Many insurance product manager resume drafts fail because they read like project logs, not product decisions tied to underwriting, pricing, and regulatory outcomes. That hurts in ATS screening and fast recruiter scans, where competition rewards clear impact.

A strong resume shows what you changed and why it mattered. Knowing how to make your resume stand out means highlighting loss ratio improvement, premium growth, retention lift, faster quote-to-bind, cleaner audit results, on-time launches across states, fewer defects, and measurable customer experience gains.

Key takeaways

- Quantify insurance outcomes like loss ratio, premium growth, and retention in every experience bullet.

- Tailor resume language to match each job posting's tools, metrics, and terminology.

- Use reverse-chronological format for experienced candidates and hybrid format for career changers.

- Anchor every listed skill to a specific project, initiative, or measurable result.

- Lead experience bullets with ownership scope, execution approach, and business impact delivered.

- Pair certifications like CPCU or CSPO with your education section to reinforce credibility.

- Use Enhancv to transform vague job duties into measurable, recruiter-ready resume bullets quickly.

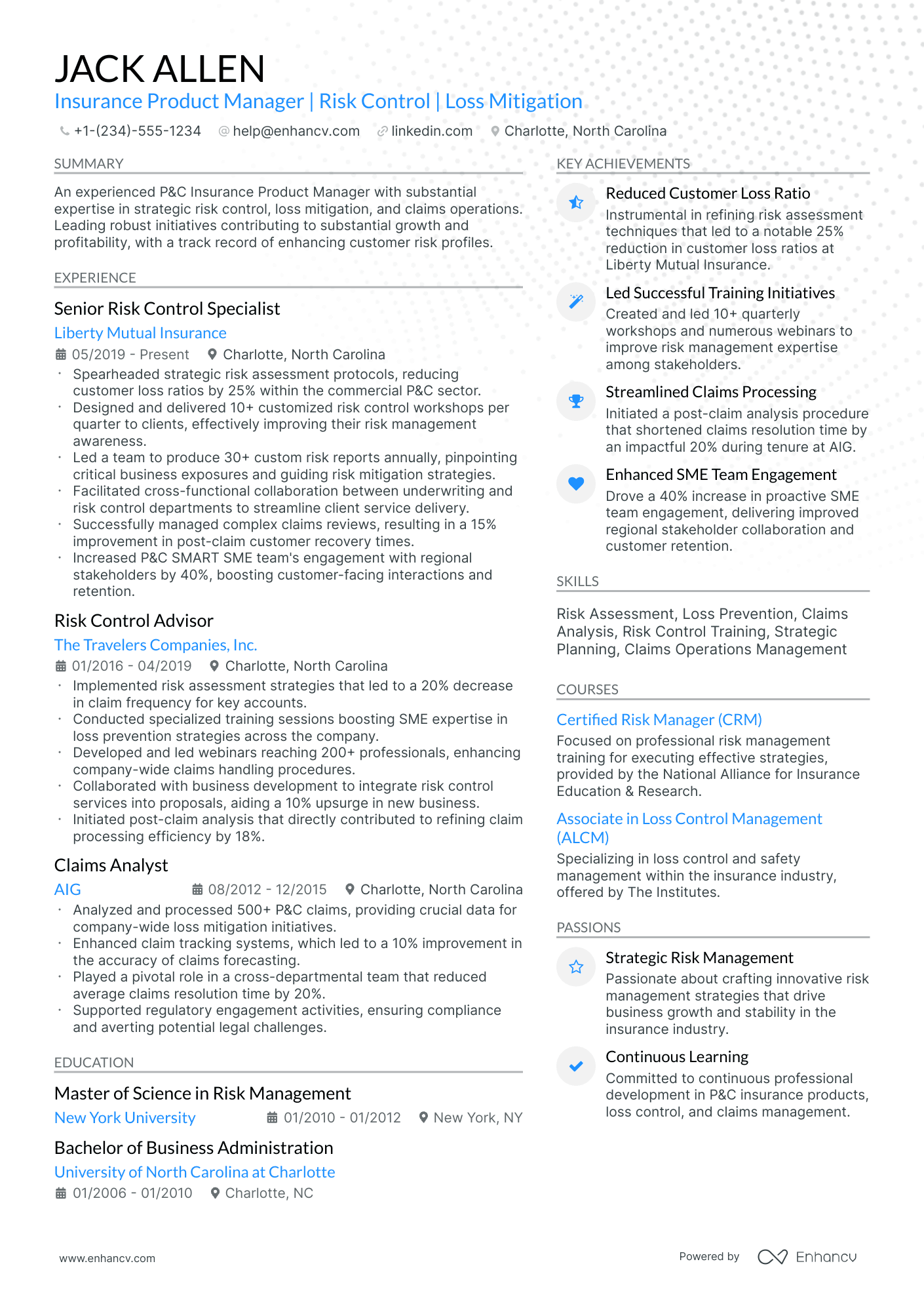

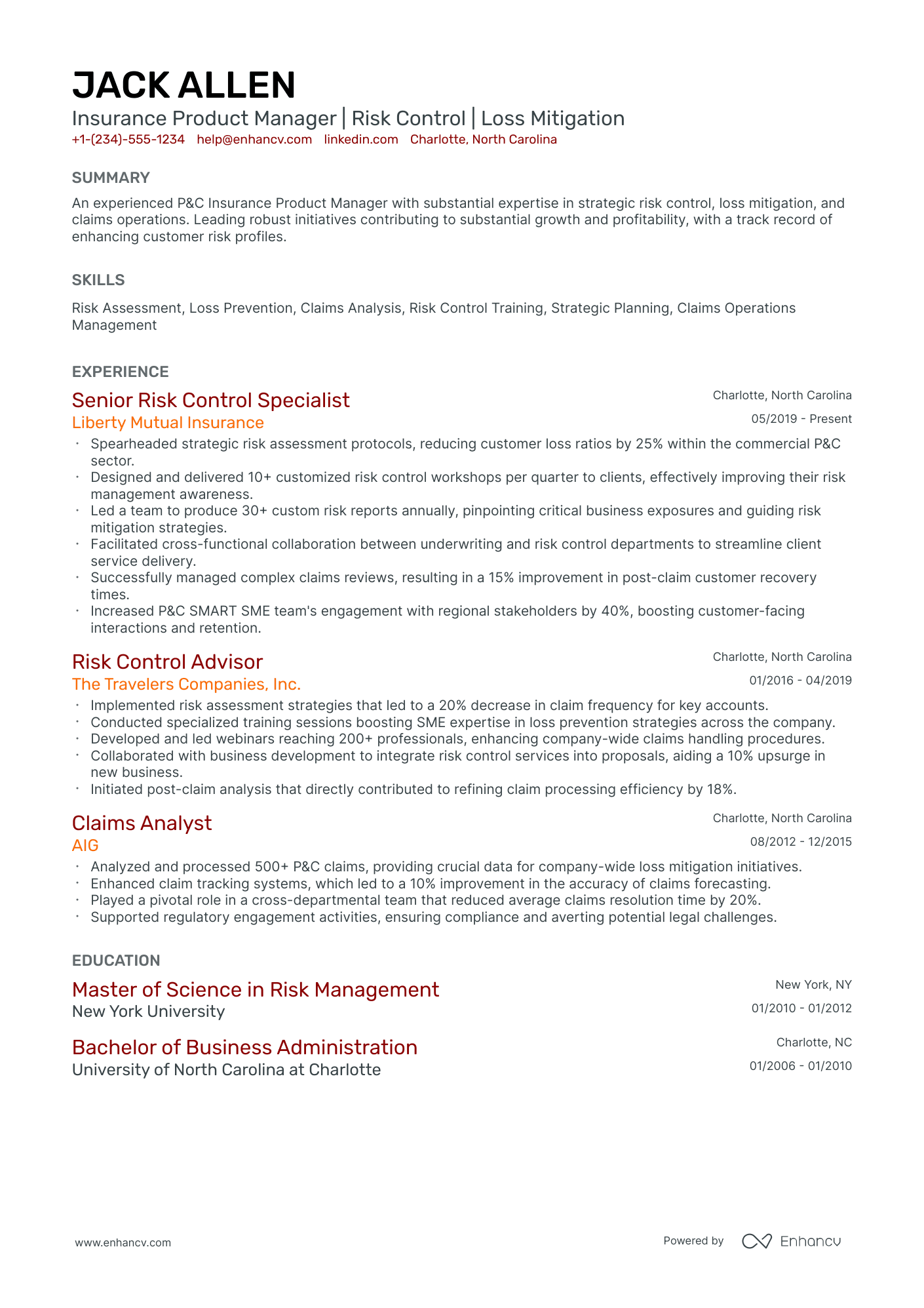

How to format a insurance product manager resume

Recruiters evaluating insurance product manager candidates prioritize product lifecycle ownership, cross-functional leadership, and measurable business outcomes such as premium growth, loss ratio improvement, or speed-to-market for new insurance products. Your resume format determines how quickly a hiring manager can trace those signals across your career trajectory, so choosing the right structure is essential.

