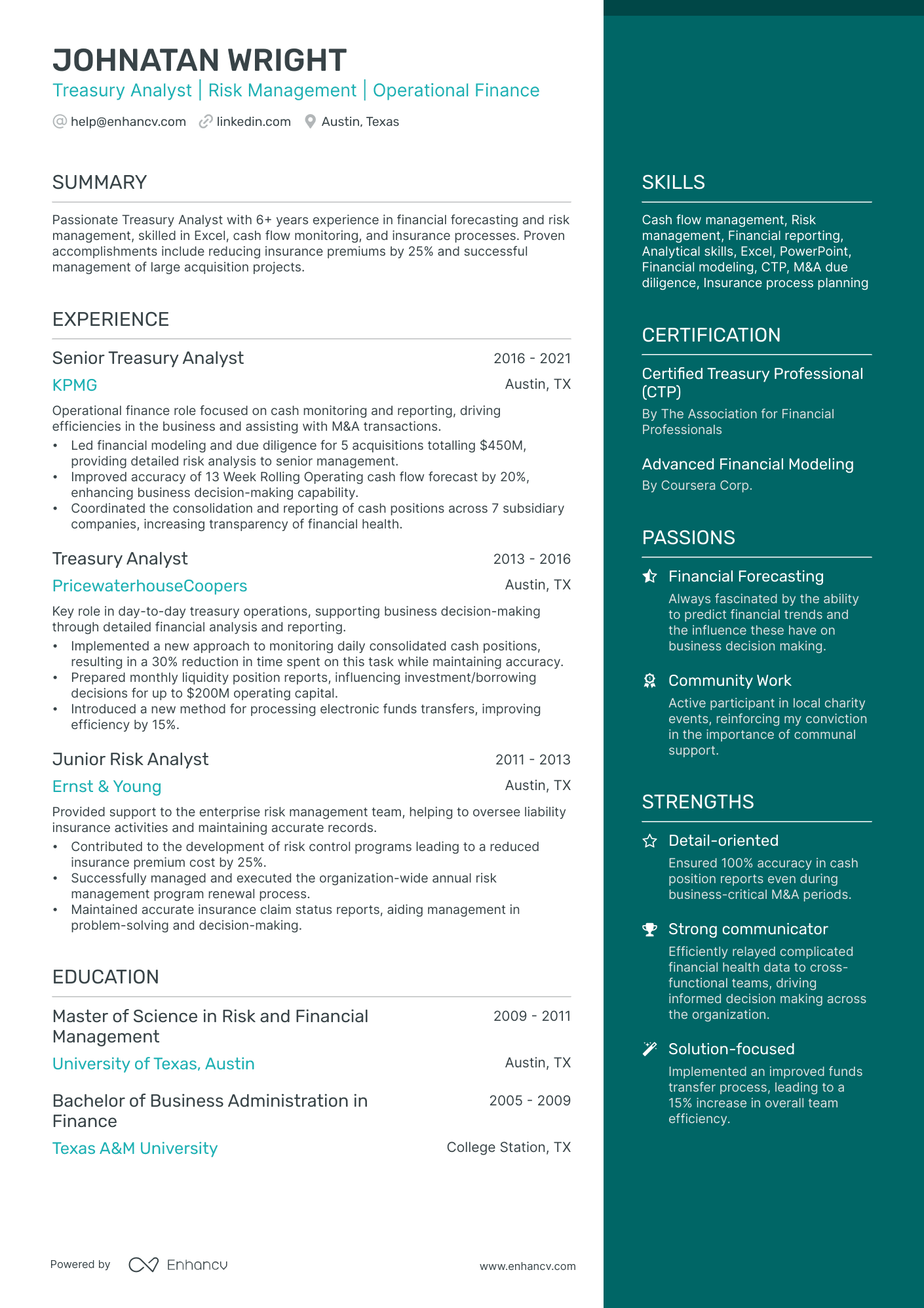

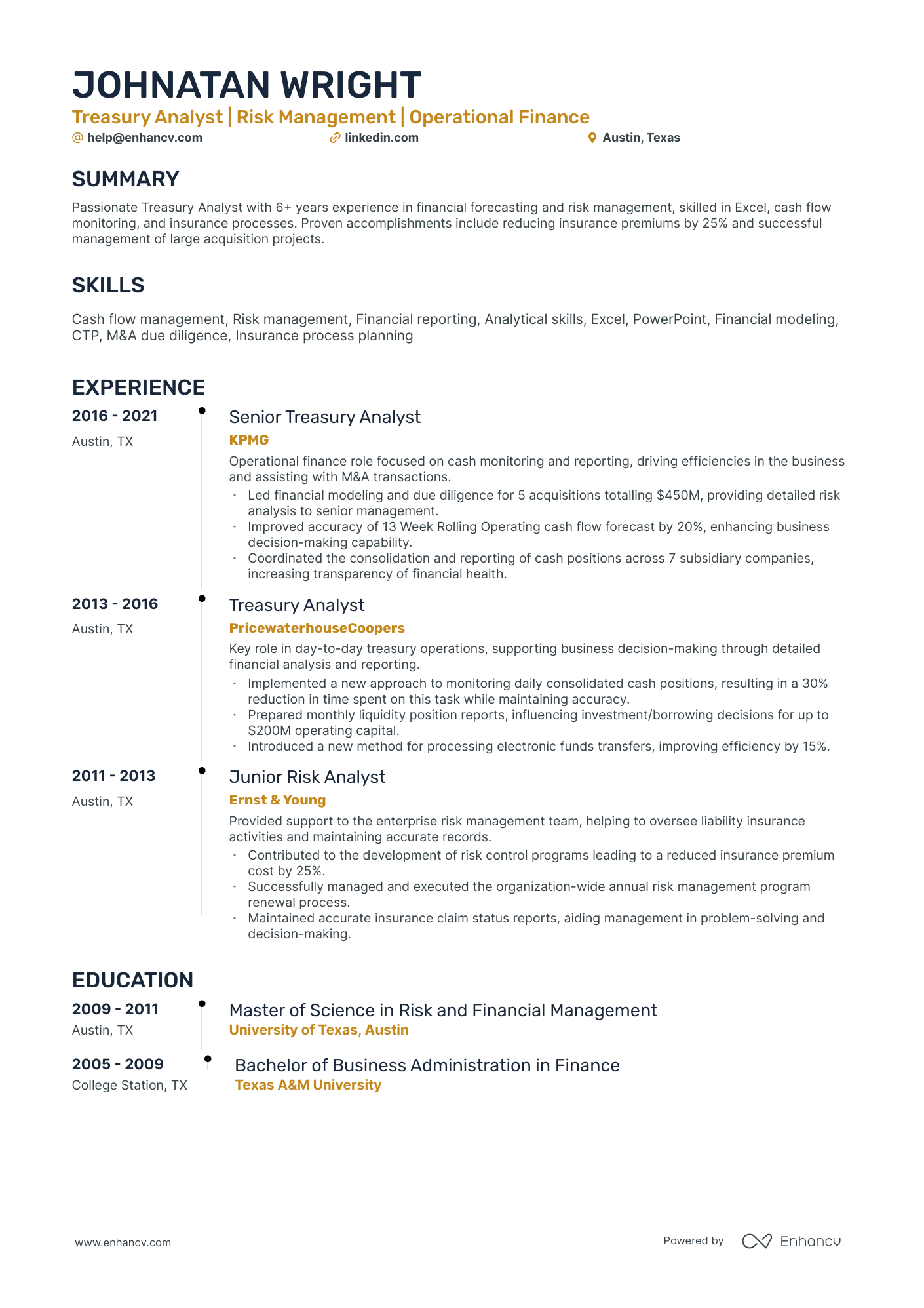

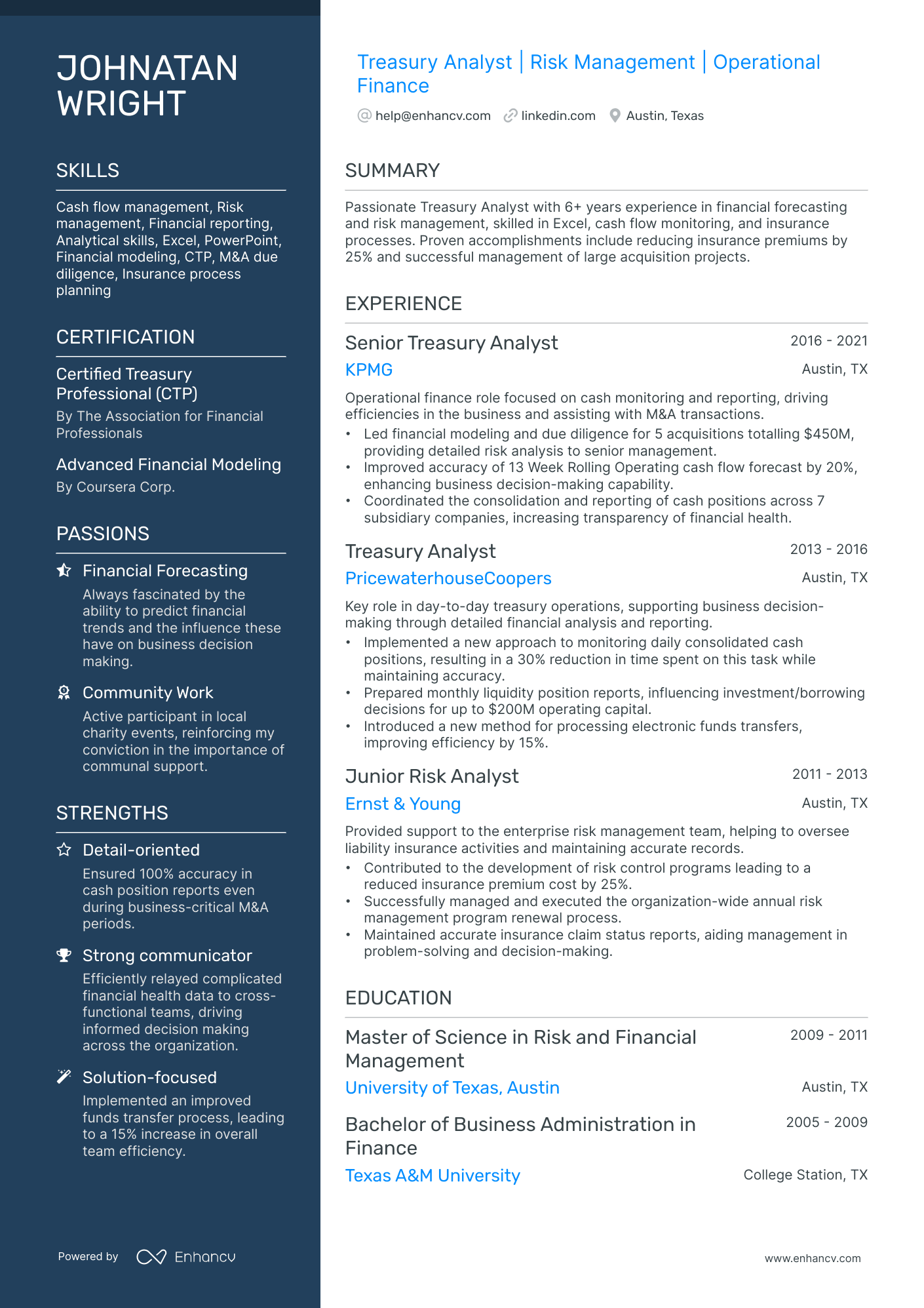

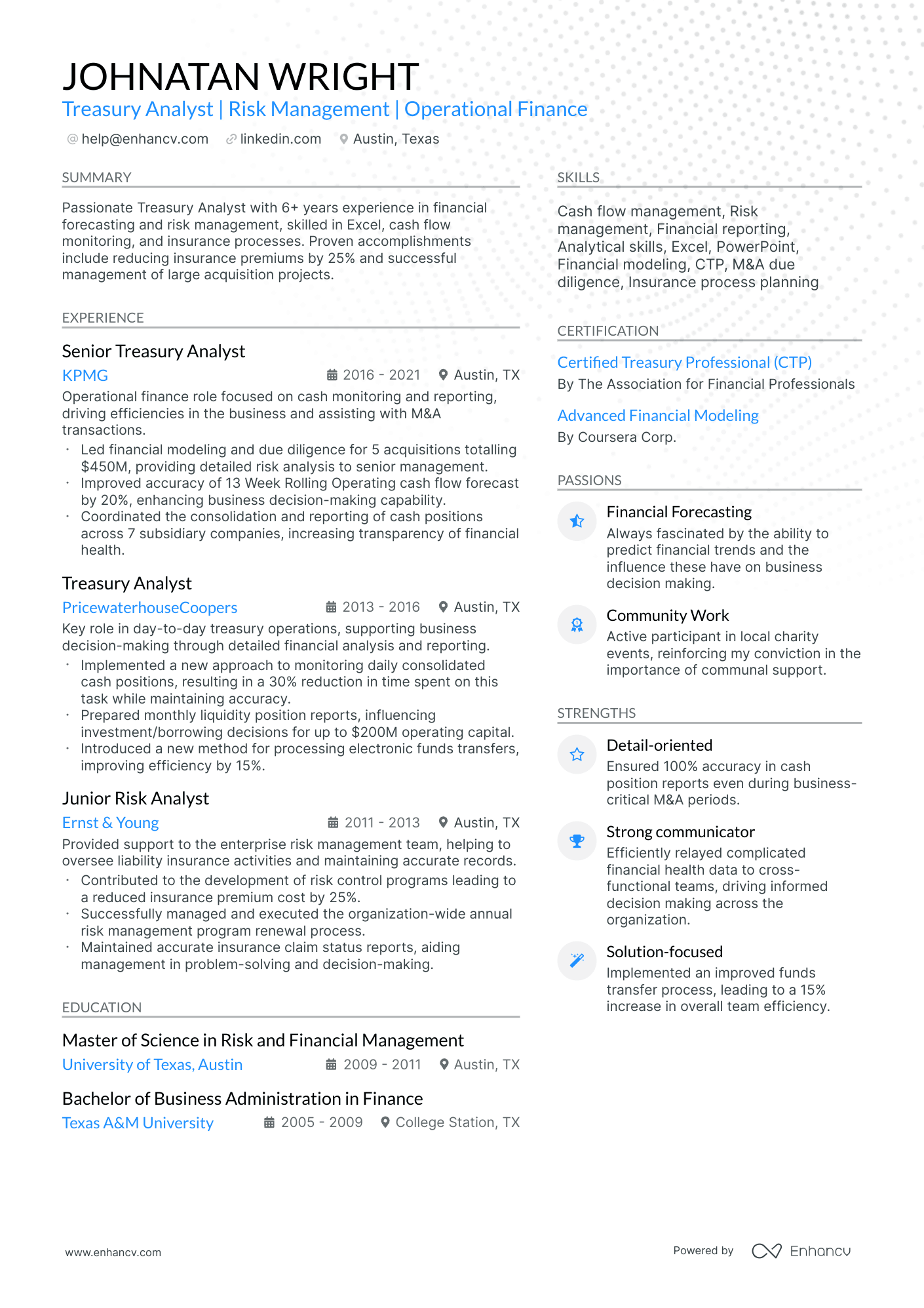

How to format a treasury analyst resume

Recruiters evaluating treasury analyst resumes prioritize cash management expertise, financial modeling proficiency, and a clear track record of optimizing liquidity and mitigating risk. A clean, well-structured resume format ensures these signals surface quickly during both automated screening and the initial human review.

I have significant experience in this role—which format should I use?

Use a reverse-chronological format to showcase your deepening expertise in treasury operations and progressively complex financial responsibilities. Do:

- Lead with your most recent role and emphasize scope—number of entities managed, portfolio size, or cash flow volume you oversaw.

