As a fund accountant, articulating the complexity of your financial reporting and analysis skills in a concise resume format can be challenging. Our guide will provide you with the strategies and tailored language to effectively showcase your expertise and make your resume stand out to potential employers.

- Apply best practices from professional resumes to spotlight your application;

- Quantify your professional experience with achievements, career highlights, projects, and more;

- Write an eye-catching fund accountant resume top one-third with your header, summary/objective, and skills section;

- Fill in the gaps of your experience with extracurricular, education, and more vital resume sections.

We've selected, especially for you, some of our most relevant fund accountant resume guides. Getting you from thinking about your next career move to landing your dream job.

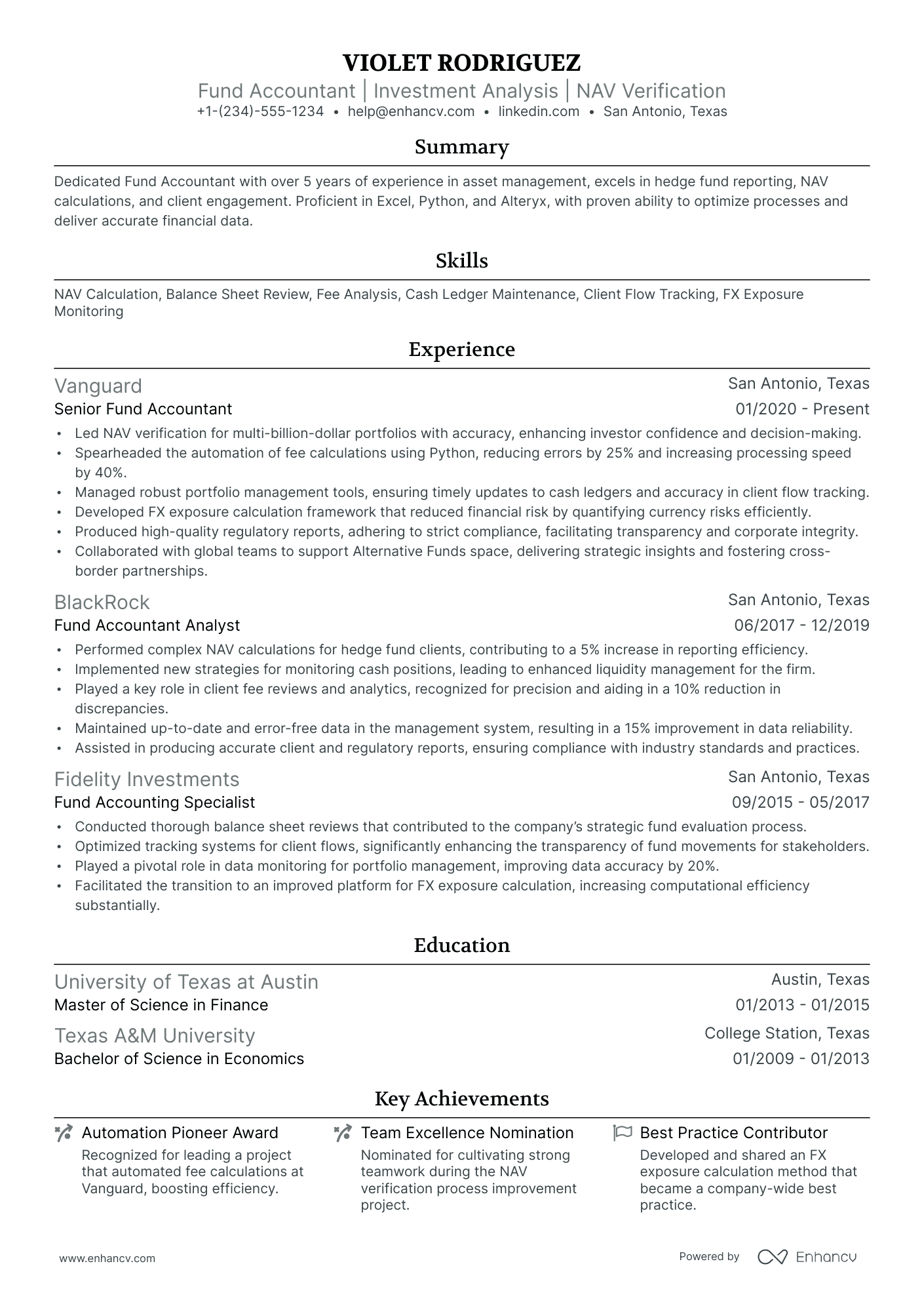

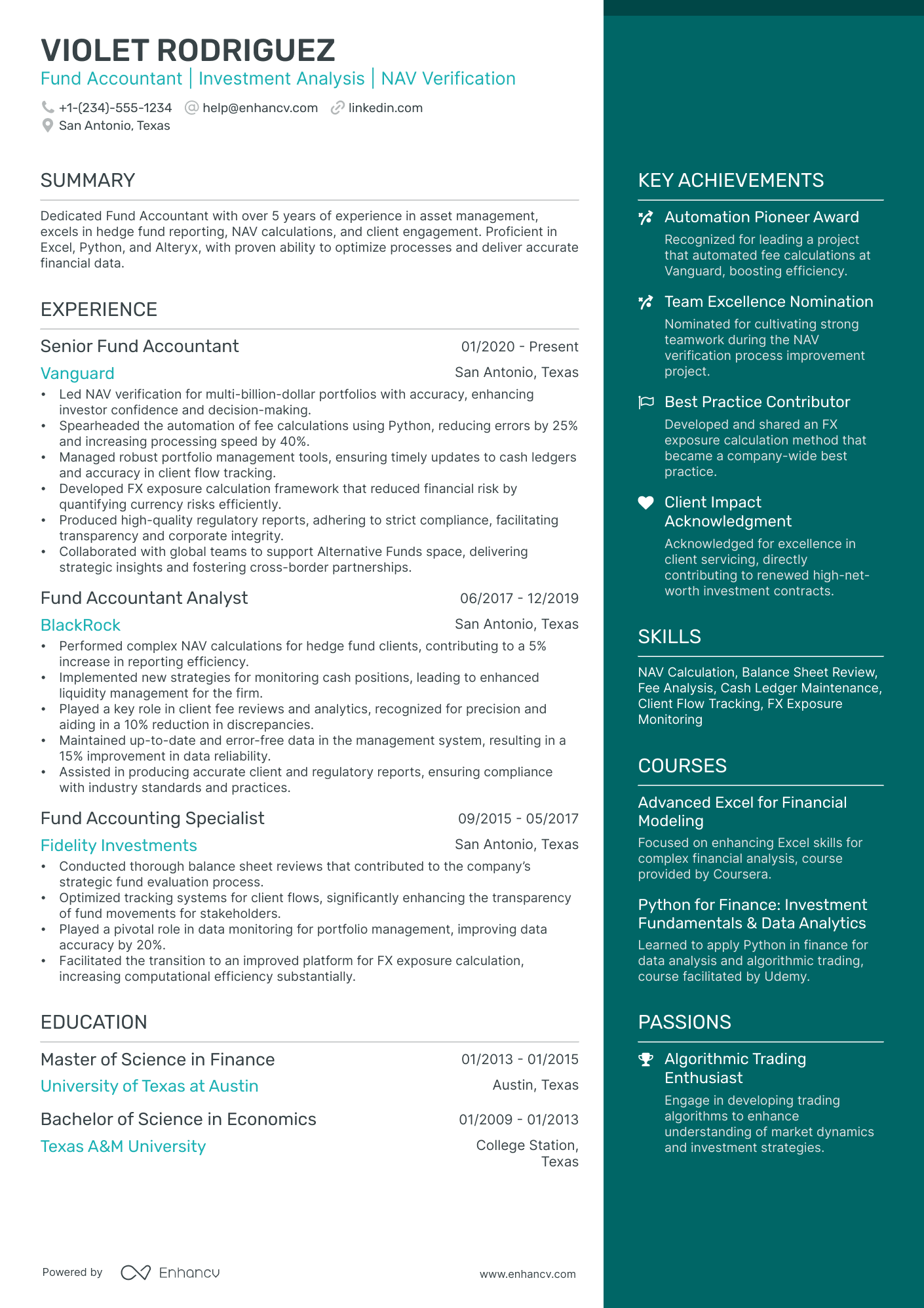

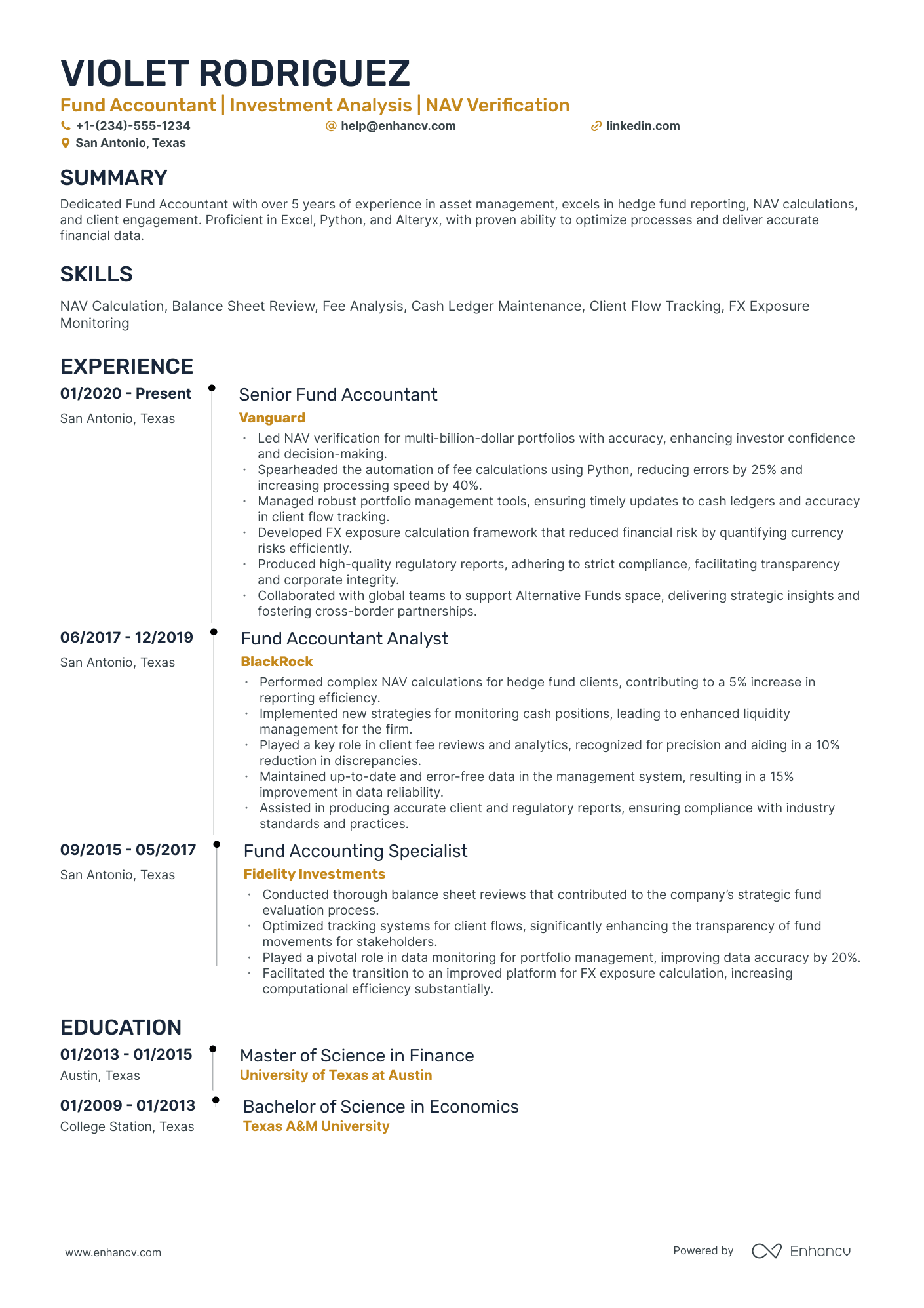

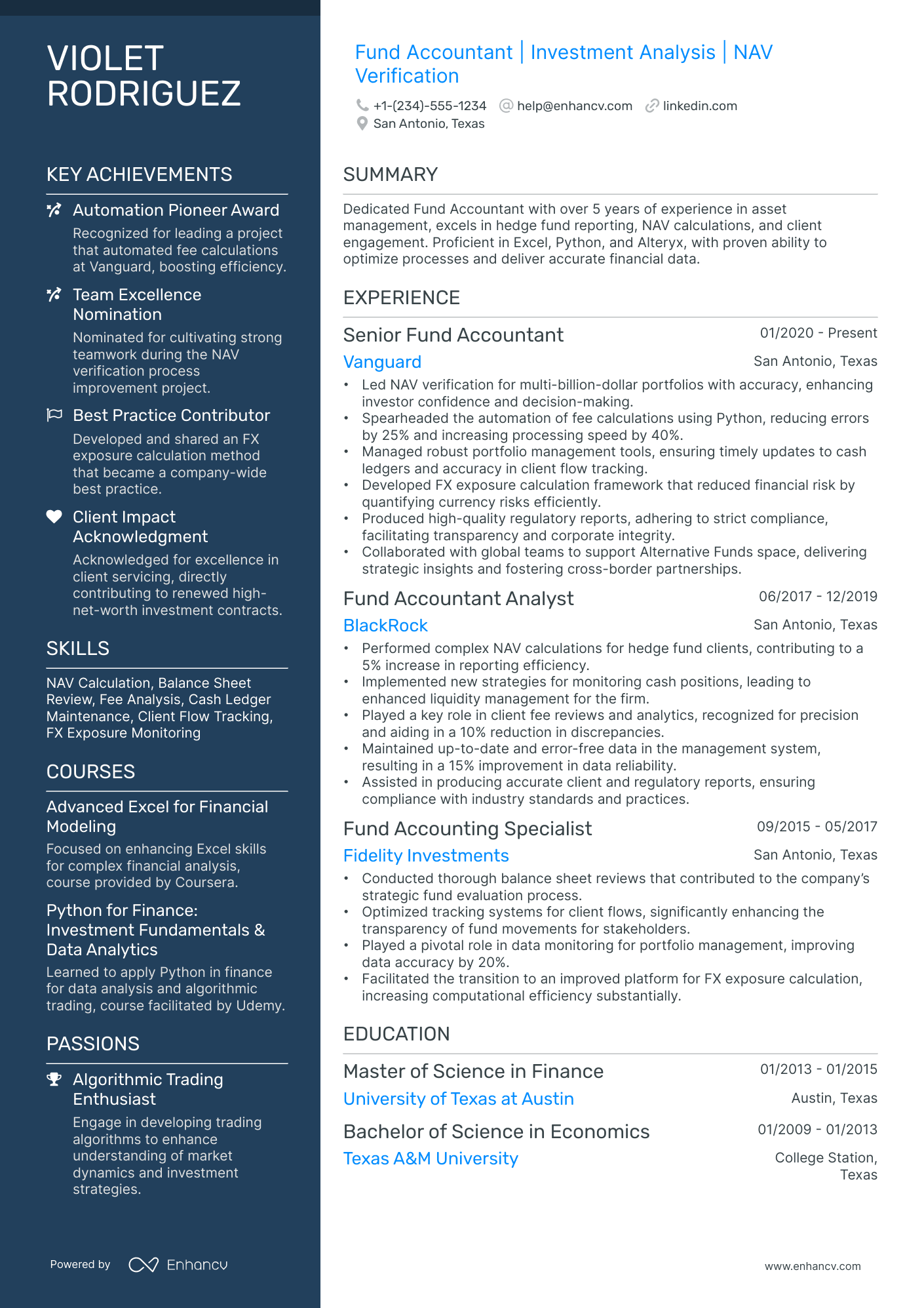

