Most stock broker resume drafts fail because they list licenses and platforms but don't prove revenue impact or risk control. That gap gets exposed fast in ATS filters and in ten-second recruiter scans, especially when competition is high.

A strong resume shows what you delivered, not what you used. Knowing how to make your resume stand out means you should highlight assets gathered, net new accounts, retention rate, trade accuracy, compliance outcomes, portfolio performance versus benchmarks, and how your recommendations improved client outcomes and firm revenue.

Key takeaways

- Quantify revenue, assets gathered, retention, and compliance outcomes in every experience bullet.

- Use reverse-chronological format if experienced; use a hybrid format when switching careers.

- Tailor each resume to mirror the job posting's platforms, asset classes, and compliance terms.

- Place licenses like Series 7 and Series 63 where recruiters see them first.

- Demonstrate skills inside experience bullets, not only in a standalone skills list.

- Use AI to tighten language and add metrics, but stop before it inflates real experience.

- Build a polished, scannable resume quickly with Enhancv to highlight measurable brokerage results.

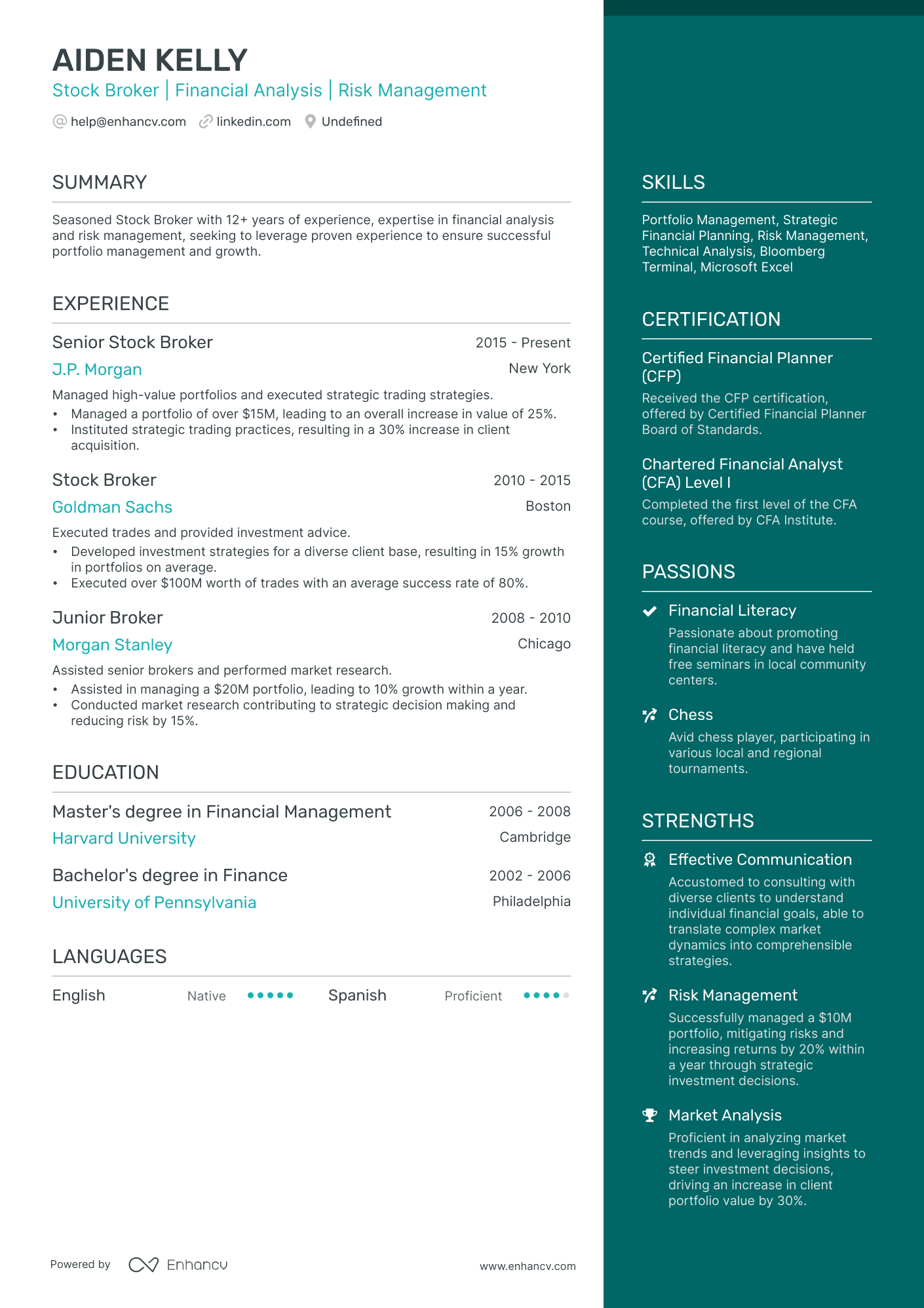

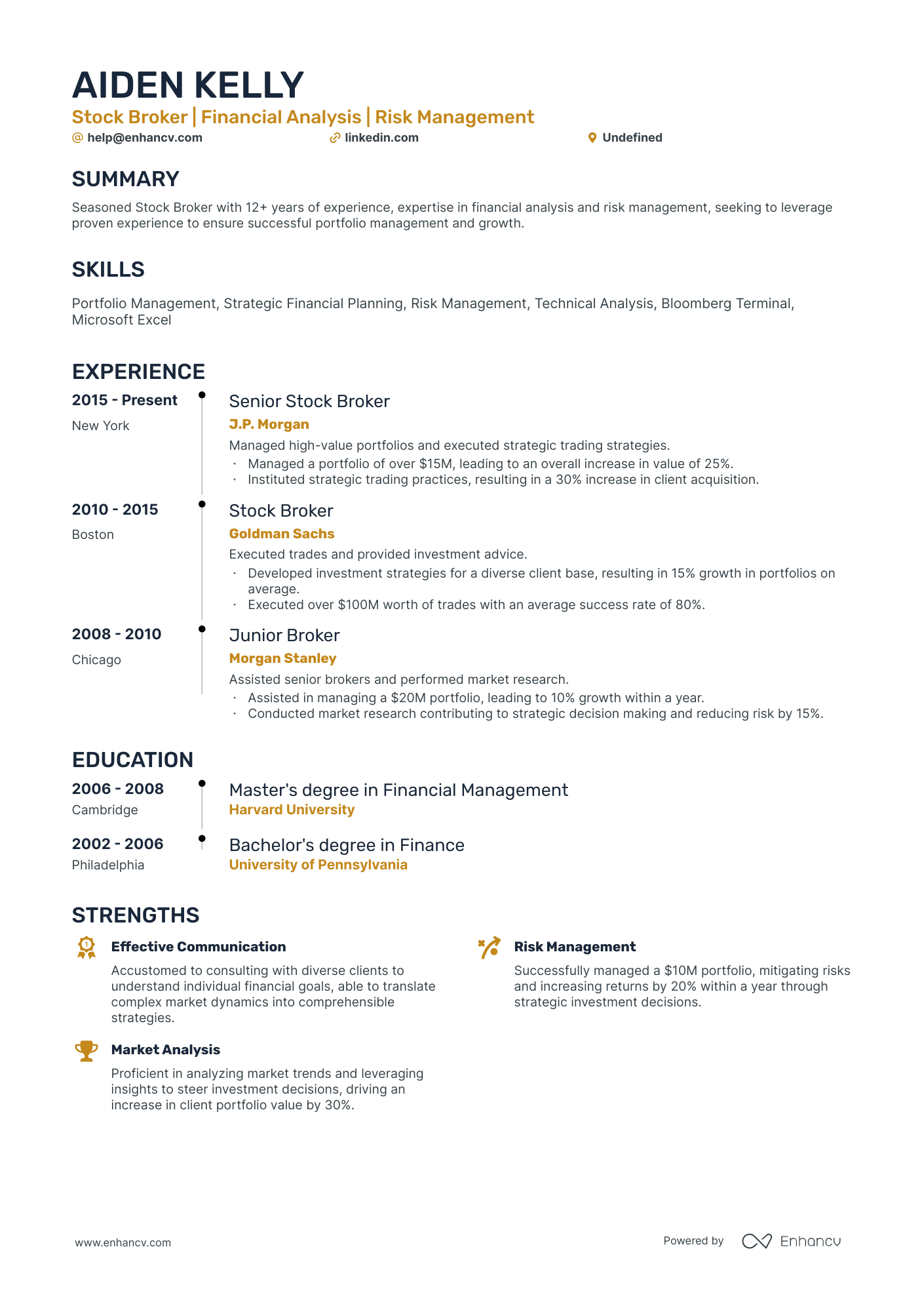

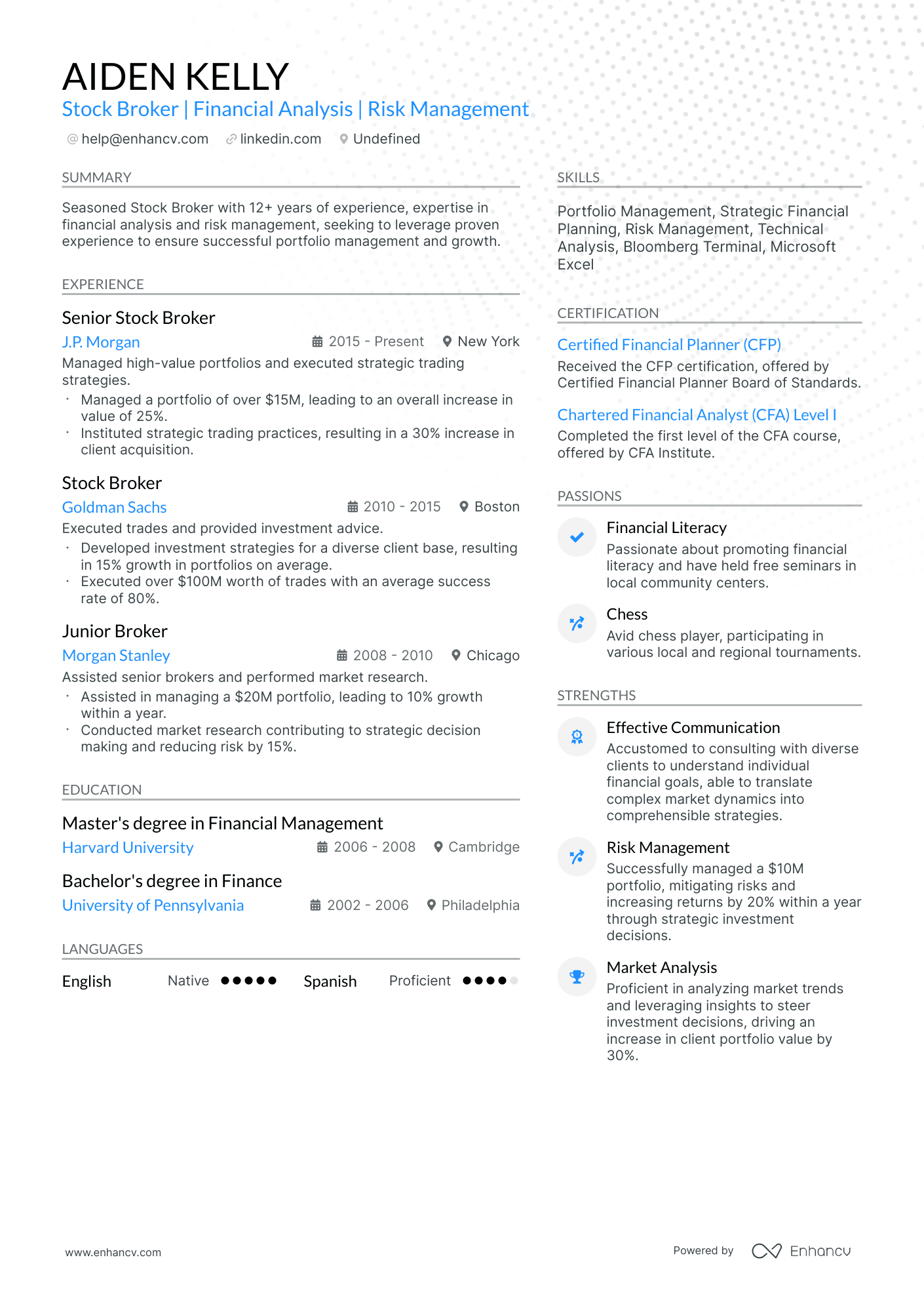

