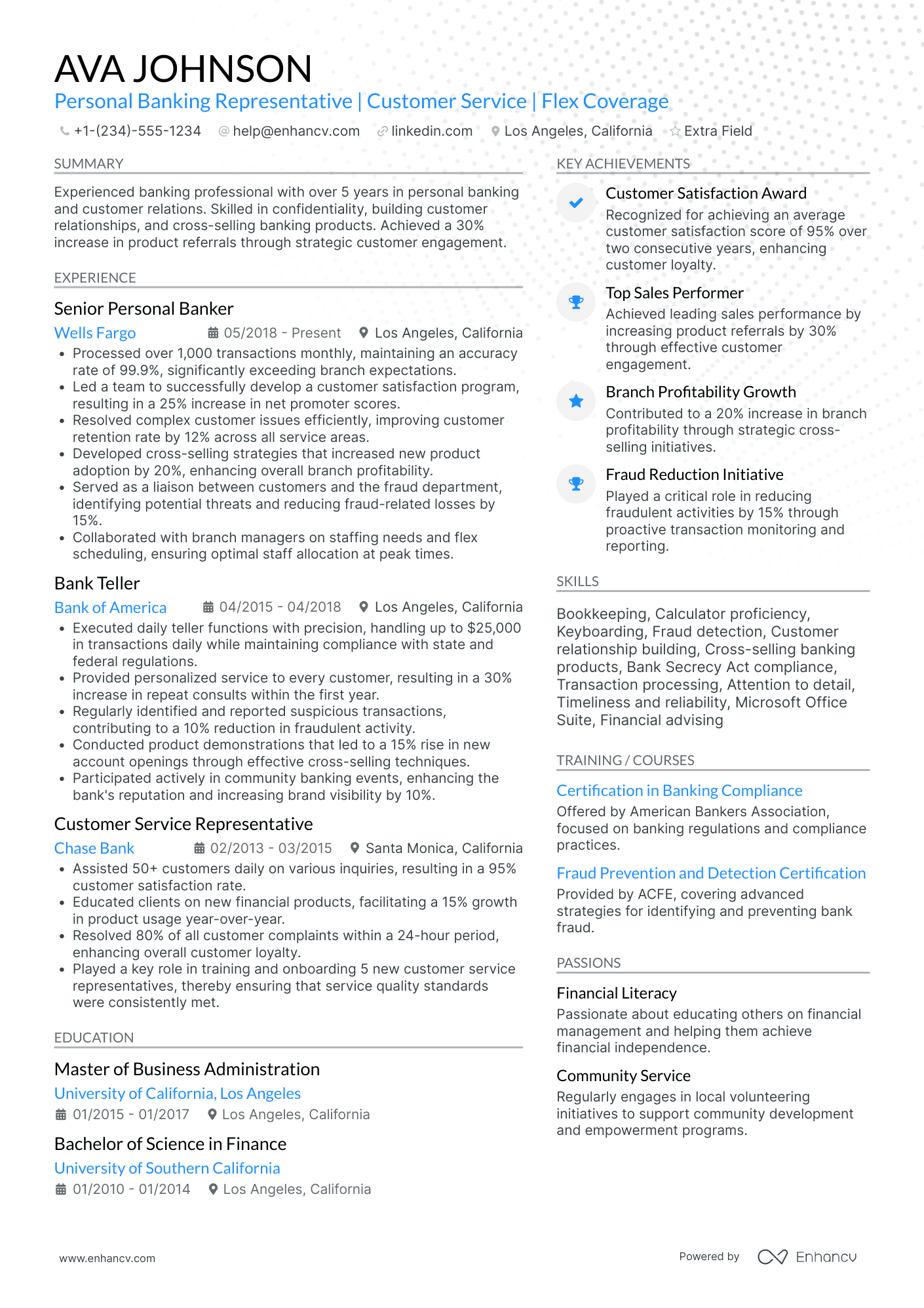

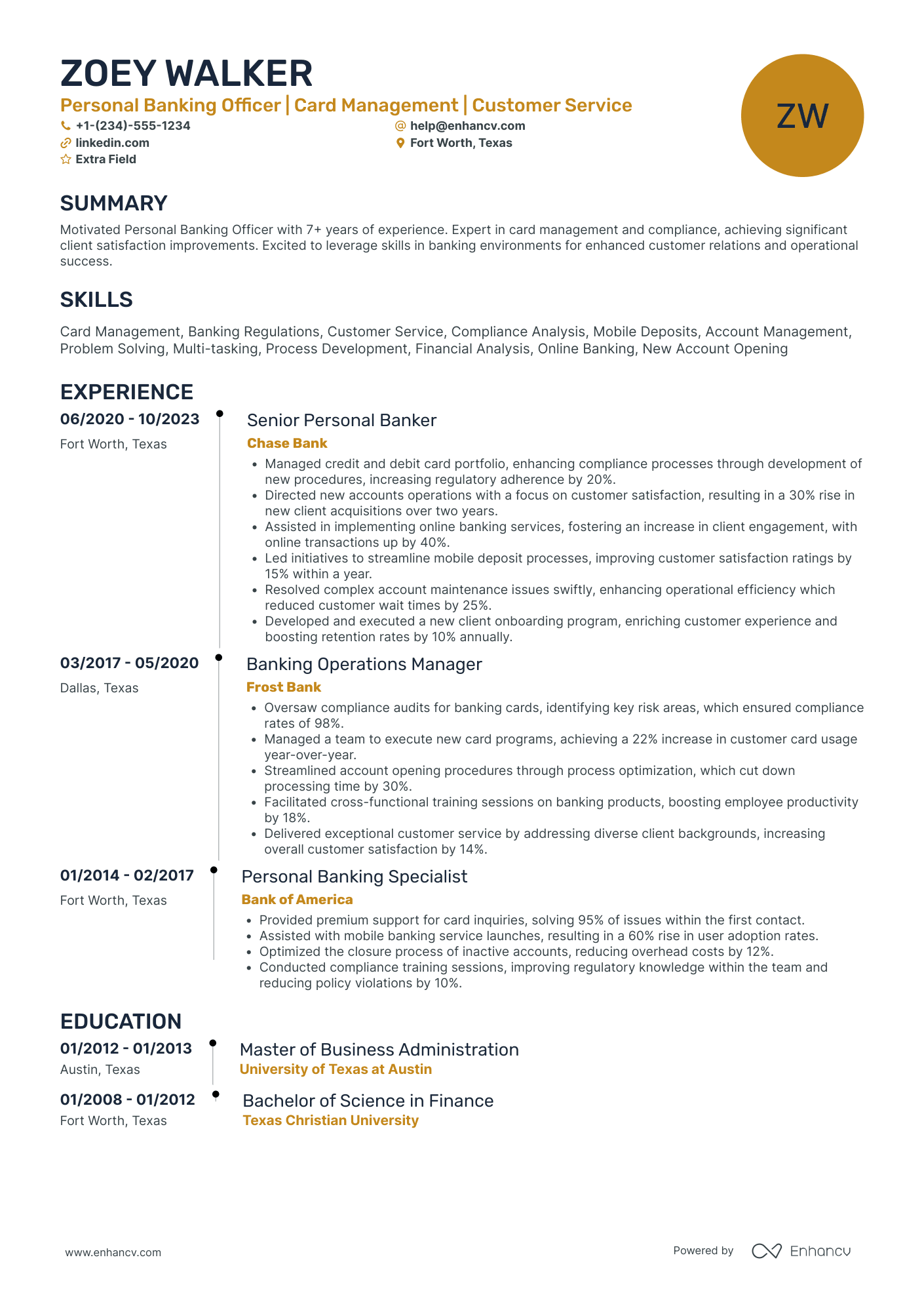

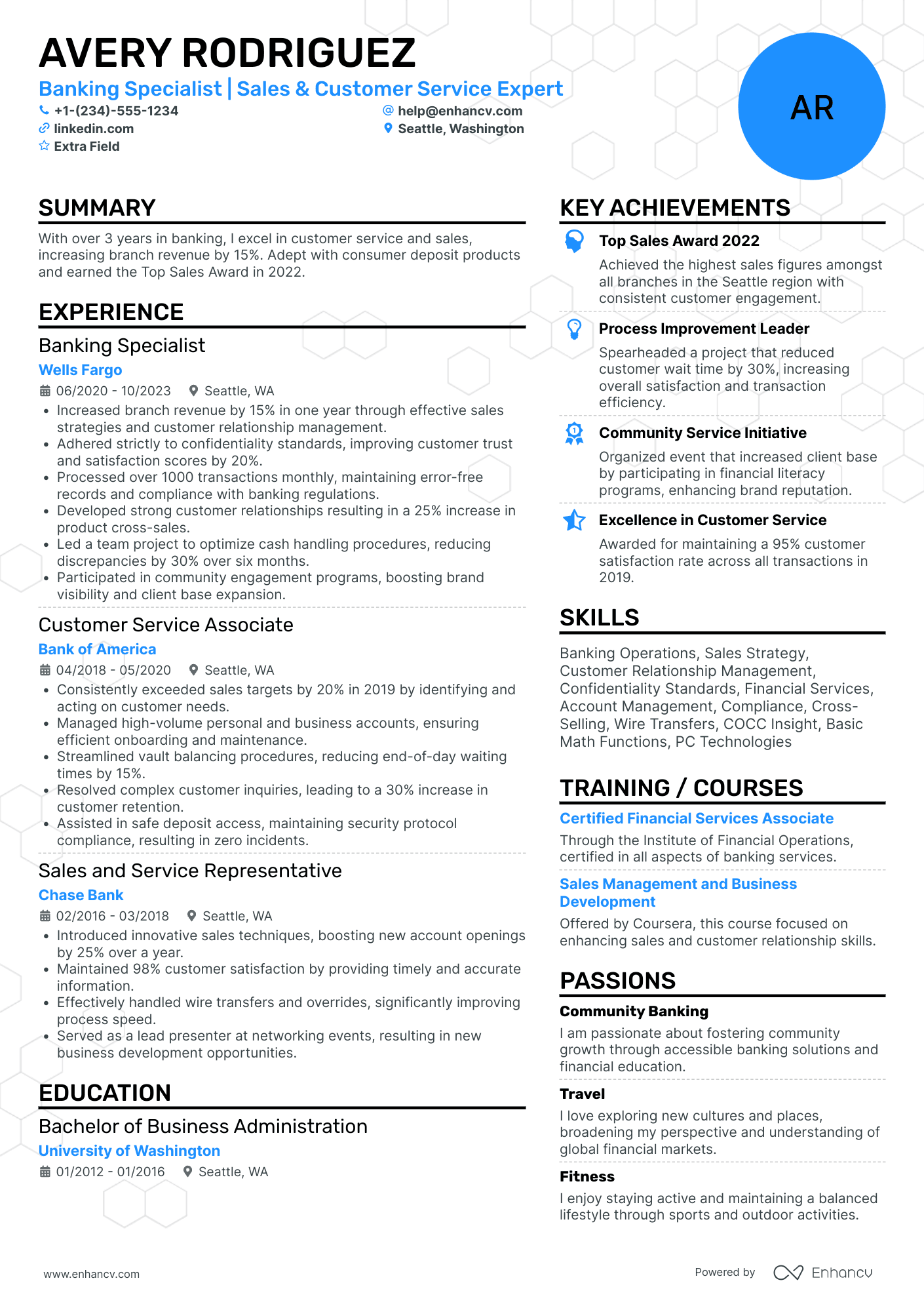

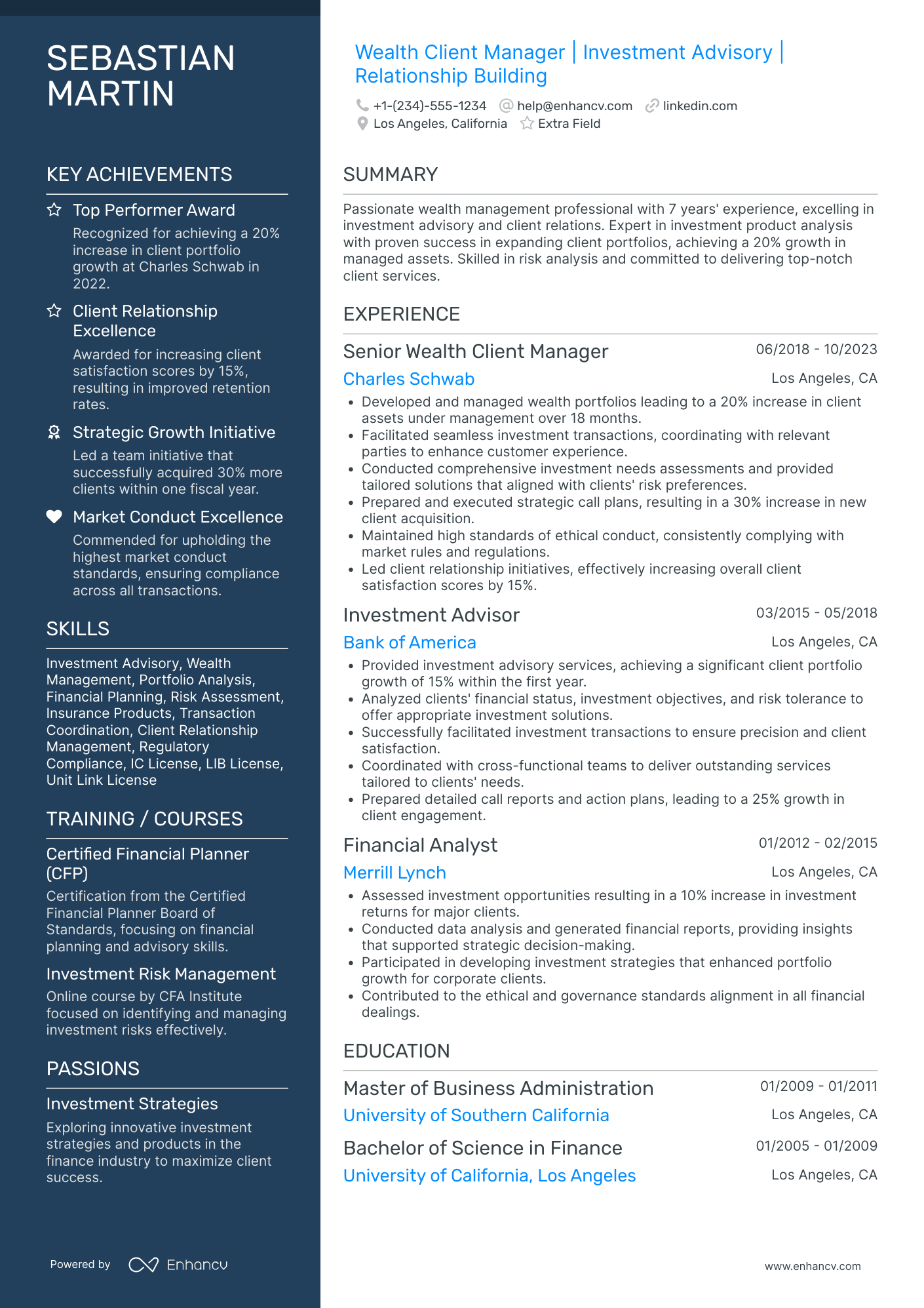

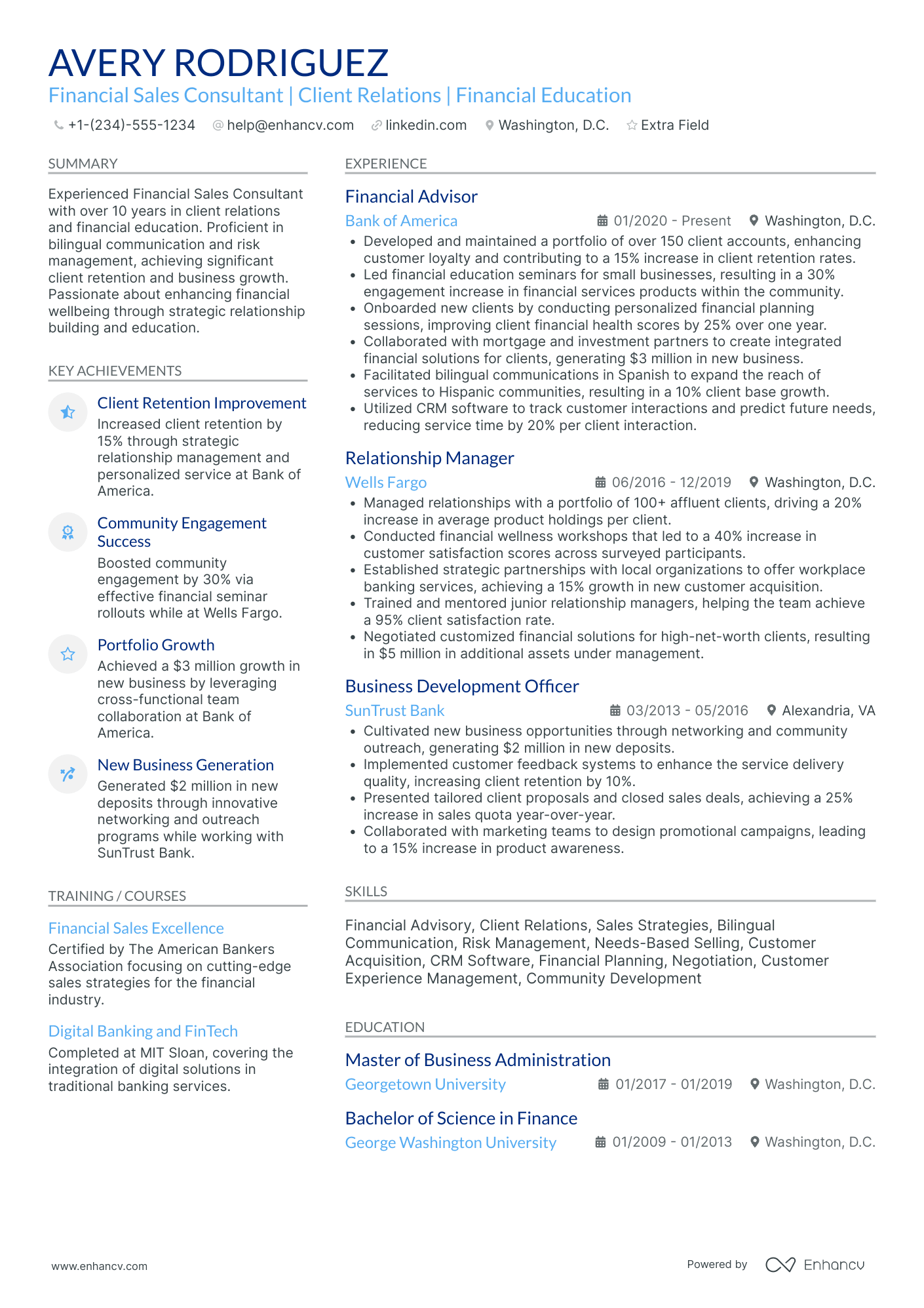

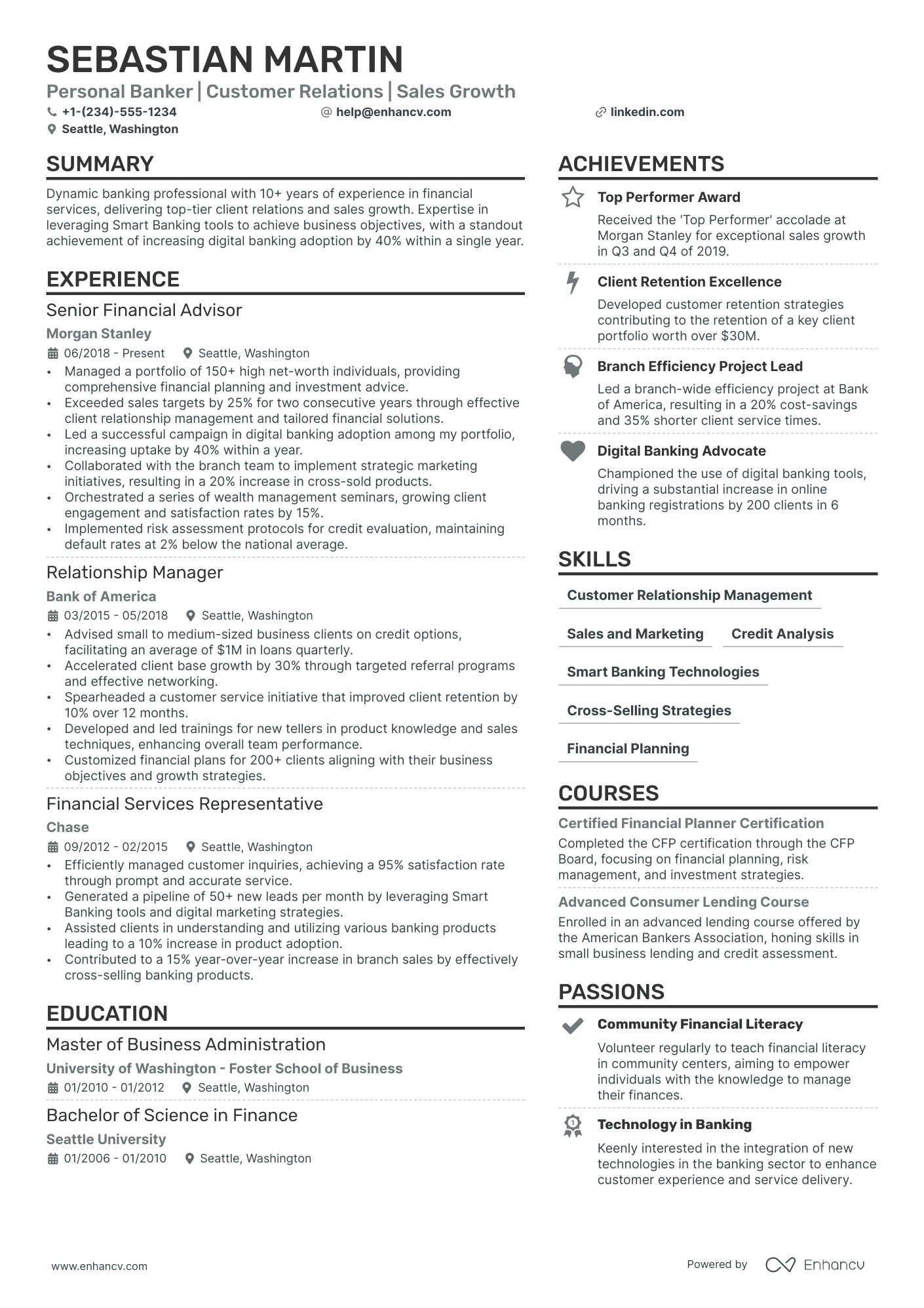

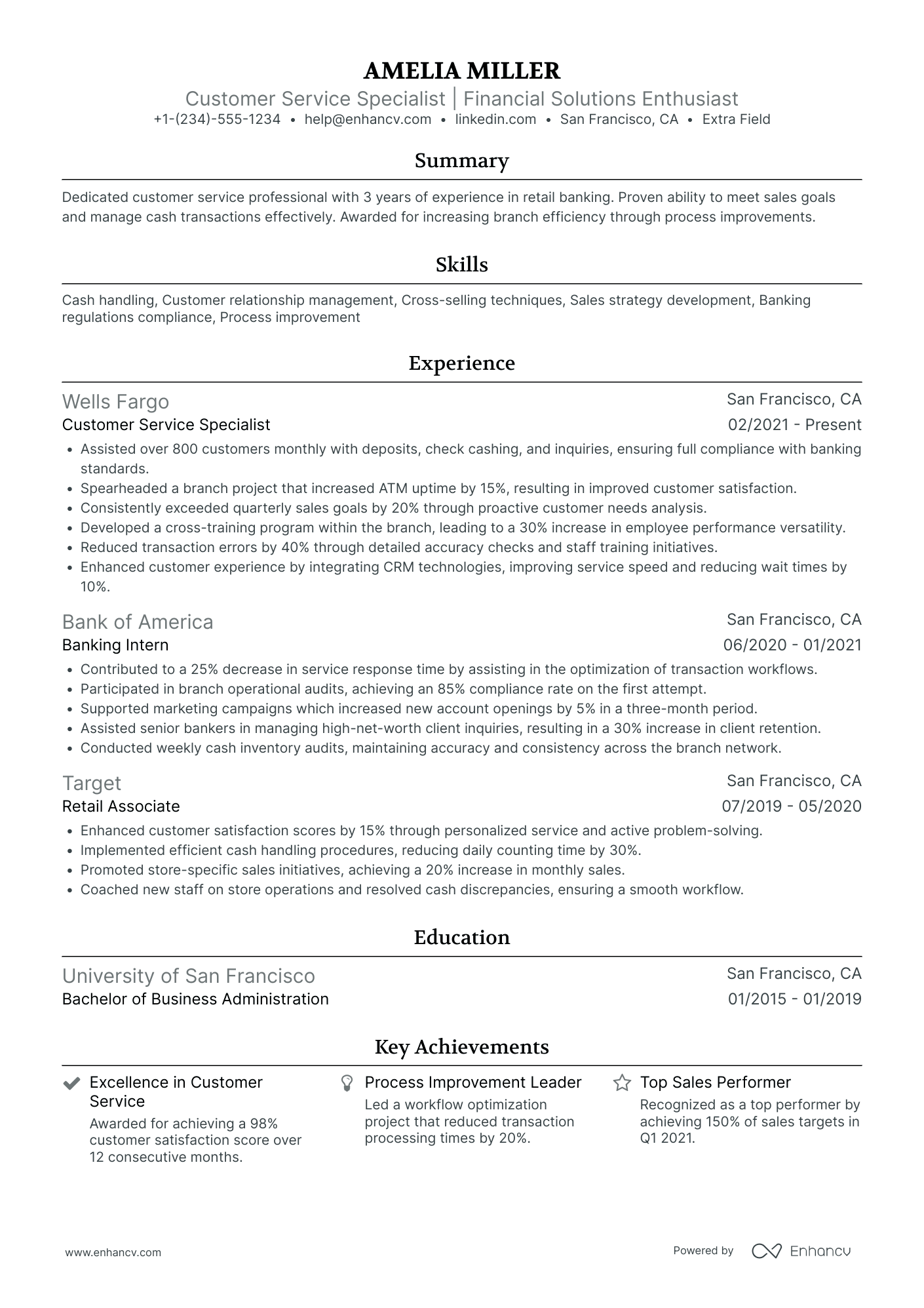

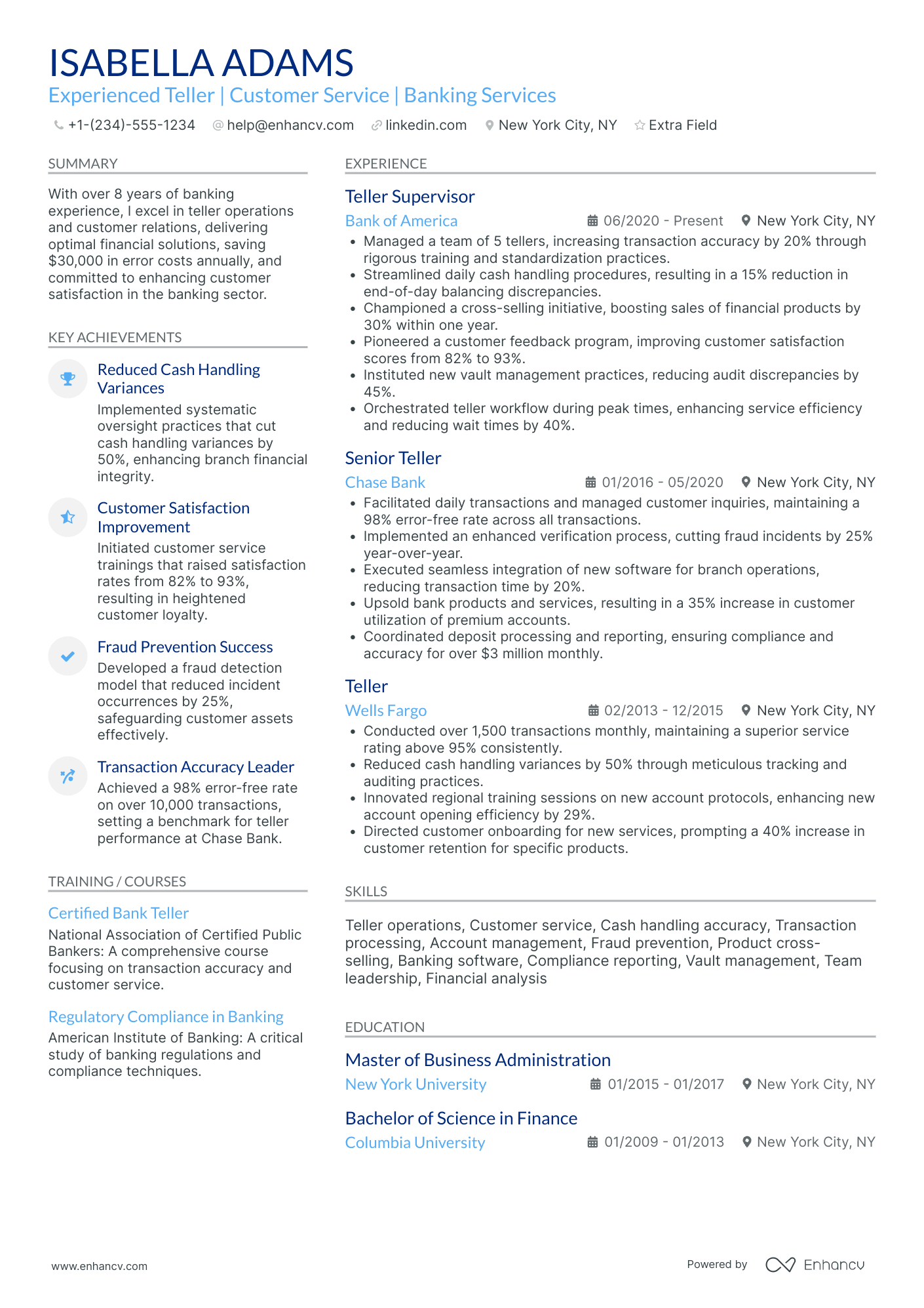