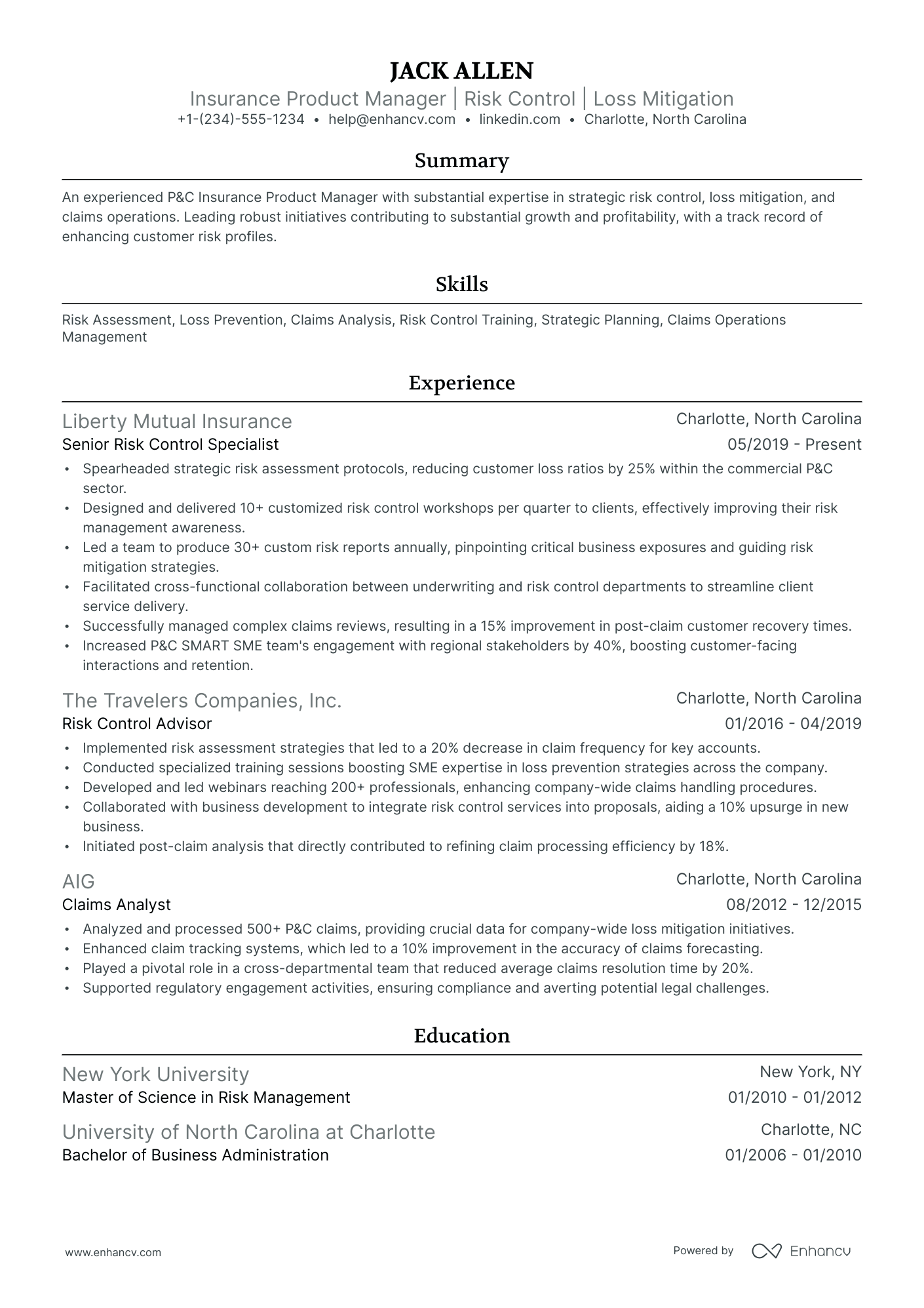

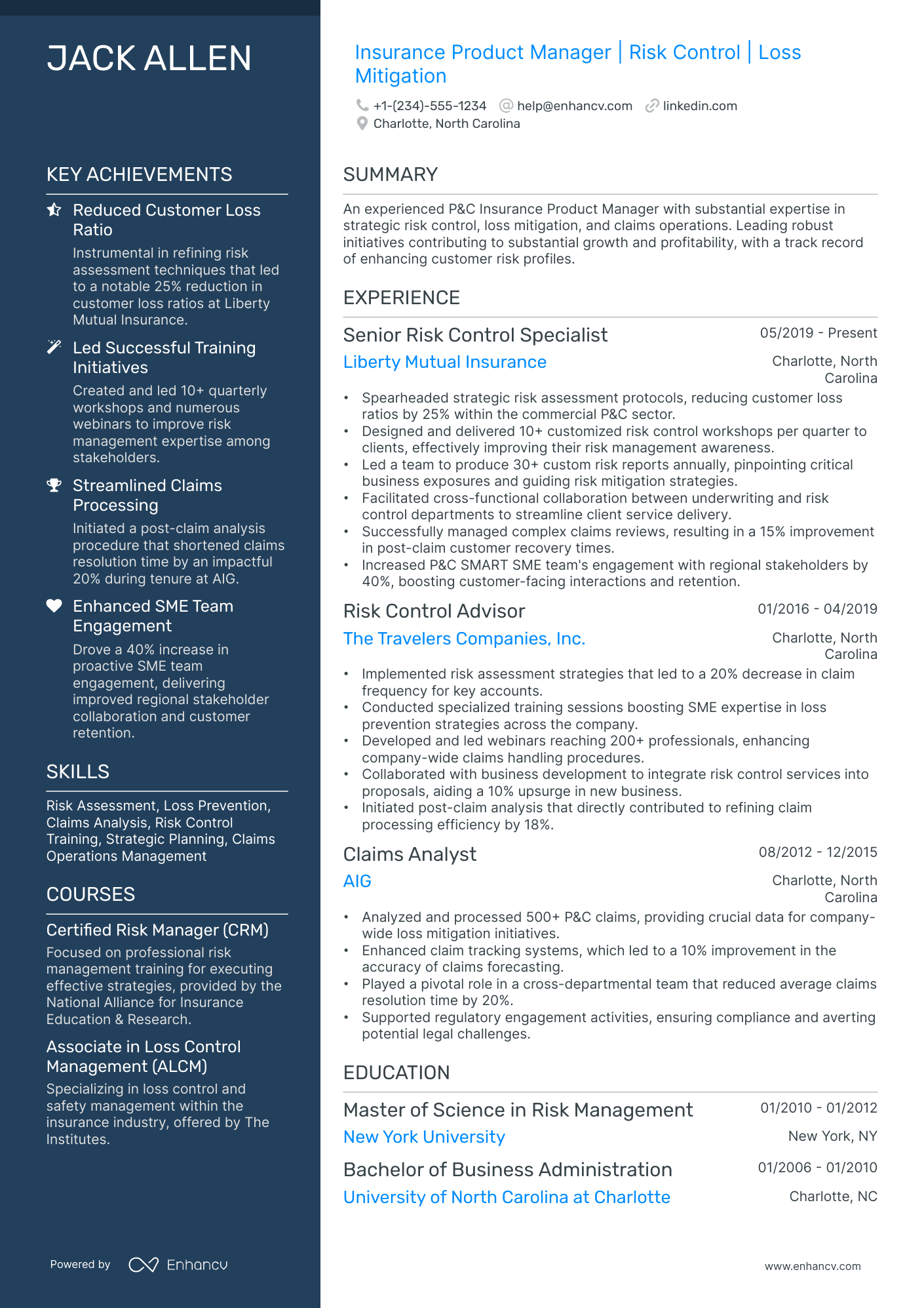

I have significant experience in this role—which format should I use?

Use a reverse-chronological format to present your insurance product management career in a clear, linear progression that highlights growing scope and accountability. Do:

- Lead each role entry with your scope of ownership—product lines managed, book size, team headcount, and market segments (commercial, personal, specialty).

- Feature domain-specific tools and competencies such as actuarial collaboration, regulatory compliance (state filings, SERFF), rating engine configuration, and competitive benchmarking platforms.

- Quantify business impact with metrics tied to revenue, profitability, retention, or launch timelines.