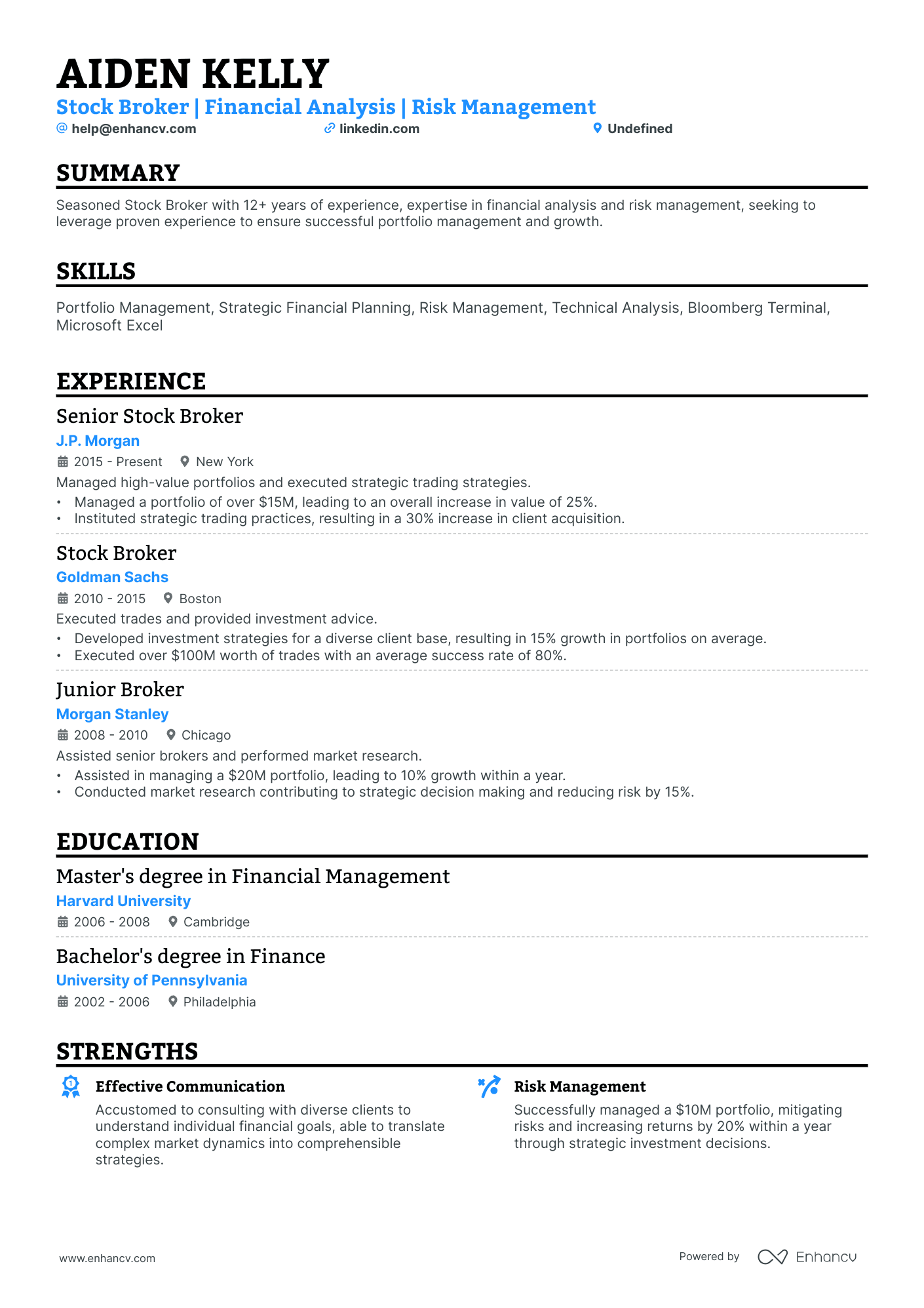

How to format a stock broker resume

Recruiters evaluating stock broker resumes prioritize revenue generation, client portfolio size, regulatory compliance, and sales performance. A clean, well-organized resume format ensures these high-impact signals surface immediately—both for human reviewers scanning in seconds and for applicant tracking systems parsing your credentials.

I have significant experience in this role—which format should I use?

Use a reverse-chronological format to lead with your strongest, most recent production numbers and client relationships. Do:

- Highlight the scope and ownership of your book of business, including assets under management, client segments, and territory size.

- Feature relevant licenses (Series 7, Series 63, Series 66), trading platforms (Bloomberg Terminal, Eikon, ThinkOrSwim), and asset classes you specialize in.

- Quantify outcomes tied to revenue growth, portfolio performance, client retention, and new account acquisition.

I'm junior or switching into this role—what format works best?

A hybrid format works best, letting you spotlight transferable skills and relevant credentials before a shorter work history section. Do:

- Place licenses, certifications (Series 7, SIE), and core competencies—such as financial analysis, client prospecting, and risk assessment—near the top of the resume.

