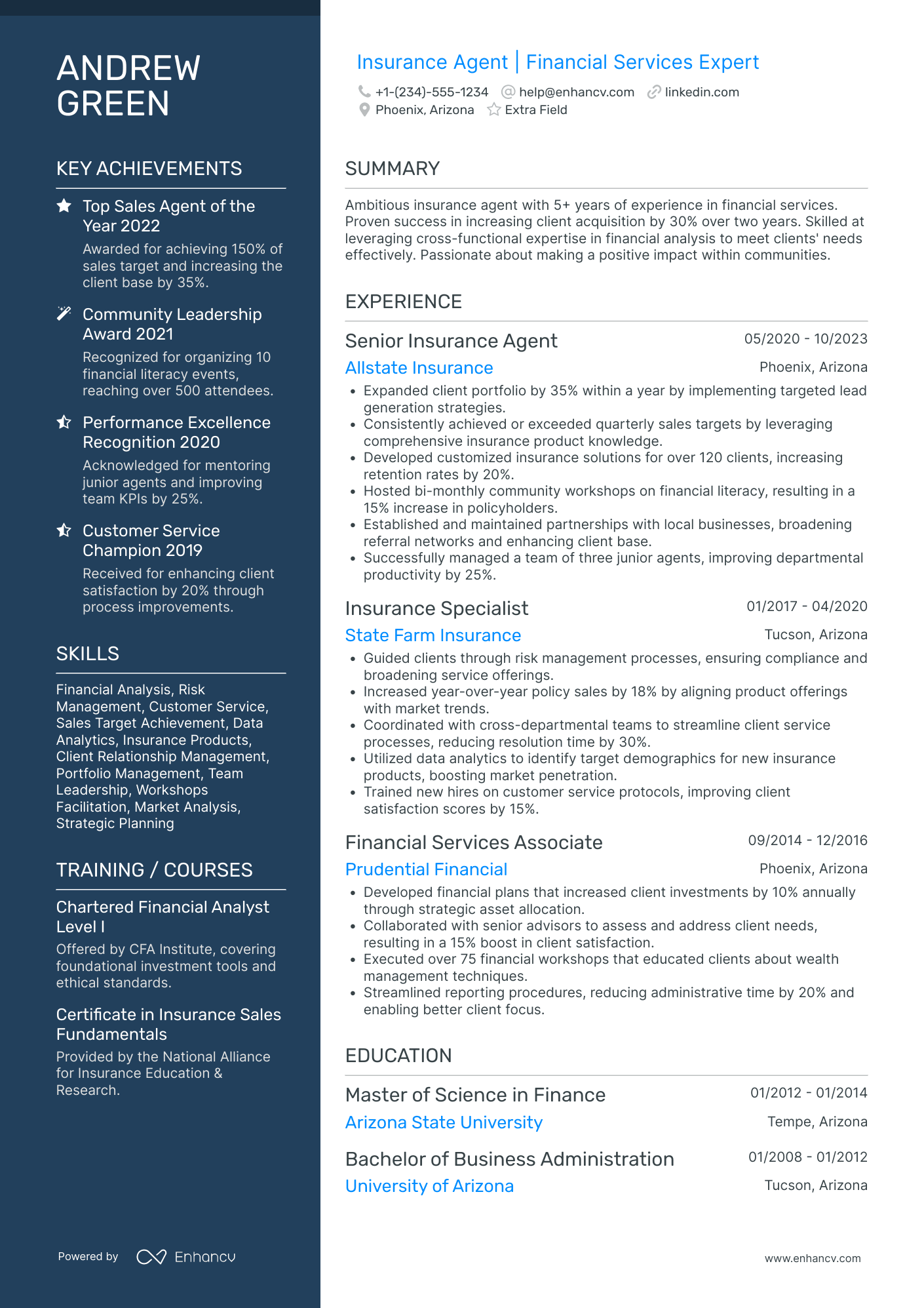

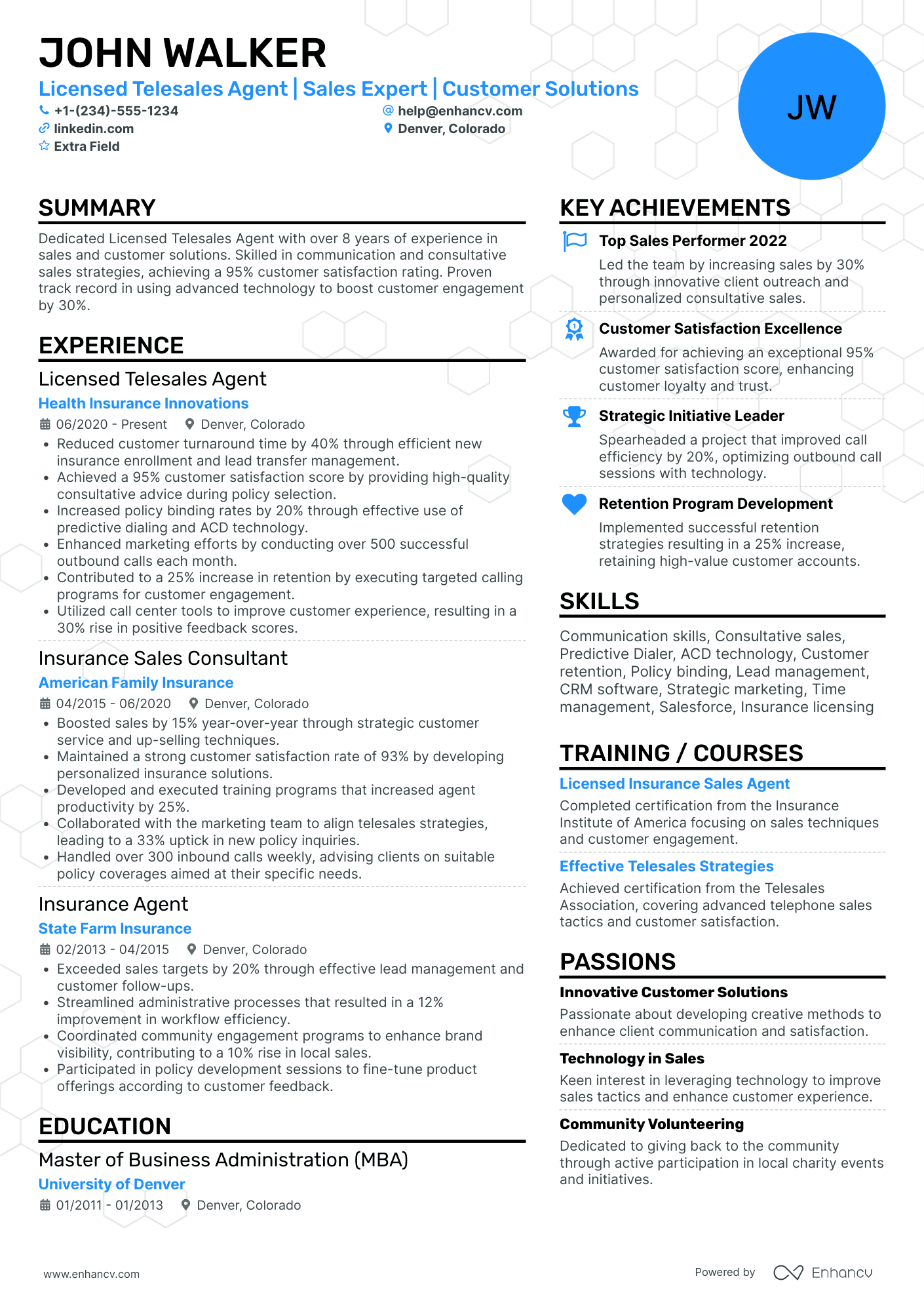

One difficulty that an Insurance Agent might encounter is highlighting diverse skills that go beyond basic sales proficiency. Our resume examples provide strategic guidance to effectively showcase a broad range of abilities and accomplishments in the insurance sector. Now, let's delve into these examples to elevate your professional profile.