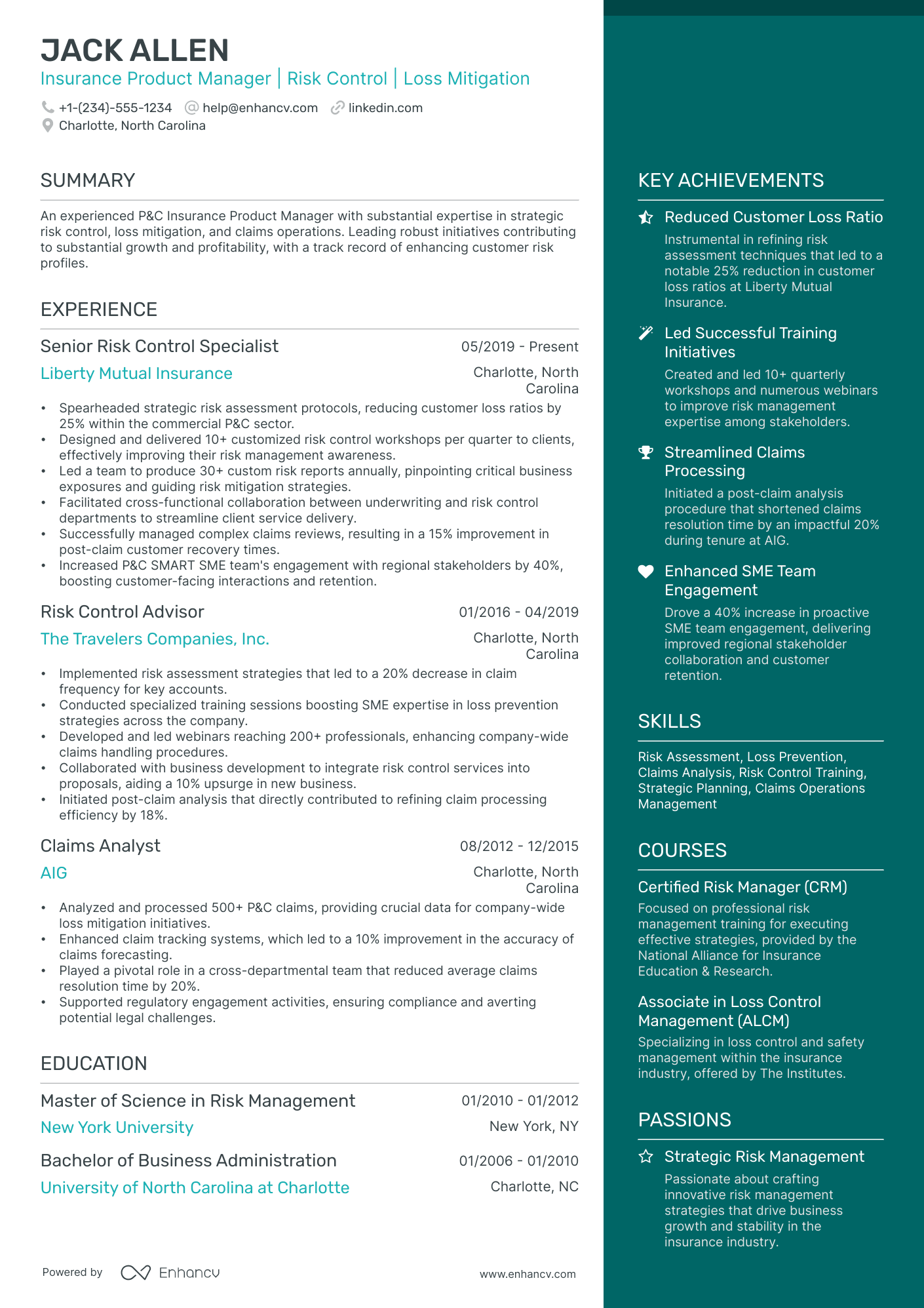

I'm junior or switching into this role—what format works best?

A hybrid format works best because it lets you lead with transferable skills and relevant projects before a shorter work history section. Do:

- Place a dedicated skills section near the top, highlighting insurance knowledge areas (underwriting guidelines, product filing, policy administration systems) alongside transferable competencies like market analysis and stakeholder management.

- Include project-based entries—such as product pilots, pricing studies, or cross-departmental initiatives—even if they weren't formal product management roles.

- Connect every action to a result, making it clear how your contributions moved a measurable outcome forward.

