Many financial reporting manager resume drafts fail because they read like task lists and bury audit-ready results behind dense accounting jargon. That hurts you in ATS screening and fast recruiter scans, where clarity and impact win amid heavy competition. Understanding how to make your resume stand out is essential in a field where so many candidates share similar credentials.

A strong resume proves outcomes, not tools. You should show faster close cycles, fewer post-close adjustments, clean audit results, timely SEC filings, improved controls, and scalable processes. Quantify scope with entities, revenue, deadlines met, and error-rate reductions.

Key takeaways

- Quantify close-cycle improvements, audit outcomes, and error reductions instead of listing routine duties.

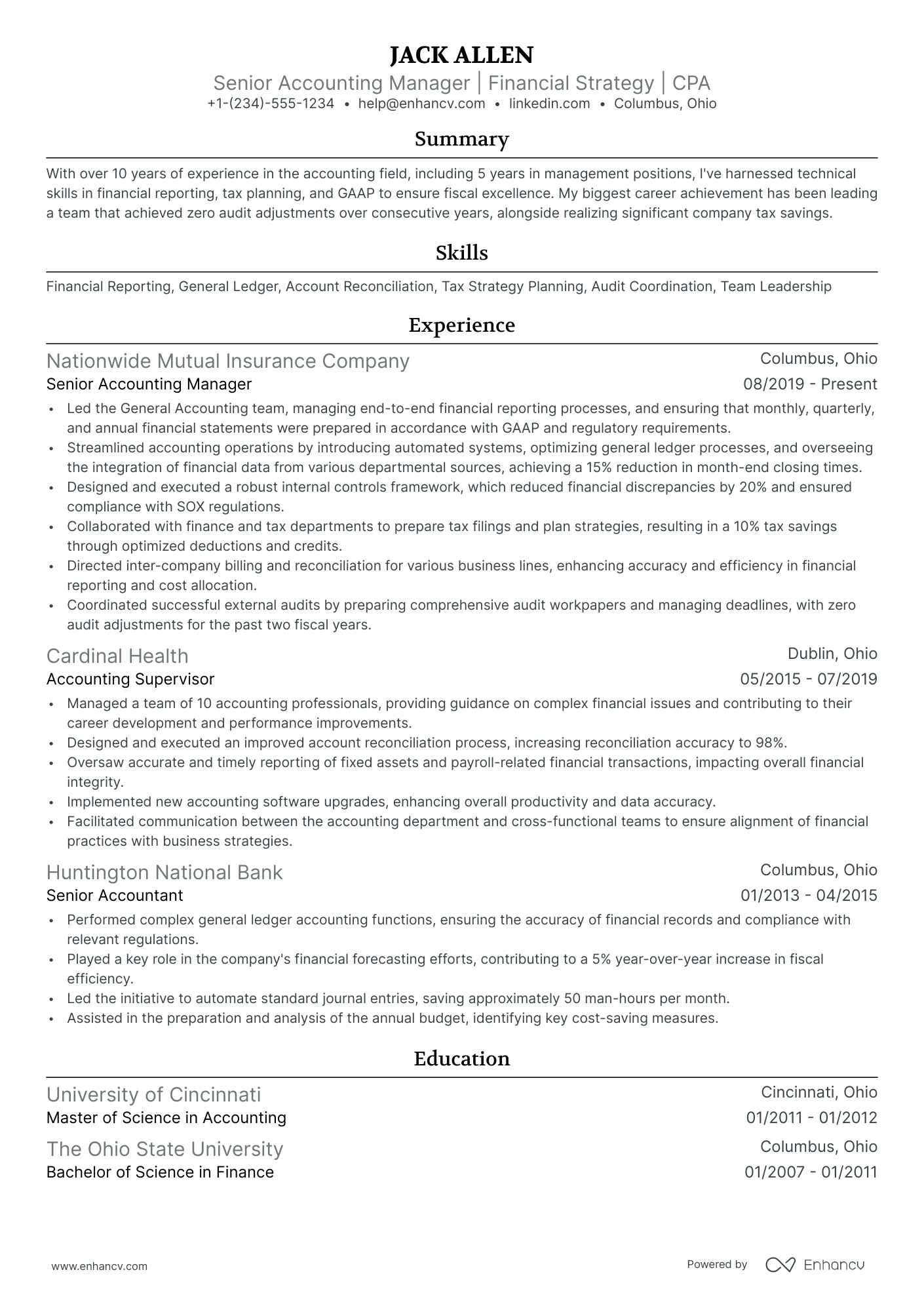

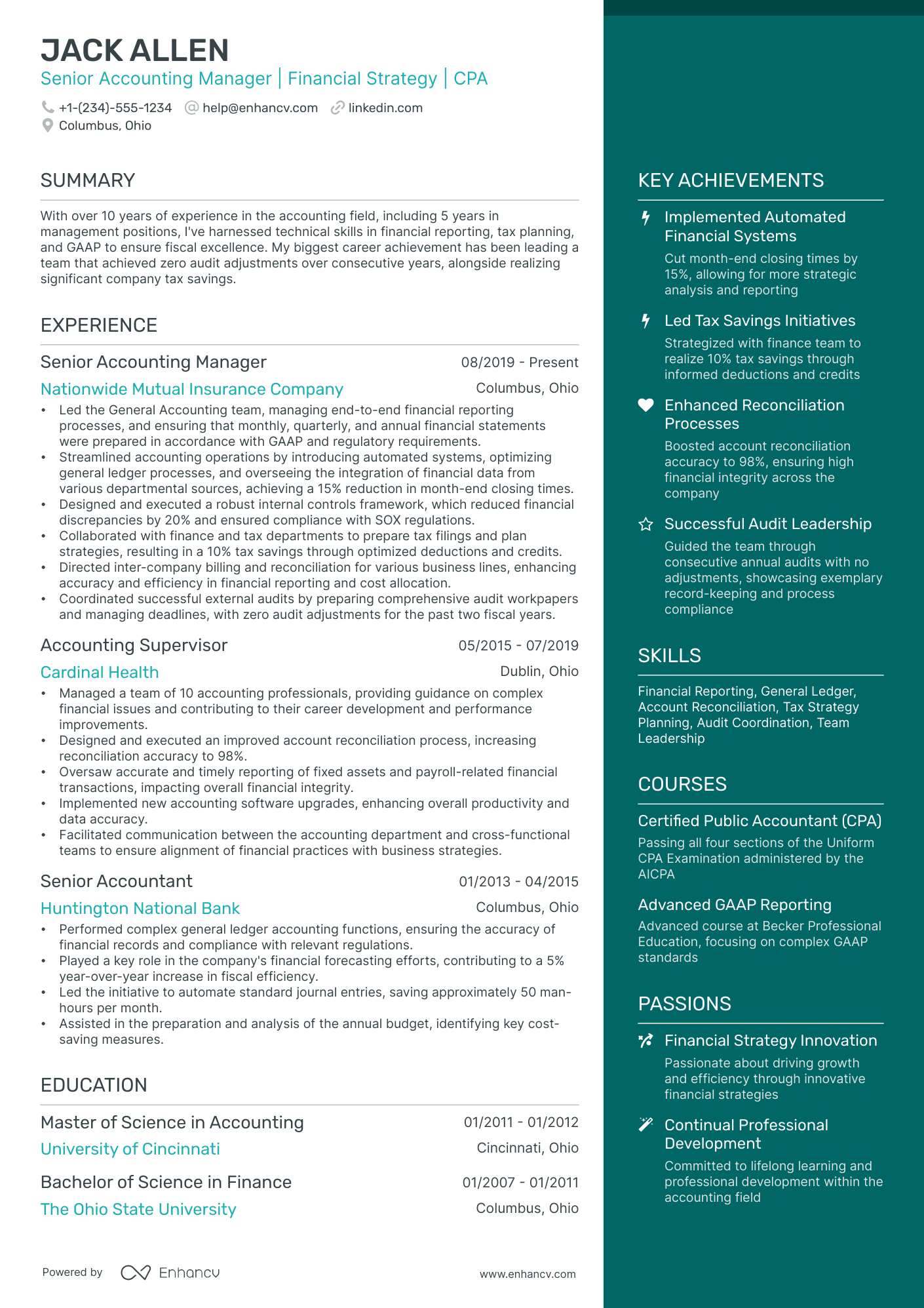

- Use reverse-chronological format to show progressive reporting leadership and growing scope clearly.

- Tailor every bullet to mirror the job posting's tools, standards, and compliance language.

- Anchor skills in measurable experience results rather than isolating them in a standalone list.

- Lead each role entry with ownership scope: team size, entity count, and reporting jurisdictions.

- Place certifications like CPA or CMA near education to reinforce credibility with hiring managers.

- Use Enhancv to turn vague responsibilities into specific, recruiter-ready bullets with measurable impact.

