Most CPA resume drafts fail because they list tasks and accounting software instead of audit-ready results, so recruiters can't see impact fast. In today's CPA resume reviews, applicant tracking system filters and quick scans punish vague bullets in a crowded market.

A strong resume shows what changed because of your work. Knowing how to write a resume that highlights time saved in month-end close, dollar value of tax savings, audit findings reduced, controls strengthened, forecast accuracy improved, and compliance issues prevented across entities and budgets is what separates top CPA candidates from the rest.

Key takeaways

- Lead every experience bullet with measurable outcomes like cost savings, close speed, or audit findings reduced.

- Use a reverse-chronological format to showcase progressive CPA responsibility and leadership clearly.

- Tailor each bullet to mirror the job posting's exact tools, standards, and scope requirements.

- Place skills in your summary and experience sections, not only in a standalone list.

- List CPA licensure and complementary certifications directly after education for immediate recruiter validation.

- Use AI to tighten language and quantify results, but stop before it inflates claims.

- Build your CPA resume faster with Enhancv to align structure, skills, and impact in one workflow.

Job market snapshot for CPAs

We analyzed 173 recent CPA job ads across major US job boards. These numbers help you understand regional hotspots, skills in demand, role specialization trends at a glance.

What level of experience employers are looking for CPAs

| Years of Experience | Percentage found in job ads |

|---|---|

| 1–2 years | 7.5% (13) |

| 3–4 years | 2.9% (5) |

| 5–6 years | 2.3% (4) |

| 9–10 years | 2.3% (4) |

| 10+ years | 2.9% (5) |

| Not specified | 84.4% (146) |

CPA ads by area of specialization (industry)

| Industry (Area) | Percentage found in job ads |

|---|---|

| Finance & Banking | 84.4% (146) |

| Professional Services | 6.4% (11) |

Top companies hiring CPAs

| Company | Percentage found in job ads |

|---|---|

| PwC | 72.3% (125) |

| FTI Consulting, Inc. | 6.4% (11) |

Role overview stats

These tables show the most common responsibilities and employment types for CPA roles. Use them to align your resume with what employers expect and to understand how the role is structured across the market.

Day-to-day activities and top responsibilities for a CPA

| Responsibility | Percentage found in job ads |

|---|---|

| Financial statement analysis | 50.9% (88) |

| Project management | 39.3% (68) |

| Tax compliance | 32.9% (57) |

| Tax planning | 32.9% (57) |

| Accounting practices | 32.4% (56) |

| Financial audits | 32.4% (56) |

| Regulatory compliance | 32.4% (56) |

| Tax research | 32.4% (56) |

| Internal controls | 31.8% (55) |

| Corporate tax planning | 30.6% (53) |

| Financial analysis | 30.1% (52) |

| Data analysis | 28.9% (50) |

Type of employment (remote vs on-site vs hybrid)

