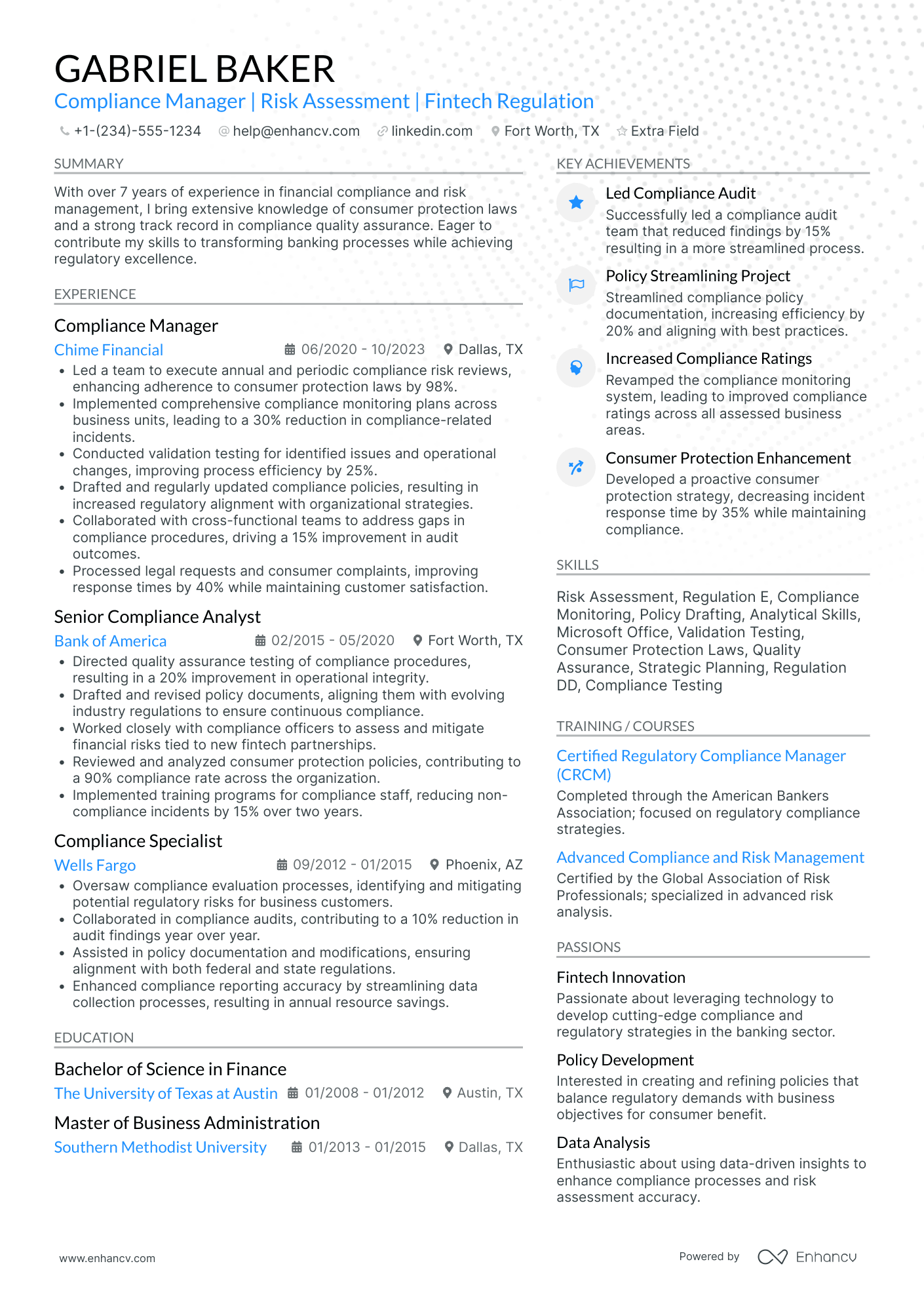

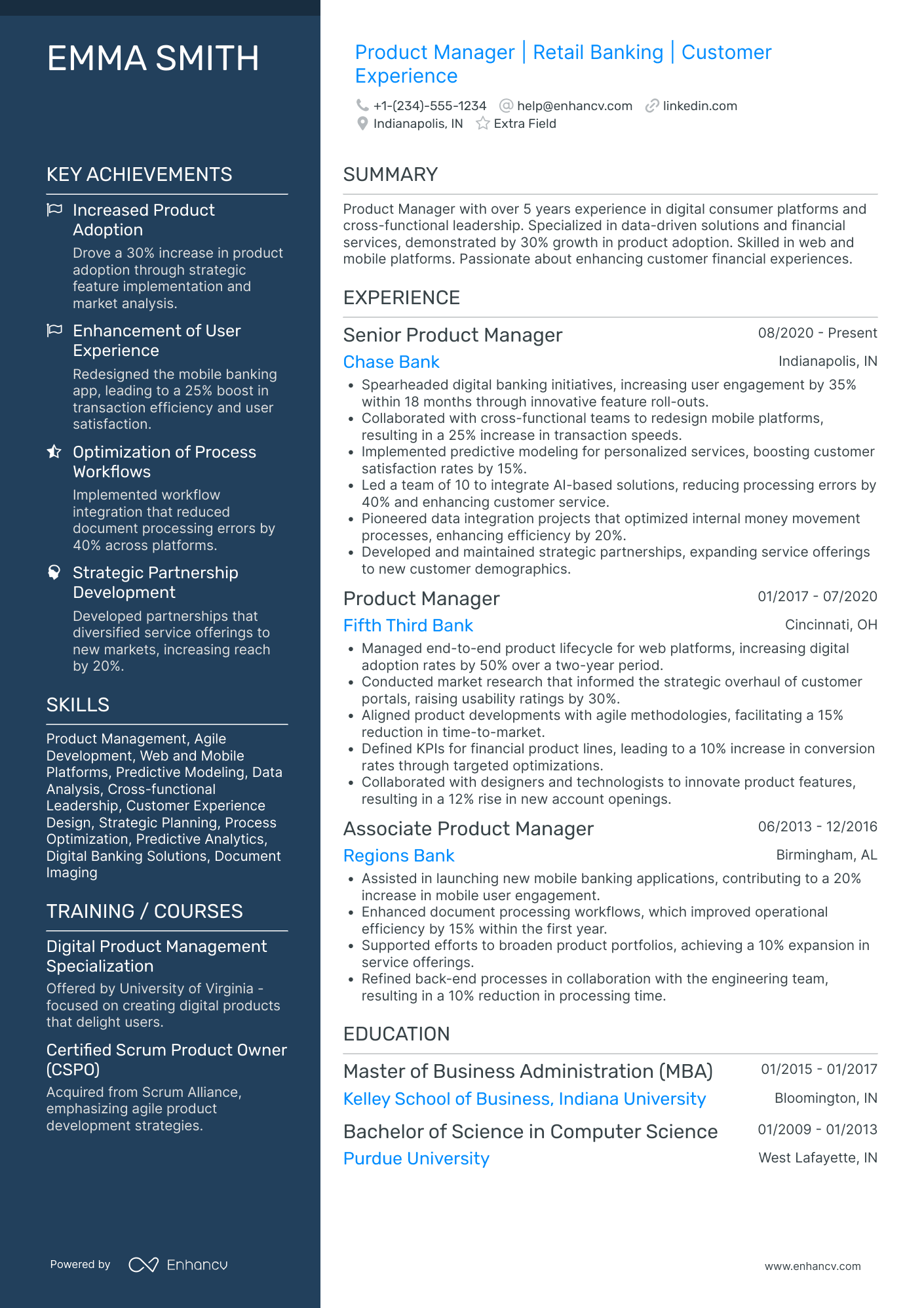

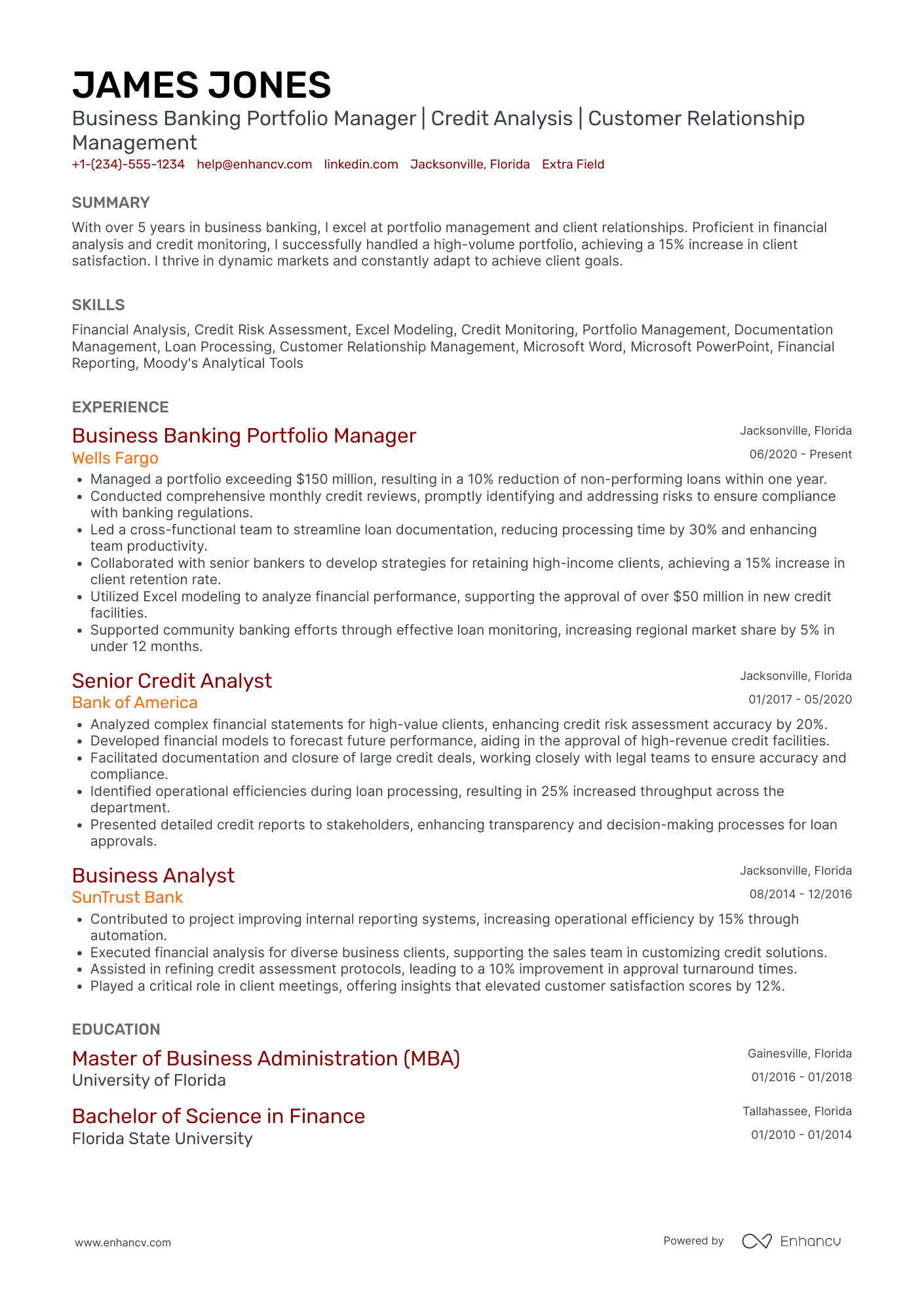

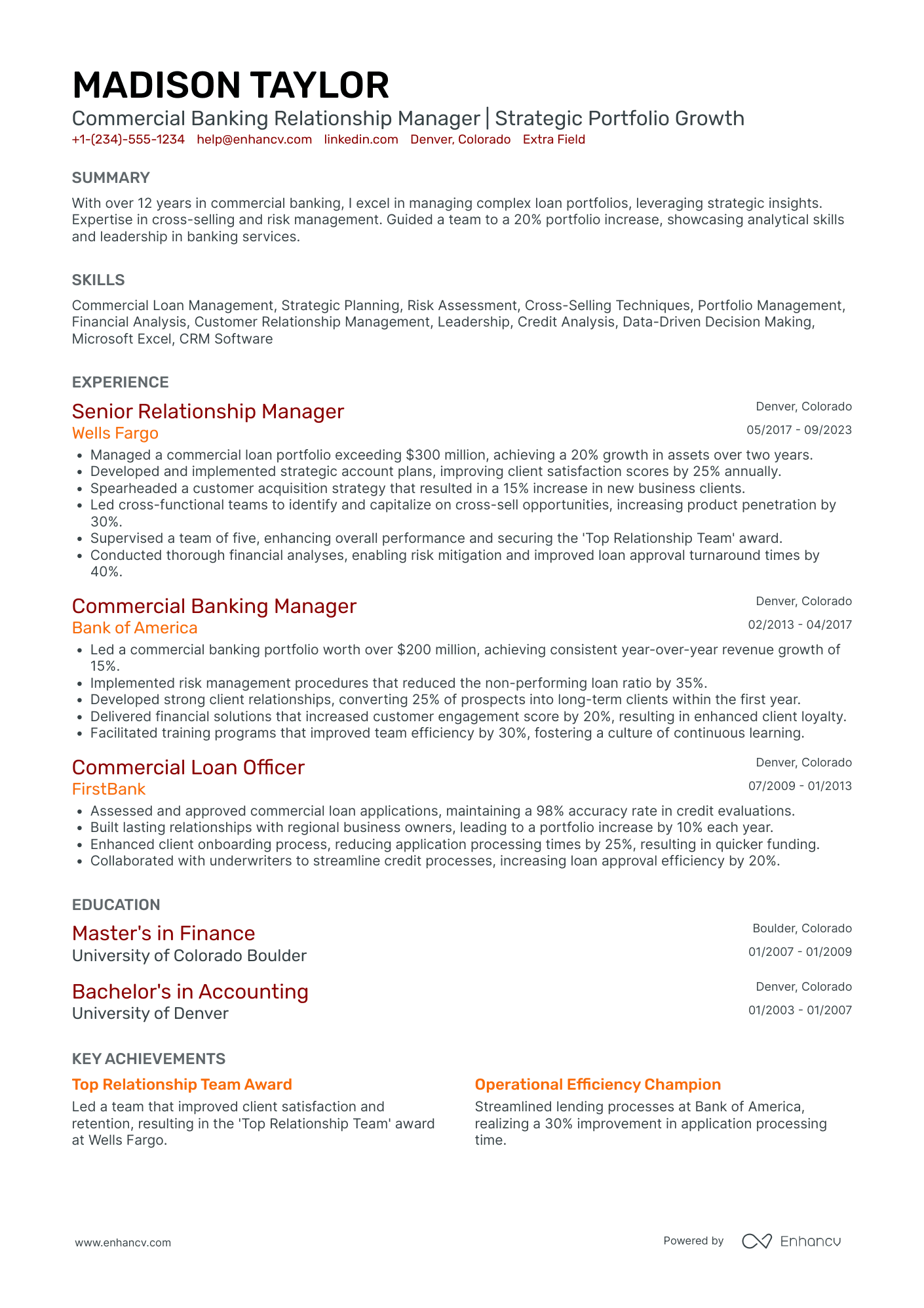

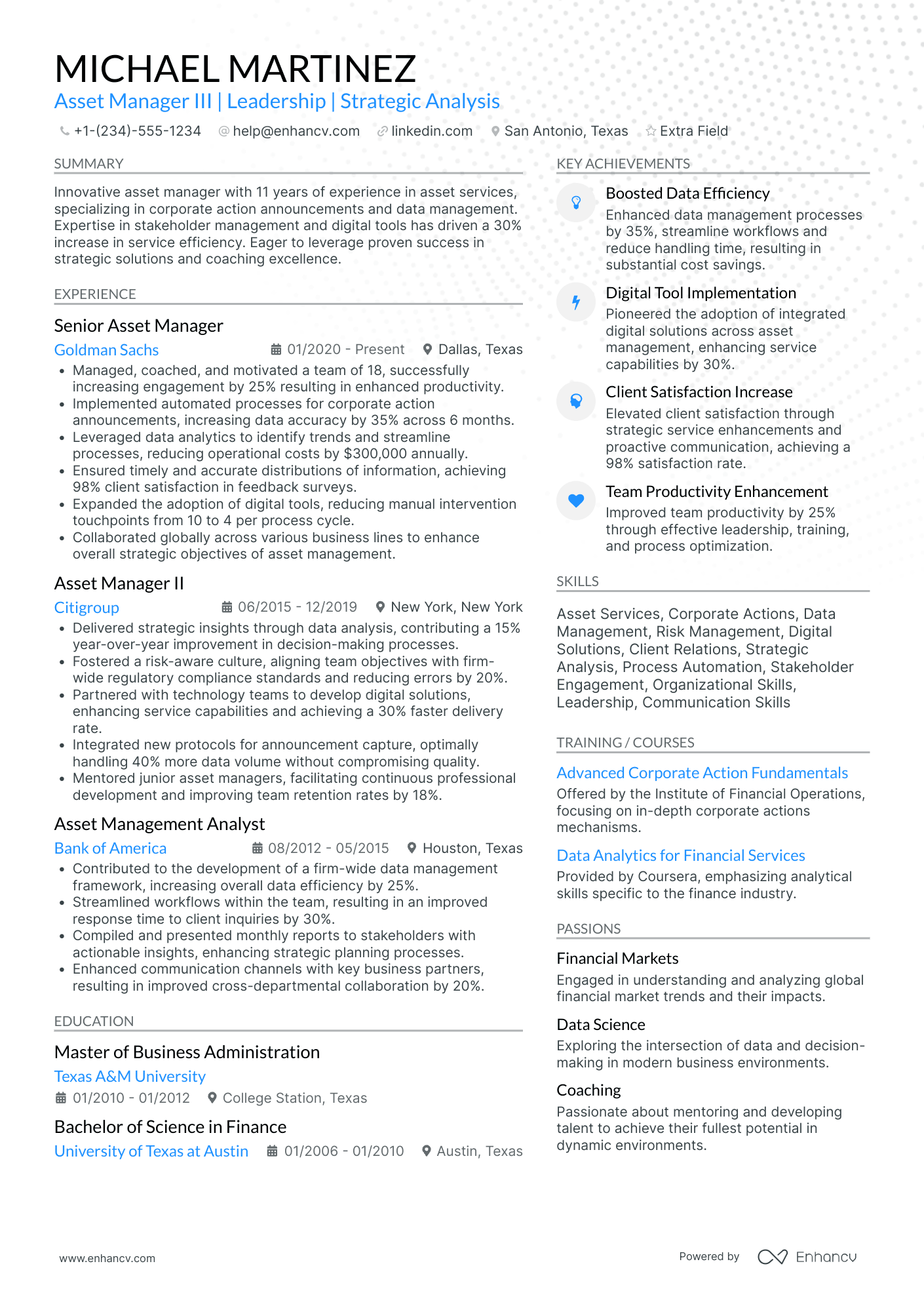

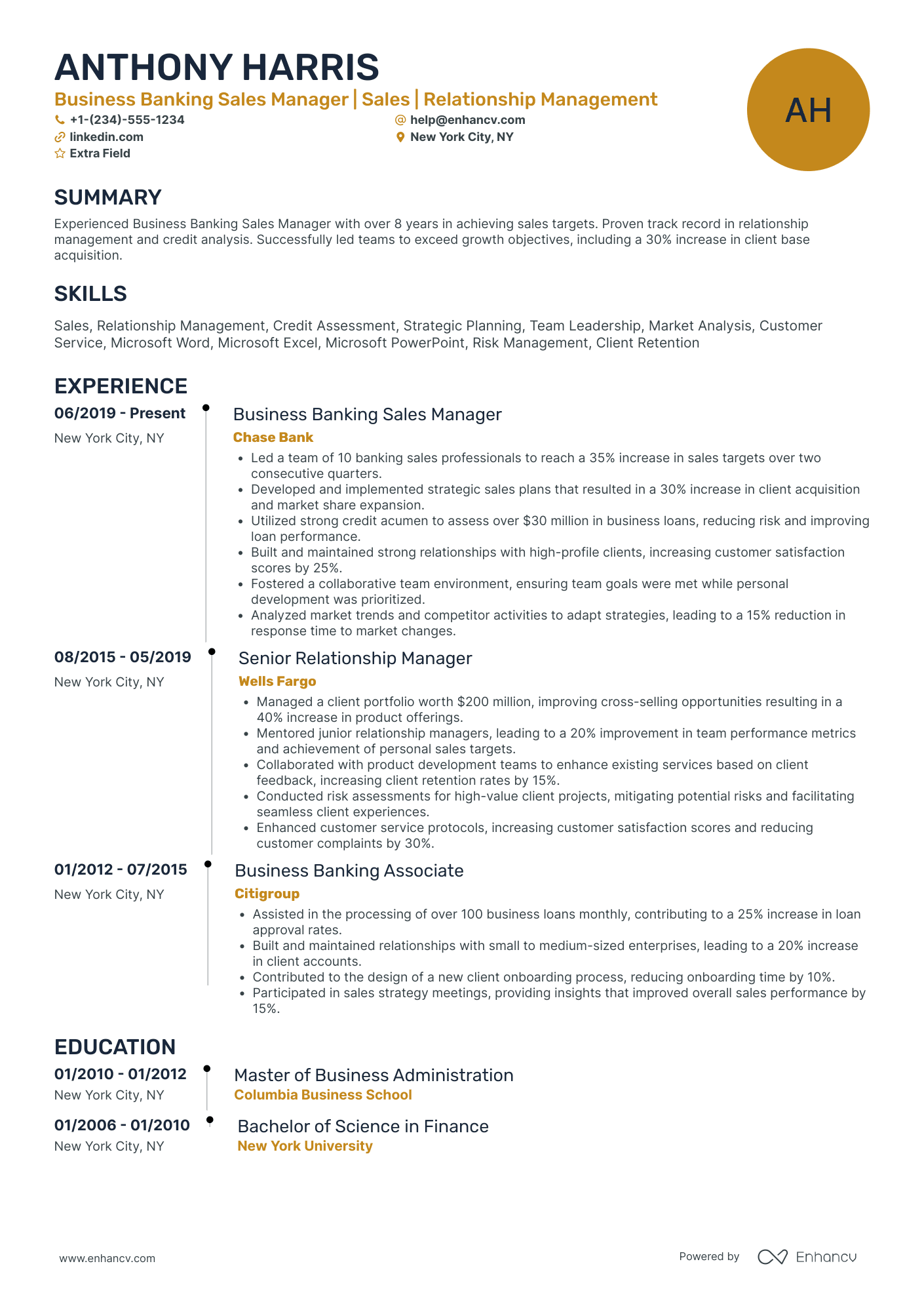

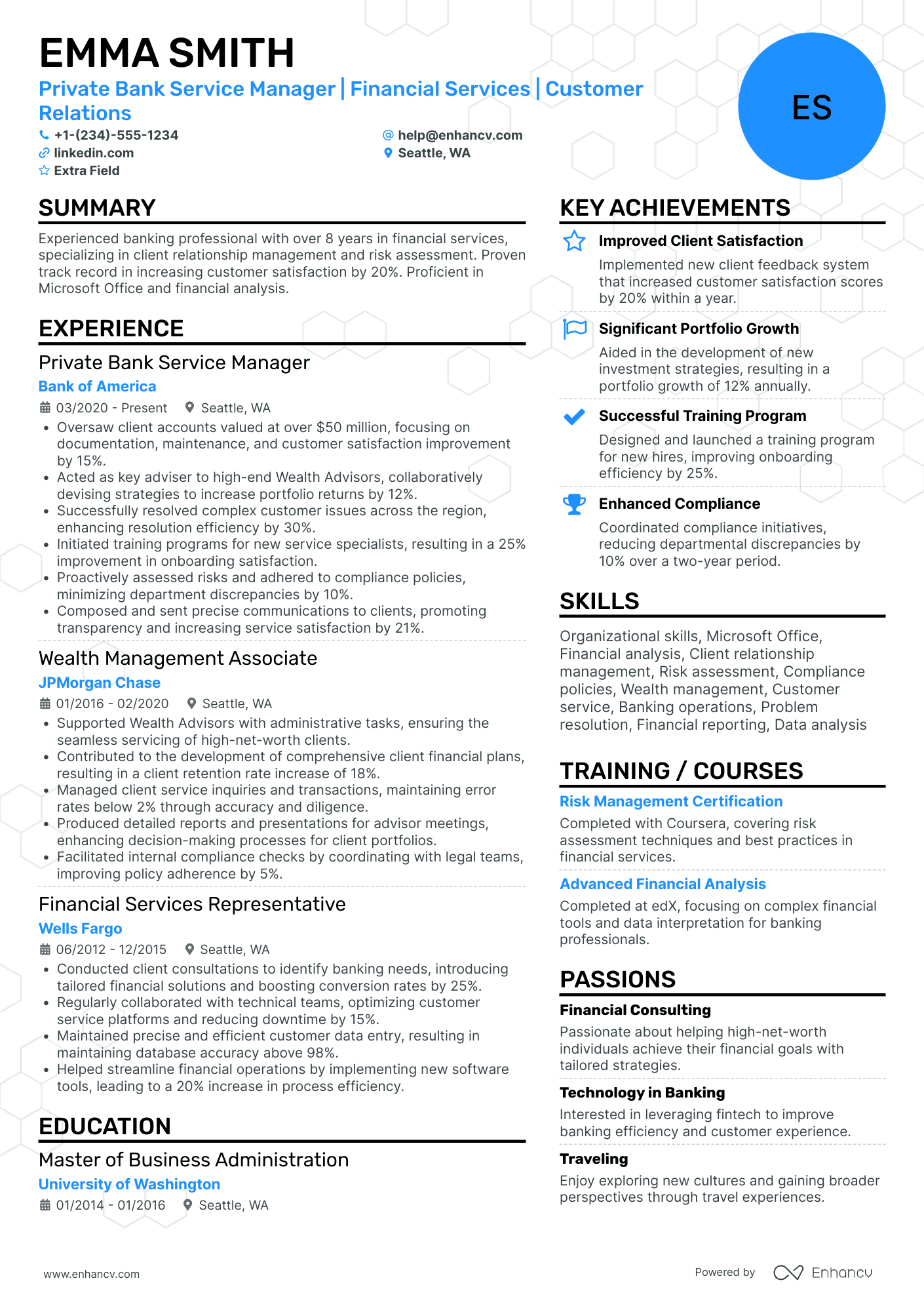

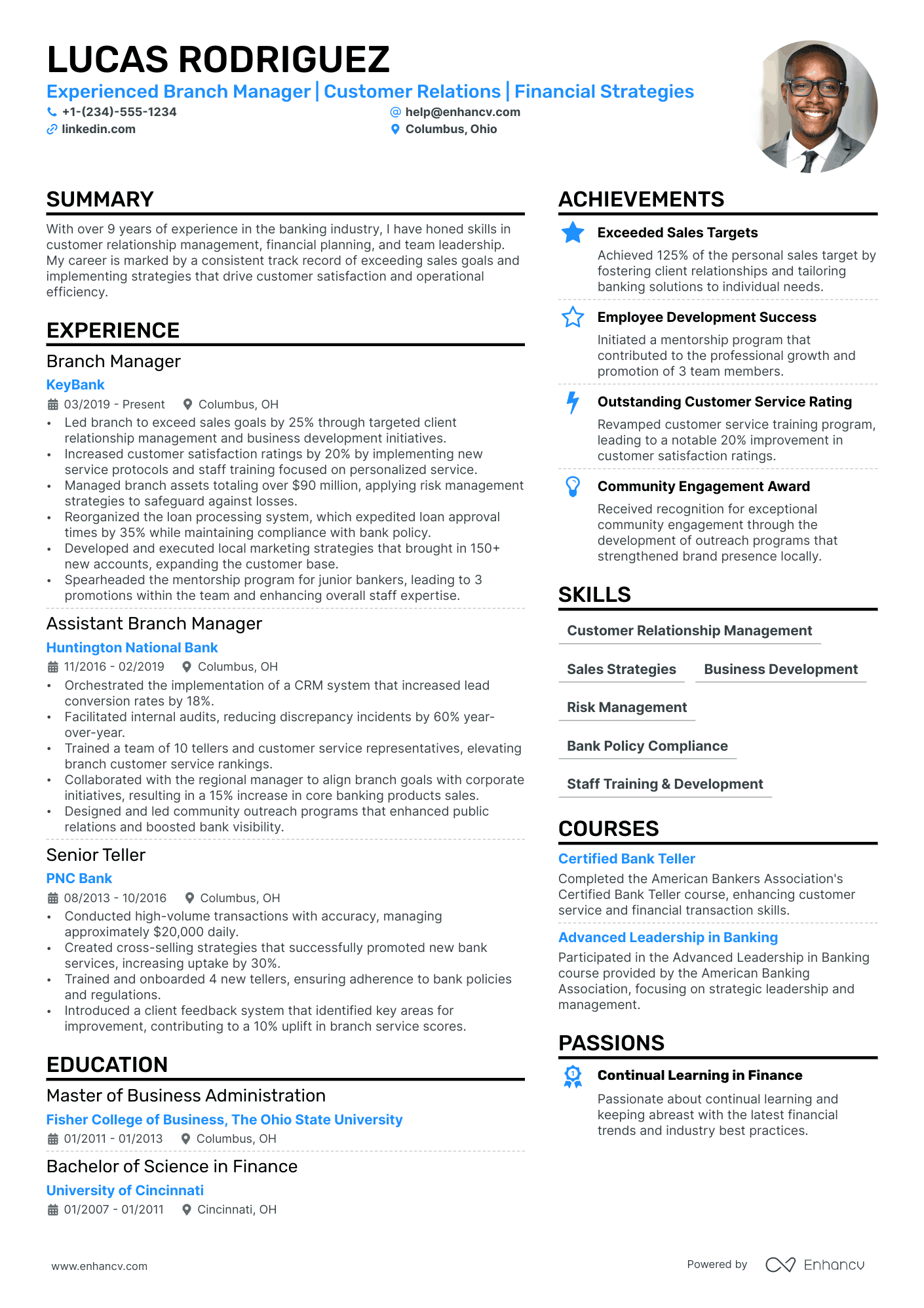

Bank Managers often find it difficult to concisely represent their extensive experience and diverse skill set on a one-page resume. Our resume examples provide clear and tailored templates that highlight critical leadership and financial management skills effectively. Explore these examples to enhance your resume's impact.