How to format a financial reporting manager resume

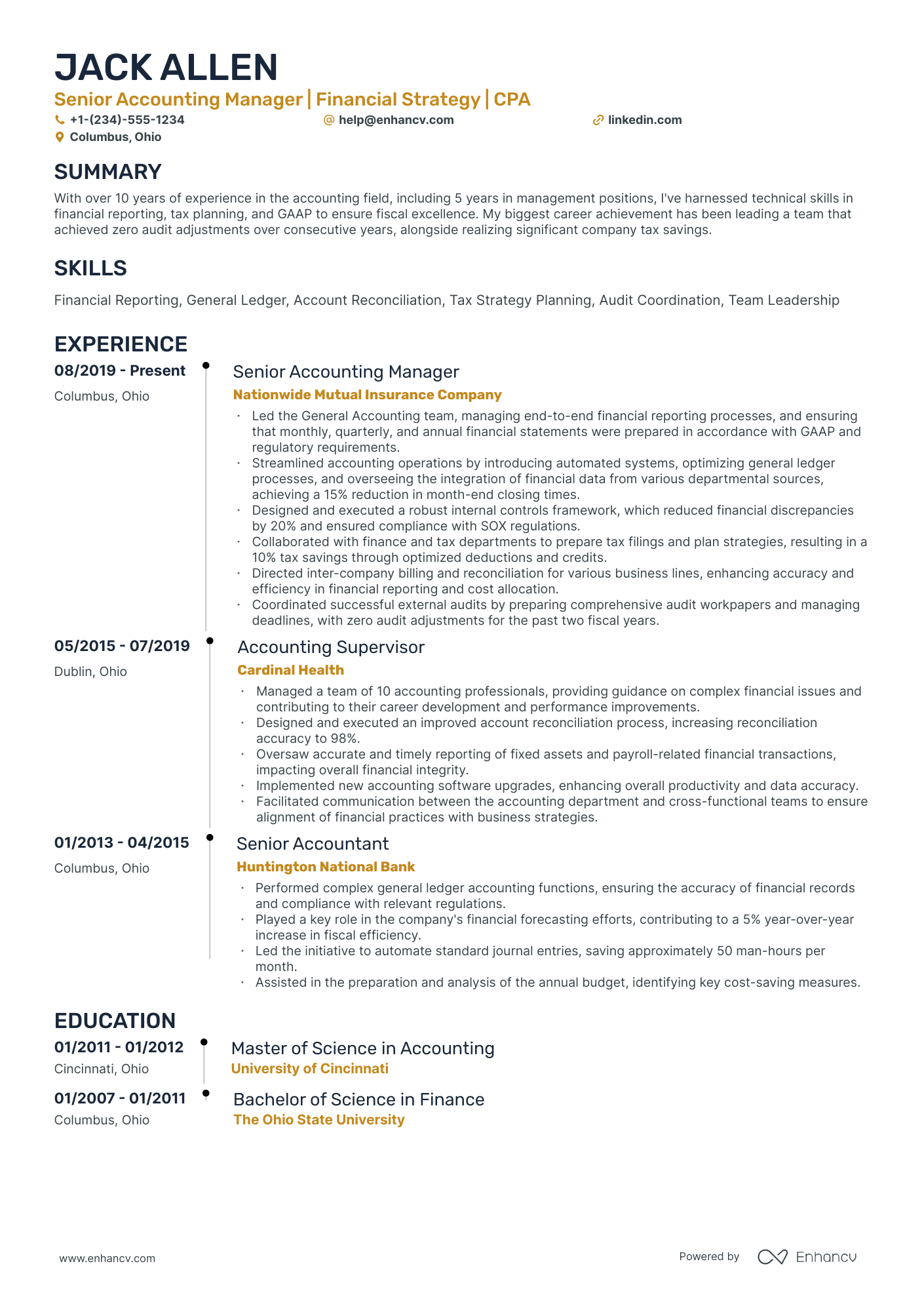

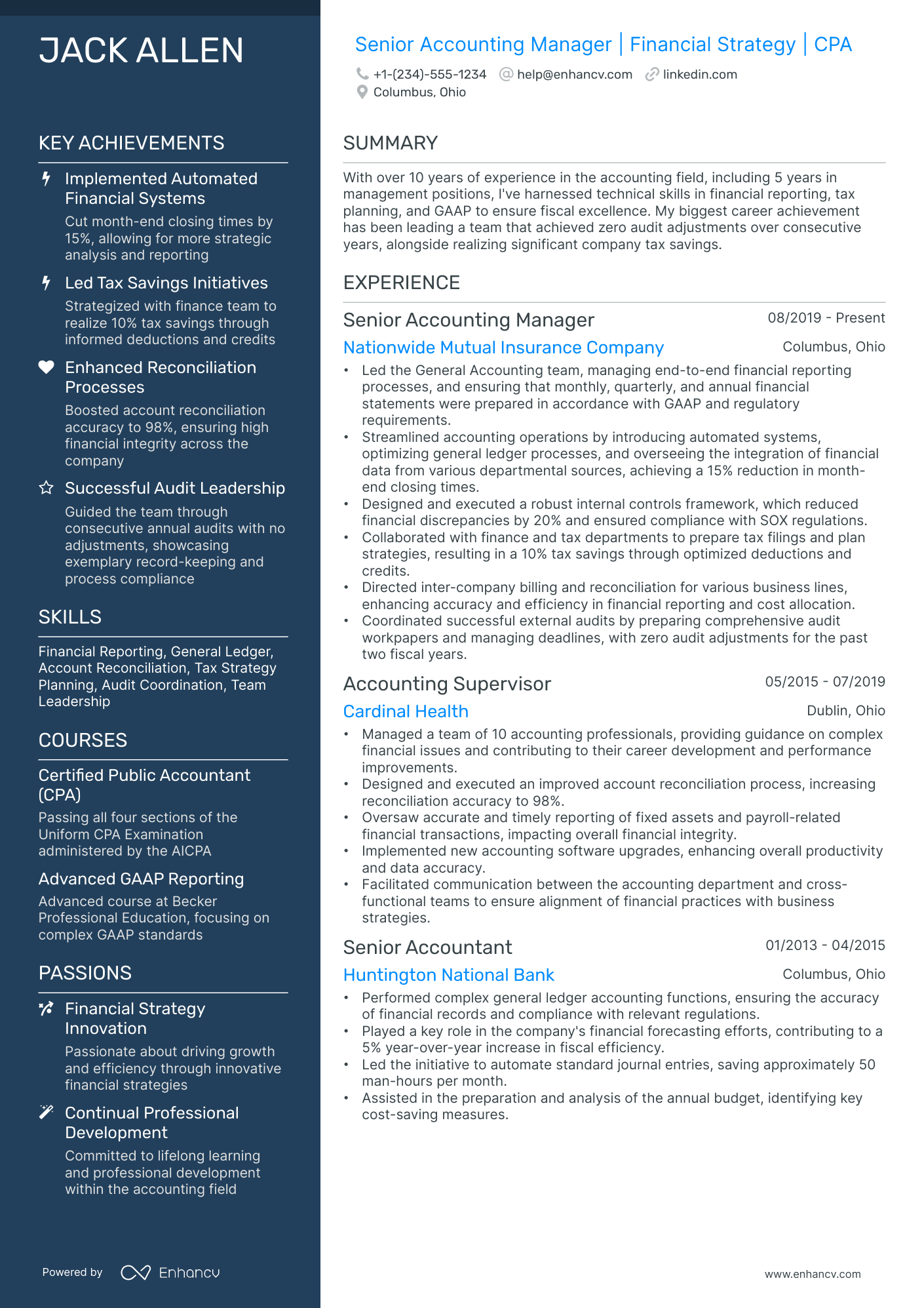

Recruiters evaluating financial reporting manager candidates prioritize evidence of progressive leadership in close processes, SEC/GAAP compliance, and cross-functional oversight of reporting cycles. A well-chosen resume format ensures these signals—scope of accountability, team leadership, and measurable improvements to reporting accuracy or efficiency—are immediately visible rather than buried beneath formatting choices that obscure career progression.

I have significant experience in this role—which format should I use?

Use a reverse-chronological format—it's the correct choice for experienced financial reporting managers. Do:

- Lead each role entry with your scope of ownership: team size, number of entities consolidated, and reporting jurisdictions (domestic, international, SEC, statutory).

- Highlight proficiency in role-critical systems and domains such as Oracle HFM, SAP BPC, Workiva, BlackLine, SOX compliance, and technical accounting under ASC 842 or ASC 606.

- Quantify outcomes tied to reporting quality, audit readiness, and process efficiency rather than listing routine duties.

Why hybrid and functional resumes don't work for senior roles

Hybrid formats fragment your leadership narrative by pulling key accomplishments out of their organizational context, making it harder for reviewers to assess the progression of your accountability across reporting cycles, team growth, and compliance mandates. Functional formats go further, stripping away timeline and role-level detail entirely—diluting evidence of decision ownership, stakeholder management, and the escalating complexity that defines a strong financial reporting career. Avoid hybrid and functional formats entirely when your career demonstrates a clear trajectory of increasing scope in financial reporting, consolidation, or close management.

- Edge-case exception: A functional format may be acceptable only if you're transitioning into financial reporting management from an adjacent discipline (such as external audit or technical accounting advisory) with limited direct reporting titles—but even then, every skill claim must be anchored to specific projects, deliverables, and quantified outcomes to remain credible with hiring managers and applicant tracking systems.

Once your format establishes a clean, scannable structure, the next step is determining which sections to include so each one serves a clear purpose.