- Highlight proficiency in role-specific tools and domains such as treasury management systems (Kyriba, SAP TRM, FIS), FX hedging strategies, debt covenant compliance, and bank relationship management.

- Quantify outcomes tied to cost savings, yield improvements, or risk reduction to demonstrate direct business impact.

I'm junior or switching into this role—what format works best?

A hybrid format works best, allowing you to lead with a targeted skills section while still presenting your work history in chronological order. Do:

- Place a skills section near the top that highlights treasury-relevant competencies such as cash positioning, bank reconciliation, variance analysis, and ERP platforms.

- Include academic projects, internships, or transitional experience that involved forecasting, liquidity analysis, or financial reporting—even if outside a formal treasury function.

- Connect every action to an outcome so recruiters can see how your skills translate into measurable results.

Why not use a functional resume?

A functional format strips away the timeline and context that recruiters need to evaluate how your treasury skills were applied in real work settings, making it harder to assess your readiness for the role. A functional format may be acceptable if you're transitioning from a related field like accounting or banking, have limited direct treasury experience, or are re-entering the workforce after a gap—but only if every listed skill is anchored to a specific project, coursework, or outcome rather than presented in isolation.

Once your layout and formatting choices are in place, the next step is deciding which sections to include so each one reinforces your qualifications.

What sections should go on a treasury analyst resume

Recruiters expect a treasury analyst resume to clearly show cash management experience, financial analysis skills, and measurable business results. Understanding which resume sections to include ensures you cover every area hiring managers look for.

Use this structure for maximum clarity:

- Header

- Summary

- Experience

- Skills

- Projects

- Education

- Certifications

- Optional sections: awards, leadership, languages

Strong experience bullets should emphasize impact on liquidity, cash forecasting accuracy, working capital, risk exposure, and process efficiency, backed by clear outcomes and scope.

Is your resume good enough?

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

Once you’ve organized your resume with the right core components, the next step is to build out your treasury analyst experience section so it supports each part with relevant, results-focused detail.