| Employment type | Percentage found in job ads |

|---|---|

| On-site | 85.5% (148) |

| Hybrid | 8.7% (15) |

| Remote | 5.8% (10) |

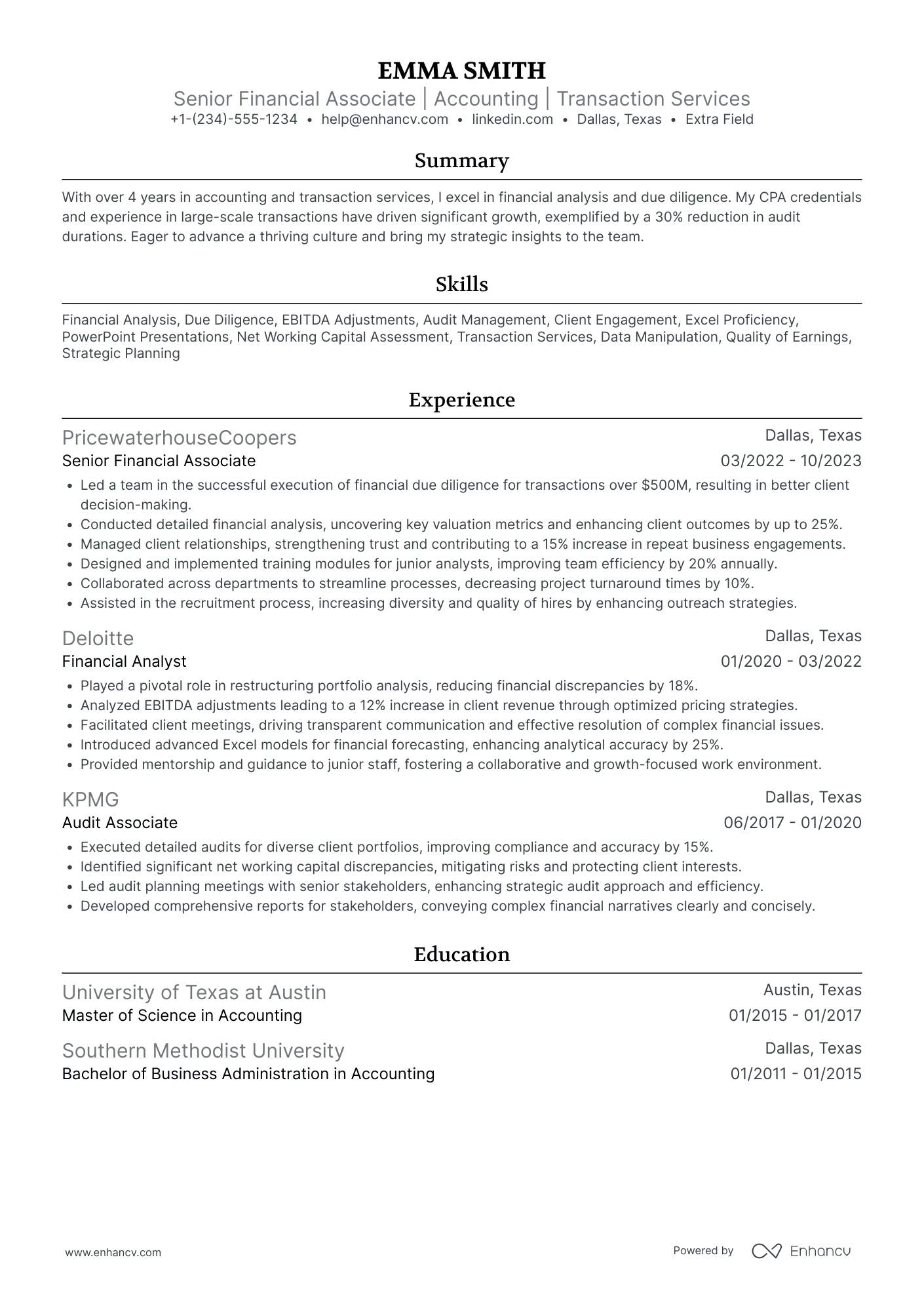

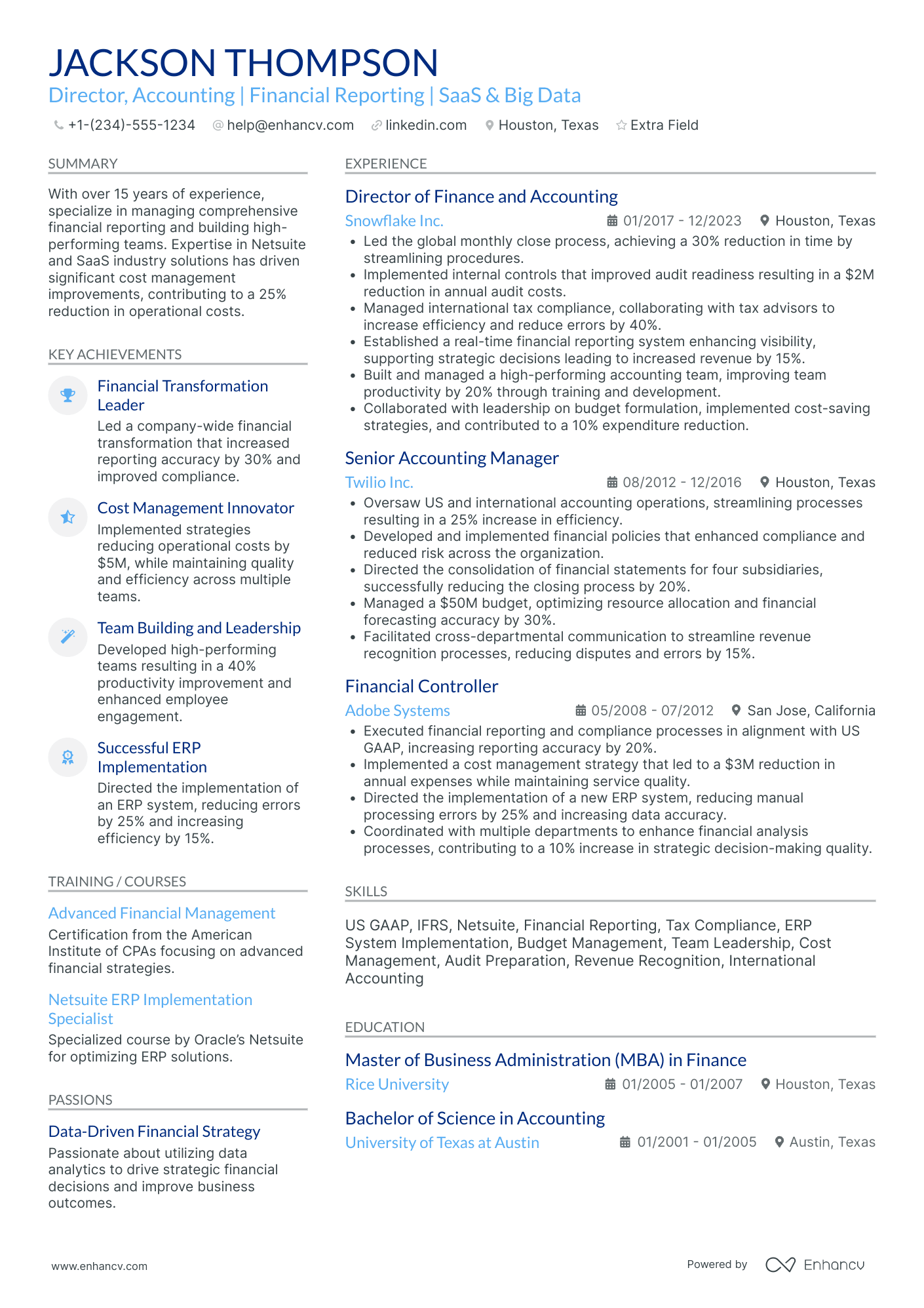

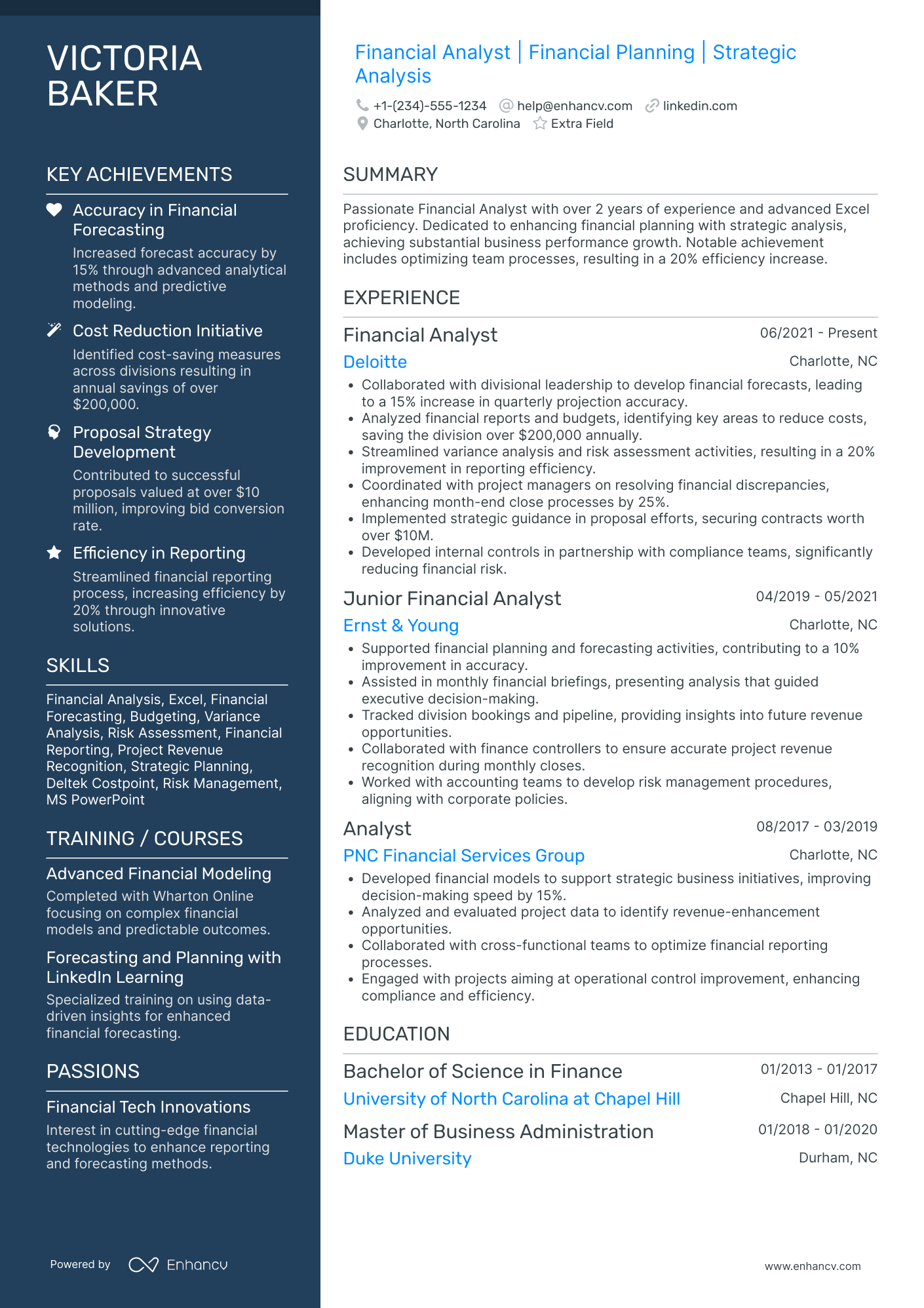

How to format a CPA resume

Recruiters evaluating CPA resumes prioritize active licensure, technical accounting expertise, and a clear record of progressive responsibility across auditing, tax, financial reporting, or advisory functions. A reverse-chronological format ensures these signals surface immediately, letting hiring managers trace your career trajectory and scope of accountability without hunting through disconnected sections. Choosing the right resume format is one of the most important decisions you'll make before writing a single bullet point.

I have significant experience in this role—which format should I use?

Use a reverse-chronological format—it's the only structure that properly showcases the depth of your CPA career and the progression of your responsibilities. Do:

- Lead each position with scope and ownership details: team size managed, portfolio value overseen, number of entities or clients served, and reporting lines.

- Highlight role-specific proficiencies such as GAAP/IFRS compliance, tax provision (ASC 740), ERP platforms (SAP, Oracle, NetSuite), audit methodology, and regulatory filings (10-K, 10-Q, SOX).

- Quantify outcomes tied to business impact—cost savings, audit efficiency gains, error reduction rates, revenue recovered, or compliance milestones achieved.

Why hybrid and functional resumes don't work for senior roles

