Many actuary resumes fail because they bury business impact under exam lists and dense technical jargon. That hurts when an actuary resume must pass ATS screening and win a fast recruiter scan in a crowded applicant pool.

A strong resume shows what changed because of your work. Knowing how to make your resume stand out means highlighting portfolio lift, loss ratio improvement, reserve accuracy gains, model governance that reduced audit findings, faster rate filings, and clearer pricing decisions. Quantify dollars, timelines, error rates, and stakeholder adoption.

Key takeaways

- Quantify actuarial impact with specific metrics like loss ratios, reserve accuracy, and dollar savings.

- Use reverse-chronological format so ATS and recruiters find exam progress and experience quickly.

- Tailor resume language to mirror each job posting's tools, methods, and terminology.

- Anchor every listed skill to a specific project, analysis, or measurable outcome.

- Place certifications and exam progress where they'll be seen first for your career stage.

- Write a three- to four-line summary featuring your domain, credentials, and a key result.

- Use Enhancv's tools to refine bullet points and align your resume with actuarial job descriptions.

Job market snapshot for actuaries

We analyzed 1,208 recent actuary job ads across major US job boards. These numbers help you understand skills in demand, salary landscape, career growth patterns at a glance.

What level of experience employers are looking for actuaries

| Years of Experience | Percentage found in job ads |

|---|---|

| 1–2 years | 10.1% (122) |

| 3–4 years | 10.7% (129) |

| 5–6 years | 3.9% (47) |

| 7–8 years | 4.7% (57) |

| 9–10 years | 2.6% (31) |

| 10+ years | 3.3% (40) |

| Not specified | 66.8% (807) |

Actuary ads by area of specialization (industry)

| Industry (Area) | Percentage found in job ads |

|---|---|

| Finance & Banking | 69.5% (839) |

| Healthcare | 28.7% (347) |

Top companies hiring actuaries

| Company | Percentage found in job ads |

|---|---|

| Elevance Health | 9.8% (118) |

| CVS Health | 9.0% (109) |

| Deloitte | 7.2% (87) |

| Willis Towers Watson | 6.8% (82) |

| Marsh & McLennan Companies, Inc. | 6.2% (75) |

| Munich Re | 5.0% (61) |

| Kaiser Permanente | 3.7% (45) |

| American International Group | 3.1% (37) |

| The Travelers Companies | 1.9% (23) |

| CNA Financial Corp. | 1.8% (22) |

Role overview stats

These tables show the most common responsibilities and employment types for actuary roles. Use them to align your resume with what employers expect and to understand how the role is structured across the market.

Day-to-day activities and top responsibilities for a actuary

| Responsibility | Percentage found in job ads |

|---|---|

| Sql | 32.1% (388) |

| Excel | 31.5% (380) |

| Python | 23.1% (279) |

| R | 19.6% (237) |

| Actuarial | 18.2% (220) |

| Sas | 16.9% (204) |

| Vba | 15.6% (189) |

| Microsoft office | 15.0% (181) |

| Data analysis | 12.8% (155) |

| Pricing | 12.0% (145) |

| Actuarial science | 10.3% (124) |

| Powerpoint | 9.4% (114) |

Type of employment (remote vs on-site vs hybrid)

| Employment type | Percentage found in job ads |

|---|---|

| Hybrid | 48.4% (585) |

| On-site | 41.2% (498) |

| Remote | 10.3% (125) |

How to format a actuary resume

Recruiters evaluating actuary resumes prioritize exam progress (SOA or CAS), technical modeling proficiency, and quantifiable contributions to pricing, reserving, or risk assessment. A clear, chronological format ensures these signals surface quickly, especially since applicant tracking systems parse standard reverse-chronological layouts most reliably. Choosing the right resume format is essential for making your qualifications easy to find.

I have significant experience in this role—which format should I use?

Use a reverse-chronological format to showcase your deepening actuarial expertise and growing scope of responsibility. Do:

- Lead each role entry with scope indicators—team size, book of business managed, lines of business owned, or enterprise-level decisions influenced.

- Highlight actuarial tools and domains prominently: predictive modeling platforms (e.g., GGY AXIS, Prophet, ResQ), programming languages (R, Python, SQL), and specific practice areas such as life pricing, P&C reserving, or pension valuation.

- Quantify outcomes tied to business impact—loss ratio improvements, reserve accuracy, premium growth, or cost savings from model refinements.

I'm junior or switching into this role—what format works best?

A hybrid format works best, letting you lead with actuarial skills and exam credentials before detailing your work history. Do:

- Place a dedicated skills section near the top featuring exam progress (e.g., "ASA, 5 of 7 FSA exams passed"), software proficiency, and relevant coursework or designations.

- Include actuarial internships, university capstone projects, case competitions, or cross-functional analytics work that demonstrates applied actuarial reasoning—even if the job title wasn't "actuary."

- Connect every listed skill or project to a specific action and a measurable or observable result.

Why not use a functional resume?

A functional resume strips away the timeline and context that hiring managers need to verify exam progression, growing technical depth, and hands-on actuarial project ownership—all of which are evaluated relative to career stage. Avoid this format unless you have no other way to present your qualifications coherently.

- A functional format may be acceptable if you're transitioning into actuarial work from a related quantitative field (e.g., data science or underwriting), have significant resume gaps, or lack formal actuarial job titles—but only if every listed skill is anchored to a specific project, analysis, or outcome rather than presented as a standalone claim.

Once you've established a clean, readable format, the next step is determining which sections to include so each one reinforces your qualifications.

What sections should go on a actuary resume

Recruiters expect to quickly see your actuarial credentials, pricing or reserving experience, and measurable business impact. Understanding which resume sections to include helps you organize this information for maximum clarity.

Use this structure for maximum clarity:

- Header

- Summary

- Experience

- Skills

- Projects

- Education

- Certifications

- Optional sections: Awards, Publications, Leadership

Strong experience bullets should emphasize quantified impact, decision-making outcomes, model scope, and results tied to pricing, reserving, capital, or risk.

Is your resume good enough?

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

Once you’ve organized your resume with the right core components, the next step is writing your actuary resume experience section so it supports that structure with role-specific detail.

How to write your actuary resume experience

The experience section is where you prove you've delivered actuarial work that moved the needle—through pricing models, reserve analyses, risk assessments, and tools like SQL, Python, or specialized actuarial software. Hiring managers prioritize demonstrated impact over descriptive task lists, so focus on what you owned, how you executed, and the measurable outcomes your work produced.