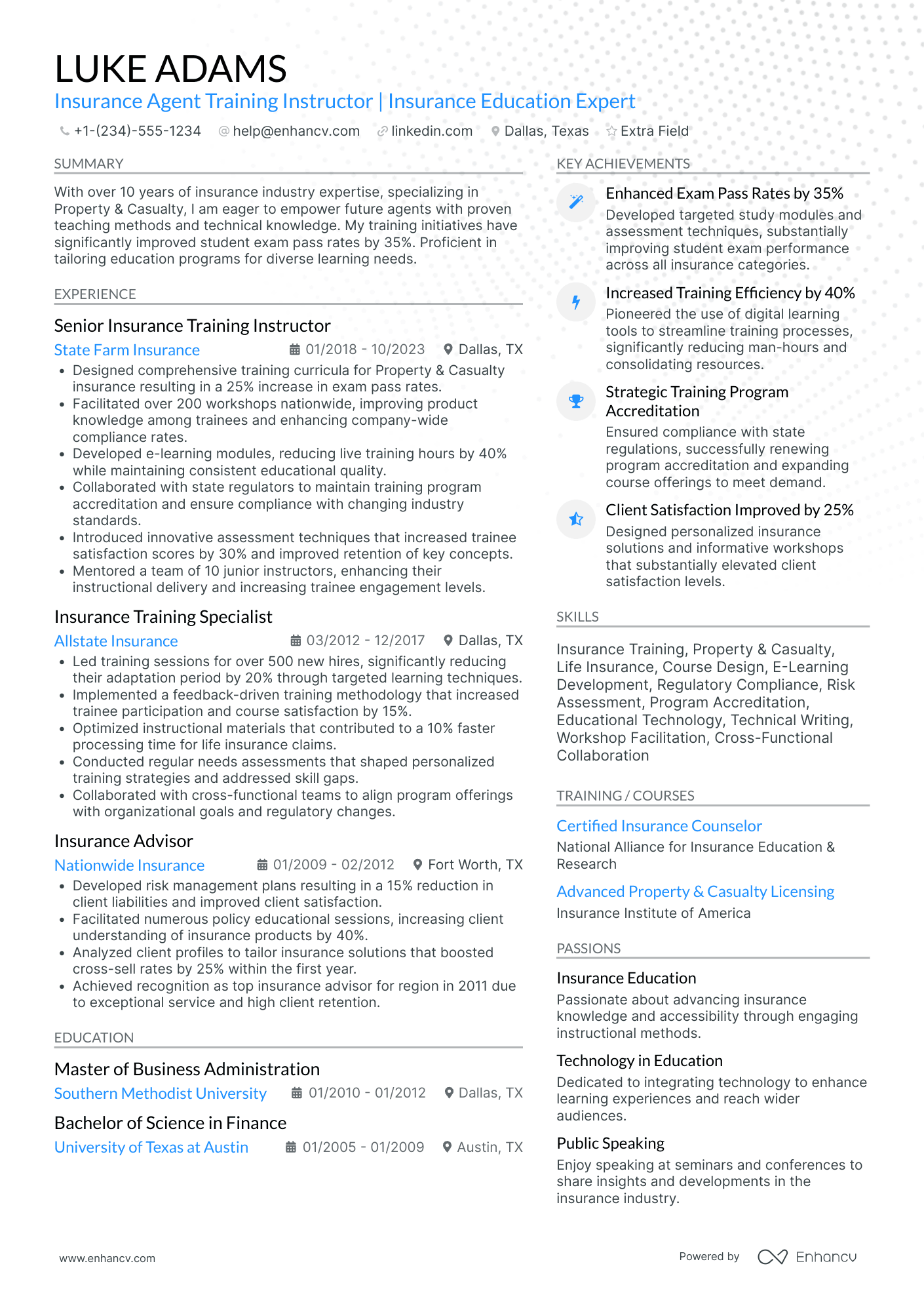

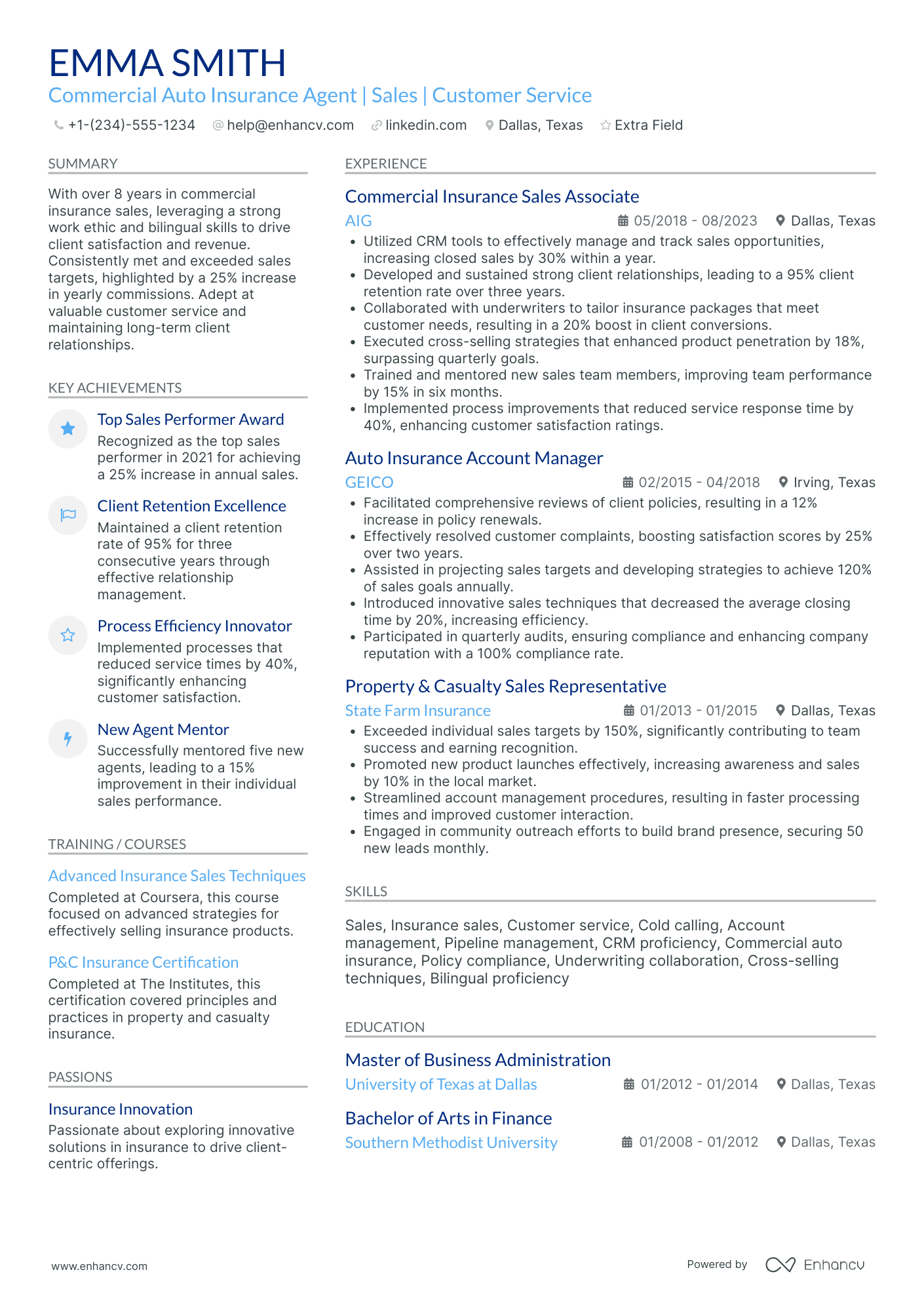

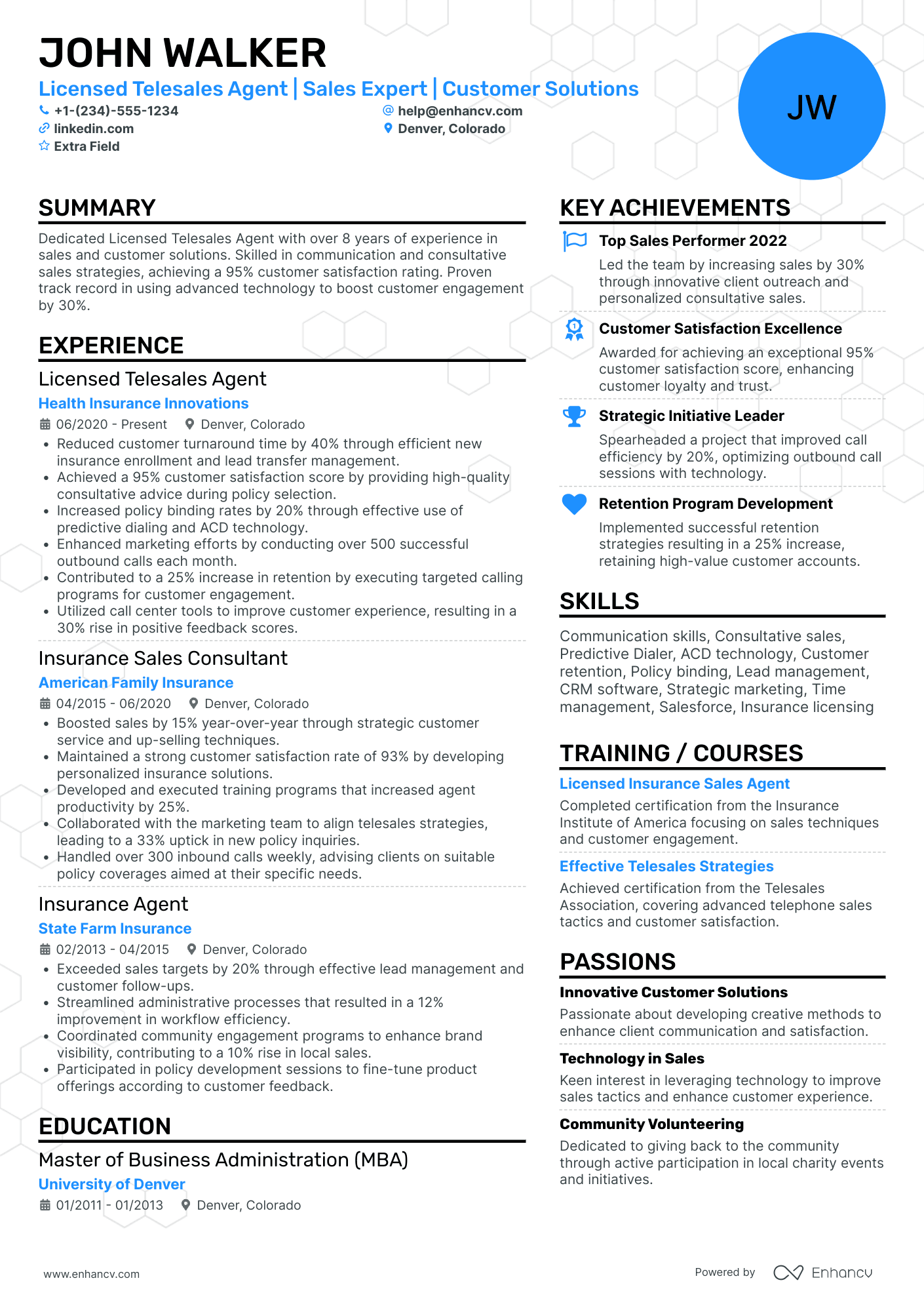

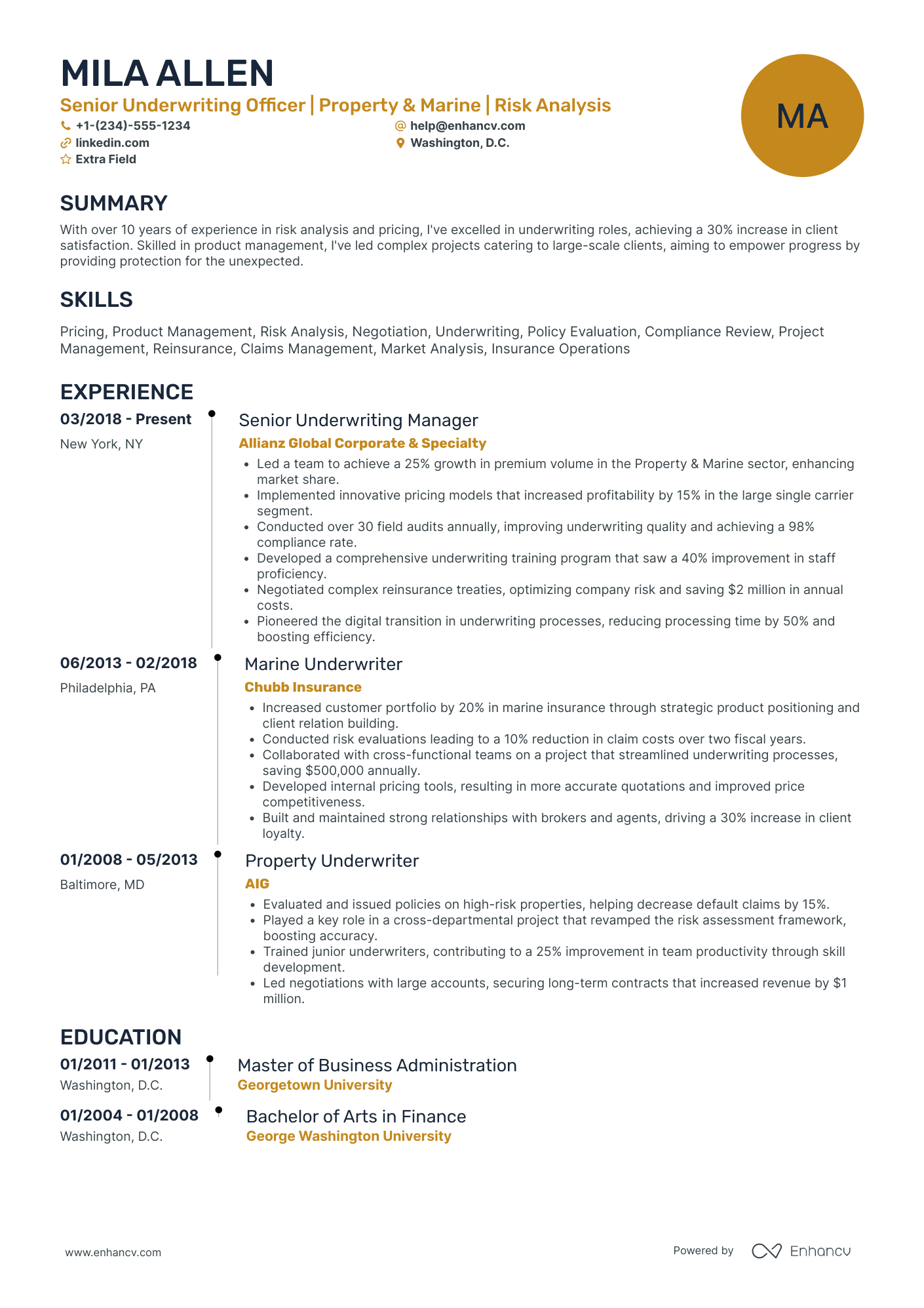

Insurance Agent resume examples

By Experience

Junior Insurance Agent

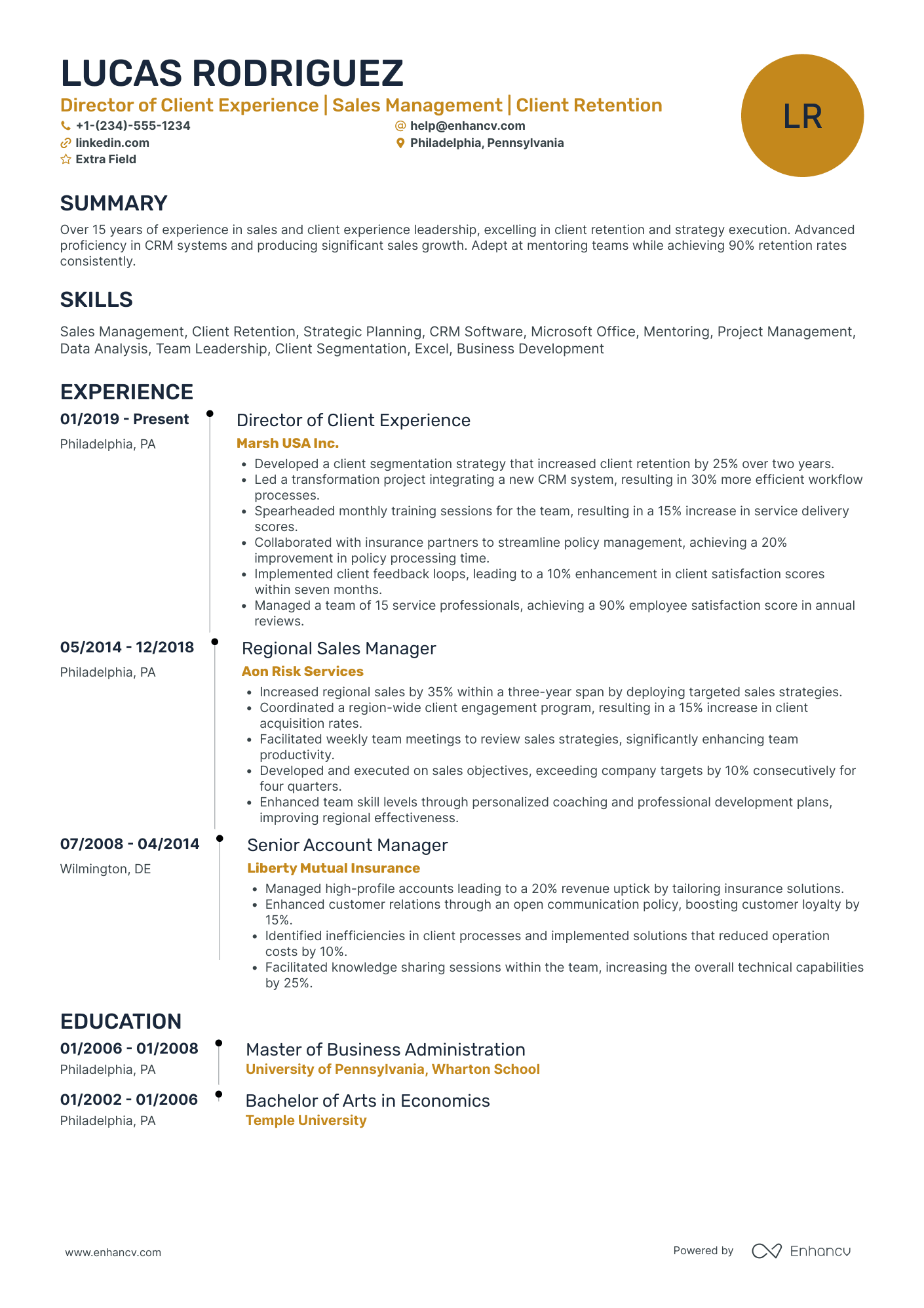

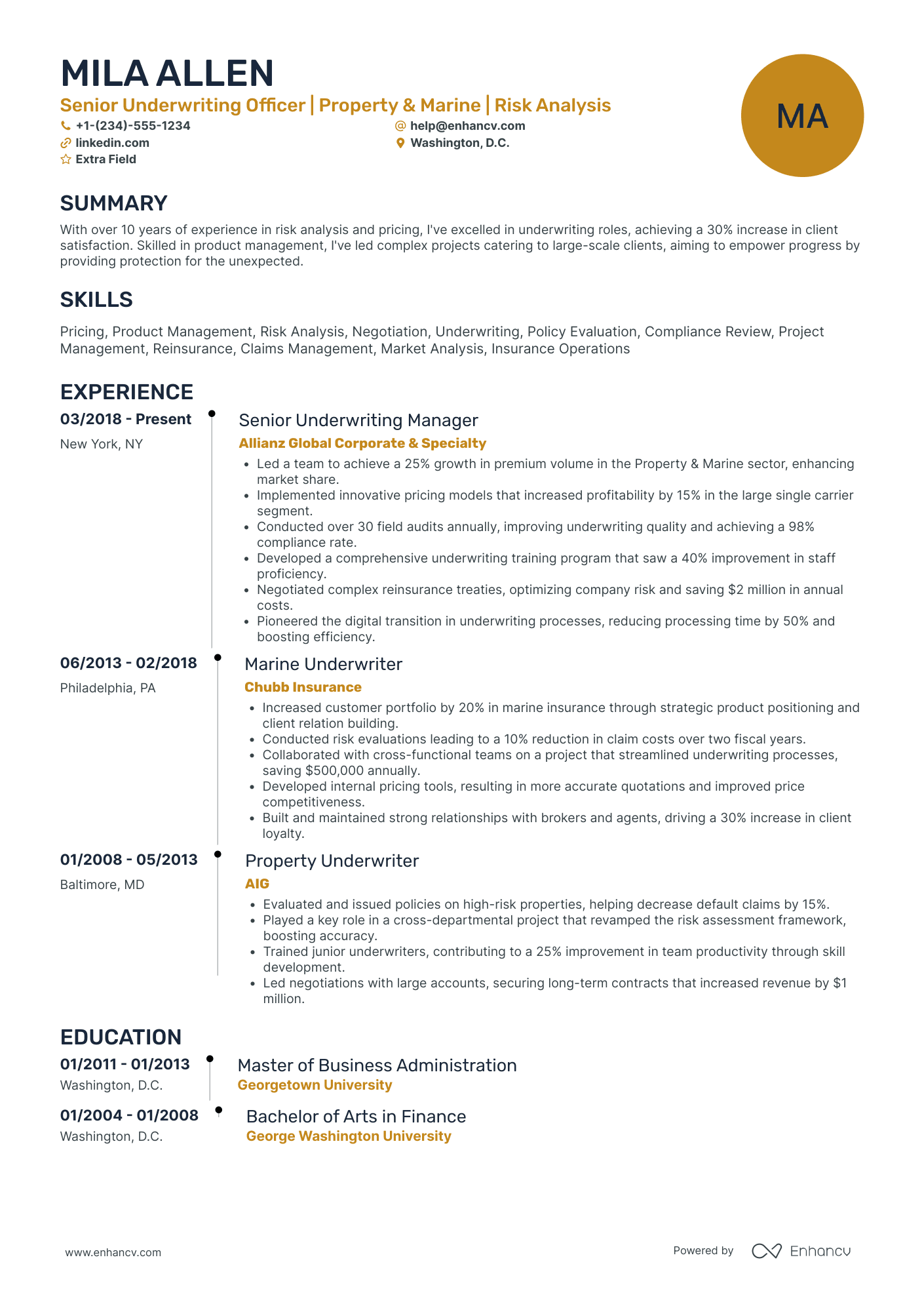

Senior Insurance Agent

Insurance Agent Trainee

Entry Level Insurance Agent

Experienced Insurance Agent

Insurance Agent Manager

Director of Insurance Agents