How to write your treasury analyst resume experience

The experience section is where you prove you've delivered real results as a treasury analyst—through cash management strategies, forecasting models, banking platforms, and risk mitigation frameworks that moved the needle for your organization. Hiring managers prioritize demonstrated impact over descriptive task lists, so every bullet should connect what you did to a measurable outcome.

Each entry should include:

- Job title

- Company and location (or remote)

- Dates of employment (month and year)

Three to five concise bullet points showing what you owned, how you executed, and what outcomes you delivered:

- Ownership scope: the cash positions, liquidity portfolios, banking relationships, debt instruments, or treasury systems you were directly accountable for managing or optimizing.

- Execution approach: the tools, frameworks, and methods you relied on—such as treasury management systems, ERP platforms, cash flow forecasting models, FX hedging strategies, or variance analysis techniques—to inform decisions and deliver work.

- Value improved: the specific improvements you drove in liquidity visibility, forecasting accuracy, borrowing costs, working capital efficiency, counterparty risk exposure, or compliance reliability within your treasury function.

- Collaboration context: how you partnered with finance leadership, accounting teams, banking partners, auditors, or business unit stakeholders to align treasury operations with broader organizational objectives.

- Impact delivered: the tangible results your work produced—expressed through reductions in idle cash, improvements in forecast precision, tighter covenant compliance, faster reporting cycles, or stronger risk-adjusted returns—rather than a summary of daily activities.

Experience bullet formula

A treasury analyst experience example

✅ Right example - modern, quantified, specific.

Treasury Analyst

Redwood Components, Inc. | Austin, TX

2022–Present

Mid-market manufacturing company with $850M annual revenue and multi-bank global cash operations.

- Automated daily cash positioning across eight bank accounts using Kyriba, SWIFT MT940 feeds, and Power Query, cutting close-to-cash visibility from four hours to forty-five minutes.

- Built a thirteen-week cash forecast in Excel (Power Pivot) and Power BI using actuals from Oracle NetSuite and sales inputs, improving forecast accuracy from 82% to 93% and reducing revolver draws by $6.5M.

- Executed $420M in monthly payments through bank portals and Kyriba with dual-approval controls, reducing payment exceptions by 38% and maintaining zero confirmed fraud losses.

- Partnered with accounting and external auditors to strengthen bank reconciliation and SOX controls, shortening month-end treasury close by two days and eliminating five recurring control deficiencies.

- Negotiated fee changes with two relationship banks using analysis from bank fee statements and SQL-based spend reporting, lowering annual bank fees by 14% ($180K) while expanding same-day ACH coverage.

Now that you've seen how a strong experience section comes together, let's look at how to adjust yours to match the specific treasury analyst role you're targeting.

How to tailor your treasury analyst resume experience

Recruiters evaluate treasury analyst resumes through both manual review and applicant tracking systems, filtering for specific qualifications before scheduling interviews. Tailoring your resume to the job description and mirroring the language and priorities in each job posting keeps your resume competitive at every stage.

Ways to tailor your treasury analyst experience:

- Match treasury management systems or platforms named in the posting.

- Mirror the exact cash forecasting methods the employer references.

- Align your liquidity management terminology with the job description.

- Highlight bank relationship experience when the role requires it.

- Emphasize FX hedging or debt management if listed as priorities.

- Reflect compliance standards like SOX or internal controls mentioned.

- Include intercompany funding or capital structure work when relevant.

- Reference ERP tools such as SAP or Oracle if the posting specifies them.

Tailoring means aligning your real accomplishments with what the employer asks for, not forcing keywords into sentences where they don't belong.

Resume tailoring examples for treasury analyst

| Job description excerpt | Untailored | Tailored |

|---|---|---|

| Manage daily cash positioning across multiple bank accounts and prepare short-term cash flow forecasts using Kyriba. | Helped with cash management tasks and prepared reports for the finance team. | Managed daily cash positioning across 12 domestic and international bank accounts, building 13-week rolling cash flow forecasts in Kyriba that reduced idle cash balances by 18%. |

| Execute FX hedging strategies to mitigate currency exposure and monitor compliance with the company's treasury policy. | Assisted with foreign exchange transactions and followed company policies. | Executed FX forward and option hedging strategies covering $45M in monthly currency exposure, ensuring full compliance with the corporate treasury policy and reducing FX losses by 12% year over year. |

| Perform bank fee analysis, optimize banking relationships, and support debt covenant reporting under the company's revolving credit facility. | Worked on banking activities and helped prepare financial reports for leadership. | Analyzed quarterly bank fee statements across seven banking partners, identifying $130K in annual fee savings, and prepared monthly debt covenant compliance packages for a $200M revolving credit facility. |

Once you’ve aligned your experience with the role’s priorities, the next step is to quantify your treasury analyst achievements so hiring managers can see the scope and impact of your work.

