Most investment manager resume drafts fail because they describe market commentary and tools, not repeatable decisions and results. That gets filtered by ATS keywords and lost in recruiter scans. In a crowded field, vague impact reads like risk.

A strong resume shows how you drive performance and manage risk. Knowing how to make your resume stand out starts with quantifying returns versus benchmarks, assets under management, drawdown control, and client retention. Highlight mandates delivered, investment theses validated, and governance improvements that reduced errors.

Key takeaways

- Quantify portfolio returns, assets under management, and risk metrics in every experience bullet.

- Use reverse-chronological format to show expanding responsibility across fund sizes and asset classes.

- Tailor each resume to the job posting's exact tools, asset classes, and terminology.

- Anchor every listed skill to a measurable outcome in your experience or projects section.

- Place certifications like the CFA or FRM near education to reinforce credibility fast.

- Write a three- to four-line summary highlighting domain focus, core skills, and one key achievement.

- Use Enhancv to turn vague job duties into concise, results-driven resume bullets.

Job market snapshot for investment managers

We analyzed 325 recent investment manager job ads across major US job boards. These numbers help you understand employer expectations, industry demand, skills in demand at a glance.

What level of experience employers are looking for investment managers

| Years of Experience | Percentage found in job ads |

|---|---|

| 1–2 years | 8.3% (27) |

| 3–4 years | 13.8% (45) |

| 5–6 years | 10.2% (33) |

| 7–8 years | 14.2% (46) |

| 9–10 years | 2.2% (7) |

| 10+ years | 2.8% (9) |

| Not specified | 50.8% (165) |

Investment manager ads by area of specialization (industry)

| Industry (Area) | Percentage found in job ads |

|---|---|

| Finance & Banking | 97.2% (316) |

Top companies hiring investment managers

| Company | Percentage found in job ads |

|---|---|

| Deloitte | 34.2% (111) |

| Morgan Stanley | 28.0% (91) |

| Bank of America Corporation | 6.2% (20) |

| State Street Corporation | 4.9% (16) |

| MassMutual Financial Group | 4.0% (13) |

Role overview stats

These tables show the most common responsibilities and employment types for investment manager roles. Use them to align your resume with what employers expect and to understand how the role is structured across the market.

Day-to-day activities and top responsibilities for a investment manager

| Responsibility | Percentage found in job ads |

|---|---|

| Project management | 39.7% (129) |

| Investment management | 23.4% (76) |

| Program management | 23.1% (75) |

| Financial modeling | 19.4% (63) |

| Ai | 16.9% (55) |

| Financial analysis | 16.9% (55) |

| Excel | 14.8% (48) |

| Sql | 13.2% (43) |

| Microsoft excel | 12.9% (42) |

| Python | 12.9% (42) |

| Testing | 12.3% (40) |

| Aladdin | 12.0% (39) |

Type of employment (remote vs on-site vs hybrid)