What sections should go on a financial reporting manager resume

Recruiters expect to see how you lead accurate, compliant reporting and drive timely closes with clear ownership and measurable results. Knowing what to put on a resume helps you prioritize the sections that matter most for this role.

Use this structure for maximum clarity:

- Header

- Summary

- Experience

- Skills

- Projects

- Education

- Certifications

- Optional sections: Awards, Leadership, Languages

Strong experience bullets should emphasize reporting accuracy, close-cycle improvements, audit readiness, stakeholder impact, and the scope of entities, systems, and standards you owned.

Is your resume good enough?

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

Once you’ve organized your resume with the right sections, the next step is to write your financial reporting manager experience in a way that fits that structure and shows impact.

How to write your financial reporting manager resume experience

Your work experience section should demonstrate the financial reporting work you've delivered, the tools and methodologies you've applied, and the measurable outcomes you've produced. Hiring managers prioritize demonstrated impact—improved accuracy, streamlined close processes, successful audit outcomes—over descriptive task lists.

Each entry should include:

- Job title

- Company and location (or remote)

- Dates of employment (month and year)

Three to five concise bullet points showing what you owned, how you executed, and what outcomes you delivered:

- Ownership scope: The reporting functions, financial statements, consolidation processes, entity structures, or teams you were directly accountable for as a financial reporting manager.

- Execution approach: The ERP systems, reporting platforms, accounting standards, internal controls, or analytical frameworks you used to produce accurate and timely financial reports.

- Value improved: The changes you drove in reporting accuracy, close-cycle efficiency, compliance posture, data reliability, or risk reduction across the financial reporting function.

- Collaboration context: How you partnered with auditors, tax teams, FP&A, treasury, legal counsel, or executive leadership to align reporting outputs with organizational and regulatory requirements.

- Impact delivered: The outcomes your work produced—expressed through business results, regulatory milestones, process improvements, or operational scale rather than routine activity descriptions.

Experience bullet formula

A financial reporting manager experience example

✅ Right example - modern, quantified, specific.

Financial Reporting Manager

Arcstone Energy | Houston, TX

2021–Present

Publicly traded energy company with $6B+ revenue, operating across upstream and midstream assets.

- Led SEC reporting for 10-Q and 10-K filings using Workiva and Oracle Financials, cutting close-to-file cycle time by 20% (from 40 to 32 days) while maintaining zero late filings.

- Streamlined monthly close by redesigning account reconciliations in BlackLine and automating journal entry workflows in Oracle, reducing rework by 30% and saving 120+ hours per quarter.

- Implemented ASC 842 lease accounting in LeaseQuery and coordinated adoption with FP&A, tax, and external auditors, improving completeness testing and reducing audit adjustments by 35%.

- Built GAAP-to-management reporting bridge in Power BI with SQL-based data validation, improving forecast-to-actual variance analysis accuracy by 15% and accelerating leadership reporting by two days.

- Partnered with internal audit and IT to strengthen SOX controls over revenue recognition and consolidation (Hyperion Financial Management), lowering control exceptions by 40% and improving PBC turnaround time by 25%.

Now that you've seen how a strong experience section comes together, let's look at how to adjust yours to match the specific job you're targeting.

How to tailor your financial reporting manager resume experience

Recruiters evaluate your financial reporting manager resume through applicant tracking systems and manual review, scoring how closely your experience matches the posting. Tailoring your resume to the job description by adjusting each bullet to reflect the posting's language and priorities increases your chances of clearing both filters.

Ways to tailor your financial reporting manager experience:

- Mirror the exact ERP or consolidation tools listed in the posting.

- Match terminology for GAAP or IFRS standards the role requires.

- Align your reporting KPIs with the metrics the employer tracks.

- Highlight SEC filing experience when the job description mentions it.

- Reference the specific close cycle timelines the posting emphasizes.

- Include industry experience that matches the company's sector focus.

- Reflect cross-functional collaboration models described in the role listing.

- Emphasize SOX compliance or internal controls when the posting calls for them.

Tailoring means aligning your real accomplishments with the employer's stated requirements, not forcing disconnected keywords into your experience section.

