Crafting a resume that effectively highlights your proficiency in reducing days sales outstanding (DSO) and managing a clean aged receivables report is a common challenge for accounts receivable professionals. Our guide offers detailed strategies and examples on how to showcase your financial skills and successes, ensuring your resume stands out to potential employers.

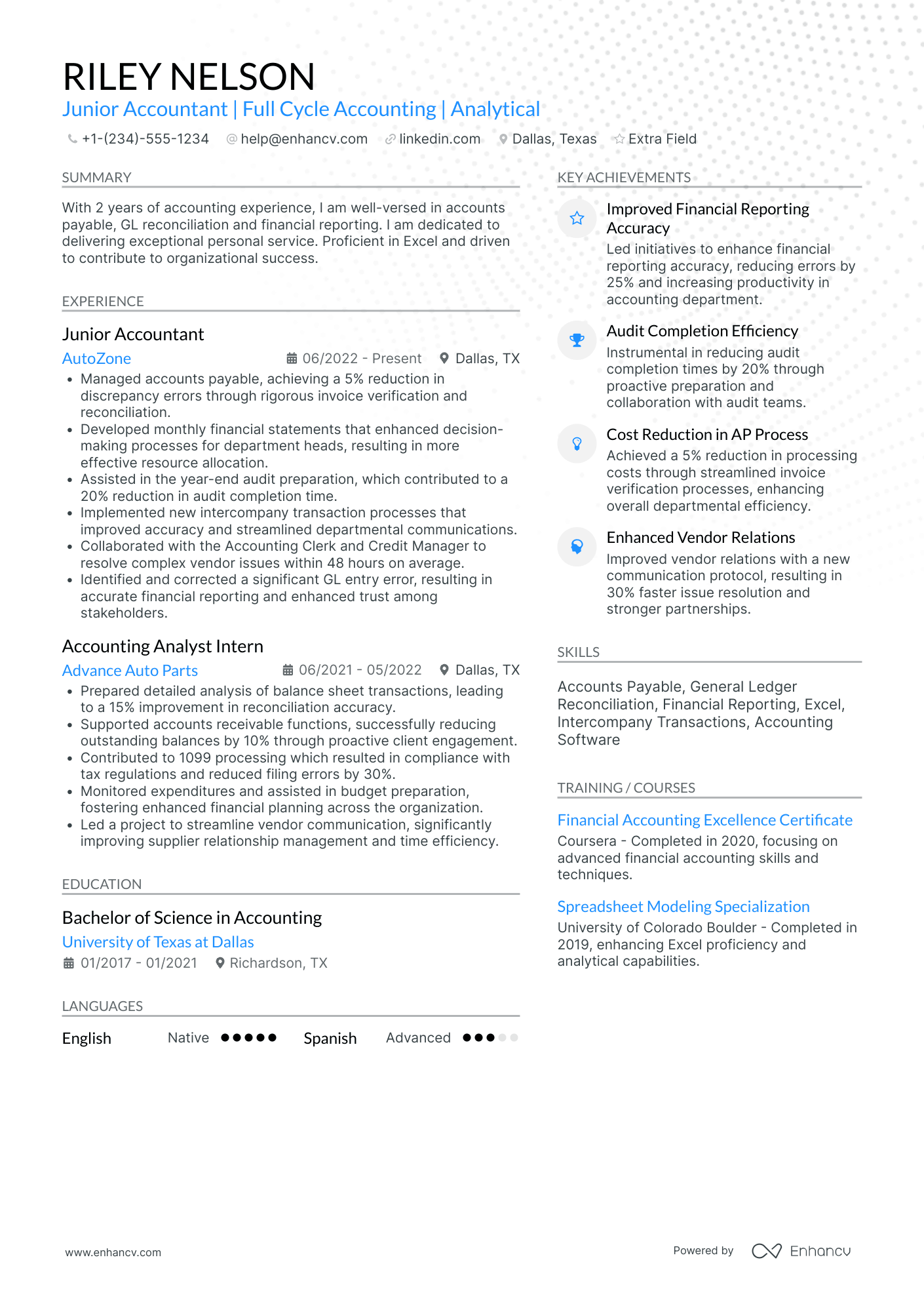

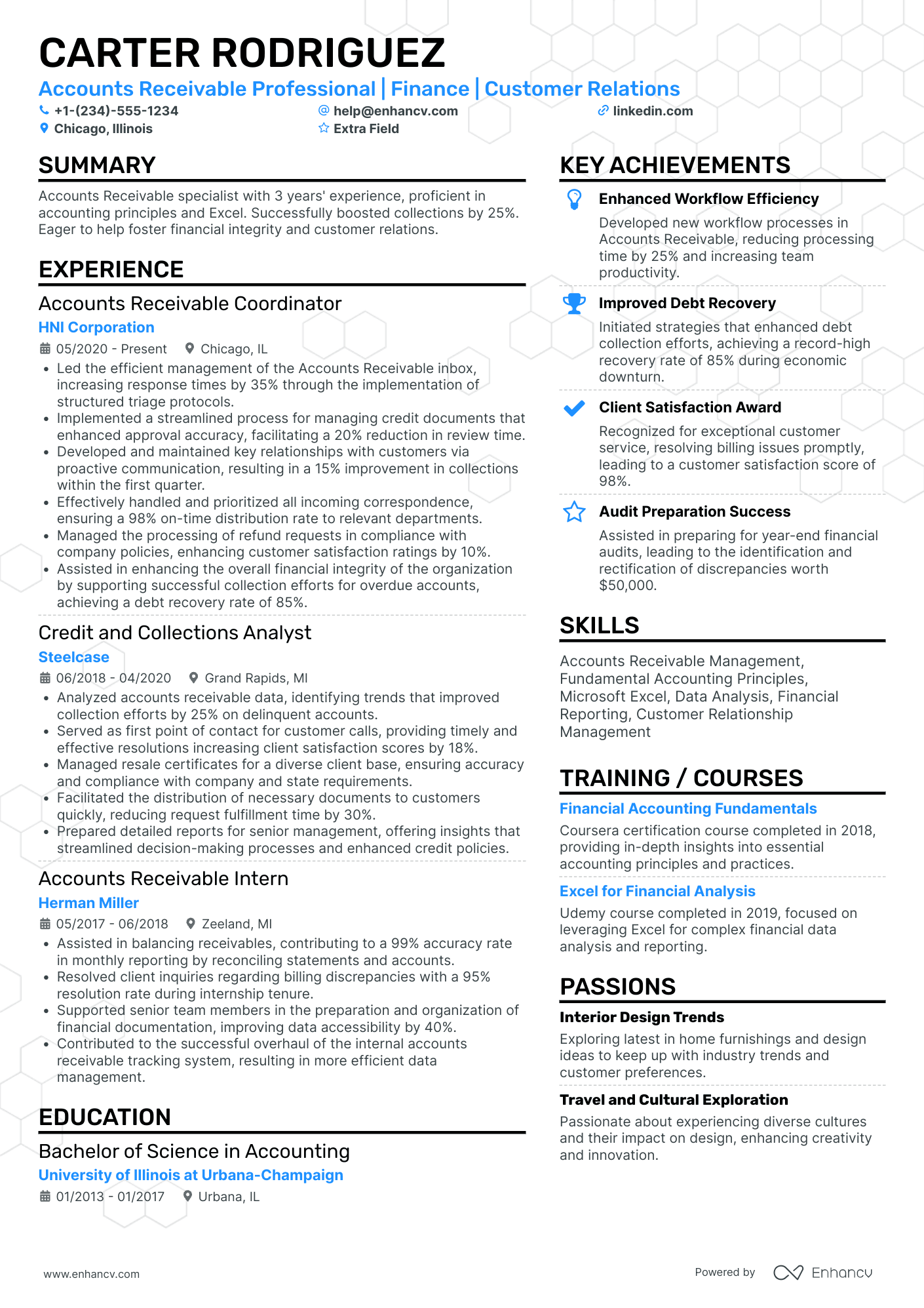

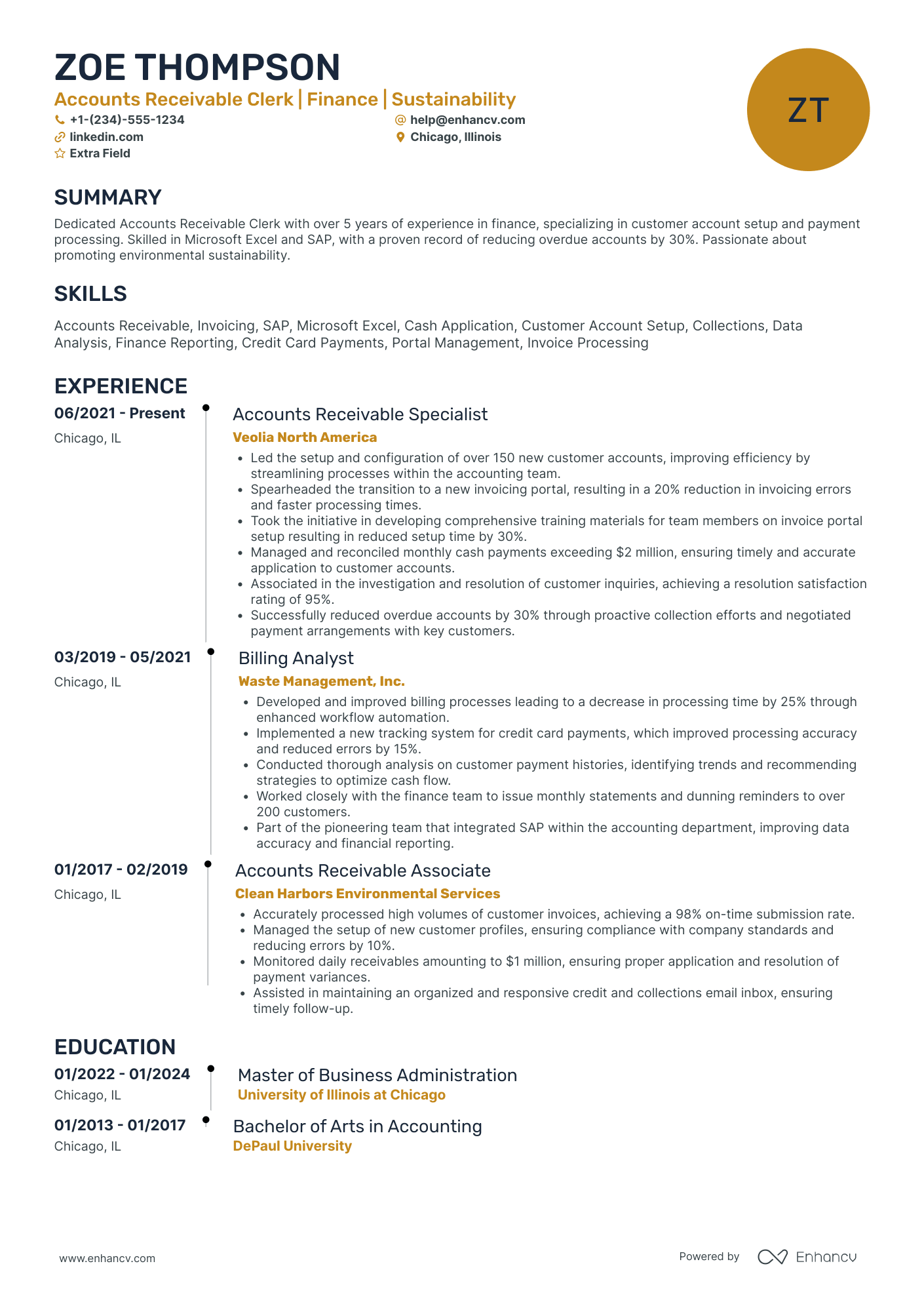

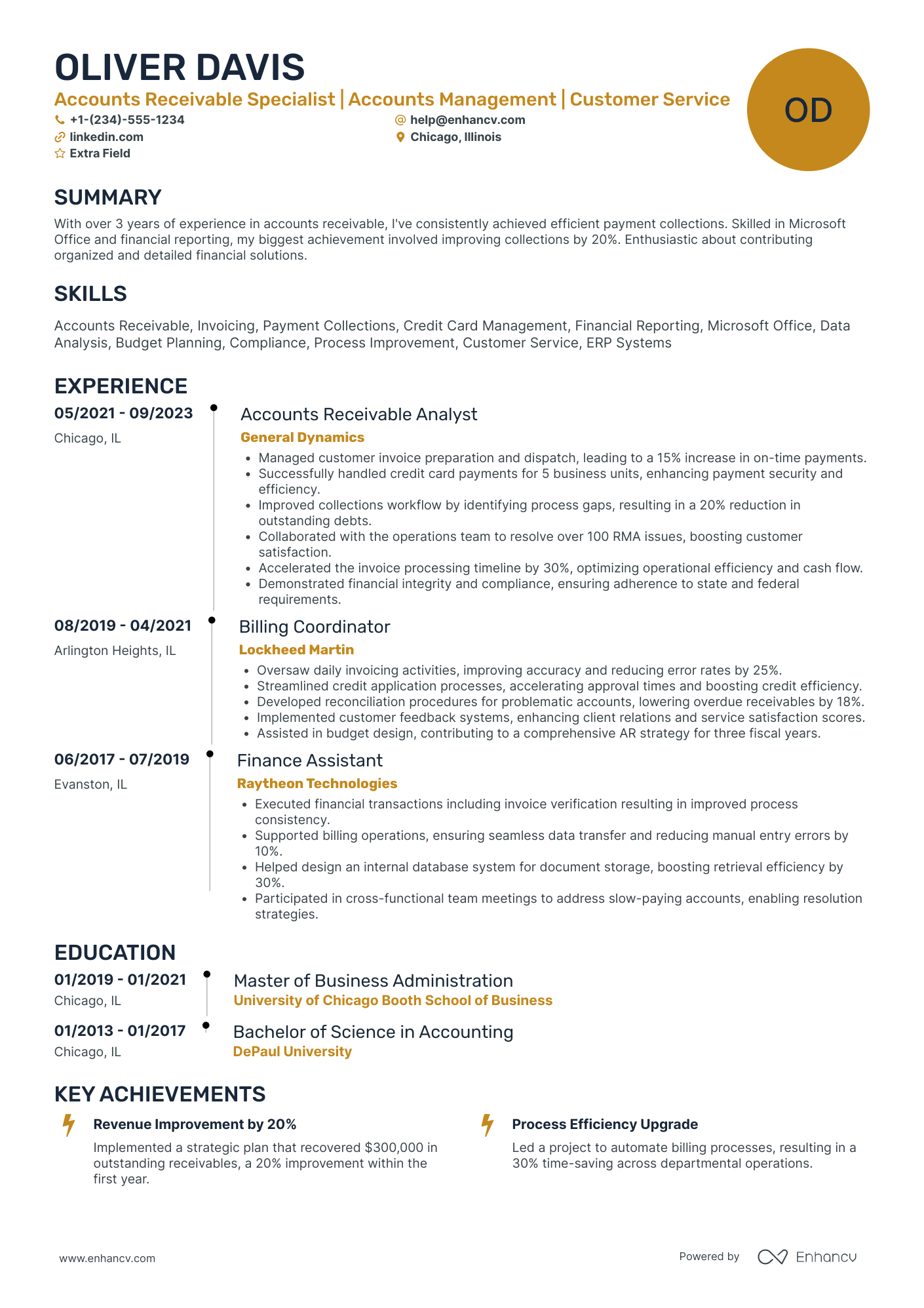

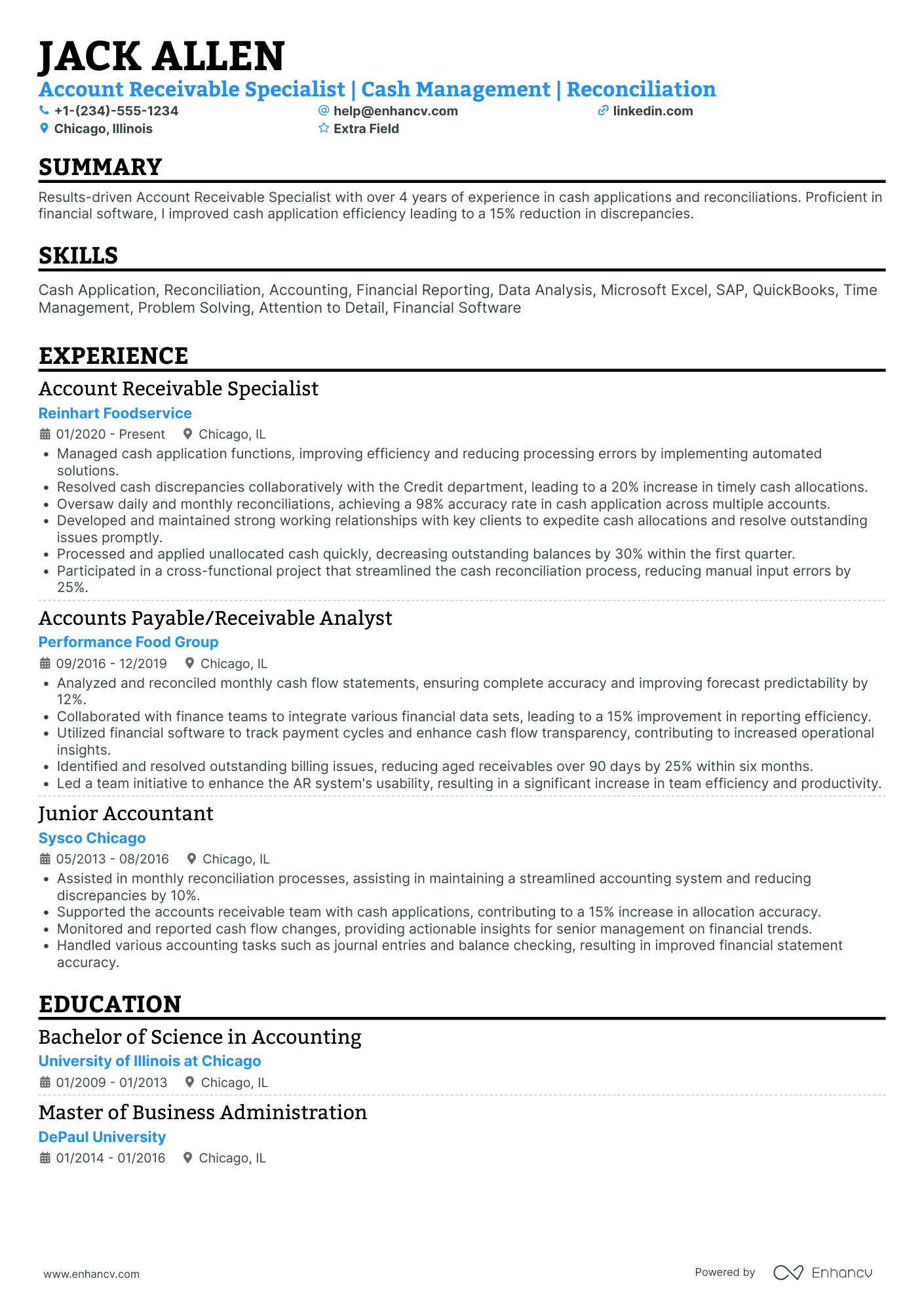

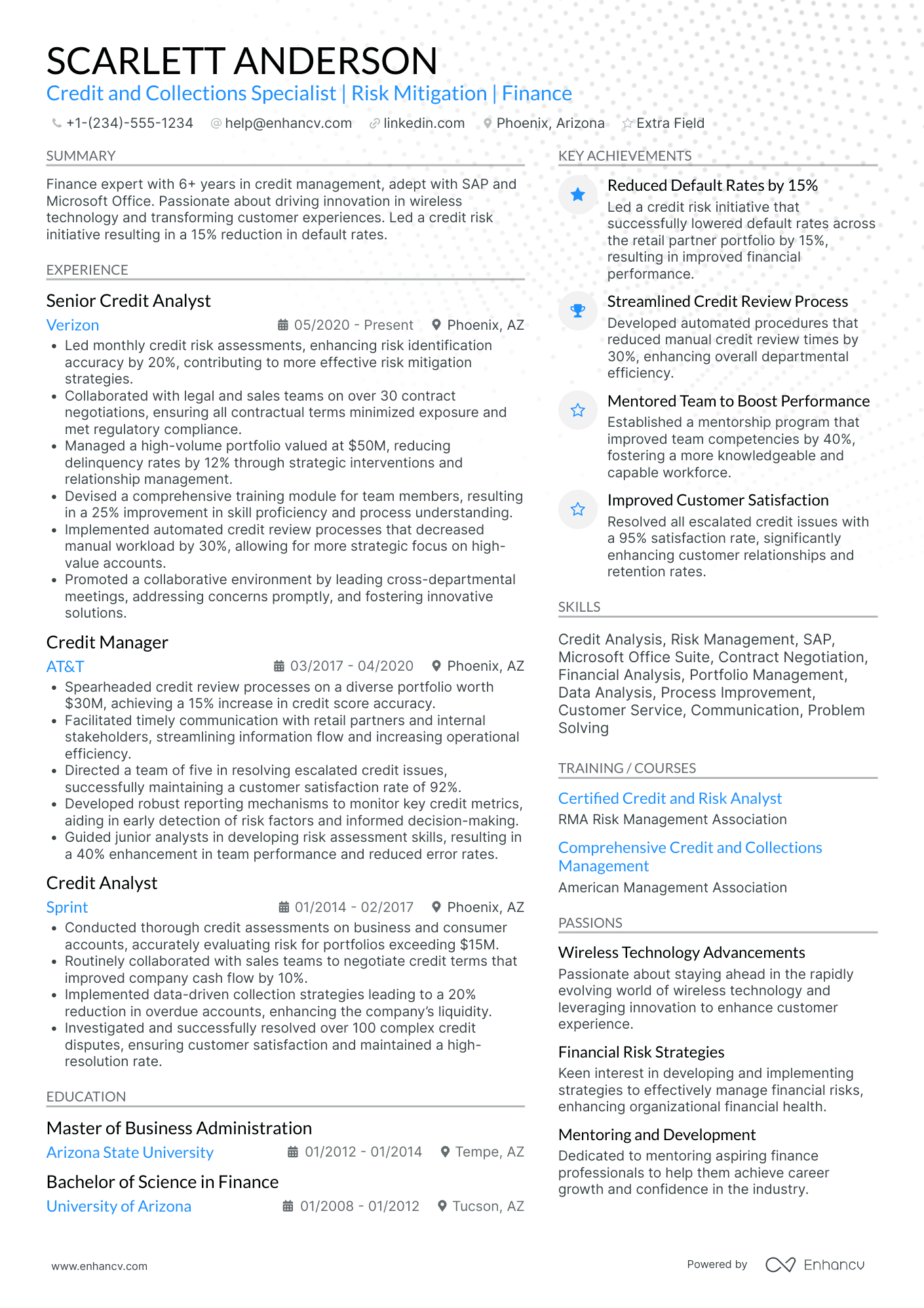

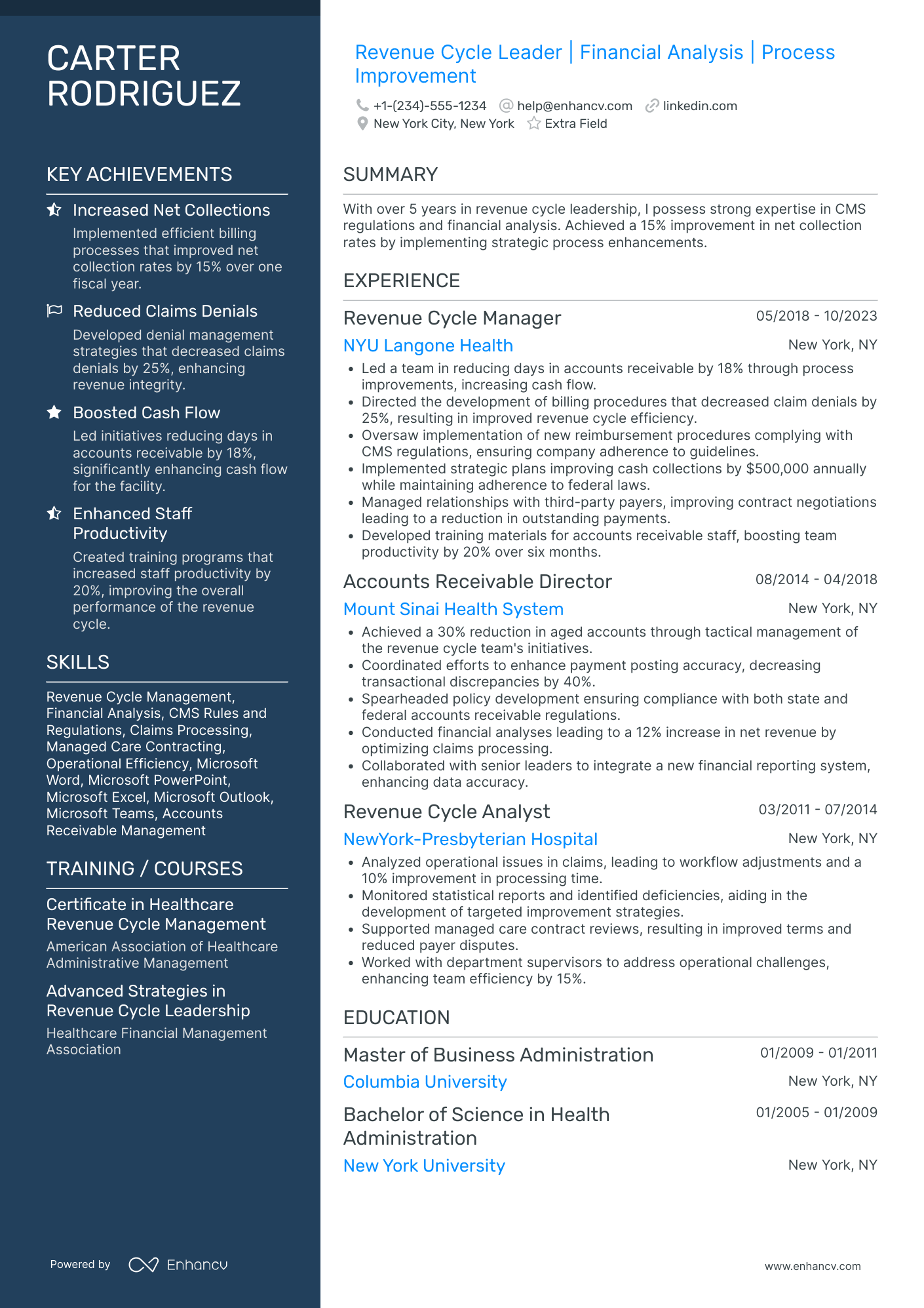

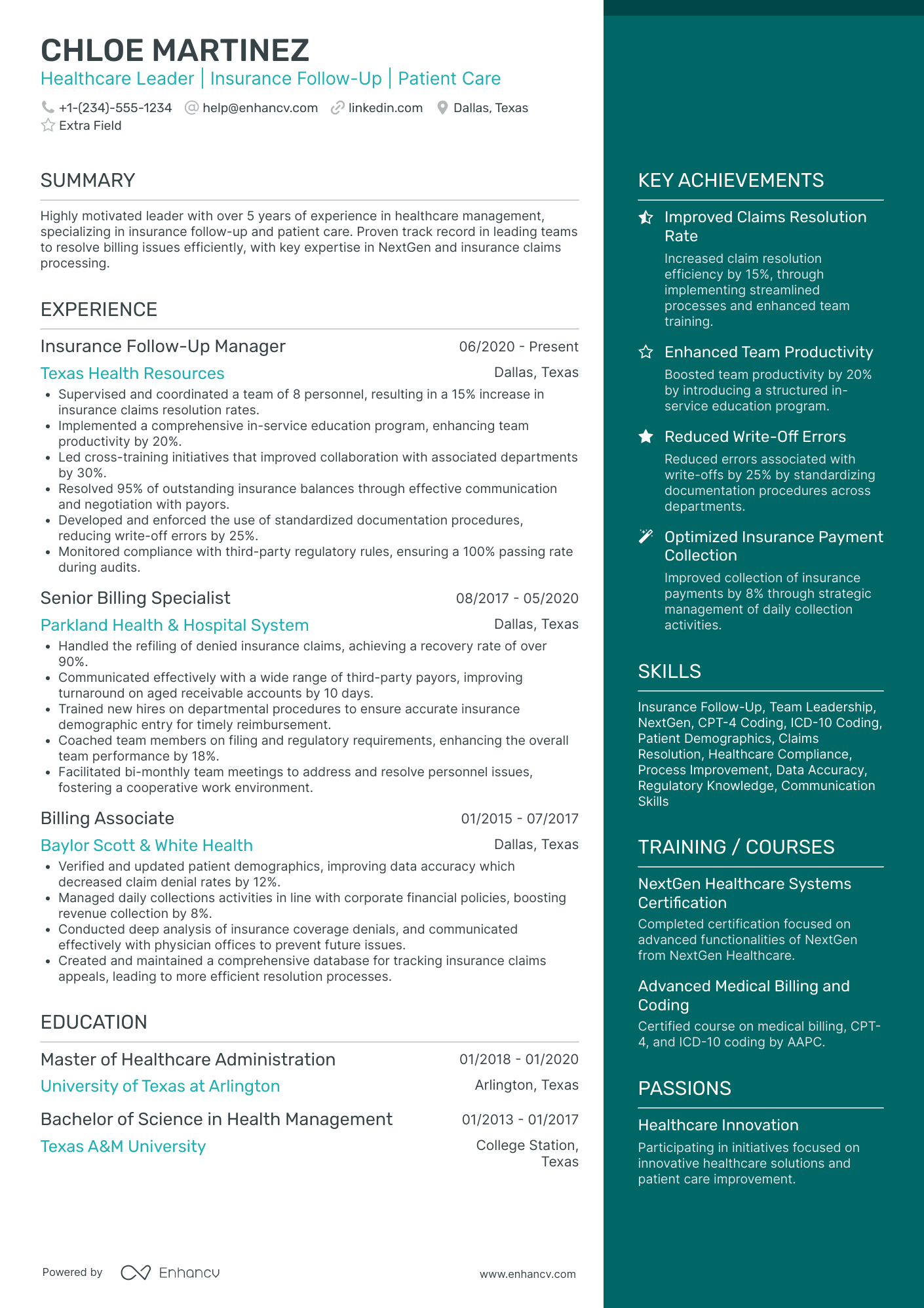

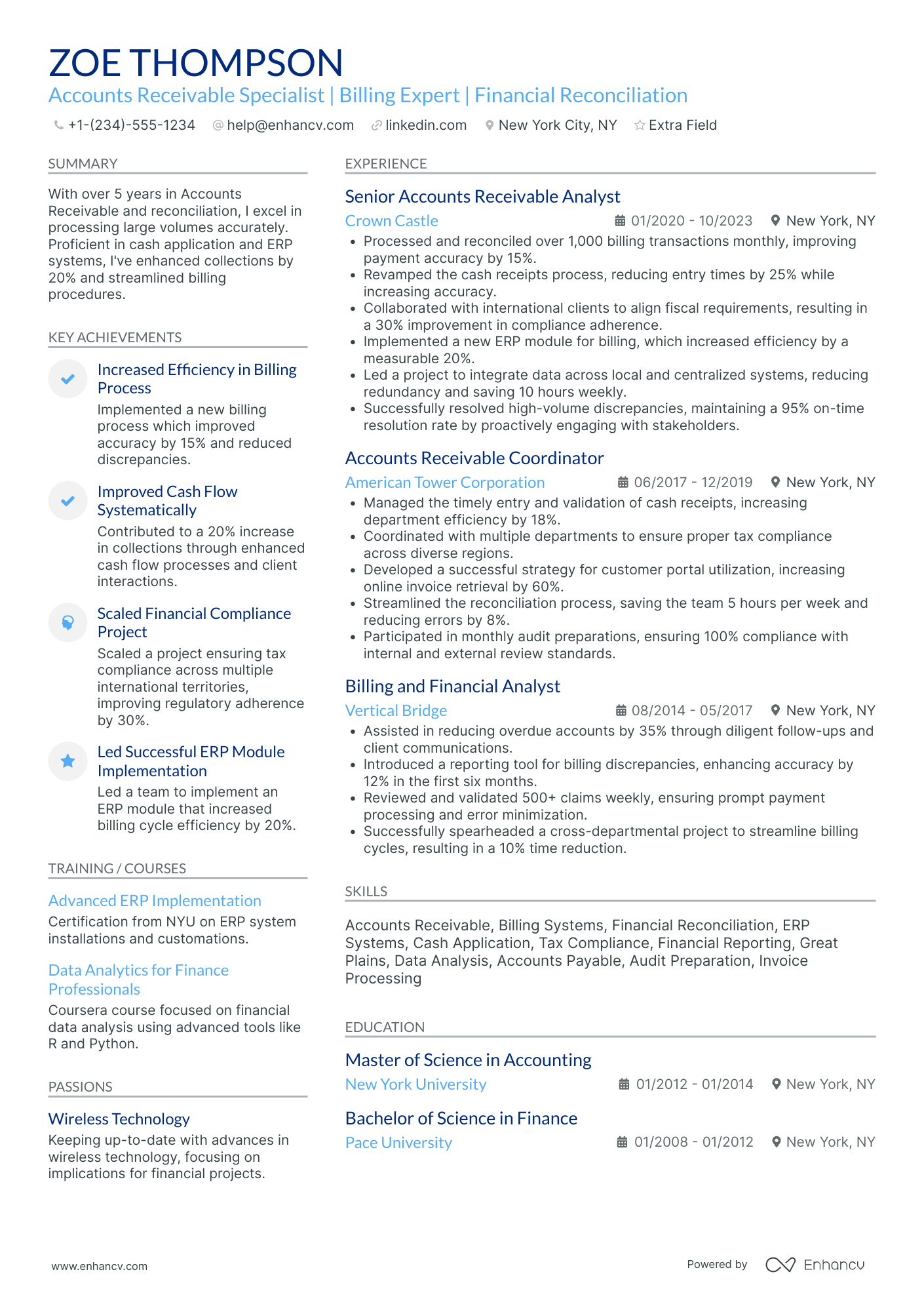

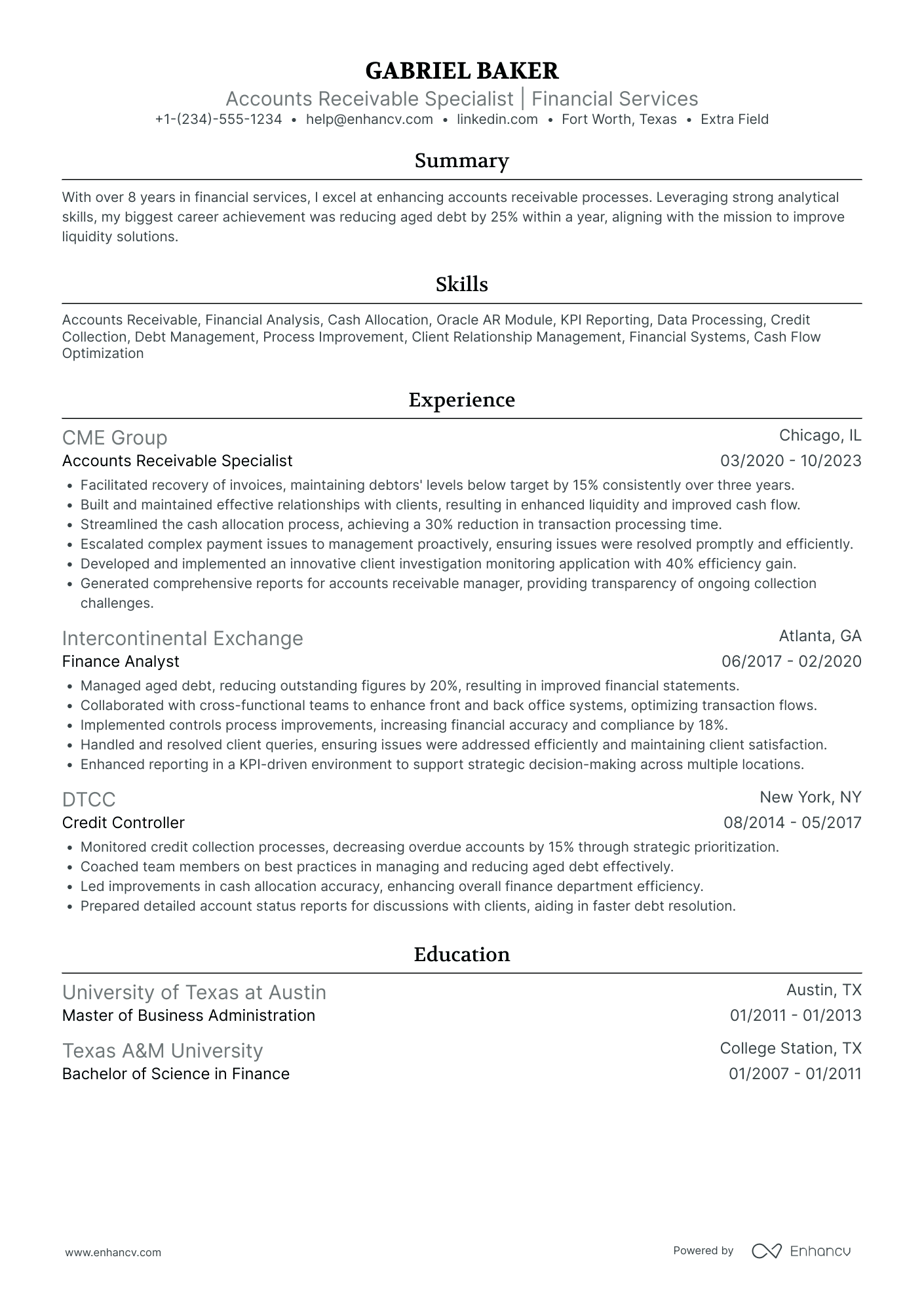

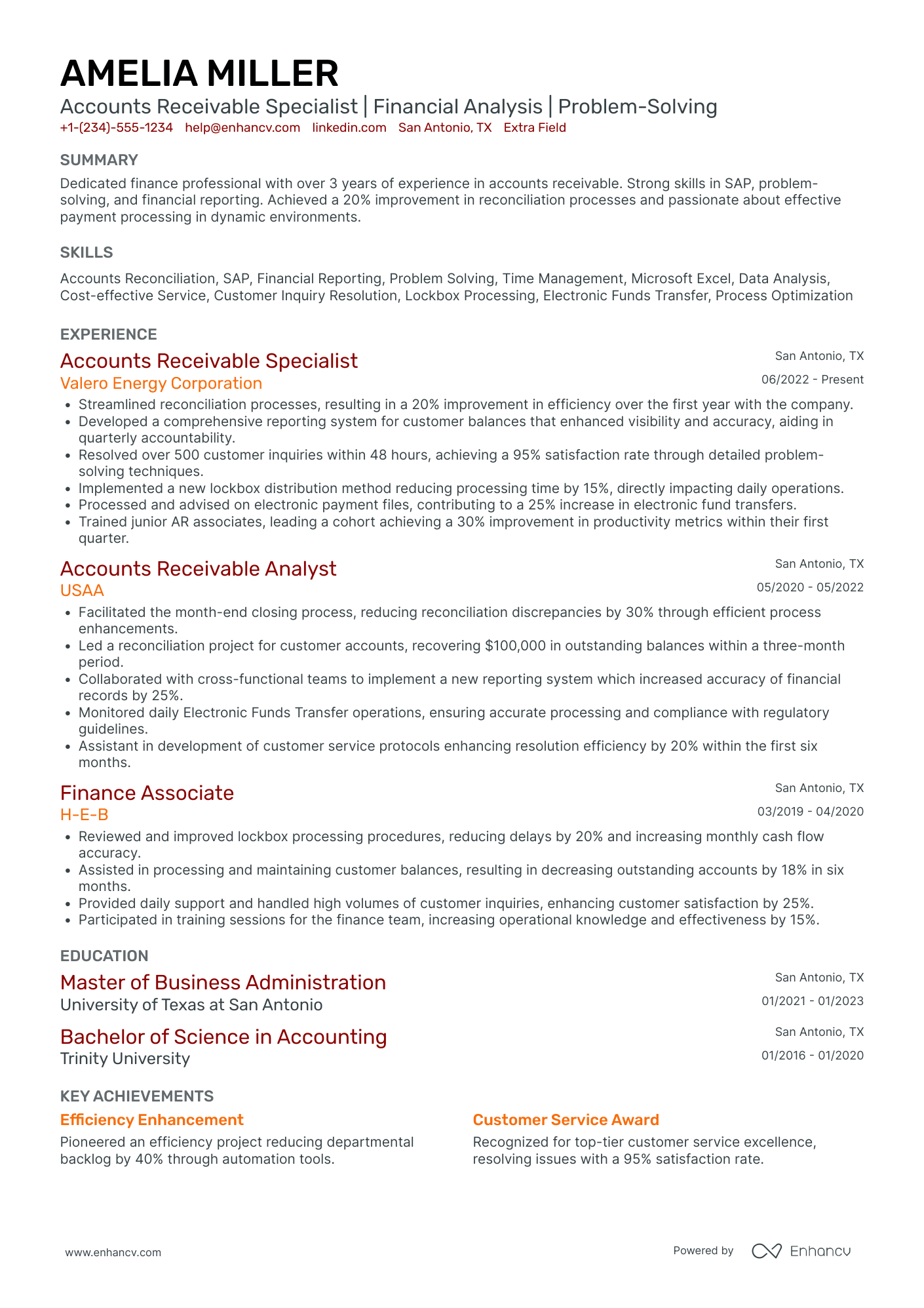

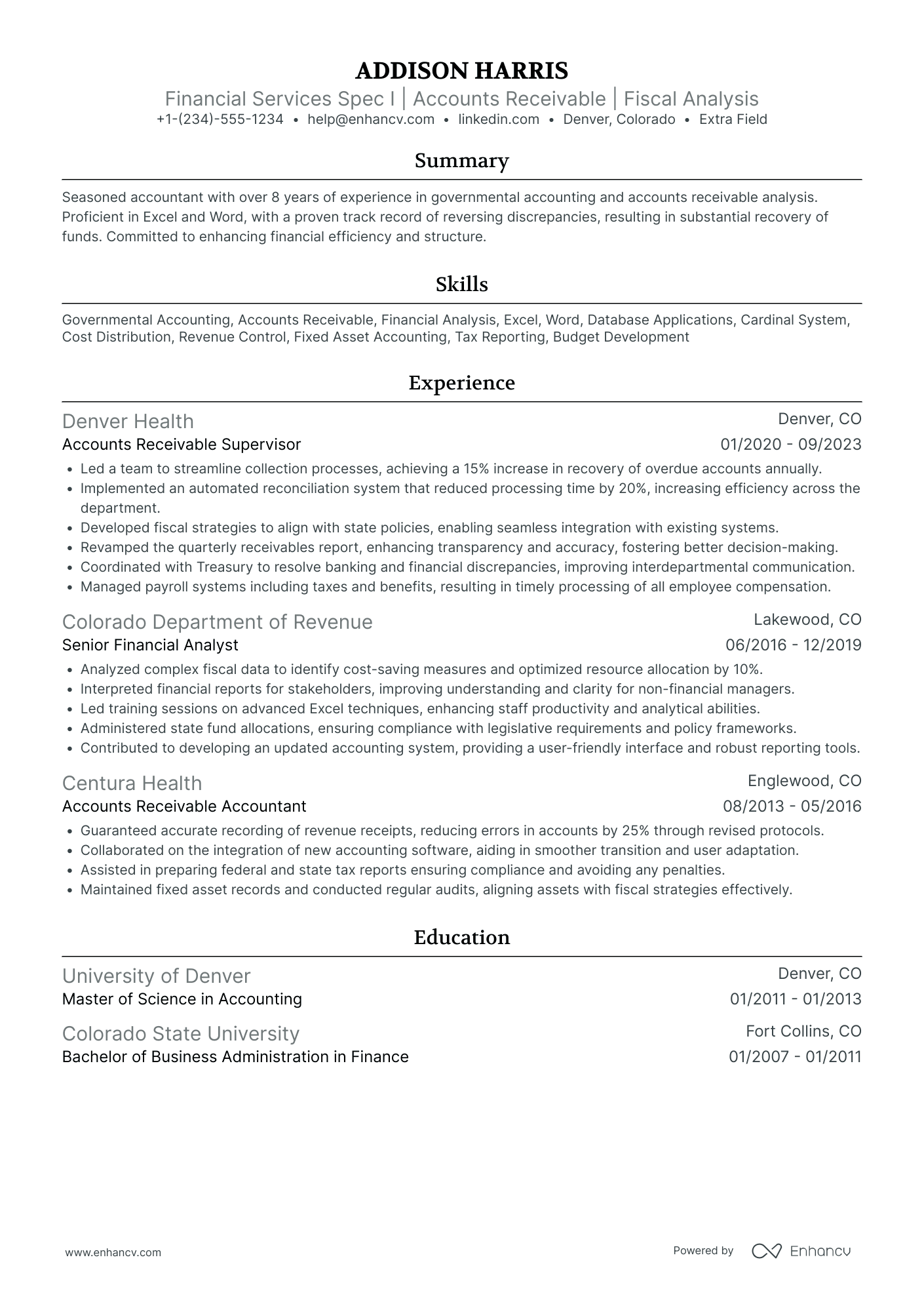

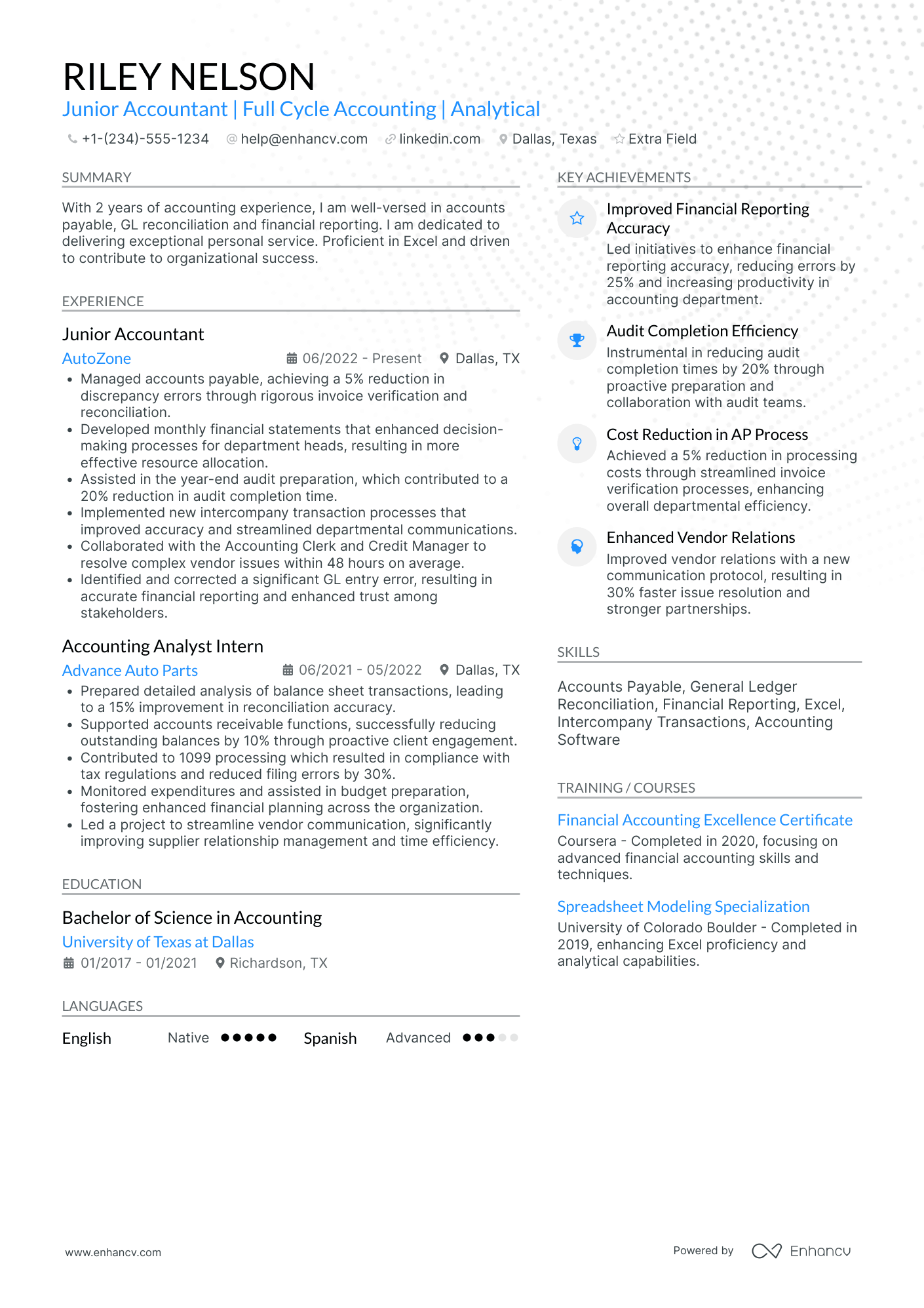

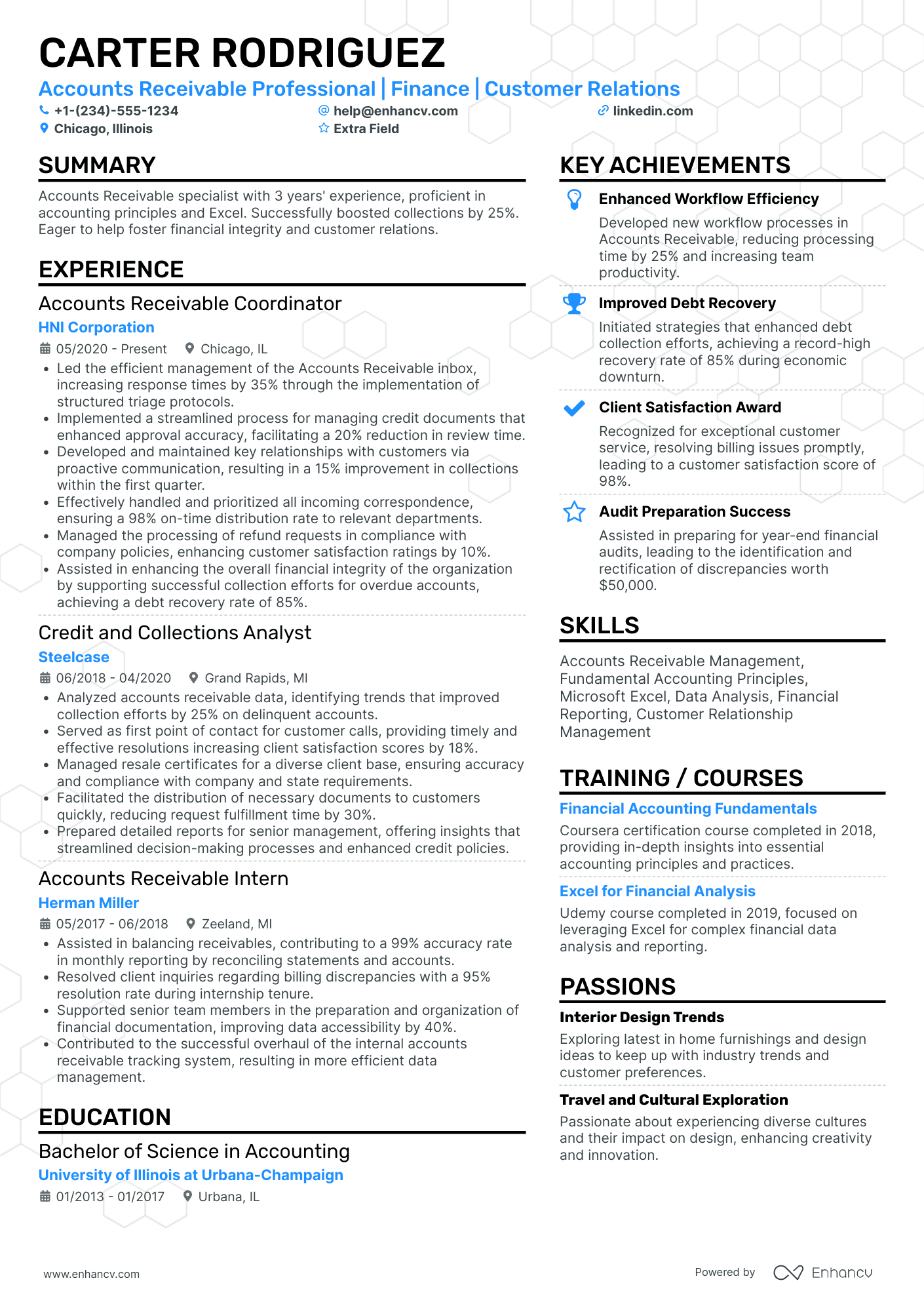

