Payroll analysts often struggle with articulating their complex responsibilities and showcasing their ability to optimize payroll processes within the brief, clear format required for resumes. Our guide can assist in addressing this challenge by providing specific verbiage, examples, and templates designed to effectively communicate these critical skills and experiences in a concise yet impactful manner.

Dive into our concise guide to learn how to:

- Show your payroll analyst career's brightest moments through your resume's summary, objective, and experience sections.

- Explore top-notch payroll analyst resume examples to understand how to distinguish yourself from other candidates.

- Identify the most sought-after payroll analyst skills and certifications in the industry.

- Design a structured yet unique resume layout.

Recommended reads:

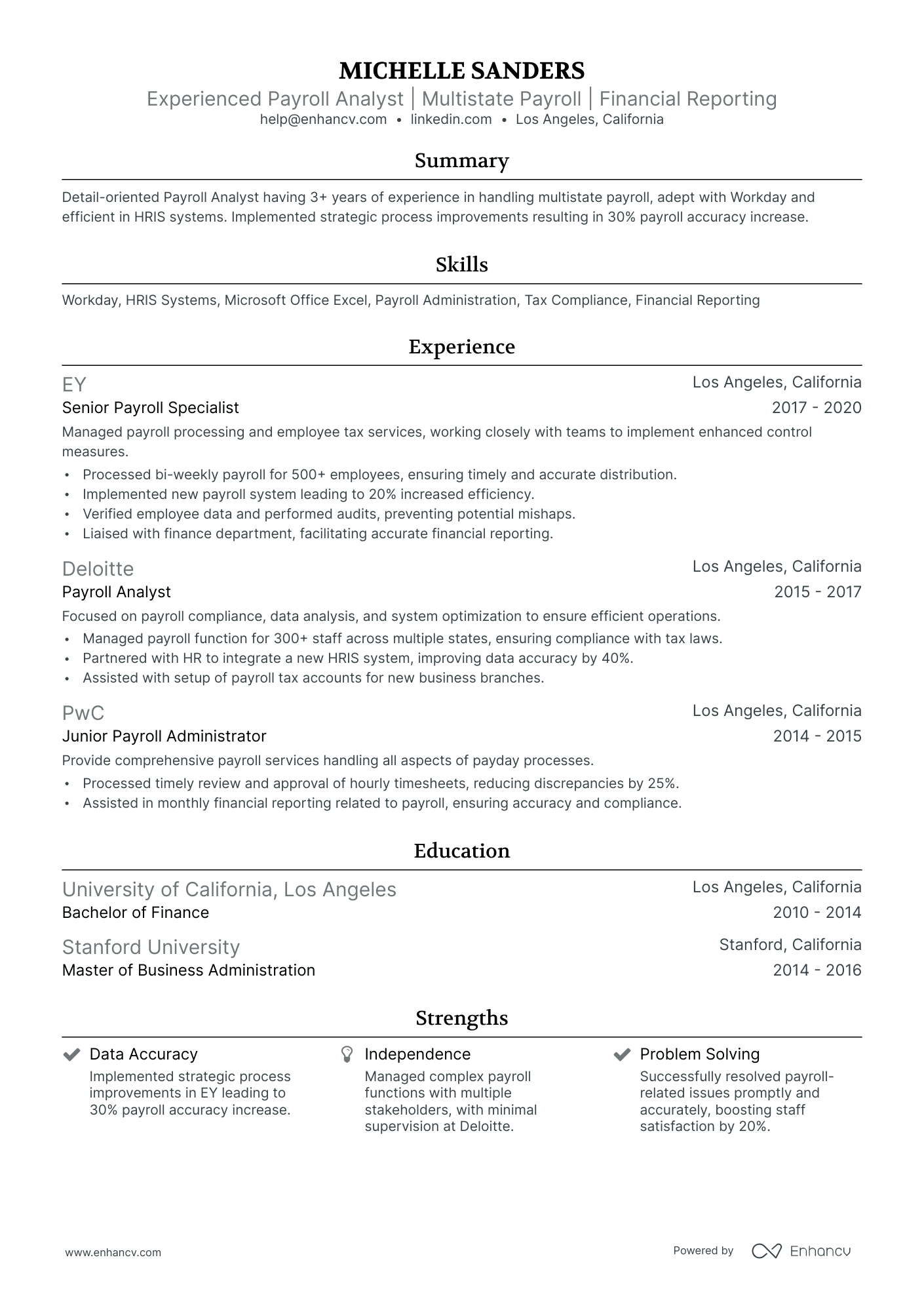

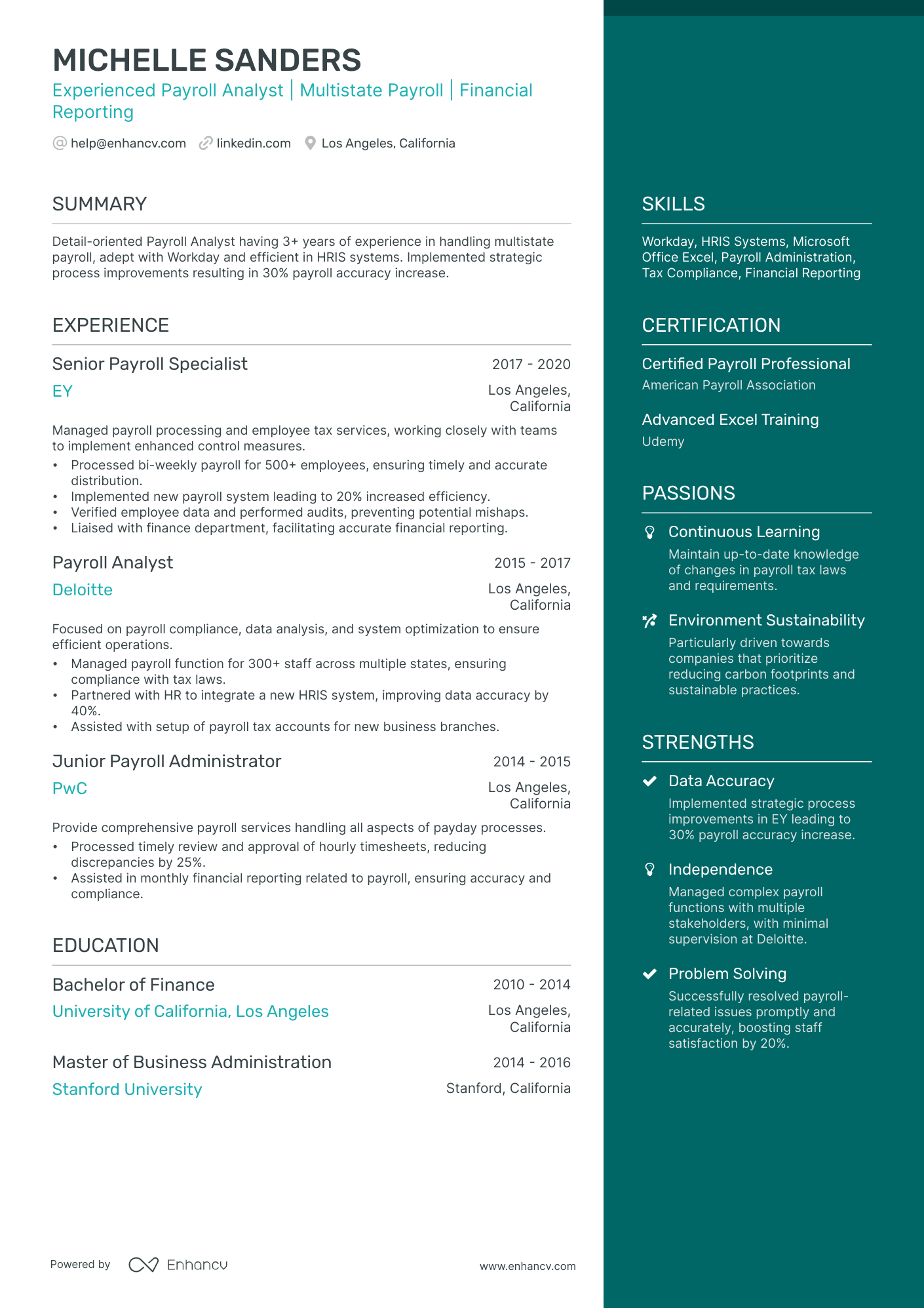

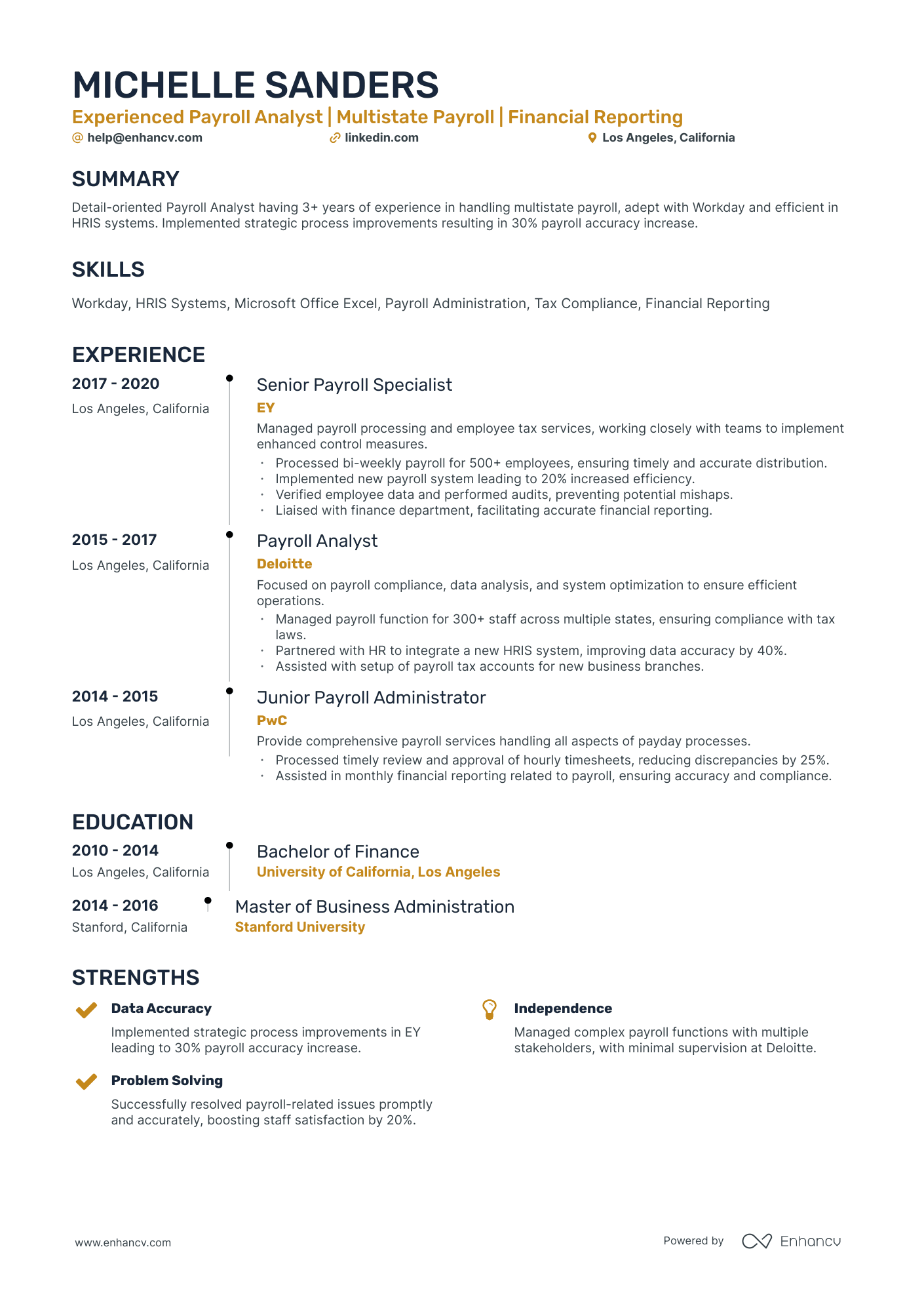

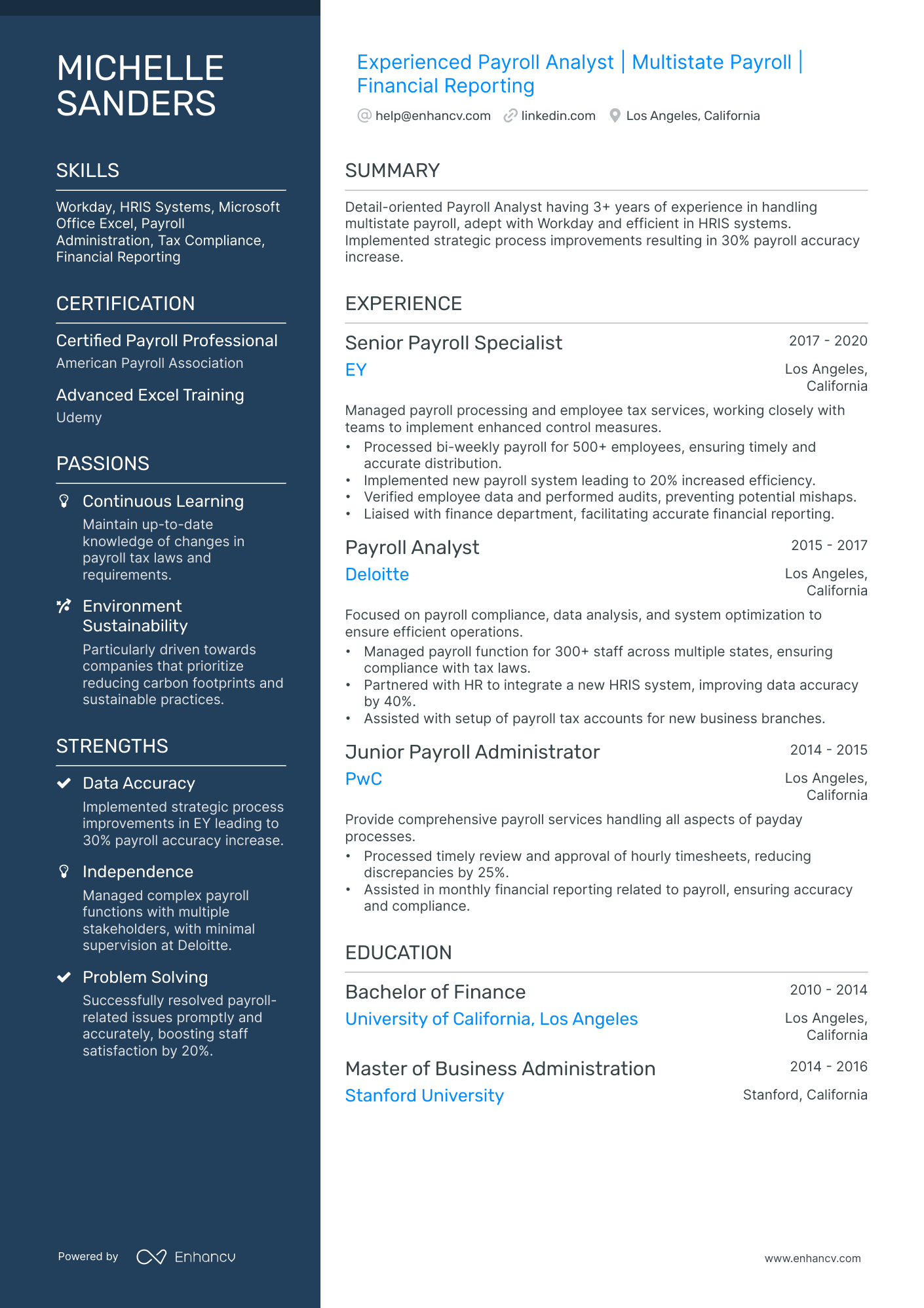

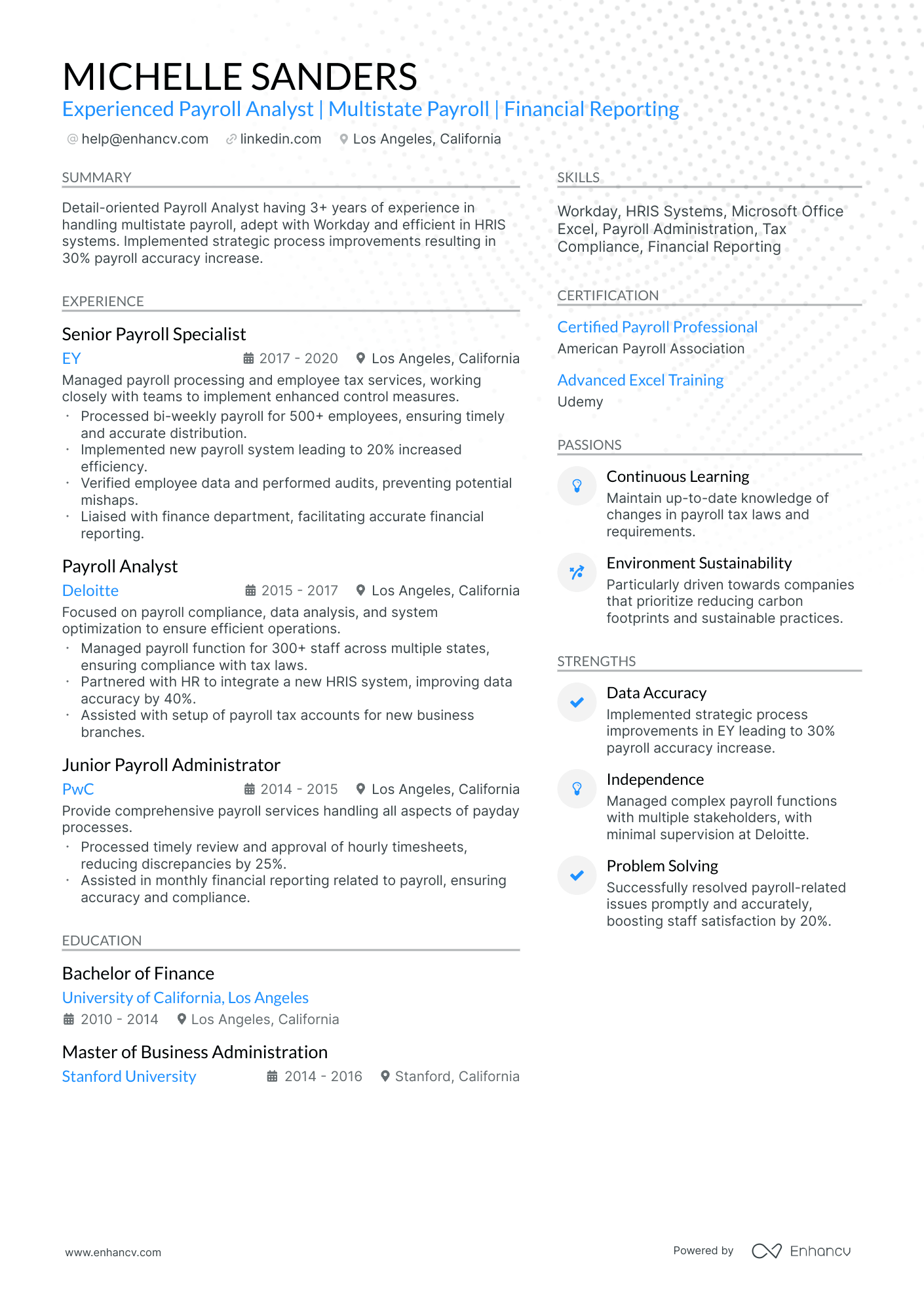

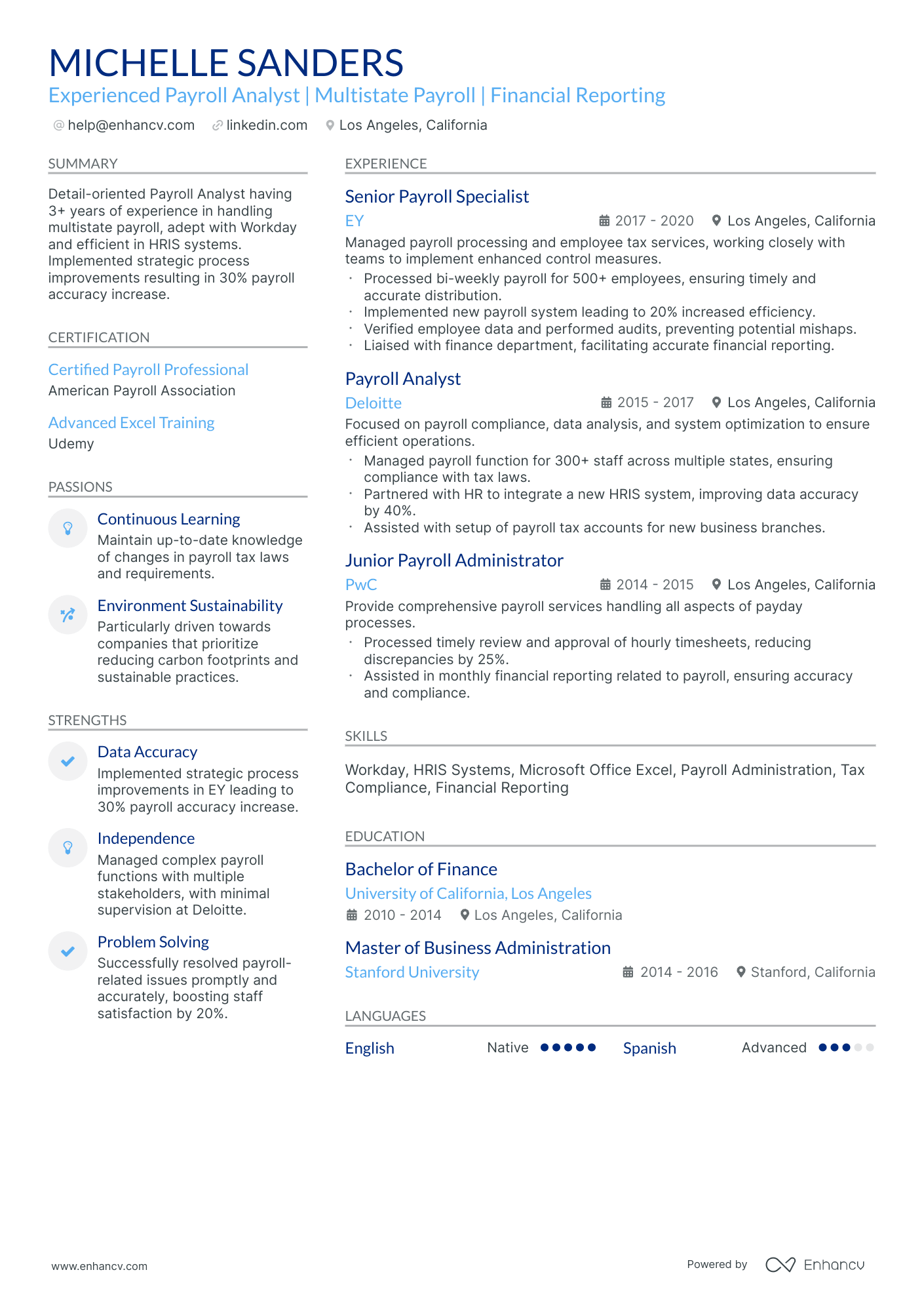

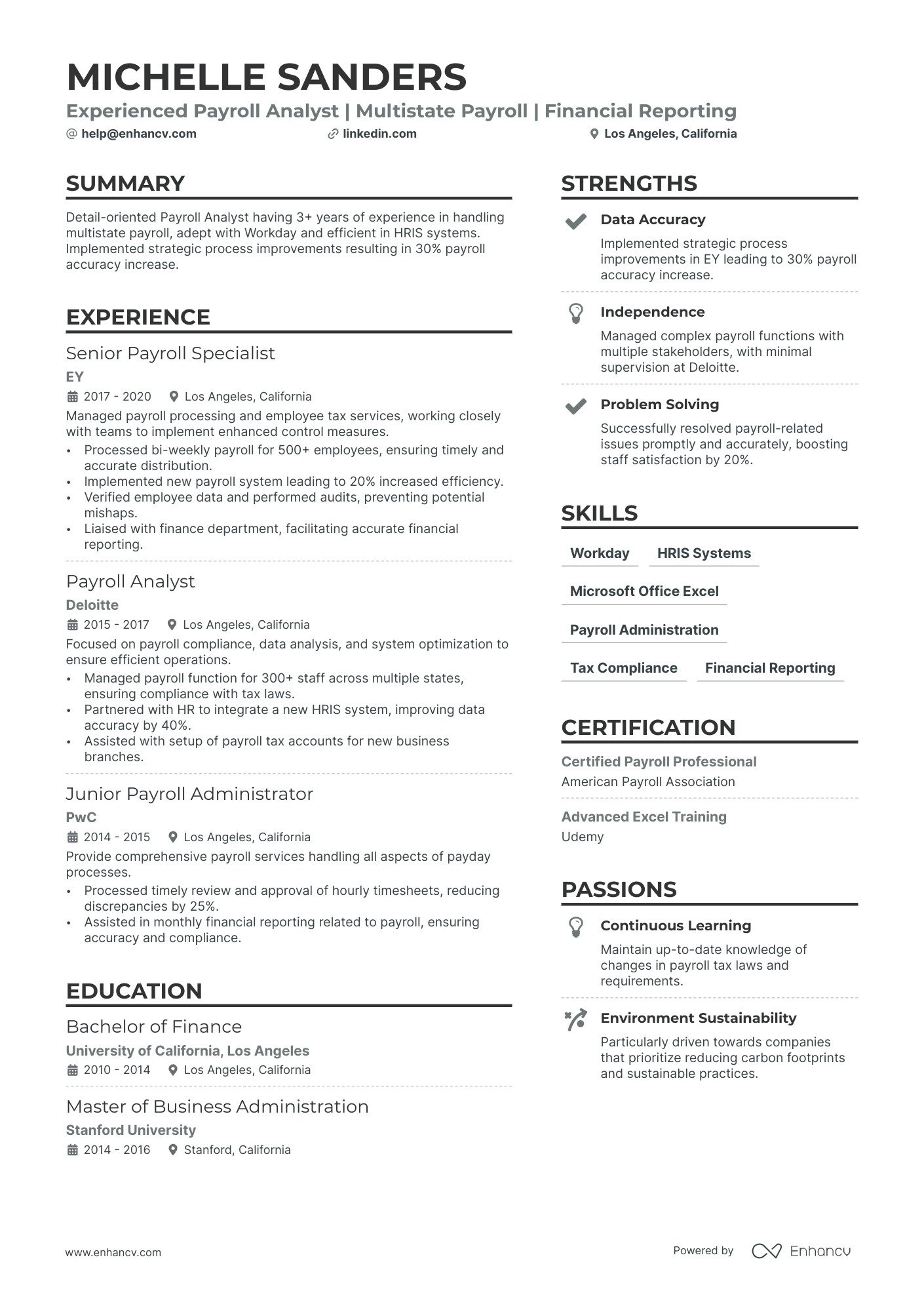

crafting a stellar payroll analyst resume format

Navigating the maze of resume formatting can be challenging. But understanding what recruiters prioritize can make the process smoother.