| Employment type | Percentage found in job ads |

|---|---|

| On-site | 88.3% (287) |

| Hybrid | 10.8% (35) |

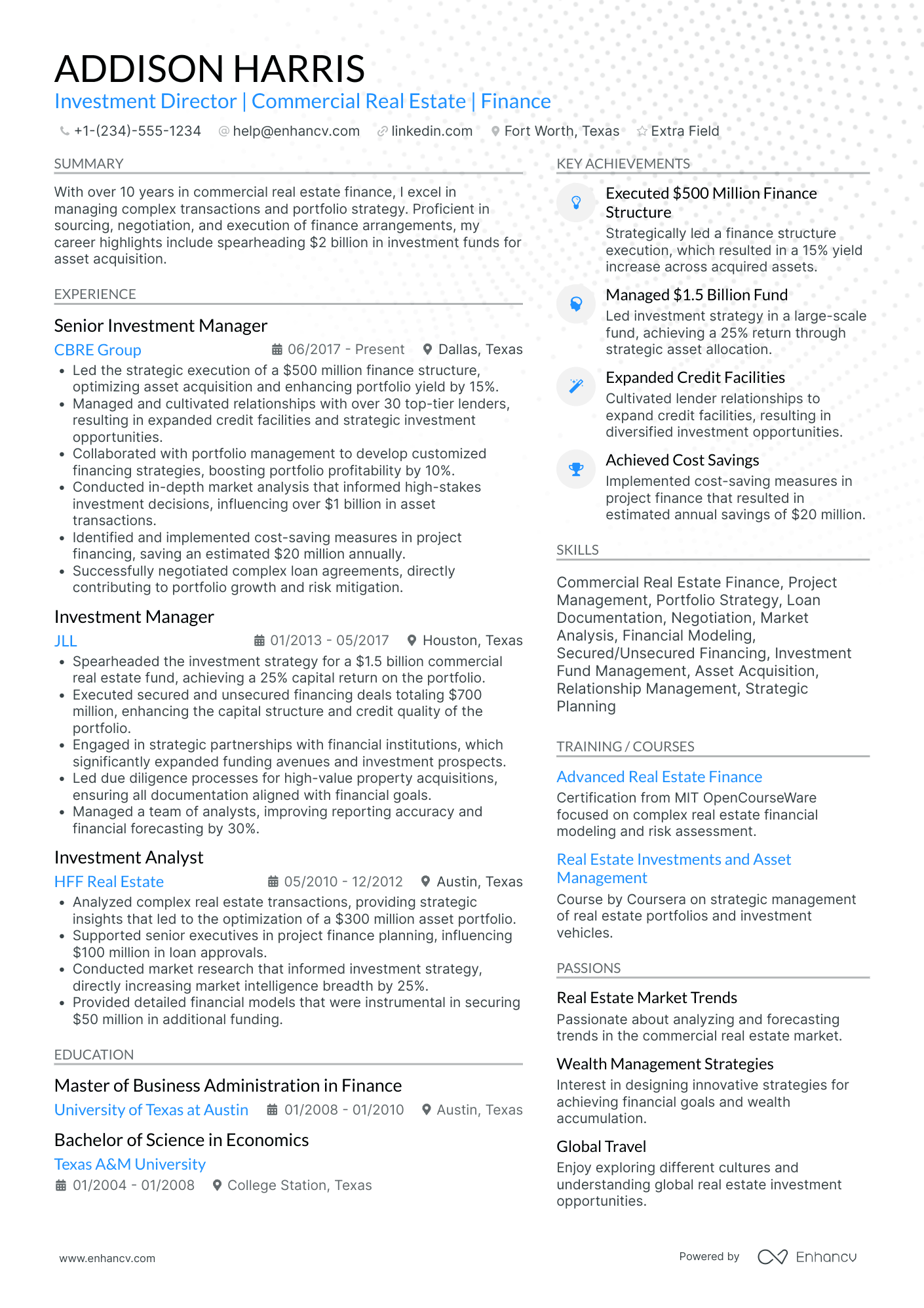

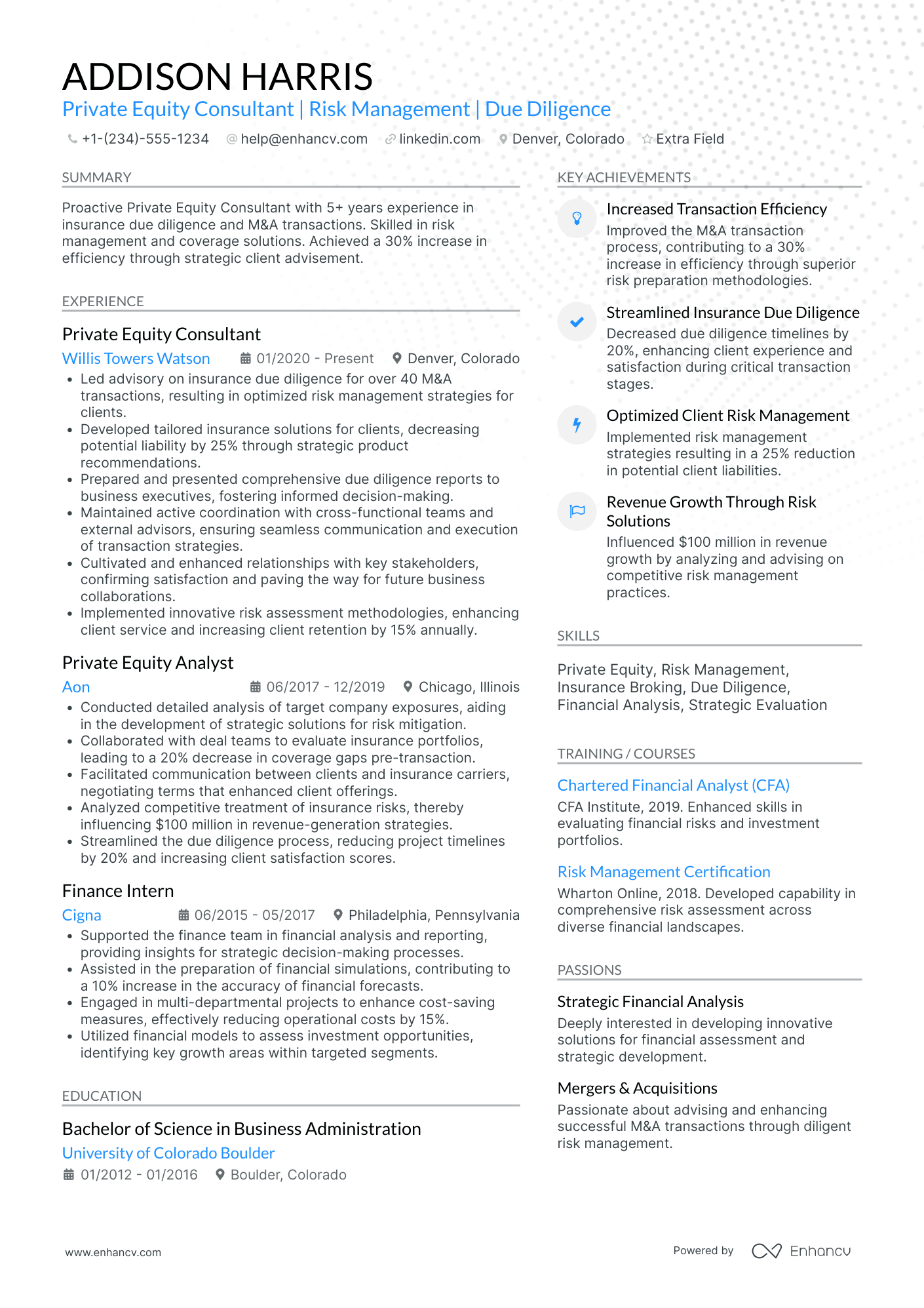

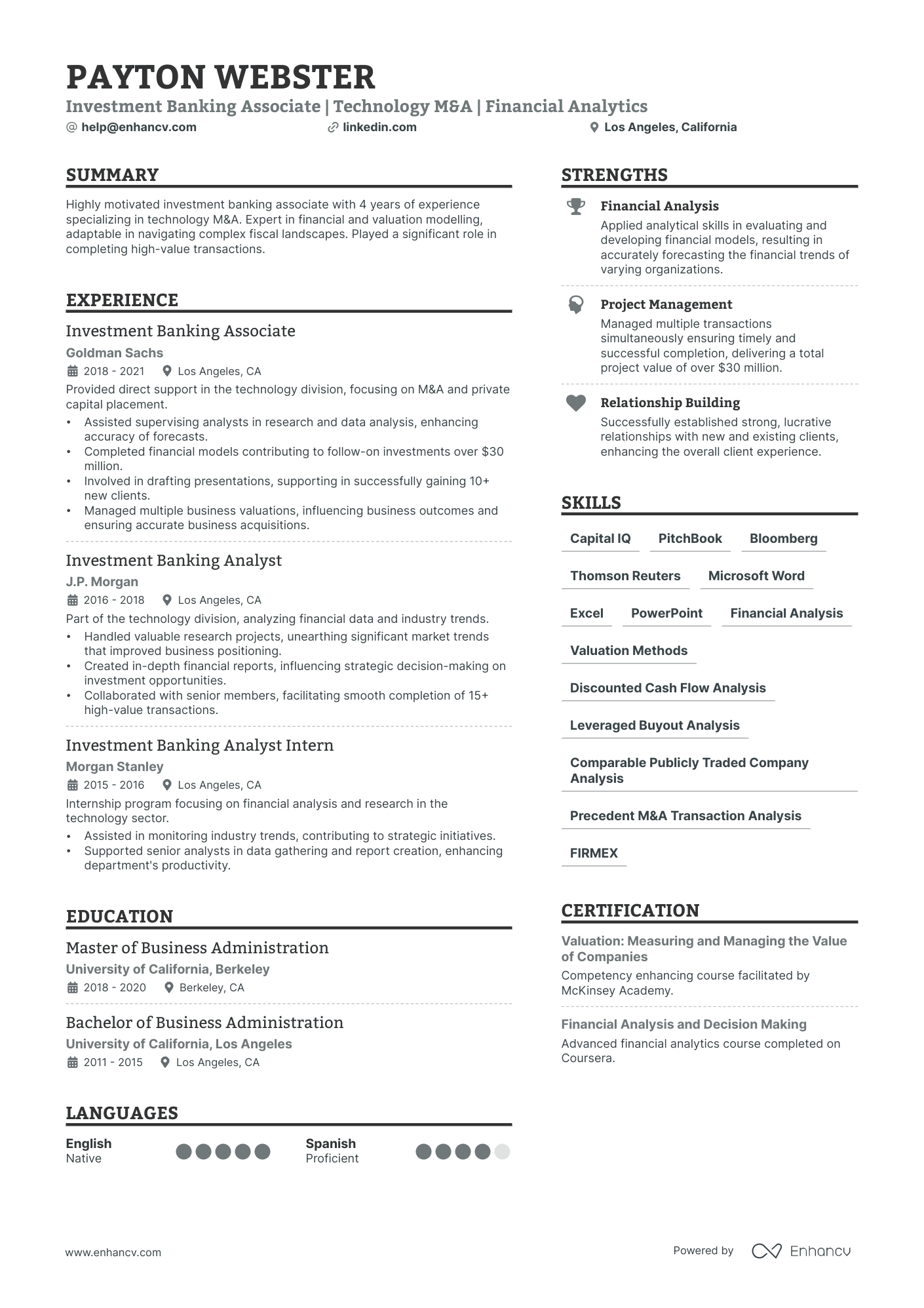

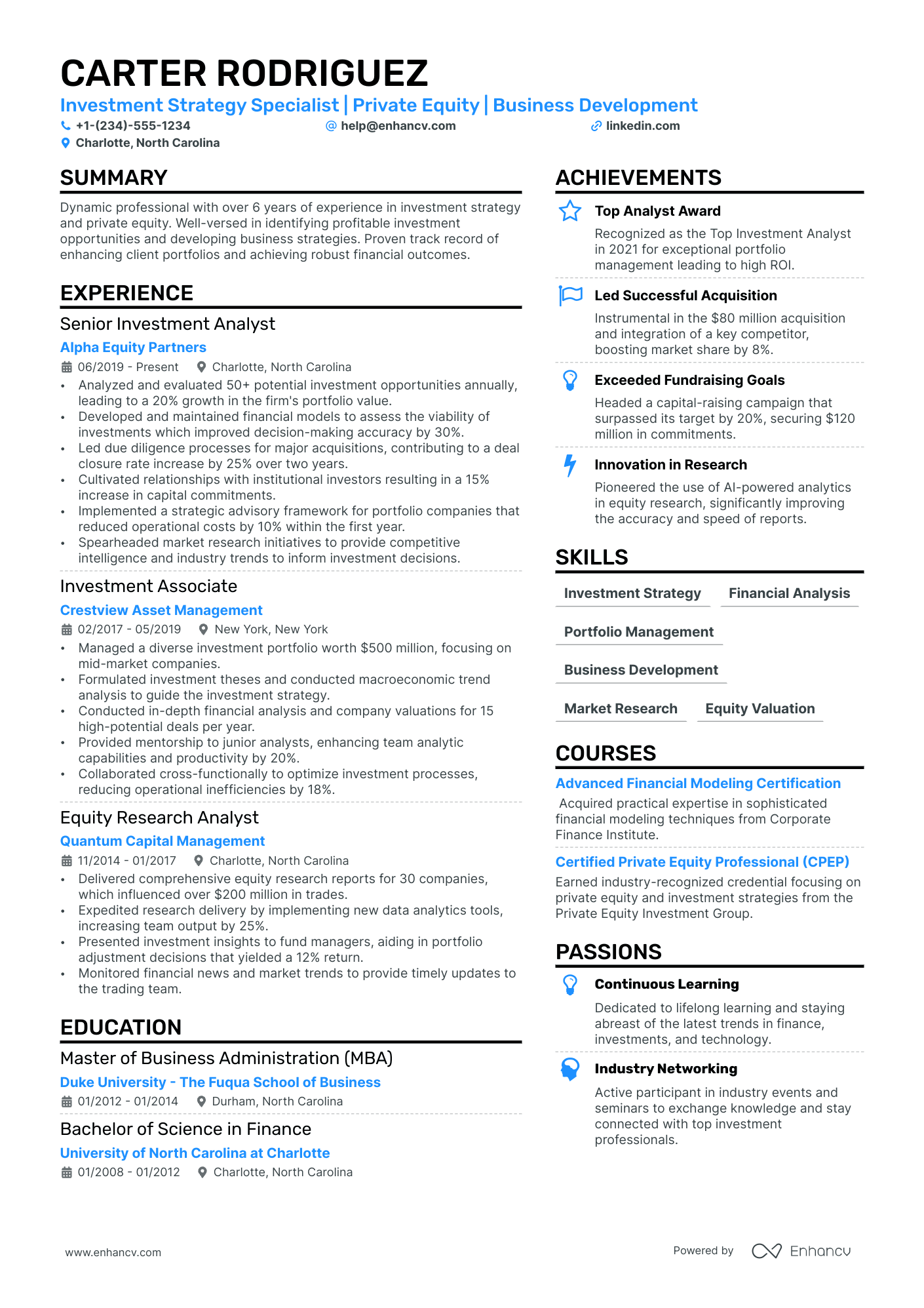

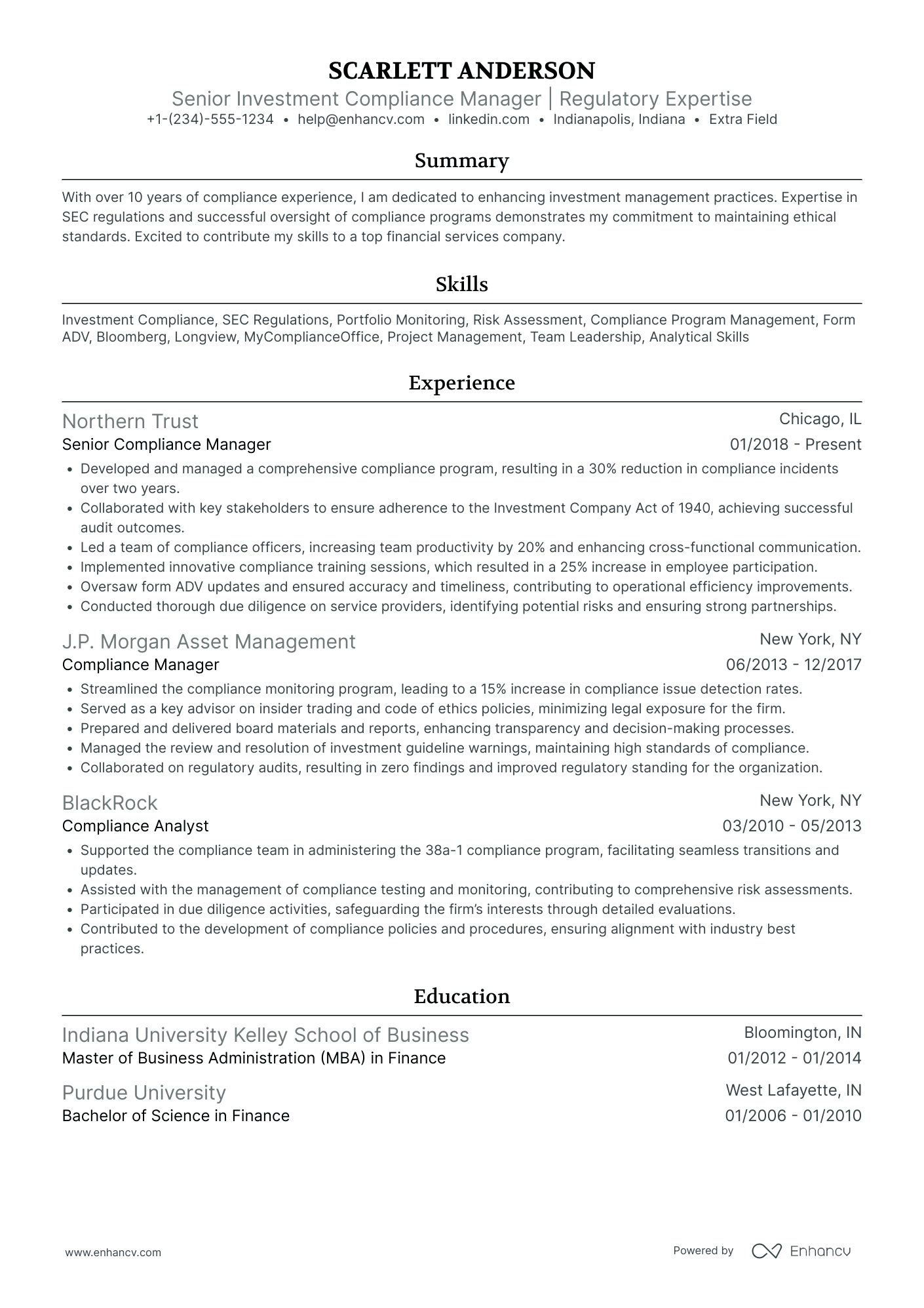

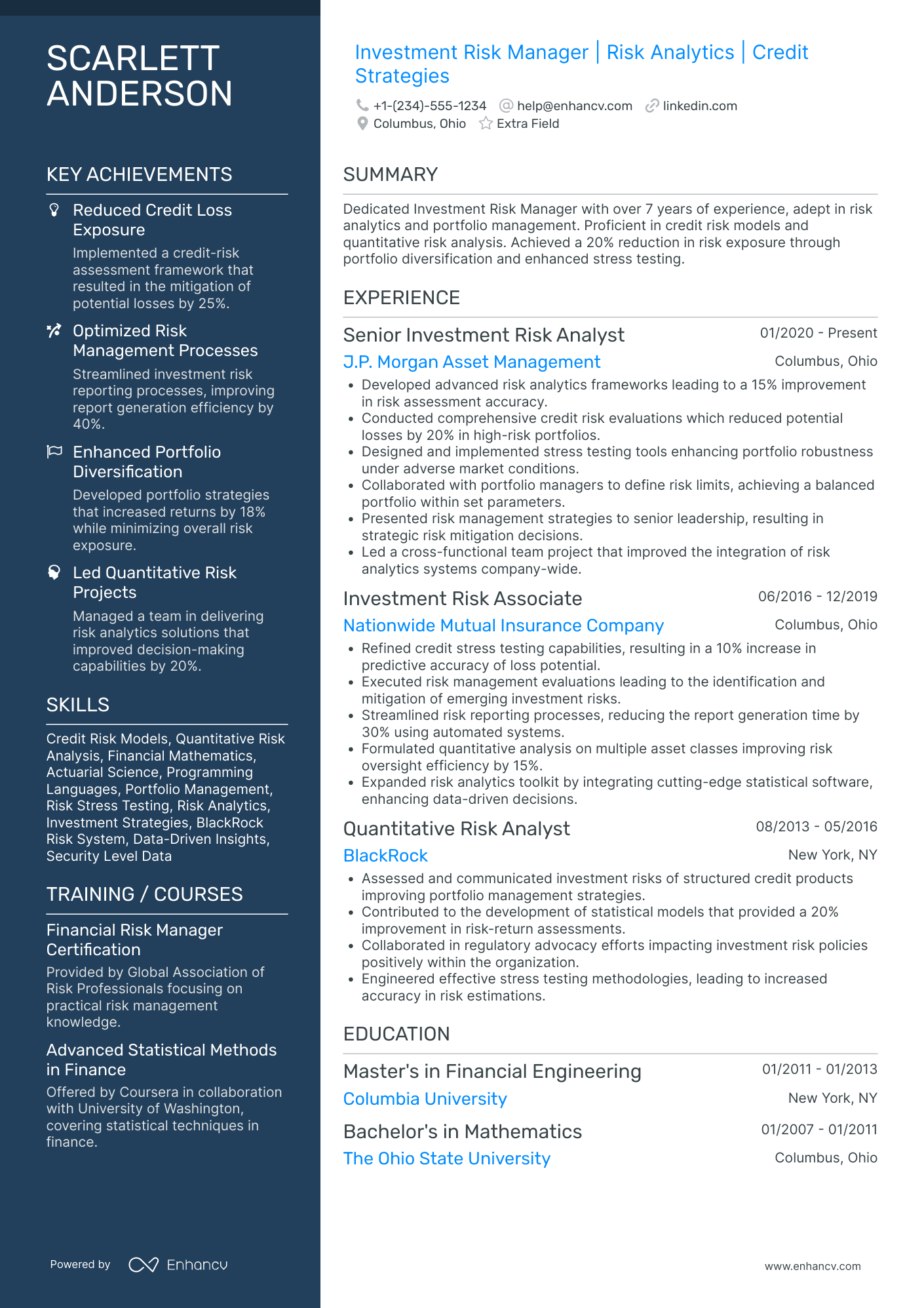

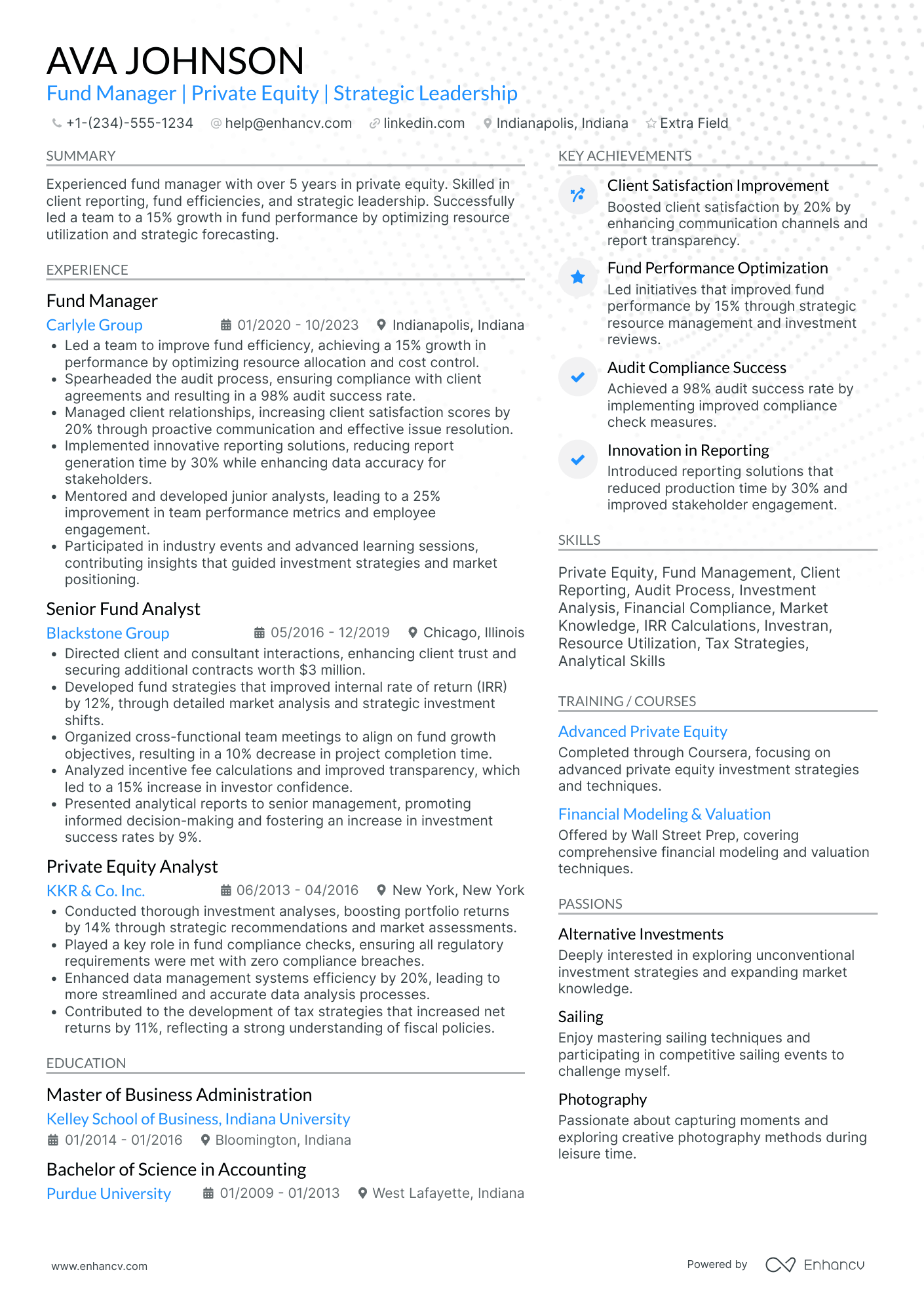

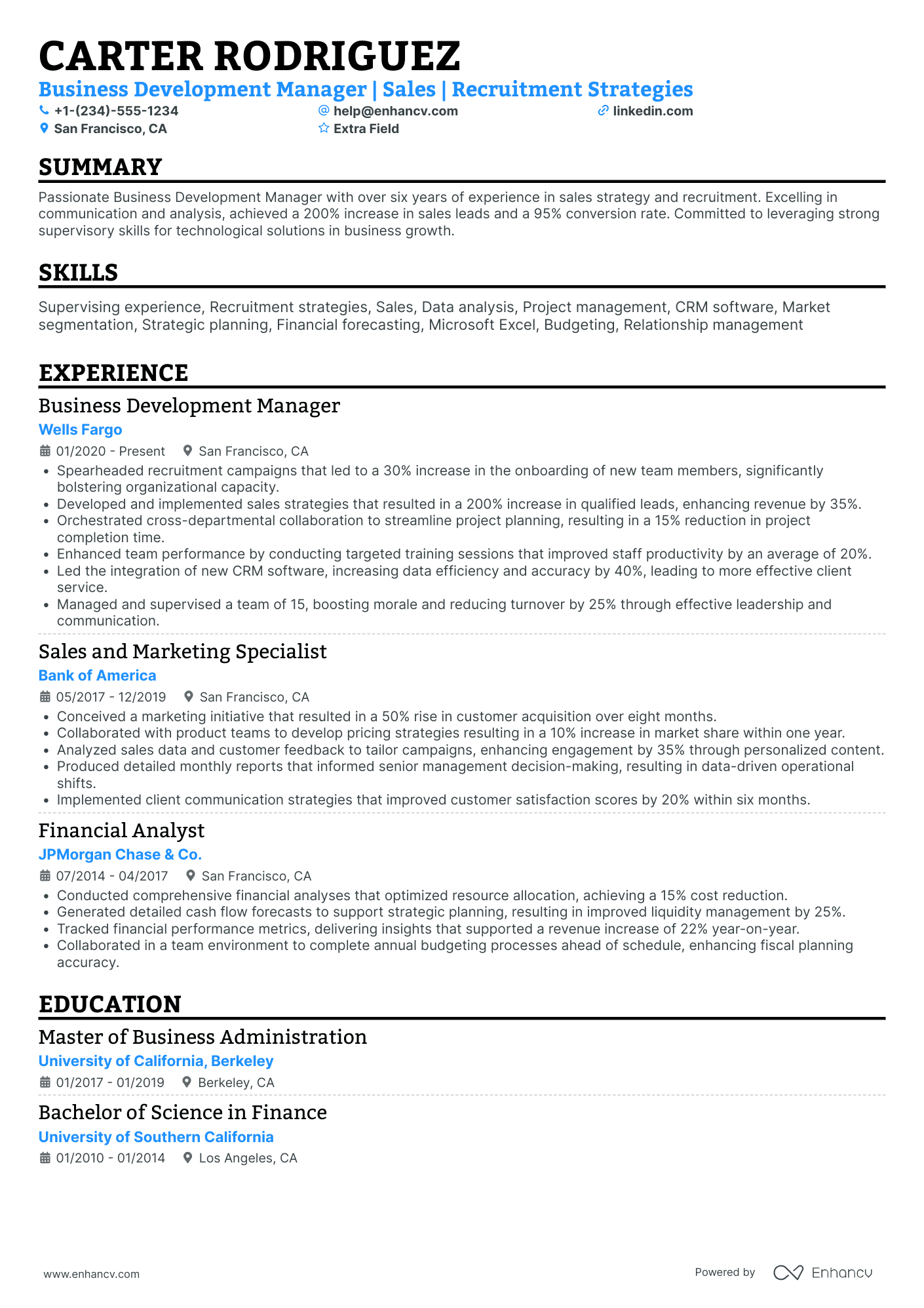

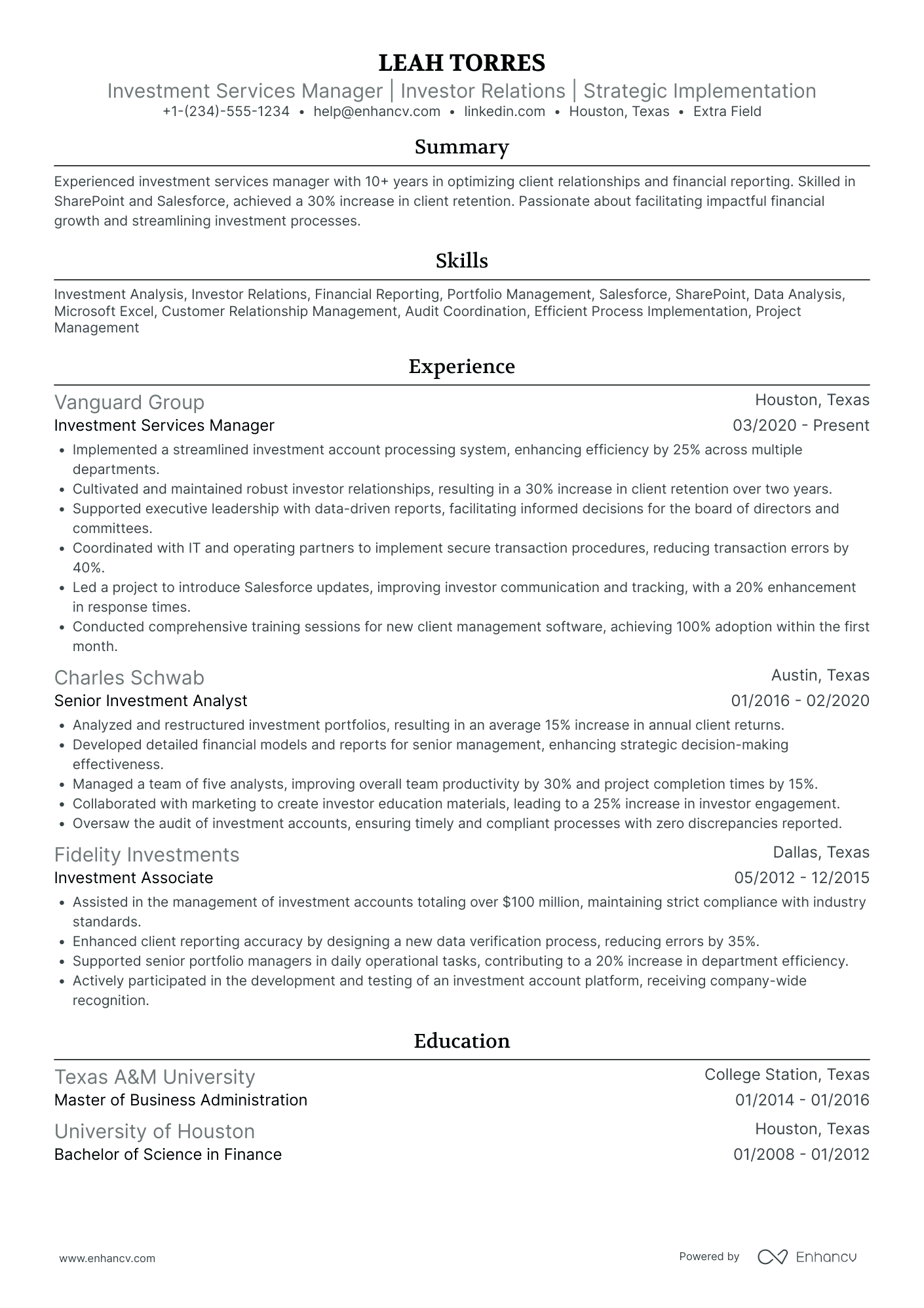

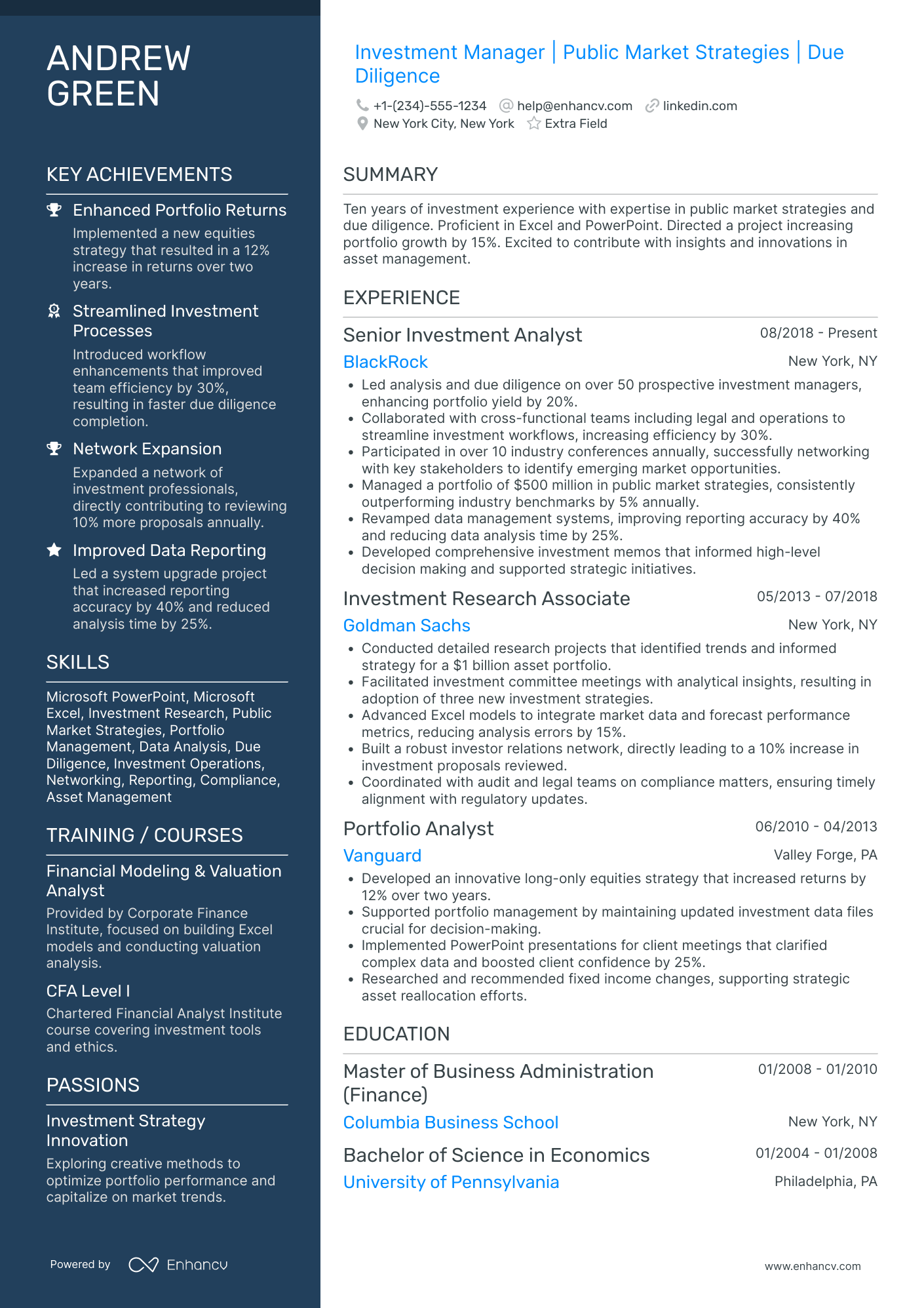

How to format a investment manager resume

Recruiters evaluating investment manager candidates prioritize evidence of portfolio performance, risk management decisions, and progressive responsibility across asset classes or fund sizes. A reverse-chronological format surfaces these signals immediately, letting hiring managers trace your growth from analyst-level execution to strategic allocation and client oversight.

I have significant experience in this role—which format should I use?