Hybrid formats fragment your leadership narrative by pulling key accomplishments out of their positional context, making it difficult for recruiters to evaluate the scope and scale of your decision-making authority at each stage of your career. Functional formats go further in the wrong direction—they strip away progression entirely, obscuring the accountability arc and organizational influence that define a senior CPA's candidacy. Avoid both formats entirely if you have five or more years of progressive CPA experience, as they will weaken your positioning for roles that demand demonstrated leadership and fiduciary oversight.

- A functional resume may be acceptable only if you're a licensed CPA re-entering the workforce after an extended gap or transitioning from a non-traditional accounting path (such as moving from government audit into corporate finance), provided every listed skill is anchored to a specific project, engagement, or measurable outcome.

With your format established, the next step is filling it with the right sections to give hiring managers exactly what they're looking for.

What sections should go on a CPA resume

Recruiters expect to see clear evidence that you can deliver accurate reporting, ensure compliance, and improve financial outcomes. Understanding which resume sections to include ensures you present that evidence in the order hiring managers expect.

Use this structure for maximum clarity:

- Header

- Summary

- Experience

- Skills

- Projects

- Education

- Certifications

- Optional sections: Awards, Publications, Leadership

Strong experience bullets should emphasize measurable impact, audit or close scope, compliance results, and the business outcomes your work enabled.

Is your resume good enough?

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

Once you’ve organized your resume with the right core components, the next step is to write your CPA resume experience section so it supports that structure with relevant, results-focused details.