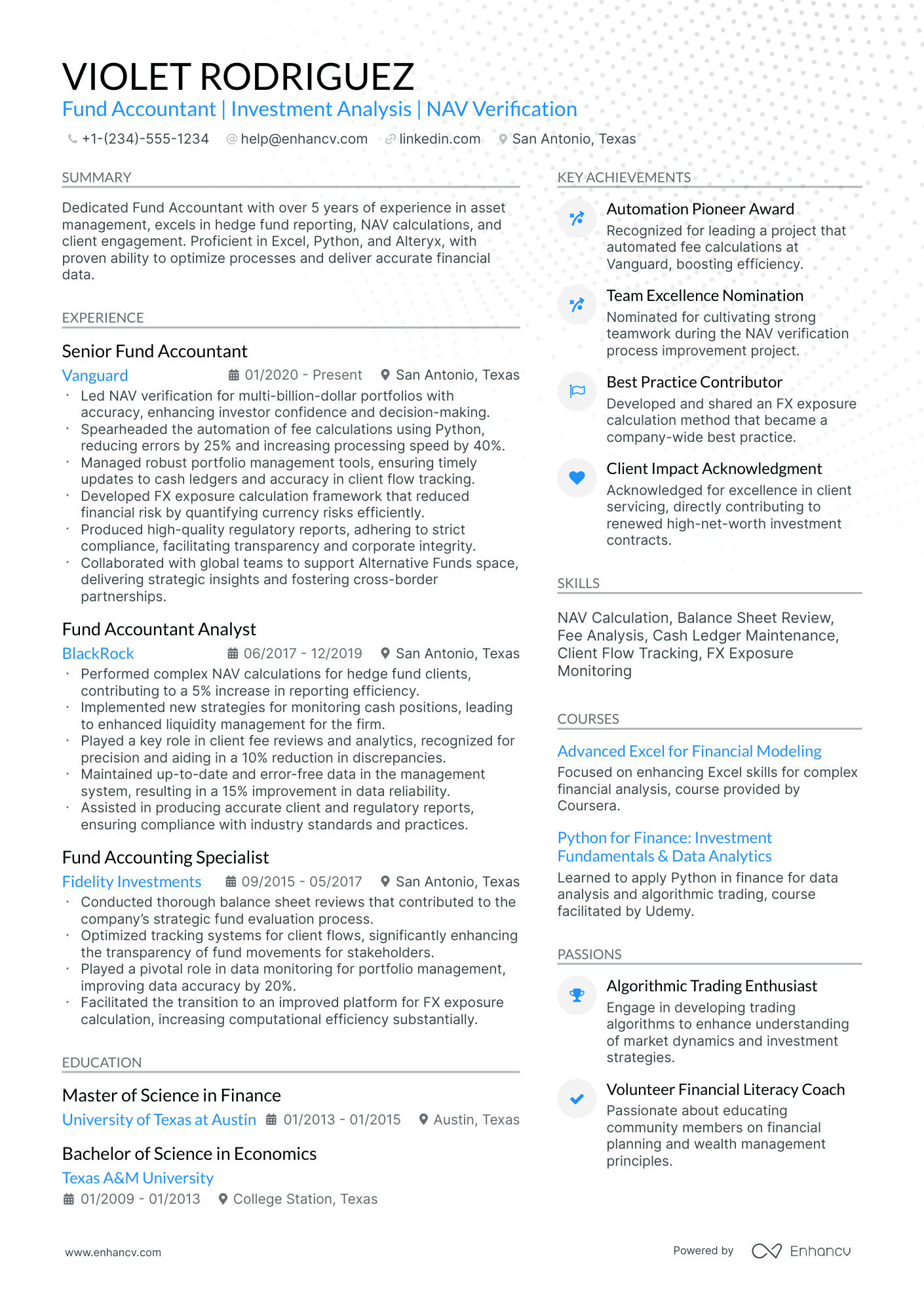

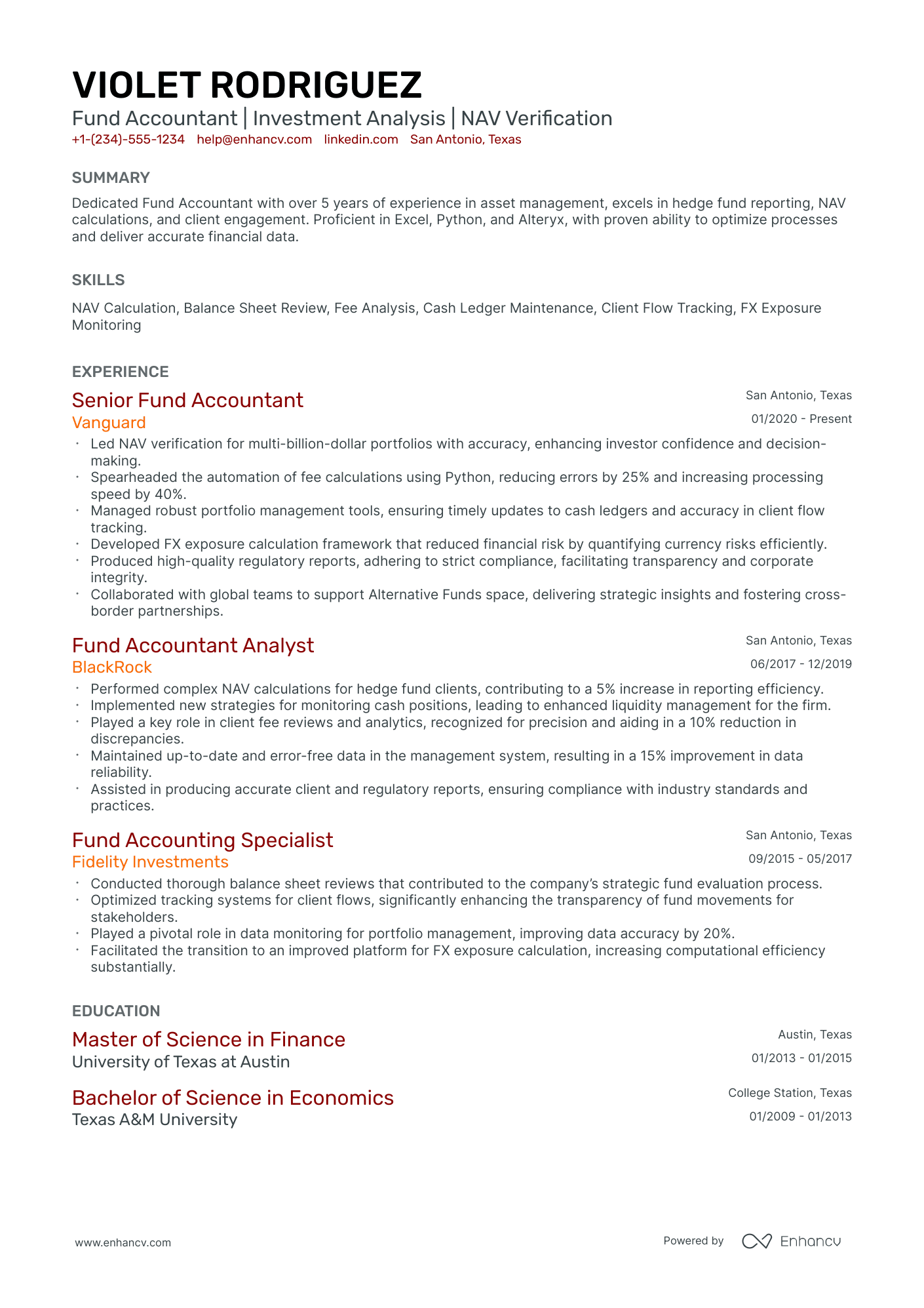

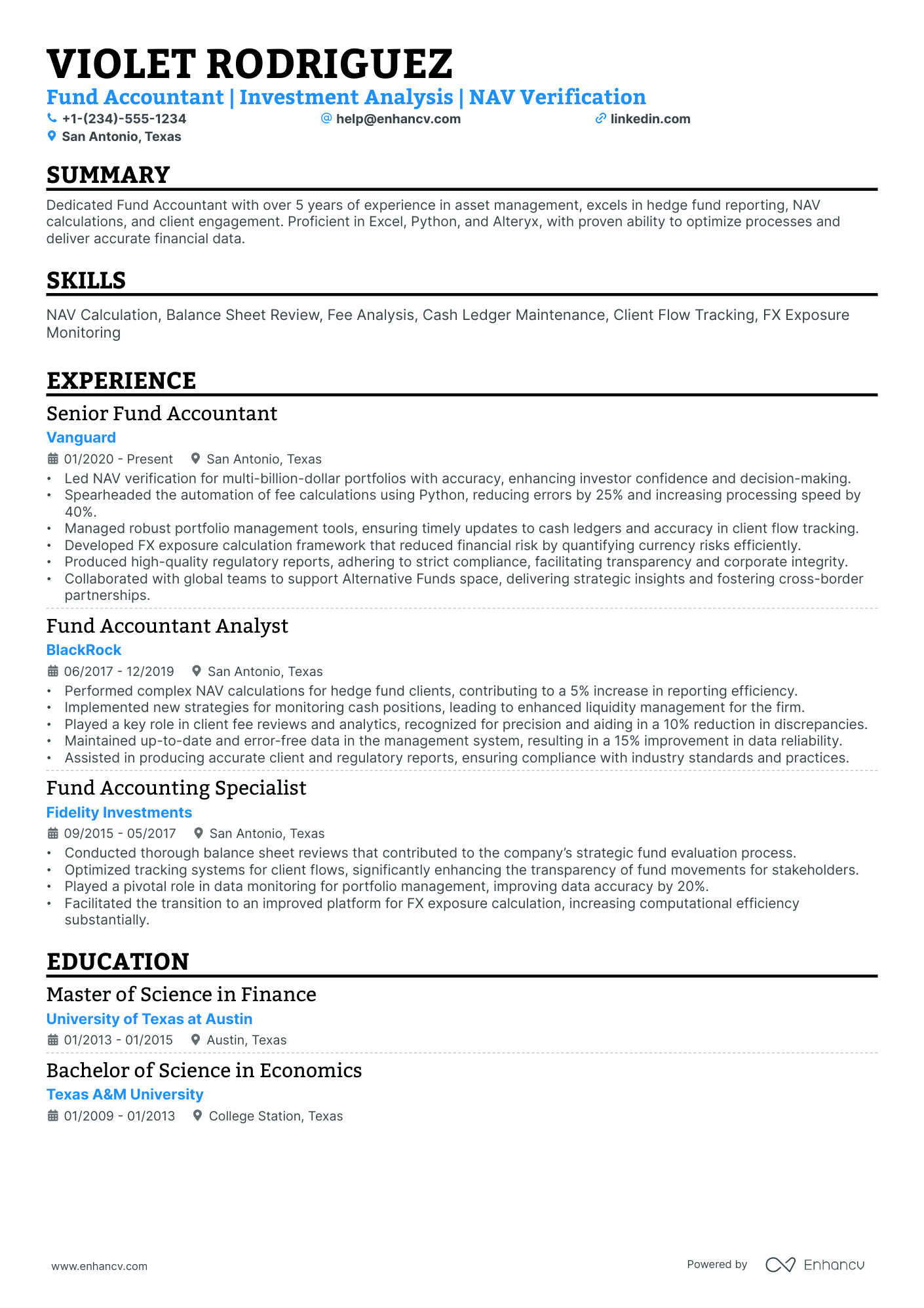

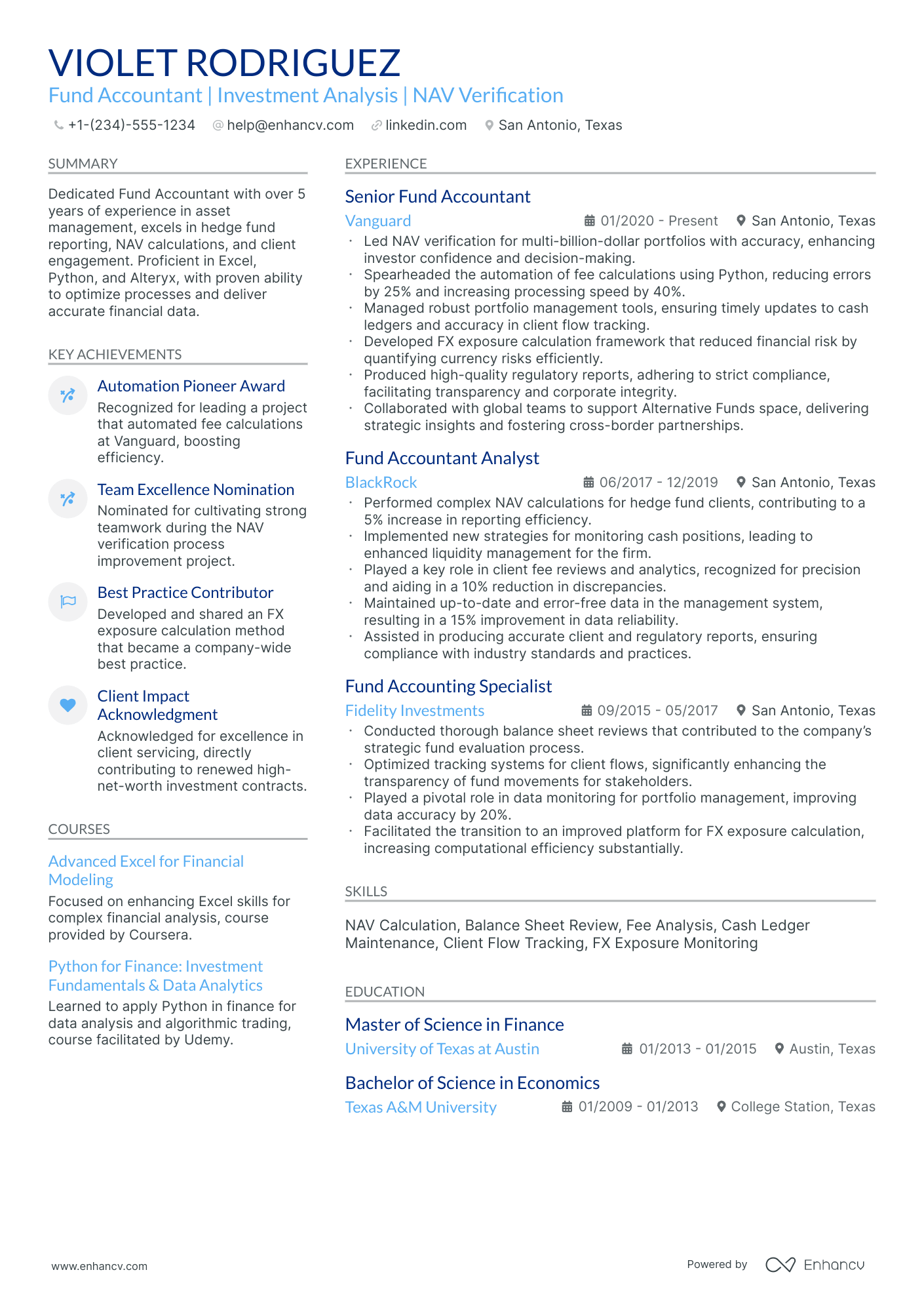

Formatting the layout of your fund accountant resume: design, length, and more

When it comes to the format of your fund accountant resume , you've plenty of opportunities to get creative. But, as a general rule of thumb, there are four simple steps you could integrate into your resume layout.

- If you have plenty of experience, you'd like to showcase, invest in the reverse-chronological resume format . This format focuses on your latest experience items and skills you've learned during your relevant (and recent) jobs.

- Don't go over the two-page limit, when creating your professional fund accountant resume. Curate within it mainly experience and skills that are relevant to the job.

- Make sure your fund accountant resume header includes all of your valid contact information. You could also opt to display your professional portfolio or LinkedIn profile.