Use a reverse-chronological format—it's the only structure that clearly communicates your career progression, expanding scope, and accountability over assets and investment outcomes. Do:

- Lead each role entry with scope indicators: fund size, asset classes managed, team size, and decision-making authority.

- Highlight domain-specific proficiencies such as equity research, fixed-income strategies, derivatives pricing, Bloomberg Terminal, and risk modeling platforms.

- Quantify outcomes tied to portfolio returns, alpha generation, risk-adjusted performance, or capital raised.

Why hybrid and functional resumes don't work for senior roles

Hybrid formats fragment your leadership narrative by pulling key skills out of the roles where you demonstrated them, obscuring the progression from portfolio analyst to fund-level decision-maker and diluting the accountability context that hiring committees need to see. Functional formats are even more damaging—they eliminate the timeline entirely, making it impossible for recruiters to evaluate how your investment authority, team leadership, and performance track record expanded over time. Avoid both formats entirely if you have five or more years of progressive investment management experience, as they will weaken your candidacy at firms that expect clear evidence of compounding responsibility and decision ownership. Choosing the right resume layout ensures your progression and accountability remain front and center.

- A functional resume may be acceptable only if you're transitioning into investment management from a related field (such as equity research, actuarial science, or financial advisory), have a significant employment gap, or lack a traditional fund management career path—but even then, every listed skill must be anchored to specific projects, portfolio outcomes, or measurable results.

Once you've established a clean, readable format, the next step is deciding which sections to include so each one earns its place on the page.