Principal Insurance Agent

Associate Insurance Agent

Lead Insurance Agent

By Role

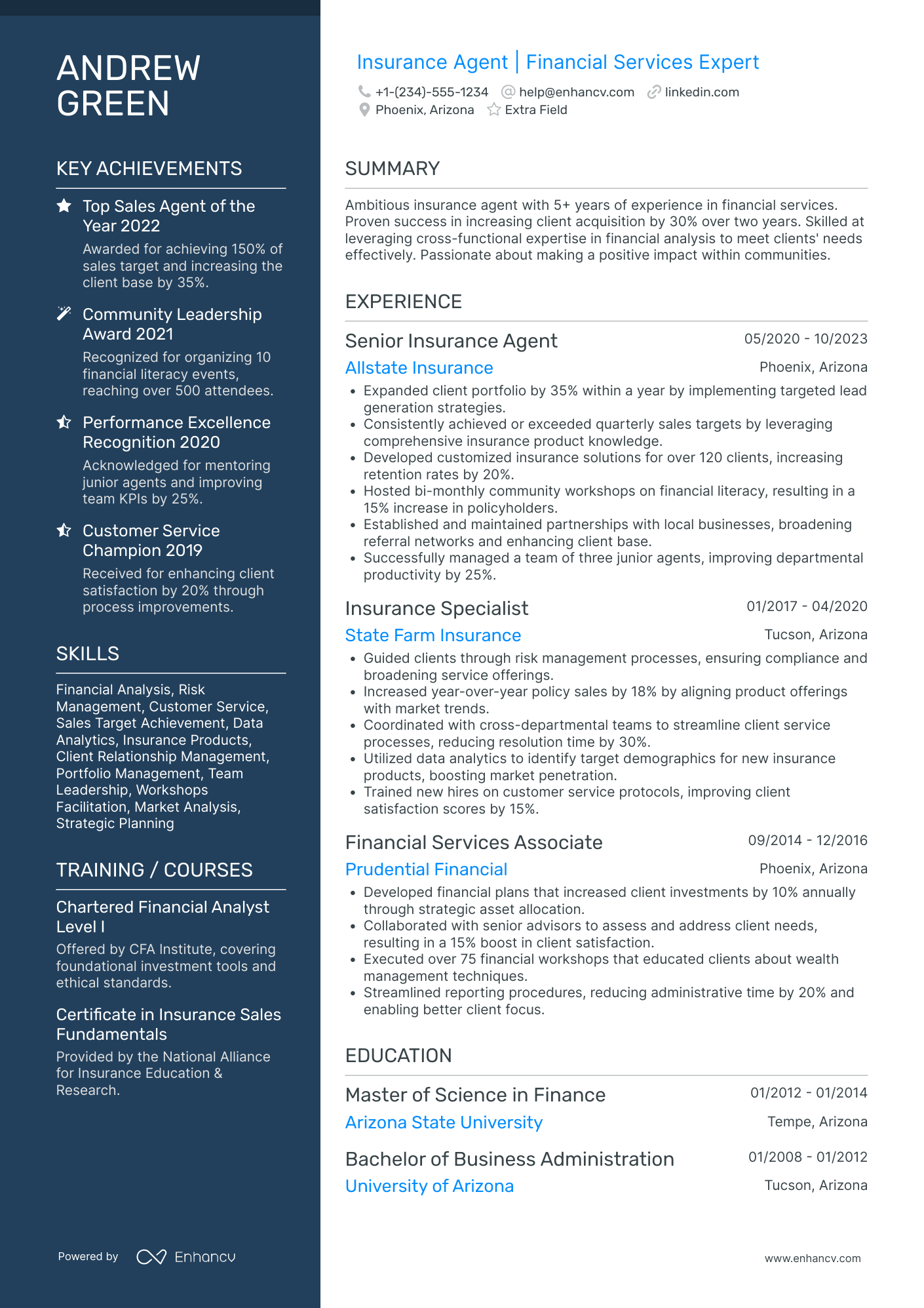

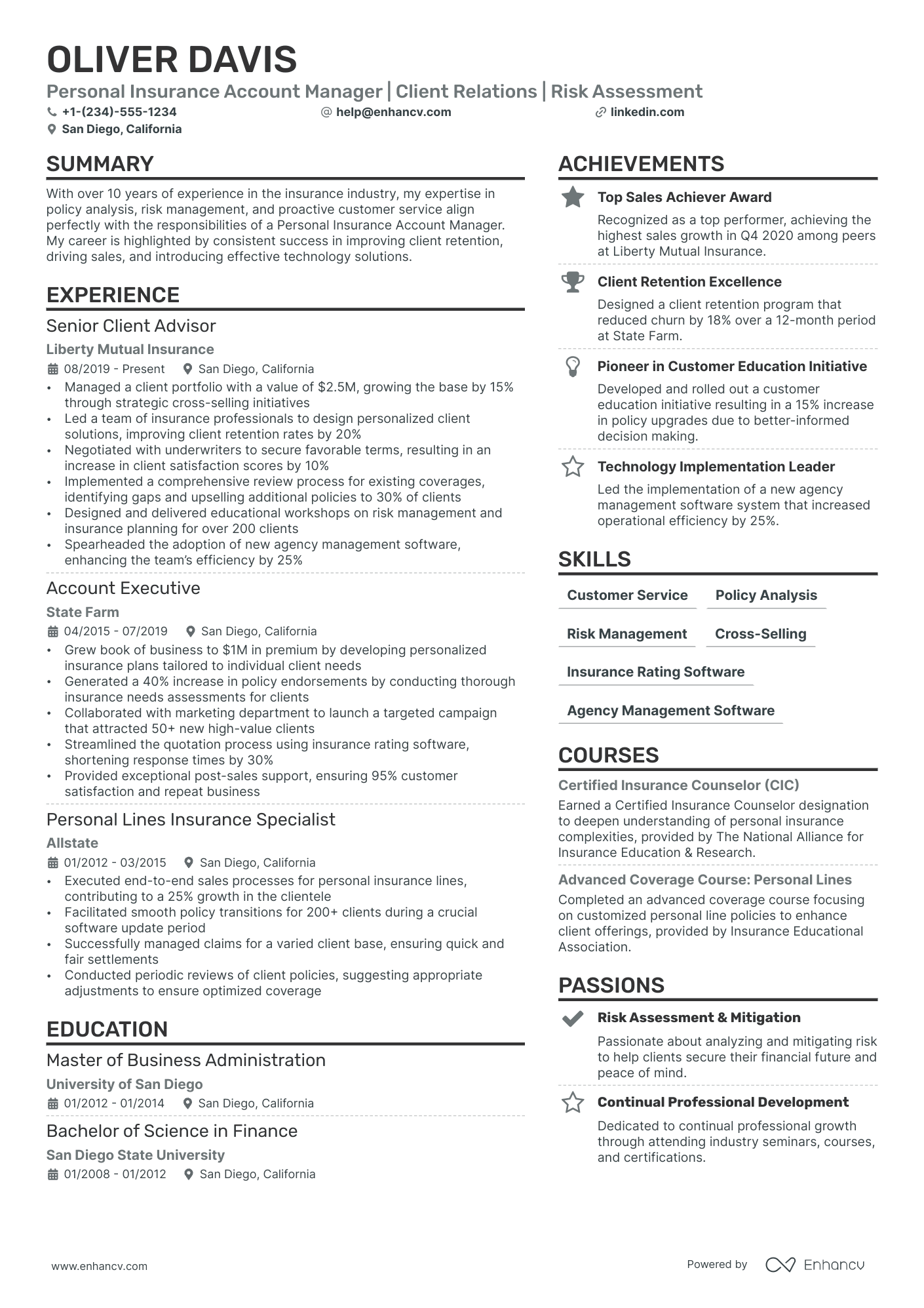

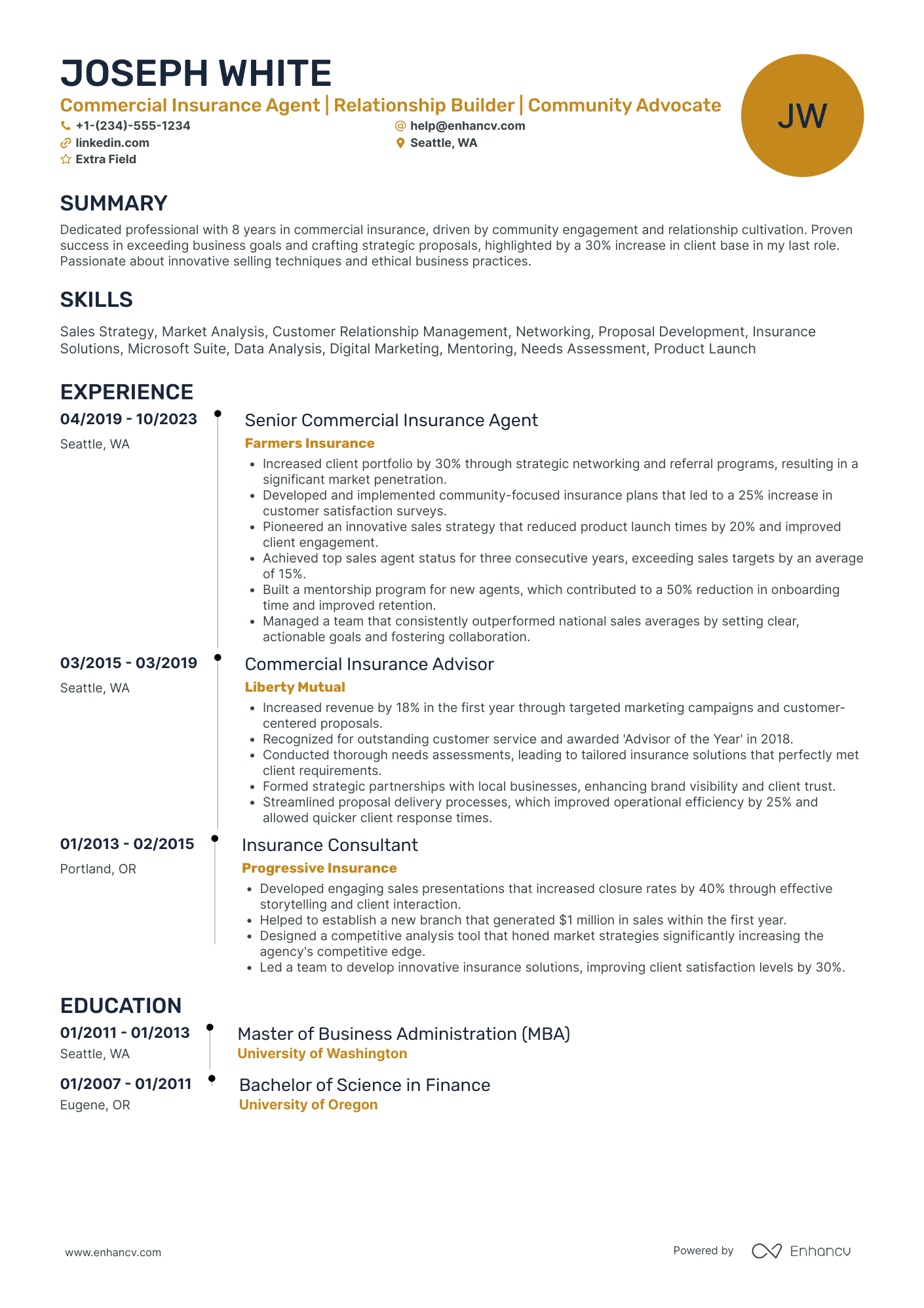

Insurance Account Manager

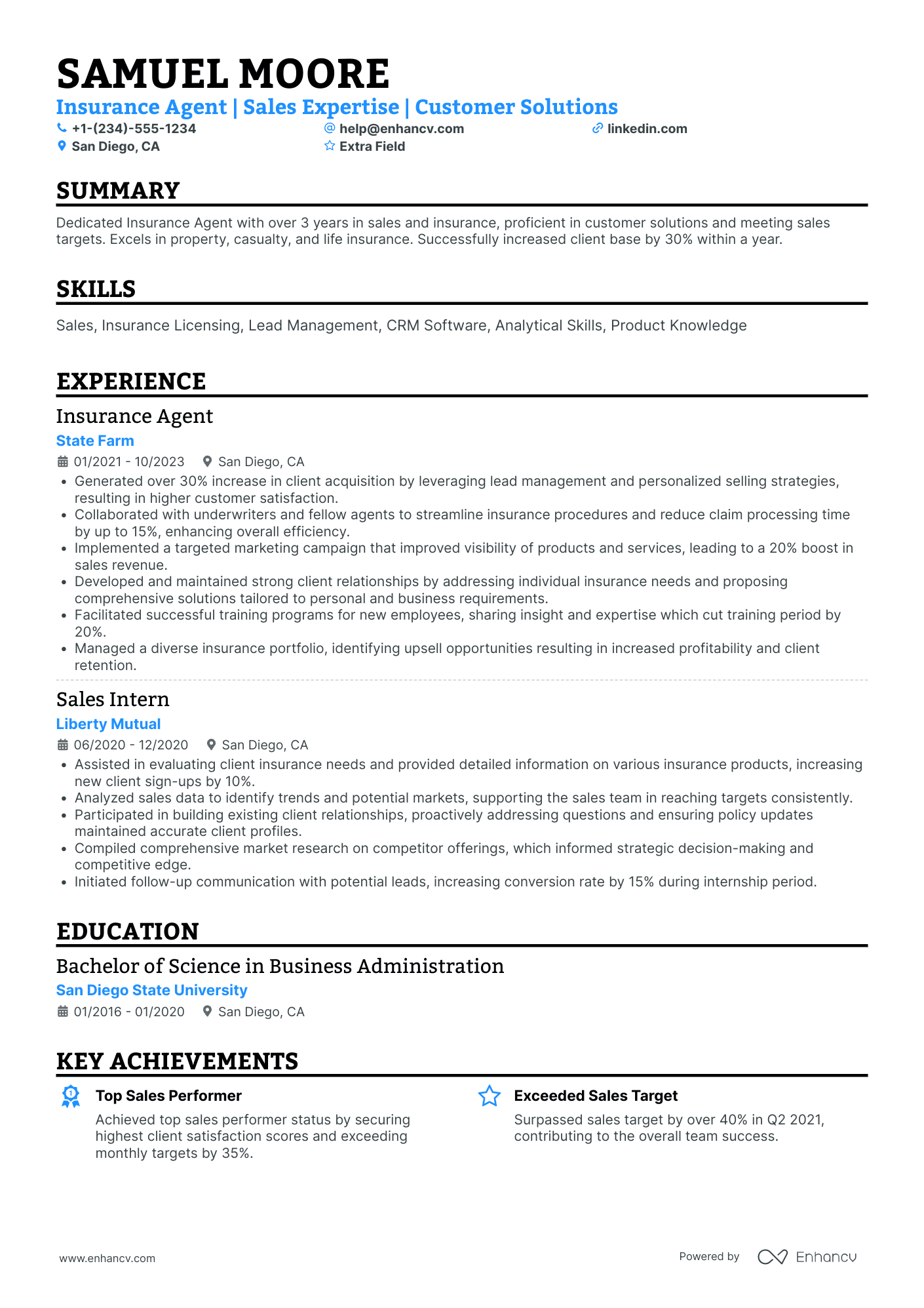

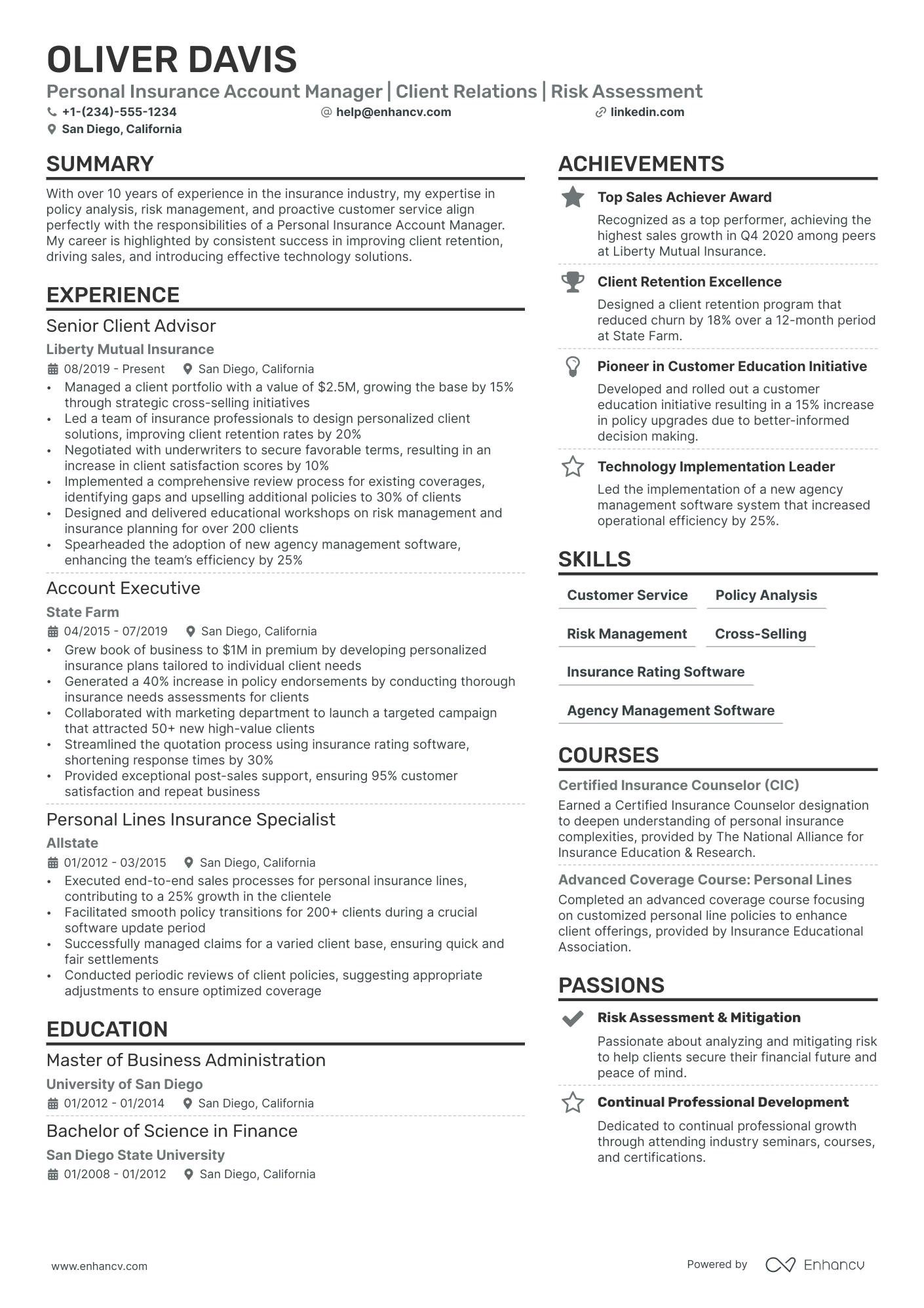

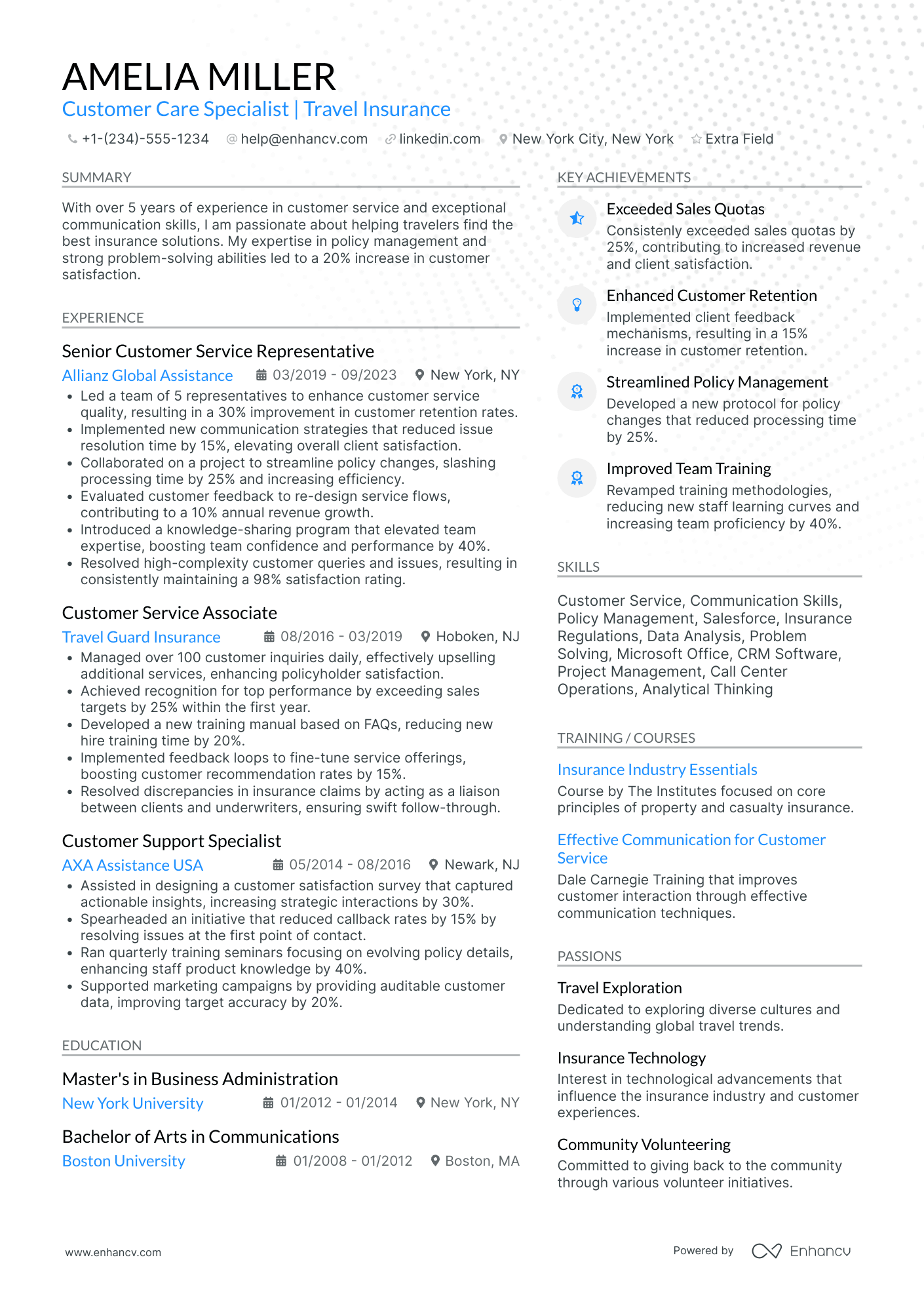

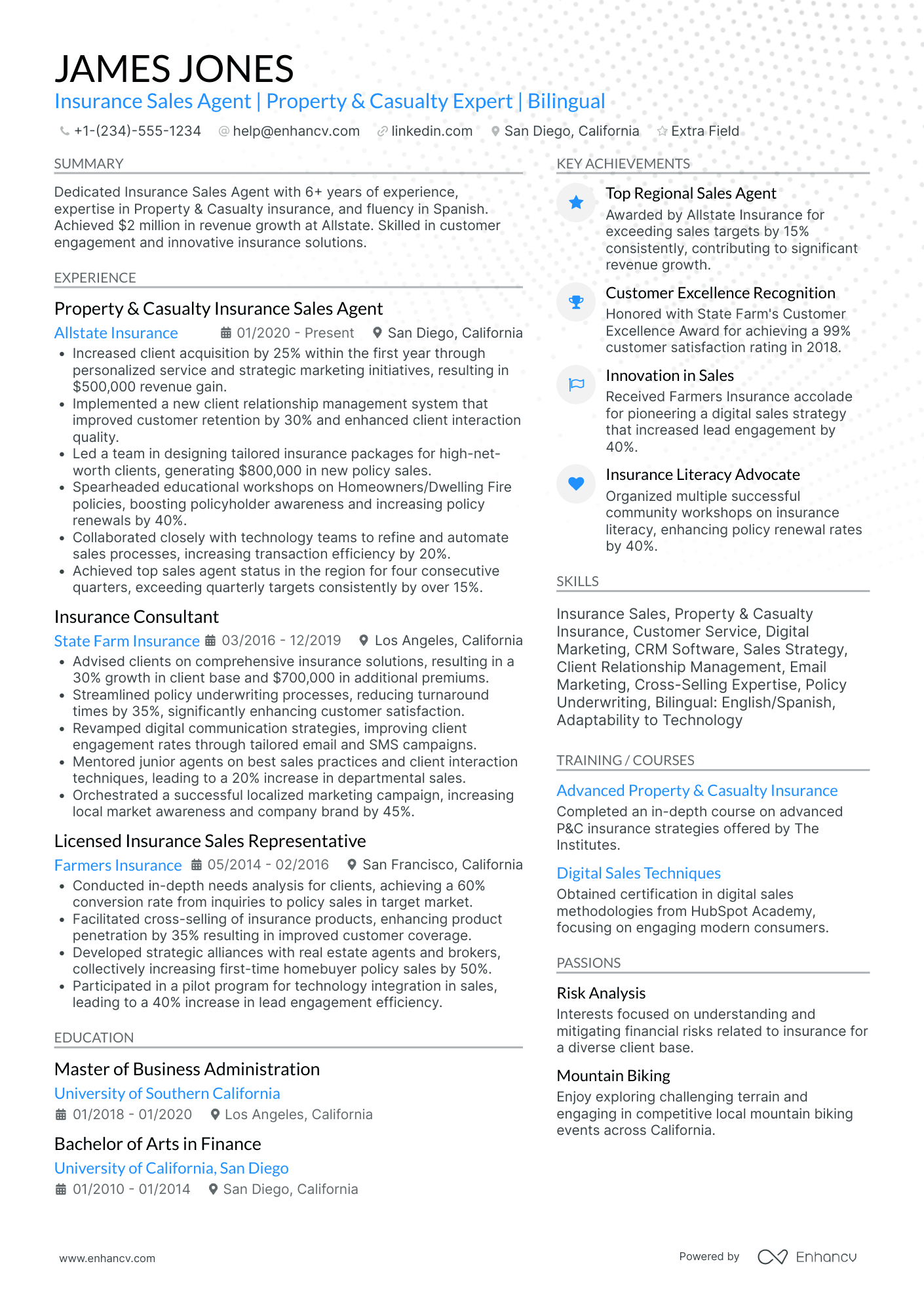

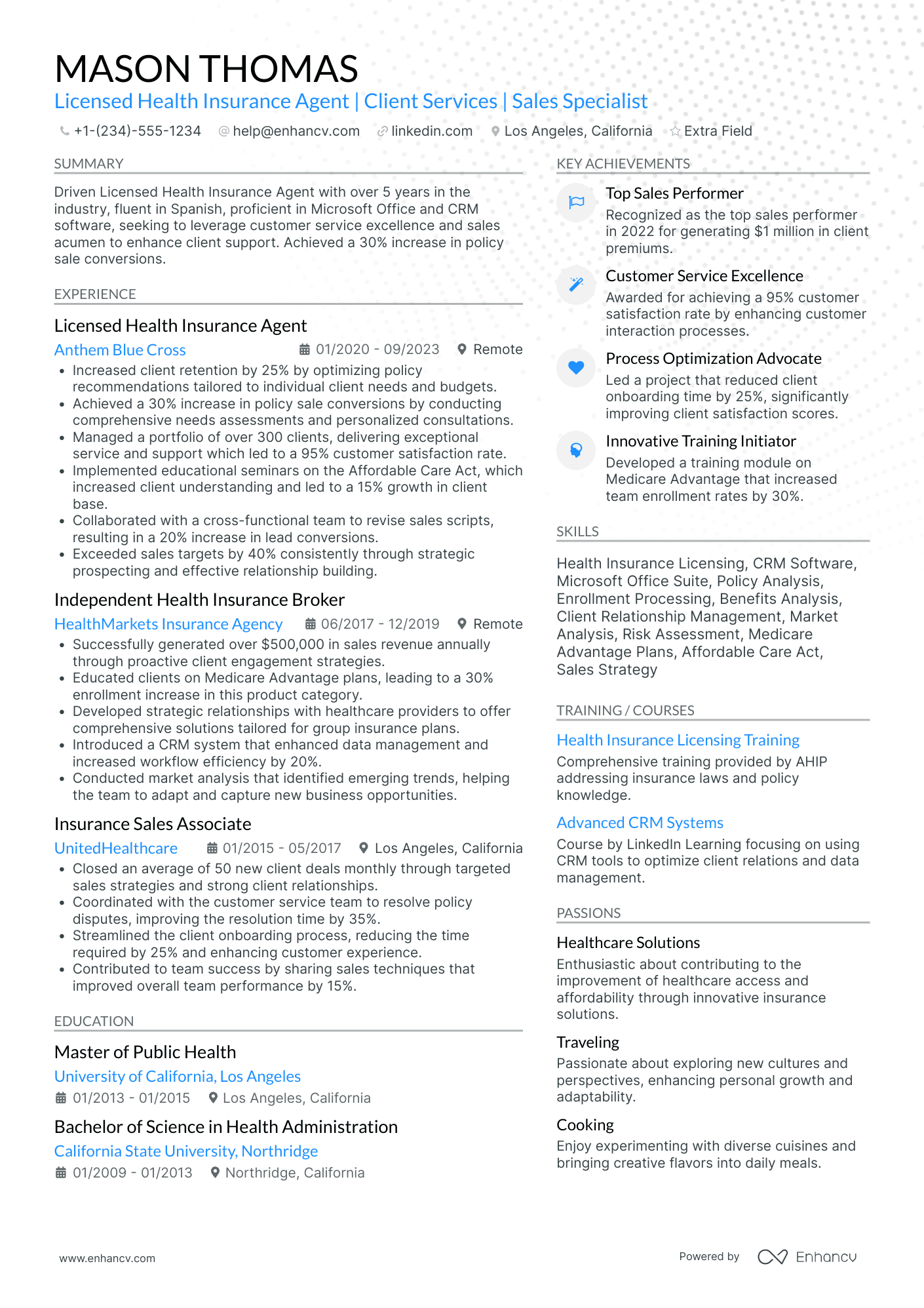

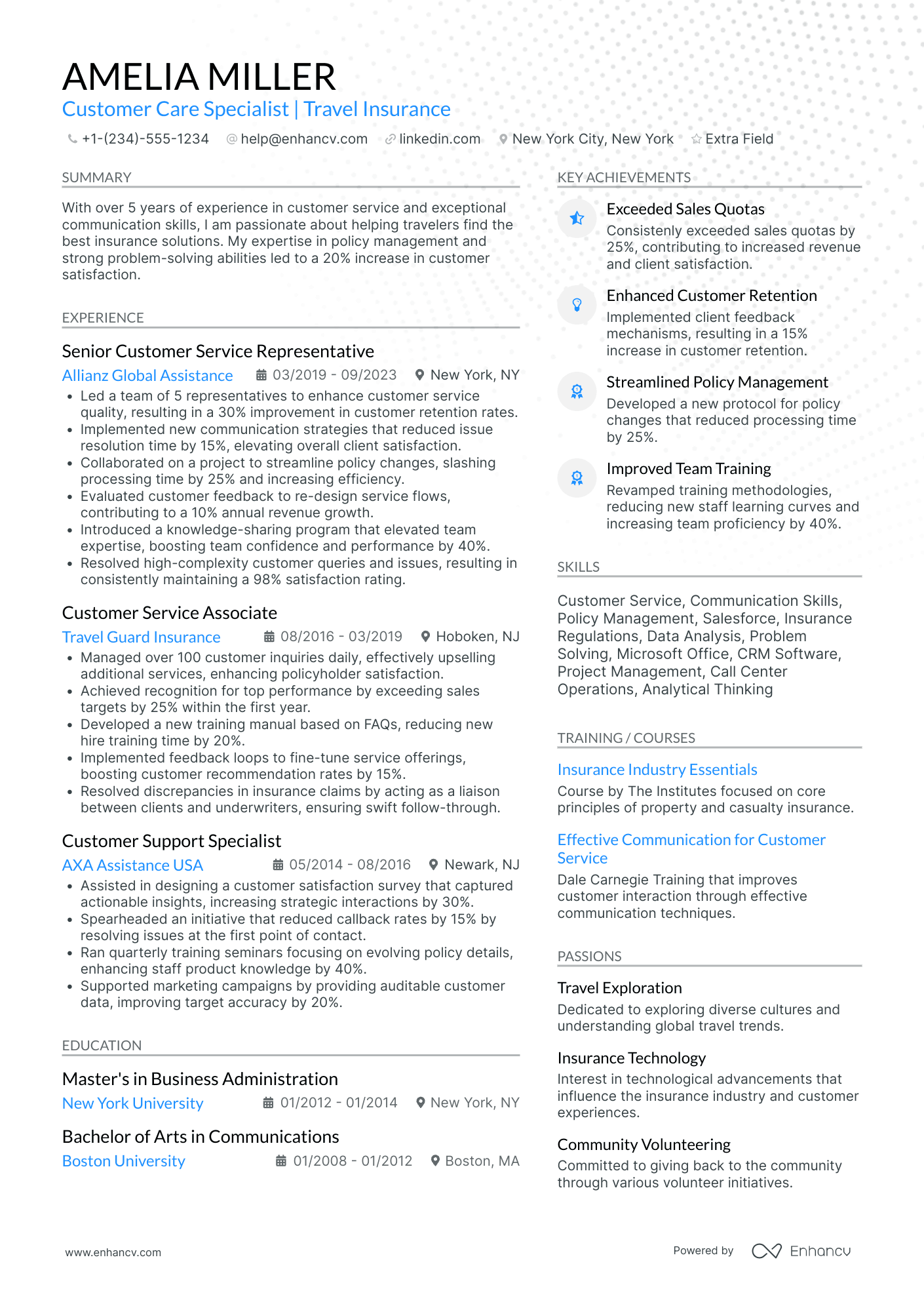

Insurance Agent

Insurance Agent positions stem from direct client communication roles within the insurance industry.

Tips to increase your probability of success when applying for Insurance Agent roles include:

- Experience with insurance underwriting and strong product knowledge is paramount. Highlight your familiarity with various insurance policies and their underwriting processes.

- Mention your abilities in client sourcing and relationship building. This should form a substantial part of your resume as tapping new clients and nurturing existing relationships are key to this role.

- Showcase strong negotiation and sales skills. Success as an insurance agent involves excellent negotiation tactics.

- Instead of merely listing skills, show how those skills have generated measured results. For instance, 'increased policy sales by...' or 'boosted client base by...'. Stick to the 'skill-action-results' paradigm in your resume.