Wondering about the optimal format, the importance of certain sections, or how to detail your experience? Here's a blueprint for a polished resume:

- Adopt the reverse-chronological resume format. By spotlighting your latest roles upfront, you offer recruiters a snapshot of your career trajectory and recent accomplishments.

- Your header isn't just a formality. Beyond basic contact information, consider adding a link to your portfolio and a headline that encapsulates a significant achievement or your current role.

- Distill your content to the most pertinent details, ideally fitting within a two-page limit. Every line should reinforce your candidacy for the payroll analyst role.

- To preserve your resume's layout across different devices and platforms, save it as a PDF.

Remember, resume layouts can vary by country – for example, a Canadian resume format could look different.

Upload your resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

Pro tip

Your resume will likely be processed by an Applicant Tracking System (ATS). Ensure your header, summary, or objective incorporates essential skills required for the role.

Key sections to include in your payroll analyst resume are:

- The header - with your contact details (like email and phone number), a link to your portfolio, and a headline.

- The summary (or objective) - highlighting the high points of your career so far.

- The experience section - limit yourself to six bullets per role to focus on specific results.

- The skills list - offering a balanced mix of your personal and professional talents.

- Education and certification - displaying your most relevant degrees and certificates for the payroll analyst role.

What recruiters want to see on your resume:

- Experience with payroll software and systems: Familiarity with tools such as ADP, Workday, or SAP is often highly sought after in a payroll analyst.

- Detailed understanding of payroll-related regulations: Knowledge of federal, state, and even international tax laws and labor legislation is crucial for managing payroll accurately.

- Strong numerical and analytical skills: The ability to handle complex calculations, analyze data trends, and spot irregularities is essential for this role.

- Experience in payroll accounting: Understanding how payroll interacts with the greater financial system of an organization shows that the candidate can handle the wider implications of their work.

- Excellent attention to detail: Given the precision required in payroll operations, a high degree of accuracy and meticulousness is a must for this role.