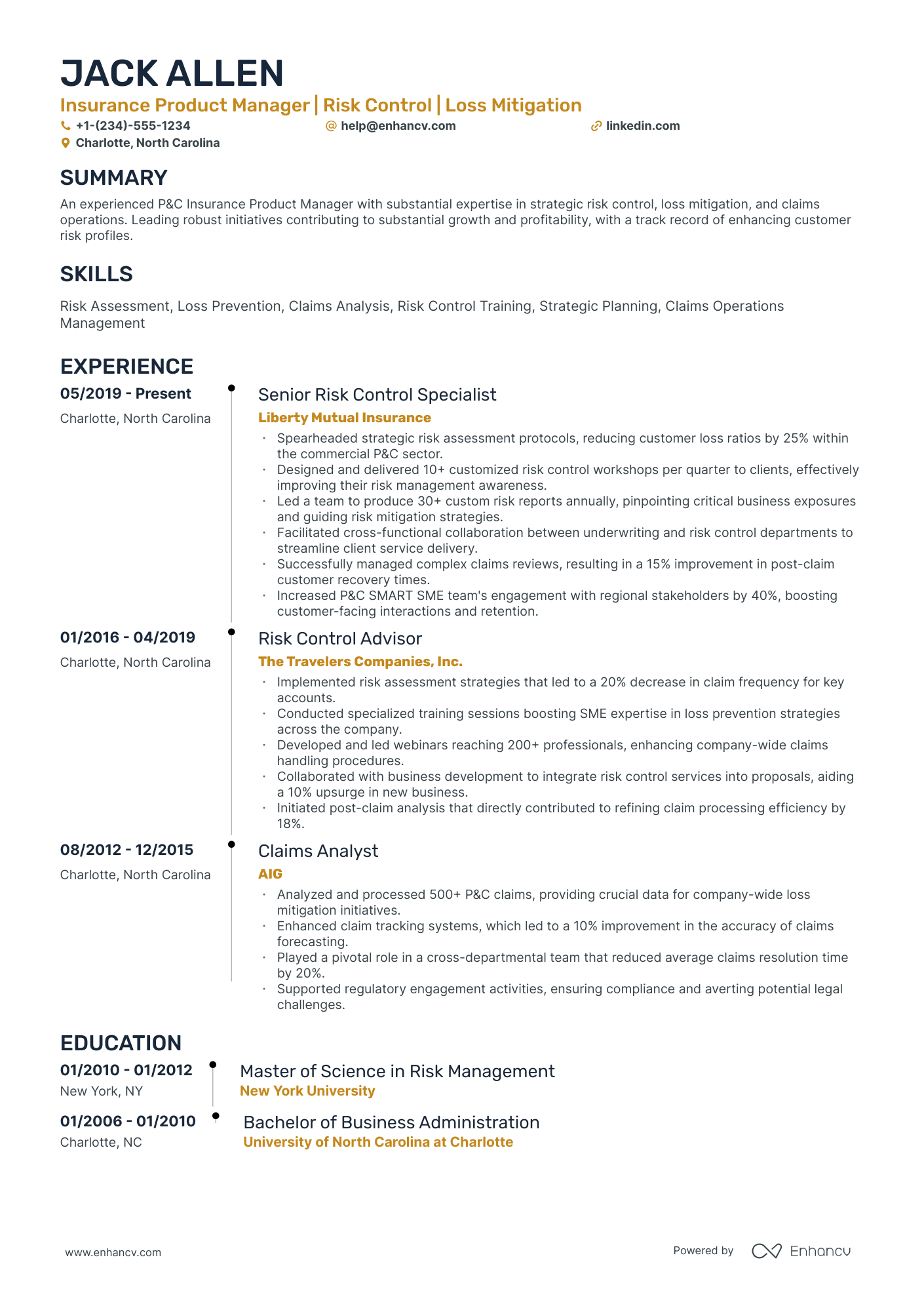

Why not use a functional resume?

A functional format strips away the timeline and context recruiters need to assess how your product management capabilities developed, making it harder to verify your readiness for full product ownership.

- A functional resume may be acceptable if you're making a career change into insurance product management from a closely related field—such as underwriting, actuarial analysis, or insurance operations—and have limited direct product management titles, but you must still anchor every listed skill to a specific project, initiative, or outcome rather than presenting skills in isolation.

With your format establishing a clean, scannable structure, the next step is identifying the specific sections that make up a strong insurance product manager resume.

What sections should go on a insurance product manager resume

Recruiters expect to see clear evidence that you can drive insurance product strategy, delivery, and performance across the full product lifecycle. Understanding which resume sections to include ensures your qualifications are easy to find and evaluate.

Use this structure for maximum clarity:

- Header

- Summary

- Experience

- Skills

- Projects

- Education

- Certifications

- Optional sections: Awards, Leadership, Languages

Strong experience bullets should emphasize measurable business impact, premium and loss ratio outcomes, regulatory scope, cross-functional leadership, and results delivered at scale.

Is your resume good enough?

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

Once you’ve organized your resume with the right sections, the next step is to write an insurance product manager experience section that fills them with clear, relevant impact.

How to write your insurance product manager resume experience

The experience section is where you prove you've shipped insurance products, improved policyholder outcomes, and driven measurable business results using role-relevant tools and frameworks. Hiring managers prioritize demonstrated impact—underwriting improvements, claims efficiency gains, platform launches—over descriptive task lists that merely outline daily responsibilities.

Each entry should include:

- Job title

- Company and location (or remote)

- Dates of employment (month and year)

Three to five concise bullet points showing what you owned, how you executed, and what outcomes you delivered:

- Ownership scope: the insurance products, policy lines, digital platforms, rating engines, or cross-functional teams you were directly accountable for—clarifying whether you led a single product or an entire portfolio across personal, commercial, or specialty markets.

- Execution approach: the tools, frameworks, and methods you relied on to make product decisions and deliver work, such as actuarial modeling, competitive benchmarking, regulatory analysis, agile product development, or customer research specific to insurance buyers and distribution channels.

- Value improved: the specific dimensions of quality, performance, or risk you changed—whether that meant strengthening loss ratios, accelerating policy issuance, reducing coverage gaps, improving regulatory compliance, or enhancing the digital experience for agents and policyholders.

- Collaboration context: how you partnered with underwriting, actuarial, claims, compliance, engineering, marketing, or external partners like reinsurers and InsurTech vendors to align product strategy with enterprise goals and market demands.

- Impact delivered: the business outcomes your work produced, expressed through results and scale rather than activity—encompassing growth in bound premium, expansion into new markets, retention improvements, faster speed-to-market for product launches, or reductions in combined ratio.