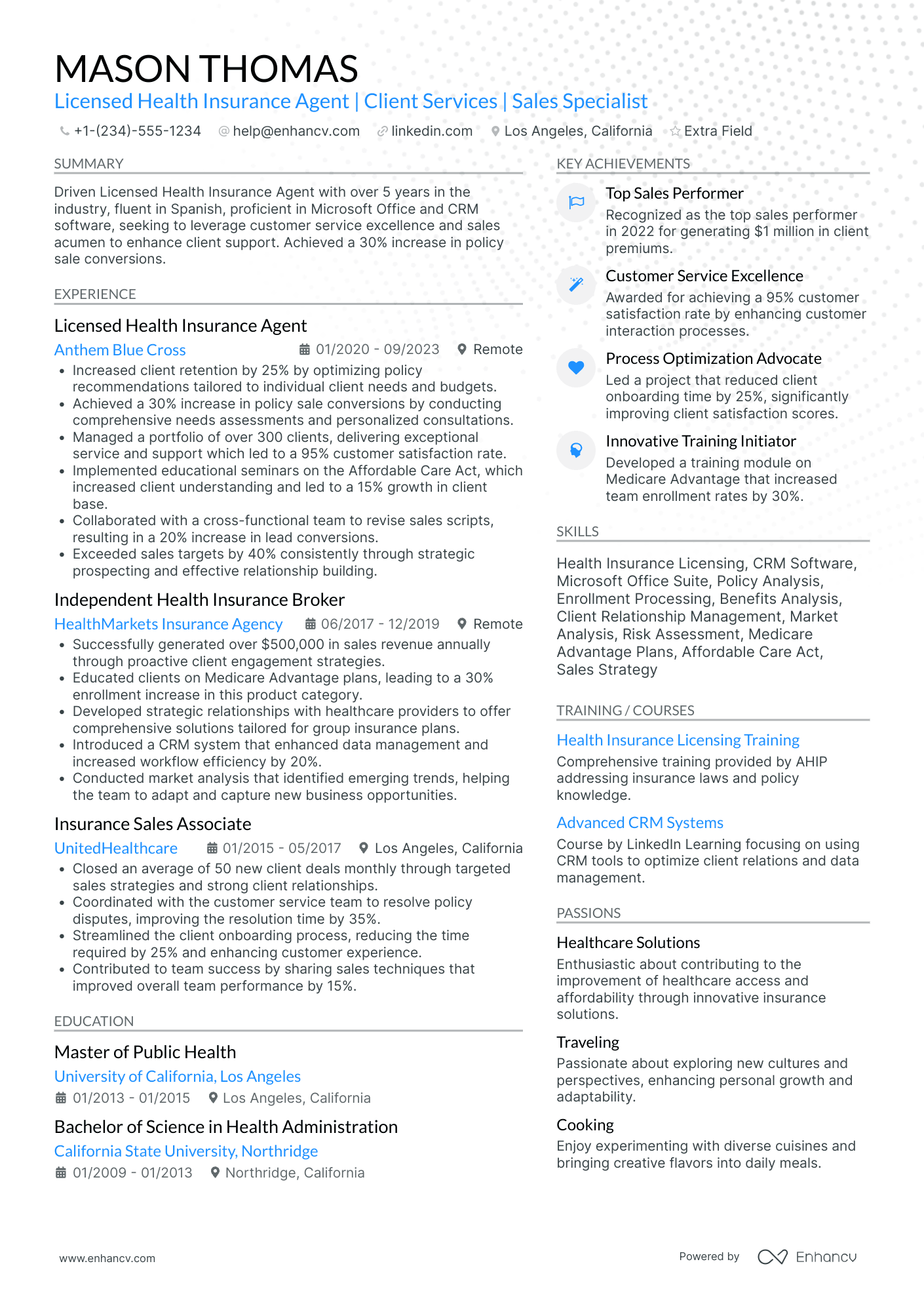

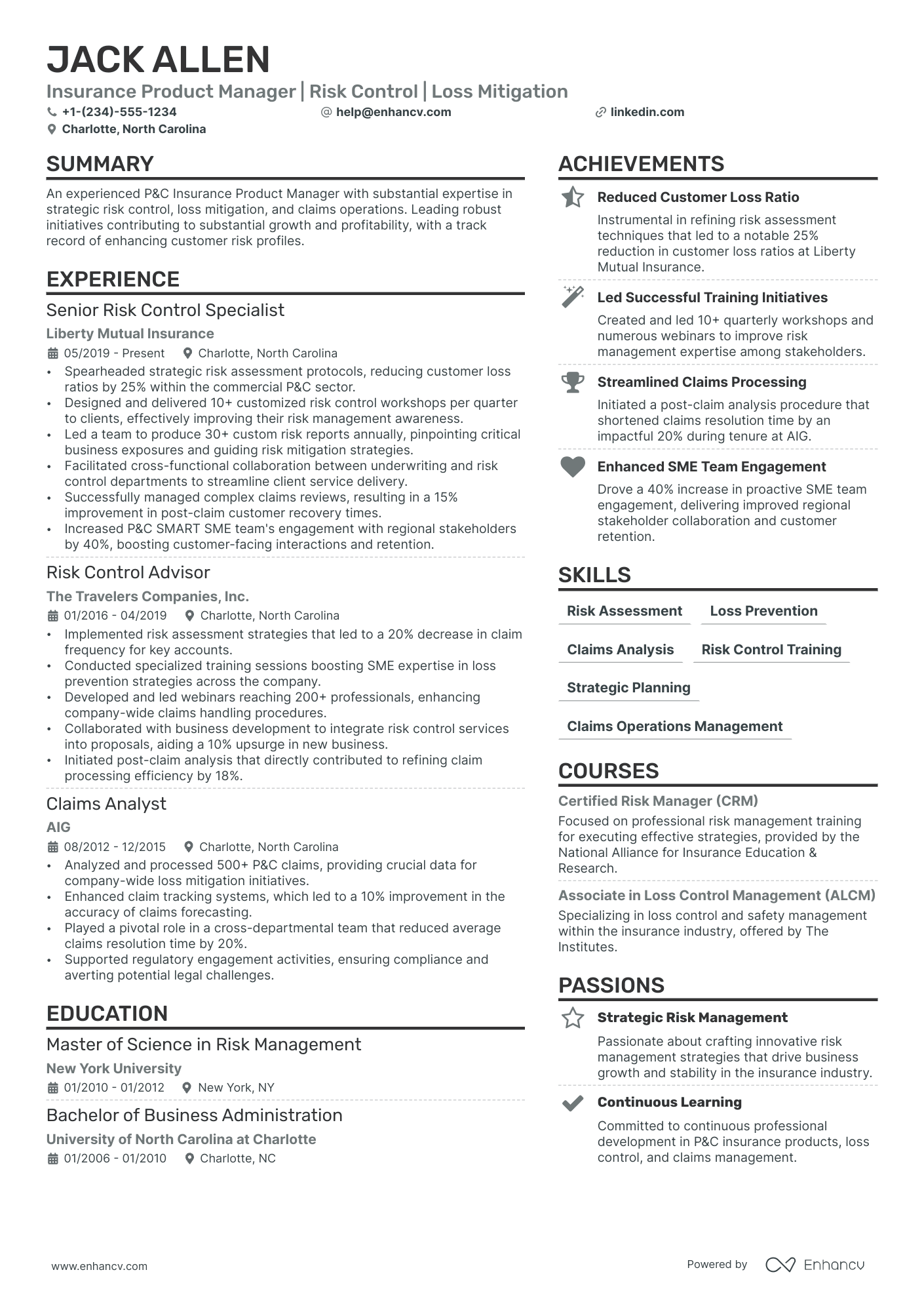

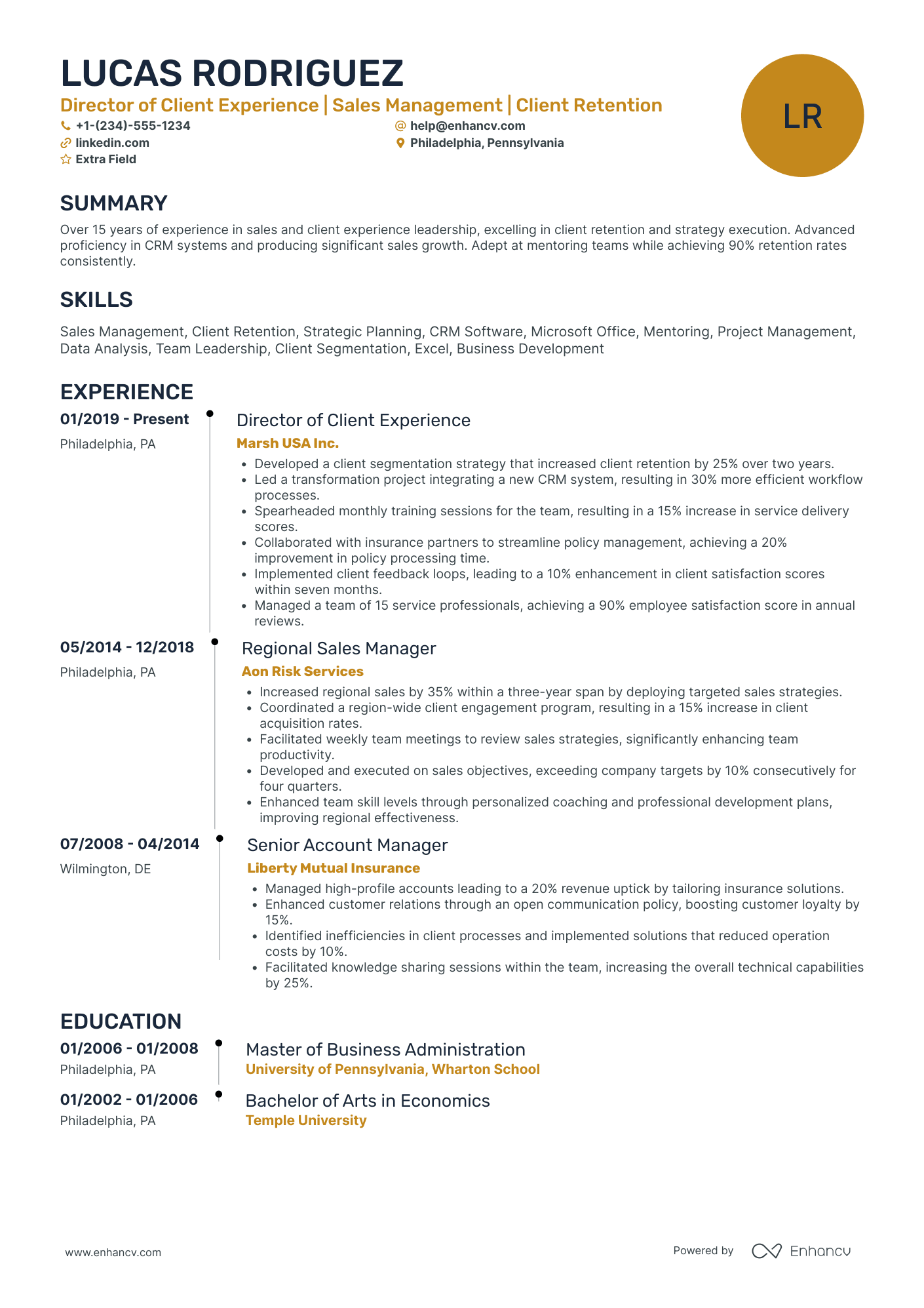

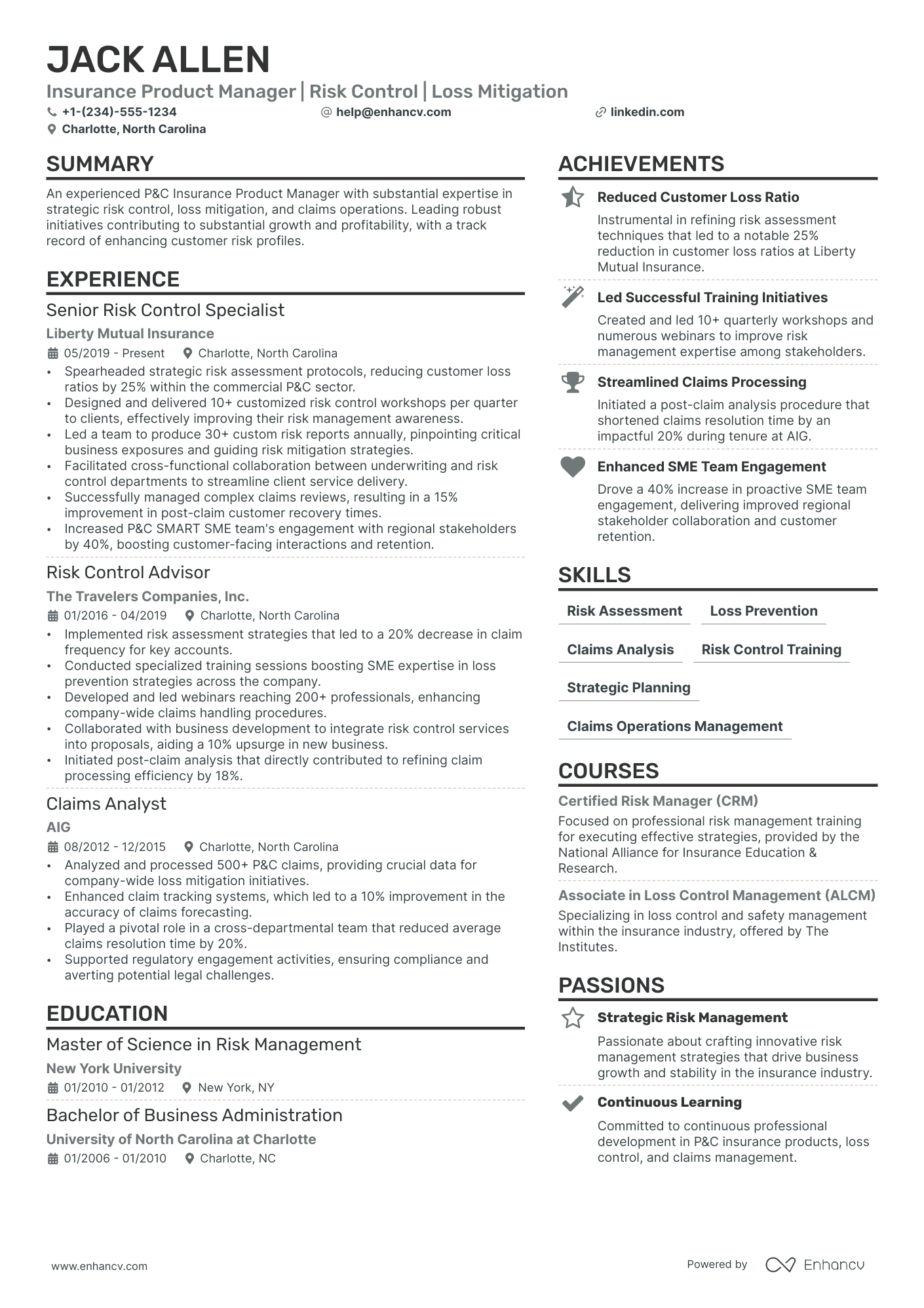

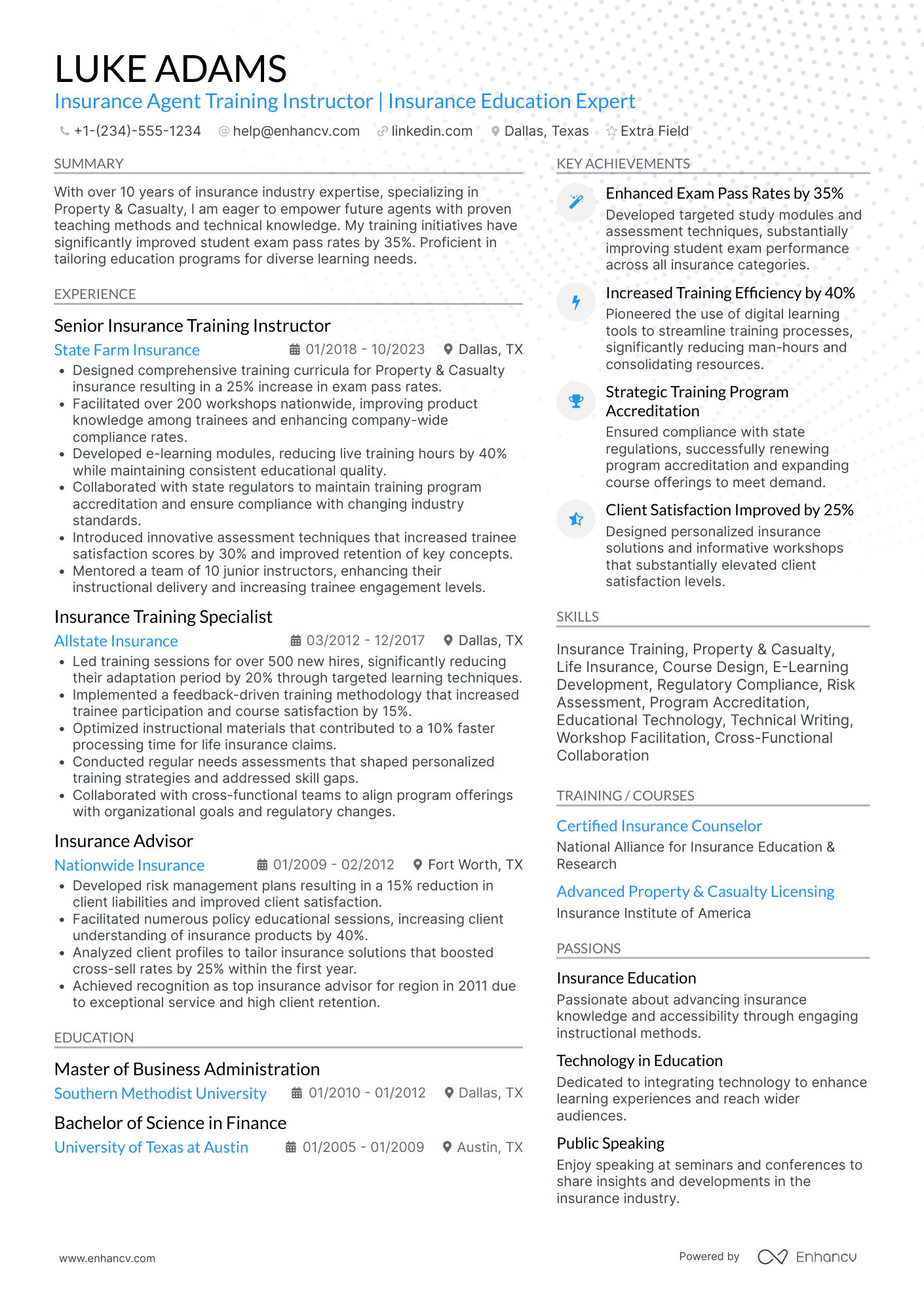

Insurance Product Manager

Insurance Product Manager roles have emerged from a blend of insurance industry knowledge and product management principals.

To make your application for Insurance Product Manager roles successful:

- Experience in insurance product development and management is important. Highlight your exposure to various stages of product development and lifecycle in the insurance sector.

- Emphasize your integration of market research into product creation. Demonstrating your ability to shape products based on customer needs and market trends is vital.

- Showcase your strategic planning and forecasting skills.

- Instead of listing skills, demonstrate how they translated to meaningful outcomes, for example 'launched a product that captured...%' of the market, or 'improvement of product features led to...%'. Attach numbers to your achievements and stick to the 'skill-action-results' rule.