- Submit or send out your fund accountant resume as a PDF, so you won't lose its layout and design.

Be mindful of regional differences in resume formats – a Canadian layout, for instance, might vary.

Upload & Check Your Resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

PRO TIP

List your educational qualifications and certifications in reverse chronological order.

The key to your fund accountant job-winning resume - present your expertise with these sections:

- A header to make your resume more scannable

- Snapshot of who you are as a professional with your resume soft skills, achievements, and summary or objective

- Job advert keywords in the skills section of your resume

- Resume experience quantifying your past job successes with metrics

- A relevant education, certification, and technical sills section to provide background to your technological/software capabilities

What recruiters want to see on your resume:

- Demonstrated knowledge of accounting principles and financial reporting specific to investment funds, such as GAAP, IFRS, or other regulatory accounting standards.

- Experience with fund accounting software and platforms, like Advent Geneva, Bloomberg, or Investran.

- Familiarity with various financial instruments and investment vehicles, including mutual funds, hedge funds, private equity, and derivatives.

- Understanding of fund structures, fee calculations, and performance attributions in the context of fund accounting.

- Ability to perform accurate NAV (Net Asset Value) calculations, reconcile portfolio transactions, and prepare financial statements for funds.

The experience section or the essence of your professional fund accountant resume

Recruiters always have and always will appreciate well-written fund accountant resume experience sections.

The experience section is perhaps the most crucial element of your professional presentation, as it needs to answer job requirements while showcasing your technical expertise and personality.

Create your best resume experience section yet by:

- Selecting only relevant experience items to the role you're applying for;

- Always ensure you've listed a metric to quantify your success alongside each experience item;

- Create a narrative that showcases your fund accountant career succession: this goes to show the time and effort you've invested in the field to build your experience from the ground up;

- Within each experience bullet, consider a problem you've solved, the skills you've used, and the bigger impact this has made in the organization.

Take a look at how other real-life professionals have curated their experience with the fund accountant samples below:

- Analyzed and reconciled investment portfolios for 15 mutual funds, ensuring compliance with investment strategies and fund agreements.

- Coordinated with external auditors to facilitate the annual audit process, leading to an audit completion rate 20% more efficient than in previous years.

- Identified and resolved pricing disparities in the portfolio accounting system for securities worth over $500 million, enhancing the accuracy of net asset value calculations.

- Managed and maintained the accounting books for hedge funds with assets over $800 million, accurately reporting monthly financials to stakeholders.

- Developed an improved system for tracking and monitoring fund expenses which decreased month-end closing time by an estimated 25%.

- Coordinated with investment managers to interpret complex fund strategies translating to the implementation of customized accounting practices.

- Provided detailed fund performance reports to management and clients on a quarterly basis, showcasing insights on over 30 investment portfolios.

- Facilitated the transition of fund accounting software, which involved migrating data and training 40 staff members, resulting in a 15% gain in productivity.

- Performed due diligence and statistical analysis on fund investments, contributing to a fund growth of 18% in the 2013 fiscal year.

- Led a team of 7 to operate and improve accounting functions for private equity funds, effectively handling portfolios worth over $1 billion.