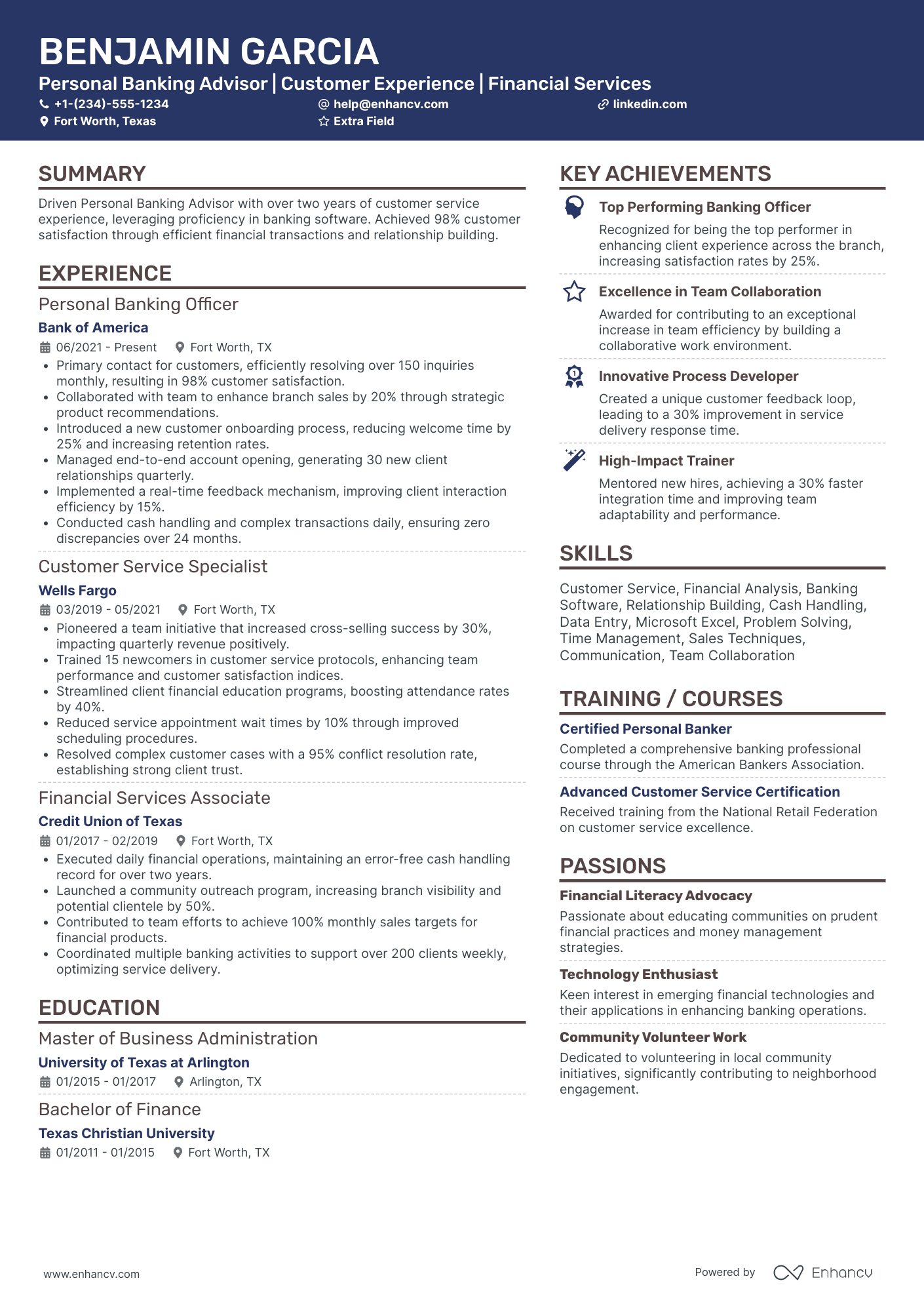

One resume challenge you may face as a personal banker is effectively showcasing the breadth of your financial expertise and customer service skills in a concise manner. Our guide provides targeted advice to help you distill your diverse experiences into a compelling narrative, ensuring your resume stands out to potential employers.