Experience bullet formula

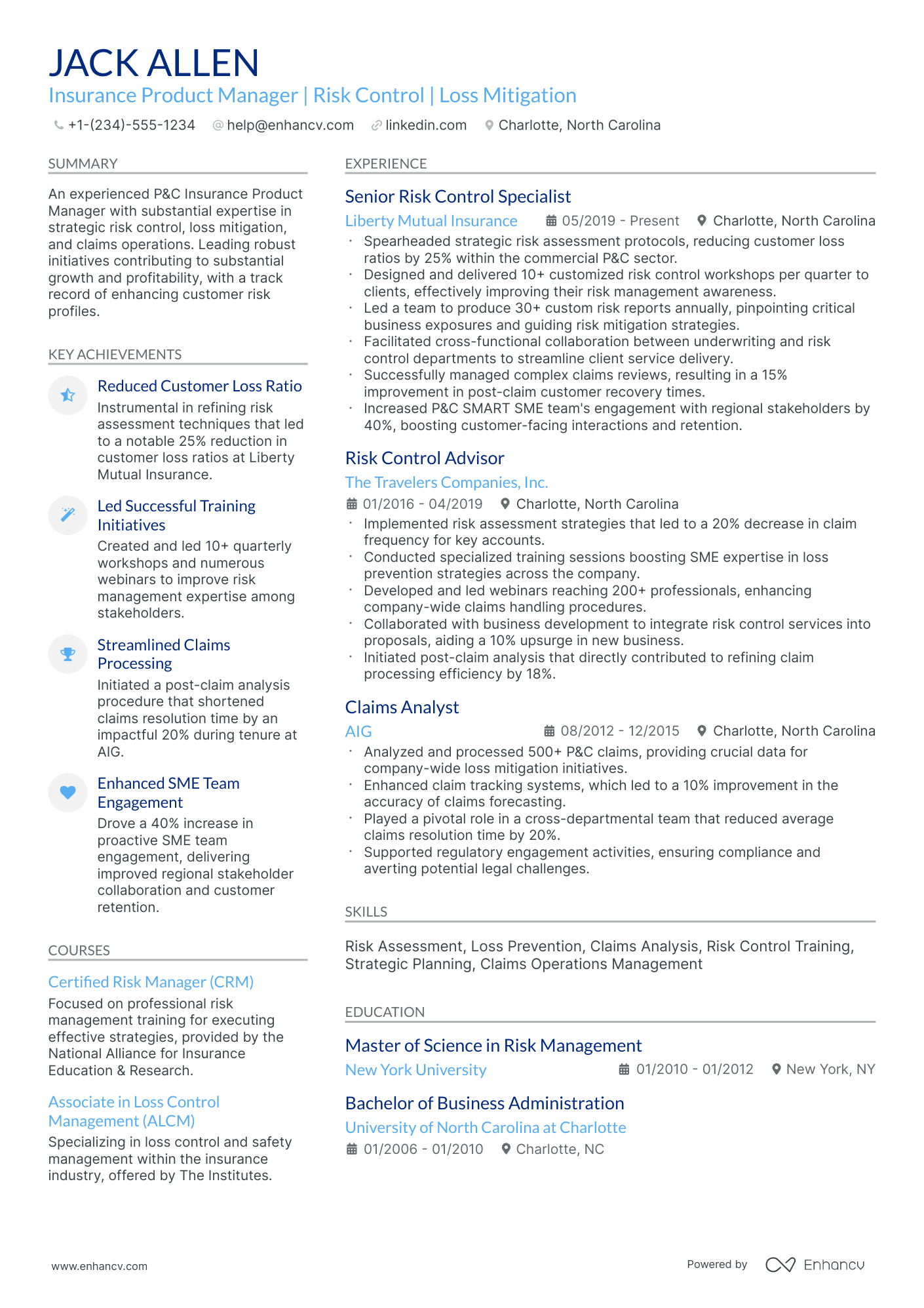

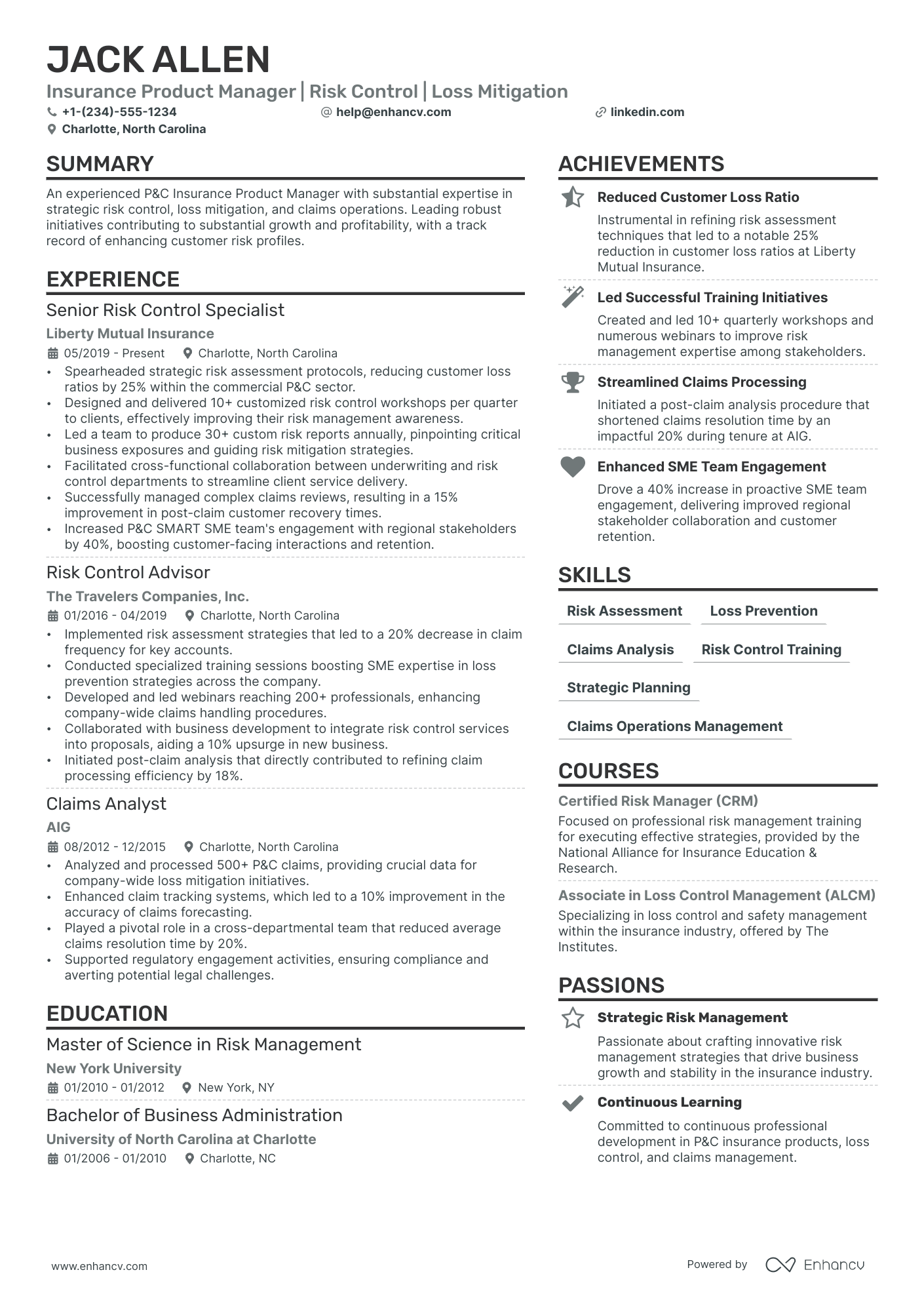

A insurance product manager experience example

✅ Right example - modern, quantified, specific.

Insurance Product Manager

HarborPoint Insurance | Chicago, IL

2022–Present

Mid-market P&C carrier serving 1.2M policyholders across eight states with a digital-first policy and claims platform.

- Led end-to-end launch of usage-based auto insurance product using Telematics APIs, Amplitude, and SQL cohort analysis; grew new business written premium by 12% ($8.4M annualized) within nine months.

- Partnered with actuarial, underwriting, and data science to rebuild rating and eligibility rules in Guidewire PolicyCenter; reduced quote-to-bind fallout by 9% and improved loss ratio by 1.3 points through tighter risk segmentation.

- Drove claims digital intake redesign with UX, claims ops, and engineering using Figma, Jira, and A/B testing; increased first notice of loss self-service adoption from 38% to 61% and cut average cycle time by 1.8 days.

- Implemented fraud and compliance controls by integrating LexisNexis Risk Solutions, sanctions screening, and audit logging; lowered manual review volume by 22% while meeting state filing and model governance requirements.

- Established KPI dashboards in Looker with event taxonomy and data quality checks; improved reporting accuracy from 92% to 99% and saved six hours per week for product, underwriting, and leadership stakeholders.

Now that you've seen what a strong experience section looks like in practice, let's break down how to customize yours for each specific insurance product manager role you're targeting.