- Streamlined the valuation process for illiquid securities, significantly reducing the potential for valuation errors and maintaining investor confidence.

- Acted as the liaison between fund administrators and clients to resolve complex issues surrounding fund operations and regulatory compliance.

- Oversaw daily NAV calculations and reporting for a set of diversified fixed-income funds, maintaining the highest standards of accuracy and timeliness.

- Introduced automation tools for financial statement preparation, cutting the time needed by 30% and enhancing reporting efficiency.

- Assisted in developing a risk assessment framework that proactively identified potential accounting anomalies across the fund's financial operations.

- Performed complex reconciliations for fund portfolios, detecting and correcting discrepancies amounting to over $2 million in misallocated funds.

- Efficiently managed the financial reporting for international funds with assets totaling in excess of $650 million, adhering to multiple regulatory standards.

- Collaborated with IT specialists to enhance financial software, leading to a 20% improvement in reporting capabilities and data accuracy.

- Spearheading the integration of ESG (Environmental, Social, Governance) criteria into fund accounting practices, adapting to new market trends and investor preferences.

- Automated expense report generation for funds, reducing the risk of human error and enabling the reallocation of 200 man-hours annually towards strategic analysis.

- Piloted a cross-functional project to evaluate and implement tax optimization strategies across managed funds, ultimately saving an estimated $4 million in tax liabilities annually.

- Administered daily accounting procedures for over $900 million in managed fund assets, reinforcing fund integrity and investor trust through meticulous financial oversight.

- Drove the adoption of a new reconciliation system that curtailed monthly close cycles by three days, directly enhancing reporting responsiveness and stakeholder satisfaction.

- Conducted in-depth variance analysis and presented quarterly findings to the executive board, playing a pivotal role in strategic decision-making processes.

The following content includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top responsibilities present on the task lists for fund accountant professionals.

Top Responsibilities for Fund Accountant:

- Prepare detailed reports on audit findings.

- Report to management about asset utilization and audit results, and recommend changes in operations and financial activities.

- Collect and analyze data to detect deficient controls, duplicated effort, extravagance, fraud, or non-compliance with laws, regulations, and management policies.

- Inspect account books and accounting systems for efficiency, effectiveness, and use of accepted accounting procedures to record transactions.

- Supervise auditing of establishments, and determine scope of investigation required.

- Confer with company officials about financial and regulatory matters.

- Examine and evaluate financial and information systems, recommending controls to ensure system reliability and data integrity.

- Inspect cash on hand, notes receivable and payable, negotiable securities, and canceled checks to confirm records are accurate.

- Examine records and interview workers to ensure recording of transactions and compliance with laws and regulations.

- Prepare, examine, or analyze accounting records, financial statements, or other financial reports to assess accuracy, completeness, and conformance to reporting and procedural standards.

Quantifying impact on your resume

- Highlight the volume of transactions processed daily to demonstrate efficiency and ability to handle large datasets.

- Quantify the value of the funds you've reconciled to showcase your experience with managing significant financial figures.

- Include the number of financial statements and reports generated to reflect your productivity and attention to detail.

- Specify the percentage of error reduction achieved through process improvements to illustrate your problem-solving capabilities.

- Mention the size of the investment portfolios you've assessed for risks and returns to indicate your analytical skills.

- Detail the number of compliance audits completed to convey your understanding of regulatory requirements and commitment to accuracy.

- Describe the extent of your collaboration by listing the number of departments or teams you've supported, showing teamwork and communication skills.

- Include the amount of cost savings you've identified through operational efficiencies to highlight your proactive approach to financial management.

Action verbs for your fund accountant resume

Making the most of your little to none professional experience

If you're hesitant to apply for your dream job due to limited professional experience, remember that recruiters also value the unique contributions you can offer.

Next time you doubt applying, consider this step-by-step approach for your resume's experience section:

- Rather than the standard reverse chronological order, opt for a functional-based format. This shifts the focus from your work history to your achievements and strengths;

- Include relevant internships, volunteer work, or other non-standard experiences in your fund accountant resume's experience section;

- Utilize your education, qualifications, and certifications to bridge gaps in your fund accountant resume experience;

- Emphasize your interpersonal skills and transferable skills from various industries. Often, recruiters seek a personality match, giving you an advantage over other candidates.

Recommended reads:

PRO TIP

Mention specific courses or projects that are pertinent to the job you're applying for.

Balancing hard and soft skills in your fund accountant resume

Recruiters indeed pay close attention to the specific hard and soft skills candidates possess. Hard skills refer to technical abilities or your proficiency in technologies, while soft skills are the personal attributes and qualities developed over your lifetime.

If you're unsure about effectively quantifying these skills on your resume, follow our step-by-step guide. It's crucial to first understand the key job requirements for the role. Doing so enables you to accurately list your:

- Hard skills in sections like skills, education, and certifications. Your technical expertise is straightforward to quantify. Most organizations find it sufficient to mention the certificates you've earned, along with your proficiency level.

- Soft skills within your experience, achievements, strengths, etc. Defining interpersonal communication traits in your resume can be challenging. Focus on showcasing the accomplishments you've achieved through these skills.

Remember, when tailoring your fund accountant resume, ensure that the skills you list match exactly with those in the job requirements. For instance, if the job listing specifies "Microsoft Word," include this exact term rather than just "Word" or "MSO."

Top skills for your fund accountant resume:

GAAP

Fund Accounting Software (e.g., Investran, SS&C)

Excel (Advanced)

Financial Reporting

Reconciliation Techniques

Tax Compliance

Investment Performance Measurement

Portfolio Management Systems

Database Management

Accounting Software (e.g., QuickBooks, SAP)

Attention to Detail

Analytical Thinking

Time Management

Problem Solving

Communication Skills

Team Collaboration

Adaptability

Organizational Skills

Critical Thinking

Ethical Judgment

Next, you will find information on the top technologies for fund accountant professonals from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license.