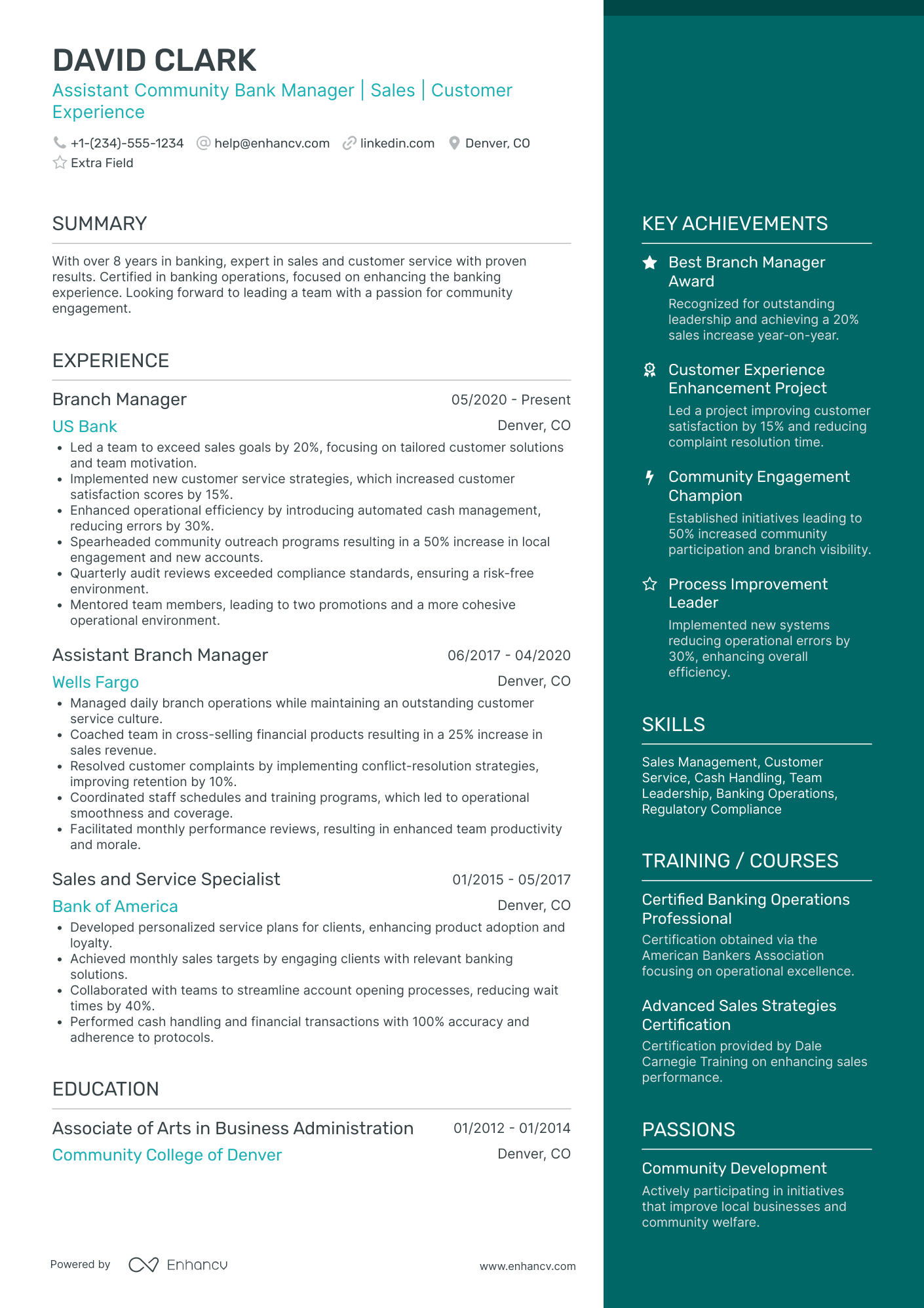

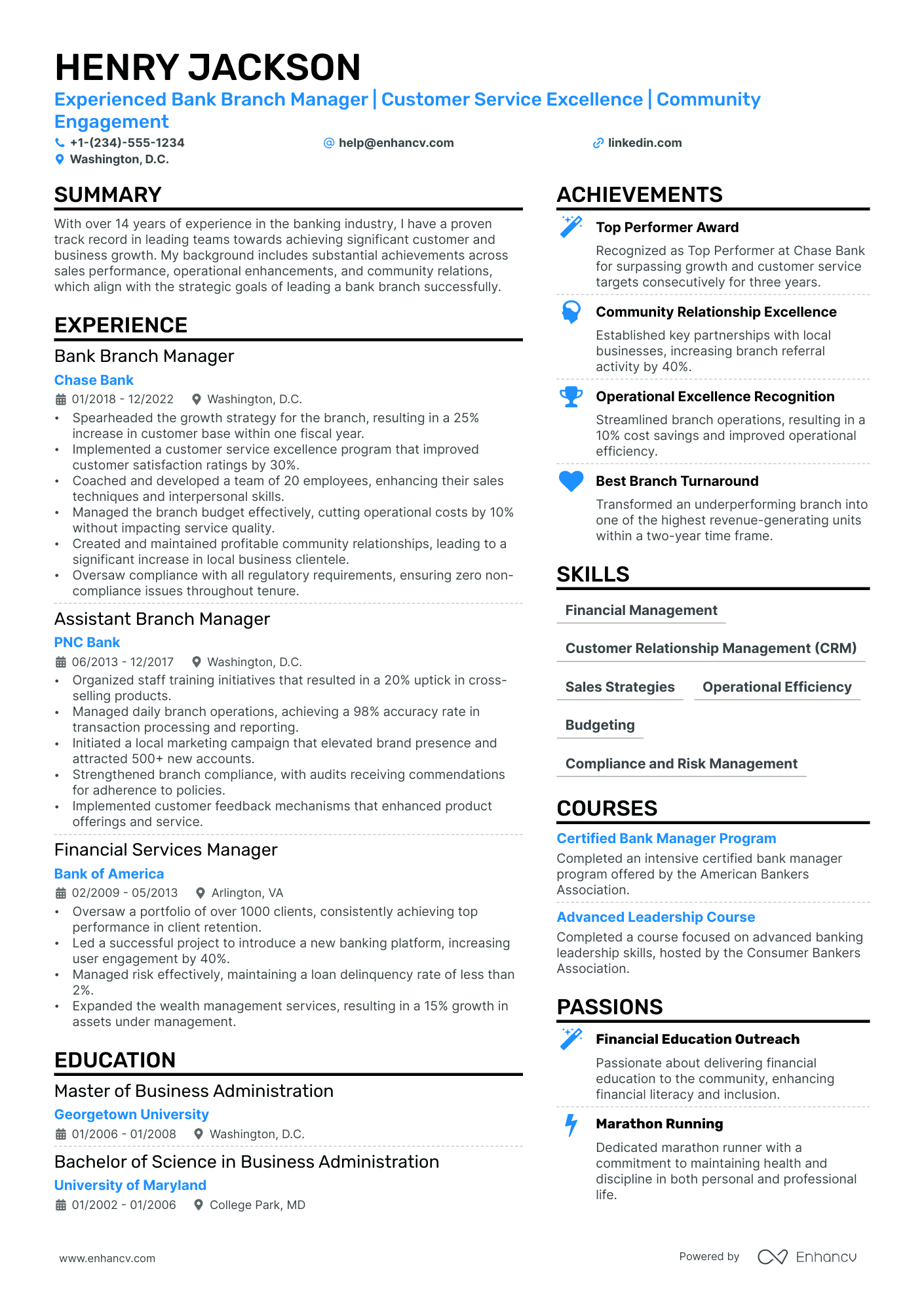

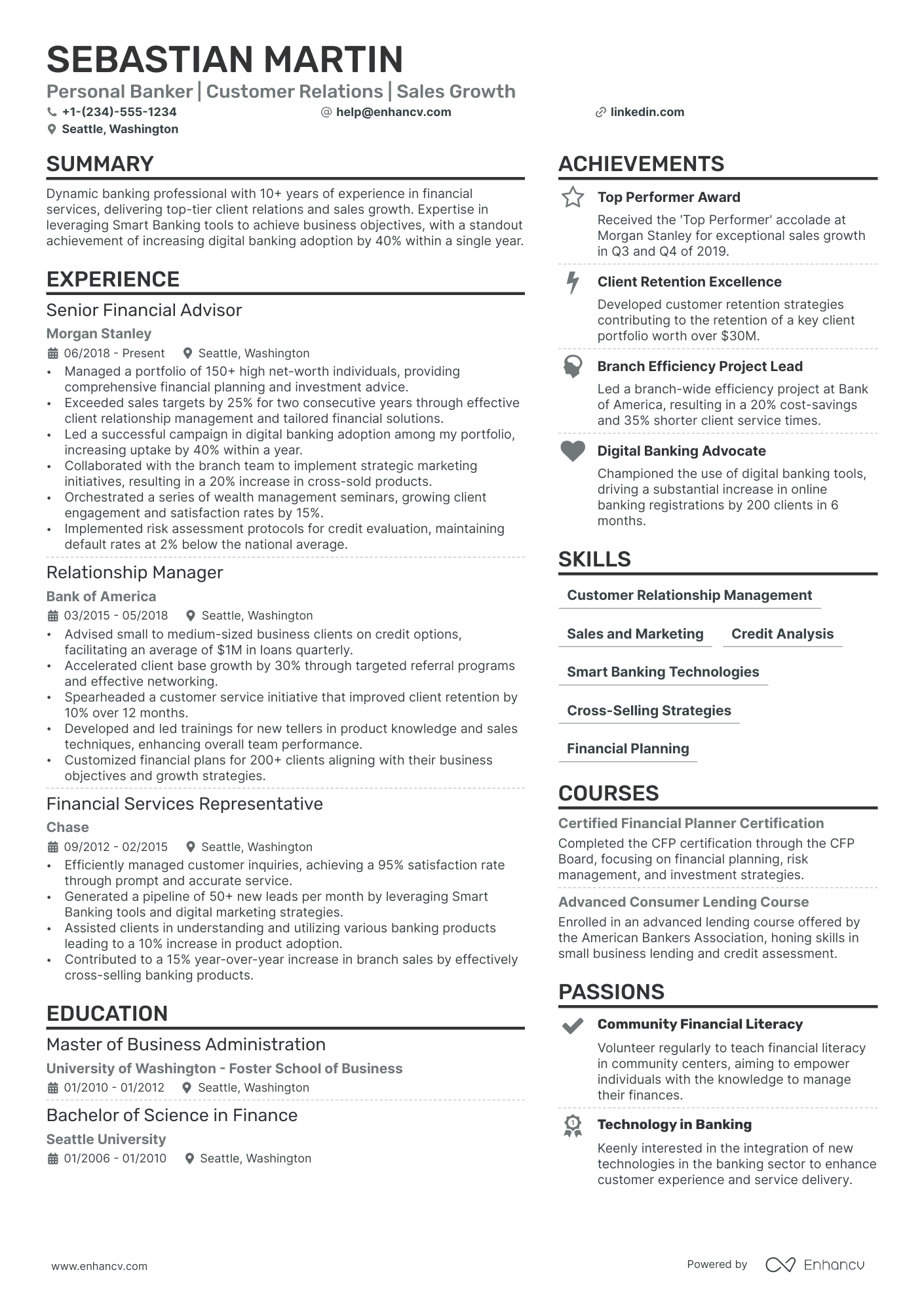

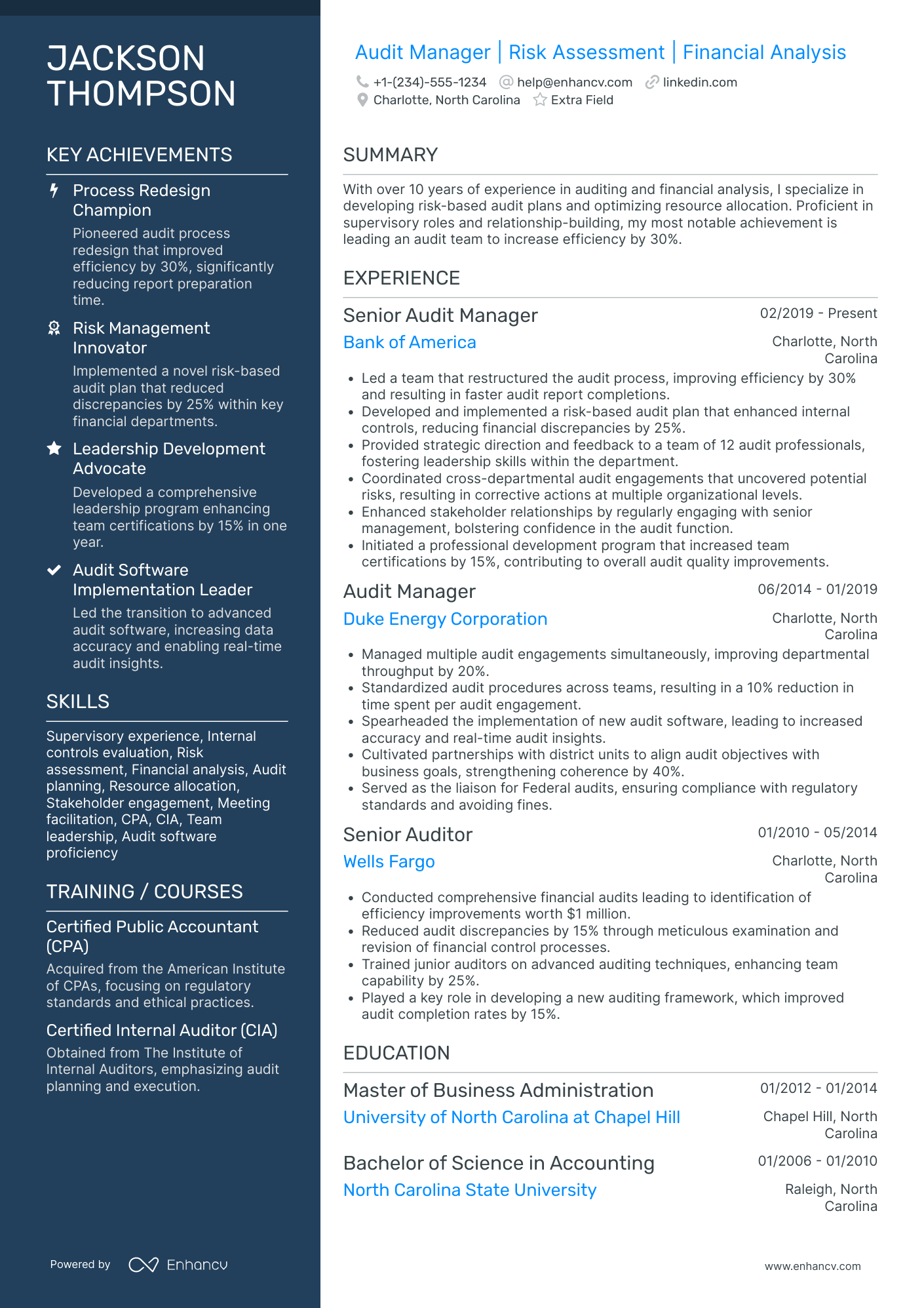