How to tailor your insurance product manager resume experience

Recruiters evaluate your insurance product manager resume through both applicant tracking systems and manual review. Tailoring your experience section to mirror the job posting ensures your qualifications connect directly with what the hiring team needs.

Ways to tailor your insurance product manager experience:

- Match policy administration platforms or insurtech tools named in the posting.

- Mirror the exact terminology used for underwriting or claims processes.

- Reflect specific KPIs like loss ratios or policyholder retention rates.

- Highlight regulatory compliance experience with state or federal insurance standards.

- Include relevant lines of business such as P&C or life insurance.

- Align your workflow descriptions with Agile or SAFe frameworks referenced.

- Emphasize cross-functional collaboration with actuarial and claims teams when listed.

- Reference rate filing or product approval processes specific to the role.

Tailoring means aligning your real accomplishments with the language and priorities of each job posting, not forcing disconnected keywords into your experience.

Resume tailoring examples for insurance product manager

| Job description excerpt | Untailored | Tailored |

|---|---|---|

| Lead product development for commercial lines insurance, partnering with actuarial and underwriting teams to launch profitable products within state regulatory guidelines | Managed product launches and worked with cross-functional teams to deliver results on time. | Led end-to-end development of three commercial lines products, collaborating with actuarial and underwriting teams to secure regulatory approval across 12 states and achieve a 94% combined ratio in the first policy year. |

| Analyze loss ratio trends, policyholder behavior data, and competitive benchmarks using Guidewire and Tableau to inform product pricing and coverage adjustments | Reviewed data and created reports to support business decisions and strategy improvements. | Analyzed loss ratio trends and policyholder lapse patterns in Guidewire and Tableau, identifying pricing gaps that informed a 7% rate adjustment across personal auto lines and reduced adverse selection by 15%. |

| Own the product P&L for group benefits portfolio, driving growth through broker channel enablement and digital quoting platform enhancements | Responsible for financial performance of product lines and worked on improving sales processes. | Owned the $140M P&L for a group benefits portfolio, increasing broker-submitted quotes 32% by redesigning the digital quoting platform's UX and launching a tiered commission incentive program. |

Once you’ve aligned your experience with the role’s priorities, the next step is to quantify your insurance product manager achievements so hiring teams can see the impact behind those choices.

How to quantify your insurance product manager achievements

Quantifying your work proves business impact and de-risks your claims. Focus on numbers tied to premium growth, loss ratio, underwriting accuracy, compliance outcomes, release speed, and customer adoption across digital quoting, policy admin, and claims.

Quantifying examples for insurance product manager

| Metric | Example |

|---|---|

| Loss ratio | "Reduced loss ratio by 1.8 points in six months by tightening eligibility rules and adding fraud signals in the pricing engine." |

| Premium revenue | "Grew annualized written premium by $6.2M by launching a usage-based endorsement across three states with a 14-week rollout." |

| Compliance risk | "Cut compliance exceptions by 37% by embedding state filing checks into Jira workflows and automating audit evidence in Confluence." |

| Cycle time | "Reduced rate change cycle time from 28 days to 12 days by standardizing requirements and aligning actuarial, legal, and engineering reviews." |

| Adoption rate | "Increased agent portal quote-to-bind adoption from 46% to 61% by simplifying data entry and adding real-time eligibility feedback." |

Turn vague job duties into measurable, recruiter-ready resume bullets in seconds with Enhancv's Bullet Point Generator.

With strong, tailored bullet points in place, the next step is ensuring your skills section presents the right mix of hard and soft skills that insurance hiring managers are looking for.

How to list your hard and soft skills on a insurance product manager resume

Your skills section shows you can shape insurance products within regulatory constraints, use data to prioritize outcomes, and execute launches—recruiters and applicant tracking systems scan this section to confirm fit quickly, so aim for a balanced mix of hard skills and role-specific soft skills. insurance product manager roles require a blend of:

- Product strategy and discovery skills.

- Data, analytics, and experimentation skills.

- Delivery, execution, and go-to-market discipline.

- Soft skills.

Your skills section should be:

- Scannable (bullet-style grouping).

- Relevant to the job post.

- Backed by proof in experience bullets.

- Updated with current tools.

Place your skills section:

- Above experience if you're junior or switching careers.

- Below experience if you're mid/senior with strong achievements.

Hard skills

- Product discovery, customer interviews

- Roadmapping, backlog management

- Pricing and underwriting collaboration

- Policy administration systems (PAS)

- Claims workflows, loss cost basics

- Regulatory compliance, filings support

- SQL, data validation

- Tableau, Power BI

- A B testing, experiment design

- KPI design, cohort analysis

- Jira, Confluence

- API integrations, data mapping

Soft skills

- Translate regulation into requirements

- Align underwriting, claims, and legal

- Write clear product requirements

- Prioritize tradeoffs with evidence

- Lead cross-functional decision-making

- Communicate risks and mitigations

- Manage stakeholders through conflict

- Own outcomes end to end

- Run tight execution cadences

- Present product narratives to executives

- Negotiate scope, timeline, and impact

- Follow up relentlessly on dependencies

How to show your insurance product manager skills in context

Skills shouldn't live only in a dedicated skills list. Browse resume skills examples to see how top candidates weave competencies into real achievements.

They should be demonstrated in:

- Your summary (high-level professional identity)

- Your experience (proof through outcomes)

Here's what that looks like in practice.

Summary example

Insurance product manager with 10+ years leading P&C product portfolios. Skilled in Guidewire, Agile roadmapping, and regulatory compliance. Drove a 22% reduction in policy processing time by redesigning quoting workflows across commercial lines.

- Signals senior-level expertise immediately

- Names industry-specific tools directly

- Quantifies a concrete operational outcome

- Conveys cross-functional leadership ability

Experience example

Senior Insurance Product Manager

Clearpath Underwriting Group | Remote

March 2019–August 2024

- Launched a digitized claims intake workflow using Guidewire ClaimCenter, reducing average cycle time by 31% across four regional offices.

- Partnered with actuarial and compliance teams to redesign homeowners product tiers, increasing policyholder retention by 18% year over year.

- Led Agile sprint planning for a cross-functional squad of 12, delivering a self-service quoting portal that cut broker processing costs by $1.2M annually.

- Every bullet includes measurable proof.

- Skills surface naturally through outcomes.

Once you’ve tied your product work to measurable outcomes and insurance-specific impact, the next step is applying that same approach to a resume when you have no direct insurance product manager experience.

How do I write a insurance product manager resume with no experience

Even without full-time experience, you can demonstrate readiness through the strategies outlined in our guide on writing a resume without work experience:

- Insurance product case study portfolio

- Internships in underwriting or claims

- Actuarial or risk analysis projects

- Policy admin system configuration labs

- Regulatory compliance research summaries

- Customer journey mapping for policyholders

- Pricing and profitability modeling exercises

- Product requirement documents from coursework

Focus on:

- Evidence-based product decisions

- Insurance metrics and profitability

- Regulatory awareness and documentation

- Cross-functional deliverables and artifacts

Resume format tip for entry-level insurance product manager

Use a combination resume format to highlight projects and skills first, then list experience. It works because it proves product work through artifacts and measurable outcomes. Do:

- Lead with a Projects section.

- Quantify impact using insurance metrics.

- Name tools: Excel, SQL, Jira.

- Include product artifacts: PRDs, roadmaps.

- Add compliance notes tied to work.

- Built an insurance product manager case study with PRD, pricing model in Excel, and Jira backlog; improved projected loss ratio by 3.2 points versus baseline.

Even without direct experience, your education section can demonstrate the foundational knowledge and relevant coursework that qualify you for an insurance product manager role.