Each entry should include:

- Job title

- Company and location (or remote)

- Dates of employment (month and year)

Three to five concise bullet points showing what you owned, how you executed, and what outcomes you delivered:

- Ownership scope: the books of business, product lines, valuation models, pricing segments, or reserve portfolios you were directly accountable for as an actuary.

- Execution approach: the actuarial methods, statistical software, programming languages, modeling platforms, or regulatory frameworks you applied to analyze risk, set assumptions, and deliver recommendations.

- Value improved: the changes your work drove in loss ratios, pricing accuracy, reserve adequacy, solvency margins, forecasting reliability, or regulatory compliance relevant to actuarial practice.

- Collaboration context: how you partnered with underwriters, finance teams, product managers, regulators, reinsurers, or data engineering groups to translate actuarial findings into business decisions.

- Impact delivered: the outcomes your actuarial analyses produced—expressed through improvements in profitability, capital efficiency, risk reduction, or strategic positioning rather than a list of tasks performed.

Experience bullet formula

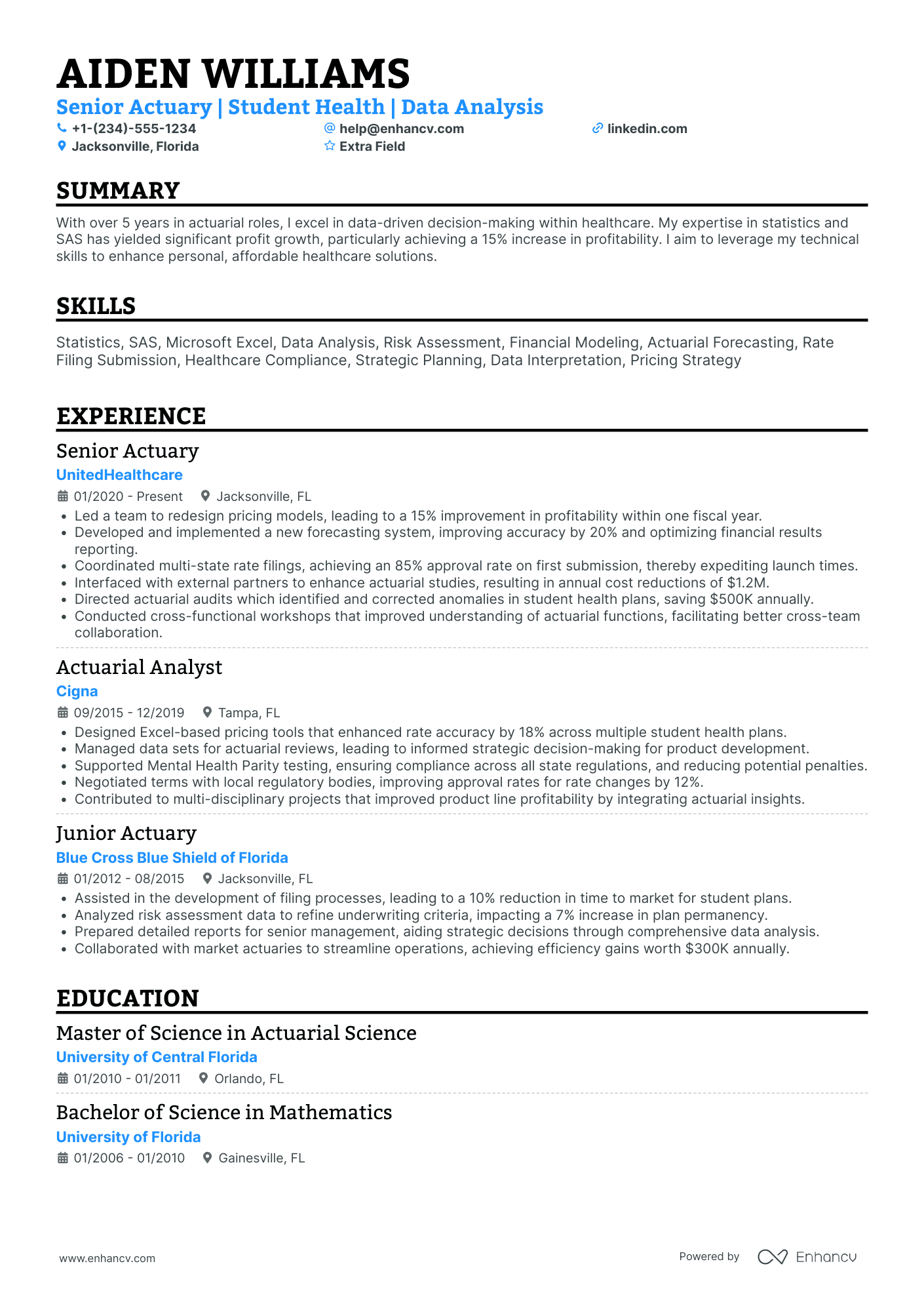

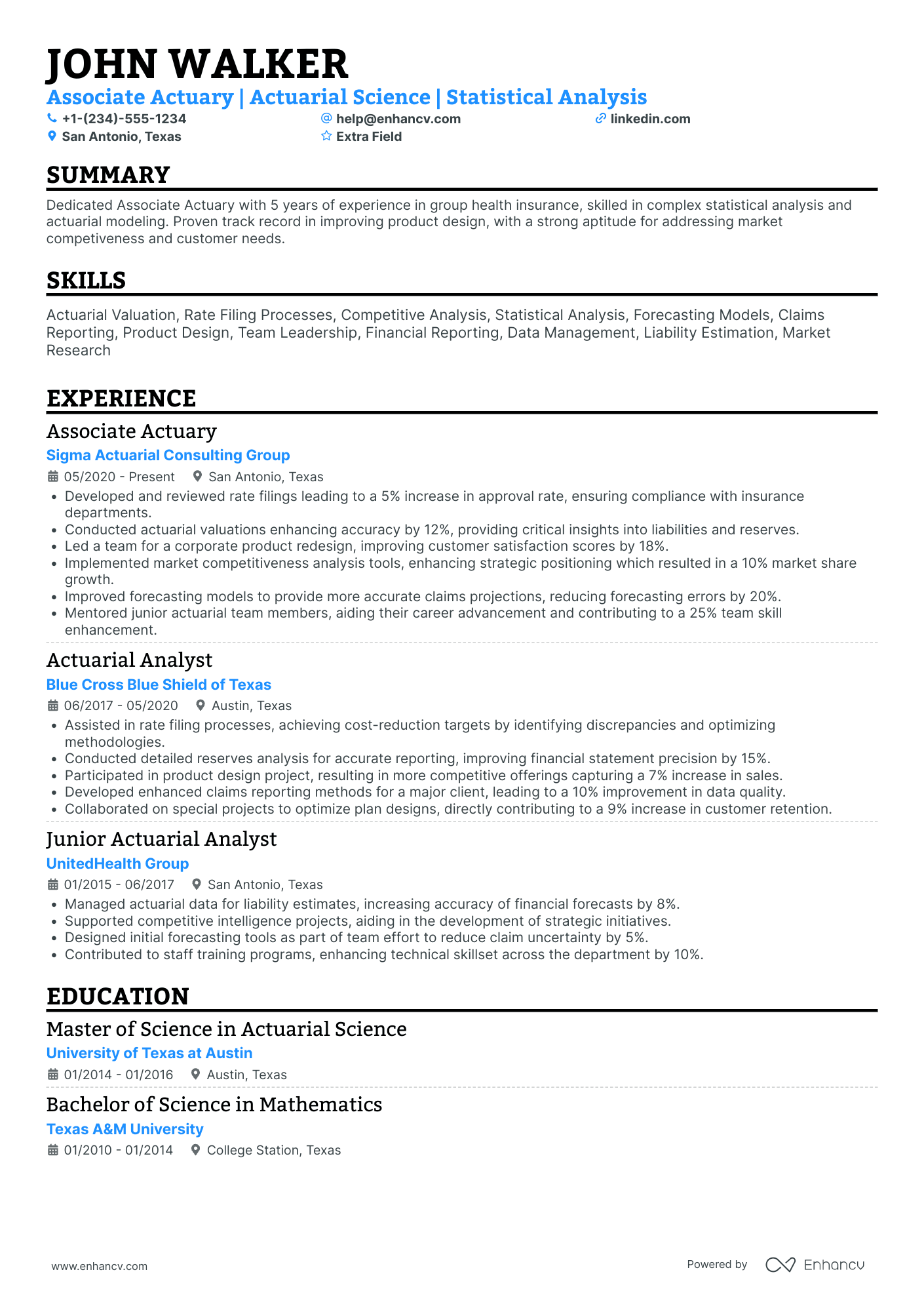

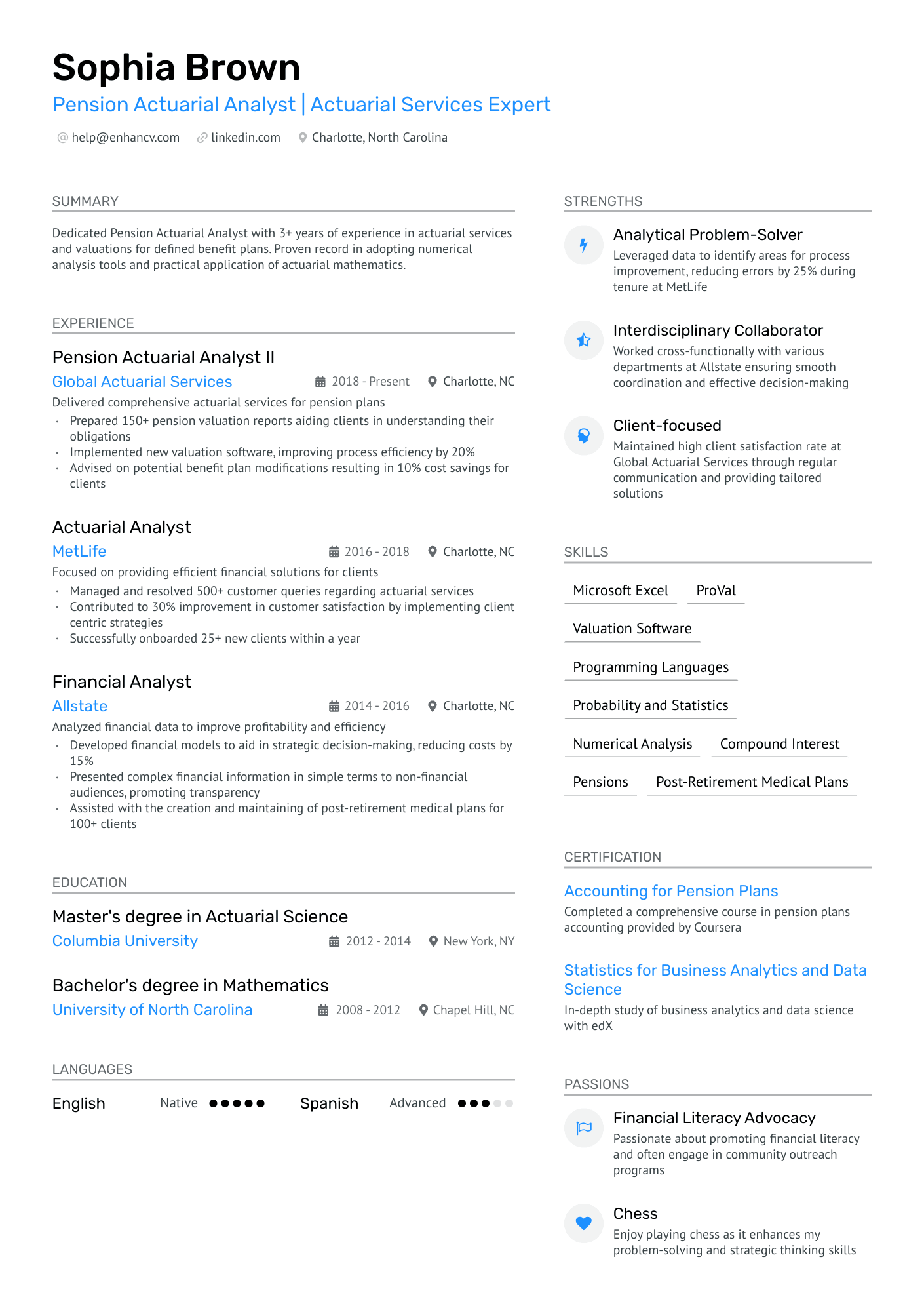

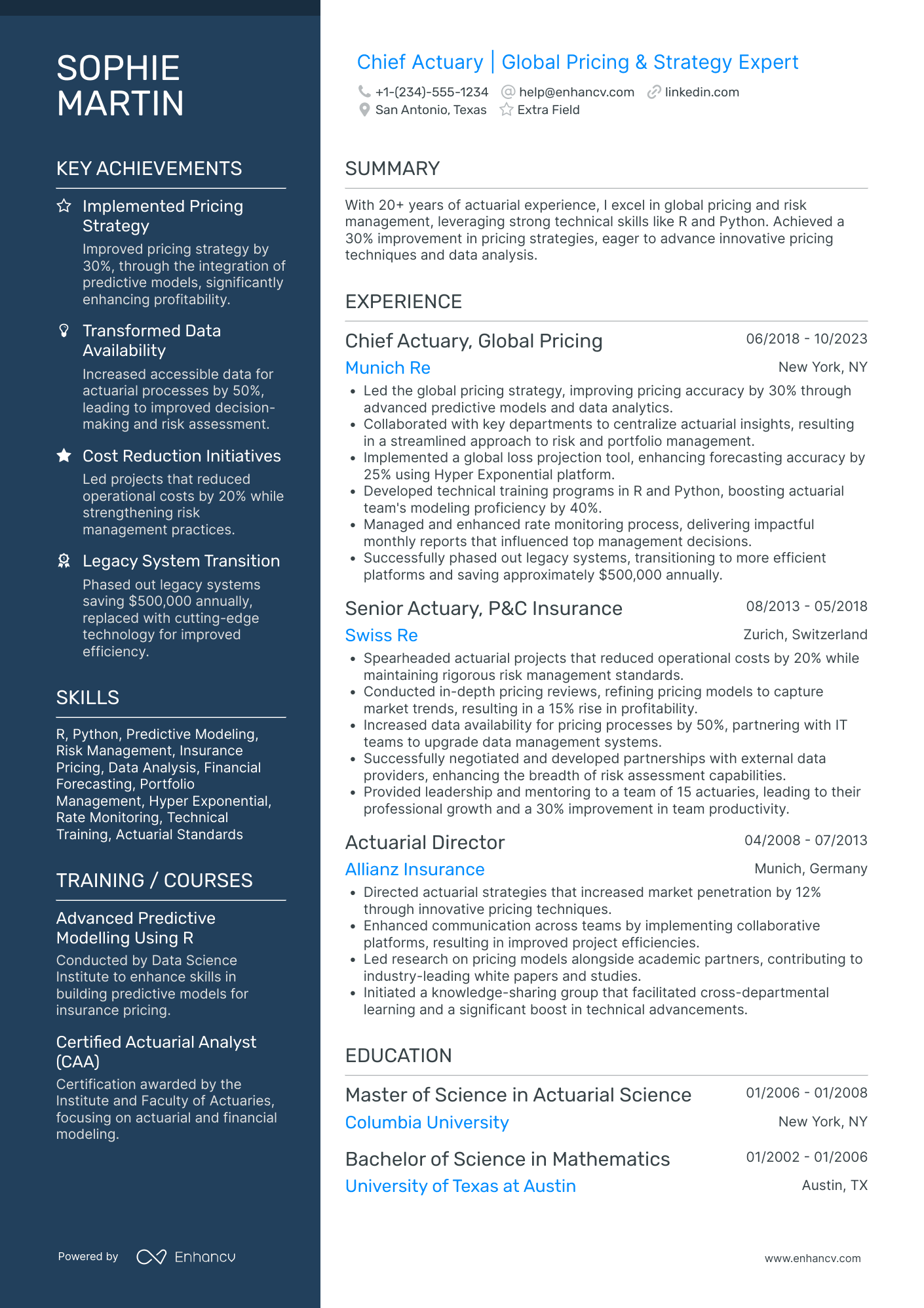

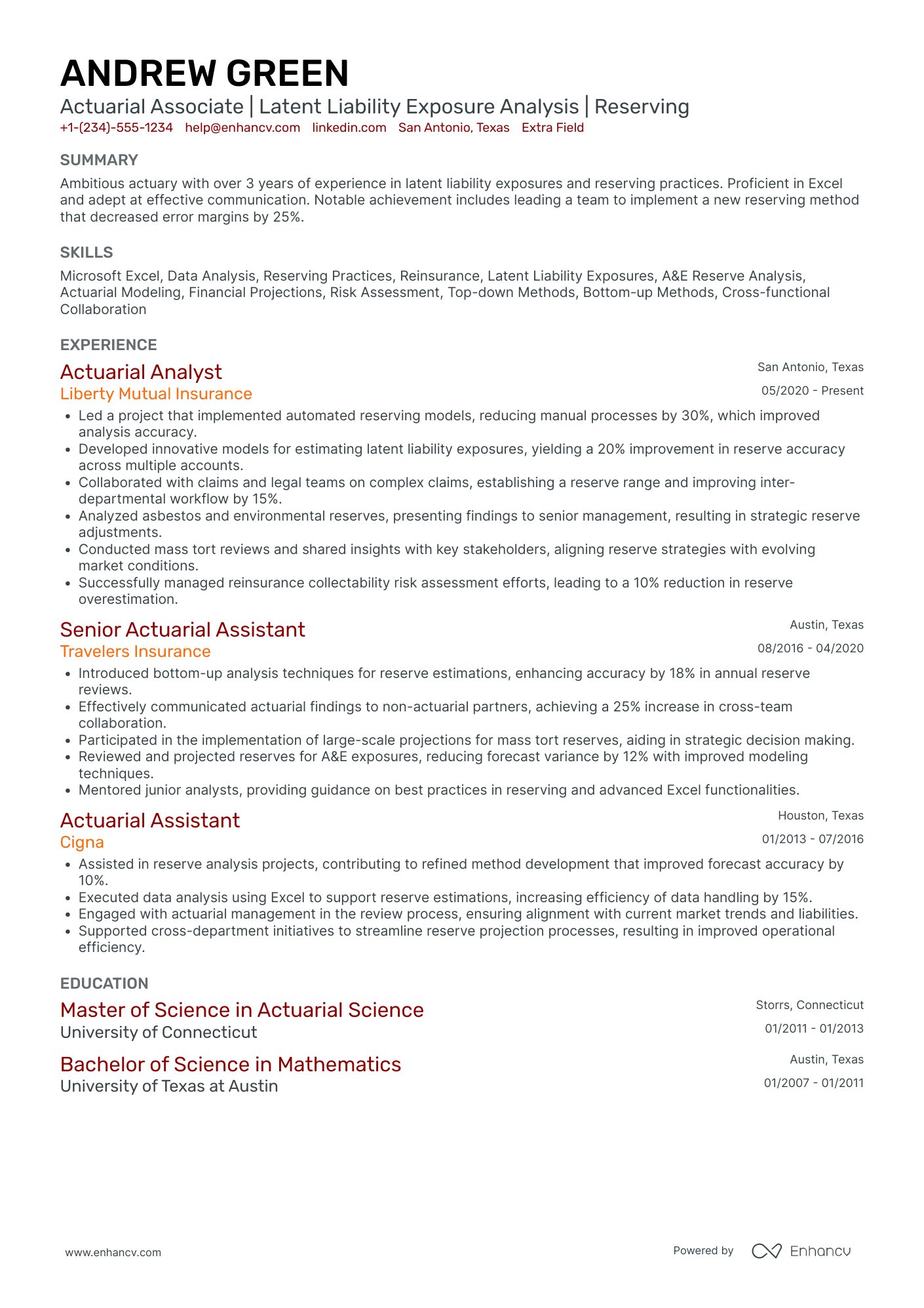

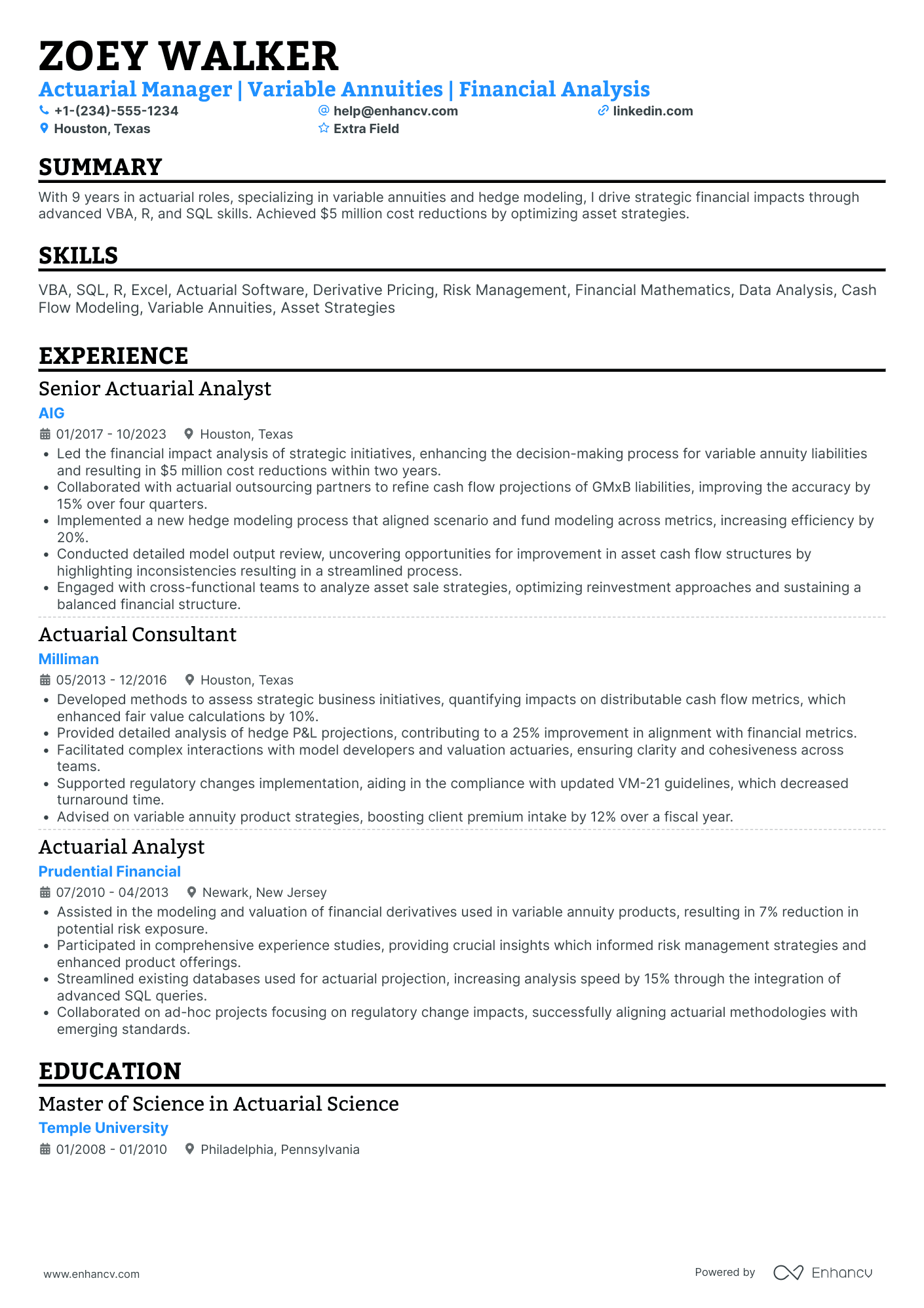

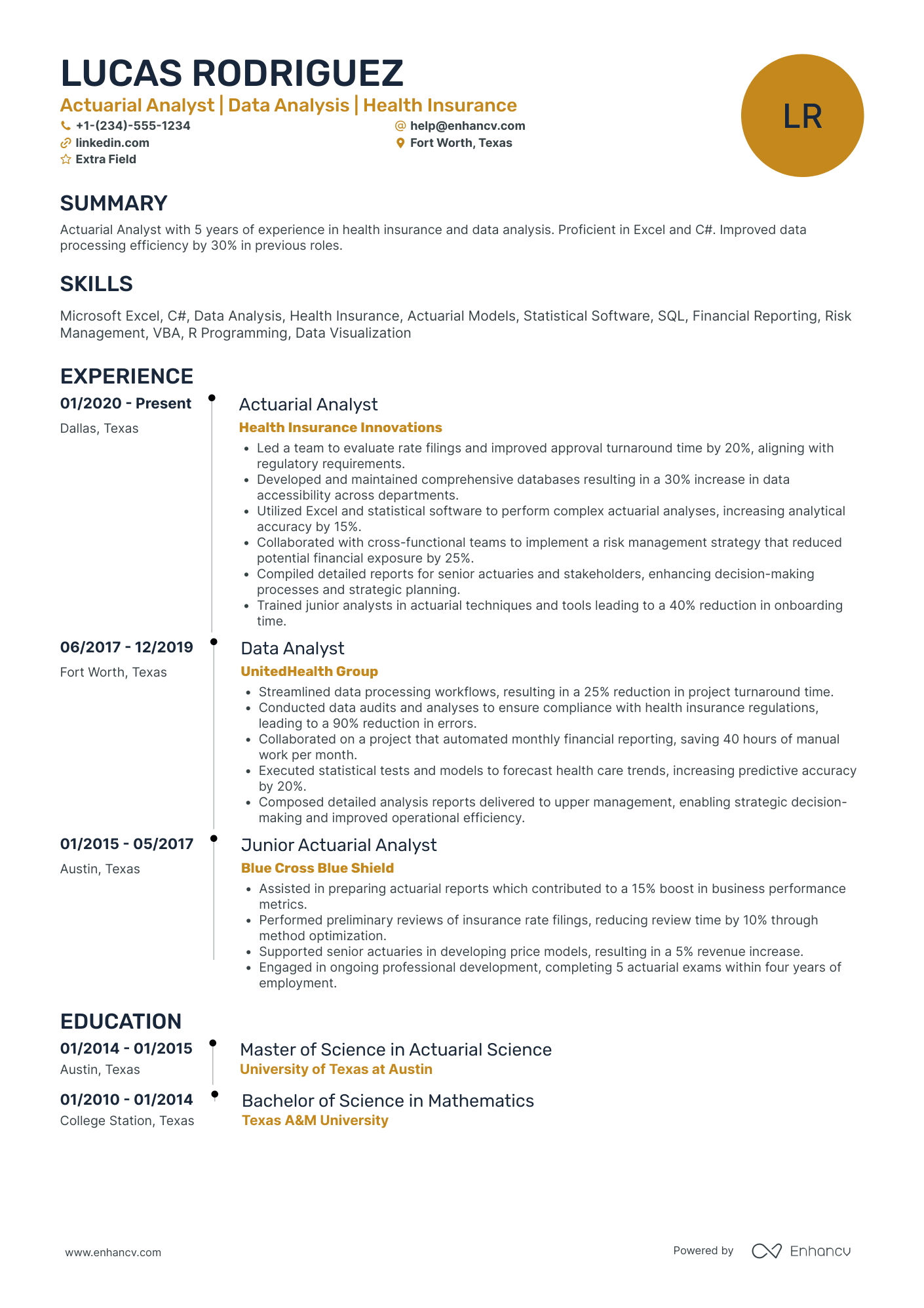

A actuary experience example

✅ Right example - modern, quantified, specific.

Senior Actuary, Pricing & Analytics

HarborPoint Insurance | Chicago, IL

2021–Present

Mid-market P&C carrier pricing commercial auto and workers’ comp across fifteen states with $1.2B in annual written premium.

- Built and deployed generalized linear models (Poisson, Gamma) in R (tidymodels) and Python (scikit-learn) using Snowflake data to refresh territory and class relativities, improving indicated rate accuracy by 3.8% and reducing quarterly review time by 40%.

- Led an end-to-end rate filing for commercial auto in six states, aligning with underwriting, legal, and product stakeholders; achieved 96% first-pass approval and captured $18M in incremental annual premium at target loss ratios.