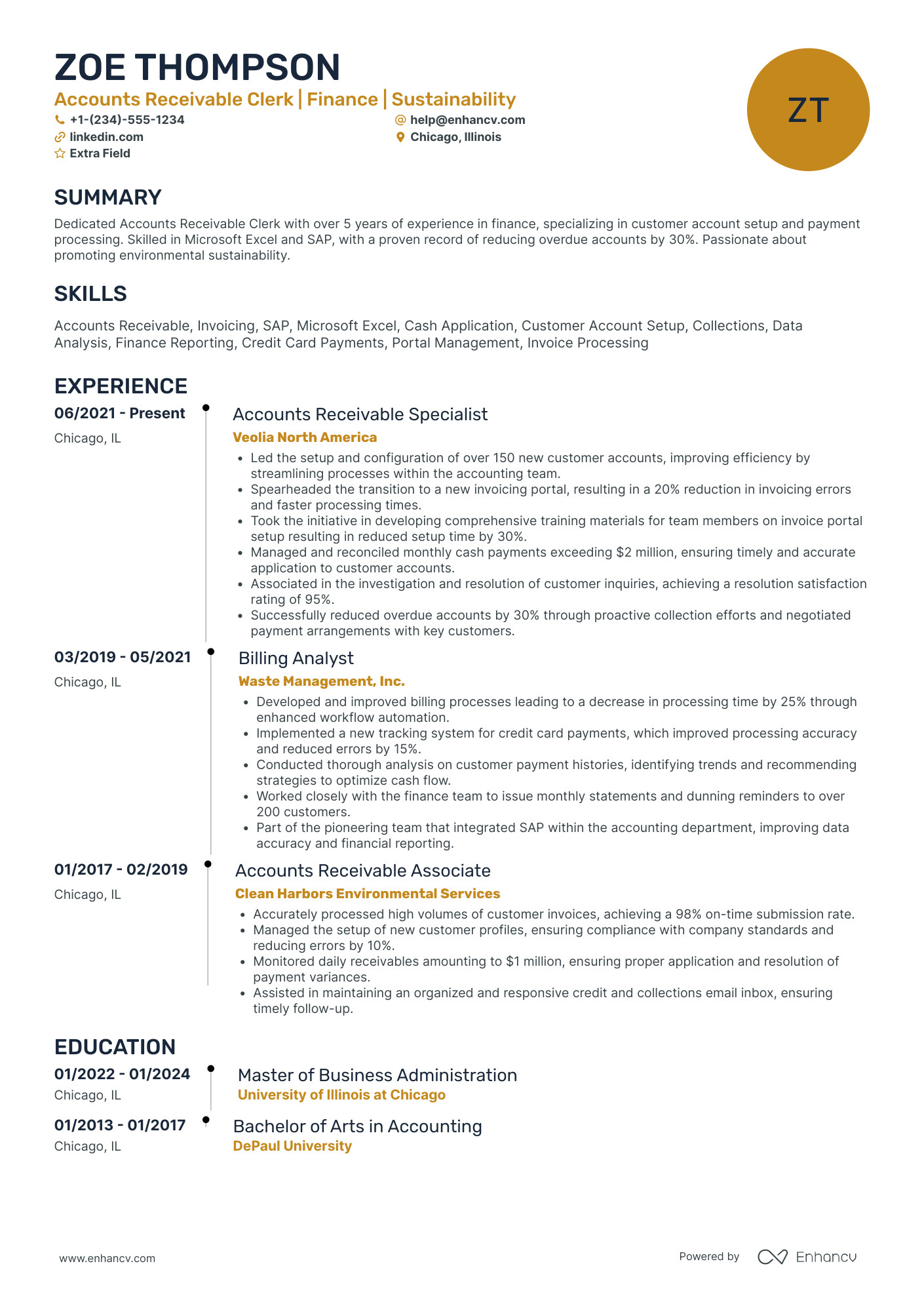

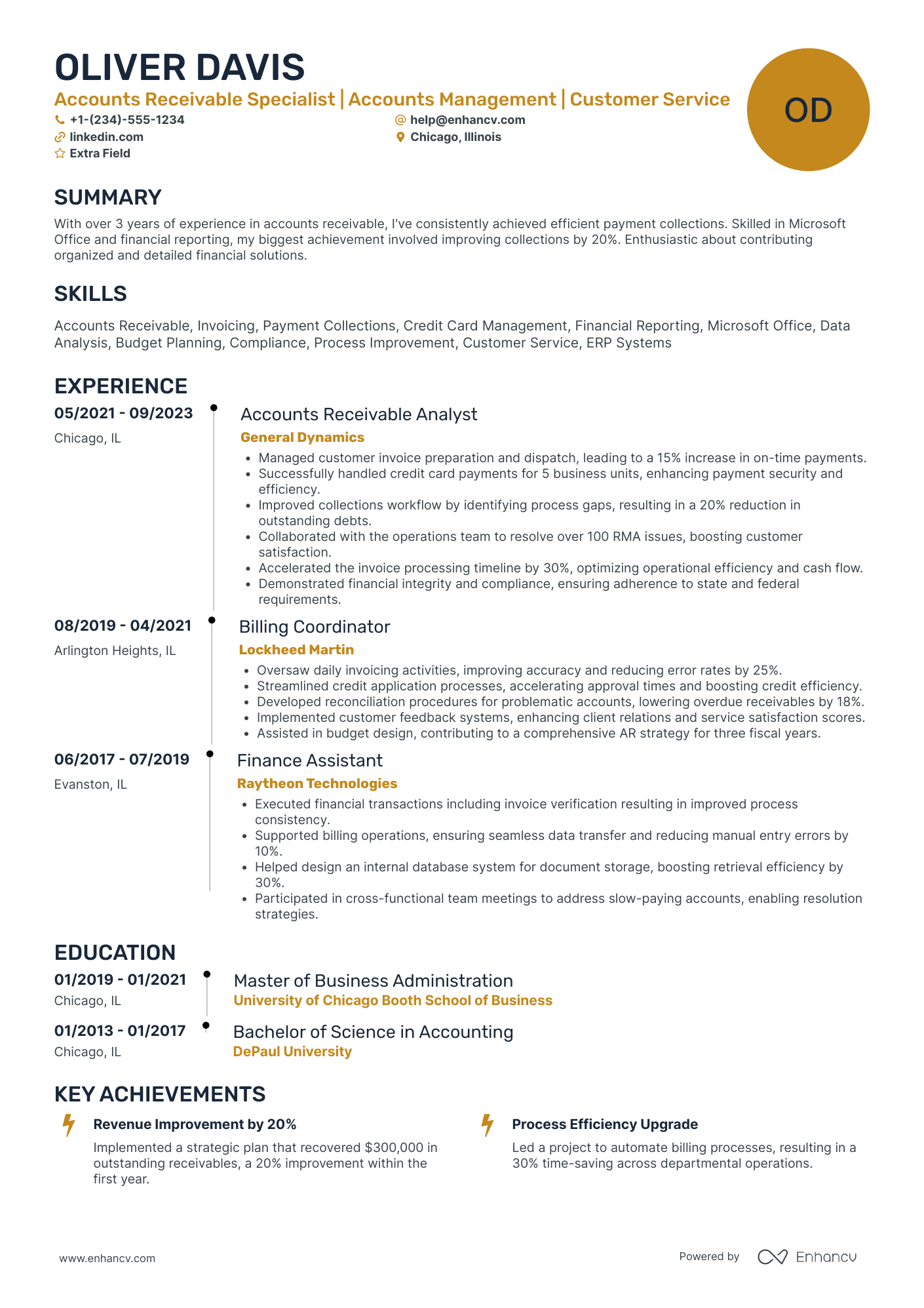

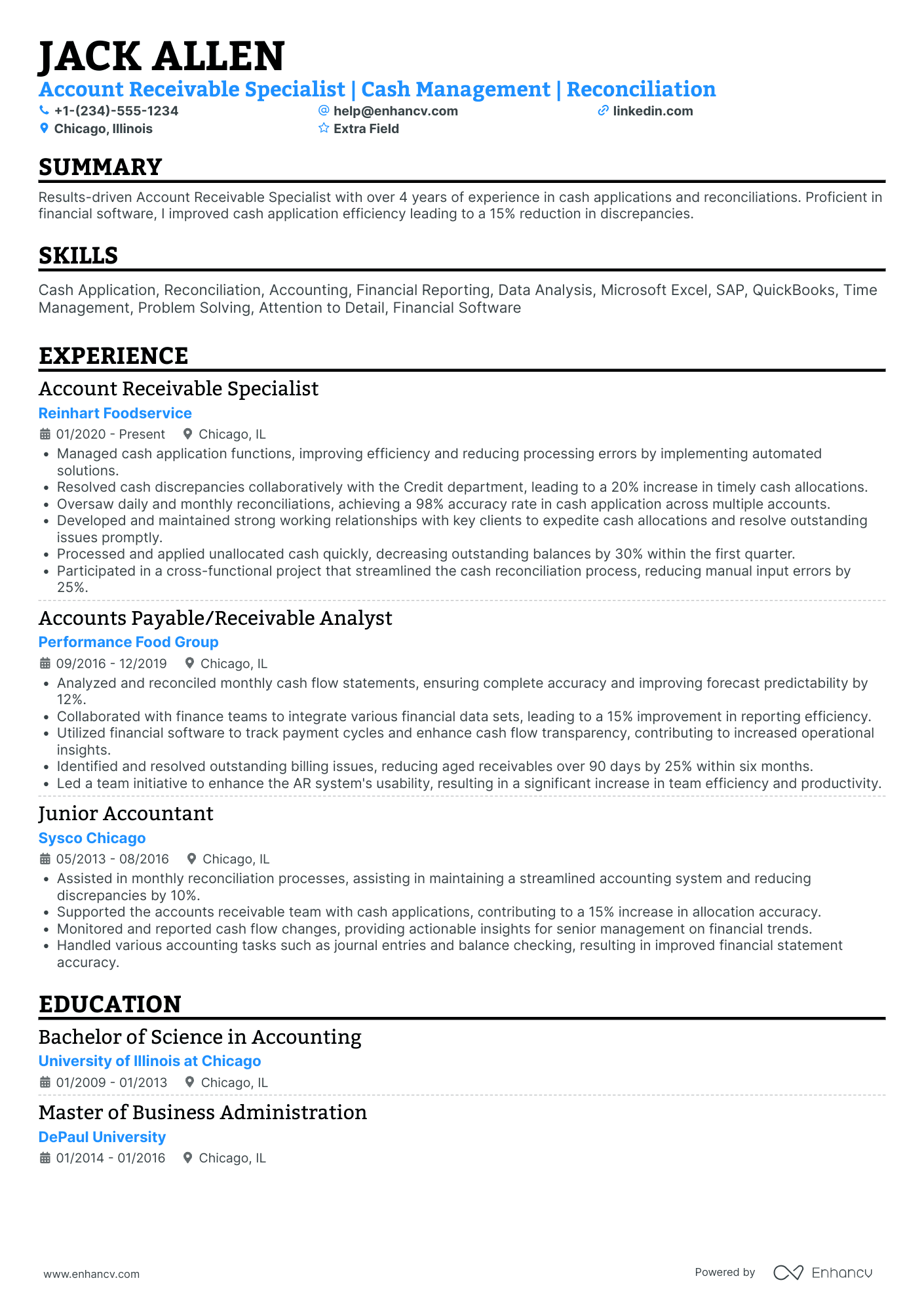

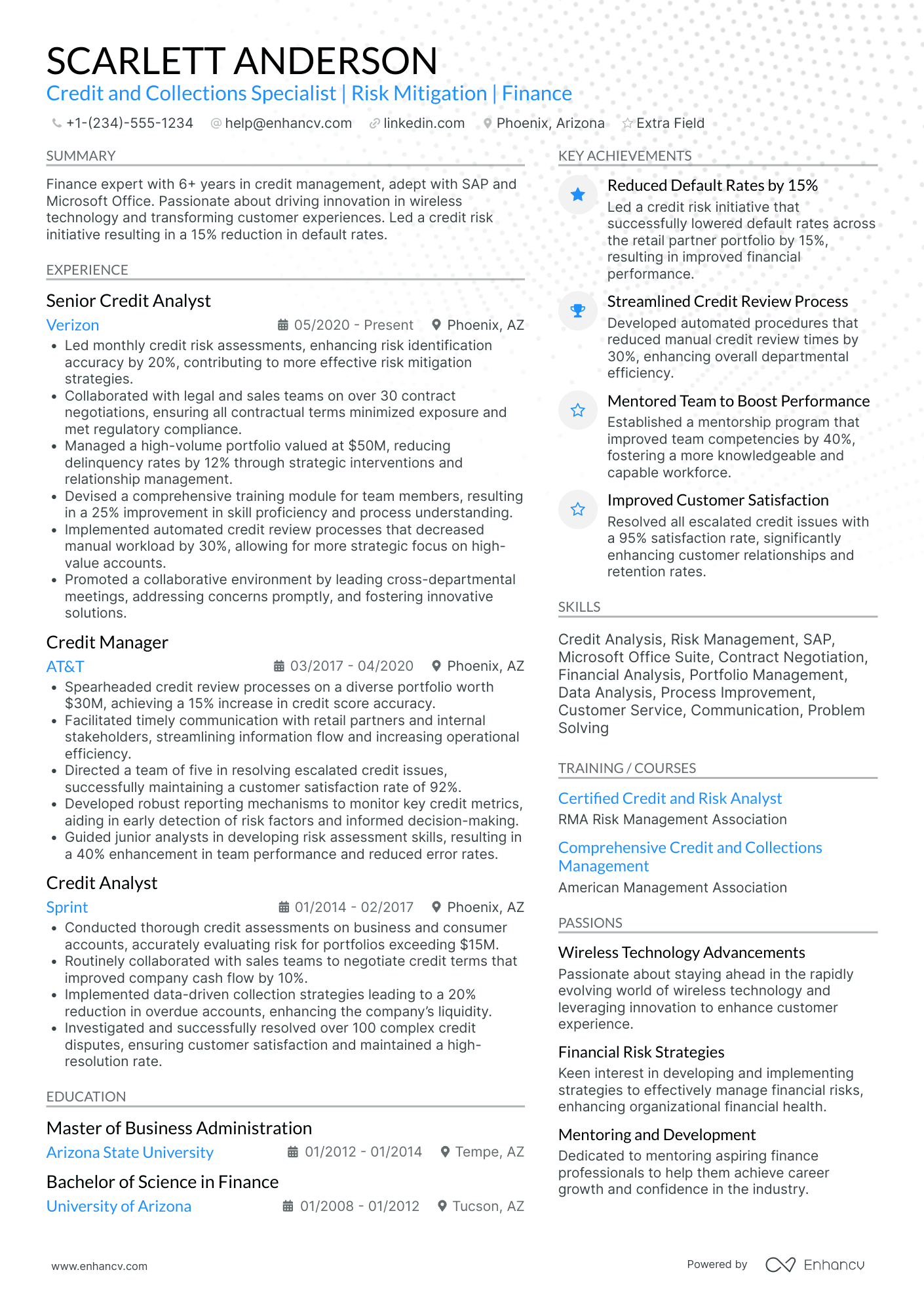

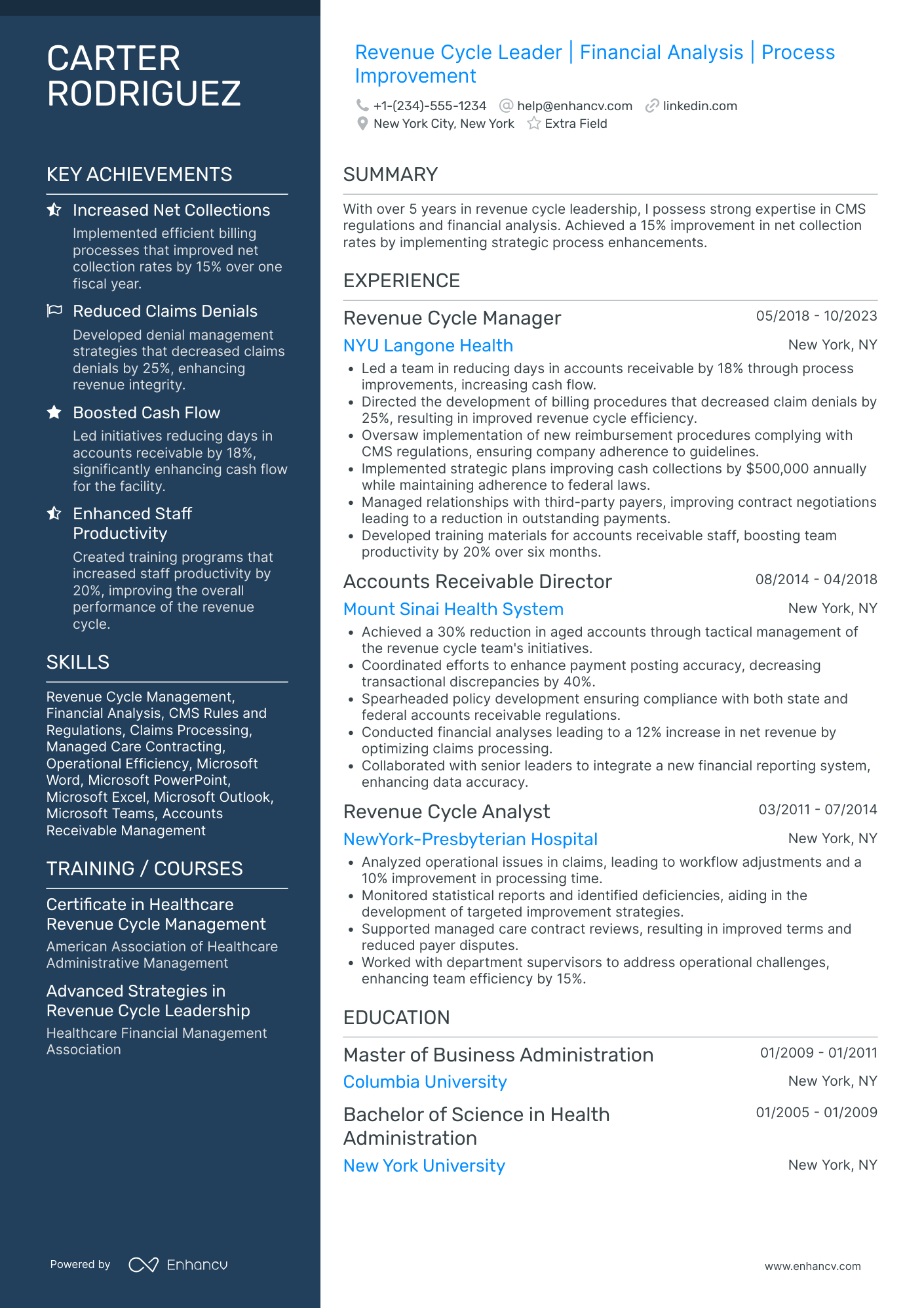

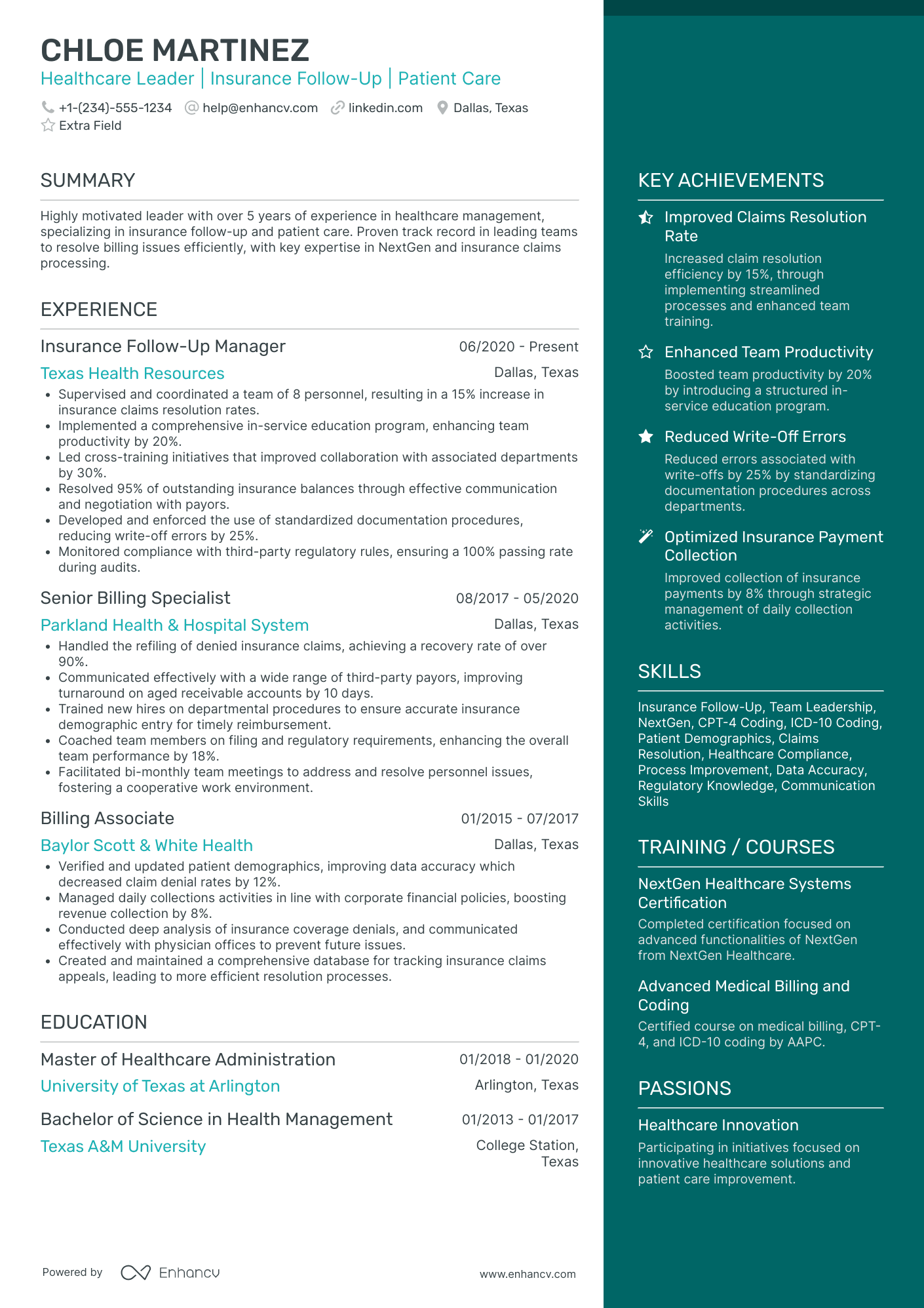

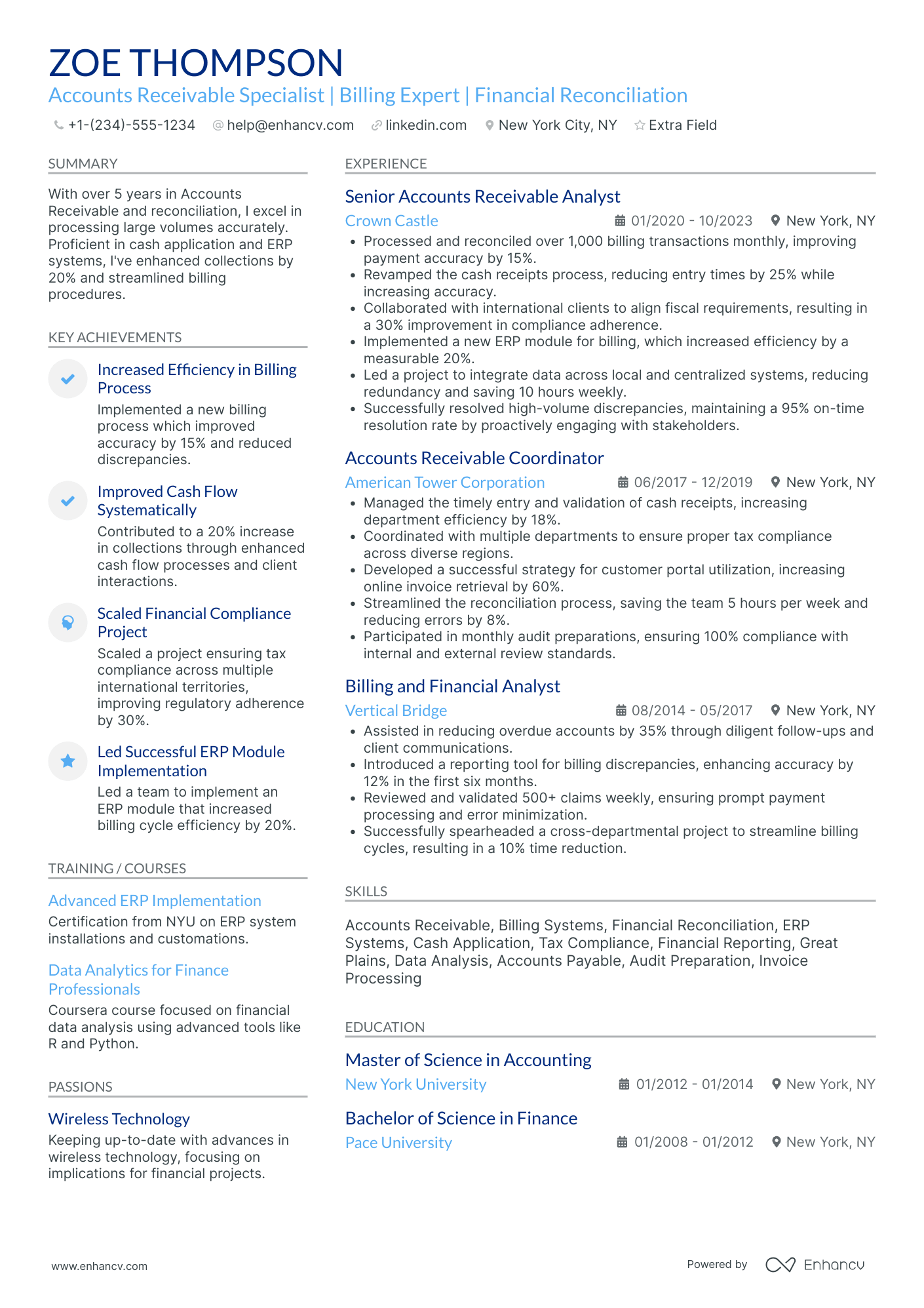

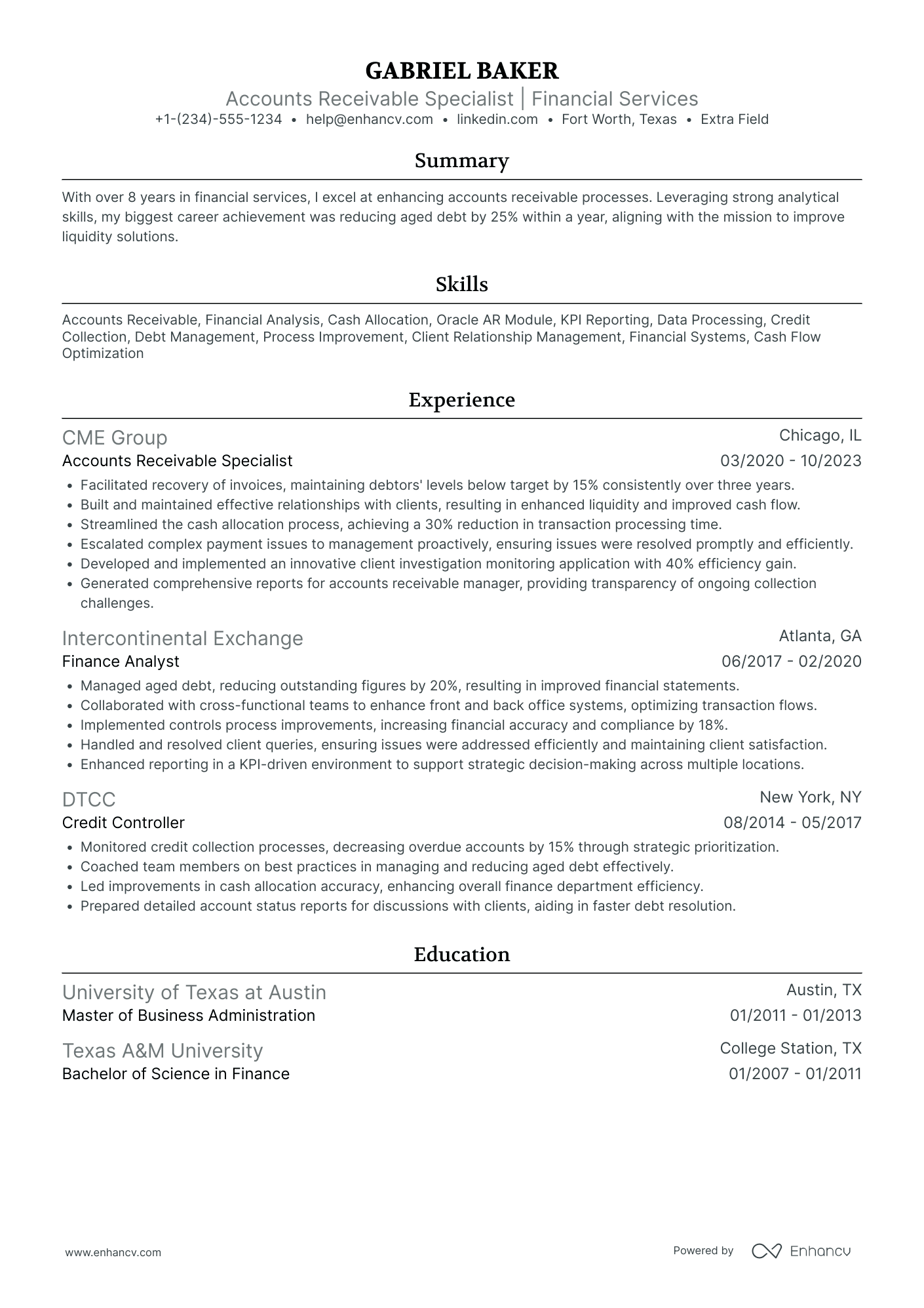

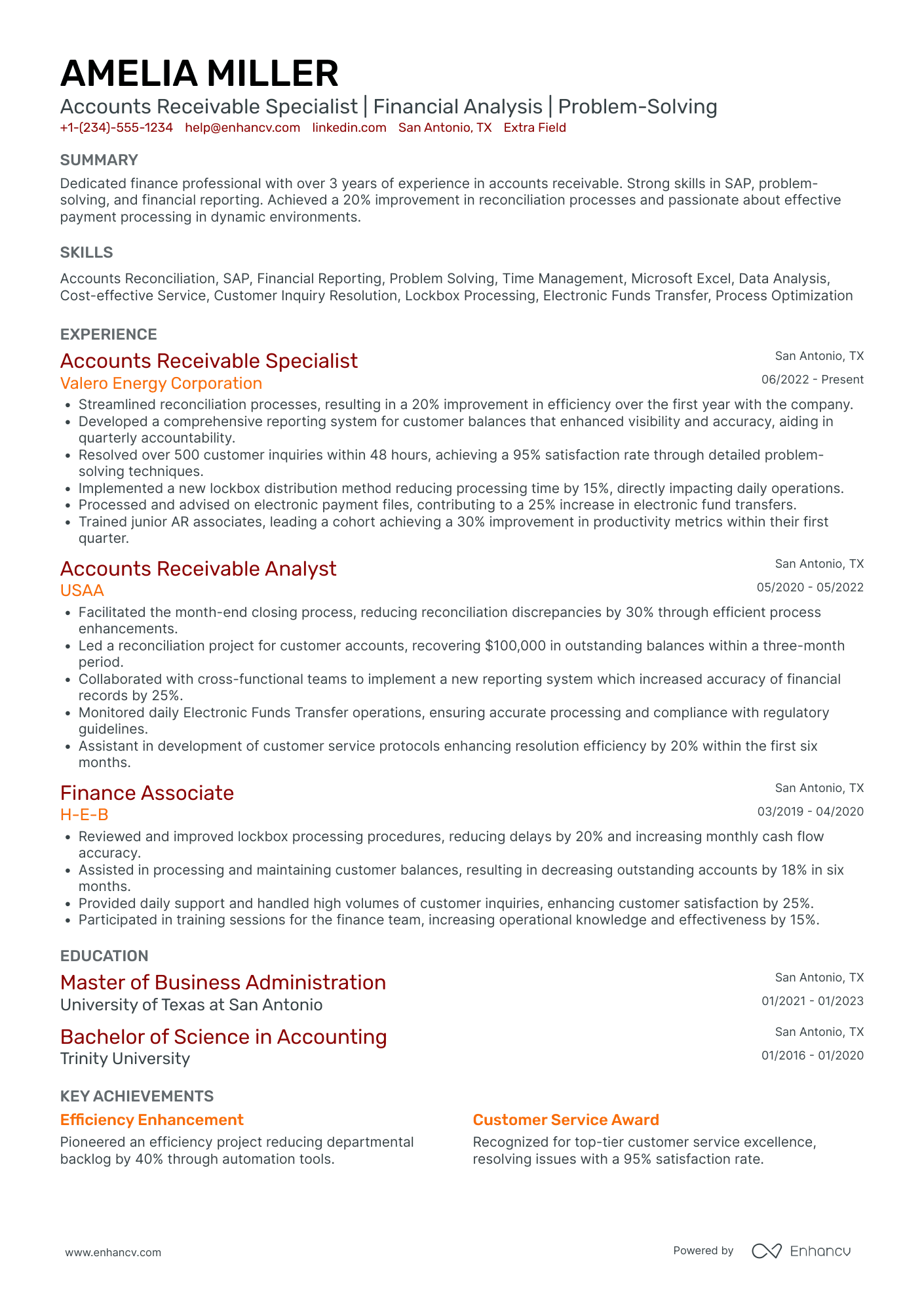

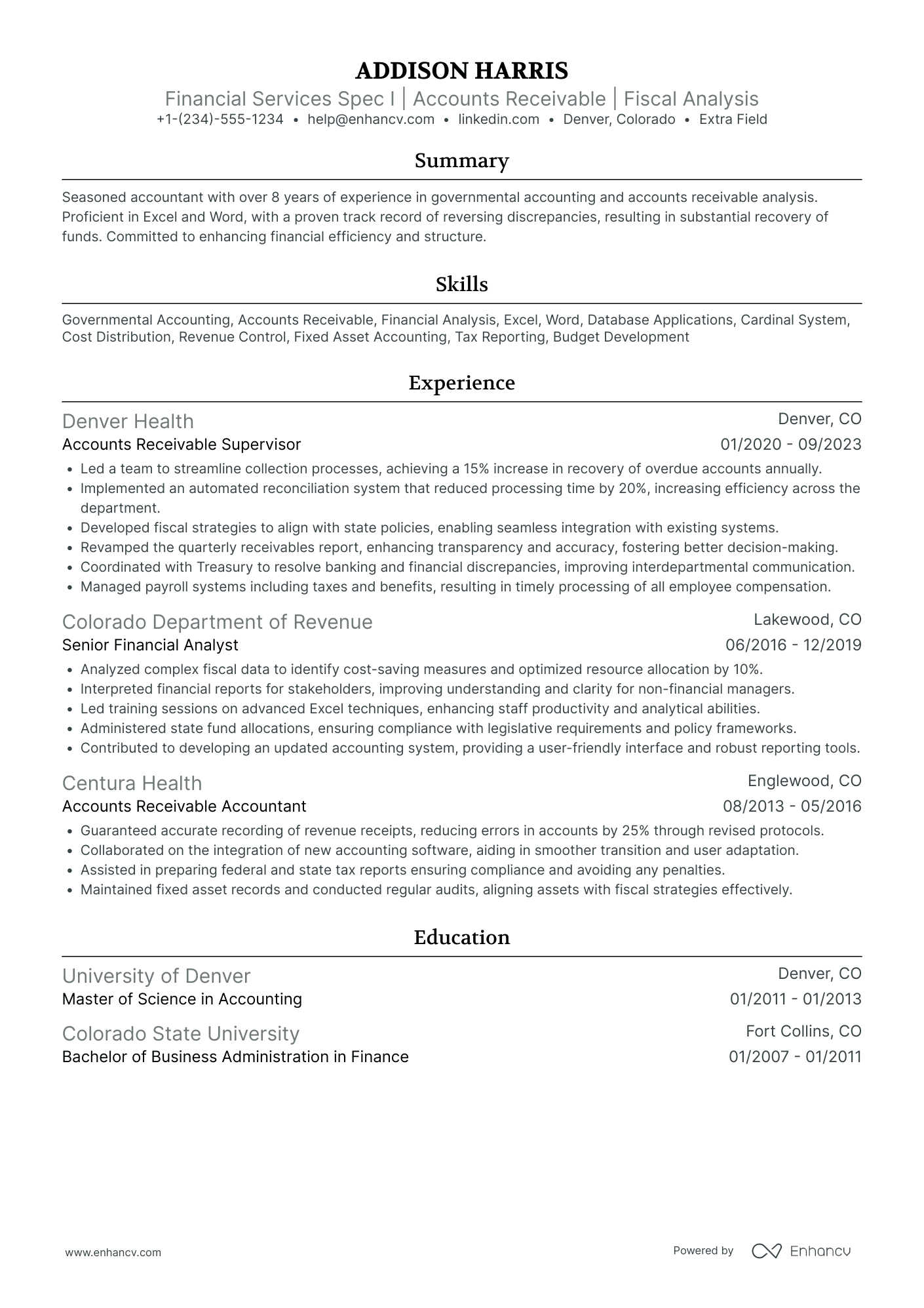

- Find different accounts receivable resume examples to serve as inspiration to your professional presentation.

- How to use the summary or objective to highlight your career achievements.

- How to create the experience section to tell your story.

- Must have certificates and what to include in the education section of your resume.

If the accounts receivable resume isn't the right one for you, take a look at other related guides we have:

- Accounts Clerk Resume Example

- Management Accounting Resume Example