- Include internships, personal trading portfolios, financial modeling projects, or sales roles that demonstrate client-facing and analytical ability.

- Connect every skill or experience to a clear action and measurable result, even at a small scale.

Why not use a functional resume?

A functional format strips away the timeline and context recruiters need to verify your production track record, licensing history, and compliance standing—making it harder to trust your candidacy for a role built on accountability and measurable results. A functional format may be acceptable if you're transitioning from a related field (such as financial advising, insurance sales, or banking) with no direct brokerage experience, but only if you anchor every listed skill to specific projects, client outcomes, or quantified results rather than presenting them in isolation.

Once you've locked in a clean, consistent format, the next step is deciding which sections to include and how to arrange them for maximum impact.

What sections should go on a stock broker resume

Recruiters expect you to present a compliance-ready record of client-facing performance, revenue impact, and market expertise. Understanding what to put on a resume for a stock broker role is critical for making the right impression.

Use this structure for maximum clarity:

- Header

- Summary

- Experience

- Skills

- Projects

- Education

- Certifications

- Optional sections: Awards, Leadership, Languages

Strong experience bullets should emphasize assets gathered, revenue generated, client retention, trade volume, risk and compliance outcomes, and the scope of books managed.

Is your resume good enough?

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

Now that you’ve organized the key parts of your resume, the next step is to write a strong experience section that uses that structure to present your impact clearly.

How to write your stock broker resume experience

Your experience section is where you prove you've delivered real results—not just held a seat on a trading desk. Hiring managers prioritize demonstrated impact, including the markets you've navigated, the platforms and analytical tools you've used, and the measurable outcomes you've generated for clients and firms, over descriptive task lists.

Each entry should include:

- Job title

- Company and location (or remote)

- Dates of employment (month and year)

Three to five concise bullet points showing what you owned, how you executed, and what outcomes you delivered:

- Ownership scope: the client portfolios, asset classes, market segments, trading accounts, or advisory relationships you were directly accountable for as a stock broker.

- Execution approach: the trading platforms, research methodologies, risk assessment frameworks, financial modeling tools, or regulatory compliance protocols you used to inform decisions and execute trades.

- Value improved: changes to portfolio performance, trade execution speed, client retention, risk exposure, regulatory compliance accuracy, or cost efficiency that resulted from your work.

- Collaboration context: how you coordinated with research analysts, compliance officers, portfolio managers, institutional clients, or underwriting teams to align on investment strategies and meet fiduciary obligations.

- Impact delivered: outcomes framed as tangible results—growth in assets under management, expansion of your client book, reduction in portfolio risk, or contribution to firm revenue—rather than a summary of daily brokerage activities.

Experience bullet formula

A stock broker experience example

✅ Right example - modern, quantified, specific.

Stock Broker

Morgan Stanley | New York, NY

2021–Present

Full-service wealth management firm supporting high-net-worth clients with multi-asset portfolios and institutional-grade execution.

- Executed equity, options, and fixed-income trades via Bloomberg Terminal and FIX-enabled OMS, improving average execution slippage by 12% and cutting order-to-fill time by 18% across 200+ monthly orders.

- Built client-ready portfolio analytics in Microsoft Excel (Power Query) and Python, reducing weekly performance reporting time by 40% while improving attribution accuracy to 99.5%.

- Rebalanced $85M in discretionary and advisory accounts using Modern Portfolio Theory (MPT) and tax-loss harvesting workflows, increasing after-tax returns by 1.3% and reducing portfolio volatility by 9%.

- Partnered with compliance, legal, and operations to tighten suitability and best-execution documentation in the customer relationship management system, lowering trade exception rates by 28% and passing two internal audits with zero findings.

- Expanded fee-based assets under management by $14.2M through consultative reviews and risk profiling, increasing annual recurring revenue by $168K while maintaining a 97% client retention rate.

How to tailor your stock broker resume experience

Recruiters evaluate your stock broker resume through both applicant tracking systems and manual review. Tailoring your experience section to mirror the job posting ensures your qualifications connect directly with what the employer needs.

Ways to tailor your stock broker experience:

- Match trading platforms and order management systems listed in the posting.

- Mirror the exact compliance frameworks and regulatory standards mentioned.

- Use the same terminology for client acquisition and retention processes.

- Reflect portfolio performance KPIs or benchmarks the employer prioritizes.

- Highlight experience with specific asset classes or market sectors referenced.

- Align your risk management methods with those described in the role.