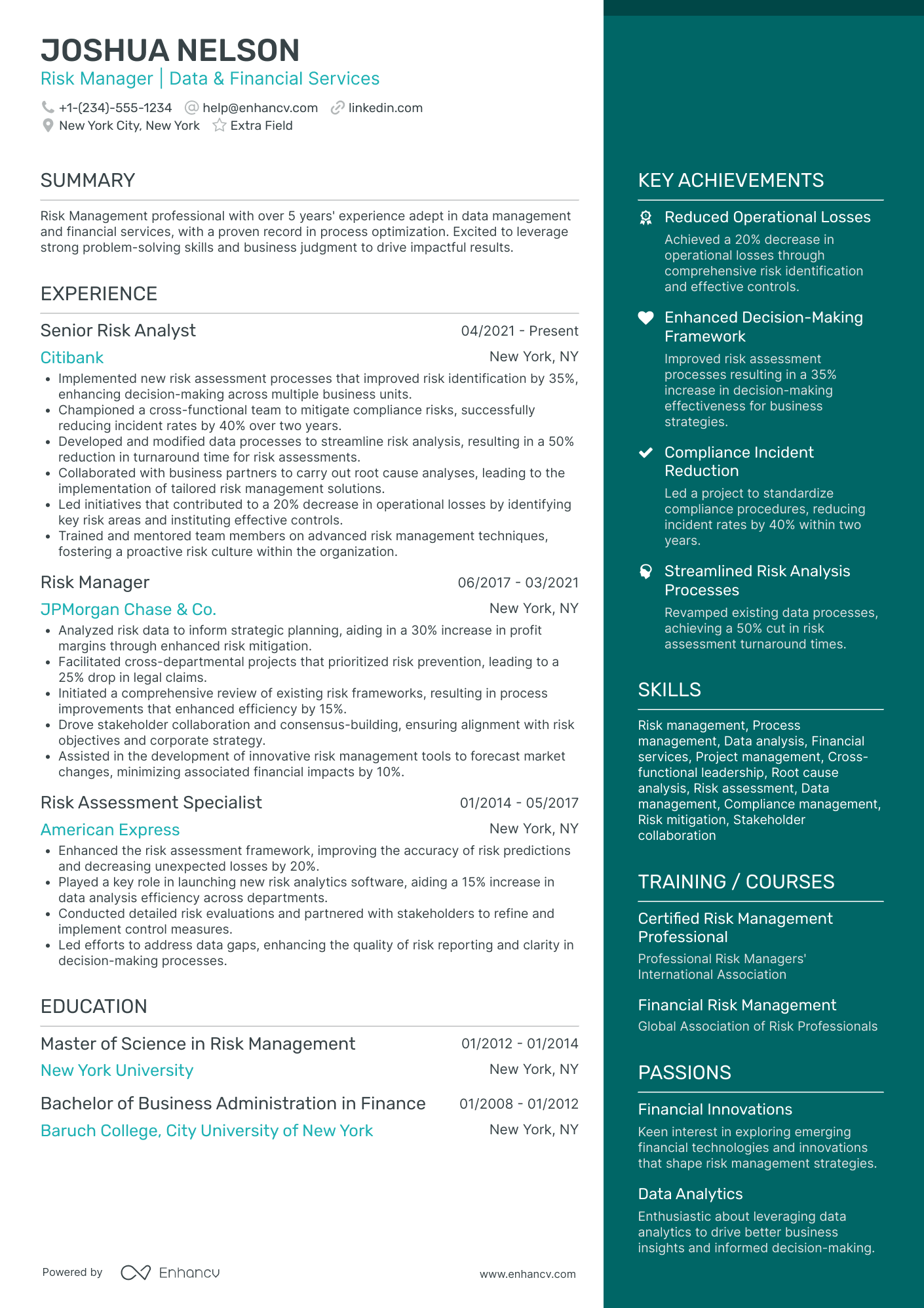

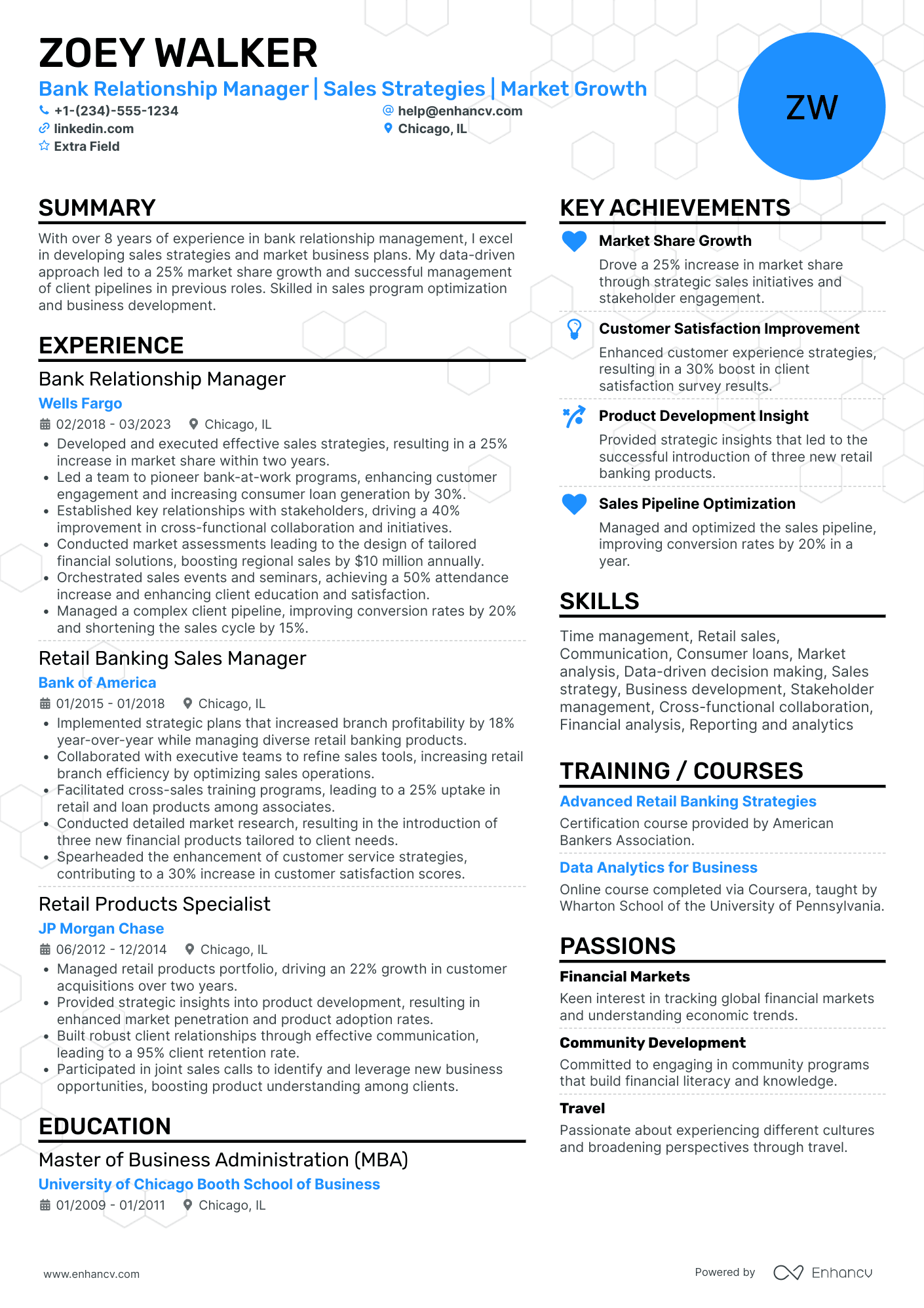

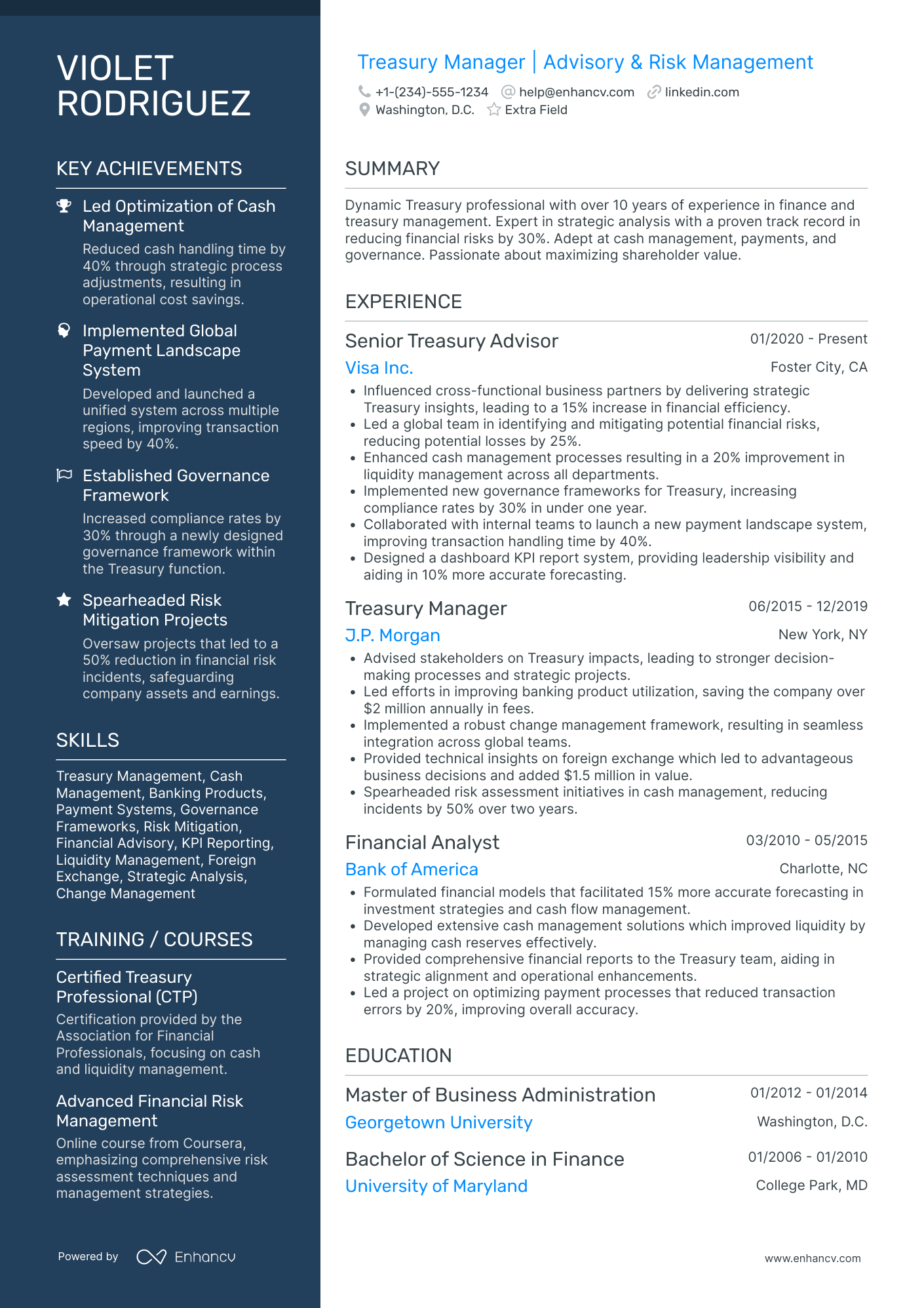

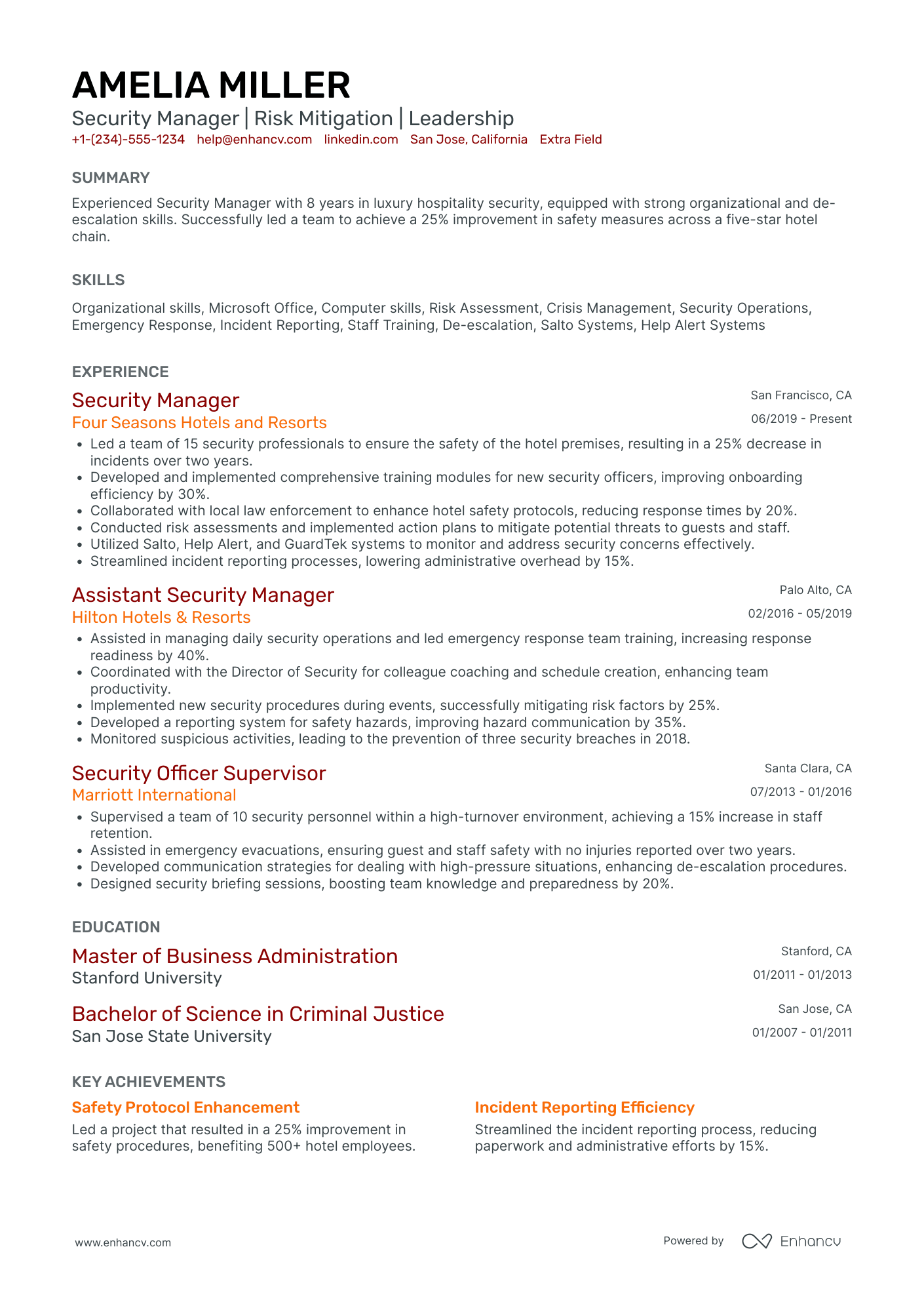