- Finance Intern Resume Example

- Portfolio Manager Resume Example

- Bank Manager Resume Example

- Business Analyst Accounting Resume Example

- Account Executive Resume Example

- Accounting Assistant Resume Example

- Tax Accountant Resume Example

- CPA Resume Example

Accounts receivable resume format made simple

You don't need to go over the top when it comes to creativity in your accounts receivable resume format .

What recruiters care about more is the legibility of your accounts receivable resume, alongside the relevancy of your application to the role.

That's why we're presenting you with four simple steps that could help your professional presentation check all the right boxes:

- The reverse-chronological resume format is the one for you, if you happen to have plenty of relevant (and recent) professional experience you'd like to showcase. This format follows a pretty succinct logic and puts the focus on your experience.

- Keep your header simple with your contact details; a headline that details the role you're applying for or your current job; and a link to your portfolio.

- Ensure your resume reaches an up-to-two-page limit, only if you happen to be applying for a more senior role or you have over a decade of relevant experience.

- Save your accounts receivable resume as a PDF to retain its structure and presentation.

Different markets have specific resume styles – a Canadian resume, for instance, may require a different approach.

Upload & Check Your Resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

PRO TIP

If you're in the process of obtaining your certificate or degree, list the expected date you're supposed to graduate or be certified.

Don't forget to include these six sections on your accounts receivable resume:

- Header and summary for your contact details and to highlight your alignment with the accounts receivable job you're applying for