How to quantify your treasury analyst achievements

Quantifying your achievements shows how your work improves cash visibility, reduces risk, and speeds execution. Focus on cash forecasting accuracy, payment timeliness, fee savings, control exceptions, and exposure reductions across accounts, entities, and banking partners.

Quantifying examples for treasury analyst

| Metric | Example |

|---|---|

| Forecast accuracy | "Improved thirteen-week cash forecast accuracy from 82% to 93% by rebuilding the model in Excel with Power Query and tighter AR and AP assumptions." |

| Cycle time | "Cut daily cash positioning time from two hours to 45 minutes by automating bank statement imports and reconciliation across 12 accounts." |

| Fee savings | "Reduced bank fees by $180,000 annually by benchmarking service charges, renegotiating pricing, and consolidating low-usage accounts across three banks." |

| Risk reduction | "Lowered FX exposure by $4.2 million by implementing weekly netting and setting hedging thresholds aligned with policy limits." |

| Compliance quality | "Decreased payment control exceptions from 14 per month to three by tightening dual-approval workflows and documenting controls for quarterly audits." |

Turn vague job duties into measurable, recruiter-ready resume bullets in seconds with Enhancv's Bullet Point Generator.

With strong bullet points in place, the next step is ensuring your treasury analyst resume highlights the right mix of hard and soft skills.

How to list your hard and soft skills on a treasury analyst resume

Your skills section shows you can manage liquidity, risk, and banking operations, and recruiters and ATS scan this section for role-matching keywords; aim for a balanced mix of hard skills like cash forecasting and systems plus soft skills like stakeholder communication.

treasury analyst roles require a blend of:

- Product strategy and discovery skills.

- Data, analytics, and experimentation skills.

- Delivery, execution, and go-to-market discipline.

- Soft skills.

Your skills section should be:

- Scannable (bullet-style grouping).

- Relevant to the job post.

- Backed by proof in experience bullets.

- Updated with current tools.

Place your skills section:

- Above experience if you're junior or switching careers.

- Below experience if you're mid/senior with strong achievements.

Hard skills

- Cash forecasting models

- Daily cash positioning

- Liquidity management

- Bank account management

- Payment rails: ACH, wire, SWIFT

- Treasury management systems (TMS)

- Excel: Power Query, PivotTables

- ERP cash modules: SAP, Oracle

- FX exposure tracking

- Hedge accounting support

- Debt covenant monitoring

- Bank fee analysis

Soft skills

- Partnering with accounting and FP&A

- Translating cash impacts to leaders

- Managing priorities across deadlines

- Driving issue resolution with banks

- Documenting controls and procedures

- Presenting variance drivers clearly

- Escalating risks with recommendations

- Maintaining audit-ready accuracy

- Challenging assumptions with data

- Owning end-to-end reconciliations

How to show your treasury analyst skills in context

Skills shouldn't live only in a dedicated skills list. Browse examples of resume skills shown in context to see how top candidates weave competencies into their summaries and experience bullets.

They should be demonstrated in:

- Your summary (high-level professional identity)

- Your experience (proof through outcomes)

Here's how that looks in practice.

Summary example

Treasury analyst with eight years in corporate cash management, skilled in Kyriba, FX hedging, and debt covenant analysis. Reduced borrowing costs by 18% through optimized credit facility structures. Known for clear cross-functional communication with finance leadership.

- Reflects senior-level experience clearly

- Names specific platforms and methods

- Leads with a measurable cost reduction

- Highlights communication as a soft skill

Experience example

Senior Treasury Analyst

Vanden Capital Group | Chicago, IL

June 2019–Present

- Managed a $420M daily cash position using Kyriba, improving forecast accuracy by 22% over two years.

- Partnered with FP&A and accounting teams to restructure intercompany lending, cutting transfer costs by $1.3M annually.

- Developed automated bank reconciliation workflows in SAP, reducing manual processing time by 35%.

- Every bullet includes measurable proof.

- Skills appear naturally within achievements.

Once you’ve tied your treasury analyst abilities to real outcomes and responsibilities, the next step is applying that approach to a treasury analyst resume with no experience so you can present relevant strengths without a work history.