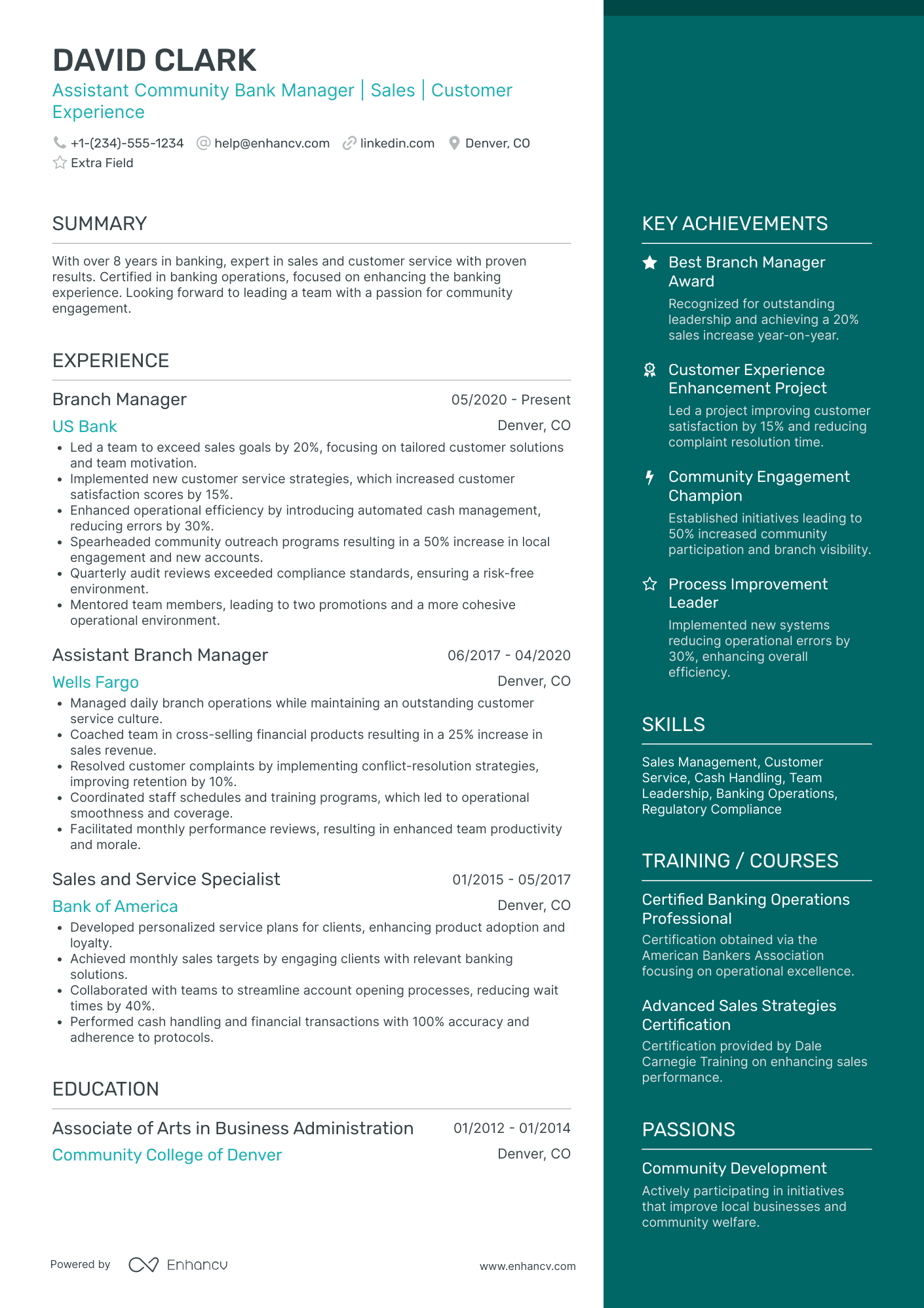

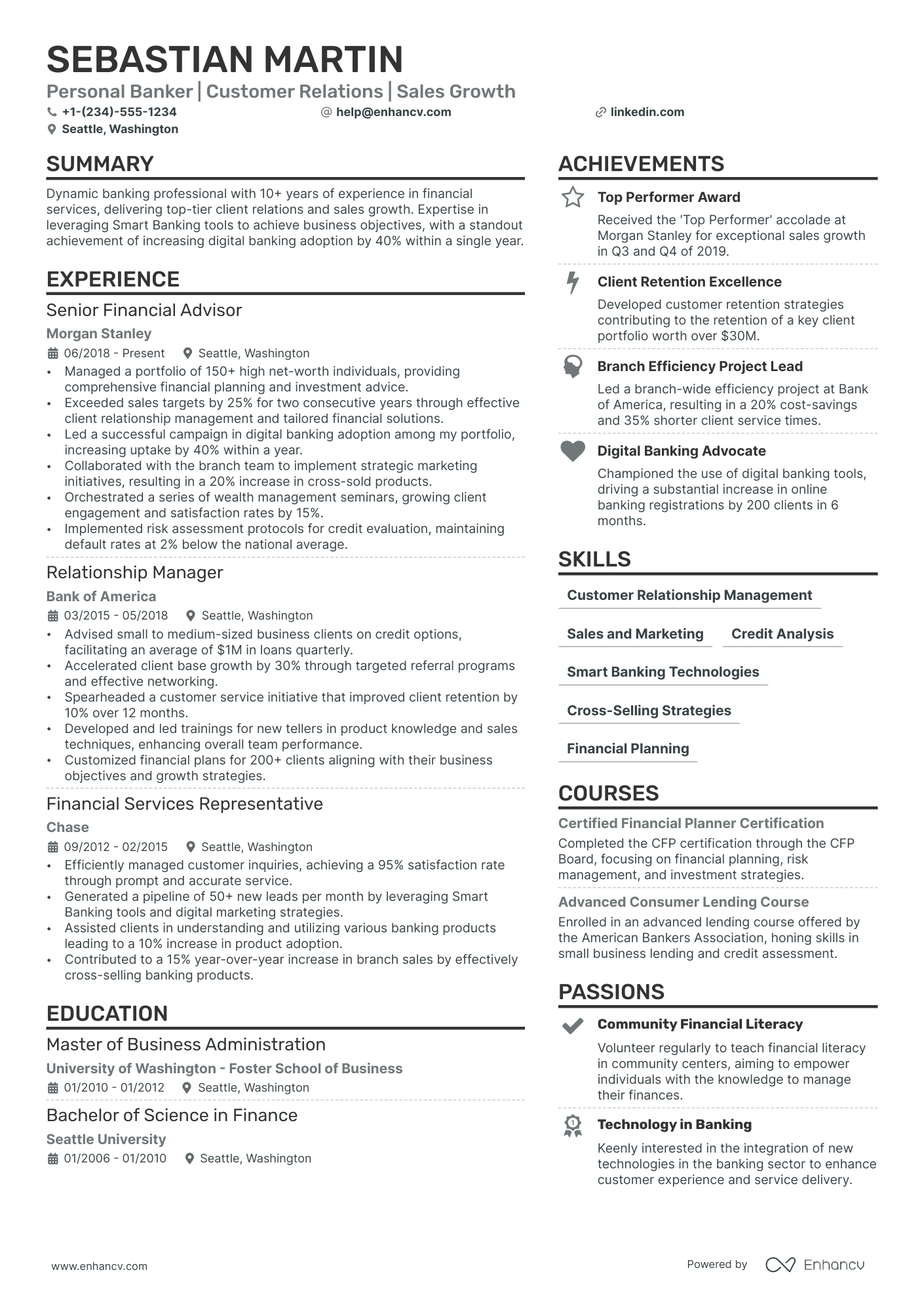

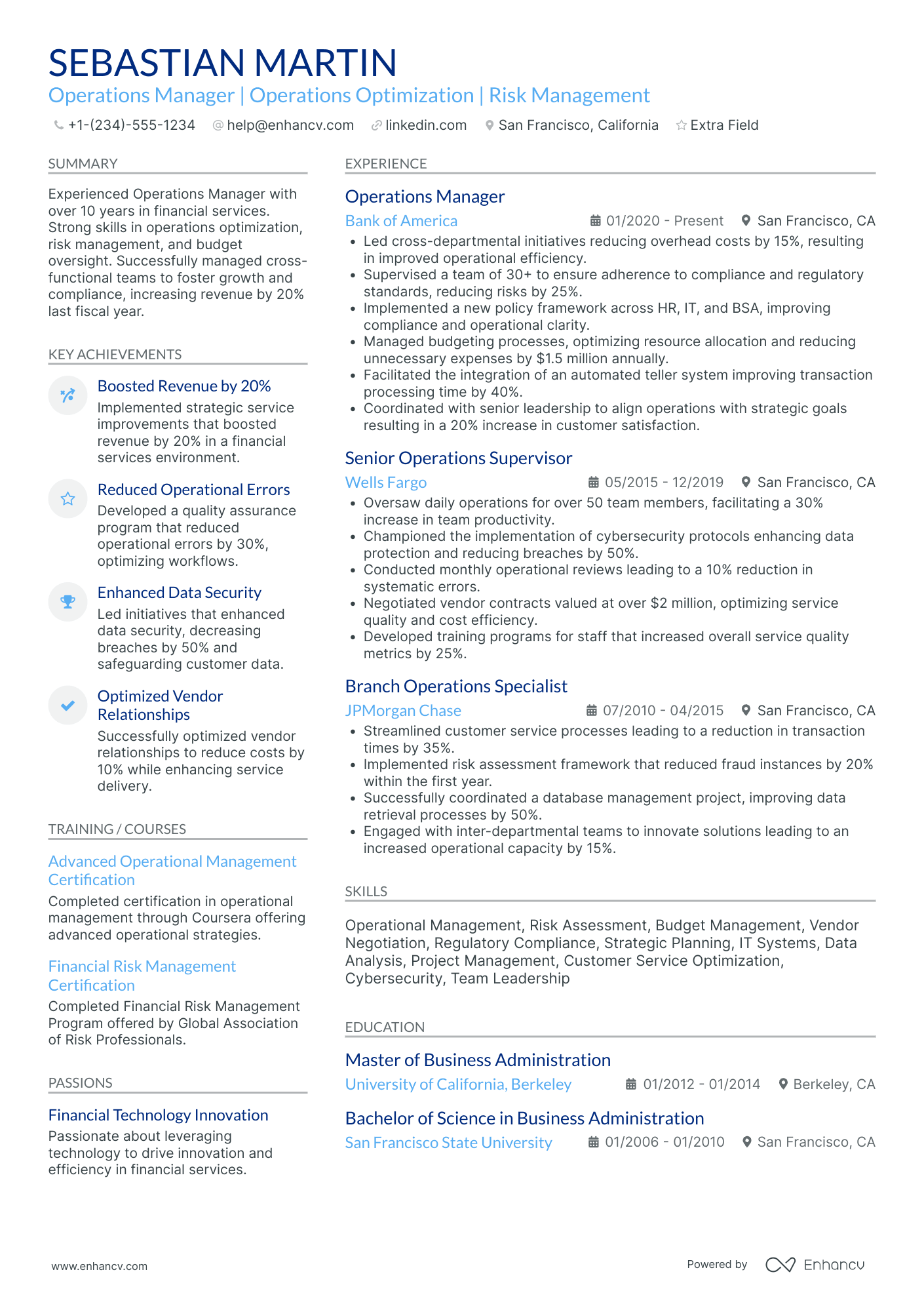

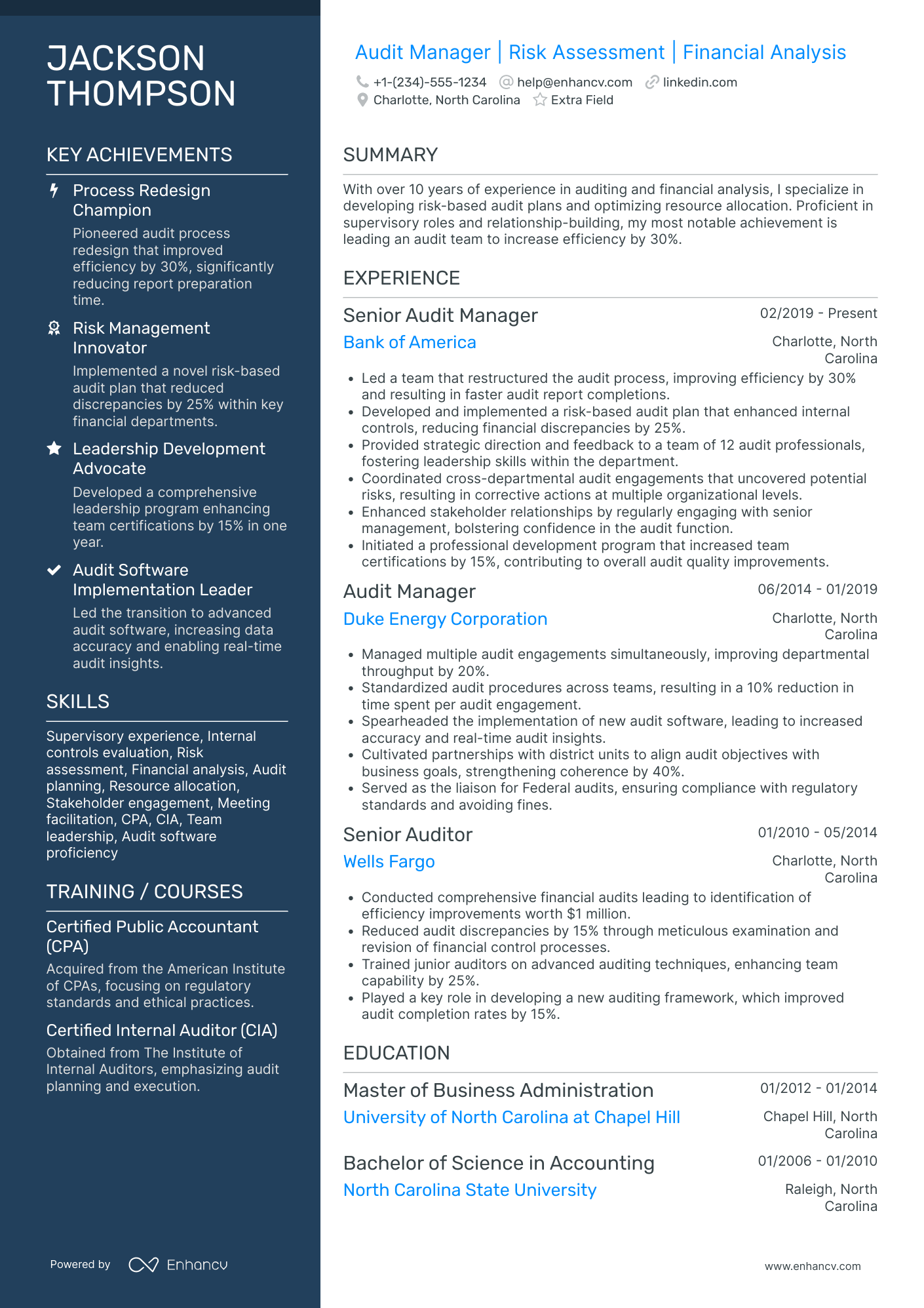