- Experience section to get into specific technologies you're apt at using and personal skills to deliver successful results

- Skills section to further highlight how your profile matches the job requirements

- Education section to provide your academic background

- Achievements to mention any career highlights that may be impressive, or that you might have missed so far in other resume sections

What recruiters want to see on your resume:

- Demonstration of proficiency in accounting software and systems, such as QuickBooks or SAP.

- Experience with billing, invoicing, and following up on overdue accounts.

- Strong understanding of credit controls and risk management practices.

- Proven ability to reconcile accounts and resolve discrepancies.

- Detail-oriented with a strong track record of accurate and timely accounts receivable reporting.

What to include in the experience section of your accounts receivable resume

The resume experience section is perhaps the most important element in your application as it needs to showcase how your current profile matches the job.

While it may take some time to perfect your accounts receivable experience section, here are five tips to keep in mind when writing yours:

- Assess the advert to make a list of key requirements and look back on how each of your past jobs answers those;

- Don't just showcase you know a particular skill, instead, you need proof in the form of tangible results (e.g. numbers, percent, etc.);

- It's perfectly fine to leave off experience items that don't bring anything extra to your skill set or application;

- Recruiters want to understand what the particular value is of working with you, so instead of solely featuring technologies, think about including at least one bullet that's focused on your soft skills;

- Take care with wording each bullet to demonstrate what you've achieved, using a particular skill, and an action verb.