How to list your education on a insurance product manager resume

Your education section helps hiring teams confirm you have the foundational knowledge needed for an insurance product manager role. It validates analytical, business, and industry-specific expertise quickly.

Include:

- Degree name

- Institution

- Location

- Graduation year

- Relevant coursework (for juniors or entry-level candidates)

- Honors & GPA (if 3.5 or higher)

Skip month and day details—list the graduation year only.

Here's a strong education entry tailored for an insurance product manager resume.

Example education entry

Bachelor of Science in Finance and Risk Management

University of Illinois Urbana-Champaign, Champaign, IL

Graduated 2019

GPA: 3.7/4.0

- Relevant Coursework: Insurance Economics, Product Development Strategy, Data Analytics, Actuarial Science Fundamentals

- Honors: Dean's List (six semesters), Beta Gamma Sigma Honor Society

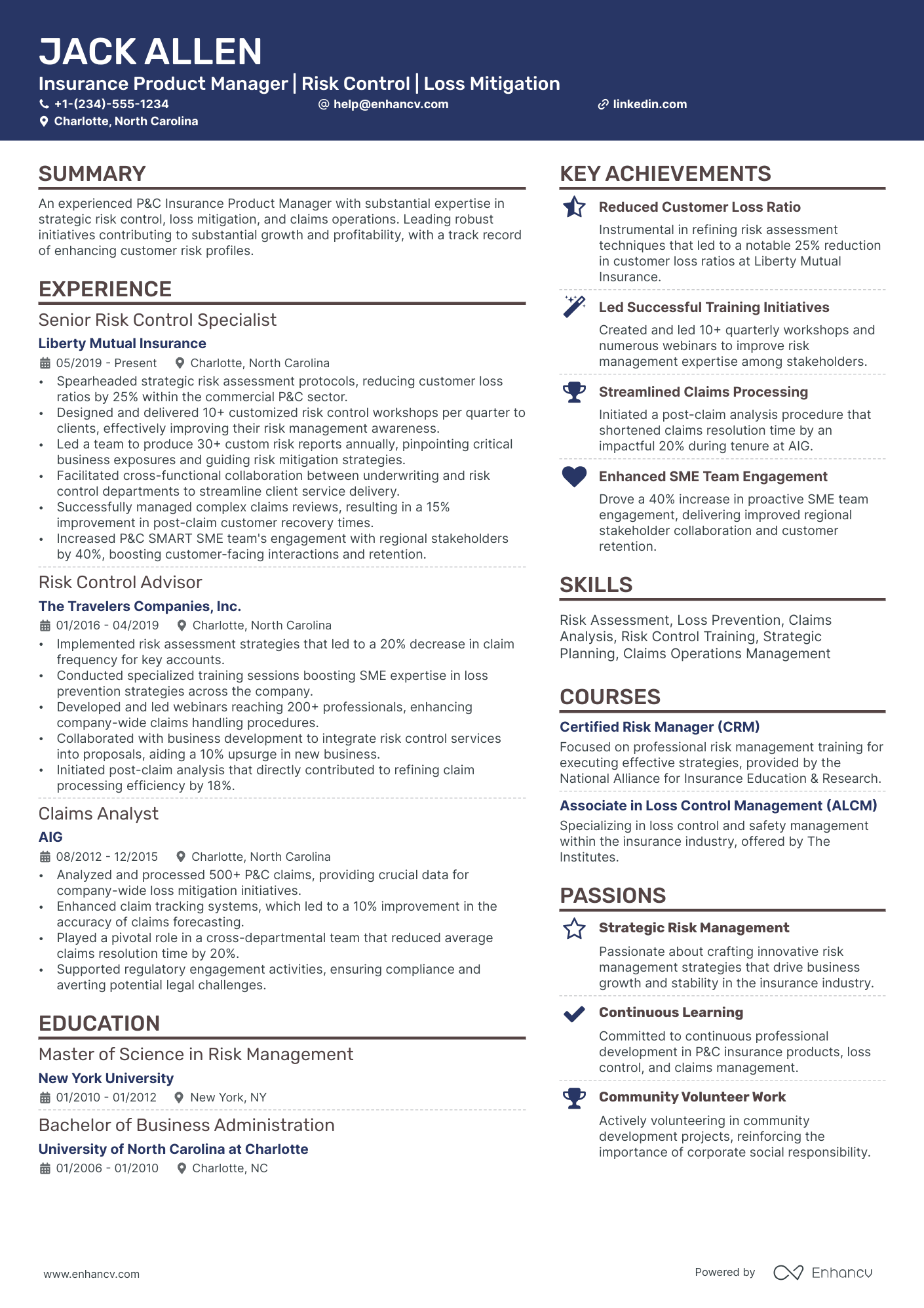

How to list your certifications on a insurance product manager resume

Certifications show your commitment to learning, prove tool proficiency, and signal industry relevance for an insurance product manager. They also help recruiters validate your expertise beyond job titles.

Include:

- Certificate name

- Issuing organization

- Year

- Optional: credential ID or URL

- List certifications below education when your degree is recent and the certifications are older or only loosely related to insurance product manager work.

- List certifications above education when they are recent, highly relevant, or required for the insurance product manager roles you target.

Best certifications for your insurance product manager resume

- Certified Scrum Product Owner (CSPO)

- Professional Scrum Product Owner (PSPO I)

- Associate in Product Management (APM)

- Associate in Insurance Data Analytics (AIDA)

- Associate in General Insurance (AINS)

- Associate in Risk Management (ARM)

- Chartered Property Casualty Underwriter (CPCU)

Once you’ve positioned your credentials to reinforce your qualifications, move to your insurance product manager resume summary to highlight your value upfront and connect those qualifications to the role.