- Implemented loss development and trend monitoring in SAS and Excel Power Query, flagging emerging severity shifts eight weeks earlier and enabling underwriting actions that reduced projected calendar-year loss ratio by 1.6 points.

- Partnered with data engineering to automate policy and claims validation checks in SQL and dbt, cutting data defects by 55% and increasing model-ready record yield from 88% to 97%.

- Presented pricing impacts and risk tradeoffs to executives and reinsurance partners using Tableau dashboards, supporting a deductible strategy change that lowered large-loss frequency by 9% while maintaining retention within 2%.

Now that you've seen how a strong experience section comes together, let's look at how to adjust yours to match a specific actuary job posting.

How to tailor your actuary resume experience

Recruiters evaluate actuary resumes through both applicant tracking systems and human review, so alignment with the job posting matters. Tailoring your resume to the job description ensures the most relevant qualifications surface immediately.

Ways to tailor your actuary experience:

- Match actuarial software listed in the posting like Prophet or MoSes.

- Mirror the exact exam abbreviations and credentials the employer specifies.

- Reflect the reserving or pricing methodologies the role requires.

- Include relevant insurance domain experience such as life health or casualty.

- Emphasize regulatory compliance and solvency standards when the posting mentions them.

- Highlight cross-functional collaboration with underwriting or finance teams referenced.

- Use the same loss modeling or risk framework terminology from the description.

- Align your stated results with the KPIs or success criteria they outline.

Tailoring means framing your real accomplishments in language that directly reflects what the employer asked for, not forcing keywords where they don't belong.

Resume tailoring examples for actuary

| Job description excerpt | Untailored | Tailored |

|---|---|---|

| Develop and maintain loss reserve models using Python and SQL, supporting P&C lines of business with quarterly reserve analyses for management reporting. | Performed data analysis and helped with financial reporting tasks. | Built and maintained loss reserve models in Python and SQL across four P&C lines, delivering quarterly reserve analyses that reduced estimation variance by 12%. |

| Price group life and disability products using experience rating methodologies, collaborating with underwriting to assess risk and ensure rate adequacy. | Assisted with insurance pricing and worked with other departments on projects. | Priced group life and disability products using experience rating methodologies, partnering with underwriting to refine risk assessments and achieve a 98% rate adequacy target across a $200M book of business. |

| Prepare actuarial filings and rate indications for state regulatory submissions, ensuring compliance with Department of Insurance requirements and ASOP standards. | Helped prepare documents and ensured compliance with regulations. | Prepared actuarial filings and rate indications for regulatory submission across 15 states, ensuring full compliance with Department of Insurance requirements and ASOP standards while reducing filing revision cycles by 30%. |

Once you’ve aligned your experience with the role’s priorities, the next step is to quantify your actuary achievements so hiring teams can quickly see your impact.