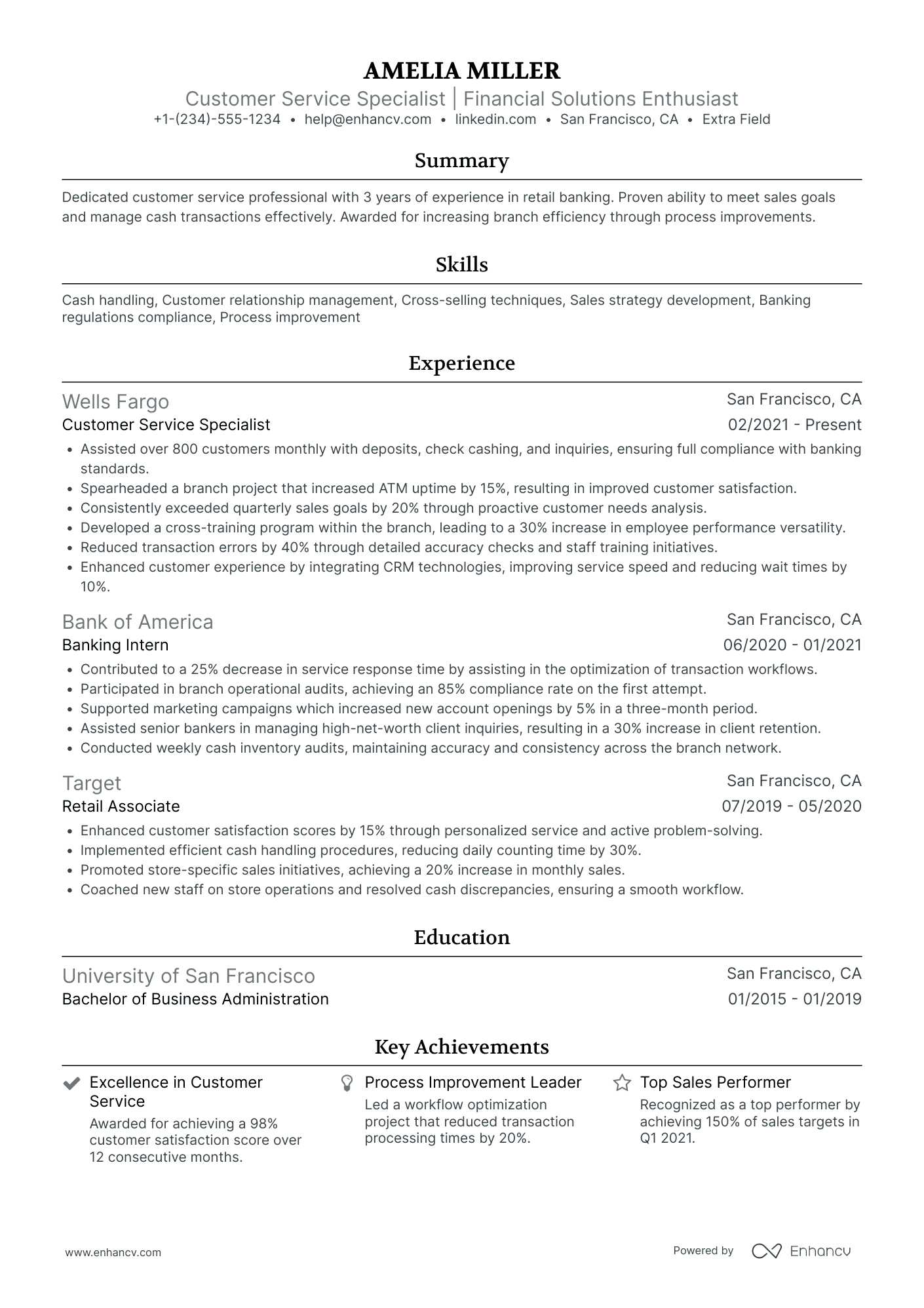

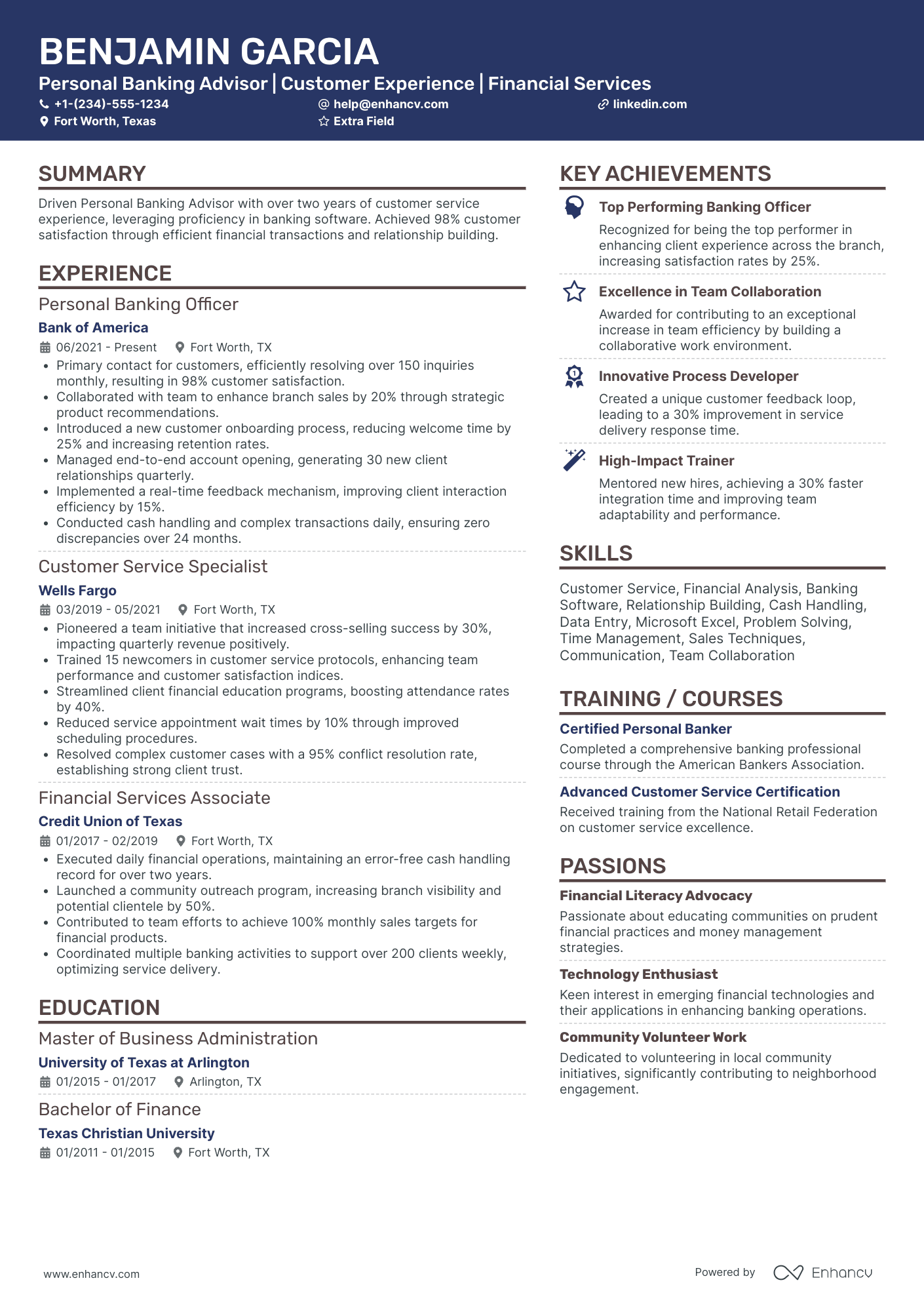

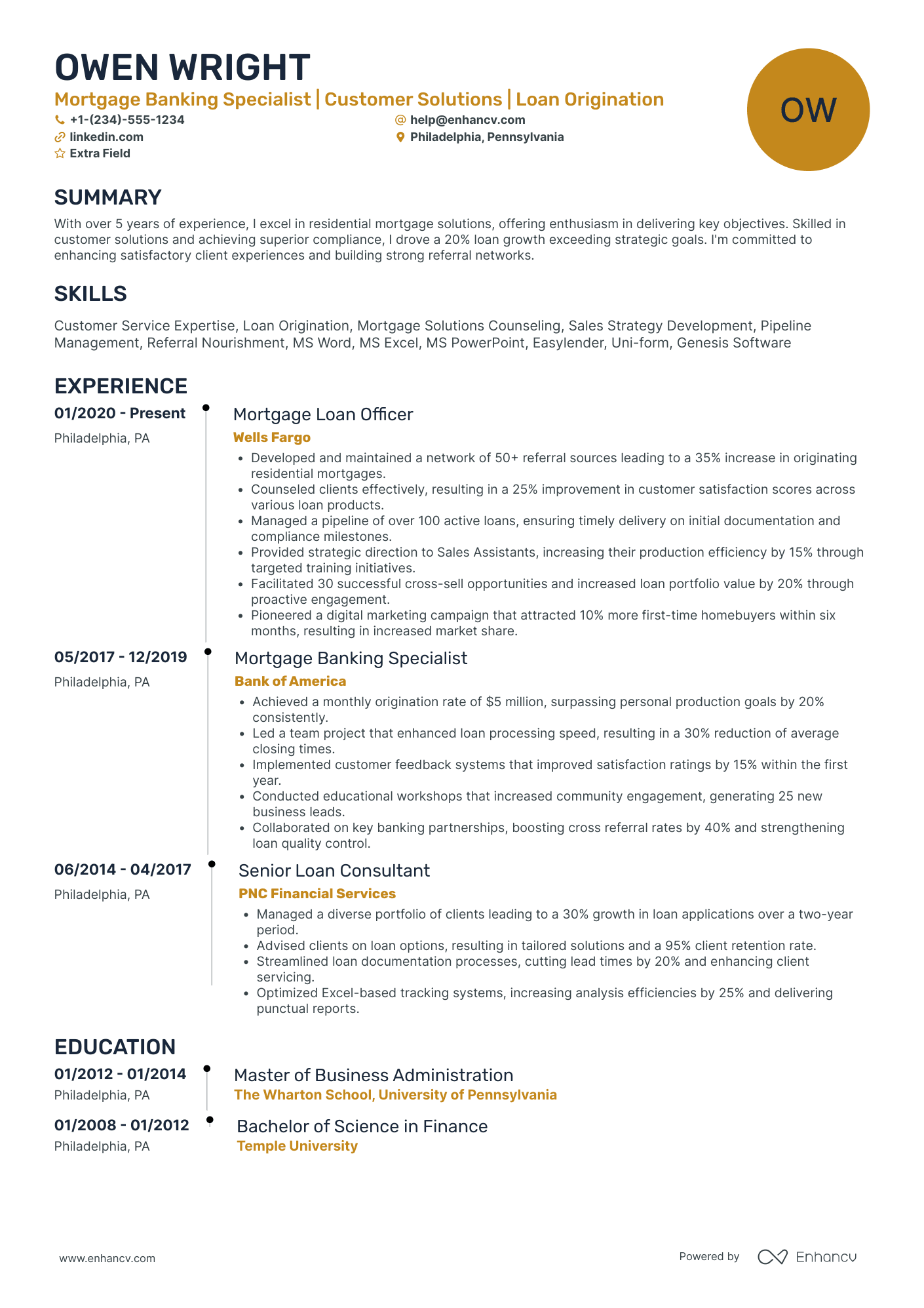

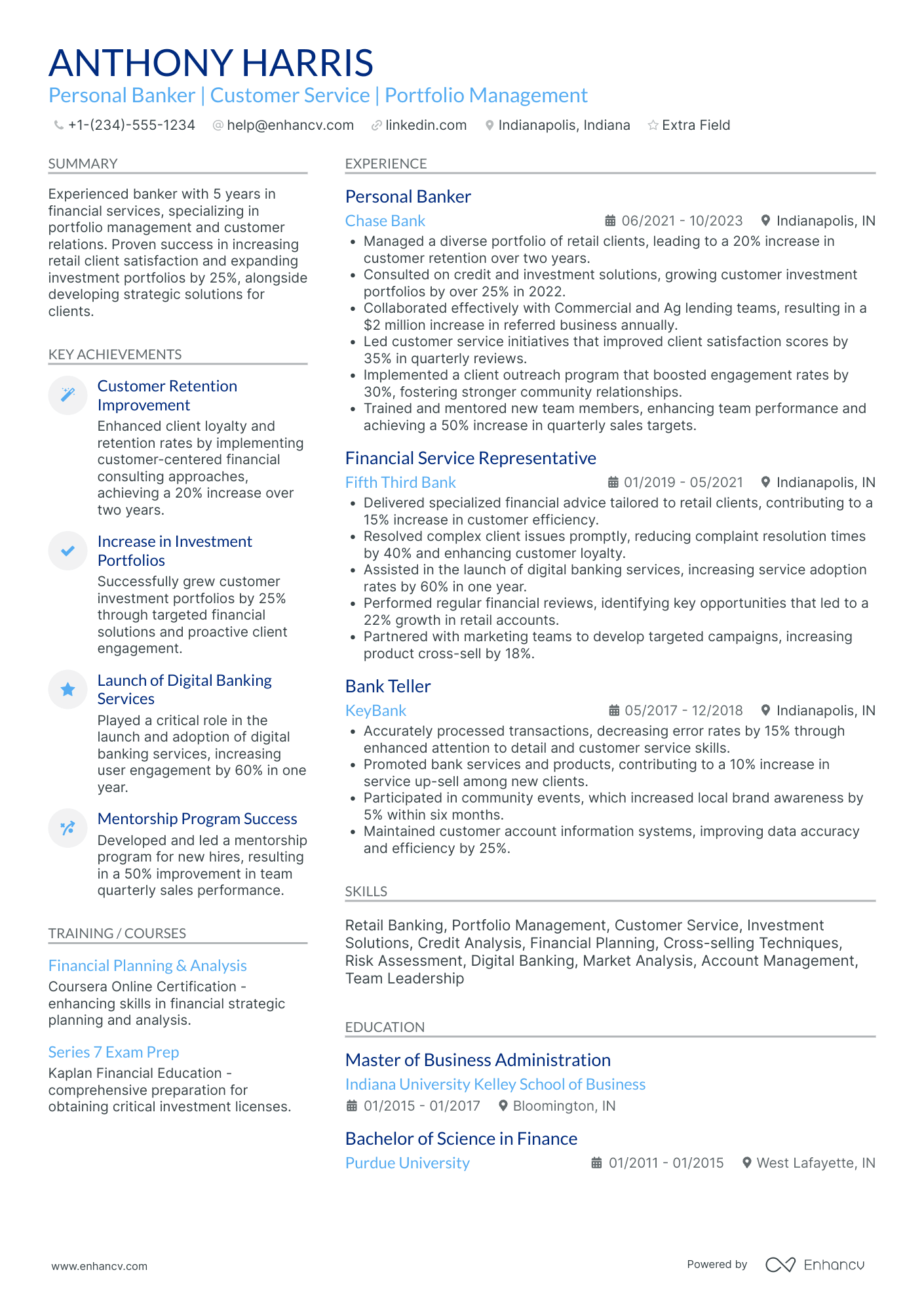

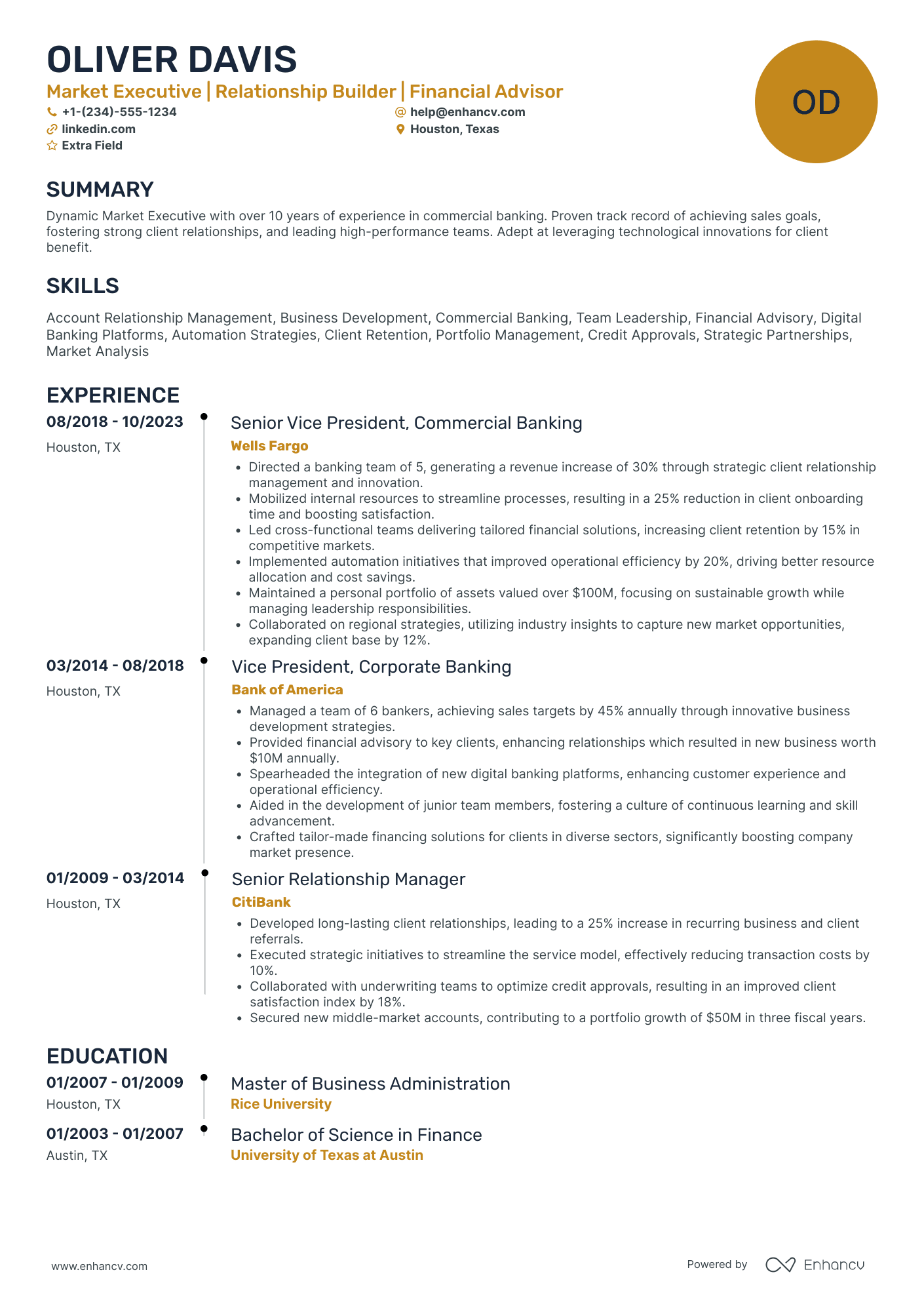

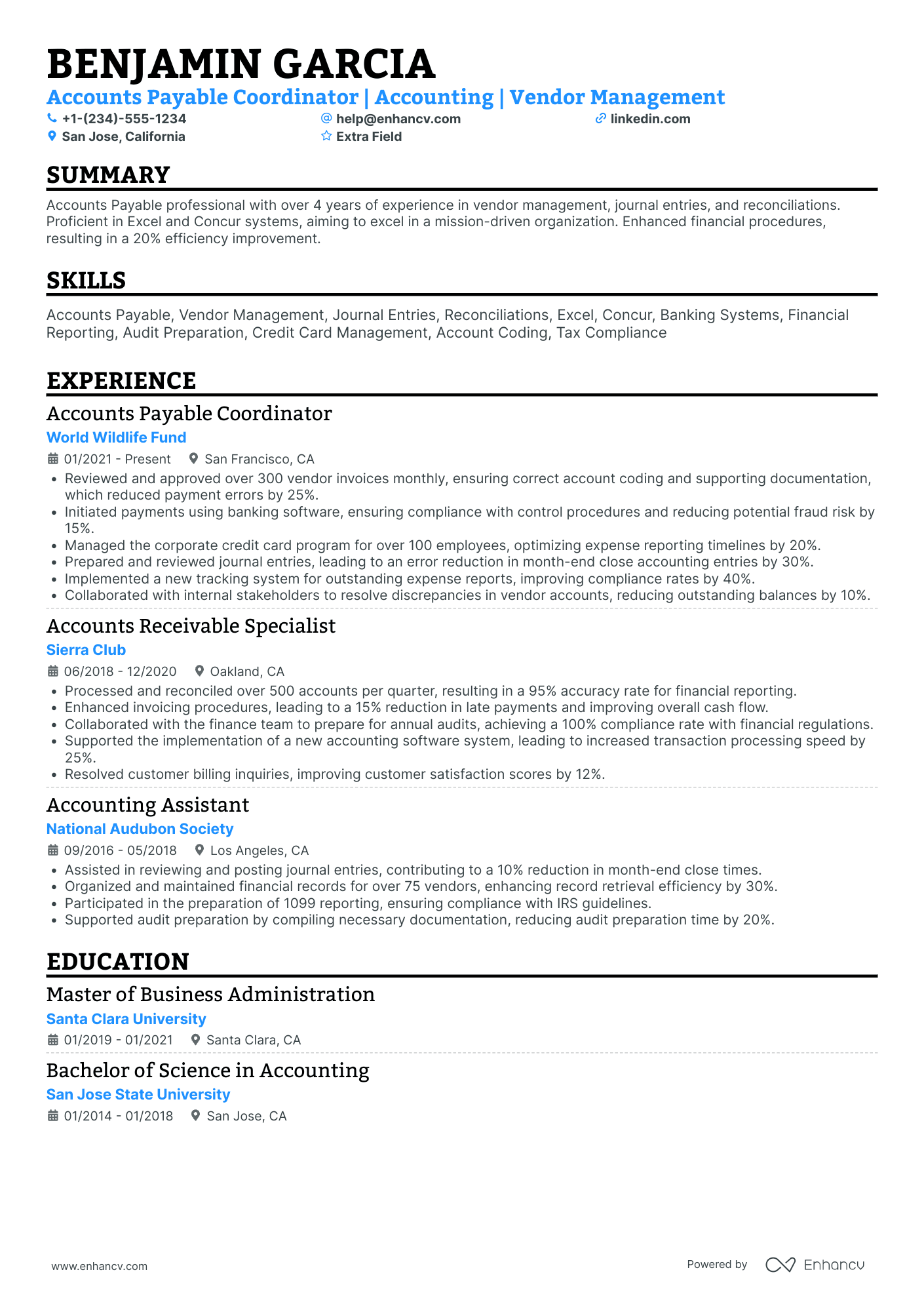

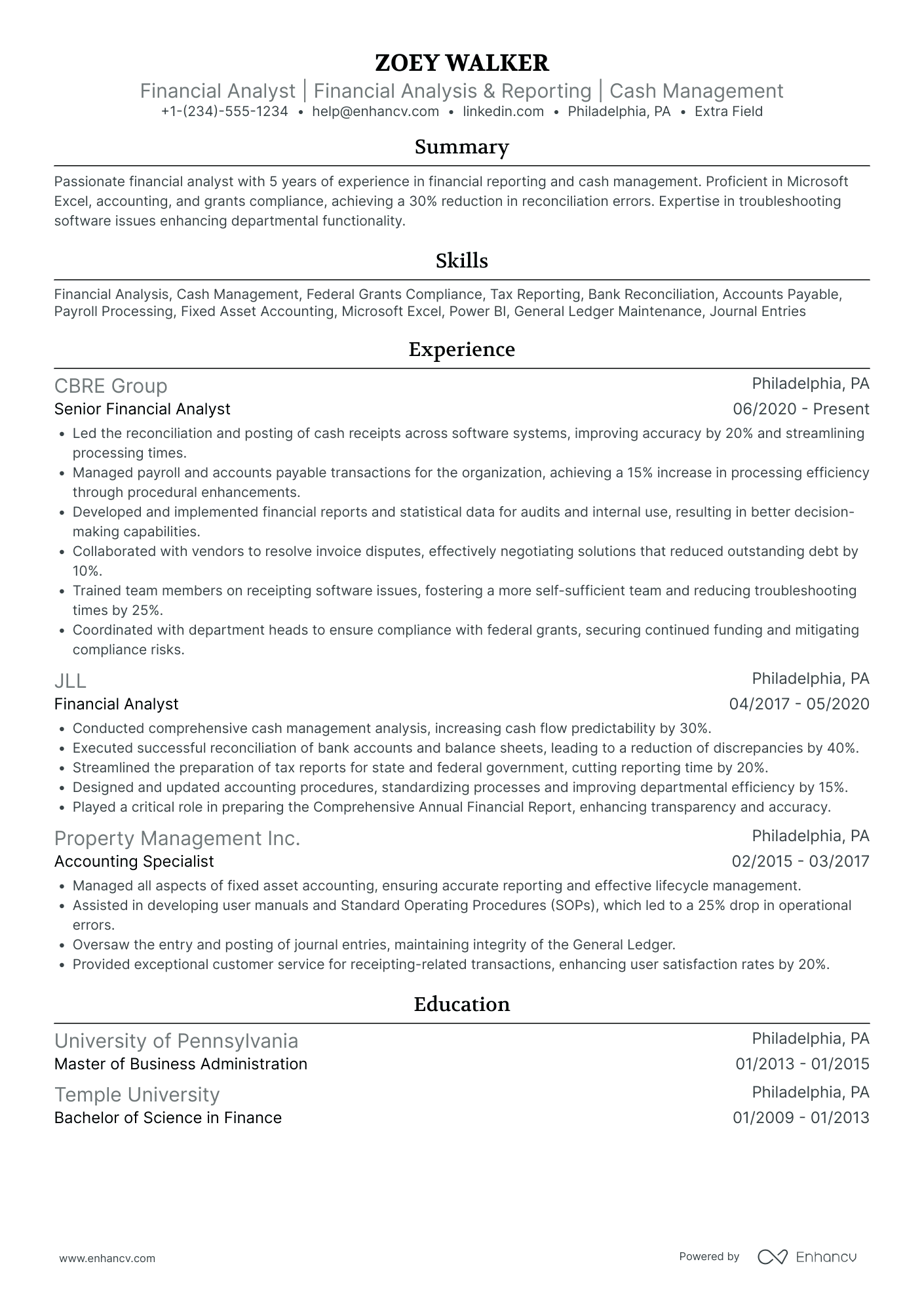

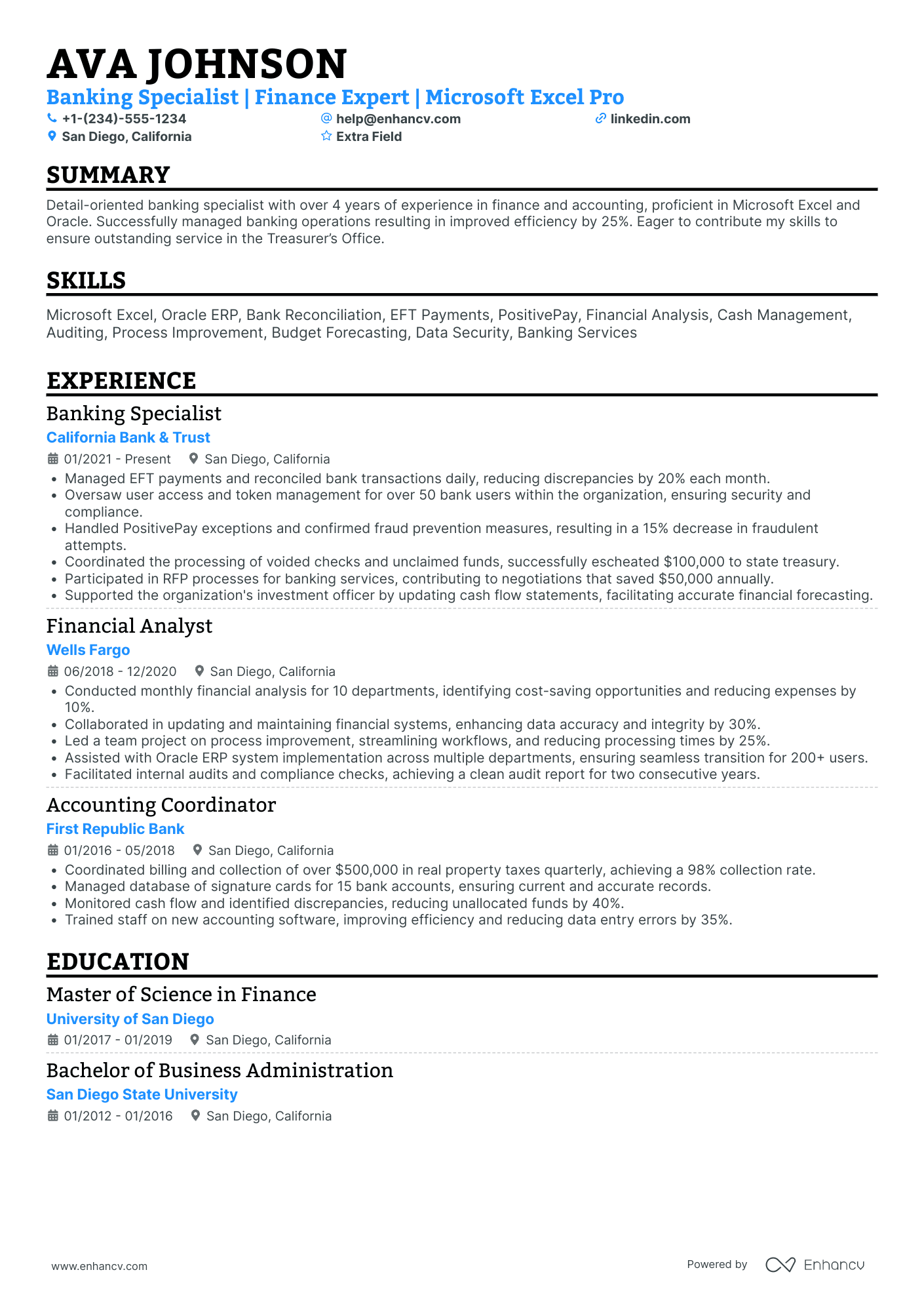

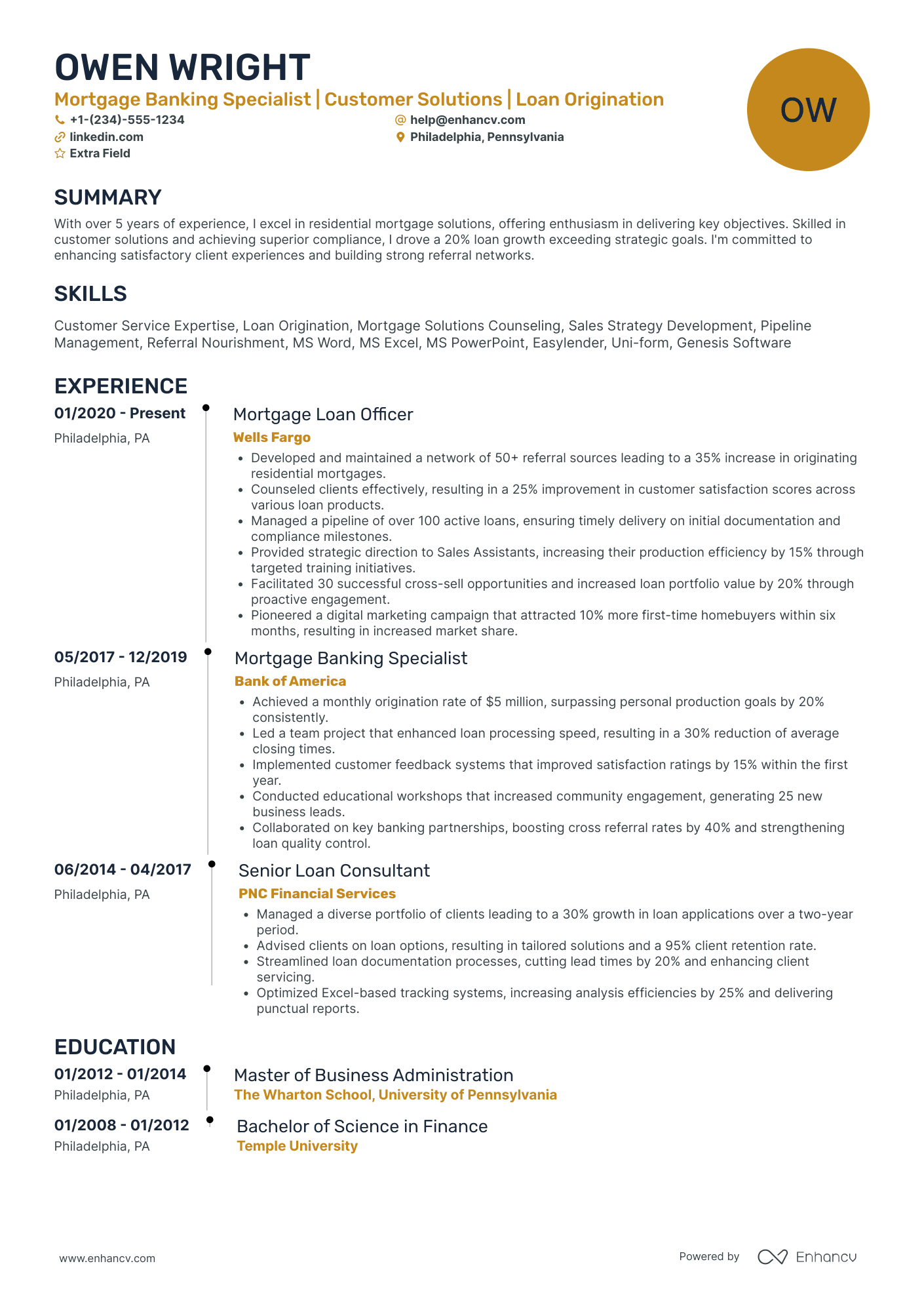

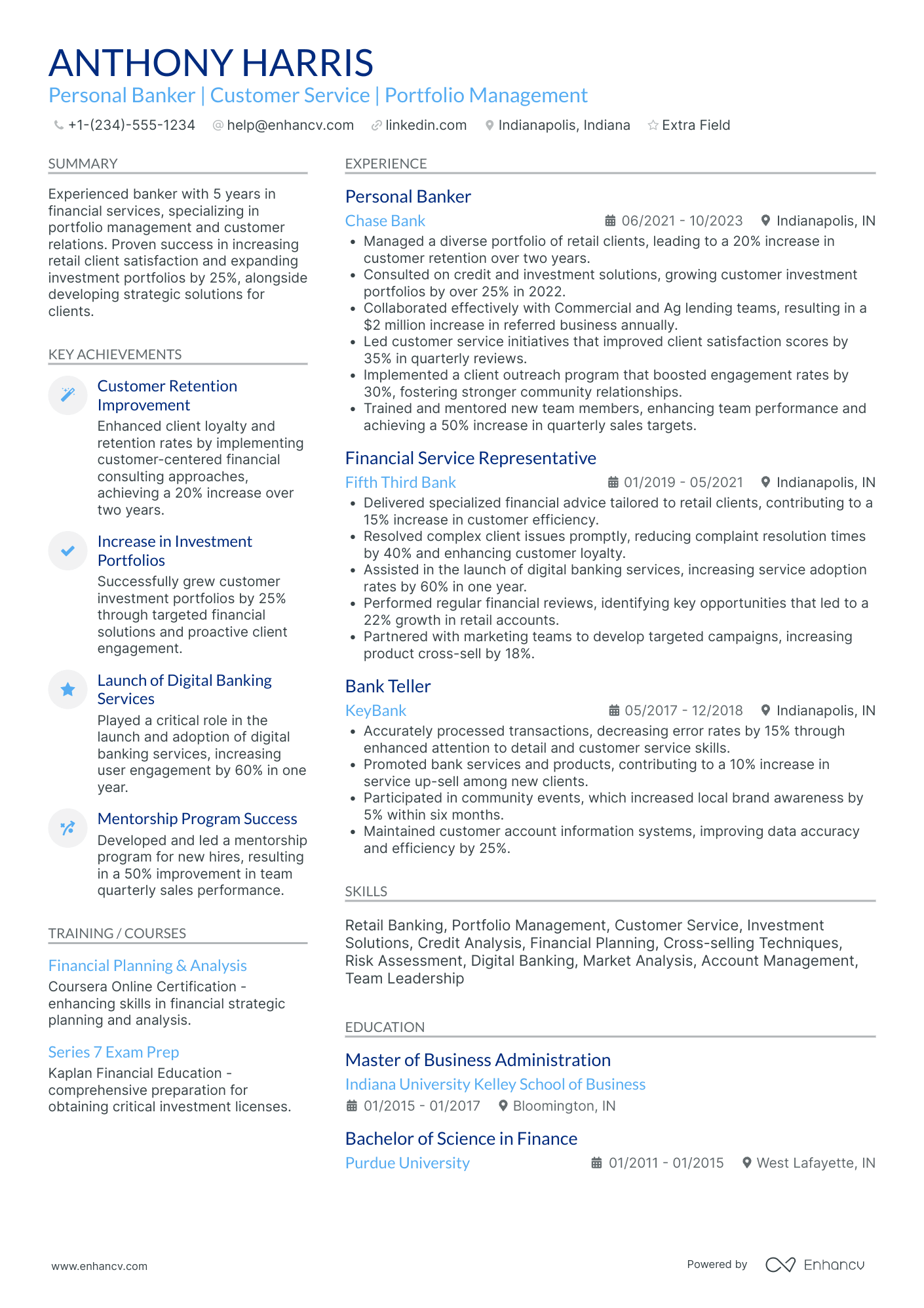

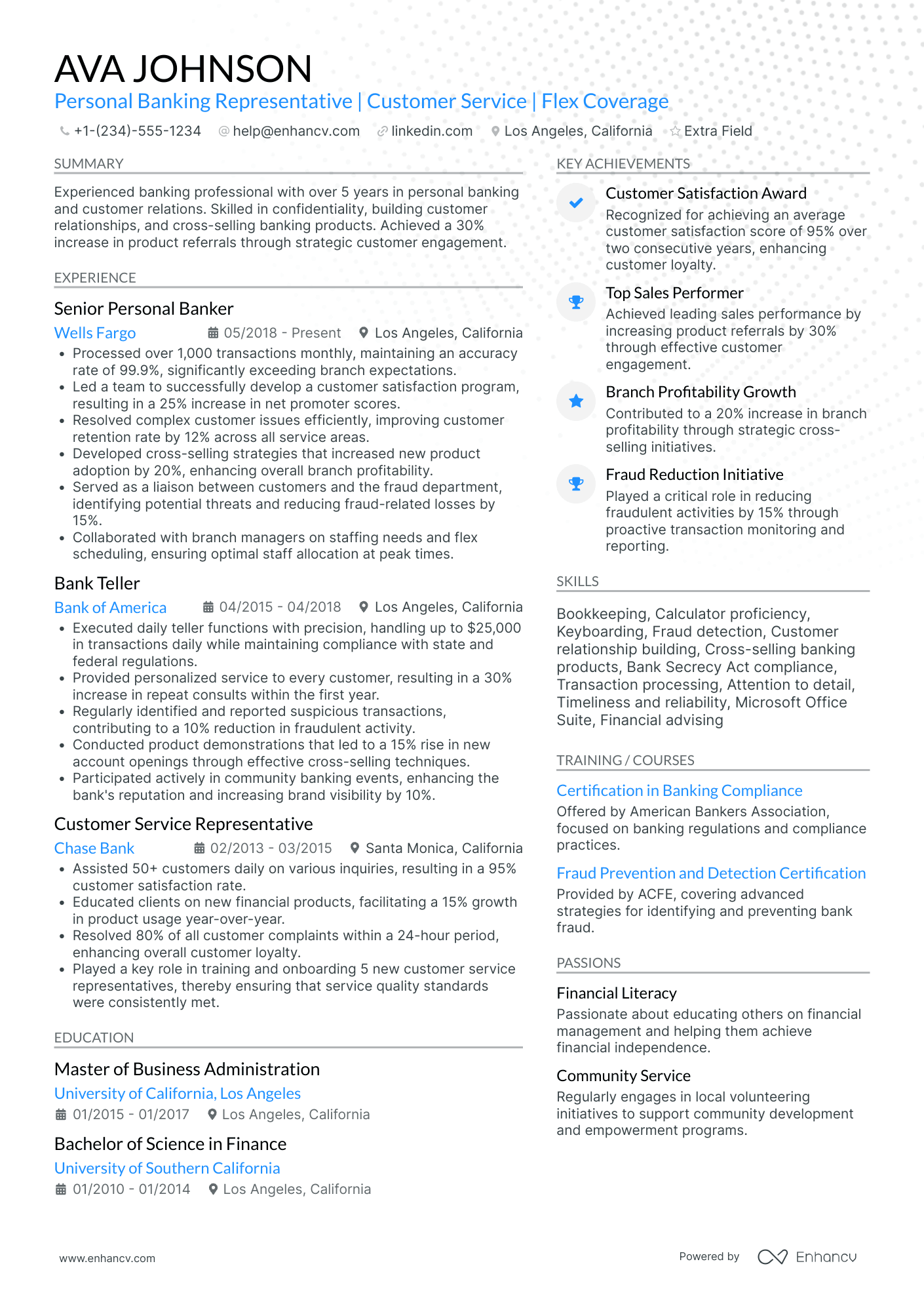

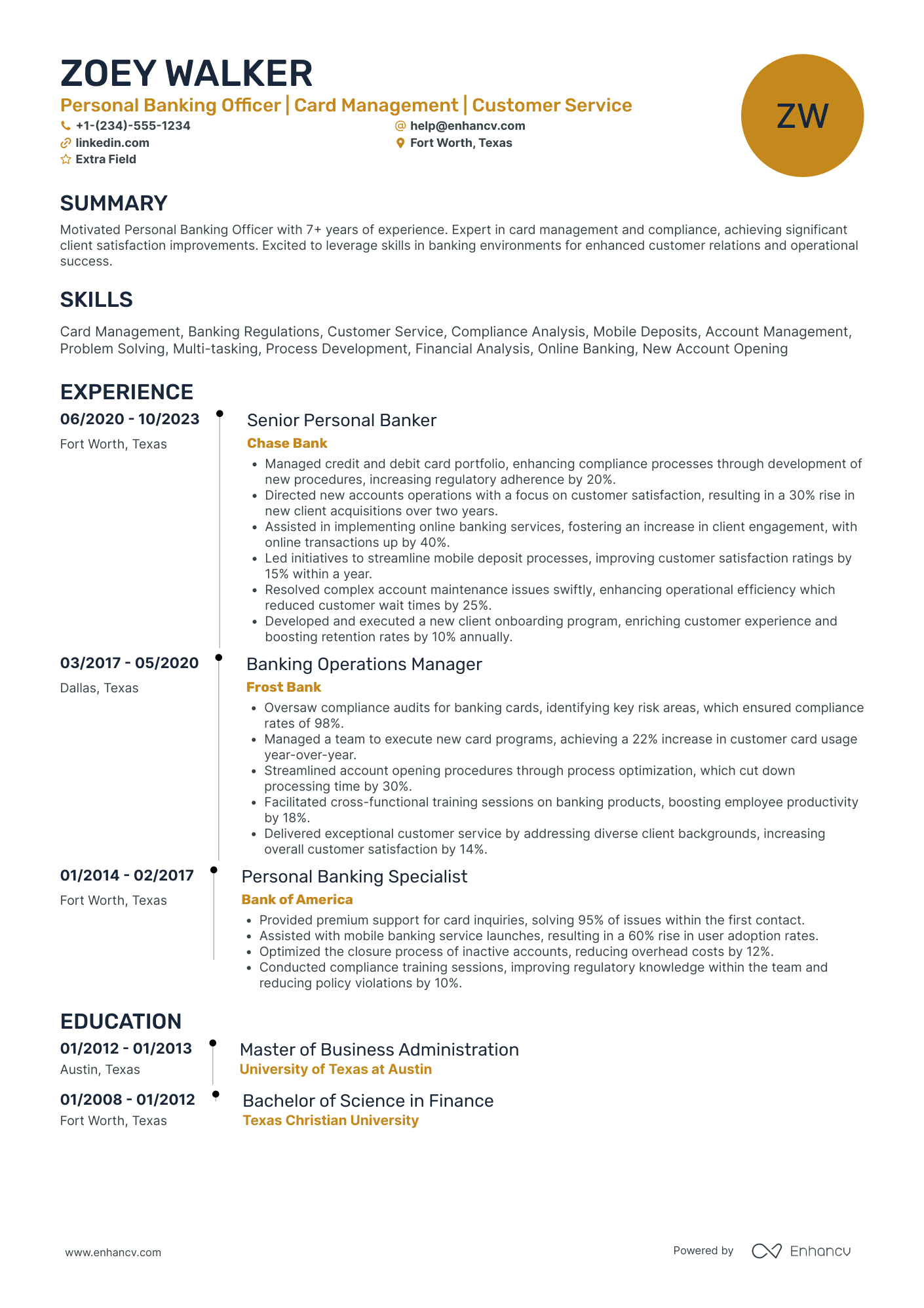

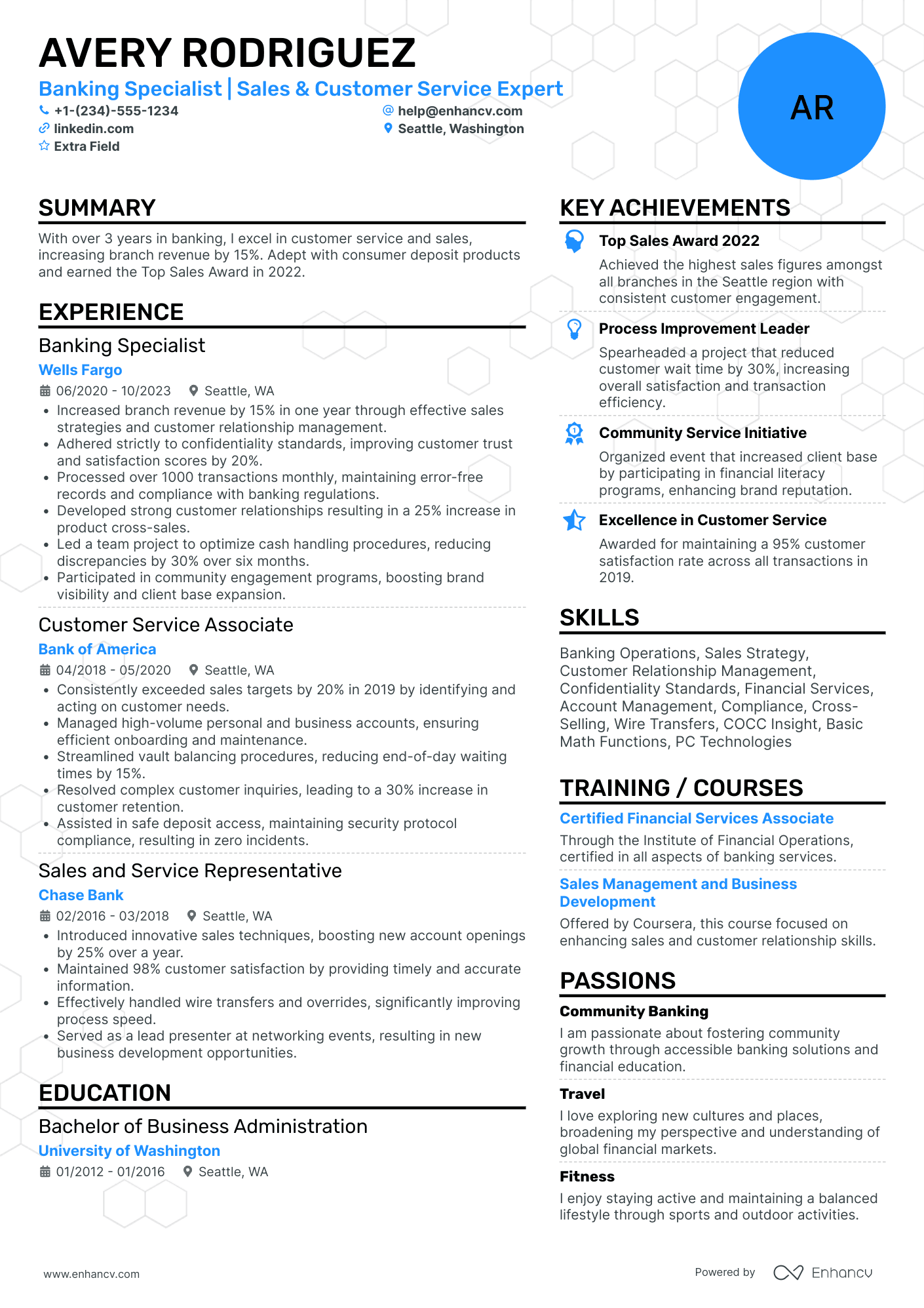