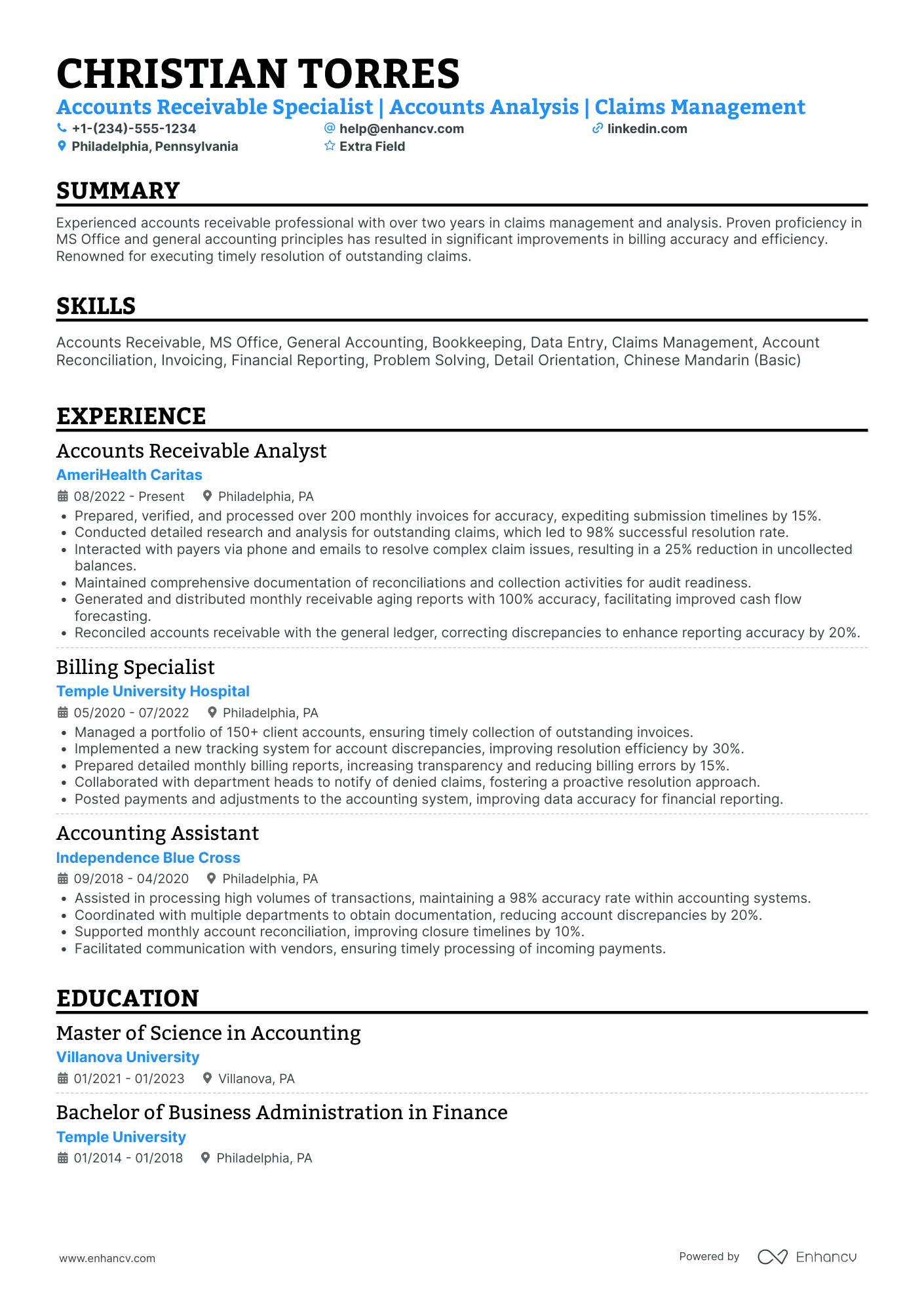

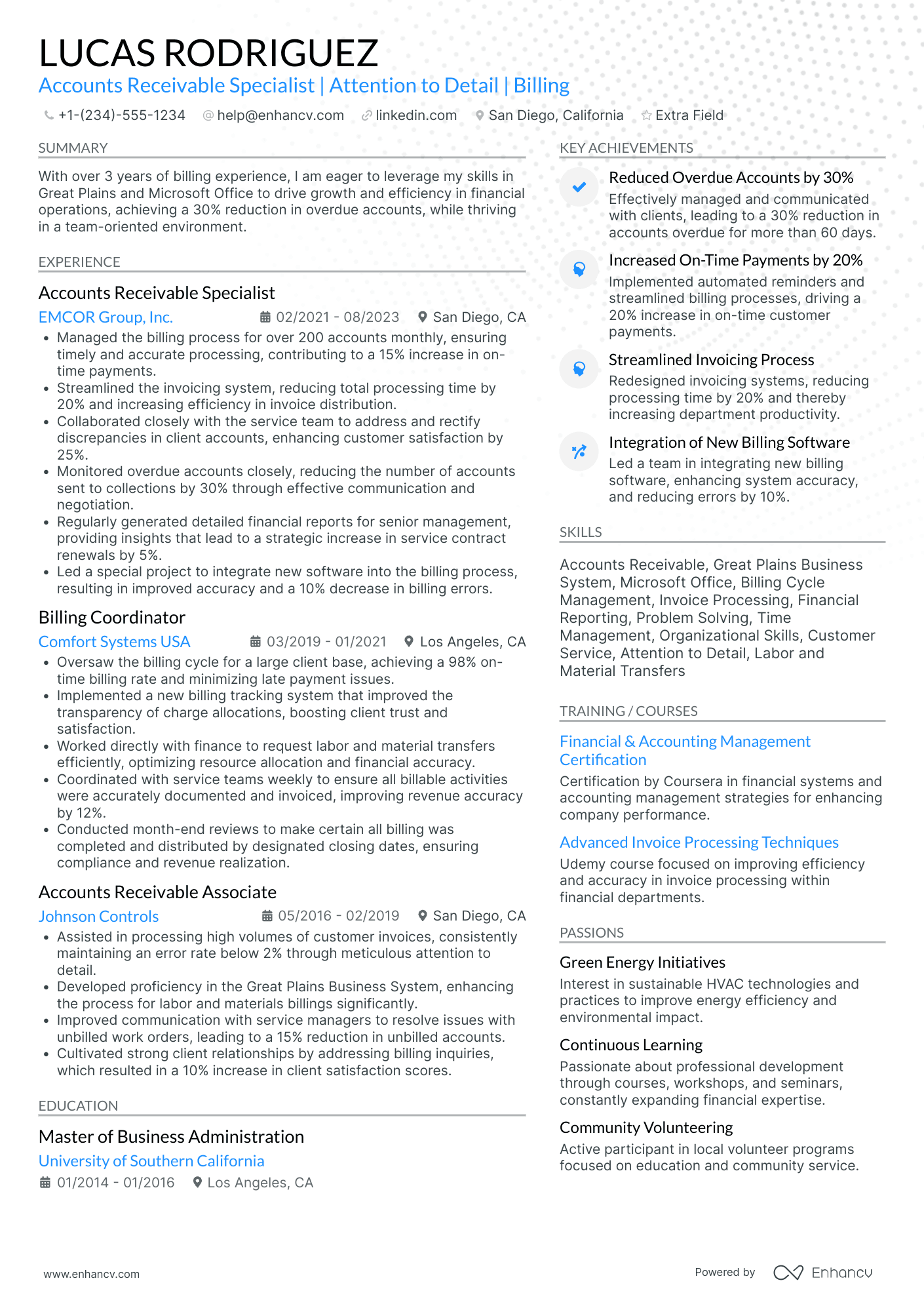

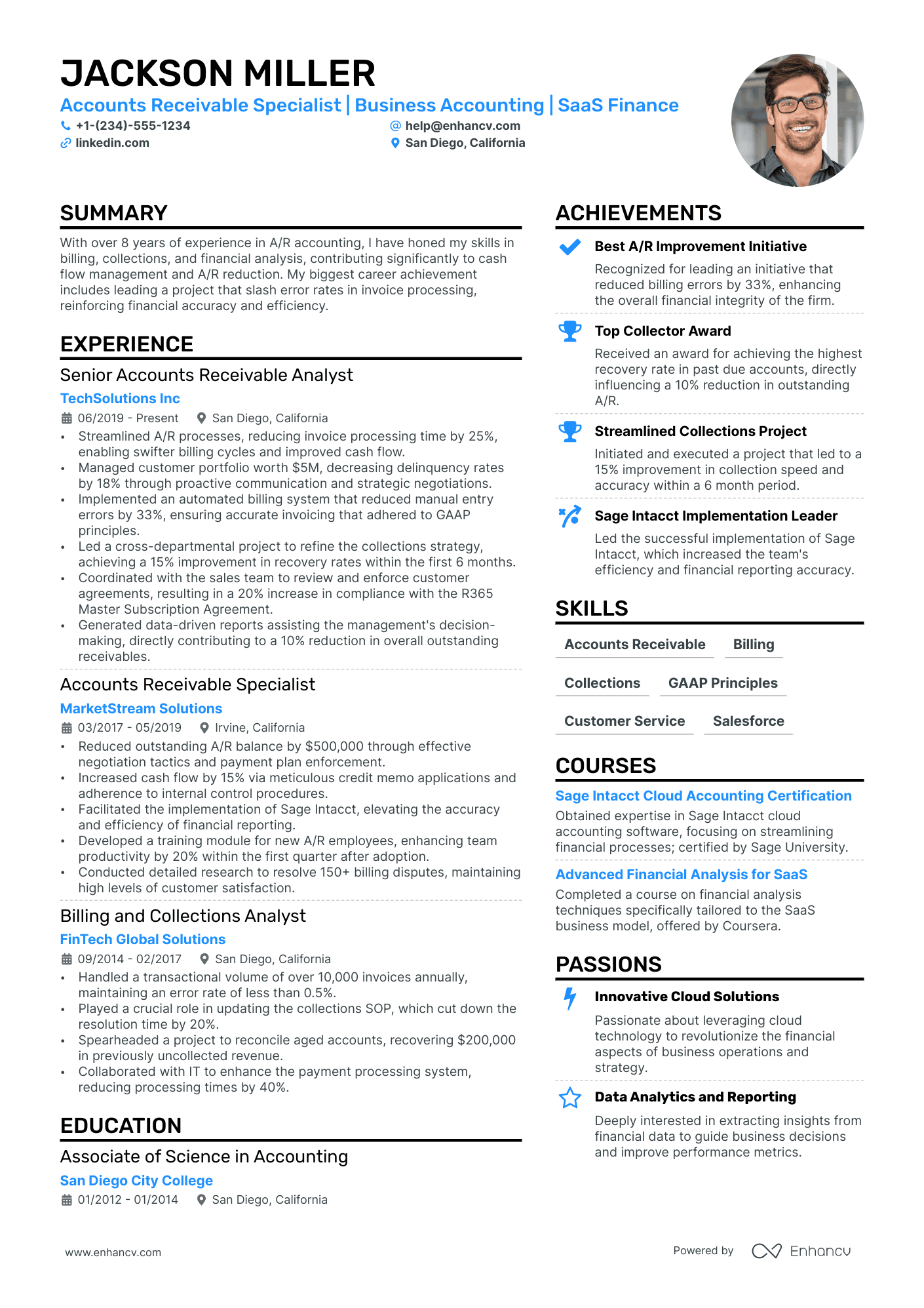

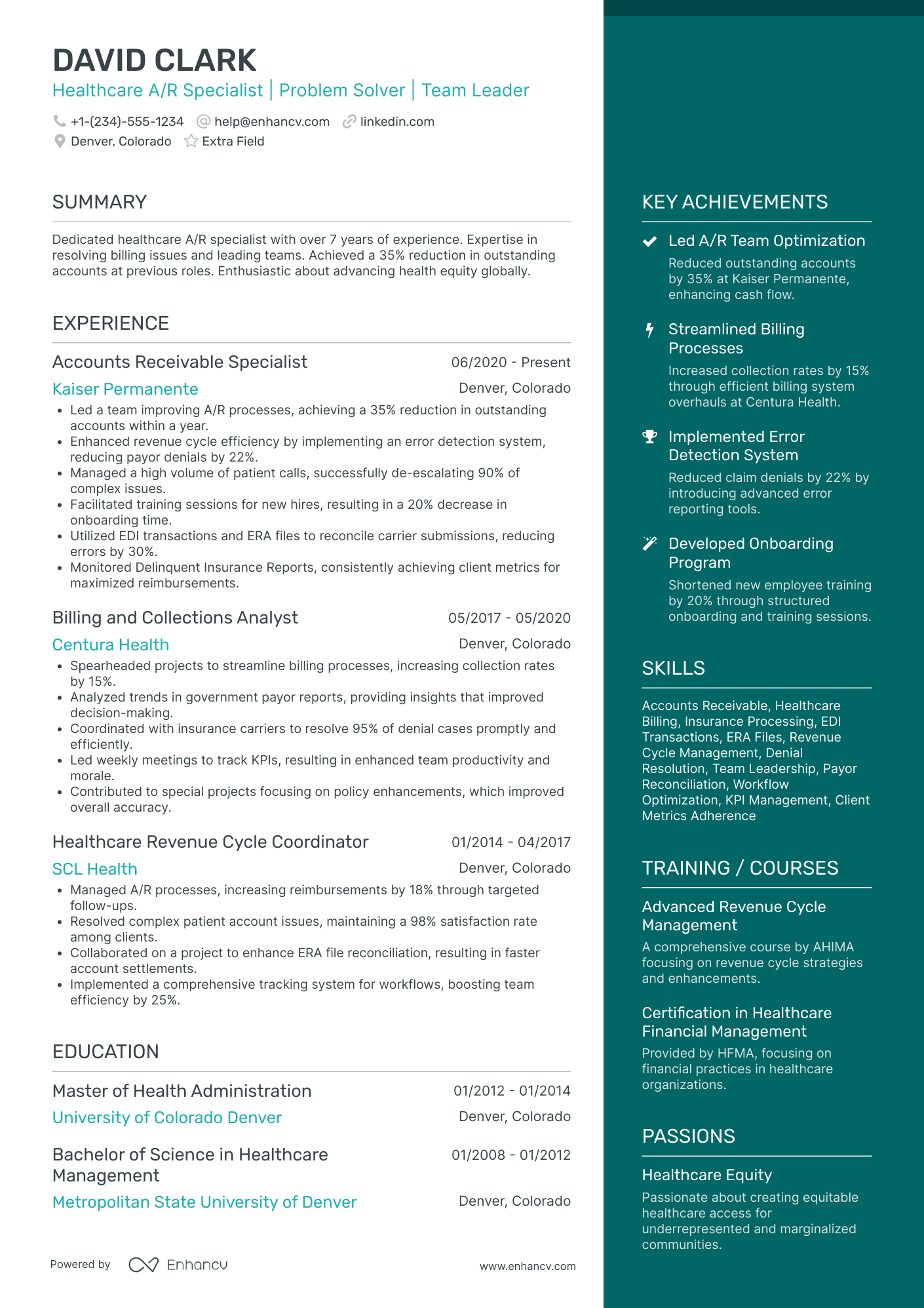

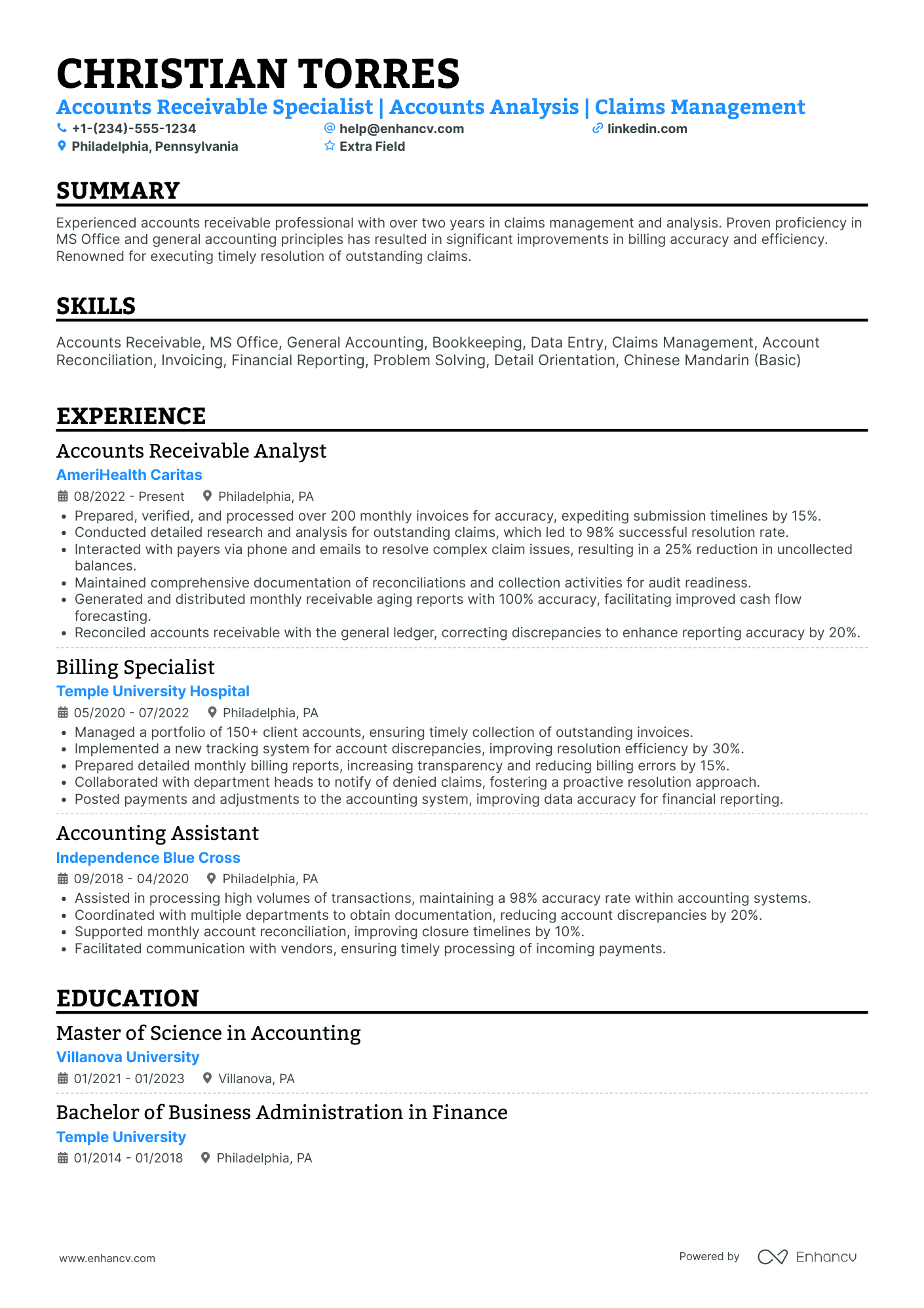

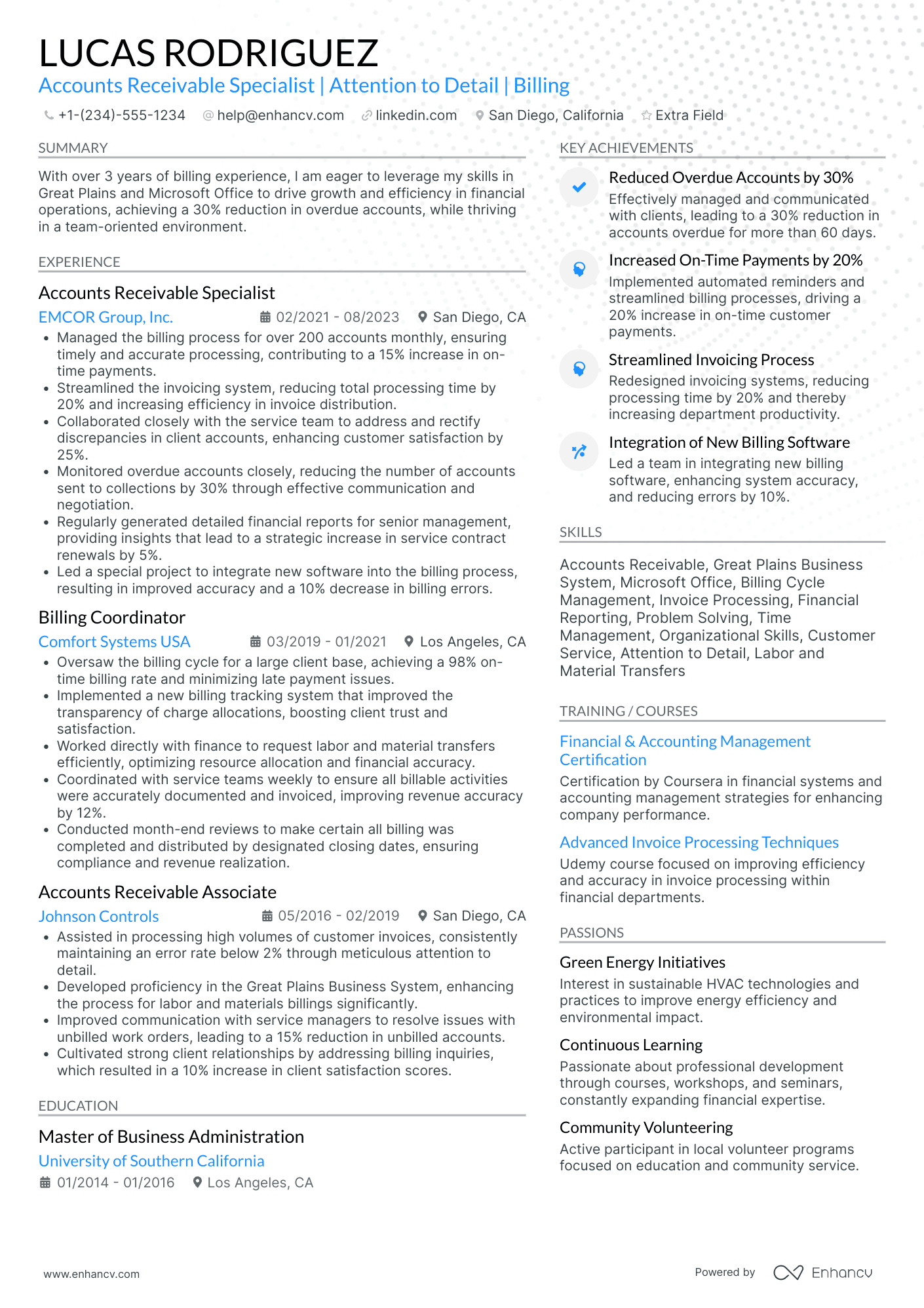

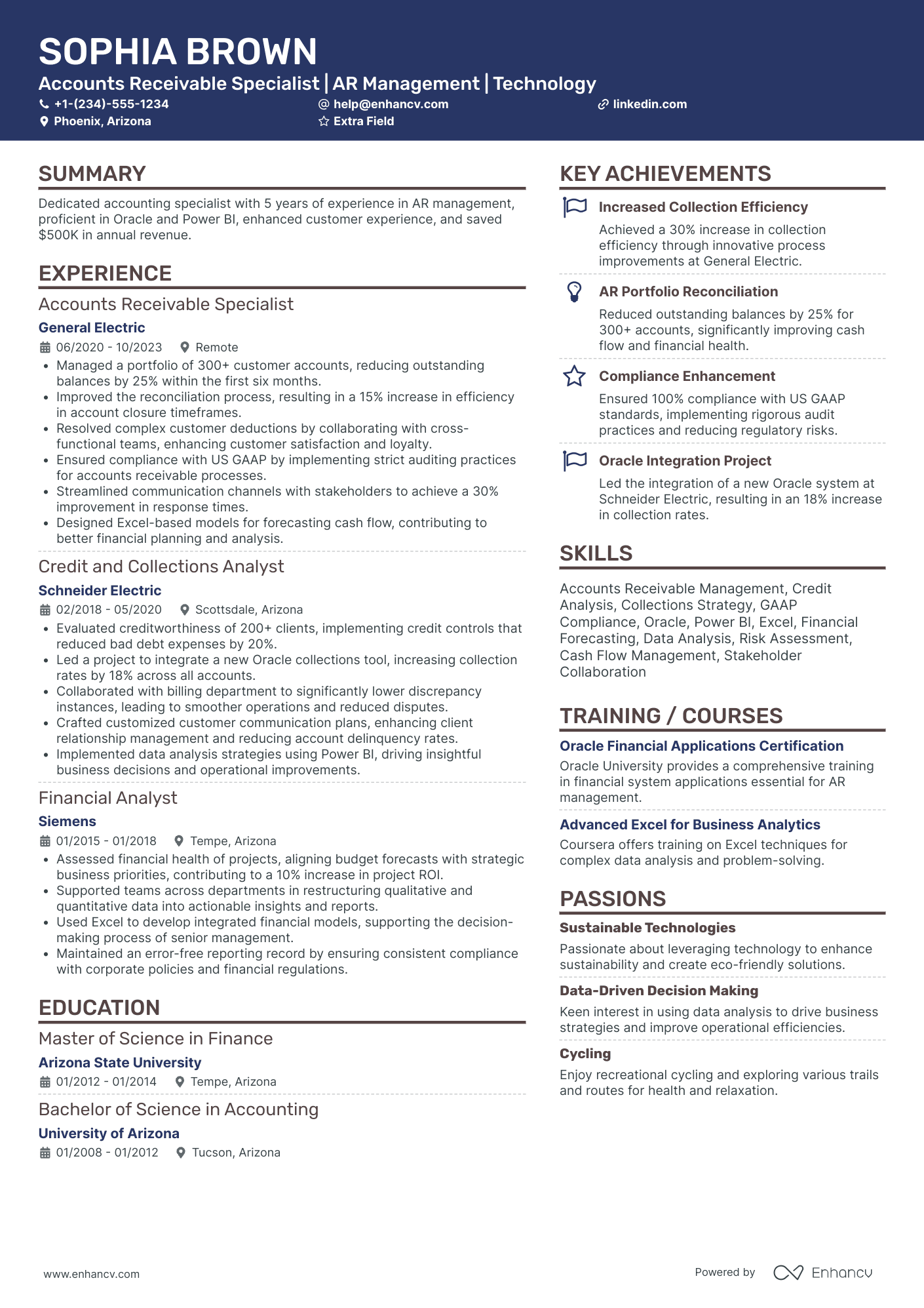

The below accounts receivable resume examples can help guide you to curate your professional experience, following industry-leading tips and advice.

- Managed a portfolio of over 500 client accounts, consistently maintaining a 98% rate for on-time collections, thus enhancing cash flow for the company.

- Implemented a new automated billing system that reduced invoice errors by 35% and increased overall team efficiency.

- Negotiated payment plans with delinquent accounts, successfully recovering more than $2 million in outstanding receivables.

- Reconciled daily AR transactions, maintaining accurate ledgers across various currencies for a global financial service company.

- Collaborated cross-departmentally to resolve billing discrepancies, resulting in a 15% reduction in disputed invoices.

- Provided comprehensive monthly reports on account statuses, critical for executive decision-making and fiscal strategy revisions.

- Streamlined the collections process, reducing the average Days Sales Outstanding (DSO) from 45 to 30 days.

- Developed and maintained strong relationships with key clients, leading to a 20% decrease in late payments.

- Oversaw the successful implementation of credit management software, enhancing the accuracy of credit risk assessments.

- Initiated a client education program on best billing practices which expedited payment times by 25%.

- Played a key role in the transition to a paperless AR system, cutting physical mail processing time by 50%.

- Prepared detailed financial forecasts, contributing to the company's strategic planning and short-term resource allocation.

- Instrumental in reducing the bad debt reserve by 40% through improved collection strategies and meticulous credit checks.

- Efficiently managed an AR ledger of over $50 million while ensuring compliance with all financial regulations.

- Directed a team of 10 AR associates, fostering a collaborative environment that prioritized skill development and effective communication.

- Performed in-depth financial analysis on accounts receivable trends, identifying patterns that informed policy changes reducing charge-offs by 30%.

- Championed a customer relationship management initiative that improved client satisfaction scores by 10%.

- Coordinated with the sales department to align credit and billing policies, which helped to increase sales closure rates by 5% without increasing financial risk.

- Reduced errors in invoice processing by 22% through meticulous oversight and the introduction of quality control measures.

- Fostered a culture of continuous improvement leading to the adoption of optimized AR practices that sped up invoice-to-cash cycles.

- Promoted from within the department due to exemplary performance and leadership, elevating the overall team's productivity by 15%.

- Led a project for the integration of AR functionalities with the CRM system, leading to a 20% increase in dispute resolution efficiency.

- Oversaw audit preparations for the AR department, ensuring 100% compliance with internal and external reporting standards.

- Trained and mentored new hires on AR processes and software, leading to a decrease in training time by 30%.

Quantifying impact on your resume

- Managed a portfolio of 200+ accounts amounting to $5 million in receivables.

- Reduced average days sales outstanding (DSO) by 15% through improved collection processes.

- Increased cash flow by implementing more stringent credit checks, reducing bad debt by 25%.

- Processed an average of 300 invoices per month with a 99% accuracy rate.

- Improved customer satisfaction scores by 20% by developing a streamlined dispute resolution process.

- Achieved a 90% rate of on-time payments through effective account monitoring and reminder systems.

- Conducted monthly reconciliation of accounts receivable ledger, resolving discrepancies worth over $100K.

- Coordinated with sales and customer service departments to introduce a loyalty program that increased repeat business by 30%.

Action verbs for your accounts receivable resume

Writing your accounts receivable experience section without any real-world experience

Professionals, lacking experience, here's how to kick-start your accounts receivable career:

- Substitute experience with relevant knowledge and skills, vital for the accounts receivable role

- Highlight any relevant certifications and education - to showcase that you have the relevant technical training for the job

- Definitely include a professional portfolio of your work so far that could include university projects or ones you've done in your free time

- Have a big focus on your transferable skills to answer what further value you'd bring about as a candidate for the accounts receivable job

- Include an objective to highlight how you see your professional growth, as part of the company

Recommended reads:

PRO TIP

If you failed to obtain one of the certificates, as listed in the requirements, but decide to include it on your resume, make sure to include a note somewhere that you have the "relevant training, but are planning to re-take the exams". Support this statement with the actual date you're planning to be re-examined. Always be honest on your resume.

The heart and soul of your accounts receivable resume: hard skills and soft skills

If you read between the lines of the accounts receivable role you're applying for, you'll discover that all requirements are linked with candidates' hard skills and soft skills.

What do those skills have to do with your application?

Hard or technical skills are the ones that hint at your aptitude with particular technologies. They are easy to quantify via your professional experience or various certifications.

Meanwhile, your soft skills are more difficult to assess as they are personality traits, you've gained thanks to working in different environments/teams/organizations.

Your accounts receivable resume skills section is the perfect opportunity to shine a light on both types of skills by:

- Dedicating a technical skills section to list up to six technologies you're apt at.

- Focusing a strengths section on your achievements, thanks to using particular people skills or technologies.

- Including a healthy balance of hard and soft skills in the skills section to answer key job requirements.

- Creating a language skills section with your proficiency level - to hint at an abundance of soft skills you've obtained, thanks to your dedication to learning a particular language.

Within the next section of this guide, stay tuned for some of the most trending hard skills and soft skills across the industry.

Top skills for your accounts receivable resume:

Accounts Receivable Software (e.g., QuickBooks, SAP)

Excel (Advanced)

Data Entry

Invoicing Systems

Payment Processing Tools

Financial Reporting

Bank Reconciliation

Credit Management Software

Database Management

Billing Systems

Attention to Detail

Time Management

Communication Skills

Problem-Solving

Analytical Thinking

Customer Service Orientation

Team Collaboration

Adaptability

Organizational Skills