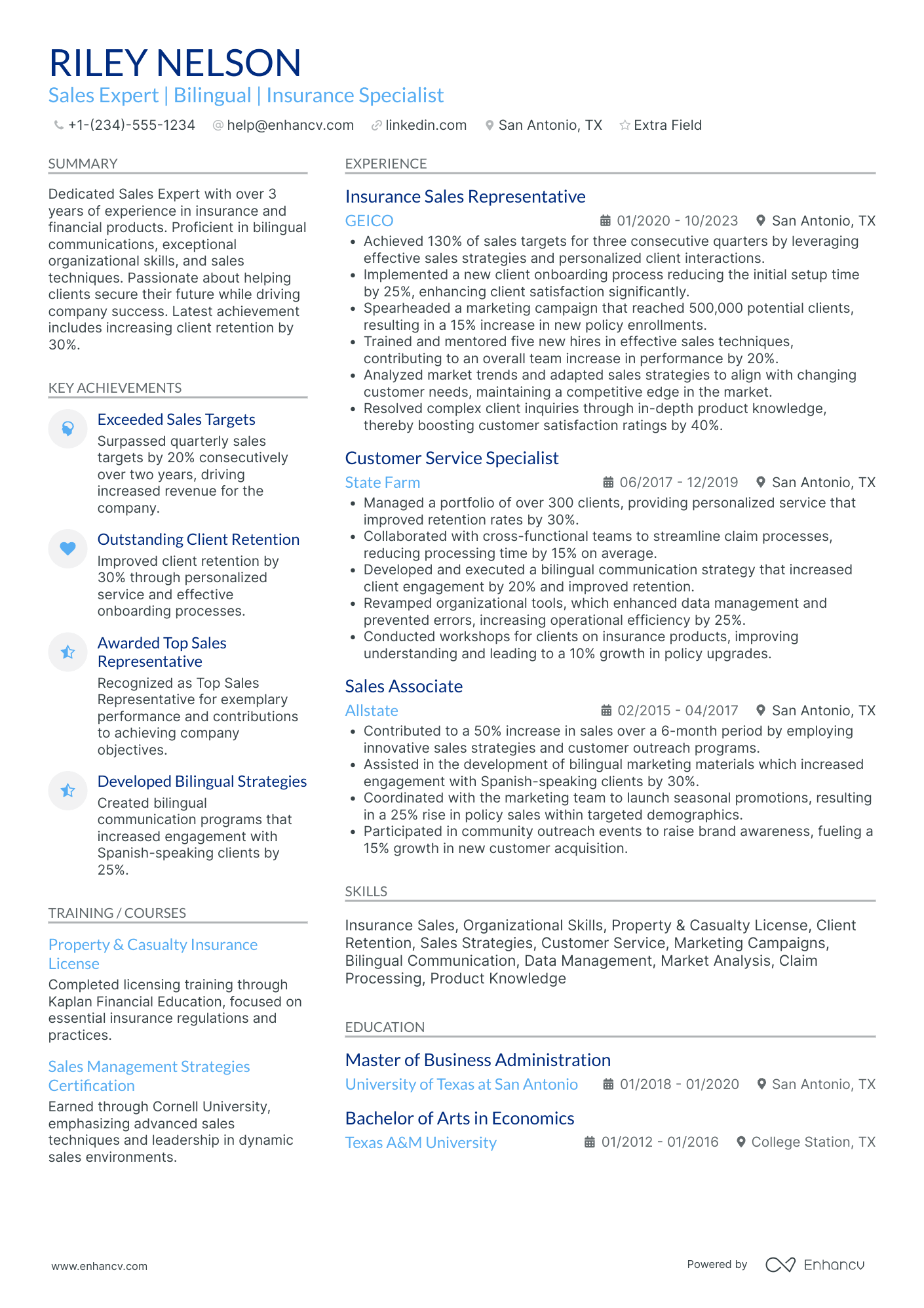

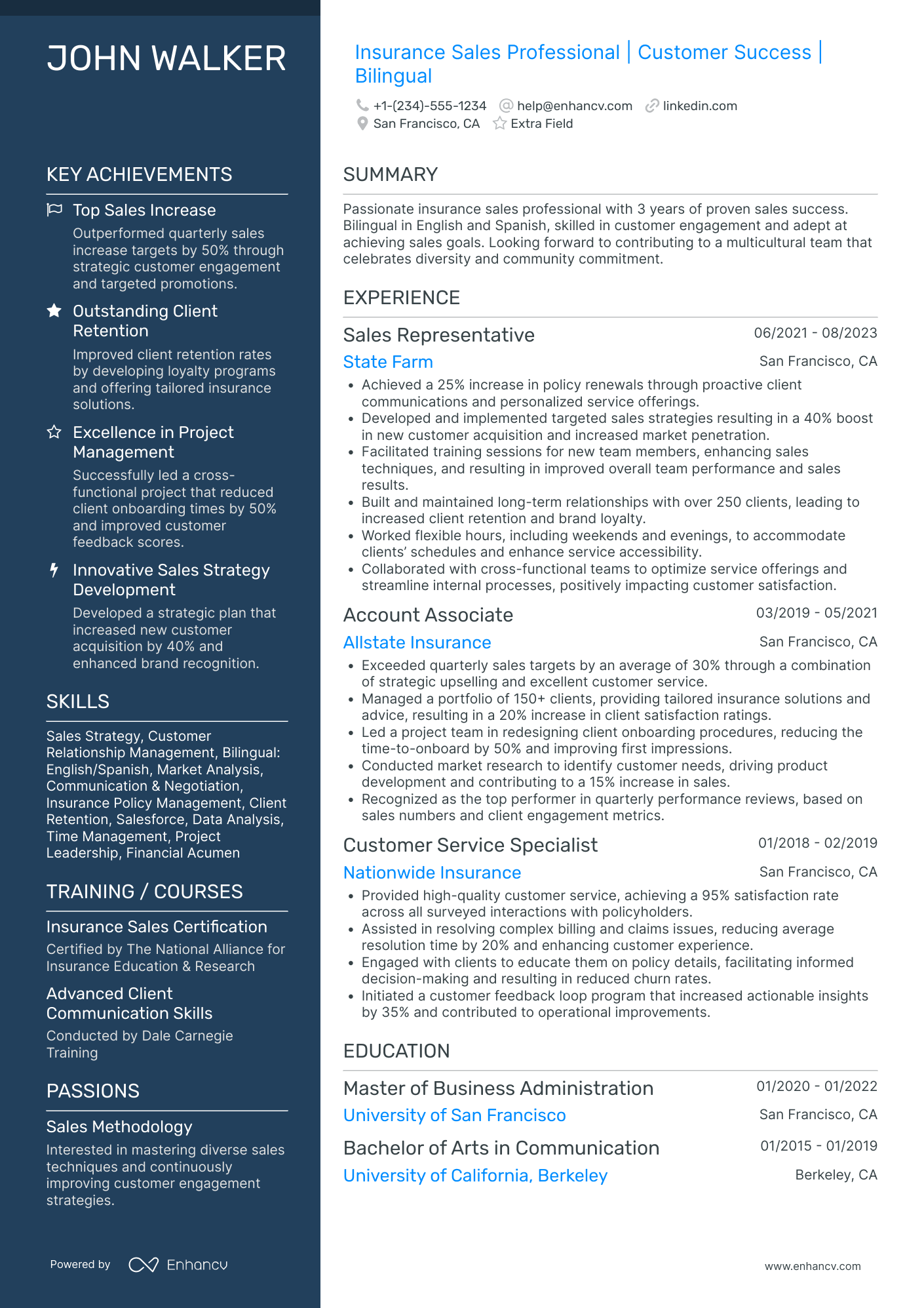

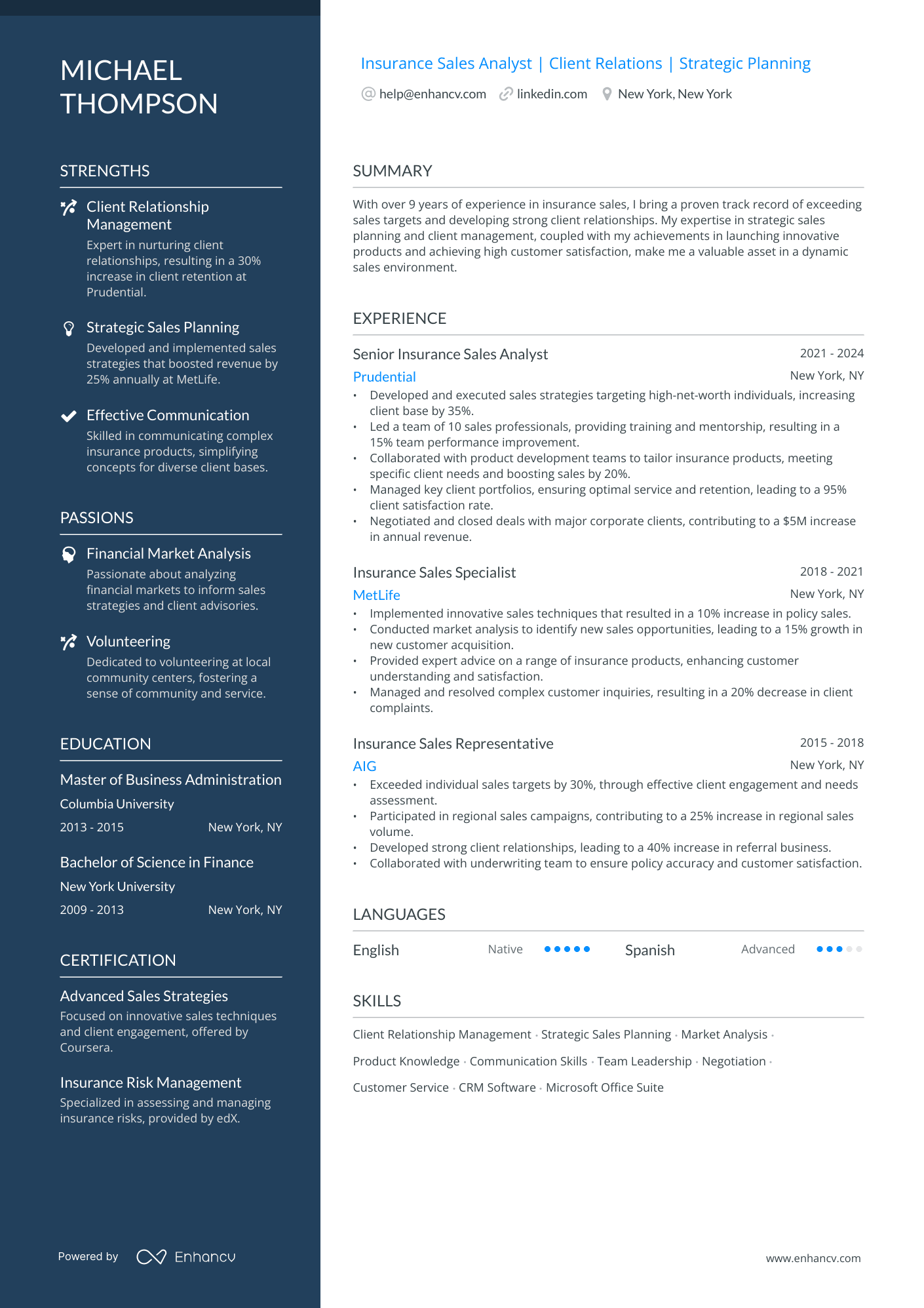