Top technologies for Fund Accountant’s resume:

- Intuit QuickBooks

- Sage 50 Accounting

- Google Docs

- Microsoft Word

- Oracle E-Business Suite Financials

- Tropics workers' compensation software

PRO TIP

The more trusted the organization you've attained your certificate (or degree) from, the more credible your skill set would be.

Listing your education and certifications on your fund accountant resume

Don't underestimate the importance of your resume education section . As it may hint at various skills (and experience) that are relevant to the job. When writing your education section:

- Include only higher education degrees with information about the institution and start/end dates

- If you're in the process of obtaining your degree, include your expected graduation date

- Consider leaving off degrees that aren't relevant to the job or industry

- Write a description of your education if it presents you with an opportunity to further showcase your achievements in a more research-focused environment

When describing your certifications on your resume, always consider their relevancy to the role. Use the same format to describe them as you would for your education. If you're wondering what the best certificates out there are for fund accountant roles, check out the list below.

The top 5 certifications for your fund accountant resume:

- Chartered Financial Analyst (CFA) - CFA Institute

- Certified Public Accountant (CPA) - American Institute of CPAs

- Chartered Alternative Investment Analyst (CAIA) - CAIA Association

- Certified Management Accountant (CMA) - Institute of Management Accountants

- Financial Risk Manager (FRM) - Global Association of Risk Professionals

The content below includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top associations for fund accountant professionals.

Top US associations for a Fund Accountant professional

- AACSB

- AICPA and CIMA

- American Accounting Association

- Association for Financial Professionals

- Association of Government Accountants

PRO TIP

Showcase any ongoing or recent educational efforts to stay updated in your field.

Recommended reads:

Best practices to your fund accountant resume summary or objective

To start, how do you know if you should include a resume summary or a resume objective ?

- Resume summaries are ideal for fund accountant professionals with more experience, who'd like to give a quick glimpse of their biggest career achievements in the top one-third of their resumes.

- On the other hand, resume objectives serve as a road map for recruiters. Candidates use the objective to show how their experience aligns with the fund accountant role they're applying for while showcasing the North Star of their career (or where they want to be as a professional in the next couple of years).

The resume summary or resume objective could be the perfect fit for your fund accountant resume. The function of both is to highlight your professionalism succinctly. So, keep your writing specific: include no more than four sentences and target your application to the role. Here's how these specific resume sections help the fund accountant candidates stand out.

Resume summaries for a fund accountant job

- With over 7 years of dedicated experience as a fund accountant at a top-tier investment firm in Manhattan, I bring a consistent track record of meticulous financial reporting, comprehensive fund valuation, and effective stakeholder communication. Mastermind in driving process efficiency, my tenure is marked by implementing a new accounting software that increased reporting accuracy by 25%.

- Former financial analyst transitioning to fund accounting, I hold a robust analytical background accentuated by 5 years of dissecting complex market trends to inform investment strategies. Eager to leverage my deep understanding of financial instruments and excel in fund accounting, my analytical prowess can refine fund performance analysis.

- As a professional with 10 years in public accounting, my journey to fund accounting is fueled by a profound knowledge of auditing, tax laws, and GAAP. Recognized for developing tax saving strategies that saved clients millions, I am keen to apply my forensic examination skills to ensure precise fund accounting practices.

- Passionate in the pursuit of excellence in fund accounting, I come with an extensive 8-year background in asset management, highlighted by a relentless commitment to regulatory compliance and optimizing client investment strategies. Noteworthy is my role in expanding a small-cap fund's portfolio by 40% through strategic asset allocation.

- Aiming to delve into the dynamic world of fund accounting, I bring a zealous aptitude for numerical data analysis and a meticulous eye for detail, drawn from a summa cum laude finance degree. My objective is to harness these proficiencies to further the financial integrity and growth of managed funds.

- Determined to launch my career in fund accounting, my educational foundation in finance is complemented by a strong analytical skillset from extracurricular statistical research projects. My goal is to deliver exceptional fund analysis and reporting, contributing to the optimal financial performance of clients' investment portfolios.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Average salary info by state in the US for fund accountant professionals

Local salary info for Fund Accountant.” Source: My Next Move, National Center for O*NET Development. Accessed 10/15/2024

| State | Average Salary (in USD) |

|---|---|

| US National Average | $79,880 |

| California (CA) | $92,160 |

| Texas (TX) | $78,900 |

| Florida (FL) | $76,480 |

| New York (NY) | $101,090 |

| Pennsylvania (PA) | $75,370 |

| Illinois (IL) | $78,280 |

| Ohio (OH) | $75,550 |

| Georgia (GA) | $78,970 |

| North Carolina (NC) | $79,920 |

| Michigan (MI) | $76,190 |

Additional valuable fund accountant resume sections to stand out

When assessing candidate applications, recruiters are often on the lookout for elements that go beyond meeting standard requirements and technical expertise.

This is where extra sections could play a key role in showcasing your unique skill set and personality.

Make sure to include sections dedicated to:

- How you spend your free time, outside of work. The interests resume section also goes to show your personality and transferrable skills; and may also serve to fill in gaps in your experience;

- Most innovative work. The projects resume section brings focus to what you're most proud of within the field;

- How you're able to overcome language barriers. The language resume section is always nice to have, especially if communication would be a big part of your future role;

- Industry-wide recognitions. Remember that the awards resume section should highlight your most noteworthy accolades and prizes.

Key takeaways

Securing your ideal job starts with crafting a compelling fund accountant resume. It should not only highlight your professional strengths but also reflect your personality. Key aspects to remember include:

- Choose a clear, easily editable format, allowing more time to focus on the content of your resume;

- Emphasize experience relevant to the job, focusing on your impact on the team;

- Opt for a resume summary if you have extensive professional experience, and a resume objective if you're just starting out;

- Include technical skills in the skills section and interpersonal skills in the achievements section;

- Recognize the importance of various resume sections (e.g., My Time, Projects) in showcasing both your professional abilities and personal traits.