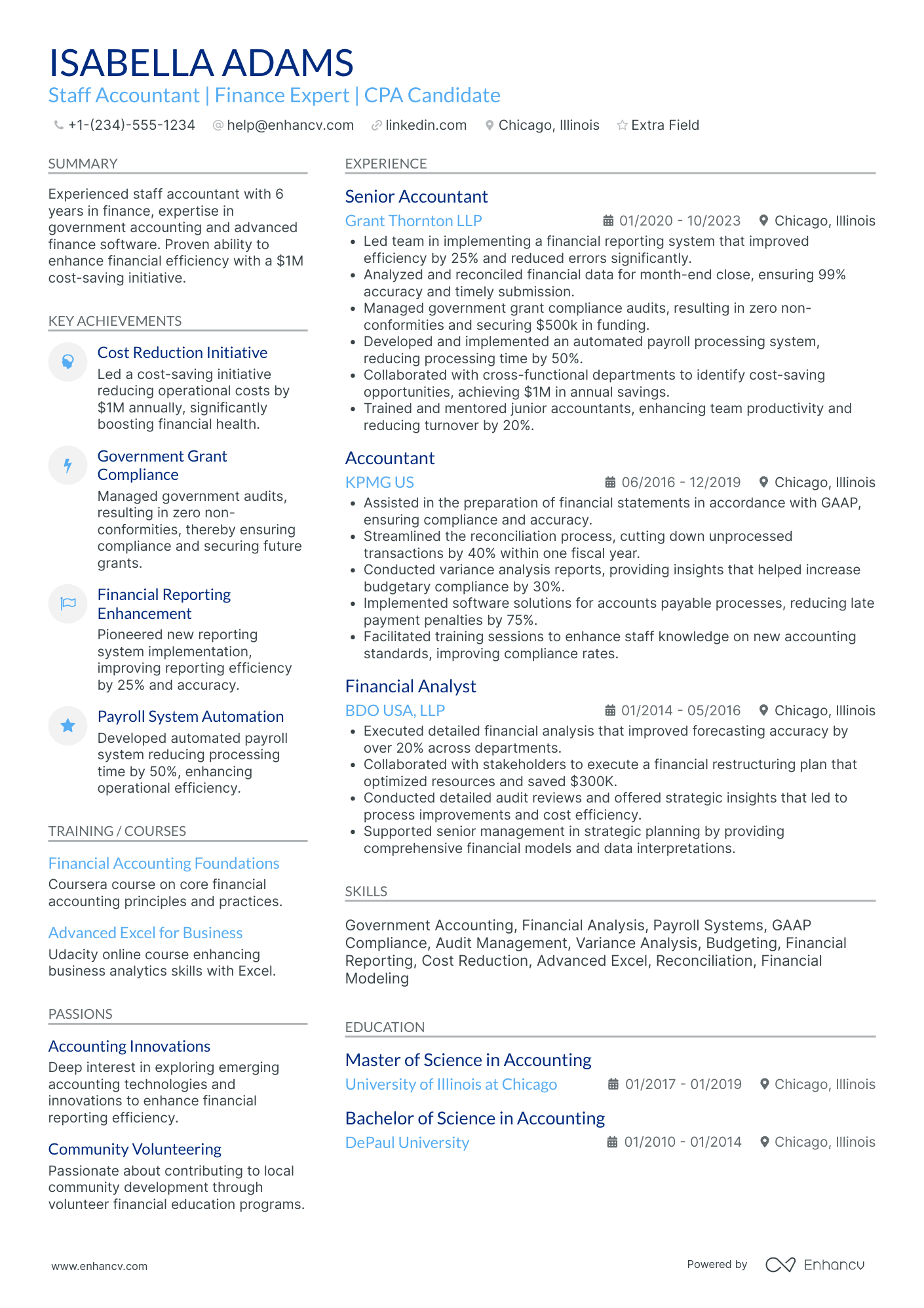

How to write your CPA resume experience

Your experience section is where you prove you've delivered real accounting work—not just performed duties. Hiring managers scanning CPA resumes prioritize demonstrated impact through accurate financial reporting, regulatory compliance, and measurable improvements over generic task descriptions. Building a targeted resume for each application ensures your experience section speaks directly to the role's priorities.

Each entry should include:

- Job title

- Company and location (or remote)

- Dates of employment (month and year)

Three to five concise bullet points showing what you owned, how you executed, and what outcomes you delivered:

- Ownership scope: the financial processes, client portfolios, reporting cycles, tax engagements, or audit functions you were directly accountable for as a CPA.

- Execution approach: the accounting standards, tax codes, audit methodologies, ERP systems, or analytical tools you applied to complete engagements and inform financial decisions.

- Value improved: the changes you drove in reporting accuracy, compliance posture, cost efficiency, internal controls, or risk mitigation within your accounting responsibilities.

- Collaboration context: how you partnered with controllers, executives, legal counsel, regulators, or cross-departmental teams to align financial operations with broader organizational goals.

- Impact delivered: the outcomes your work produced—expressed through business results, audit findings, cost recoveries, or compliance milestones rather than a list of activities performed.

Experience bullet formula

A CPA experience example

✅ Right example - modern, quantified, specific.

Senior Certified Public Accountant (CPA)

NorthBridge Manufacturing | Columbus, OH

2021–Present

Mid-market industrial manufacturer with $180M annual revenue across three plants and multi-entity operations.

- Led monthly close in NetSuite and BlackLine, cutting close time from nine to six business days and reducing post-close adjustments by 38%.

- Built a Power BI financial dashboard fed by NetSuite and SQL exports, improving forecast accuracy from 85% to 93% and enabling weekly margin reviews with the CFO and plant leaders.

- Implemented ASC 606 revenue recognition controls and a contract review workflow with Sales and Legal, reducing billing disputes by 27% and accelerating cash collection by eight days.

- Partnered with external auditors (Deloitte) to streamline PBC (provided by client) requests using SharePoint and standardized workpapers, cutting audit fieldwork hours by 22% and eliminating two repeat findings.

- Automated AP accruals and variance analysis in Excel (Power Query, PivotTables), saving twelve hours per month and improving expense classification accuracy by 15%.

Now that you've seen how to structure a strong experience entry, let's focus on adjusting that content to match the specific CPA role you're targeting.

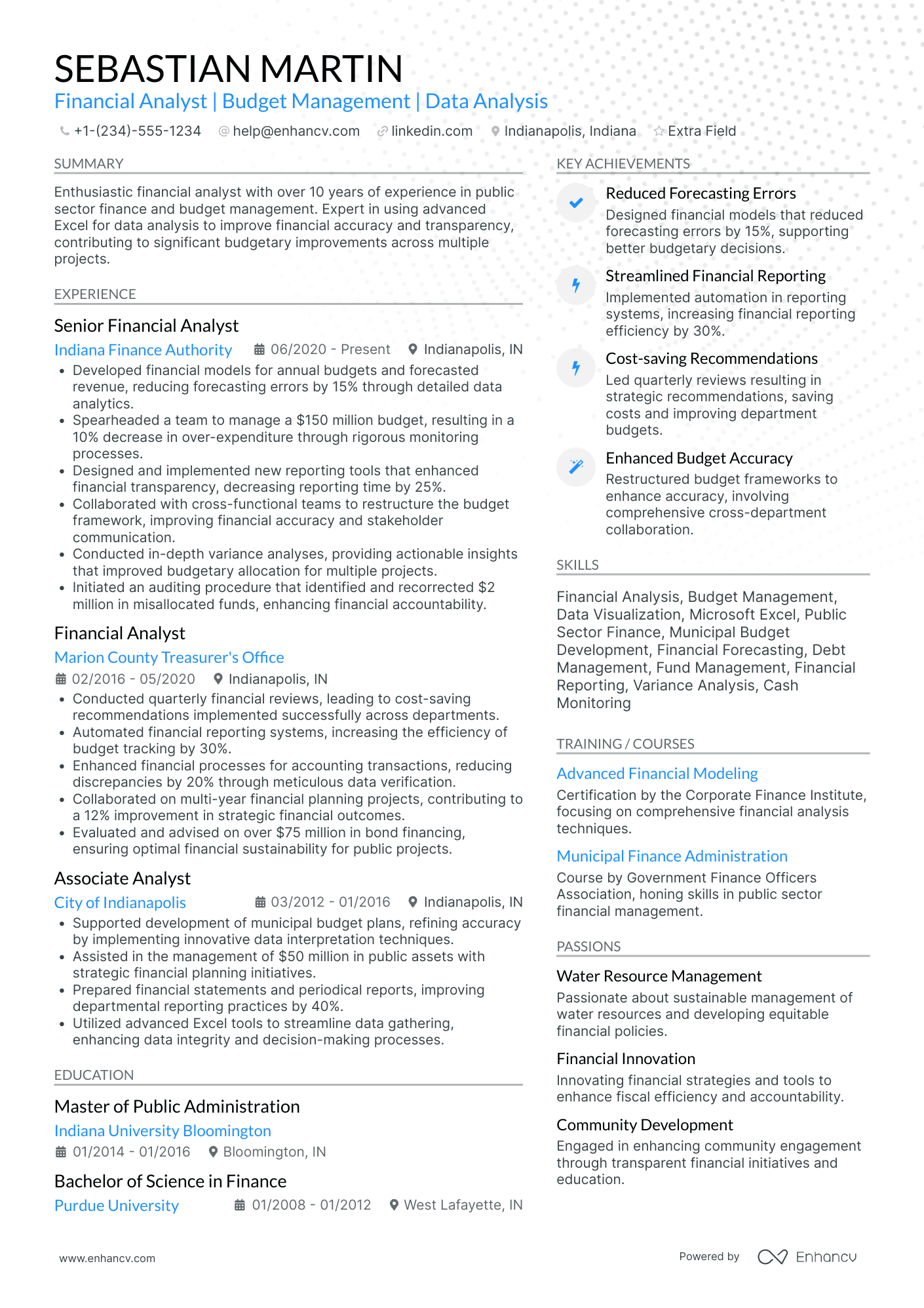

How to tailor your CPA resume experience

Recruiters evaluate your CPA resume through applicant tracking systems and manual review, scoring candidates on how closely their experience matches the posting. Tailoring your resume to the job description ensures your qualifications surface during both stages of screening.