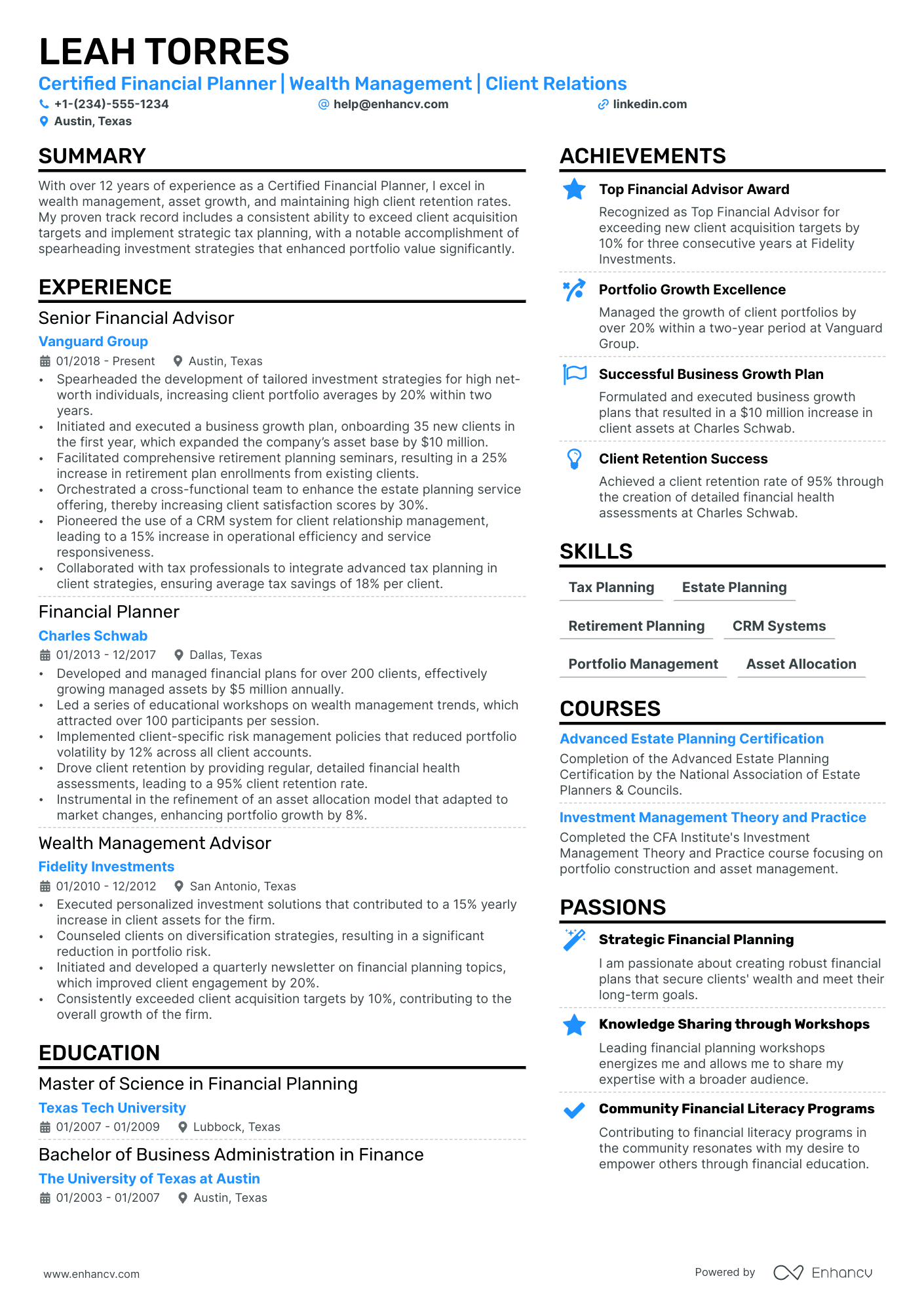

What sections should go on a investment manager resume

Recruiters expect to see a clear record of portfolio decisions, client outcomes, and risk-adjusted performance on your investment manager resume. Understanding what to put on a resume helps you prioritize the right content. Use this structure for maximum clarity:

- Header

- Summary

- Experience

- Skills

- Projects

- Education

- Certifications

- Optional sections: Awards, Publications, Languages

Strong experience bullets should emphasize measurable performance, assets under management scope, risk management decisions, and client or firm outcomes.

Is your resume good enough?

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

Once you’ve organized your resume with the right components in place, the next step is to write your investment manager resume experience section so you can fill that structure with relevant, results-driven detail.