- Emphasize Series 7 or Series 63 licensing if the posting requires them.

- Include client relationship workflows or advisory models the firm uses.

Tailoring means aligning your real accomplishments with stated job requirements, not forcing disconnected keywords into your experience.

Resume tailoring examples for stock broker

| Job description excerpt | Untailored | Tailored |

|---|---|---|

| Execute equity and fixed-income trades on behalf of high-net-worth clients using Bloomberg Terminal and manage portfolios exceeding $10M in assets under management. | Helped clients with their investment needs and managed accounts. | Executed 50+ daily equity and fixed-income trades for high-net-worth clients through Bloomberg Terminal, managing portfolios totaling $14M in assets under management. |

| Prospect and acquire new brokerage clients through cold calling, referral networks, and financial seminars while maintaining a minimum 85% client retention rate. | Responsible for finding new clients and keeping existing ones happy. | Acquired 35 new brokerage clients annually through cold calling campaigns and quarterly financial seminars, sustaining a 92% client retention rate over three consecutive years. |

| Monitor market trends and provide actionable trade recommendations aligned with each client's risk tolerance using Charles Schwab's proprietary research platform and Morningstar analytics. | Gave investment advice to clients based on market conditions. | Delivered weekly trade recommendations to 120+ clients using Charles Schwab's research platform and Morningstar analytics, aligning each position with documented risk-tolerance profiles and generating an average 11% annual portfolio return. |

Once you’ve aligned your experience with the role’s priorities, the next step is to quantify your stock broker achievements so employers can see the impact behind those responsibilities.

How to quantify your stock broker achievements

Quantifying your achievements shows how you improved client outcomes and managed risk. Focus on revenue generated, assets gathered, retention, trade volume, execution quality, and compliance accuracy.

Quantifying examples for stock broker

| Metric | Example |

|---|---|

| Revenue growth | "Generated $1.2M in annualized commissions by expanding options and fixed-income activity across 48 active accounts using Bloomberg Terminal and Salesforce." |

| Assets gathered | "Brought in $18.5M in new client assets in nine months through referral outreach and portfolio reviews, increasing average household assets by 22%." |

| Client retention | "Improved twelve-month client retention from 86% to 93% by setting quarterly check-ins and rebalancing alerts for 60 households." |

| Execution quality | "Reduced average order slippage from 8 bps to 3 bps on liquid equities by using limit orders and routing rules during high-volatility sessions." |

| Compliance accuracy | "Maintained zero trade errors and zero compliance findings across 1,300 trades by tightening suitability notes and pre-trade checks in the firm's order system." |

Turn vague job duties into measurable, recruiter-ready resume bullets in seconds with Enhancv's Bullet Point Generator.

With strong bullet points in place, the next step is ensuring your skills section presents the right mix of hard and soft skills that stock broker recruiters are looking for.

How to list your hard and soft skills on a stock broker resume

Your skills section shows you can execute trades, manage risk, and grow client portfolios; recruiters and applicant tracking system (ATS) scans use them to confirm role fit and keywords, so aim for a hard-skill-heavy mix supported by client-facing soft skills. stock broker roles require a blend of:

- Product strategy and discovery skills

- Data, analytics, and experimentation skills

- Delivery, execution, and go-to-market discipline

- Soft skills

Your skills section should be:

- Scannable (bullet-style grouping).

- Relevant to the job post.

- Backed by proof in experience bullets.

- Updated with current tools.

Place your skills section:

- Above experience if you're junior or switching careers.

- Below experience if you're mid/senior with strong achievements.

Hard skills

- Equity and options execution

- Fixed income trading

- Order types, routing, and fills

- Level II quotes, time and sales

- Technical analysis, charting platforms

- Fundamental analysis, valuation models

- Portfolio construction, rebalancing

- Risk management, position sizing

- Margin, short selling, suitability rules

- FINRA and SEC compliance

- Trade reporting and audit trails

- Bloomberg Terminal, Reuters Eikon

Soft skills

- Client discovery and needs analysis

- Explaining risk and trade-offs clearly

- Objection handling and negotiation

- High-stakes decision-making under time pressure

- Discipline with trading plans

- Prioritizing across accounts and deadlines

- Coordinating with compliance and operations

- Documenting recommendations and rationale

- Following up and closing next steps

- Managing expectations during volatility

- Handling sensitive client information responsibly

- Owning errors and corrective actions

How to show your stock broker skills in context

Skills shouldn't live only in a dedicated skills list. Browse resume skills examples to see how top candidates weave competencies into their experience.