Ways to tailor your CPA experience:

- Match accounting software and ERP systems named in the job description.

- Mirror the exact terminology used for reporting standards or frameworks.

- Reflect revenue thresholds or portfolio sizes specified in the posting.

- Incorporate industry-specific experience such as nonprofit or public sector accounting.

- Emphasize tax compliance or audit functions when the role prioritizes them.

- Highlight collaboration with cross-functional teams if the posting references it.

- Align your process language with their stated methodologies or workflows.

- Reference regulatory bodies or standards like GAAP or IFRS when relevant.

Tailoring means restructuring your real accomplishments to speak directly to what the employer asked for—not forcing disconnected keywords into your bullets.

Resume tailoring examples for CPA

| Job description excerpt | Untailored | Tailored |

|---|---|---|

| Prepare and review corporate tax returns (1120, 1120S) using CCH Axcess, ensuring compliance with ASC 740 provisions for multi-state entities. | Handled tax preparation and filing for various clients. | Prepared and reviewed over 150 federal and multi-state corporate tax returns (1120, 1120S) annually in CCH Axcess, applying ASC 740 income tax provisions that reduced audit adjustments by 30%. |

| Perform month-end close procedures, including bank reconciliations, journal entries, and variance analysis in NetSuite for a $40M revenue portfolio. | Assisted with month-end closing activities and general ledger maintenance. | Executed full month-end close for a $40M revenue portfolio in NetSuite, completing bank reconciliations, posting journal entries, and delivering variance analysis reports within five business days each cycle. |

| Lead external audit coordination, prepare PBC schedules, and ensure timely delivery of documentation in accordance with GAAP and SOX 404 internal control requirements. | Supported audit processes and prepared financial documents as needed. | Coordinated annual external audits by preparing 25+ PBC schedules, liaising directly with Big Four auditors, and maintaining SOX 404 internal control documentation that achieved zero material weaknesses over two consecutive audit cycles. |

Once your experience aligns with the role’s priorities, the next step is to quantify your CPA achievements so hiring managers can see the measurable impact behind your work.

How to quantify your CPA achievements

Quantifying your achievements proves business impact beyond responsibilities. Focus on close speed, accuracy, compliance outcomes, dollars saved or recovered, and risk reduced across audits, reporting, tax, and controls.

Quantifying examples for CPA

| Metric | Example |

|---|---|

| Close cycle time | "Cut month-end close from 10 to seven business days by automating reconciliations in BlackLine and standardizing journal entry templates." |

| Audit findings | "Reduced audit adjustments from 12 to three by strengthening revenue recognition support and implementing a PBC tracker in SharePoint." |

| Tax savings | "Identified $185,000 in state tax credits and improved documentation in Thomson Reuters ONESOURCE to sustain positions through review." |

| Error rate | "Lowered bank reconciliation exceptions from 2.8% to 0.9% by adding Excel Power Query checks and a two-step variance review." |

| Cost reduction | "Saved $60,000 annually by renegotiating software renewals and consolidating three finance tools into NetSuite reporting workflows." |

Turn your everyday tasks into measurable, recruiter-ready resume bullets in seconds with Enhancv's Bullet Point Generator.

Once you've crafted strong bullet points to showcase your experience, the next step is ensuring your resume also highlights the right hard and soft skills CPAs need.

How to list your hard and soft skills on a CPA resume

Your skills section shows you can deliver accurate reporting, compliance, and advisory work, and recruiters and an ATS (applicant tracking system) use them to screen for role match—aim for a balanced mix of technical accounting skills and execution-focused soft skills. CPA roles require a blend of:

- Product strategy and discovery skills.

- Data, analytics, and experimentation skills.

- Delivery, execution, and go-to-market discipline.

- Soft skills.

Your skills section should be:

- Scannable (bullet-style grouping).

- Relevant to the job post.

- Backed by proof in experience bullets.

- Updated with current tools.

Place your skills section:

- Above experience if you're junior or switching careers.

- Below experience if you're mid/senior with strong achievements.

Hard skills

Listing hard skills on your resume demonstrates the technical accounting proficiencies employers need to see:

- US GAAP financial reporting

- IFRS reporting

- ASC 606 revenue recognition

- ASC 842 lease accounting

- SOX 404 controls testing

- Audit planning and fieldwork

- Tax compliance, extensions

- Sales and use tax

- Fixed asset accounting

- Month-end close, reconciliations

- QuickBooks, NetSuite, SAP

- Excel pivots, Power Query

Soft skills

Equally important, soft skills on your resume show how you apply that technical knowledge in collaborative, high-pressure environments:

- Translate findings for stakeholders

- Lead close timelines and owners

- Challenge assumptions with evidence

- Resolve variances with partners

- Write clear memos and support

- Present audit-ready documentation

- Manage competing deadlines reliably

- Coordinate with tax and audit teams

- Escalate risks early and clearly

- Drive process improvements to closure

- Negotiate priorities with business leads

- Maintain confidentiality and discretion

How to show your CPA skills in context

Skills shouldn't live only in a dedicated skills list. Explore resume skills examples to see how top candidates weave competencies throughout their applications.

They should be demonstrated in:

- Your summary (high-level professional identity)

- Your experience (proof through outcomes)

Here's how that looks in practice.

Summary example

Senior CPA with 12 years in corporate tax compliance and financial reporting. Skilled in SAP, multistate tax strategy, and cross-functional audit coordination. Reduced year-end close cycle by 30% through streamlined reconciliation workflows.

- Signals senior-level expertise immediately

- Names specific tools like SAP

- Leads with a measurable outcome

- Highlights cross-functional collaboration skills

Experience example

Senior Tax Accountant

Redfield & Associates | Denver, CO

June 2018–Present

- Managed multistate tax filings using Thomson Reuters ONESOURCE, reducing compliance errors by 22% across 14 jurisdictions.

- Partnered with FP&A and legal teams to restructure intercompany transactions, generating $1.3M in annual tax savings.

- Led quarterly SOX compliance audits in SAP, cutting documentation review time by 35% through standardized templates.