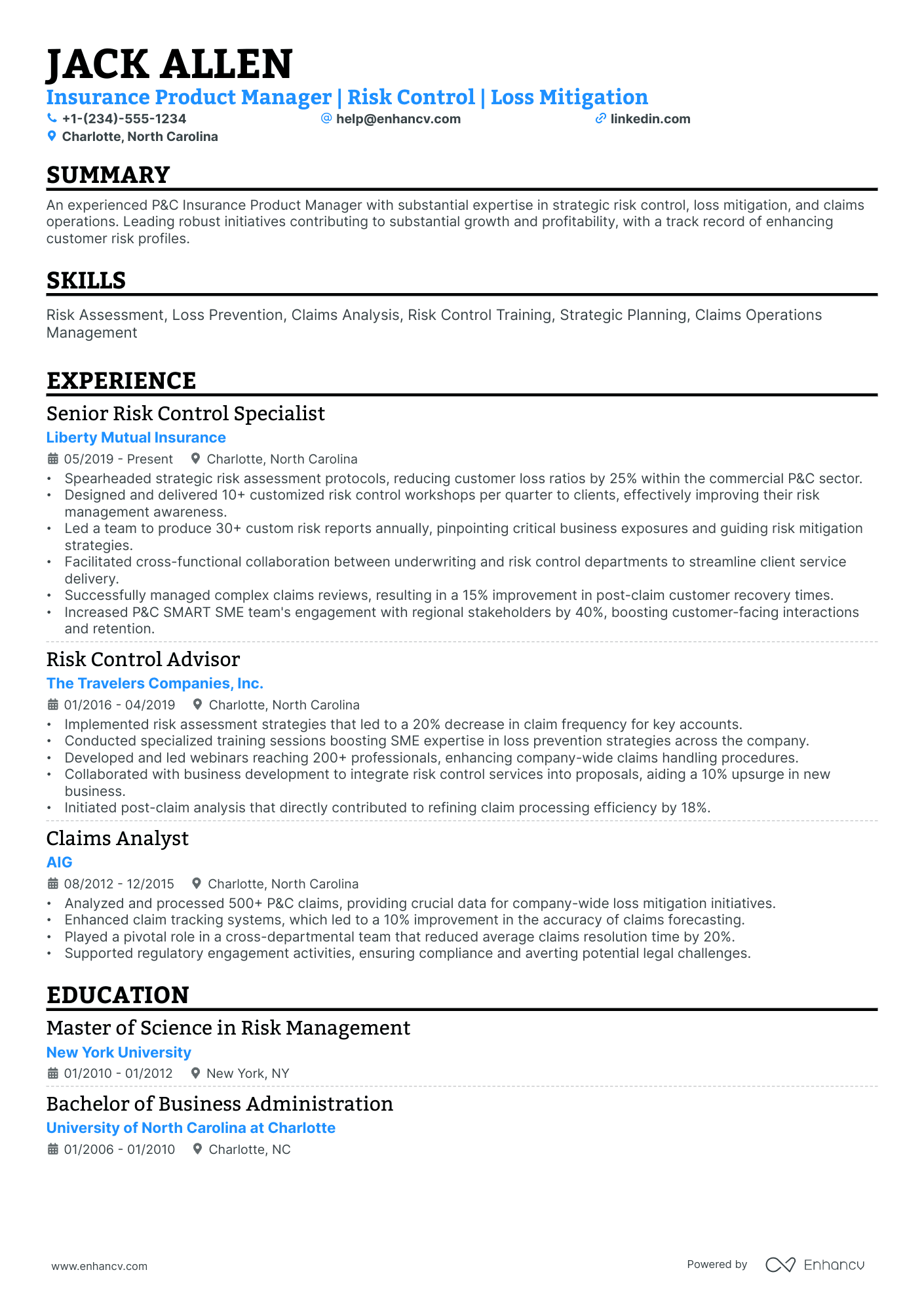

How to write your insurance product manager resume summary

Your resume summary is the first thing a recruiter reads. A sharp, specific opening signals you understand insurance products and can deliver results.

Keep it to three to four lines, with:

- Your title and total years of experience in product management.

- The insurance domain or product type you specialize in, such as P&C, life, or health.

- Core tools and skills like Jira, SQL, Agile frameworks, or regulatory compliance.

- One or two measurable achievements that show your impact on growth or efficiency.

- Soft skills tied to real outcomes, such as cross-functional collaboration that shortened a launch cycle.

PRO TIP

At this level, focus on relevant skills, tools, and early wins rather than broad claims. Highlight specific insurance products you've worked on and measurable contributions. Avoid vague phrases like "passionate self-starter" or "results-driven professional." Let concrete details speak for you.

Example summary for a insurance product manager

Insurance product manager with three years of experience in P&C policy platforms. Led a quoting tool redesign using Jira and SQL, reducing processing time by 22%. Skilled in Agile delivery and cross-functional stakeholder alignment.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Now that your summary captures your professional value, make sure your header presents the essential contact and identification details that let recruiters actually reach you.

What to include in a insurance product manager resume header

A resume header lists your key contact and identity details, helping insurance product manager candidates boost visibility, credibility, and pass recruiter screening fast.

Essential resume header elements

- Full name

- Tailored job title and headline

- Location

- Phone number

- Professional email

- GitHub link

- Portfolio link

A LinkedIn link lets recruiters confirm your roles, dates, and scope quickly, which supports faster, more accurate screening.

Do not include photos on a insurance product manager resume unless the role is explicitly front-facing or appearance-dependent.

Match your header title to the job posting and keep every link current, readable, and consistent with your resume content.

Example

Insurance product manager resume header

Jordan Taylor

Insurance Product Manager | Commercial Lines Product Strategy

Chicago, IL

(312) 555-01XX

jordan.taylor@enhancv.com

github.com/jordantaylor

jordantaylor.com

linkedin.com/in/jordantaylor

Once your contact details and role identifiers are clearly presented at the top, you can strengthen the rest of your application with additional resume sections that add relevant context and credibility.

Additional sections for insurance product manager resumes

When your core qualifications match other candidates, additional sections help you stand out by showcasing unique, role-relevant strengths.

- Languages

- Industry certifications (CPCU, FLMI, PMP)

- Publications and thought leadership

- Insurance technology conference presentations

- Professional associations and memberships

- Volunteer and board experience

- Awards and industry recognition

Once you've finalized every section of your resume, the next step is pairing it with a strong cover letter to maximize your application's impact.

Do insurance product manager resumes need a cover letter

An insurance product manager cover letter rarely is required, but it often helps in competitive searches or when hiring teams expect narrative context. Understanding what a cover letter is and when to use one can make a difference when your resume doesn't clearly show fit, scope, or impact.

Use a cover letter to add context your resume can't:

- Explain role and team fit by matching your experience to the product area, distribution model, and cross-functional partners.

- Highlight one or two projects with outcomes, such as loss ratio improvement, retention gains, faster underwriting decisions, or higher digital conversion.

- Show understanding of the product, users, and business context, including regulators, claims, underwriting, pricing, and channel constraints.

- Address career transitions or non-obvious experience by connecting your background to insurance product manager responsibilities and decision-making.

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Since your application can stand on its own without an extra document, using AI to improve your insurance product manager resume is the next step to sharpen what hiring teams see first.

Using AI to improve your insurance product manager resume

AI can sharpen your resume's clarity, structure, and impact. It helps tighten language and highlight measurable results. But overuse dulls authenticity. Once your content feels clear and role-aligned, step away from AI tools. For practical starting points, explore these ChatGPT resume writing prompts.

Here are 10 practical prompts to strengthen specific sections of your insurance product manager resume:

- Sharpen your summary. "Rewrite my resume summary to highlight my core value as an insurance product manager in under four sentences."

- Quantify experience bullets. "Add measurable outcomes to each experience bullet point on my insurance product manager resume."

- Align skills section. "Review my skills section and remove any that aren't directly relevant to an insurance product manager role."

- Strengthen action verbs. "Replace weak or repeated verbs in my insurance product manager experience section with stronger, more specific alternatives."

- Tighten project descriptions. "Condense my project descriptions to focus on results and relevance for an insurance product manager position."

- Improve certification clarity. "Reformat my certifications section so each entry clearly supports my qualifications as an insurance product manager."

- Refine education details. "Edit my education section to emphasize coursework and achievements most relevant to an insurance product manager career."

- Remove filler language. "Identify and remove vague or redundant phrases throughout my insurance product manager resume."

- Tailor to job postings. "Compare my insurance product manager resume against this job description and suggest targeted adjustments."

- Focus achievement impact. "Rewrite my top three accomplishments to clearly show business impact in an insurance product manager context."

Stop using AI once your resume sounds accurate, specific, and aligned with real experience. AI should never invent experience or inflate claims—if it didn't happen, it doesn't belong here.

Conclusion

A strong insurance product manager resume proves impact with measurable outcomes, such as premium growth, loss ratio improvement, retention gains, and faster launches. It highlights role-specific skills, including pricing, underwriting collaboration, regulatory awareness, and roadmap ownership, in a clean structure.

Use clear headings, concise bullets, and consistent formatting to make your experience easy to scan. This approach shows you can deliver results now and adapt to changing customer needs, data expectations, and compliance demands in the hiring market.