They should be demonstrated in:

- Your summary (high-level professional identity)

- Your experience (proof through outcomes)

Here's how that looks in practice.

Summary example

Senior stock broker with 12 years in equities and derivatives trading. Skilled in Bloomberg Terminal, portfolio rebalancing, and client risk profiling. Grew a $180M book of business by 34% while maintaining a 96% client retention rate.

- Signals senior-level expertise immediately

- Names industry-standard tools directly

- Quantifies portfolio growth with metrics

- Highlights client relationship strengths

Experience example

Senior Stock Broker

Caldwell & Pierce Financial | Chicago, IL

March 2018–Present

- Managed a $220M client portfolio using Bloomberg Terminal and Refinitiv Eikon, generating 18% average annual returns across equity and fixed-income positions.

- Collaborated with compliance analysts and wealth advisors to restructure risk models, reducing portfolio volatility by 12% during the 2020 downturn.

- Acquired 45 high-net-worth clients through consultative selling and tailored hedging strategies, expanding the desk's revenue by $2.6M annually.

- Every bullet includes measurable proof

- Skills appear naturally within achievements

Once you’ve tied your abilities to real outcomes and situations, the next step is applying that approach to a stock broker resume with no experience so you can present transferable strengths with the same clarity.

How do I write a stock broker resume with no experience

Even without full-time experience, you can demonstrate readiness through building a resume without work experience that leverages projects and credentials:

- FINRA Securities Industry Essentials coursework

- Student-managed investment fund participation

- Paper trading with documented performance

- Equity research reports on public companies

- Bloomberg Terminal market data exercises

- Client outreach role-play case studies

- Series 7 study plan milestones

- Investment club portfolio presentations

Focus on:

- Regulatory knowledge and compliance basics

- Trade execution workflow and order types

- Quantified results from market projects

- Finance education and exam progress

Resume format tip for entry-level stock broker

Use a skills-based resume format because it highlights trading, research, and compliance knowledge before limited work history. Do:

- Lead with licenses, exams, and coursework.

- Quantify results from paper trading and research.

- List tools: Bloomberg Terminal, Excel, and broker platforms.

- Add compliance keywords: suitability, know your customer, and disclosures.

- Include one to two market projects.

- Built a paper-trading equity portfolio in Thinkorswim, executed 60 trades using limit orders and stop losses, and beat the S&P 500 by 2.1% over eight weeks.

Even without traditional work experience, your education section can carry significant weight on a stock broker resume—so it's worth formatting it strategically.

How to list your certifications on a stock broker resume

Certifications on your resume show your commitment to learning, proficiency with trading tools, and alignment with industry standards, helping you stand out as a stock broker.

Include:

- Certificate name

- Issuing organization

- Year

- Optional: credential ID or URL

- Place certifications below education when they're older, less relevant to your target stock broker role, or simply support your baseline qualifications.

- Place certifications above education when they're recent, highly relevant to the stock broker role, or central to the job requirements.

Best certifications for your stock broker resume

FINRA Series 7 (General Securities Representative Examination) FINRA Series 63 (Uniform Securities Agent State Law Examination) FINRA Series 66 (Uniform Combined State Law Examination) FINRA Series 24 (General Securities Principal Examination) Chartered Financial Analyst (CFA) Certified Financial Planner (CFP) Securities Industry Essentials (SIE) Exam

Once you’ve positioned your credentials where recruiters can verify them quickly, shift to your stock broker resume summary to frame those qualifications in a clear, results-focused snapshot.

How to write your stock broker resume summary

Your resume summary is the first thing a recruiter reads, so it sets the tone for everything that follows. A strong opening positions you as a qualified stock broker who delivers measurable results.

Keep it to three to four lines, with:

- Your title and total years of experience in brokerage or financial services.

- Domain expertise, such as equities, fixed income, or portfolio management.

- Core skills like trade execution, client acquisition, or risk assessment.

- One or two quantified achievements, such as portfolio growth or client retention rates.

- Soft skills tied to real outcomes, like relationship building that drove account expansion.

PRO TIP

At the entry level, focus on relevant licenses, technical skills, and early wins like accounts opened or trades processed. Avoid vague phrases like "passionate self-starter" or "driven professional." Recruiters want specifics—certifications earned, platforms mastered, and concrete contributions to team or client goals.