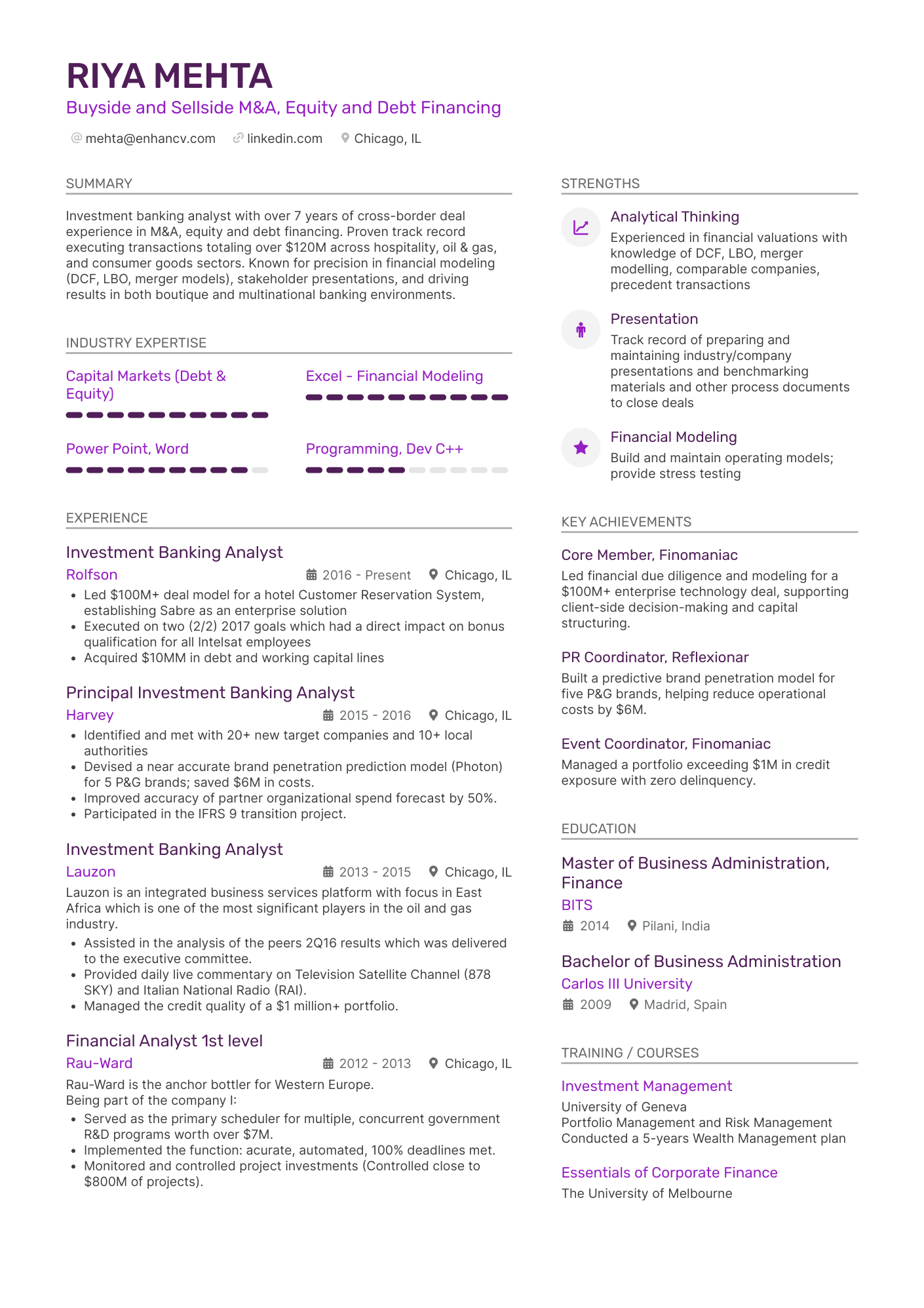

How to write your investment manager resume experience

Your experience section proves you can generate returns, manage risk, and steward capital—not just describe daily responsibilities. Hiring managers prioritize demonstrated impact over descriptive task lists, so every bullet should highlight shipped or delivered work, role-relevant tools or methods, and measurable outcomes.

Each entry should include:

- Job title

- Company and location (or remote)

- Dates of employment (month and year)

Three to five concise bullet points showing what you owned, how you executed, and what outcomes you delivered:

- Ownership scope: the portfolios, asset classes, fund strategies, or client relationships you were directly accountable for as an investment manager.

- Execution approach: the analytical frameworks, valuation models, research platforms, or risk management methodologies you used to inform investment decisions and allocate capital.

- Value improved: the changes you drove in portfolio performance, risk-adjusted returns, downside protection, cost efficiency, or compliance adherence relevant to your mandate.

- Collaboration context: how you partnered with research analysts, traders, compliance teams, client advisors, or external counterparties to execute investment strategies and meet fiduciary obligations.

- Impact delivered: the outcomes you produced expressed through fund growth, capital preservation, client retention, or strategic positioning rather than routine activity.

Experience bullet formula

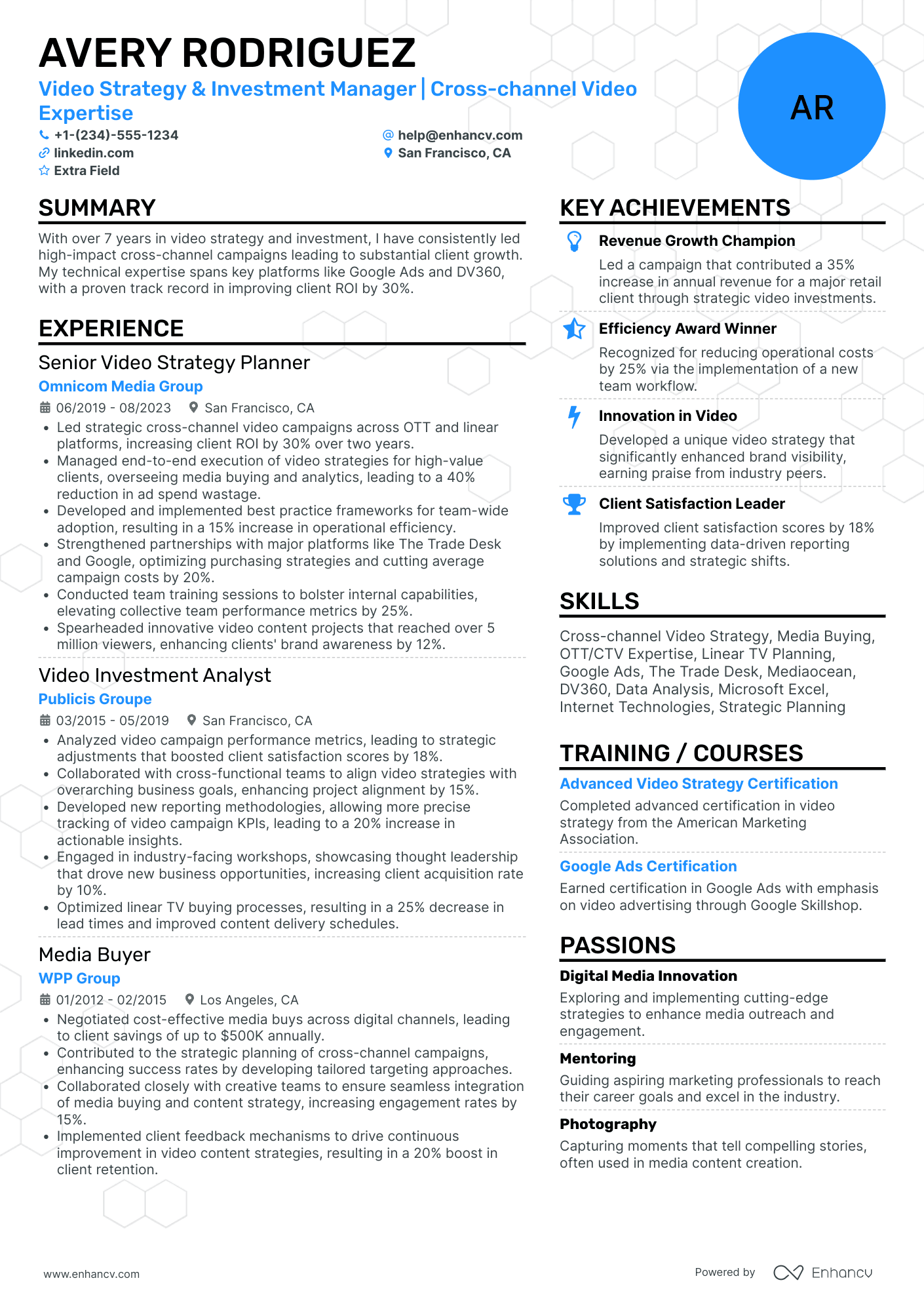

A investment manager experience example

✅ Right example - modern, quantified, specific.

Investment Manager

Redwood Capital Partners | New York, NY

2021–Present

Middle-market private credit manager overseeing $3.2B in assets across senior secured and unitranche strategies.

- Originated and underwrote twenty-seven new investments ($640M) using Bloomberg, Capital IQ, and a proprietary credit scorecard; improved portfolio yield by 90 basis points while keeping net loss rate under 0.30%.

- Built a Python and Excel (Power Query) cash-flow model library and standardized covenant templates in Microsoft Word; cut underwriting turnaround time by 25% and reduced model errors by 40% through version control and peer review.

- Led quarterly portfolio risk reviews in Tableau with scenario and stress testing (rates +200 basis points, revenue -10%); reduced watchlist exposure from 14% to 9% by executing amendments and proactive de-risking plans with borrowers.

- Negotiated terms with sponsors, legal counsel, and internal credit committee using covenant analytics and comps; tightened documentation to increase covenant compliance from 92% to 97% and lowered amendment frequency by 18%.