Recommended reads:

Optimizing your payroll analyst resume experience section

Your resume's experience section should resonate with your accomplishments while aligning with the job's demands. Here's how:

- Highlight significant career moments, and back them up with relevant skills.

- Analyze the job description to address both basic and advanced requirements.

- If you have unrelated roles, consider a separate section, but emphasize transferable skills.

- Avoid listing roles from over a decade ago unless they showcase your trajectory, especially for senior roles.

- Illustrate how your contributions enhanced the team or company, linking challenges to solutions.

Review how seasoned payroll analyst professionals have crafted their experience sections, emphasizing their contributions.

- Performed end-to-end payroll processing for over 500 employees using ADP Workforce Now, ensuring accurate and timely salary disbursements.

- Collaborated with HR department to resolve payroll discrepancies resulting in a 30% reduction in payroll errors.

- Developed and implemented standardized payroll policies and procedures, streamlining the payroll process.

- Managed complex multi-state payroll for a workforce of 1,000+ employees, incorporating various pay structures and union agreements.

- Performed regular audits on payroll data, identifying and rectifying discrepancies resulting in a cost savings of $50,000 per year.

- Led the implementation of an automated time and attendance system, reducing manual data entry by 60%.

- Administer and maintain accurate records for employee benefits, including health insurance, retirement plans, and flexible spending accounts.

- Collaborate with cross-functional teams to develop and implement payroll-related projects, such as implementing a new payroll software system.

- Conduct regular audits of payroll processes to ensure compliance with federal, state, and local regulations.

- Coordinated with finance department to reconcile payroll reports and general ledger entries, ensuring accurate financial reporting.

- Developed and delivered comprehensive training sessions for managers on payroll processes and system usage resulting in improved accuracy and efficiency.

- Collaborated with external auditors during annual payroll audits, providing necessary documentation and ensuring compliance.

- Processed payroll for hourly and salaried employees, including wage garnishments and deductions, using UltiPro HRIS system.

- Implemented a time-tracking system resulting in a 20% reduction in payroll-related errors.

- Assisted in the development and documentation of payroll policies and procedures, ensuring adherence to relevant regulations.

- Led the implementation of a self-service portal for employees to access pay stubs and tax forms, reducing administrative workload by 30%.

- Analyzed and resolved complex payroll issues, such as retroactive pay adjustments and reconciliations, ensuring accuracy and employee satisfaction.

- Managed year-end payroll processes, including W-2 preparation and reporting, resulting in timely distribution and compliance.

- Collaborated with IT department to enhance payroll system functionality, implementing automated interfaces resulting in a 25% reduction in manual data entry.

- Performed regular audits of payroll tax withholdings and filings, ensuring compliance with federal and state regulations.

- Developed and delivered training programs for new hires, improving payroll knowledge and accuracy across the organization.

- Managed payroll operations for multiple subsidiaries within a global organization, ensuring accurate and timely processing across different currencies and jurisdictions.

- Implemented a new time management system, resulting in improved efficiency and reduced overtime costs by 15%.

- Led a cross-functional team in the successful implementation of a cloud-based payroll software, optimizing processes and enhancing data security.

- Performed analysis on payroll data and trends, providing insights and recommendations to senior management for cost-saving measures.

- Collaborated with benefits administrators to ensure accurate and timely deductions for health insurance, retirement plans, and other employee benefits.

- Assisted in the development and maintenance of payroll dashboards and reports, facilitating data-driven decision-making.

- Coordinated with HR and finance teams to implement a new payroll system, resulting in improved accuracy and efficiency of payroll processing.

- Provided guidance and support to payroll coordinators, resolving complex payroll-related issues and ensuring adherence to policies and regulations.

- Led the year-end payroll process, including tax reconciliations and preparation of W-2 forms, resulting in timely and accurate reporting.

The following content includes information from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license. The data represents the top responsibilities present on the task lists for payroll analyst professionals.

Top Responsibilities for Payroll Analyst:

- Prepare detailed reports on audit findings.

- Report to management about asset utilization and audit results, and recommend changes in operations and financial activities.

- Collect and analyze data to detect deficient controls, duplicated effort, extravagance, fraud, or non-compliance with laws, regulations, and management policies.

- Inspect account books and accounting systems for efficiency, effectiveness, and use of accepted accounting procedures to record transactions.

- Supervise auditing of establishments, and determine scope of investigation required.

- Confer with company officials about financial and regulatory matters.

- Examine and evaluate financial and information systems, recommending controls to ensure system reliability and data integrity.

- Inspect cash on hand, notes receivable and payable, negotiable securities, and canceled checks to confirm records are accurate.

- Examine records and interview workers to ensure recording of transactions and compliance with laws and regulations.

- Prepare, examine, or analyze accounting records, financial statements, or other financial reports to assess accuracy, completeness, and conformance to reporting and procedural standards.