- Every bullet includes measurable proof

- Skills appear naturally through real outcomes

Once you’ve shown your accounting strengths through relevant coursework, projects, and outcomes, the next step is to apply that same approach to structuring a CPA resume when you don’t have professional experience.

How do I write a CPA resume with no experience

Even without full-time experience, you can demonstrate readiness through the strategies outlined in our guide on building a resume without work experience:

- VITA tax preparation volunteer work

- Accounting internship or externship

- Audit simulation or case competition

- University accounting capstone project

- Bookkeeping for student organization

- QuickBooks Online certification projects

- Excel financial modeling coursework

- IRS tax research memo assignment

Focus on:

- CPA exam progress and dates

- Audit, tax, and GAAP coursework

- Tools: Excel, QuickBooks, ERP

- Results-backed projects and outputs

Resume format tip for entry-level CPA

Use a combination resume format because it highlights CPA-relevant skills and projects while still showing education, certifications, and any part-time work. Do:

- Add a "Projects" section above work.

- Quantify outcomes: hours saved, errors reduced.

- List CPA exam sections passed or scheduled.

- Include tools used in each bullet.

- Tailor coursework to the job posting.

- Prepared twenty VITA returns in TaxSlayer, resolved eight IRS notice issues through document review, and achieved a 100% quality review pass rate.

Since your education and certifications carry the most weight when you lack professional experience, presenting them effectively on your resume is essential.

How to list your education on a CPA resume

Your education section lets hiring teams confirm you have the accounting foundation a CPA role demands. It validates your academic preparation and technical knowledge at a glance.

Include:

- Degree name

- Institution

- Location

- Graduation year

- Relevant coursework (for juniors or entry-level candidates)

- Honors & GPA (if 3.5 or higher)

Skip month and day details—list the graduation year only.

Here's a strong education entry tailored for a CPA resume:

Example education entry

Bachelor of Science in Accounting

University of Illinois Urbana-Champaign, Champaign, IL

2021 | GPA: 3.8/4.0

- Relevant Coursework: Advanced Auditing, Federal Taxation, Cost Accounting, Financial Statement Analysis, Forensic Accounting

- Honors: Magna Cum Laude, Beta Alpha Psi Honor Society

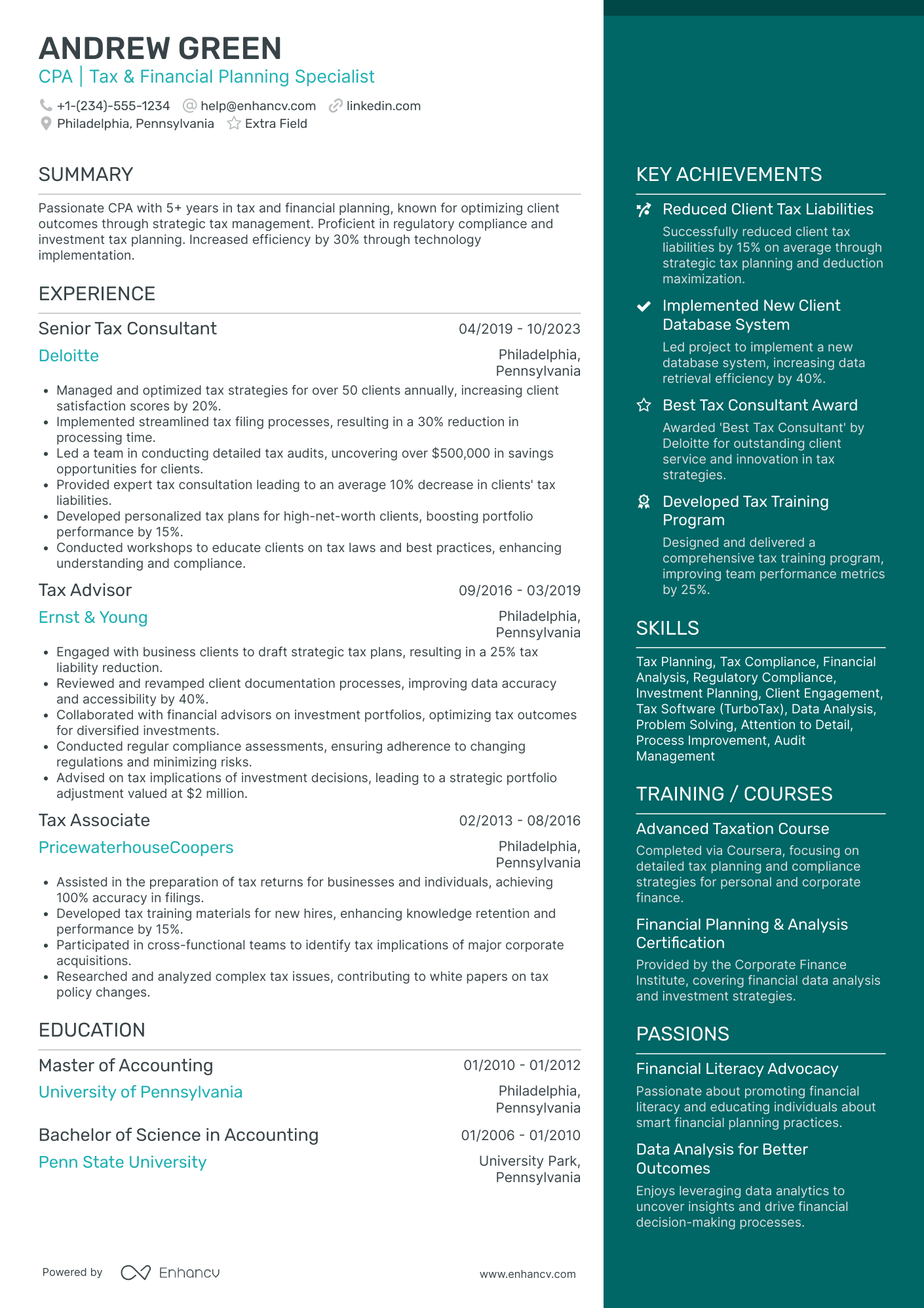

How to list your certifications on a CPA resume

Certifications on your resume show your commitment to learning, confirm tool proficiency, and signal industry relevance for a CPA. They help hiring teams trust your skills beyond your core license.

Include:

- Certificate name

- Issuing organization

- Year

- Optional: credential ID or URL

- List certifications below education when they're older, less relevant to the role, or you want your degree and CPA license to lead.

- List certifications above education when they're recent, highly relevant to the role, or required by the job posting.