- Partnered with investor relations and finance to produce limited partner reporting in Salesforce and Workiva; improved on-time delivery from 85% to 99% and reduced limited partner follow-up requests by 30%.

Now that you've seen what a strong experience section looks like in practice, let's break down how to customize yours for each specific role you're targeting.

How to tailor your investment manager resume experience

Recruiters evaluate your investment manager resume through both applicant tracking systems and manual review, so aligning your experience with the job posting is essential. Tailoring your resume to the job description ensures your most relevant qualifications surface quickly during both screening stages.

Ways to tailor your investment manager experience:

- Match portfolio management platforms and analytics tools named in the posting.

- Mirror the exact asset classes or investment vehicles the role specifies.

- Use the same terminology for risk frameworks or valuation methodologies listed.

- Reflect performance benchmarks or return metrics the job description references.

- Highlight sector or industry-specific fund experience when the role requires it.

- Emphasize regulatory compliance and fiduciary standards if the posting mentions them.

- Align your experience with the client reporting workflows described in the listing.

- Reference collaboration with research or trading teams when cross-functional work applies.

Tailoring means connecting your actual achievements to what the employer needs—not forcing keywords where they don't belong.

Resume tailoring examples for investment manager

| Job description excerpt | Untailored | Tailored |

|---|---|---|

| Manage a diversified portfolio of public equities and fixed income securities, conducting fundamental analysis and working closely with the risk management team to optimize risk-adjusted returns. | Managed investments and helped improve portfolio performance. | Managed a $450M diversified portfolio of public equities and fixed income securities, conducting bottom-up fundamental analysis and collaborating with the risk management team to achieve a 12% improvement in risk-adjusted returns over three years. |

| Source, evaluate, and execute direct private equity and real estate co-investment opportunities using detailed financial modeling in Excel and Argus Enterprise, presenting recommendations to the Investment Committee. | Analyzed potential deals and presented findings to leadership. | Sourced and evaluated 30+ direct private equity and real estate co-investment opportunities annually, building detailed financial models in Excel and Argus Enterprise and presenting actionable recommendations to the Investment Committee, resulting in $75M in deployed capital. |

| Develop and implement asset allocation strategies aligned with the fund's long-term liability profile, utilizing Bloomberg PORT and FactSet for portfolio analytics and scenario stress testing. | Helped set investment strategy and used analytics tools to monitor portfolios. | Developed and implemented asset allocation strategies aligned with $2B in long-term liabilities, leveraging Bloomberg PORT and FactSet to run scenario stress tests and rebalance exposures, reducing projected funding shortfall by 8% over a five-year horizon. |

Once your experience highlights the roles and responsibilities that match the target position, the next step is to quantify your investment manager achievements so hiring managers can quickly see your impact.

How to quantify your investment manager achievements

Quantifying your achievements proves you improved returns, controlled risk, and ran portfolios efficiently. Focus on performance versus benchmarks, assets under management, risk metrics, fees and revenue, and process accuracy and cycle time.

Quantifying examples for investment manager

| Metric | Example |

|---|---|

| Performance | "Generated 12.4% net return versus 9.1% benchmark for a $450M balanced portfolio by rebalancing monthly and tightening factor exposures in Bloomberg PORT." |

| Risk reduction | "Cut portfolio volatility from 11.8% to 9.6% and reduced max drawdown by 220 basis points by adding tail hedges and enforcing VaR limits." |

| Revenue impact | "Increased advisory fee revenue by $1.2M annually by upselling model portfolios to thirty-five high-net-worth clients and raising assets under management by $80M." |

| Compliance accuracy | "Achieved zero material audit findings across four SEC reviews by automating pre-trade compliance checks and reducing guideline breaches from twelve per quarter to one." |

| Cycle time | "Reduced trade-to-settlement cycle time from T+3 to T+2 readiness in eight weeks by coordinating custodians, updating workflows, and standardizing trade files in Excel." |

Turn vague job duties into measurable, recruiter-ready resume bullets in seconds with Enhancv's Bullet Point Generator.

With your bullet points clearly articulating your accomplishments, it's equally important to ensure your resume highlights the right mix of hard and soft skills that investment management employers prioritize.

How to list your hard and soft skills on a investment manager resume

Your skills section shows you can research, value, and manage portfolios, and recruiters and an ATS (applicant tracking system) scan this section to confirm role fit fast; aim for a heavier mix of hard skills supported by a focused set of job-critical soft skills. investment manager roles require a blend of:

- Product strategy and discovery skills.

- Data, analytics, and experimentation skills.

- Delivery, execution, and go-to-market discipline.

- Soft skills.

Your skills section should be:

- Scannable (bullet-style grouping).

- Relevant to the job post.

- Backed by proof in experience bullets.

- Updated with current tools.

Place your skills section:

- Above experience if you're junior or switching careers.

- Below experience if you're mid/senior with strong achievements.

Hard skills

- Fundamental equity research

- Financial statement analysis

- Discounted cash flow modeling

- Comparable company analysis

- Portfolio construction

- Asset allocation, rebalancing

- Risk modeling, value at risk

- Performance attribution

- Bloomberg Terminal

- FactSet, Morningstar Direct

- Excel, VBA, Python

- Macroeconomic and rates analysis

Soft skills

- Defend investment theses

- Communicate risk and downside

- Present to investment committees

- Align stakeholders on trade decisions

- Prioritize high-conviction ideas

- Challenge assumptions with data

- Execute under time pressure

- Manage client expectations

- Negotiate with brokers and counterparties

- Document decisions and rationale

- Coordinate across research and trading

- Maintain compliance-first judgment

How to show your investment manager skills in context

Skills shouldn't live only in a dedicated skills list. Explore resume skills examples to see how top candidates weave competencies throughout their resumes.

They should be demonstrated in:

- Your summary (high-level professional identity)

- Your experience (proof through outcomes)

Here's how that looks in practice.

Summary example

Senior investment manager with 12 years directing equity and fixed-income portfolios using Bloomberg Terminal and Monte Carlo modeling. Led a $400M fund restructuring that lifted risk-adjusted returns 18% over three years while mentoring a six-person analyst team.

- Signals senior-level depth immediately

- Names industry-standard tools and methods

- Quantifies portfolio-level impact clearly

- Highlights leadership as a soft skill

Experience example

Senior Investment Manager

Crestfield Capital Partners | Chicago, IL

March 2018–Present

- Managed a $650M multi-asset portfolio using factor-based analysis, delivering 14% annualized returns over five consecutive years.

- Collaborated with risk and compliance teams to redesign hedging frameworks in FactSet, reducing downside exposure by 22%.

- Mentored four junior analysts on DCF modeling and client reporting, improving team proposal turnaround time by 30%.

- Every bullet includes measurable proof.

- Skills surface naturally through real outcomes.

Once you’ve grounded your abilities in real outcomes and responsibilities, the next step is translating that approach into a resume when you don’t have direct investment management experience.

How do I write a investment manager resume with no experience

Even without full-time experience, you can demonstrate readiness through projects and academic work. Building a resume without work experience is entirely possible when you focus on transferable skills and relevant projects:

- Student-managed investment fund role

- CFA Institute Research Challenge project

- Equity research reports with valuation models

- Portfolio backtests using Python

- Bloomberg Terminal coursework simulations

- Internship in corporate finance

- Personal paper-trading portfolio with thesis

- Market risk analysis case competitions

Focus on:

- Valuation models and investment theses

- Risk metrics and portfolio construction

- Tools: Excel, Python, Bloomberg Terminal

- Measurable results and clear assumptions

Resume format tip for entry-level investment manager

Use a skills-based resume format because it foregrounds valuation, research, and portfolio work when your work history is limited. Do:

- Lead with a "Projects" section.

- Quantify results with returns and error rates.

- Name tools used in each bullet.

- Show assumptions, inputs, and outputs.

- Add relevant licenses and coursework.

- Built a Python backtested factor portfolio, rebalanced monthly, and improved Sharpe ratio from 0.62 to 0.88 versus a market benchmark over five years.

Even without direct experience, your education section can serve as the foundation of your investment manager resume—here's how to present it effectively.