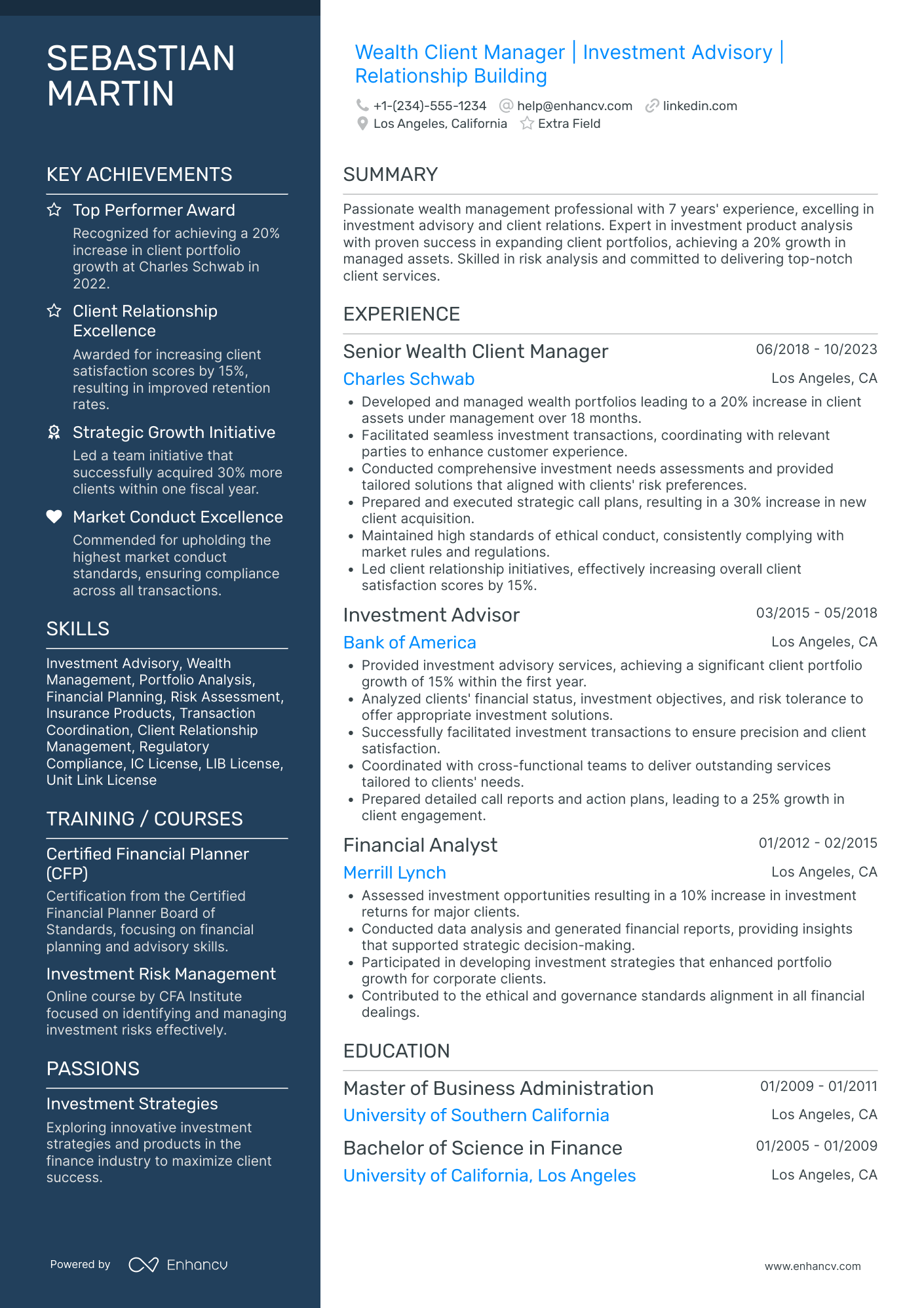

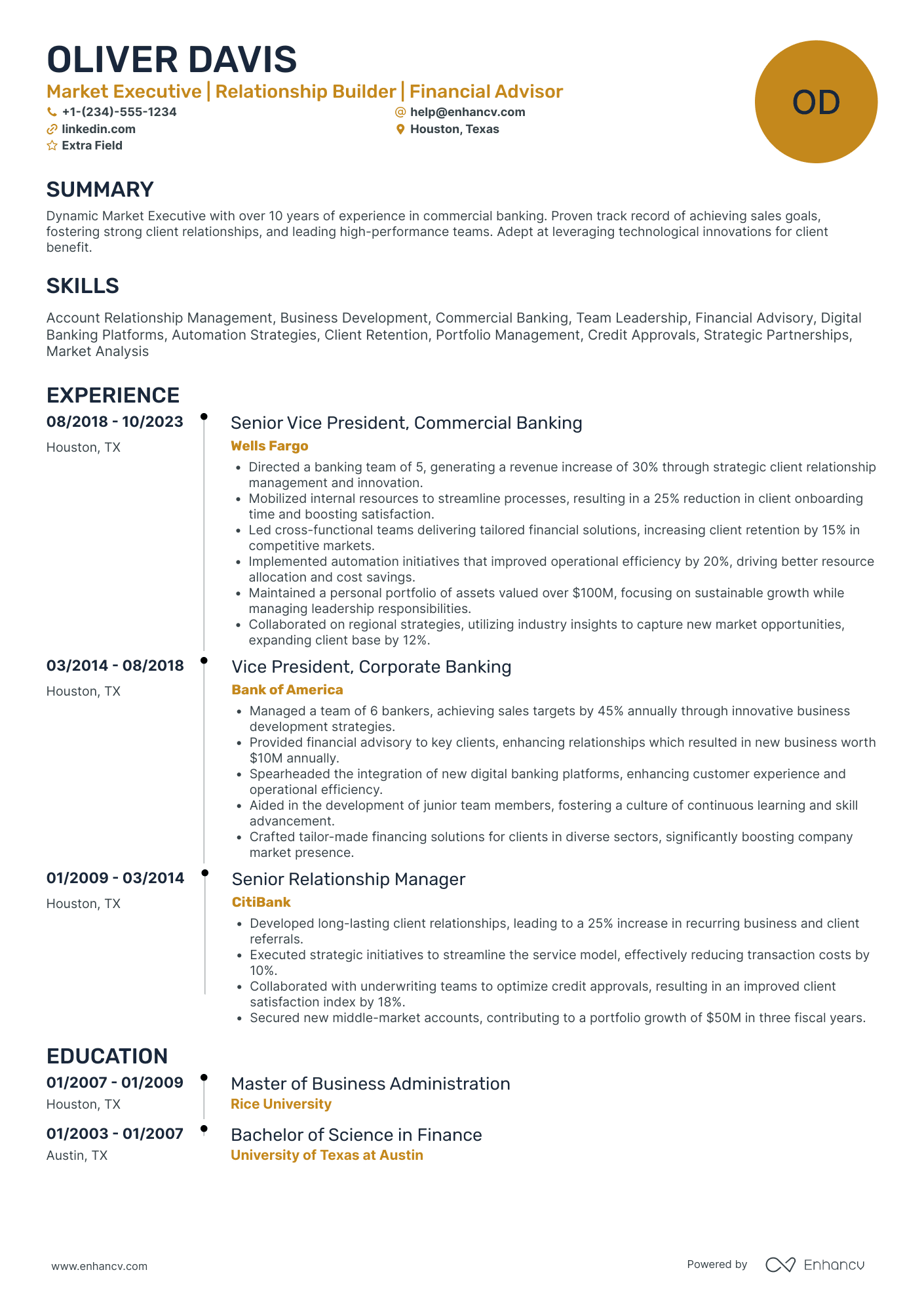

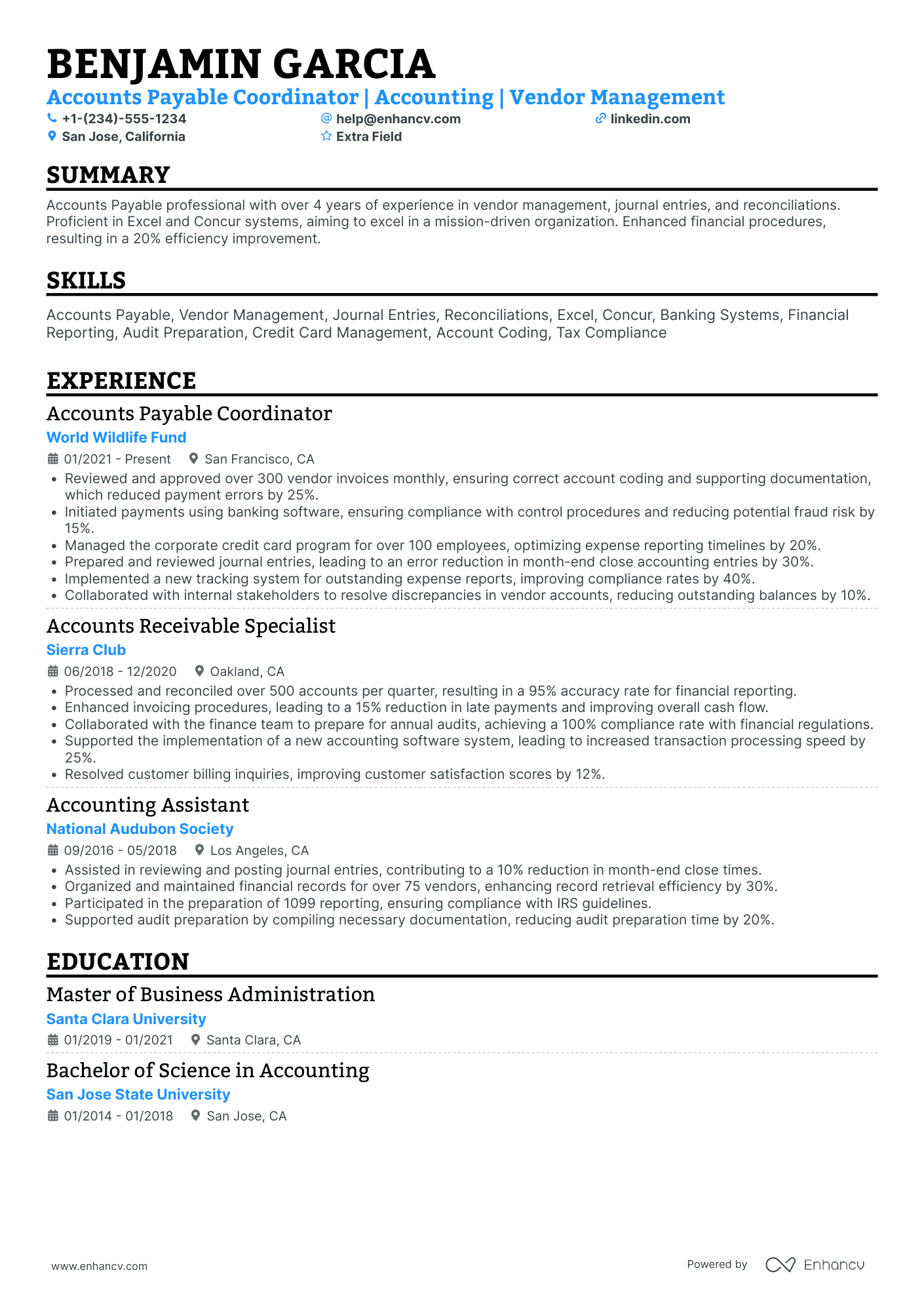

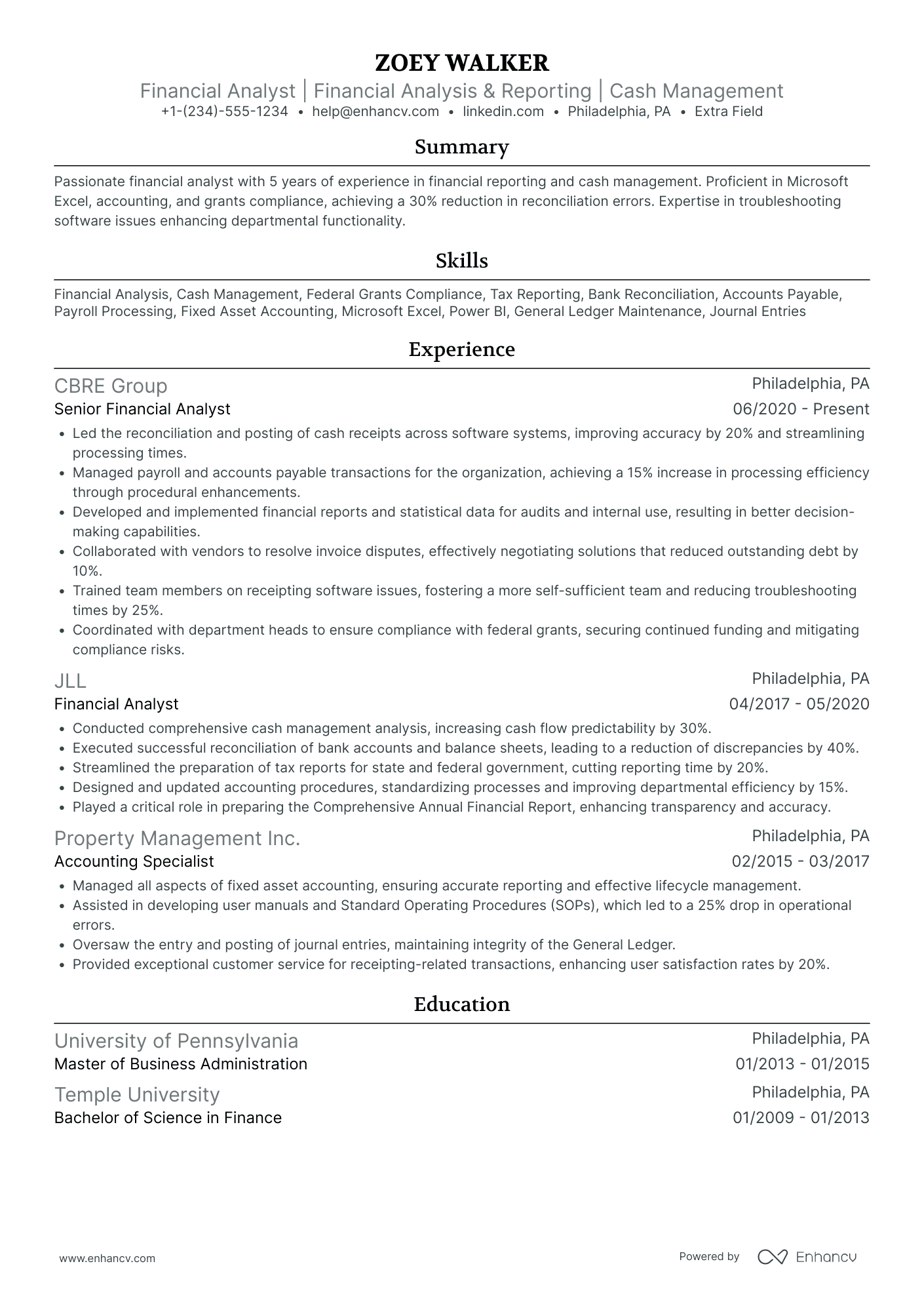

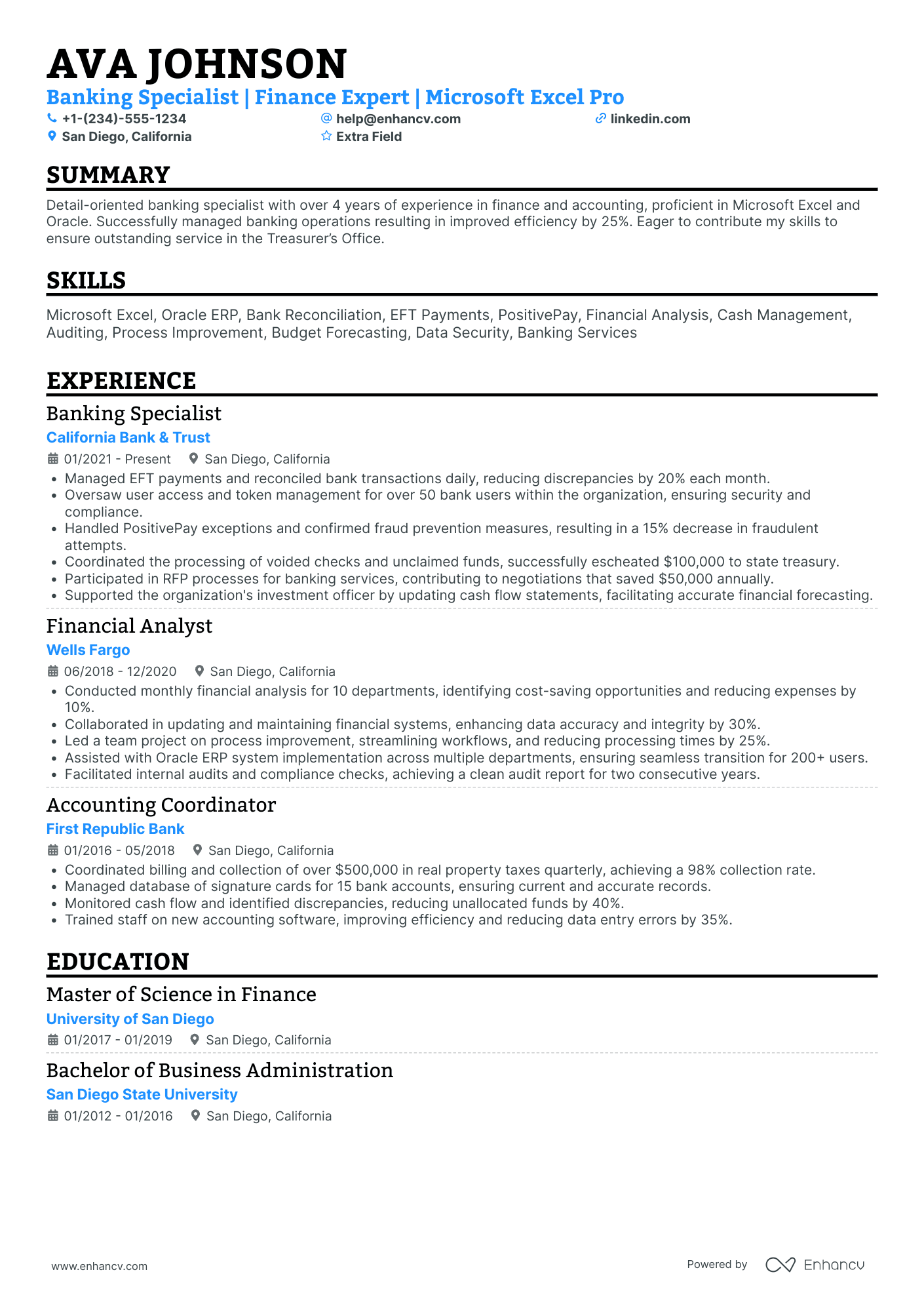

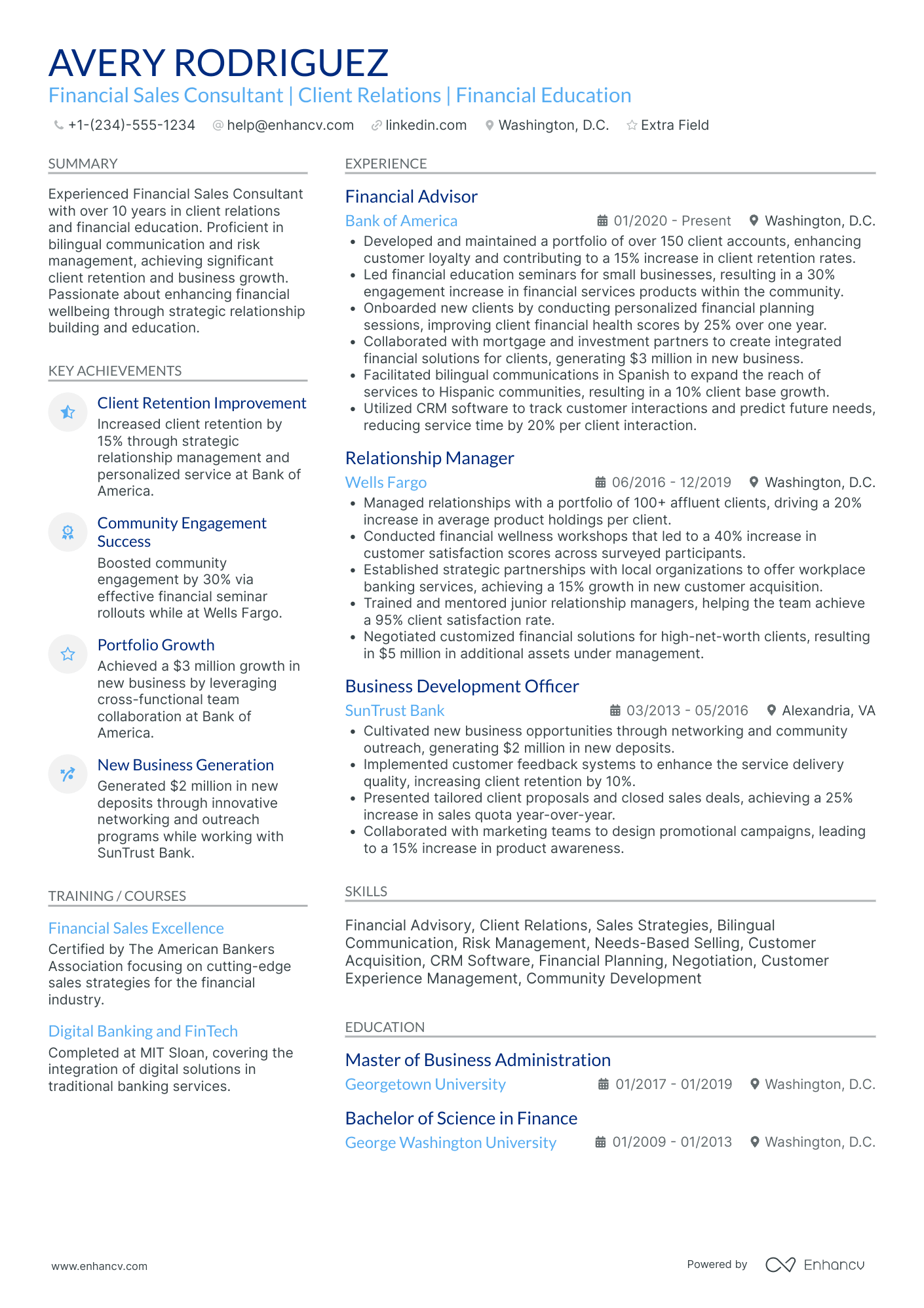

- Personal banker resume samples that got people hired at top companies.

- How to perfect the look-and-feel of your resume layout.

- How to showcase your achievements and skills through various resume sections.

- How you could hint to recruiters why your resume is the ideal profile for the job.

If the personal banker resume isn't the right one for you, take a look at other related guides we have:

Optimize your personal banker resume format to pass the recruiters' assessment

You may be wondering just how much time you need to spend on designing your personal banker resume.

What recruiters are looking for is systematised content that is clear and coherent. Thus, your personal banker resume needs to answer requirements and why you're the best candidate for the role from the get-go.

Often, a clear layout consists of:

- Sorting your experience in the reverse chronological order - starting with your most recent and relevant roles. This is an excellent choice for more experienced professionals;

- Writing your contact information (e.g. personal phone number and email address) and your portfolio or LinkedIn link in your personal banker resume header. If you're wondering to include a photo or not, always make sure that it's appropriate for the country you're applying in;

- Use the basic, most important personal banker resume sections - your experience, education, summary, etc. Use your resume's real estate wisely to tell a compelling, professional story and match job description's keywords;

- Don't go overboard with the length of your resume. One page is absolutely fine if you happen to have under a decade of relevant experience.

Are you still wondering if you should submit your personal banker resume in PDF or Word format ? The PDF has a few more advantages, as it doesn't change the format and the text can't be altered upon application.