How do I write a treasury analyst resume with no experience

How do I write a treasury analyst resume with no experience?

Even without full-time experience, you can demonstrate readiness through projects and transferable skills. Our guide on writing a resume without work experience walks you through strategies that apply directly to treasury analyst candidates.

- Cash forecasting class projects

- Bank reconciliation simulations in Excel

- Treasury management system coursework labs

- Finance case competitions on liquidity

- Student fund cash management role

- Internship in accounting or finance

- Payment operations volunteer experience

- Financial modeling capstone project

Focus on:

- Cash forecasting models and accuracy

- Reconciliations and variance explanations

- Payment workflows and controls

- Reporting cadence and measurable impact

Resume format tip for entry-level treasury analyst

Use a hybrid resume format. It highlights projects and skills first while still showing internships, roles, and leadership in reverse-chronological order. Do:

- Put a "Projects" section above experience.

- Quantify results: time saved, errors reduced.

- List tools: Excel, SQL, Power BI.

- Mirror treasury analyst keywords from postings.

- Add relevant coursework under education.

- Built a 13-week cash forecast in Excel using scenario analysis and variance tracking; improved forecast accuracy from 72% to 90% across four weekly cycles.

Since your education section carries extra weight when you don't have professional experience to showcase, presenting it strategically on your resume becomes essential.

How to list your education on a treasury analyst resume

Your education section helps hiring teams confirm you have the foundational finance, accounting, or economics knowledge a treasury analyst needs. It validates your analytical training quickly.

Include:

- Degree name

- Institution

- Location

- Graduation year

- Relevant coursework (for juniors or entry-level candidates)

- Honors & GPA (if 3.5 or higher)

Skip month and day details—list the graduation year only.

Here's a strong education entry tailored to a treasury analyst resume.

Example education entry

Bachelor of Science in Finance

Georgetown University, Washington, D.C.

Graduated 2021

GPA: 3.7/4.0

- Relevant Coursework: Corporate Treasury Management, Financial Risk Analysis, Cash Flow Modeling, Fixed Income Securities

- Honors: Dean's List (six semesters), Beta Gamma Sigma Honor Society

How to list your certifications on a treasury analyst resume

Certifications on your resume show your commitment to learning, proficiency with treasury tools, and relevance to modern cash and risk practices as a treasury analyst.

Include:

- Certificate name

- Issuing organization

- Year

- Optional: credential ID or URL

- Place certifications below education when they're older, less relevant, or you have recent, strong education credentials for a treasury analyst role.

- Place certifications above education when they're recent, highly relevant, or required, and they strengthen your treasury analyst profile immediately.

Best certifications for your treasury analyst resume

- Certified Treasury Professional (CTP)

- Chartered Financial Analyst (CFA)

- Financial Risk Manager (FRM)

- Certified Public Accountant (CPA)

- Association of Chartered Certified Accountants (ACCA)

- Chartered Institute of Management Accountants (CIMA)

- Bloomberg Market Concepts (BMC)

Once you’ve positioned your credentials to support your treasury expertise, you can write your treasury analyst resume summary to highlight that value upfront.

How to write your treasury analyst resume summary

Your resume summary is the first thing a recruiter reads, so it must immediately signal your fit for a treasury analyst role. A strong opening can determine whether your resume gets a closer look or gets passed over.

Keep it to three to four lines, with:

- Your title and total years of relevant treasury or finance experience.

- Domain focus such as corporate treasury, cash management, or banking.

- Core tools and skills like SAP, Kyriba, Bloomberg, or advanced Excel modeling.

- One or two measurable achievements that show your early impact.

- Soft skills tied to real outcomes, such as cross-team coordination that improved reporting speed.

PRO TIP

At the treasury analyst level, emphasize technical skills, tool proficiency, and concrete contributions over broad claims. Highlight how you've supported cash forecasting, liquidity analysis, or bank reconciliation with specific results. Avoid vague phrases like "passionate finance professional" or "motivated self-starter." Recruiters want evidence you can execute core treasury functions accurately and efficiently.

Example summary for a treasury analyst

Treasury analyst with two years of experience in cash management and forecasting using Kyriba and SAP. Reduced daily reconciliation time by 30% through automated reporting workflows supporting a $200M liquidity portfolio.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Now that your summary captures your strongest qualifications, make sure the header framing it presents your contact details correctly so recruiters can actually reach you.

What to include in a treasury analyst resume header

A resume header is the contact and identity block at the top, and it boosts visibility, credibility, and recruiter screening for a treasury analyst.