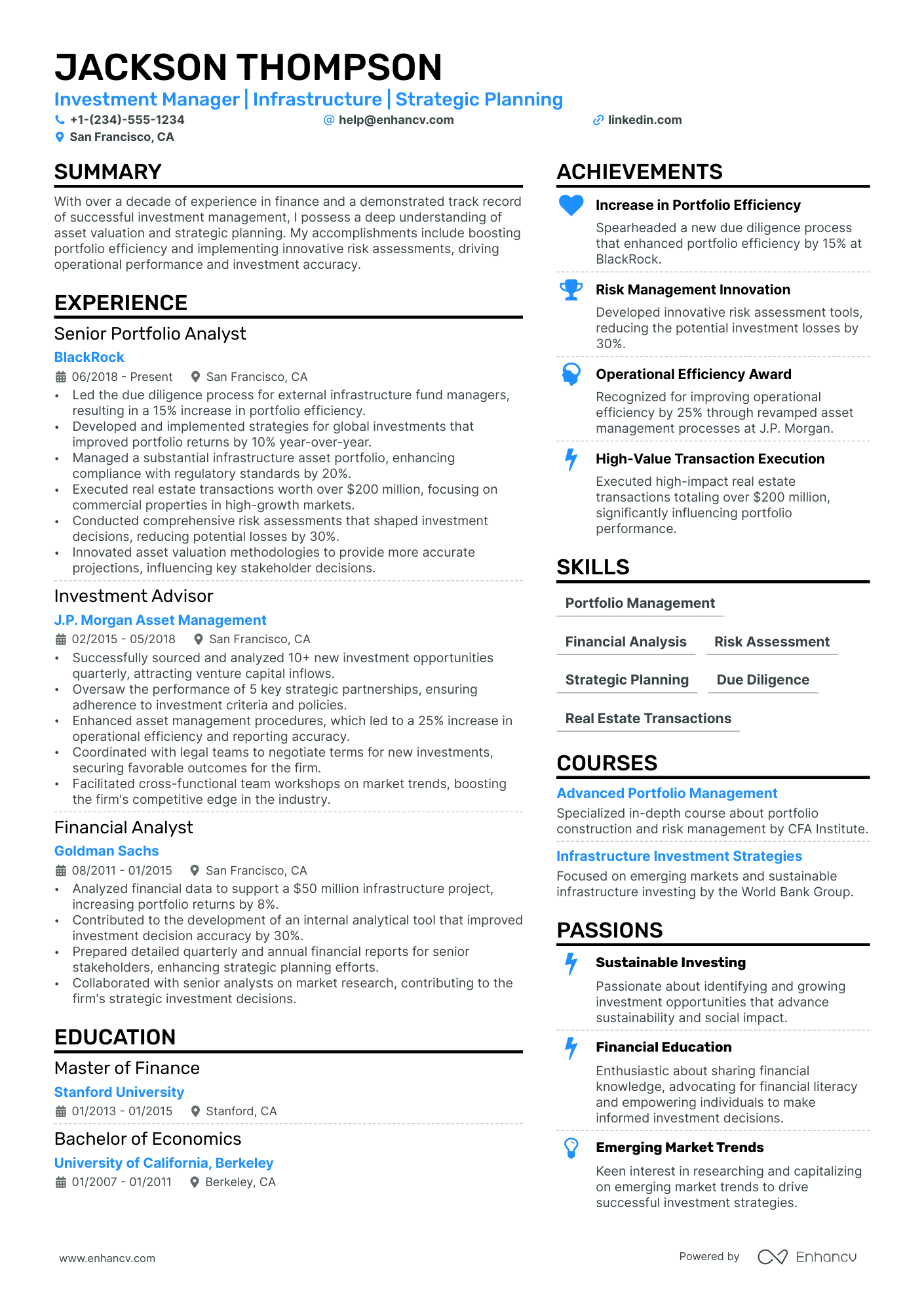

How to list your education on a investment manager resume

Your education section helps hiring teams confirm you have the foundational knowledge required. It validates analytical, financial, and quantitative skills essential for any investment manager role.

Include:

- Degree name

- Institution

- Location

- Graduation year

- Relevant coursework (for juniors or entry-level candidates)

- Honors & GPA (if 3.5 or higher)

Avoid listing specific months or days—use the graduation year only for a cleaner format.

Here's a strong education entry tailored for an investment manager resume.

Example education entry

Bachelor of Science in Finance

The Wharton School, University of Pennsylvania, Philadelphia, PA

Graduated 2019

GPA: 3.8/4.0

- Relevant coursework: Portfolio Management, Quantitative Methods, Fixed Income Analysis, Corporate Valuation, Derivatives & Risk Management

- Honors: Magna Cum Laude, Dean's List (all semesters)

How to list your certifications on a investment manager resume

Listing certifications on your resume shows an investment manager's commitment to learning, proficiency with key tools, and alignment with current industry standards and regulations.

Include:

- Certificate name

- Issuing organization

- Year

- Optional: credential ID or URL

- List certifications below education when they're older, less relevant, or you want to highlight a recent degree first.

- List certifications above education when they're recent, highly relevant, or required for the investment manager roles you target.

Best certifications for your investment manager resume

Chartered Financial Analyst (CFA) Financial Risk Manager (FRM) Chartered Alternative Investment Analyst (CAIA) Chartered Investment Manager (CIM) Certified Investment Management Analyst (CIMA) Certificate in ESG Investing (CFA Institute) Series 7

Once you’ve positioned your credentials where they’re easiest to verify, shift to writing your investment manager resume summary so it reinforces those qualifications upfront.

How to write your investment manager resume summary

Your resume summary is the first thing a recruiter reads. A sharp, tailored opening sets the tone and decides whether the rest of your resume gets attention.

Keep it to three to four lines, with:

- Your title and total years of investment management experience.

- Domain focus, such as equities, fixed income, alternatives, or multi-asset portfolios.

- Core skills like portfolio construction, risk modeling, financial analysis, or client advisory.

- One or two measurable achievements, such as returns generated or assets under management grown.

- Soft skills tied to outcomes, like client relationship building that improved retention rates.

PRO TIP

At the mid-level, emphasize domain expertise, analytical rigor, and measurable portfolio results. Highlight specific asset classes and tools you've worked with. Avoid vague phrases like "passionate professional" or "results-driven individual." Recruiters want proof, not personality statements.

Example summary for a investment manager

Investment manager with six years of experience in equities and fixed income. Built and optimized portfolios totaling $120M in AUM. Skilled in Bloomberg Terminal, risk modeling, and client advisory.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Now that your summary captures your investment management expertise, make sure your header presents the essential contact and professional details recruiters need to reach you.

What to include in a investment manager resume header

A resume header is the top section with your identity and contact details, and it drives visibility, credibility, and recruiter screening for a investment manager.

Essential resume header elements

- Full name

- Tailored job title and headline

- Location

- Phone number

- Professional email

- GitHub link

- Portfolio link

A LinkedIn link helps recruiters confirm roles, dates, and credentials fast, which speeds up screening.

Do not include a photo on a investment manager resume unless the role is explicitly front-facing or appearance-dependent.

Use a job title and headline that match the posting and highlight your core asset class focus and years of experience.

Example

Investment manager resume header

Jordan Lee

Investment Manager | Public Equities & Portfolio Construction

New York, NY

(212) 555-01XX

jordan.lee@enhancv.com github.com/jordanlee yourwebsite.com linkedin.com/in/jordanlee

Once your contact and role details are set at the top, add targeted additional sections to reinforce your fit and provide relevant context.

Additional sections for investment manager resumes

When your core qualifications align closely with other candidates, well-chosen additional sections can set your investment manager resume apart. For example, listing language skills can demonstrate your ability to work across global markets and communicate with international clients.

- Languages

- Certifications and licenses

- Industry publications and research

- Board memberships and advisory roles

- Professional affiliations

- Conferences and speaking engagements

- Volunteer experience in financial literacy

Once you've rounded out your resume with the right supplementary sections, it's worth pairing it with a strong cover letter to maximize your impact.

Do investment manager resumes need a cover letter

An investment manager cover letter rarely is required, but it often helps in competitive searches or firms with formal hiring expectations. If you're unsure where to start, understanding what a cover letter is and how it complements your resume can clarify its value. It can make a difference when your resume needs context, or when the role demands a specific investing style.

Use a cover letter to add context your resume can't show:

- Explain role and team fit: Connect your investing approach to the firm's strategy, asset mix, and decision-making process.

- Highlight one or two relevant outcomes: Pick a deal, portfolio change, or risk action, and state the result with clear numbers.

- Show business context understanding: Reference the product, users, and constraints, such as liquidity needs, benchmarks, or regulatory limits.

- Address transitions or non-obvious experience: Explain a move across asset classes, a gap, or a shift from research to portfolio management.

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Even if you include a cover letter to add context beyond your resume, using AI to improve your investment manager resume follows naturally because it helps you refine the document’s clarity and impact.

Using AI to improve your investment manager resume

AI can sharpen your resume's clarity, structure, and impact. It helps tighten language and highlight measurable results. But overuse strips authenticity fast. Once your content feels clear and role-aligned, step away from AI entirely. For specific guidance, explore ChatGPT resume writing prompts tailored for different resume sections.

Here are 10 practical prompts to strengthen specific sections of your investment manager resume:

- Sharpen your summary. "Rewrite my investment manager resume summary to highlight portfolio performance, asset classes managed, and years of experience in under four sentences."

- Quantify experience bullets. "Add specific metrics like AUM, returns, or risk-adjusted performance to each experience bullet on my investment manager resume."

- Strengthen action verbs. "Replace weak or passive verbs in my investment manager experience section with strong, finance-specific action verbs."

- Align skills section. "Compare my investment manager resume skills section against this job description and suggest missing hard or technical skills."

- Trim redundant phrasing. "Remove filler words and redundant phrases from every section of my investment manager resume without losing key details."

- Refine project descriptions. "Rewrite the projects section of my investment manager resume to emphasize strategy, outcomes, and portfolio impact."

- Improve certification placement. "Suggest the best placement and formatting for CFA, CAIA, or FRM certifications on my investment manager resume."

- Tailor education details. "Edit my education section to highlight coursework and honors most relevant to an investment manager role."

- Clarify career progression. "Restructure my investment manager experience bullets to clearly show increasing responsibility and leadership over time."

- Eliminate jargon overload. "Simplify overly technical language in my investment manager resume so it's clear to both recruiters and hiring managers."

Stop using AI once your resume sounds accurate, specific, and aligned with real experience. AI should never invent experience or inflate claims—if it didn't happen, it doesn't belong here.

Conclusion

A strong investment manager resume shows measurable outcomes, role-specific skills, and a clear structure. Lead with results like returns, risk reduction, and assets under management. Support them with strengths in portfolio construction, research, risk management, and client communication.

Keep each section focused and easy to scan. Use consistent formatting, clear headings, and concise bullets that connect actions to outcomes. This approach shows you’re ready for today’s hiring market and the next wave of expectations.