How to quantify your actuary achievements

Quantifying your achievements turns your work into business outcomes hiring teams can trust. Focus on risk reduction, model accuracy, reserve adequacy, cycle time, cost savings, and regulatory quality, backed by portfolio size, claim volume, and tool-driven improvements.

Quantifying examples for actuary

| Metric | Example |

|---|---|

| Risk reduction | "Reduced one-year value at risk by 12% on a $450M annuity block by recalibrating lapse assumptions in Prophet and validating against five years of experience." |

| Model accuracy | "Improved claim severity forecast mean absolute percentage error from 9.8% to 6.1% by adding inflation and seasonality features in Python and rebuilding the generalized linear model." |

| Reserve adequacy | "Cut quarterly reserve true-up variance from ±4.5% to ±2.0% by tightening assumption governance and automating reconciliations across 18 lines in SQL and Excel." |

| Cycle time | "Shortened quarterly valuation close from ten business days to six by streamlining data pulls, version control, and reruns in Prophet, saving about 160 analyst hours per quarter." |

| Compliance quality | "Passed an internal model risk audit with zero high findings by documenting methodology, adding unit tests, and implementing peer review for twenty-seven key assumptions." |

Turn vague job duties into measurable, recruiter-ready resume bullets in seconds with Enhancv's Bullet Point Generator.

Once you've crafted strong bullet points to showcase your experience, the next step is ensuring your resume also highlights the right hard and soft skills employers expect from an actuary.

How to list your hard and soft skills on a actuary resume

Your skills section shows you can quantify risk and financial impact, and recruiters and ATS scan it for role-matching keywords and tools; aim for a balanced mix of technical actuarial hard skills and job-critical collaboration and communication soft skills. actuary roles require a blend of:

- Product strategy and discovery skills.

- Data, analytics, and experimentation skills.

- Delivery, execution, and go-to-market discipline.

- Soft skills.

Your skills section should be:

- Scannable (bullet-style grouping).

- Relevant to the job post.

- Backed by proof in experience bullets.

- Updated with current tools.

Place your skills section:

- Above experience if you're junior or switching careers.

- Below experience if you're mid/senior with strong achievements.

Hard skills

- Pricing and rate indications

- Reserving, loss development triangles

- Experience studies, credibility theory

- Generalized linear models (GLMs)

- Predictive modeling, segmentation

- R, Python, SAS

- SQL, data validation

- Excel, VBA, Power Query

- Tableau, Power BI

- IFRS 17, GAAP reporting

- Reinsurance analysis, treaty pricing

- Monte Carlo simulation

Soft skills

- Translate results for nontechnical partners

- Present assumptions and limitations clearly

- Document methods for audit readiness

- Challenge inputs with evidence

- Align stakeholders on risk tradeoffs

- Prioritize work by business impact

- Drive decisions under uncertainty

- Partner with underwriting and finance

- Communicate timelines and dependencies

- Review work for accuracy and controls

- Handle sensitive data responsibly

- Escalate issues early with options

How to show your actuary skills in context

Skills shouldn't live only in a dedicated skills list. You can explore common resume skills to ensure you're not missing any that are relevant to actuarial roles.

They should be demonstrated in:

- Your summary (high-level professional identity)

- Your experience (proof through outcomes)

Here's what strong actuary examples look like in practice.

Summary example

Senior actuary with 12 years in property and casualty pricing. Built predictive loss models in Python and SAS that reduced reserve volatility by 18%. Led cross-functional teams to align underwriting strategy with emerging risk trends.

- Reflects senior-level depth and specialization

- Names specific tools and methods

- Leads with a measurable outcome

- Highlights leadership and collaboration

Experience example

Senior Pricing Actuary

Evergreen Re | Hartford, CT

March 2018–Present

- Developed generalized linear models in R and Emblem, improving rate accuracy by 14% across commercial auto lines.

- Partnered with underwriting and claims teams to redesign loss development triangles, cutting reserve redundancy by $3.2M annually.

- Automated quarterly IBNR reporting using Python and SQL, reducing processing time from five days to eight hours.

- Every bullet includes a measurable result.

- Skills appear naturally within real accomplishments.

Once you’ve demonstrated your actuarial strengths through specific examples and outcomes, the next step is applying that same approach to structuring an actuary resume when you don’t have direct experience.

How do I write a actuary resume with no experience

Even without full-time experience, you can demonstrate readiness through:

- Actuary exam passes and progress

- Actuarial science capstone project

- Insurance pricing case competitions

- Internship or job shadowing hours

- Excel and VBA modeling projects

- R or Python risk analysis

- SQL data cleaning and queries

- Volunteer budgeting and forecasting work

If you're building a resume without work experience, focus on:

- Exam progress with exact dates

- Quant models with documented results

- Data skills: Excel, SQL, R

- Business impact tied to insurance

Resume format tip for entry-level actuary

Use a reverse-chronological resume to highlight exams, projects, and recent coursework first, since recruiters scan for current, verifiable readiness. Do:

- List actuary exams with month, year.

- Quantify results from every project.

- Name tools used in each bullet.

- Add links to a portfolio repository.

- Tailor keywords to each job posting.

- Built an R frequency-severity model on 50,000 claims, reduced pricing error by 12% versus baseline, and documented assumptions and validation tests.

Since your education and exam progress often serve as your strongest qualifications when you lack professional experience, presenting them effectively on your resume is essential.

How to list your education on a actuary resume

Your education section helps hiring teams confirm you have the mathematical and analytical foundation required for actuary roles. It validates your quantitative training quickly and efficiently.

Include:

- Degree name

- Institution

- Location

- Graduation year

- Relevant coursework (for juniors or entry-level candidates)

- Honors & GPA (if 3.5 or higher)

Skip month and day details—list the graduation year only.

Here's a strong education entry tailored for an actuary resume.

Example education entry

Bachelor of Science in Actuarial Science

University of Illinois at Urbana-Champaign, Champaign, IL

Graduated 2022

GPA: 3.8/4.0

- Relevant Coursework: Probability Theory, Financial Mathematics, Loss Models, Time Series Analysis, Life Contingencies

- Honors: Dean's List (all semesters), Gamma Iota Sigma Honor Society

How to list your certifications on a actuary resume

Certifications on a resume show an actuary's commitment to continuous learning, proficiency with specialized tools, and alignment with current industry standards and regulations.