Best certifications for your CPA resume

- Certified Management Accountant (CMA)

- Certified Internal Auditor (CIA)

- Certified Information Systems Auditor (CISA)

- Certified Fraud Examiner (CFE)

- Certified Financial Analyst (CFA)

- Chartered Global Management Accountant (CGMA)

- Enrolled Agent (EA)

Once you’ve presented your CPA credentials with the right details and placement, focus next on writing your CPA resume summary to highlight their value upfront.

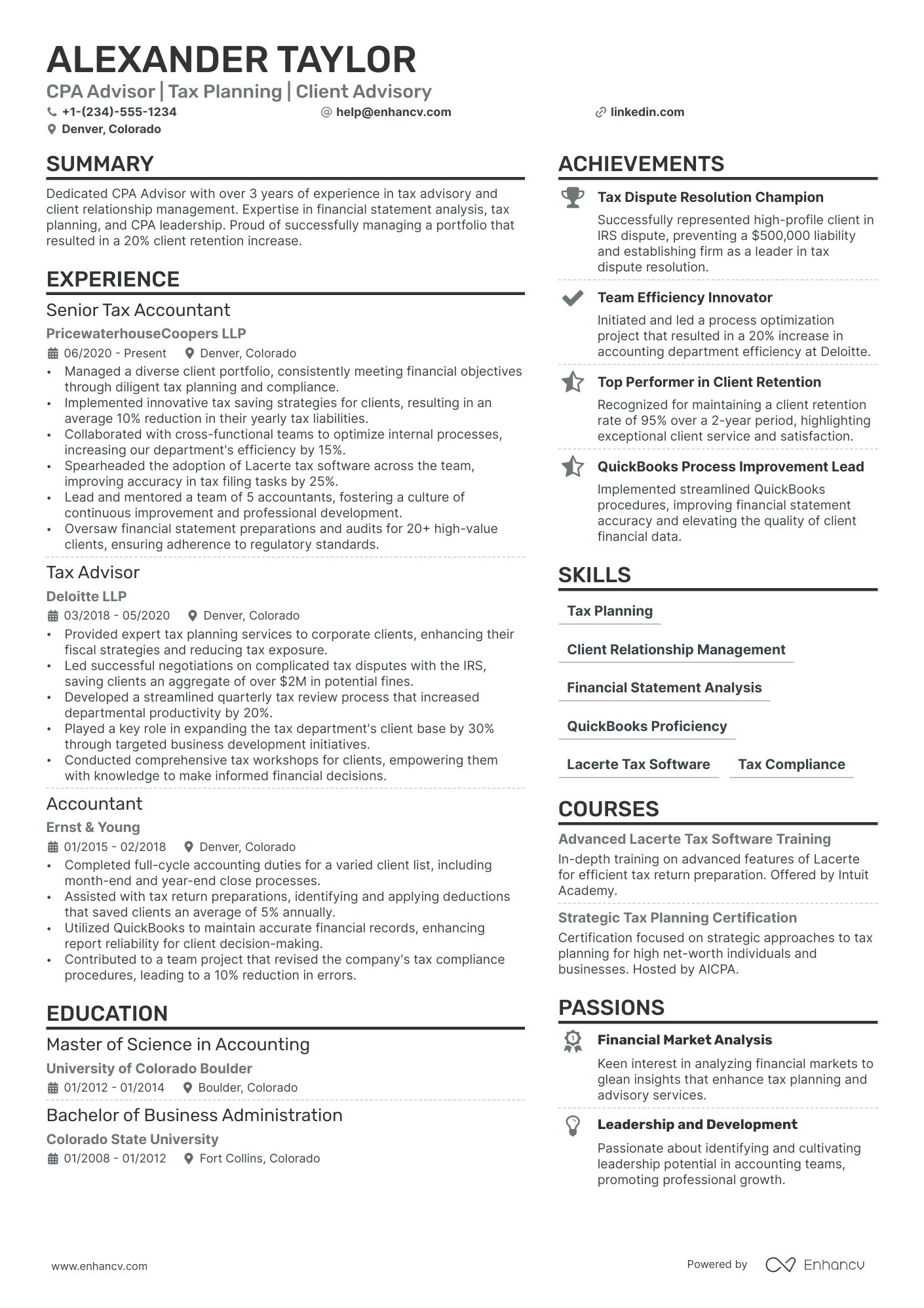

How to write your CPA resume summary

Your resume summary is the first thing a recruiter reads, so it sets the tone for your entire application. A strong summary instantly connects your accounting expertise to what the hiring manager needs.

Keep it to three to four lines, with:

- Your title and total years of relevant accounting experience.

- Domain focus, such as public accounting, tax, audit, or corporate finance.

- Core tools and skills like GAAP, QuickBooks, SAP, or Excel modeling.

- One or two measurable achievements that prove your value.

- Soft skills tied to real outcomes, such as communication that improved client retention.

PRO TIP

At an entry or mid-level CPA role, lead with relevant certifications, technical skills, and early wins that show you can deliver. Avoid vague phrases like "passionate team player" or "detail-oriented self-starter." Instead, anchor every claim to a specific tool, task, or result. Generic motivation statements waste valuable space.

Example summary for a CPA

CPA with three years in public accounting and tax compliance. Prepared 120+ returns annually using UltraTax and reduced client filing errors by 18% through streamlined review processes.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Now that your summary captures your strongest qualifications, make sure the header above it presents your contact details correctly so recruiters can actually reach you.

What to include in a CPA resume header

A resume header lists your key contact details and identity, helping CPAs boost visibility, build credibility, and pass recruiter screening faster.

Essential resume header elements

- Full name

- Tailored job title and headline

- Location

- Phone number

- Professional email

- GitHub link

- Portfolio link

A LinkedIn link helps recruiters verify your experience quickly and supports screening.

Don't include a photo on a CPA resume unless the role is explicitly front-facing or appearance-dependent.

Use a clear job title that matches the posting and include your CPA license status in the headline for faster screening.

Example

CPA resume header

Jordan M. Carter

CPA | Senior Accountant—Audit & Financial Reporting

Chicago, IL

(312) 555-12XX

jordan.carter@enhancv.com

github.com/jordancarter

jordancarter.com

linkedin.com/in/jordancarter

Once your header clearly presents your name, contact details, credentials, and location, you can strengthen your application with additional sections that add relevant context and proof of fit.