Quantifying impact on your resume

<ul>

Writing your payroll analyst experience section without any real-world experience

Professionals, lacking experience, here's how to kick-start your payroll analyst career:

- Substitute experience with relevant knowledge and skills, vital for the payroll analyst role

- Highlight any relevant certifications and education - to showcase that you have the relevant technical training for the job

- Definitely include a professional portfolio of your work so far that could include university projects or ones you've done in your free time

- Have a big focus on your transferable skills to answer what further value you'd bring about as a candidate for the payroll analyst job

- Include an objective to highlight how you see your professional growth, as part of the company

Recommended reads:

Pro tip

Highlight what sets your experience apart. Incorporate metrics, feedback, and the tangible value you've added to organizations. This specificity ensures your resume remains pertinent and memorable.

creating your payroll analyst resume skills section: balancing hard skills and soft skills

Recruiters hiring for payroll analyst roles are always keen on hiring candidates with relevant technical and people talents.

Hard skills or technical ones are quite beneficial for the industry - as they refer to your competency with particular software and technologies.

Meanwhile, your soft (or people) skills are quite crucial to yours and the company's professional growth as they detail how you'd cooperate and interact in your potential environment.

Here's how to describe your hard and soft skill set in your payroll analyst resume:

- Consider what the key job requirements are and list those towards the top of your skills section.

- Think of individual, specific skills that help you stand out amongst competitors, and detail how they've helped you succeed in the past.

- Look to the future of the industry and list all software/ technologies which are forward-facing.

- Create a separate, technical skills section to supplement your experience and further align with the payroll analyst job advert.

Find the perfect balance between your resume hard and soft skills with our two lists.

Top skills for your payroll analyst resume:

Payroll Software (e.g., ADP, Paychex, SAP)

Microsoft Excel

Data Analysis Tools

Time and Attendance Systems

HR Information Systems (HRIS)

Tax Compliance Software

Database Management

Reporting Tools (e.g., Tableau, Power BI)

Accounting Software (e.g., QuickBooks)

Familiarity with Labor Laws and Regulations

Attention to Detail

Analytical Thinking

Problem Solving

Communication Skills

Organizational Skills

Time Management

Team Collaboration

Adaptability

Confidentiality

Critical Thinking

Next, you will find information on the top technologies for payroll analyst professonals from "O*NET OnLine" by the U.S. Department of Labor, Employment and Training Administration (USDOL/ETA). Used under the CC BY 4.0 license.

Top technologies for Payroll Analyst’s resume:

- Intuit QuickBooks

- Sage 50 Accounting

- Google Docs

- Microsoft Word

- Oracle E-Business Suite Financials

- Tropics workers' compensation software

Pro tip

When detailing your skills, always back them up with tangible evidence, be it quantifiable results or certifications.

Highlighting education and certification on your payroll analyst resume

Your education section is a testament to your foundational knowledge and expertise.

Consider:

- Detailing your academic qualifications, including the institution and duration.

- If you're still studying, mention your anticipated graduation date.

- Omit degrees that aren't pertinent to the job.

- Highlight academic experiences that underscore significant milestones.

For payroll analyst roles, relevant education and certifications can set you apart.

To effectively showcase your qualifications:

- List all pertinent degrees and certifications in line with the job requirements.

- Include additional certifications if they bolster your application.

- Provide concise details: certification name, institution, and dates.

- If you're pursuing a relevant certification, indicate your expected completion date.

Your education and certification sections validate both your foundational and advanced knowledge in the industry.

Best certifications to list on your resume

Pro tip

If you're in the process of obtaining your certificate or degree, list the expected date you're supposed to graduate or be certified.

Recommended reads:

Deciding between a payroll analyst resume summary or objective

While some argue the resume summary or objective is outdated, these sections can effectively:

- Integrate pivotal payroll analyst keywords.

- Showcase your achievements.

- Clarify your motivation for applying.

The distinction lies in their focus:

- A resume objective emphasizes your career aspirations.

- A resume summary spotlights your career milestones.

Opt for a summary if you have a rich experience you wish to highlight immediately. Conversely, an objective can be ideal for those wanting to underscore their aspirations and soft skills.

For inspiration, we've curated samples from industry professionals to guide your resume summary or objective crafting:

Resume summary and objective examples for a payroll analyst resume

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Extra sections to boost your payroll analyst resume

Add more sections to show off your unique skills and personality.

- Projects - Include any impressive ones you've done outside of work.

- Awards - Show off any industry recognition.

- Volunteering - Share causes you care about and skills you've gained.

- Personality - Hobbies or favorite books can give a glimpse into who you are.

Key takeaways

- Pay special attention to the tiny details that make up your payroll analyst resume formatting: the more tailored your application to the role is, the better your chances at success would be;

- Select the sections you include (summary or objective, etc.) and formatting (reverse-chronological, hybrid, etc.) based on your experience level;

- Select experience items and, consequently, achievements that showcase you in the best light and are relevant to the job;

- Your profile will be assessed both based on your technical capabilities and personality skills - curate those through your resume;

- Certifications and education showcase your dedication to the particular industry.