Resume tailoring examples for financial reporting manager

| Job description excerpt | Untailored | Tailored |

|---|---|---|

| "Oversee preparation of consolidated financial statements in accordance with US GAAP for a multi-entity organization using Oracle HFM." | Prepared financial statements and reports for the company on a regular basis. | Led monthly and quarterly preparation of consolidated financial statements across 12 entities in full compliance with US GAAP, using Oracle HFM to streamline intercompany eliminations and reduce close cycle time by three days. |

| "Manage SEC reporting requirements including 10-K, 10-Q, and 8-K filings, ensuring accuracy and timely submission through collaboration with external auditors." | Helped with regulatory filings and worked with auditors when needed. | Managed end-to-end SEC reporting for 10-K, 10-Q, and 8-K filings, coordinating directly with external auditors to ensure zero restatements and consistent on-time submission over eight consecutive quarters. |

| "Drive process improvements in the monthly close cycle, leveraging BlackLine for account reconciliations and journal entry automation to achieve a 5-day close target." | Improved financial processes and helped the team meet deadlines more efficiently. | Redesigned the monthly close workflow by implementing BlackLine for automated account reconciliations and journal entries, cutting the close cycle from nine days to five and eliminating 40% of manual reconciliation tasks. |

Once you’ve aligned your experience with the role’s requirements, the next step is to quantify your financial reporting manager achievements so hiring teams can quickly see the impact behind those responsibilities.

How to quantify your financial reporting manager achievements

Quantifying your achievements proves you improved close speed, reporting accuracy, and compliance outcomes. Focus on close cycle time, material adjustments, audit findings, control effectiveness, and the reporting volume you delivered across entities and standards.

Quantifying examples for financial reporting manager

| Metric | Example |

|---|---|

| Close cycle time | "Cut month-end close from eight to five business days by automating reconciliations in BlackLine and standardizing journal entry workflows across six entities." |

| Reporting accuracy | "Reduced post-close adjustments by 35% by tightening flux analysis thresholds and adding a two-step review in Workiva for all SEC reporting schedules." |

| Audit outcomes | "Delivered a clean audit with zero significant deficiencies and one minor comment by improving PBC tracking and control evidence retention in SharePoint." |

| Compliance risk | "Lowered SOX control exceptions from twelve to three per quarter by redesigning key controls and retraining twenty process owners on documentation standards." |

| Volume delivered | "Produced ten-K and three ten-Q filings on time while managing 120+ footnotes and schedules, coordinating inputs from tax, treasury, and FP&A." |

Turn vague job duties into measurable, recruiter-ready resume bullets in seconds with Enhancv's Bullet Point Generator.

With strong bullet points in place, the next step is ensuring your skills section presents the right mix of hard and soft skills that hiring managers expect from a financial reporting manager.

How to list your hard and soft skills on a financial reporting manager resume

Skills matter because financial reporting managers must deliver accurate, compliant reporting on tight timelines—recruiters and ATS scan the skills section to confirm role fit fast, so aim for a balanced mix of technical reporting skills and execution-focused soft skills.

financial reporting manager roles require a blend of:

- Product strategy and discovery skills.

- Data, analytics, and experimentation skills.

- Delivery, execution, and go-to-market discipline.

- Soft skills.

Your skills section should be:

- Scannable (bullet-style grouping).

- Relevant to the job post.

- Backed by proof in experience bullets.

- Updated with current tools.

Place your skills section:

- Above experience if you're junior or switching careers.

- Below experience if you're mid/senior with strong achievements.

Hard skills

Listing relevant hard skills demonstrates your technical proficiency with the tools and standards that drive financial reporting accuracy:

- US GAAP, IFRS reporting

- SEC reporting, 10-K, 10-Q

- Financial statement consolidation

- Month-end close, flux analysis

- Technical accounting memos

- Revenue recognition (ASC 606)

- Lease accounting (ASC 842)

- Internal controls, SOX compliance

- Audit coordination, PBC management

- Workiva, EDGAR filing

- NetSuite, Oracle, SAP

- Advanced Excel, Power Query

Soft skills

Pairing those with strong soft skills shows you can lead teams and collaborate across departments under pressure:

- Own reporting calendars and deadlines

- Translate guidance into clear actions

- Partner with FP&A and controllership

- Align legal, tax, and treasury inputs

- Lead audit discussions and follow-ups

- Write crisp, defensible disclosures

- Escalate risks early with options

- Drive close process improvements

- Review work with high standards

- Communicate changes to stakeholders

- Prioritize tasks under time pressure

- Coach and develop analysts

How to show your financial reporting manager skills in context

Skills shouldn't live only in a bulleted list on your resume. Explore resume skills examples to see how top candidates weave competencies throughout their documents.

They should be demonstrated in:

- Your summary (high-level professional identity)

- Your experience (proof through outcomes)

Here's what this looks like in practice.

Summary example

Senior financial reporting manager with 12 years in healthcare finance. Skilled in SEC filings, HFM consolidations, and cross-functional leadership. Reduced close cycle by 30% while ensuring full GAAP compliance across three subsidiaries.

- Reflects senior-level experience clearly

- Names specific tools and frameworks

- Leads with a measurable outcome

- Signals cross-functional leadership ability

Experience example

Financial Reporting Manager

Brevian Health Partners | Chicago, IL

June 2019–Present

- Streamlined monthly consolidation in Oracle HFM, cutting the close cycle from 12 days to eight across four entities.