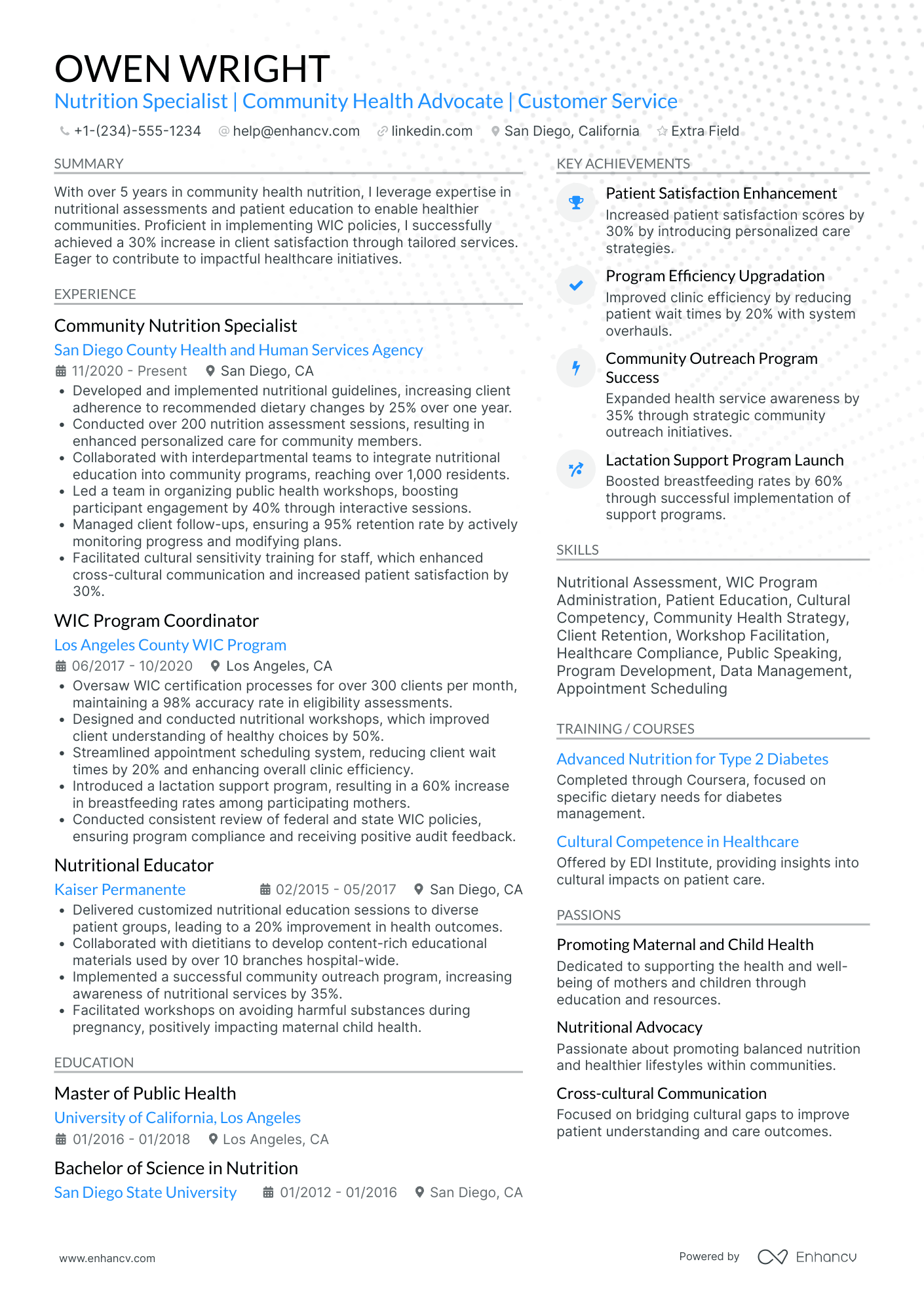

Additional sections for CPA resumes

When your core qualifications match other candidates, additional sections can set you apart and reinforce your credibility as a CPA. For example, listing language skills on your resume can be a differentiator if you work with international clients or multi-jurisdiction filings.

- Languages

- Professional affiliations

- Continuing professional education

- Publications

- Volunteer experience

- Awards and honors

- Industry conferences and speaking engagements

Once you've strengthened your resume with the right supplementary sections, the next step is pairing it with a cover letter that adds even more context to your candidacy.

Do CPA resumes need a cover letter

A cover letter isn't required for a CPA, but it often helps. If you're unsure about what a cover letter is and when it matters, it's worth learning before applying to competitive roles. It can make the difference when your resume needs context.

Use a cover letter to add detail your CPA resume can't:

- Explain role or team fit by linking your CPA strengths to the firm's client mix, audit approach, or close process.

- Highlight one or two relevant projects or outcomes, including scope, tools, and measurable results tied to accuracy, timeliness, or controls.

- Show you understand the business context by referencing the company's product, customers, revenue model, or regulatory environment.

- Address career transitions or non-obvious experience by clarifying your path, transferable skills, and how your CPA work applies to the role.

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Whether you include a cover letter depends on the role and employer expectations, and AI can help you tailor your CPA resume to match those requirements more efficiently.

Using AI to improve your CPA resume

AI can sharpen your resume's clarity, structure, and impact. It helps tighten language and highlight measurable results. But overuse kills authenticity. Once your content is clear and role-aligned, step away from AI. If you're wondering which AI is best for writing resumes, the answer depends on how you plan to use it—editing and refining beats generating from scratch.

Here are 10 practical prompts to strengthen specific sections of your CPA resume:

- Strengthen your summary. "Rewrite my CPA resume summary to highlight core competencies, years of experience, and industry focus in three concise sentences."

- Quantify experience bullets. "Revise these CPA experience bullet points to include specific metrics like cost savings, audit counts, or revenue impact."

- Tailor skills placement. "Reorganize my CPA skills section to prioritize technical proficiencies most relevant to this specific job description."

- Sharpen action verbs. "Replace weak or passive verbs in my CPA experience section with strong, precise action verbs tied to accounting functions."

- Align with job postings. "Compare my CPA resume bullets against this job posting and suggest edits to improve keyword alignment."

- Clarify project contributions. "Rewrite my CPA project descriptions to clearly state my role, tools used, and measurable outcomes delivered."

- Improve certification formatting. "Restructure my CPA certifications section so each entry lists credential name, issuing body, and date earned."

- Refine education details. "Edit my CPA resume education section to emphasize relevant coursework, honors, and accounting-specific achievements only."

- Eliminate redundant phrasing. "Identify and remove any repetitive or filler language across all sections of my CPA resume."

- Tighten bullet length. "Shorten each CPA experience bullet to one line while preserving the core achievement and quantified result."

Stop using AI once your resume sounds accurate, specific, and aligned with real experience. AI should never invent experience or inflate claims—if it didn't happen, it doesn't belong here.

Conclusion

A strong CPA resume shows measurable outcomes, role-specific skills, and a clear structure that’s easy to scan. It highlights impact in numbers, from close timelines to audit findings, and connects those results to the role.

Keep your CPA resume focused and current for today’s and near-future hiring market. When your experience, skills, and results line up cleanly, you look ready to contribute on day one.