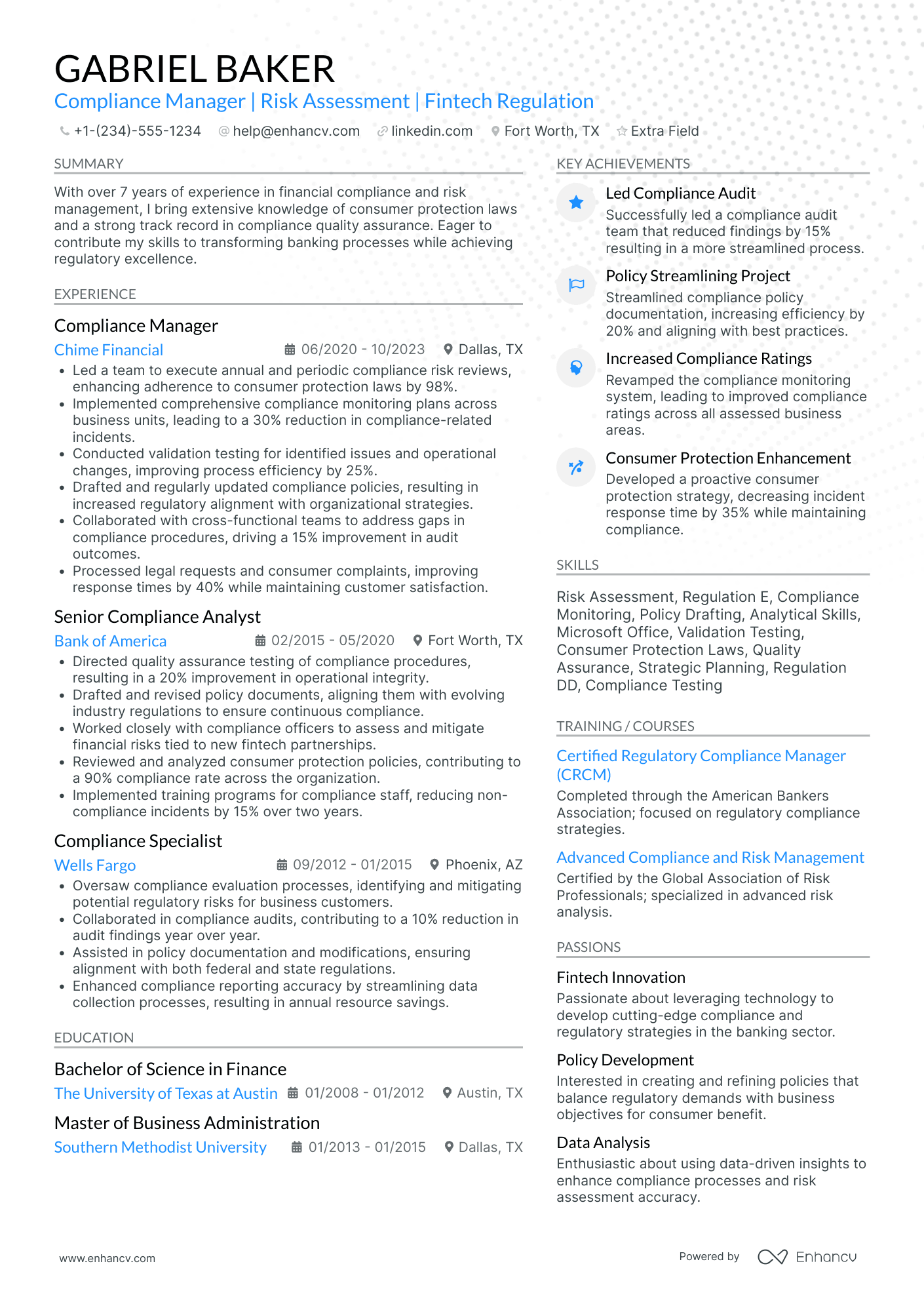

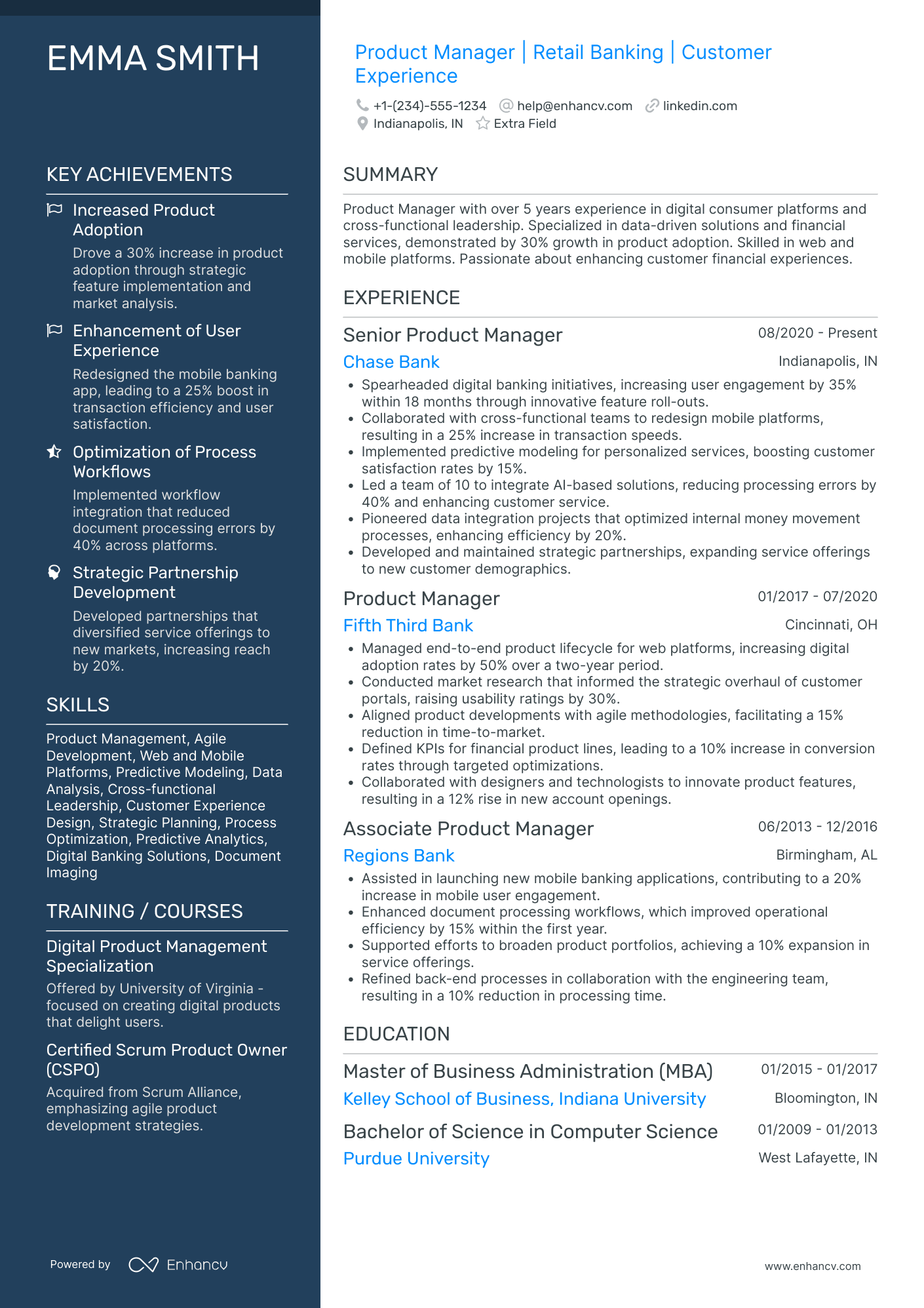

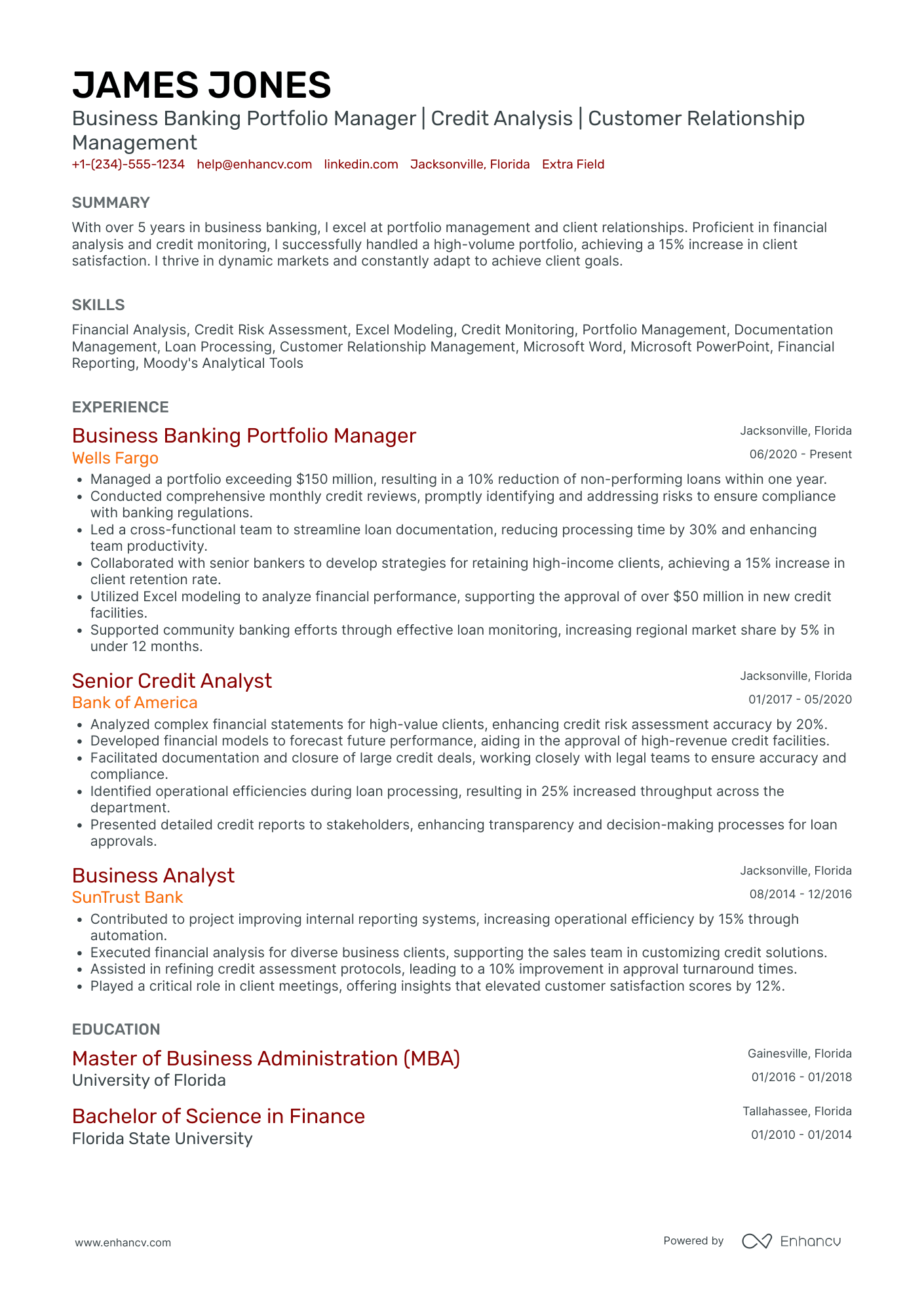