Essential resume header elements

- Full name

- Tailored job title and headline

- Location

- Phone number

- Professional email

- GitHub link

- Portfolio link

A LinkedIn link helps recruiters confirm roles and dates fast, which supports consistent screening.

Don't include photos on a treasury analyst resume unless the role is explicitly front-facing or appearance-dependent.

Keep the header on one or two lines, match the job title to the posting, and use the same name across your resume and profiles.

Treasury analyst resume header

Jordan Lee

Treasury analyst | Cash management, liquidity forecasting, bank reconciliations

Chicago, IL

(312) 555-01XX

jordan.lee@enhancv.com

github.com/jordanlee

yourwebsite.com

linkedin.com/in/jordanlee

With your contact details and role identifiers set up to make a strong first impression, add supporting resume sections that reinforce your fit and provide more context.

Additional sections for treasury analyst resumes

When your core qualifications match other candidates, additional sections can set you apart by showcasing role-specific credibility and well-rounded expertise. For example, listing language skills on your resume can be a differentiator if the role involves multi-currency operations or global banking relationships.

- Languages

- Certifications (CTP, CFA, FRM)

- Professional affiliations (AFP, ACT)

- Publications

- Volunteer experience in financial literacy

- Technical proficiencies (treasury management systems, Bloomberg, ERP platforms)

- Continuing education and workshops

Once you've strengthened your resume with relevant additional sections, it's worth pairing it with a cover letter to give hiring managers even more context about your qualifications.

Do treasury analyst resumes need a cover letter

A cover letter isn't required for a treasury analyst, but it helps in competitive searches or when hiring managers expect one. If you're unsure where to start, understanding what a cover letter is and how it complements your resume can help you decide whether to include one. It can make a difference when your resume needs context, or when you're targeting a specific team.

Use a cover letter to add context your resume can't:

- Explain role and team fit by matching your cash management, forecasting, or risk support work to the job's priorities.

- Highlight one or two projects with outcomes, such as improving liquidity visibility, reducing bank fees, or strengthening daily cash positioning accuracy.

- Show you understand the business context by referencing key products, customer segments, seasonality, or working capital drivers that affect cash flow.

- Address career transitions or non-obvious experience by connecting prior roles to treasury analyst work, including controls, reporting, or stakeholder management.

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Even if you decide a cover letter adds limited value for your application, AI tools can help you strengthen your treasury analyst resume faster and more precisely.

Using AI to improve your treasury analyst resume

AI can sharpen your resume's clarity, structure, and impact. It helps tighten language and highlight relevant accomplishments. But overuse strips authenticity. Once your content feels clear and role-aligned, step away from AI. If you're curious about where to start, explore ChatGPT resume writing prompts designed to accelerate the drafting process.

Here are 10 practical prompts to strengthen specific sections of your treasury analyst resume:

- Strengthen your summary. "Rewrite my treasury analyst resume summary to highlight cash management expertise and measurable results in under four sentences."

- Quantify experience bullets. "Add specific metrics like dollar amounts or percentages to these treasury analyst experience bullets without changing their meaning."

- Tighten action verbs. "Replace weak or passive verbs in my treasury analyst experience section with strong, finance-specific action verbs."

- Align skills section. "Compare my skills list against this treasury analyst job description and flag missing hard skills I should add."

- Clarify project contributions. "Rewrite this treasury analyst project description to clearly state my role, tools used, and the financial outcome."

- Improve certification details. "Reformat my certifications section so each entry clearly supports a treasury analyst application with relevant context."

- Refine education section. "Edit my education section to emphasize coursework and achievements most relevant to a treasury analyst role."

- Remove redundant phrasing. "Identify and cut filler words or repeated ideas across all sections of my treasury analyst resume."

- Target job descriptions. "Highlight gaps between my treasury analyst resume bullets and this specific job posting's requirements."

- Enhance readability. "Restructure long or complex sentences in my treasury analyst resume so each bullet is concise and scannable."

Stop using AI once your resume sounds accurate, specific, and aligned with real experience. AI should never invent experience or inflate claims—if it didn't happen, it doesn't belong here.

Conclusion

A strong treasury analyst resume proves impact with measurable outcomes, role-specific skills, and a clear structure. Highlight cash forecasting accuracy, liquidity improvements, and risk controls. Show proficiency in financial modeling, bank reporting, and reconciliations, and keep each section easy to scan.

Today’s hiring market rewards treasury analyst candidates who communicate results and readiness fast. Use consistent formatting, precise metrics, and targeted keywords to match modern screening and reviewer expectations. When your value is clear on the first page, you earn interviews.