Example summary for a stock broker

Series 7-licensed stock broker with two years of experience executing equity trades and managing 45+ client accounts, contributing to a 12% increase in portfolio value across retail holdings.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Now that your summary captures your strongest qualifications, make sure your header presents the essential contact and professional details recruiters need to reach you.

What to include in a stock broker resume header

A resume header lists your key contact and professional details, helping your stock broker application stay visible, credible, and easy to screen fast.

Essential resume header elements

- Full name

- Tailored job title and headline

- Location

- Phone number

- Professional email

- GitHub link

- Portfolio link

A LinkedIn link helps recruiters verify your experience quickly and supports screening.

Don't include a photo on a stock broker resume unless the role is explicitly front-facing or appearance-dependent.

Use a specific stock broker headline that matches the posting and includes your key licenses to align with recruiter searches.

Example

Stock broker resume header

Jordan Taylor

Stock broker | Series 7 and Series 63 | Equities and options execution

New York, NY

(212) 555-01XX

your.name@enhancv.com

github.com/yourname

yourwebsite.com

linkedin.com/in/yourname

Once you've strengthened your resume with relevant additional sections, the next step is pairing it with a cover letter that adds even more context to your candidacy.

Do stock broker resumes need a cover letter

A cover letter isn't required for a stock broker, but it often helps. If you're unsure what a cover letter is and when it matters, it can make the biggest difference in competitive roles, selective teams, or firms that expect client-facing communication. Skip it when the posting says not to include one.

Use a cover letter to add context your stock broker resume can't show:

- Explain role and team fit: Connect your client base, markets covered, and sales style to the desk's focus and book strategy.

- Highlight one or two outcomes: Pick a trade idea, retention win, or revenue result, and state your actions and measurable impact.

- Show business understanding: Reference the firm's products, target clients, and key risks, and explain how you'd support suitability and compliance.

- Address transitions or non-obvious experience: Translate adjacent work into brokerage skills, and explain licensing status, ramp plan, and timeline.

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Even when you decide a separate letter won’t add value, using AI to improve your stock broker resume helps you strengthen the document that hiring teams and applicant tracking systems (ATS) review first.

Using AI to improve your stock broker resume

AI can sharpen your resume's clarity, structure, and overall impact. It helps tighten language and highlight measurable results. But overuse strips authenticity fast. Once your content reads clearly and fits the role, step away from AI. If you're exploring tools, learn which AI is best for writing resumes before committing to one approach.

Here are 10 practical prompts you can copy and paste to strengthen specific sections of your stock broker resume:

- Strengthen summary focus: "Rewrite my stock broker resume summary to emphasize client portfolio growth, risk management expertise, and securities licensing credentials in three concise sentences."

- Quantify experience bullets: "Add specific metrics like portfolio size, client retention rates, or revenue generated to each experience bullet on my stock broker resume."

- Sharpen skills relevance: "Review my stock broker resume skills section and remove generic entries. Replace them with industry-specific competencies like equity analysis or derivatives trading."

- Improve action verbs: "Replace weak or passive verbs in my stock broker experience section with strong, finance-specific action verbs that convey leadership and results."

- Align with job posting: "Compare my stock broker resume against this job description and identify missing keywords, qualifications, or responsibilities I should address."

- Clarify certifications: "Reorganize my stock broker resume certifications section so each entry includes the credential name, issuing body, and date earned."

- Tighten education section: "Edit my stock broker resume education section to highlight relevant coursework, honors, or finance-related academic achievements only."

- Refine project descriptions: "Rewrite the project entries on my stock broker resume to clearly state my role, the financial objective, and the measurable outcome."

- Eliminate redundancy: "Scan my stock broker resume for repeated phrases, overlapping bullet points, or filler language—then consolidate or remove them."

- Improve readability flow: "Restructure my stock broker resume so each section follows a logical order with consistent formatting, tense, and sentence length throughout."

Stop using AI once your resume sounds accurate, specific, and aligned with real experience. AI should never invent experience or inflate claims—if it didn't happen, it doesn't belong here.

Conclusion

A strong stock broker resume proves results with numbers, highlights role-specific skills, and stays easy to scan. Use clear section headings, tight bullet points, and action verbs. Show measurable outcomes like revenue growth, client retention, trade volume, and compliance accuracy.

Hiring teams want stock brokers who can perform now and adapt fast. Your resume should connect your experience to today’s expectations, with a clean structure and relevant skills. Keep it focused, consistent, and ready for the next step.