- Partnered with FP&A and external auditors to resolve 15 disclosure gaps, achieving zero material findings in two consecutive audits.

- Built automated variance analysis dashboards in Power BI, reducing manual reporting effort by 40% for a six-person team.

- Every bullet includes measurable proof

- Skills surface naturally through real outcomes

Once you’ve tied your abilities to concrete outcomes and examples, the next step is to apply that approach to building a financial reporting manager resume with no experience, so you can present relevant strengths without a formal title.

How do I write a financial reporting manager resume with no experience

Even without full-time experience, you can demonstrate readiness through:

- Audit internship supporting close process

- Public accounting busy-season internship

- Monthly close for student org

- Financial statement prep coursework project

- ERP simulation in accounting lab

- SEC reporting case competition

- Volunteer nonprofit financial reporting

- CPA exam sections passed

If you're building a resume without work experience, focus on:

- GAAP financial statement accuracy

- Close process ownership and timelines

- Variance analysis with reconciliations

- ERP reporting and controls exposure

Resume format tip for entry-level financial reporting manager

Use a hybrid resume format because it highlights reporting projects and technical skills while keeping education and internships easy to scan. Do:

- Lead with education, exams, and certifications.

- Add a "Projects" section above experience.

- Quantify results with time, volume, or error rates.

- List tools: Excel, Power BI, NetSuite.

- Mirror keywords from the job posting.

- Built a three-statement reporting pack in Excel and Power BI from ERP simulation data, cutting month-end reporting time by 25% for a four-person team.

Even without direct experience, your academic background can serve as a strong foundation for your resume—so let's look at how to present your education effectively.

How to list your education on a financial reporting manager resume

Your education section helps hiring teams confirm you have the academic foundation for a financial reporting manager role. It validates core competencies in accounting, finance, and regulatory standards.

Include:

- Degree name

- Institution

- Location

- Graduation year

- Relevant coursework (for juniors or entry-level candidates)

- Honors & GPA (if 3.5 or higher)

Skip month and day details—list the graduation year only.

Here's a strong education entry tailored to a financial reporting manager resume:

Example education entry

Bachelor of Science in Accounting

University of Illinois at Urbana-Champaign, Champaign, IL

Graduated 2016

GPA: 3.7/4.0

- Relevant Coursework: Advanced Financial Reporting, SEC Regulatory Compliance, Corporate Consolidations, and Auditing Standards

- Honors: Magna Cum Laude, Beta Alpha Psi Honor Society

How to list your certifications on a financial reporting manager resume

Certifications on your resume show a financial reporting manager's commitment to learning, proficiency with reporting tools, and alignment with current accounting and compliance standards.

Include:

- Certificate name

- Issuing organization

- Year

- Optional: credential ID or URL

- Put certifications below education when they're older, less relevant, or limited to general professional development.

- Put certifications above education when they're recent, in progress, or directly tied to financial reporting manager responsibilities.

Best certifications for your financial reporting manager resume

- Certified Public Accountant (CPA)

- Chartered Financial Analyst (CFA)

- Certified Management Accountant (CMA)

- Chartered Global Management Accountant (CGMA)

- Certified Internal Auditor (CIA)

- Certified Information Systems Auditor (CISA)

- IFRS Certificate (ACCA)

Once you’ve positioned your credentials where they’ll be easy to find, you can write your financial reporting manager resume summary to reinforce those qualifications upfront.

How to write your financial reporting manager resume summary

Your resume summary is the first thing a recruiter reads. A strong one instantly signals you're qualified for a financial reporting manager role.

Keep it to three to four lines, with:

- Your title and total years of experience in financial reporting or accounting.

- Domain focus such as SEC reporting, GAAP compliance, or consolidations.

- Core tools like Oracle, SAP, HFM, or advanced Excel modeling.

- One or two quantified achievements tied to accuracy, efficiency, or cost savings.

- Soft skills demonstrated through real outcomes, such as cross-functional collaboration or mentoring analysts.

PRO TIP

At the manager level, emphasize ownership of reporting cycles, team leadership, and process improvements with measurable results. Highlight your ability to drive accuracy and meet tight deadlines across departments. Avoid vague phrases like "detail-oriented professional" or "passionate about finance." Show impact instead.

Example summary for a financial reporting manager

Financial reporting manager with eight years of experience leading SEC and GAAP reporting. Managed a team of five analysts and reduced close cycle time by 30% using HFM and Oracle.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Now that your summary clearly communicates your value, make sure recruiters can actually reach you by setting up a polished, complete resume header.