Include:

- Certificate name

- Issuing organization

- Year

- Optional: credential ID or URL

- Place certifications below education when your degree is more recent than your credentials and remains your strongest qualification.

- Place certifications above education when they are more recent than your degree or directly match the actuary role's requirements.

Best certifications for your actuary resume

- Associate of the Society of Actuaries (ASA)

- Fellow of the Society of Actuaries (FSA)

- Associate of the Casualty Actuarial Society (ACAS)

- Fellow of the Casualty Actuarial Society (FCAS)

- Chartered Enterprise Risk Analyst (CERA)

- Associate of the Canadian Institute of Actuaries (ACIA)

- Fellow of the Canadian Institute of Actuaries (FCIA)

Once you’ve positioned your credentials so they’re easy to verify, move on to your actuary resume summary to highlight them upfront and set the context for the rest of your resume.

How to write your actuary resume summary

Your resume summary is the first thing a recruiter reads, so it sets the tone for everything that follows. A strong opening positions you as a qualified actuary worth interviewing.

Keep it to three to four lines, with:

- Your title and years of experience in actuarial work.

- Domain focus such as life insurance, health, pension, or property and casualty.

- Core skills like predictive modeling, reserving, pricing, or risk assessment.

- One or two quantified achievements that show real business impact.

- Soft skills tied to outcomes, such as cross-functional collaboration or stakeholder communication.

PRO TIP

At the entry level, focus on relevant exam progress, technical tools like SQL or Python, and early contributions from internships or projects. Highlight clarity and relevance over breadth. Avoid vague descriptors like "passionate" or "hardworking"—recruiters want to see specific skills and measurable results, not motivation statements.

Example summary for a actuary

Junior actuary with two years of experience in health insurance pricing. Built frequency-severity models in Python that reduced loss ratio forecast error by 12%. Passed four SOA exams.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Now that your summary captures your actuarial expertise at a glance, make sure your resume header presents the essential contact and professional details recruiters need to reach you.

What to include in a actuary resume header

A resume header lists your key contact details and role focus, helping an actuary stand out in searches, build credibility, and pass recruiter screening fast.

Essential resume header elements

- Full name

- Tailored job title and headline

- Location

- Phone number

- Professional email

- GitHub link

- Portfolio link

A LinkedIn link helps recruiters verify your experience quickly and supports screening.

Do not include a photo on a actuary resume unless the role is explicitly front-facing or appearance-dependent.

Keep your header consistent with your application, and match your job title to the posting to improve search visibility.

Example

Actuary resume header

Jordan Lee

Actuary | ASA | Pricing and Reserving

Chicago, IL

(312) 555-01XX

jordan.lee@enhancv.com

github.com/jordanlee

jordanlee.com

linkedin.com/in/jordanlee

With your contact details and key identifiers set at the top, you can strengthen the rest of your application by adding the additional sections that support your actuary qualifications.

Additional sections for actuary resumes

Once your core qualifications are covered, additional sections can set you apart by showcasing depth, specialization, or professional commitment unique to actuarial work.

- Actuarial exams and progress

- Professional affiliations (SOA, CAS, AAA)

- Technical skills and software proficiencies

- Publications and research

- Conferences and continuing education

- Languages

- Volunteering and community involvement

Once you've strengthened your resume with relevant additional sections, the next step is pairing it with a cover letter that adds even more context to your candidacy.

Do actuary resumes need a cover letter

A cover letter isn't required for an actuary, but it helps in competitive roles or when employers expect one. If you're unsure what a cover letter is and when it adds value, it can make a difference when your resume needs context, or when the hiring team compares many similar actuarial profiles.

Use a cover letter to add context your resume can't show:

- Explain role and team fit by tying your actuarial focus to the job's domain, stakeholders, and decision cadence.

- Highlight one or two relevant projects with outcomes, including pricing lift, reserve accuracy, loss ratio improvement, or automation time saved.

- Show understanding of the product, users, and business context by connecting assumptions to customer behavior, regulation, and profitability tradeoffs.

- Address career transitions or non-obvious experience by mapping prior work to actuarial skills, tools, and the role's day-to-day responsibilities.

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Once you’ve decided whether a cover letter adds value to your application, the next step is using AI to improve your actuary resume so it communicates your qualifications more clearly and consistently.

Using AI to improve your actuary resume

AI can sharpen your resume's clarity, structure, and impact. It helps refine bullet points, tighten language, and align content with actuary roles. But overuse strips authenticity. Once your resume reads clearly and fits the role, step away from AI. For specific guidance, explore these ChatGPT resume writing prompts tailored to different resume sections.

Here are 10 practical prompts to strengthen specific sections of your actuary resume:

- Sharpen your summary: "Rewrite my actuary resume summary to highlight relevant credentials, technical expertise, and years of experience in under four sentences."

- Quantify experience bullets: "Add measurable outcomes to these actuary experience bullet points using metrics like reserve accuracy, loss ratios, or portfolio size."

- Align skills section: "Review this skills list and remove anything irrelevant to an actuary role. Suggest missing technical or analytical skills."

- Strengthen project descriptions: "Rewrite this actuary project description to emphasize methodology, tools used, and business impact in concise bullet points."

- Improve certification clarity: "Reorganize my actuary certifications section so exam progress, designations, and issuing bodies are immediately clear to hiring managers."

- Tighten education details: "Edit my education section to highlight coursework and honors most relevant to an entry-level actuary position."

- Reduce redundancy: "Identify and remove repeated ideas across my actuary resume's experience section without losing key accomplishments."

- Refine action verbs: "Replace weak or generic verbs in my actuary experience bullets with precise action verbs tied to analysis or risk assessment."

- Tailor to job posting: "Compare my actuary resume against this job description. Flag missing keywords and suggest where to add them naturally."

- Simplify technical language: "Simplify overly complex sentences in my actuary resume so a non-technical recruiter can still understand my contributions."

Stop using AI once your resume sounds accurate, specific, and aligned with real experience. AI should never invent experience or inflate claims. If it didn't happen, it doesn't belong here.

Conclusion

A strong actuary resume shows measurable outcomes, role-specific skills, and a clear structure. It highlights exam progress, tools, and methods, and ties them to impact like loss ratio changes, reserve accuracy, or pricing lift.

Keep each section easy to scan, and make every bullet earn its space. This approach shows you’re ready for today’s hiring market and near-future needs, with proof of results and steady growth.