Conflict Resolution

PRO TIP

List all your relevant higher education degrees within your resume in reverse chronological order (starting with the latest). There are cases when your PhD in a particular field could help you stand apart from other candidates.

Qualifying your relevant certifications and education on your accounts receivable resume

In recent times, employers have started to favor more and more candidates who have the "right" skill alignment, instead of the "right" education.

But this doesn't mean that recruiters don't care about your certifications .

Dedicate some space on your resume to list degrees and certificates by:

- Including start and end dates to show your time dedication to the industry

- Adding credibility with the institutions' names

- Prioritizing your latest certificates towards the top, hinting at the fact that you're always staying on top of innovations

- If you decide on providing further information, focus on the actual outcomes of your education: the skills you've obtained

If you happen to have a degree or certificate that is irrelevant to the job, you may leave it out.

Some of the most popular certificates for your resume include:

The top 5 certifications for your accounts receivable resume:

- Certified accounts receivable Professional (CARP) - The Institute of Financial Operations

- Certified Bookkeeper (CB) - American Institute of Professional Bookkeepers

- Certified Public Accountant (CPA) - American Institute of CPAs

- Certified Management Accountant (CMA) - Institute of Management Accountants

- Credit Business Associate (CBA) - National Association of Credit Management

PRO TIP

List your educational qualifications and certifications in reverse chronological order.

Recommended reads:

Should you write a resume summary or an objective?

No need to research social media or ask ChatGPT to find out if the summary or objective is right for your accounts receivable resume.

- Experienced candidates always tend to go for resume summaries. The summary is a three to five sentence long paragraph that narrates your career highlights and aligns your experience to the role. In it you can add your top skills and career achievements that are most impressive.

- Junior professionals or those making a career change, should write a resume objective. These shouldn't be longer than five sentences and should detail your career goals . Basically, how you see yourself growing in the current position and how would your experience or skill set could help out your potential employers.

Think of both the resume summary and objective as your opportunity to put your best foot forward - from the get go - answering job requirements with skills.

Use the below real-world accounts receivable professional statements as inspiration for writing your resume summary or objective.

Resume summaries for a accounts receivable job

- Seasoned accounts receivable Specialist with over 10 years of experience managing high-volume invoicing, maintaining an exceptional record of accurate and timely collections, and leading cross-departmental collaboration to improve cash flow processes. Spearheaded the reduction of outstanding receivables by 20% at a top-tier retail chain through strategic negotiations and persistent follow-up.

- Experienced Certified Public Accountant transitioning into accounts receivable, bringing 12 years of comprehensive financial management and auditing skills. Boasts a track record of enhancing revenue assurance practices by identifying and rectifying discrepancies that resulted in a 15% boost in revenue recognition for a prominent financial services firm.

- Human Resources professional pivoting into accounts receivable, offering a robust understanding of payroll systems and employee reimbursement processes. Over 8 years in industry-leading corporations has honed exemplary organizational, communication skills and a strong acumen for numbers, eager to apply these talents to ensure meticulous financial tracking and improve receivable operations.

- Eager to leverage a Bachelor's in Finance and a passion for numbers to excel in accounts receivable management. Holds a 3-year tenure in fast-paced startup environments where rapid adaptability and keen attention to detail were key to maintaining meticulous financial records. Adept at using accounting software to streamline invoicing and receivables tracking.

- Dynamic professional eager to embark on an accounts receivable career, filled with enthusiasm to contribute to the financial robustness of a forward-thinking organization. Dedicated to mastering industry-specific financial software and regulations to ensure precision in tracking and reporting financial transactions, despite having no formal experience in the field.

- Aspiring finance specialist graduating summa cum laude, targeting an accounts receivable role to jumpstart a promising career. Ardent about translating academic knowledge including advanced math skills and fluency in accounting software into effective financial management practices. Exceptional analytical acumen with a commitment to achieving peak accuracy in tracking and handling receivables.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Taking your accounts receivable resume to the next level with these four additional resume sections

Your accounts receivable resume can feature a variety of skills (both hard and soft) in diverse sections. Choose those that align best with the job requirements and reflect your suitability for the company culture.

Consider these four additional resume sections recommended by our experts:

- Languages - State any languages you are proficient in and your level of proficiency. This demonstrates your commitment to communication and potential for international growth.

- Projects - Highlight up to three significant projects you've completed outside of work, showcasing skill development. Include a link to your project portfolio in the accounts receivable resume header, if applicable.

- My Time - How you allocate your time outside work can indicate your organizational skills and cultural fit within the company.

- Volunteering - Detail causes you're passionate about, roles you've held, and achievements in volunteering. Such experiences likely have honed a range of soft skills crucial for your dream job.

Key takeaways

At the end of our guide, we'd like to remind you to:

- Invest in a simple, modern resume design that is ATS friendly and keeps your experience organized and legible;

- Avoid just listing your responsibilities in your experience section, but rather focus on quantifiable achievements;

- Always select resume sections that are relevant to the role and can answer job requirements. Sometimes your volunteering experience could bring more value than irrelevant work experience;

- Balance your technical background with your personality traits across various sections of your resume to hint at how much time employers would have to invest in training you and if your profile would be a good cultural fit to the organization;

- Include your academic background (in the form of your relevant higher education degrees and certifications) to show recruiters that you have the technical basics of the industry covered.

Accounts Receivable resume examples

By Experience

Senior Accounts Receivable Clerk

Junior Accounts Receivable Clerk

Accounts Receivable Assistant

By Role