What to include in a financial reporting manager resume header

A resume header lists your key identifiers and contact details, helping a financial reporting manager stand out in recruiter screening through clear visibility and credibility.

Essential resume header elements

- Full name

- Tailored job title and headline

- Location

- Phone number

- Professional email

- GitHub link

- Portfolio link

Including a LinkedIn link helps recruiters verify your experience quickly and supports screening.

Do not include photos on a financial reporting manager resume unless the role is explicitly front-facing or appearance-dependent.

Keep your header on one or two lines, match the job title to the posting, and use consistent formatting across all contact links.

Example

Financial reporting manager resume header

Jordan Taylor

Financial reporting manager | SEC reporting, GAAP compliance, monthly close leadership

Chicago, IL

(312) 555-01XX

jordan.taylor@enhancv.com

github.com/jordantaylor

jordantaylor.com

linkedin.com/in/jordantaylor

Once your contact details and role identifier are set at the top, add optional sections to reinforce your fit and round out the resume.

Additional sections for financial reporting manager resumes

When your core qualifications match other candidates, additional sections can set you apart by showcasing relevant expertise and credibility. For example, listing language skills can be especially valuable if the role involves international reporting or multi-jurisdiction consolidations.

Consider adding these sections tailored to the financial reporting manager role:

- Languages

- Professional affiliations (e.g., IMA, AICPA, FEI)

- Publications and thought leadership

- Continuing education and CPE credits

- Speaking engagements and conference presentations

- Volunteer leadership in finance or nonprofit boards

- Awards and industry recognition

Once you've strengthened your resume with relevant additional sections, it's worth pairing it with a well-crafted cover letter to maximize your impact.

Do financial reporting manager resumes need a cover letter

A cover letter isn't required for a financial reporting manager, but it often helps in competitive searches and at companies that expect one. If you're unsure what a cover letter is or how it complements your resume, it's worth learning before you decide to skip it. It can make a difference when your resume needs context, or when hiring teams compare several similar candidates.

Use a cover letter to add context your resume can't show:

- Explain role or team fit by linking your reporting experience to the company's close process, controls, and stakeholder needs.

- Highlight one or two outcomes, such as shortening the close cycle, improving audit readiness, or reducing recurring adjustments.

- Show understanding of the business context by referencing the product, revenue model, key users of reports, and how decisions rely on financial reporting.

- Address career transitions or non-obvious experience by connecting past roles to financial reporting manager responsibilities and tools.

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Even if you decide a cover letter won’t add value for this role, using AI to improve your financial reporting manager resume helps you strengthen the document that hiring teams will review first.

Using AI to improve your financial reporting manager resume

AI can sharpen your resume's clarity, structure, and impact. It helps refine bullet points, tighten language, and highlight measurable results. But overuse strips authenticity. Once your content feels clear and role-aligned, step away from AI assistance. If you're exploring tools, learn which AI is best for writing resumes before committing to one platform.

Here are 10 practical prompts you can copy and paste to strengthen specific sections of your resume:

- Sharpen your summary: "Rewrite my resume summary to highlight my core strengths as a financial reporting manager in under four sentences."

- Quantify your impact: "Add measurable results to these experience bullets for a financial reporting manager, focusing on accuracy, deadlines, and cost savings."

- Tighten bullet points: "Condense each experience bullet to one line while preserving key achievements relevant to a financial reporting manager role."

- Align with job posts: "Compare my financial reporting manager resume bullets against this job description and flag any gaps in required qualifications."

- Strengthen action verbs: "Replace weak or repeated verbs in my financial reporting manager experience section with stronger, more specific alternatives."

- Refine skills section: "Reorganize my skills section to prioritize the most relevant technical and soft skills for a financial reporting manager."

- Improve project descriptions: "Rewrite my project descriptions to clearly show scope, tools used, and outcomes for a financial reporting manager resume."

- Enhance certifications section: "Reformat my certifications section to emphasize credentials most valued for a financial reporting manager position."

- Clarify education details: "Edit my education section to highlight coursework and honors directly applicable to a financial reporting manager career path."

- Remove filler language: "Identify and remove vague or redundant phrasing throughout my financial reporting manager resume without losing important details."

Stop using AI once your resume sounds accurate, specific, and aligned with real experience. AI should never invent experience or inflate claims—if it didn't happen, it doesn't belong here.

Conclusion

A strong financial reporting manager resume proves impact with measurable outcomes, role-specific skills, and a clear structure. Use metrics that show faster closes, fewer audit findings, and stronger controls. Highlight expertise in financial statements, consolidations, disclosures, and compliance.

Keep each section direct and scannable so hiring teams can confirm fit fast. Show consistent results, clean formatting, and precise language. This positions you as a financial reporting manager ready for today’s hiring market and near-future expectations.