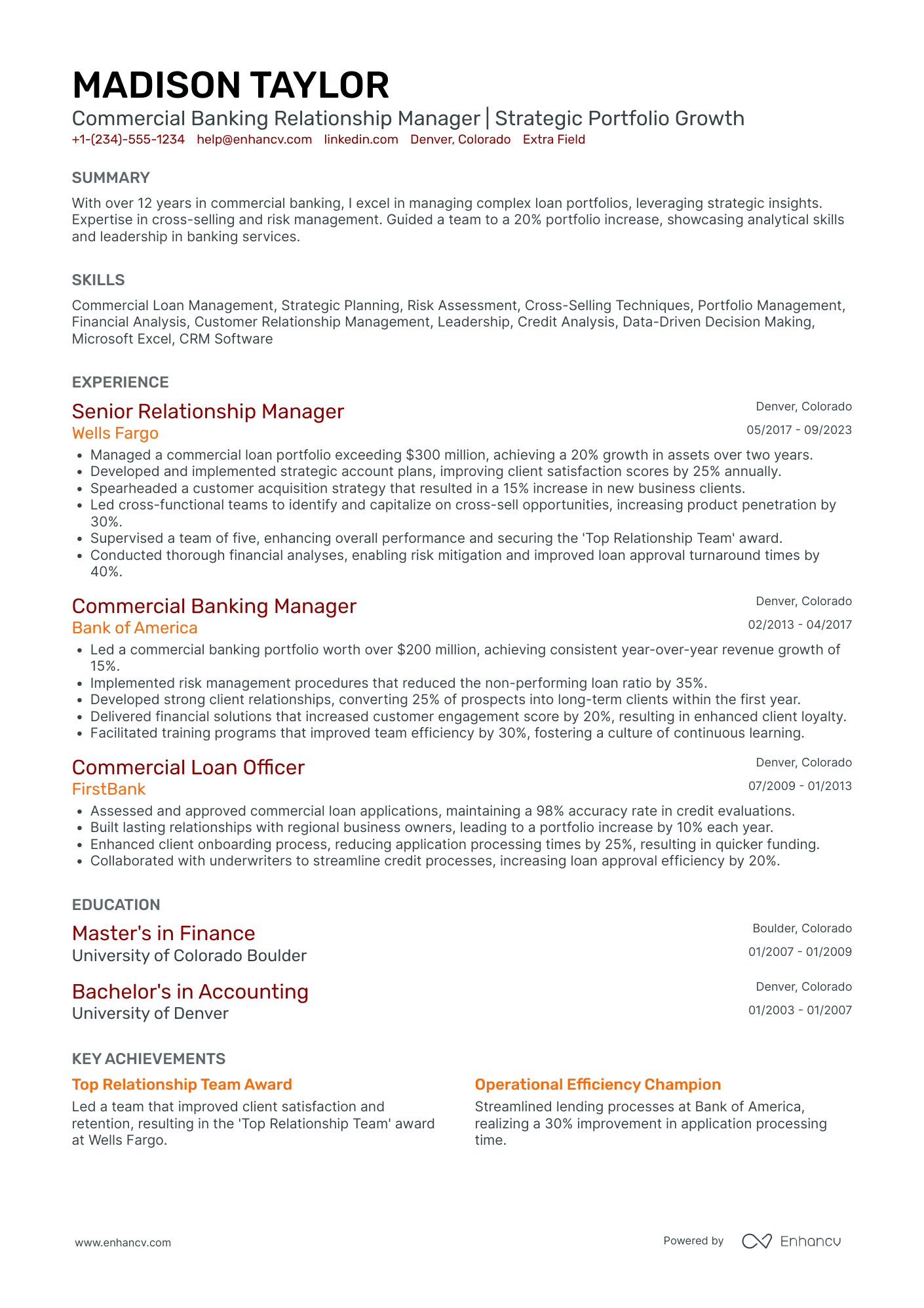

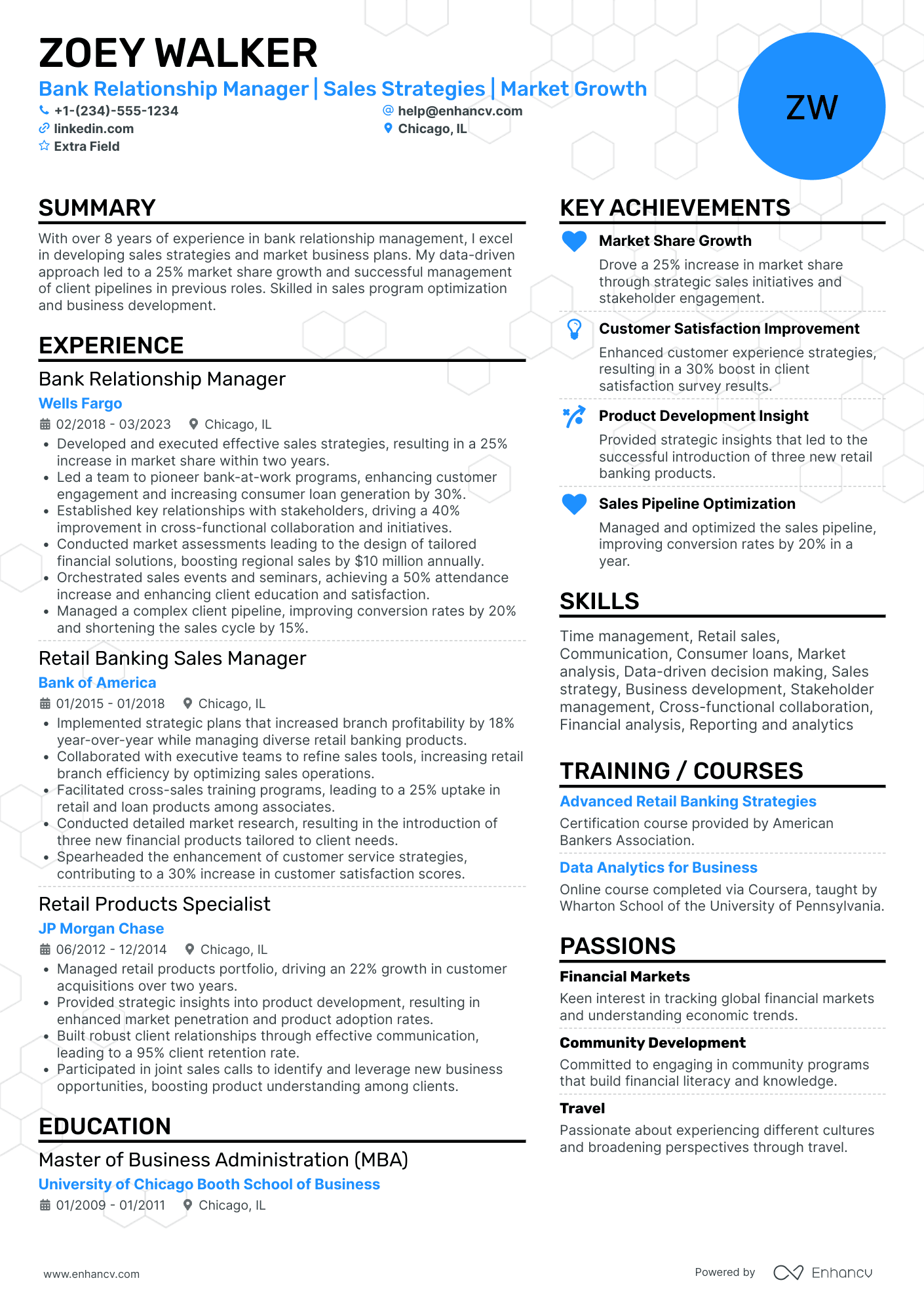

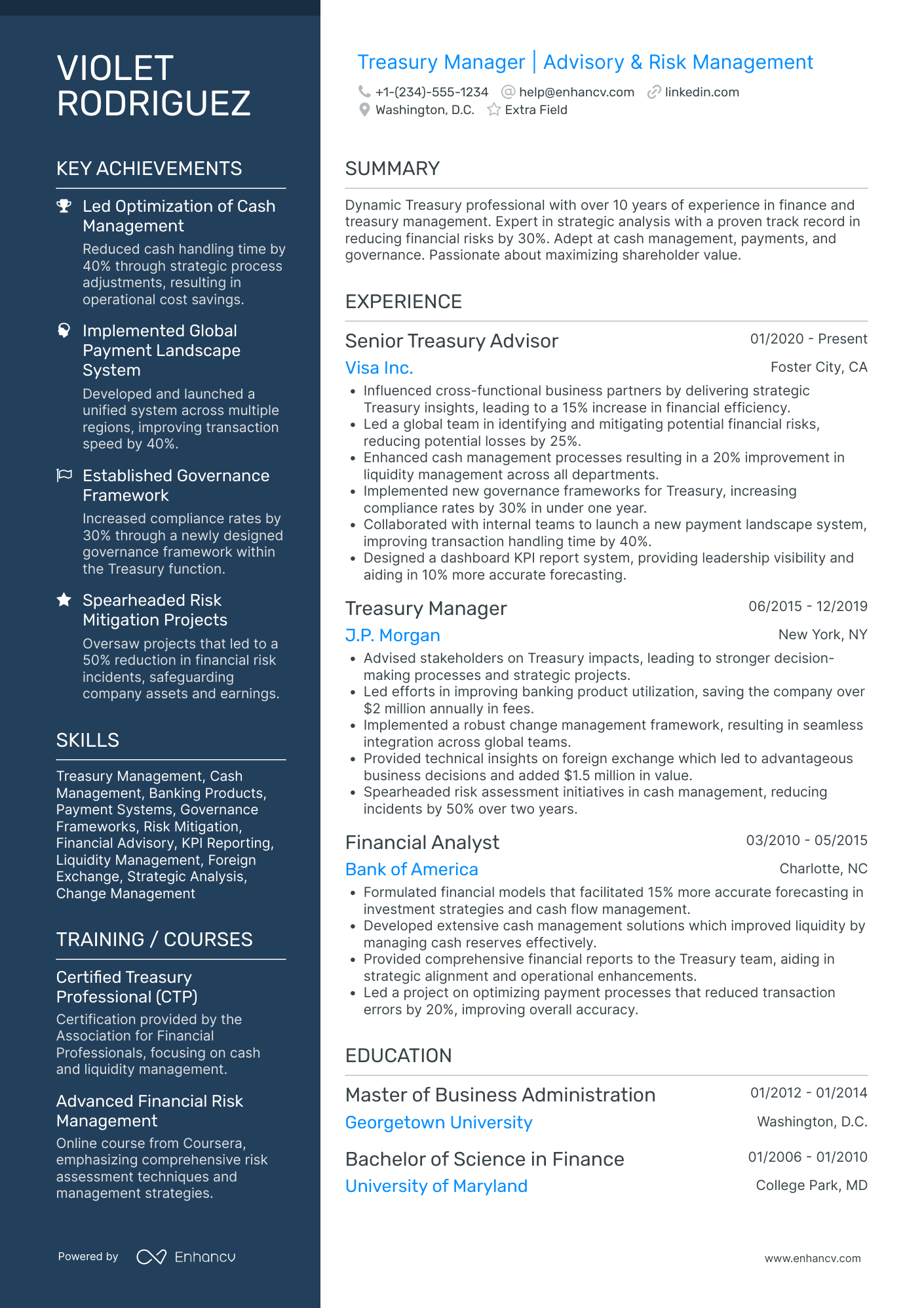

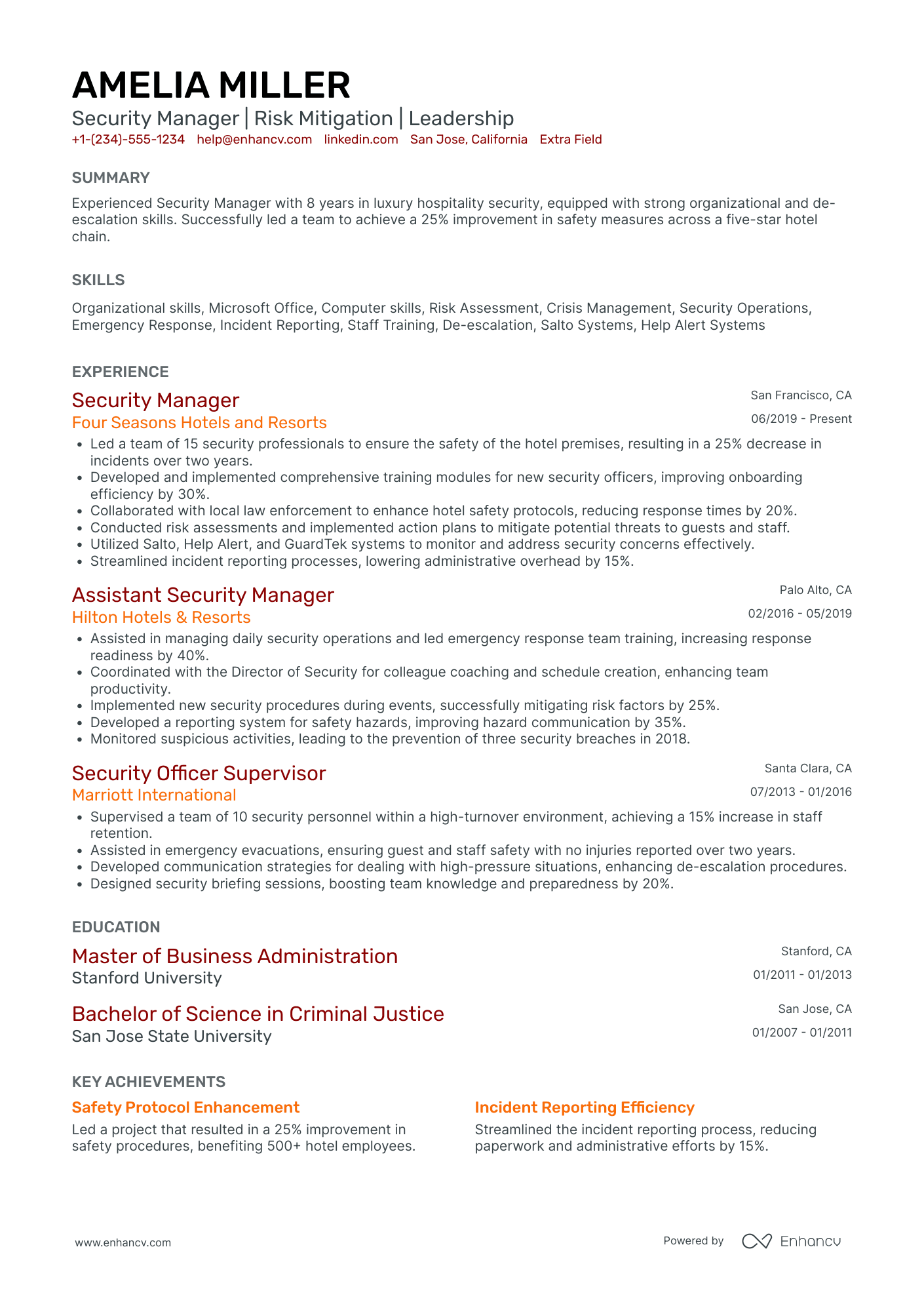