Format matters most when your personal banker resume is assessed by the Applicant Tracker System (or the ATS).

The ATS parses resumes, looking for specific keywords, skills or experience that match the job description.

P.S. We recently did a study on how the ATS works and were able to demystify three of the biggest misconceptions about how it assesses candidate resumes.

To pass the ATS evaluation, select any of the serif or sans-serif fonts. Popular choices that would help your personal banker resume stand out include Raleway, Exo 2, Montserrat, etc.

Most traditionalists go for Arial or Times New Roman, but it's often the case that many candidates choose these fonts, and you'd thus lose points on the uniqueness front.

Think about the location of your application – Canadian resumes, for instance, might follow a different structure.

Upload & Check Your Resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

PRO TIP

Always remember that your personal banker certifications can be quantified across different resume sections, like your experience, summary, or objective. For example, you could include concise details within the expertise bullets of how the specific certificate has improved your on-the-job performance.

The five (plus) definite sections your resume for a personal banker job should include are:

- Header with your headline, contact details, and/or a preview of your work

- Summary (or objective) to pinpoint how your success aligns with the role

- Experience with bullets of your most relevant achievements in the field

- Skills to integrate vital job requirements (both technical and personal)

- Your further dedication to the field, showcased via relevant higher education and/or certifications

What recruiters want to see on your resume:

- Strong understanding of financial products and services, including savings accounts, loans, mortgages, and investment options.

- Proven experience in sales and customer service, with a track record of meeting and exceeding sales targets.

- Excellent interpersonal and communication skills, with the ability to build and maintain relationships with a diverse range of clients.

- Demonstrated ability to analyze financial information and provide tailored solutions to meet individual client needs.

- Proficiency in using banking software and customer relationship management (CRM) systems.

Quick formula for writing your personal banker resume experience section

Have you ever wondered why recruiters care about your personal banker expertise?

For starters, your past roles show that you've obtained the relevant on-the job training and expertise that'd be useful for the role.

What is more, the resume work experience section isn't just your work history , but:

- shows what you're capable of achieving based on your past success;

- proves your skills with (oftentimes, tangible) achievements;

- highlights the unique value of what it's like to work with you.

To ensure your resume work experience section is as effective as possible, follow this formula:

- start each bullet with a powerful, action verb , followed up by your responsibilities, and your workplace success.

The more details you can include - that are relevant to the job and linked with your skill set - the more likely you are to catch recruiters' attention.

Additionally, you can also scan the job advert for key requirements or buzzwords , which you can quantify across your experience section.

Not sure what we mean by this? Take inspiration from the personal banker resume experience sections below:

- Increased customer portfolio by 30% through effective cross-selling of banking products, including loans, lines of credit, and deposit accounts.

- Developed and maintained relationships with 200+ high-net-worth clients, providing personalized financial advice and services.

- Spearheaded a successful financial literacy workshop series for young adults, which saw a 40% increase in attendance by the final session.

- Efficiently processed daily client transactions, including account openings, loan applications, and investment inquiries, with a focus on prompt and accurate service.

- Led a bank-wide initiative to improve client experience, resulting in a 15% boost in overall customer satisfaction ratings.

- Collaborated with the retail banking team to host quarterly financial planning seminars, leading to a 25% increase in IRA and 401(k) plan enrollments.

- Implemented an advanced client relationship management system that improved tracking of customer interactions and product offerings.

- Orchestrated a team-focused approach to exceed quarterly sales targets by an average of 20%, focusing on customer acquisition and retention.

- Designed a bespoke financial strategy for a portfolio of 100+ SMB clients, aiding in average revenue growth of 22% per client.

- Managed risk and compliance in accordance with bank policies, significantly reducing exposure to financial fraud and misconduct.

- Acted as a mentor for junior bankers, enhancing their product knowledge and sales techniques, leading to a team-wide improvement in performance metrics.

- Initiated and oversaw the transition of customer accounts to a new digital banking platform, ensuring a smooth migration with 95% customer retention rate.

- Provided expert financial advice on mortgage and insurance products, which contributed to a 35% increase in mortgage loan volume.

- Created comprehensive financial plans tailored to the individual goals of clients, resulting in a 50% increase in investment product uptake.

- Organized and led community outreach programs to promote financial literacy, establishing trust and brand loyalty within the community.

- Achieved the 'Top Personal Banker' award for two consecutive years by consistently exceeding personal and branch targets.

- Developed a robust pipeline for new business by leveraging a mix of cold-calling, community networking, and existing client referrals.

- Enhanced the onboarding process for new clients, shortening the average account setup time by 25% while maintaining high data accuracy standards.

- Central figure in a strategic team that launched a new credit card product, capturing 10% of the market share within the first year.

- Improved client retention rates by 18% through the introduction of a personalized contact program and consistent delivery of exceptional service.

- Analyzed client financial data to recommend personalized wealth management solutions, facilitating an average of $1 million in new investment per month.

- Played a pivotal role in a project team that streamlined loan processing, which reduced turnaround time by 30% and improved customer satisfaction.

- Conducted comprehensive market analysis to identify new business opportunities, resulting in the successful roll-out of tailored financial products for the millennial segment.

- Facilitated in-depth training sessions for new bankers, which enhanced their understanding of complex financial products and improved their sales efficacy by 20%.

The following content includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top responsibilities present on the task lists for personal banker professionals.

Top Responsibilities for Personal Banker:

- Interview clients to determine their current income, expenses, insurance coverage, tax status, financial objectives, risk tolerance, or other information needed to develop a financial plan.

- Analyze financial information obtained from clients to determine strategies for meeting clients' financial objectives.

- Answer clients' questions about the purposes and details of financial plans and strategies.

- Review clients' accounts and plans regularly to determine whether life changes, economic changes, environmental concerns, or financial performance indicate a need for plan reassessment.

- Manage client portfolios, keeping client plans up-to-date.

- Recommend to clients strategies in cash management, insurance coverage, investment planning, or other areas to help them achieve their financial goals.

- Recommend financial products, such as stocks, bonds, mutual funds, or insurance.

- Implement financial planning recommendations, or refer clients to someone who can assist them with plan implementation.

- Contact clients periodically to determine any changes in their financial status.

- Prepare or interpret for clients information, such as investment performance reports, financial document summaries, or income projections.

Quantifying impact on your resume

- Detail the volume of transactions processed daily to showcase efficiency and capability.

- Specify the dollar amount of loans originated to demonstrate contribution to business growth.

- Highlight the number of new accounts opened to reflect sales acumen and customer acquisition skills.

- Mention the percentage of client retention to illustrate commitment to customer satisfaction and loyalty.

- Include the number of cross-sold products to indicate proficiency in identifying customer needs and increasing bank's profitability.

- State the dollar value of assets under management to quantify your trustworthiness and investment management expertise.

- Report the size of the portfolio you manage to convey scope of responsibility and trust placed in you.

- Indicate the number of team members you supervise or train to prove leadership and teamwork abilities.

Action verbs for your personal banker resume

Experience section for candidates with zero-to-none experience

While you may have less professional experience in the field, that doesn't mean you should leave this section of your resume empty or blank.

Consider these four strategies on how to substitute the lack of experience with:

- Volunteer roles - as part of the community, you've probably gained valuable people (and sometimes even technological capabilities) that could answer the job requirements

- Research projects - while in your university days, you may have been part of some cutting-edge project to benefit the field. Curate this within your experience section as a substitute for real-world experience

- Internships - while you may consider that that summer internship in New York was solely mandatory to your degree, make sure to include it as part of your experience, if it's relevant to the role

- Irrelevant previous jobs - instead of detailing the technologies you've learned, think about the transferable skills you've gained.

Recommended reads:

PRO TIP

Always remember that your personal banker certifications can be quantified across different resume sections, like your experience, summary, or objective. For example, you could include concise details within the expertise bullets of how the specific certificate has improved your on-the-job performance.

Personal banker resume skills section: writing about your hard skills and soft skills

Recruiters always care about the skill set you'd bring about to the personal banker role. That's why it's a good idea to curate yours wisely, integrating both hard (or technical) and soft skills. Hard skills are the technology and software you're apt at using - these show your suitability for the technical aspect of the role. They are easy to track via your experience, certifications, and various resume sections. Your soft skills are those personality traits you've gained over time that show how you'd perform in the specific team, etc. Soft skills are more difficult to qualify but are definitely worth it - as they make you stand out and show your adaptability to new environments. How do you build the skills section of your resume? Best practices point that you could:

- Include up to five or six skills in the section as keywords to align with the advert.

- Create a specific technical skills section to highlight your hard skills aptitude.

- Align the culture of the company you're applying to with your soft skills to determine which ones should be more prominent in your skills section.

- Make sure you answer majority of the job requirements that are in the advert within your skills section.

A personal banker's resume requires a specific skill set that balances both industry-specific hard skills with personal, soft skills. Discover the perfect mix for the personal banker role from our list:

Top skills for your personal banker resume:

Customer Relationship Management (CRM) Software

Financial Analysis Tools

Loan Management Software

Point of Sale (POS) Systems

Microsoft Excel

Accounting Software

Budgeting Tools

Investment Software

Data Entry Software

Online Banking Platforms

Communication Skills

Customer Service Orientation

Problem-Solving Skills

Attention to Detail

Time Management

Interpersonal Skills

Sales Skills

Adaptability

Teamwork

Empathy

Next, you will find information on the top technologies for personal banker professonals from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license.

Top technologies for Personal Banker’s resume:

- Microsoft Business Contact Manager

- Salesforce software

- Financial planning presentation software

- Microsoft PowerPoint

- Oracle E-Business Suite Financials

- WealthTec Foundations

PRO TIP

List all your relevant higher education degrees within your resume in reverse chronological order (starting with the latest). There are cases when your PhD in a particular field could help you stand apart from other candidates.

The importance of your certifications and education on your personal banker resume

Pay attention to the resume education section . It can offer clues about your skills and experiences that align with the job.

- List only tertiary education details, including the institution and dates.

- Mention your expected graduation date if you're currently studying.

- Exclude degrees unrelated to the job or field.

- Describe your education if it allows you to highlight your achievements further.

Your professional qualifications: certificates and education play a crucial role in your personal banker application. They showcase your dedication to gaining the best expertise and know-how in the field. Include any diplomas and certificates that are:

- Listed within the job requirements or could make your application stand out

- Niche to your industry and require plenty of effort to obtain

- Helping you prepare for professional growth with forward-facing know-how

- Relevant to the personal banker job - make sure to include the name of the certificate, institution you've obtained it at, and dates

Both your certificates and education section need to add further value to your application. That's why we've dedicated this next list just for you - check out some of the most popular personal banker certificates to include on your resume:

The top 5 certifications for your personal banker resume:

- Certified personal banker (CPB) - American Bankers Association (ABA)

- Financial Services Certified Professional (FSCP) - The American College of Financial Services

- General Securities Representative Exam (Series 7) - Financial Industry Regulatory Authority (FINRA)

- Uniform Combined State Law Examination (Series 66) - North American Securities Administrators Association (NASAA) in coordination with FINRA

- Certified Financial Planner (CFP) - Certified Financial Planner Board of Standards, Inc.

The content below includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top associations for personal banker professionals.

Top US associations for a Personal Banker professional

- National Association of Personal Financial Advisors

- AICPA and CIMA

- American Bar Association

- Certified Financial Planner Board of Standards

- CFA Institute

PRO TIP

Mention specific courses or projects that are pertinent to the job you're applying for.

Recommended reads:

Should you write a resume summary or an objective?

No need to research social media or ask ChatGPT to find out if the summary or objective is right for your personal banker resume.

- Experienced candidates always tend to go for resume summaries. The summary is a three to five sentence long paragraph that narrates your career highlights and aligns your experience to the role. In it you can add your top skills and career achievements that are most impressive.

- Junior professionals or those making a career change, should write a resume objective. These shouldn't be longer than five sentences and should detail your career goals . Basically, how you see yourself growing in the current position and how would your experience or skill set could help out your potential employers.

Think of both the resume summary and objective as your opportunity to put your best foot forward - from the get go - answering job requirements with skills.

Use the below real-world personal banker professional statements as inspiration for writing your resume summary or objective.

Resume summaries for a personal banker job

- Seasoned personal banker with over 10 years of experience in fostering robust client relationships and delivering tailored financial solutions. Leveraging a deep understanding of investment products, estate planning, and debt management strategies, successfully grew a client portfolio by 25% within one financial year.

- Dynamic professional with a 6-year tenure at a top-performing tech firm, now eager to transition into personal banking. Demonstrated analytical acumen and negotiation skills, combined with a proven track record in sales management, amassing a $5M revenue increase through strategic partnerships and innovative product launches.

- Accomplished educator with a Master's in Business Administration looking to apply 8 years of experience in curriculum development and financial literacy coaching to a career in personal banking. Recognized for enhancing student understanding of personal finance by 40%, intent on leveraging communication skills to advance client financial goals.

- Dedicated customer service manager with an eye for details, seeking to leverage 15 years of experience in nurturing client relationships, problem-solving, and scaling customer satisfaction ratings by over 30% to the personal banking industry.

- Eager to embark on a personal banking career path, bringing forward a strong passion for financial empowerment and wealth-building strategies. Committed to acquiring the necessary knowledge and skills to become a trusted advisor and excel in helping clients achieve their long-term financial objectives.

- An aspiring personal banker, driven to develop a profound understanding of financial products and market dynamics, aiming to deliver exemplary service in managing and growing client portfolios. Keen on contributing fresh perspectives and enthusiasm to collaborate with seasoned professionals in achieving outstanding client satisfaction.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Average salary info by state in the US for personal banker professionals

Local salary info for Personal Banker.” Source: My Next Move, National Center for O*NET Development. Accessed 10/15/2024

| State | Average Salary (in USD) |

|---|---|

| US National Average | $99,580 |

| California (CA) | $103,330 |

| Texas (TX) | $81,660 |

| Florida (FL) | $92,770 |

| New York (NY) | $161,760 |

| Pennsylvania (PA) | $100,370 |

| Illinois (IL) | $95,870 |

| Ohio (OH) | $82,030 |

| Georgia (GA) | $98,330 |

| North Carolina (NC) | $102,920 |

| Michigan (MI) | $70,390 |

Extra personal banker resume sections and elements

Creating a winning personal banker resume isn't about following a rigid formula. The key is to tailor it to the job requirements while maintaining your unique personality.

Consider including these additional resume sections to enhance your profile:

- Awards - Highlight industry-specific awards as well as any personal accolades to demonstrate recognition of your expertise and achievements;

- Hobbies and interests - Share your interests outside of work. This can provide insights into your personality and indicate whether you'd be a good cultural fit for the organization;

- Projects - Detail significant projects you've been involved in, focusing on your contributions and the outcomes;

- Publications - If you've authored or co-authored academic papers or other publications, include them to establish your credibility and in-depth knowledge of the field.

These sections can give a more comprehensive view of your capabilities and character, complementing the standard resume content.

Key takeaways

- Pay special attention to the tiny details that make up your personal banker resume formatting: the more tailored your application to the role is, the better your chances at success would be;

- Select the sections you include (summary or objective, etc.) and formatting (reverse-chronological, hybrid, etc.) based on your experience level;

- Select experience items and, consequently, achievements that showcase you in the best light and are relevant to the job;

- Your profile will be assessed both based on your technical capabilities and personality skills - curate those through your resume;

- Certifications and education showcase your dedication to the particular industry.

Personal Banker resume examples

By Experience

By Role