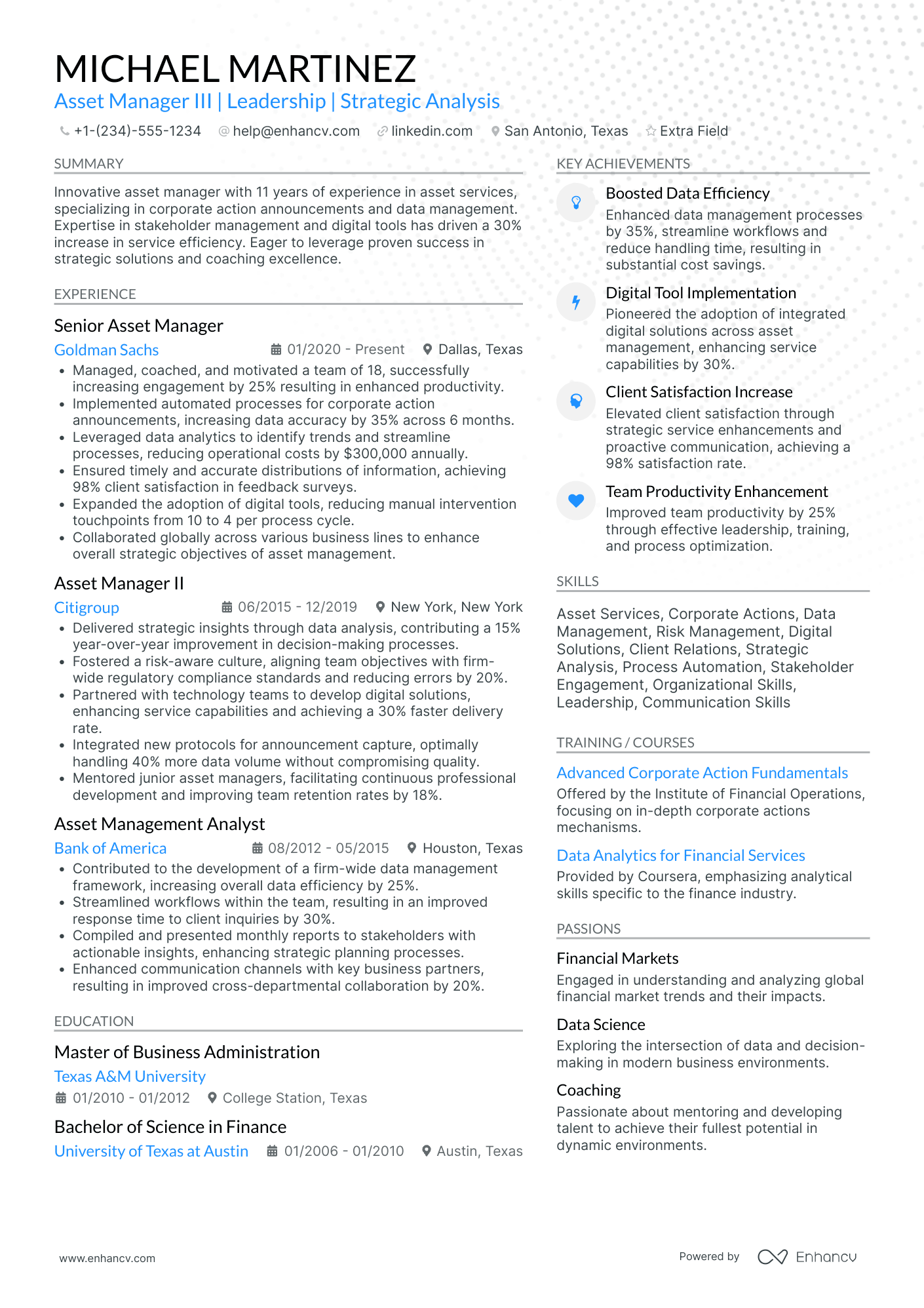

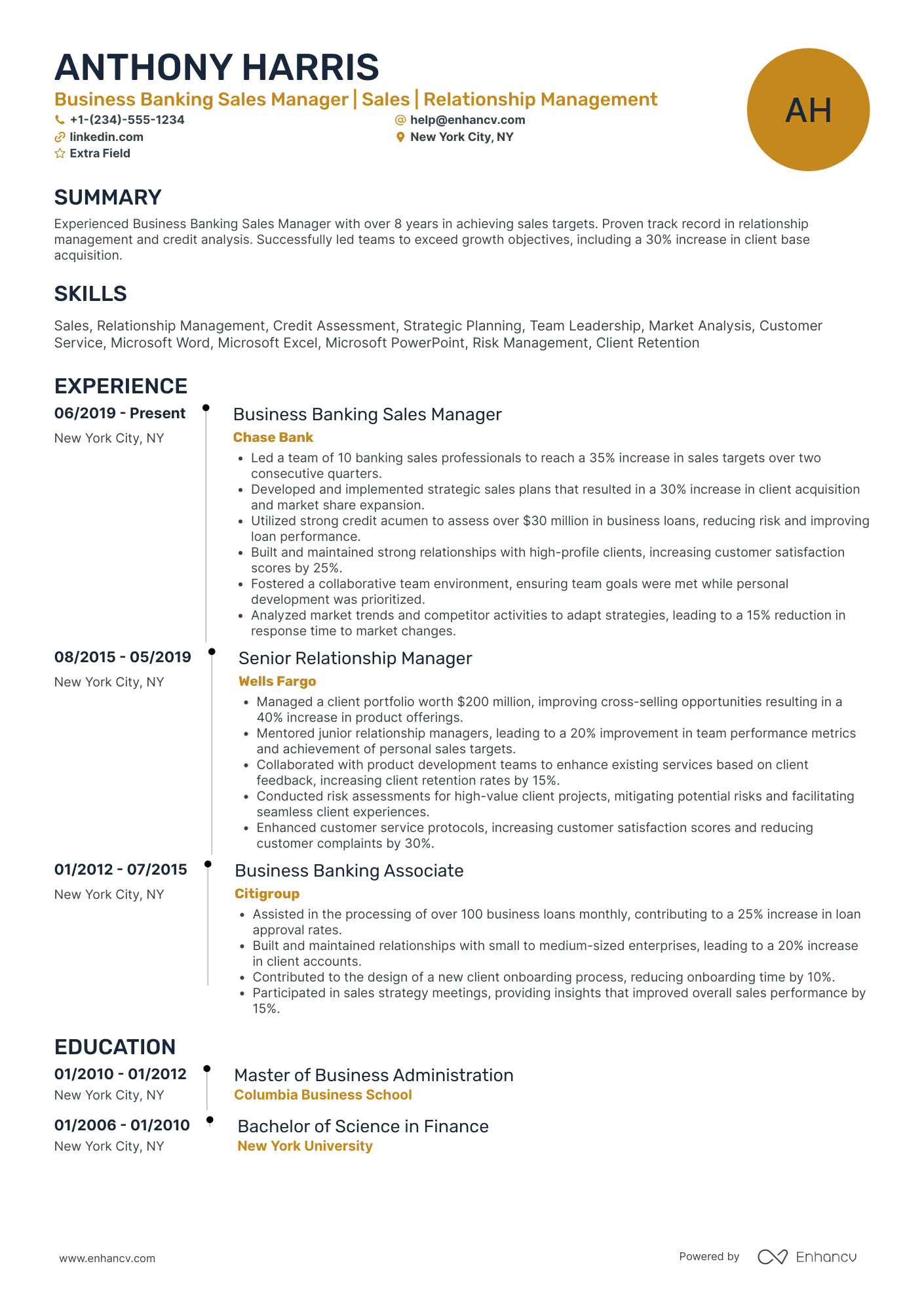

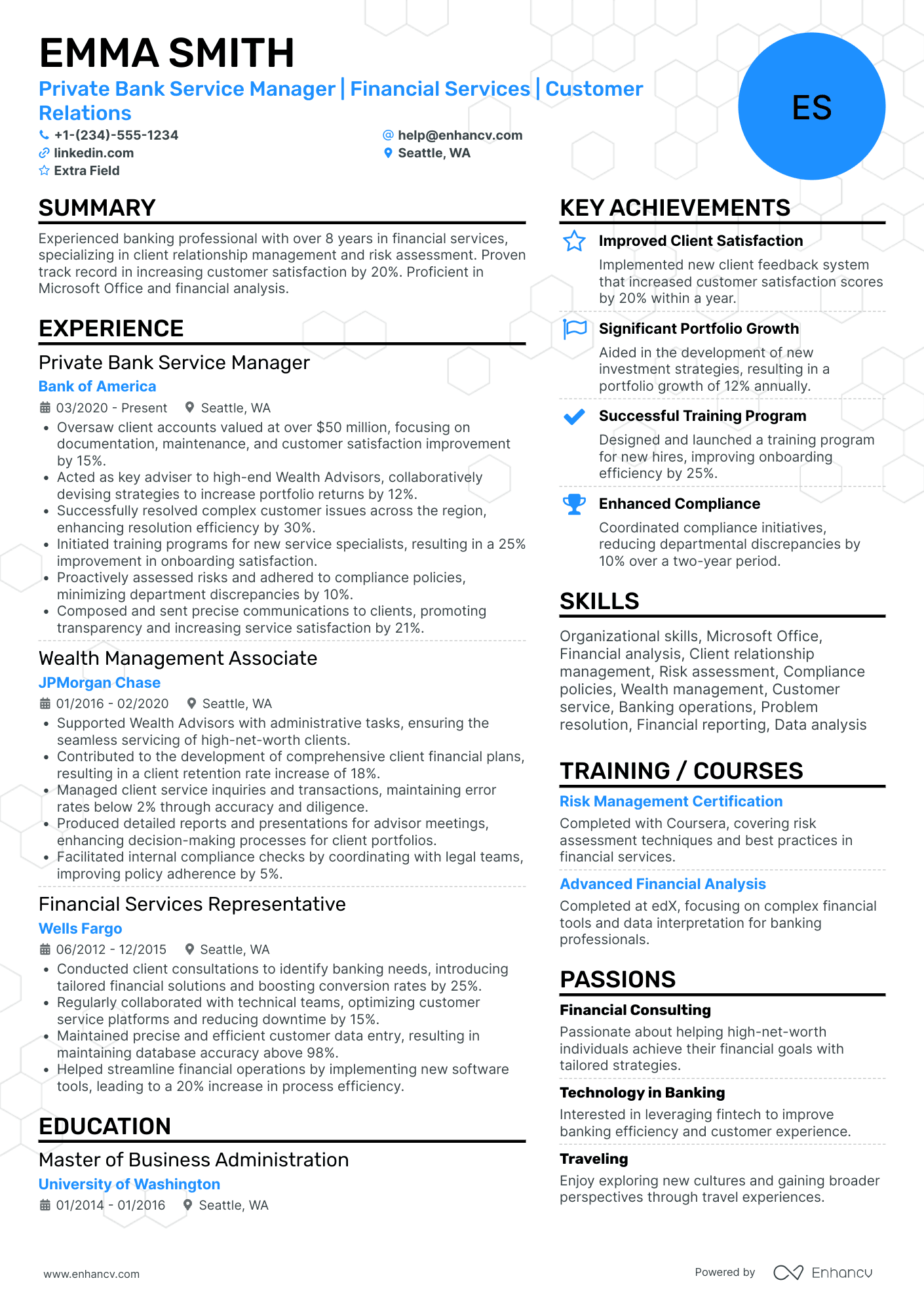

Bank Manager resume examples

By Experience

By Role