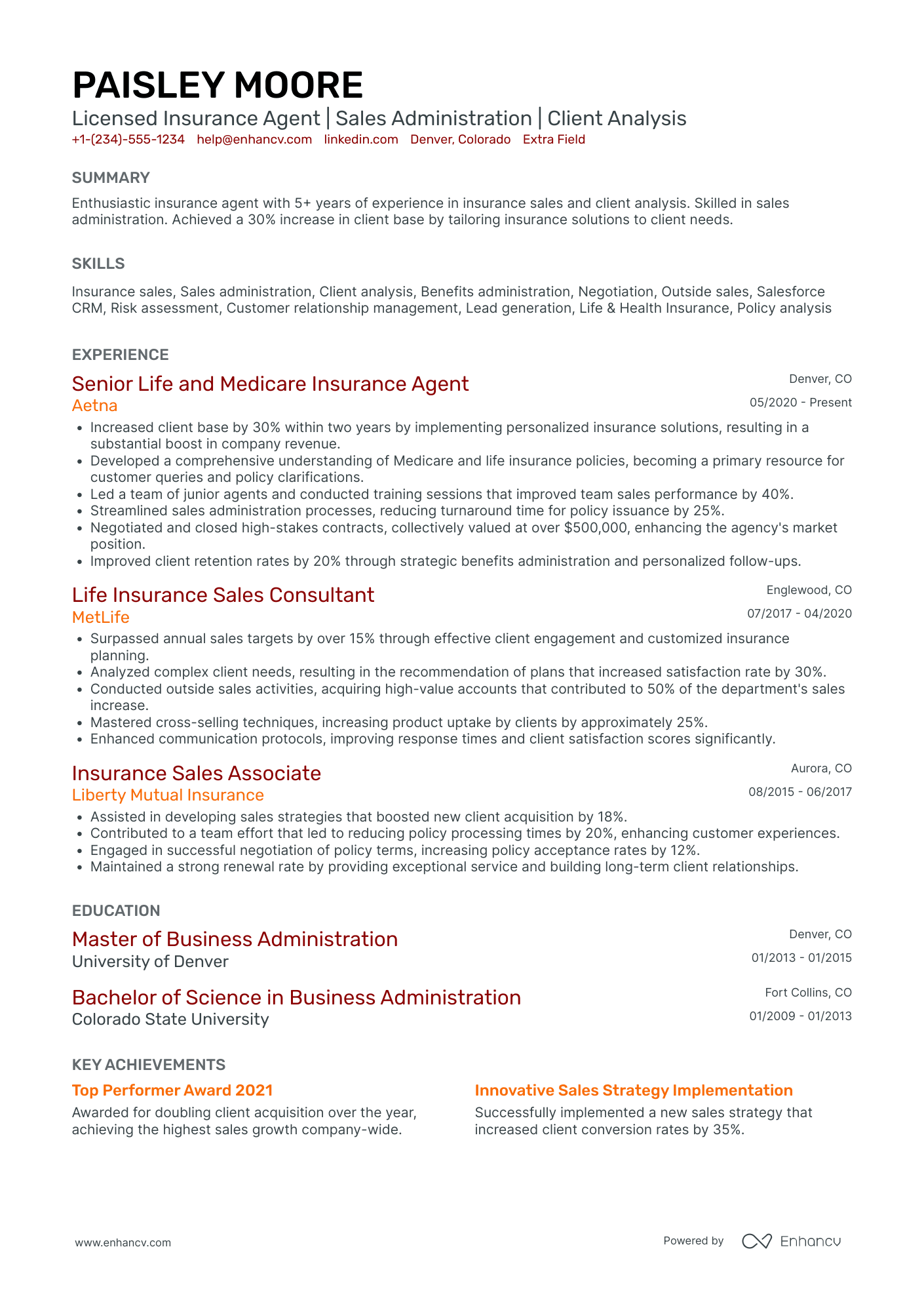

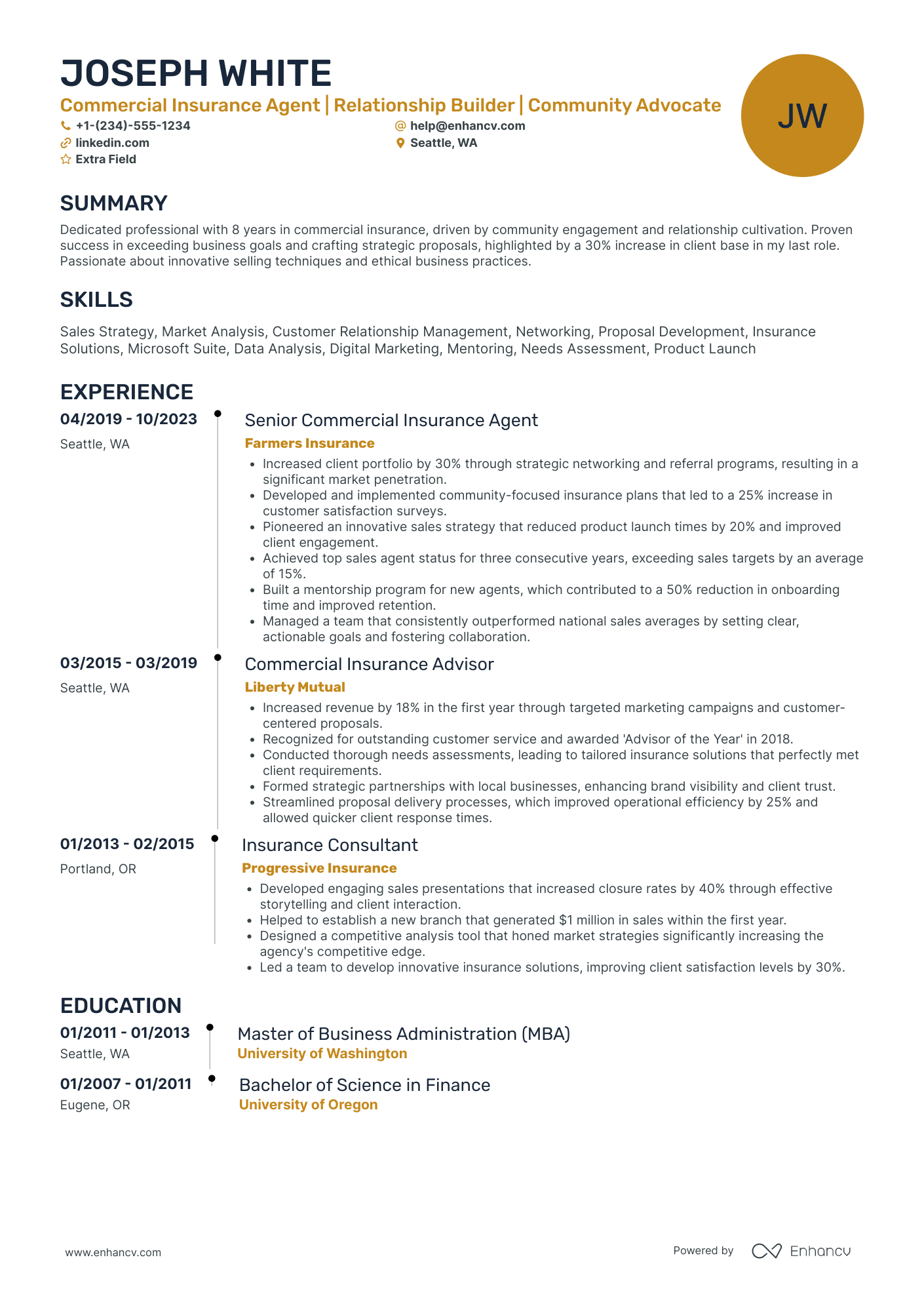

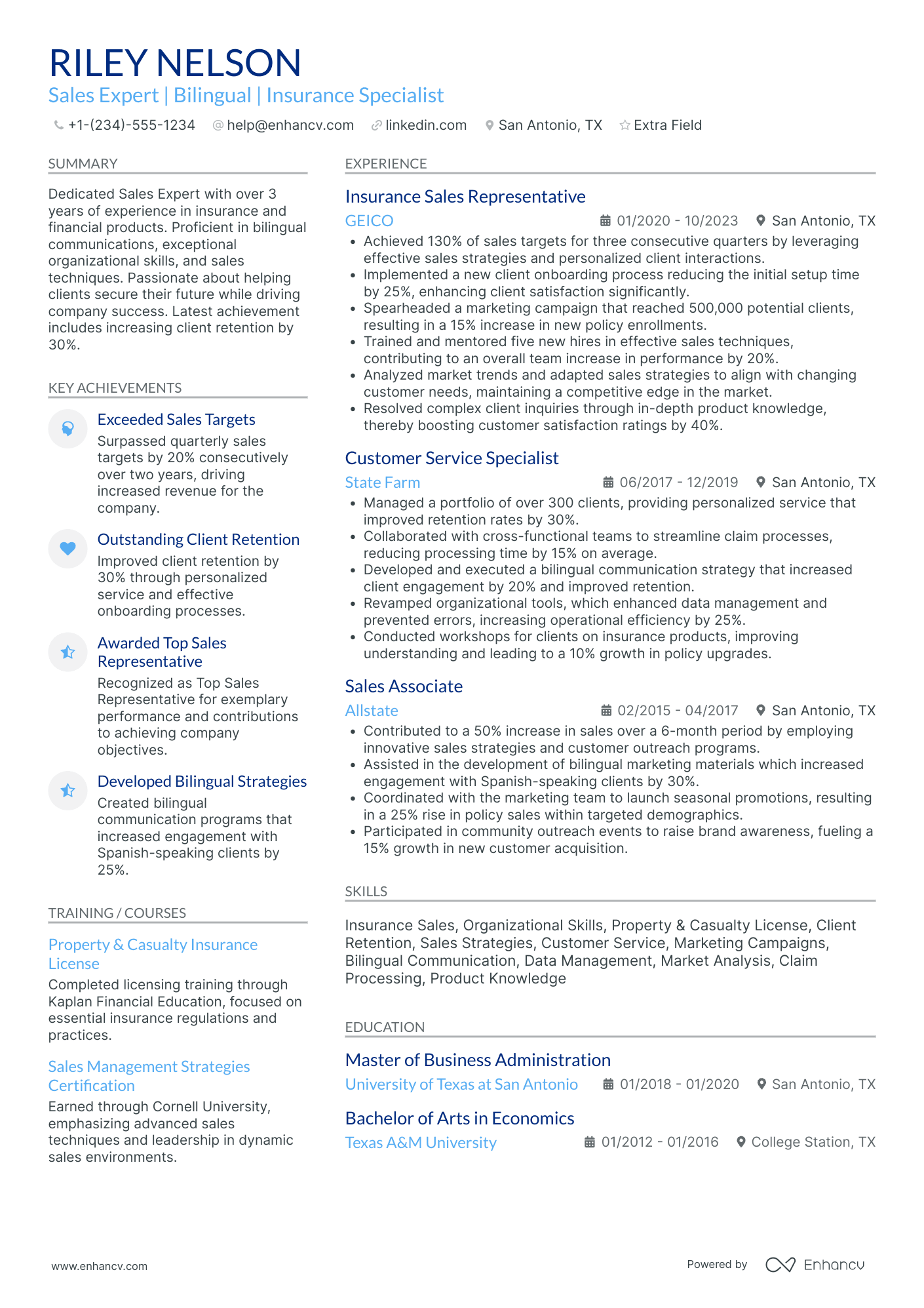

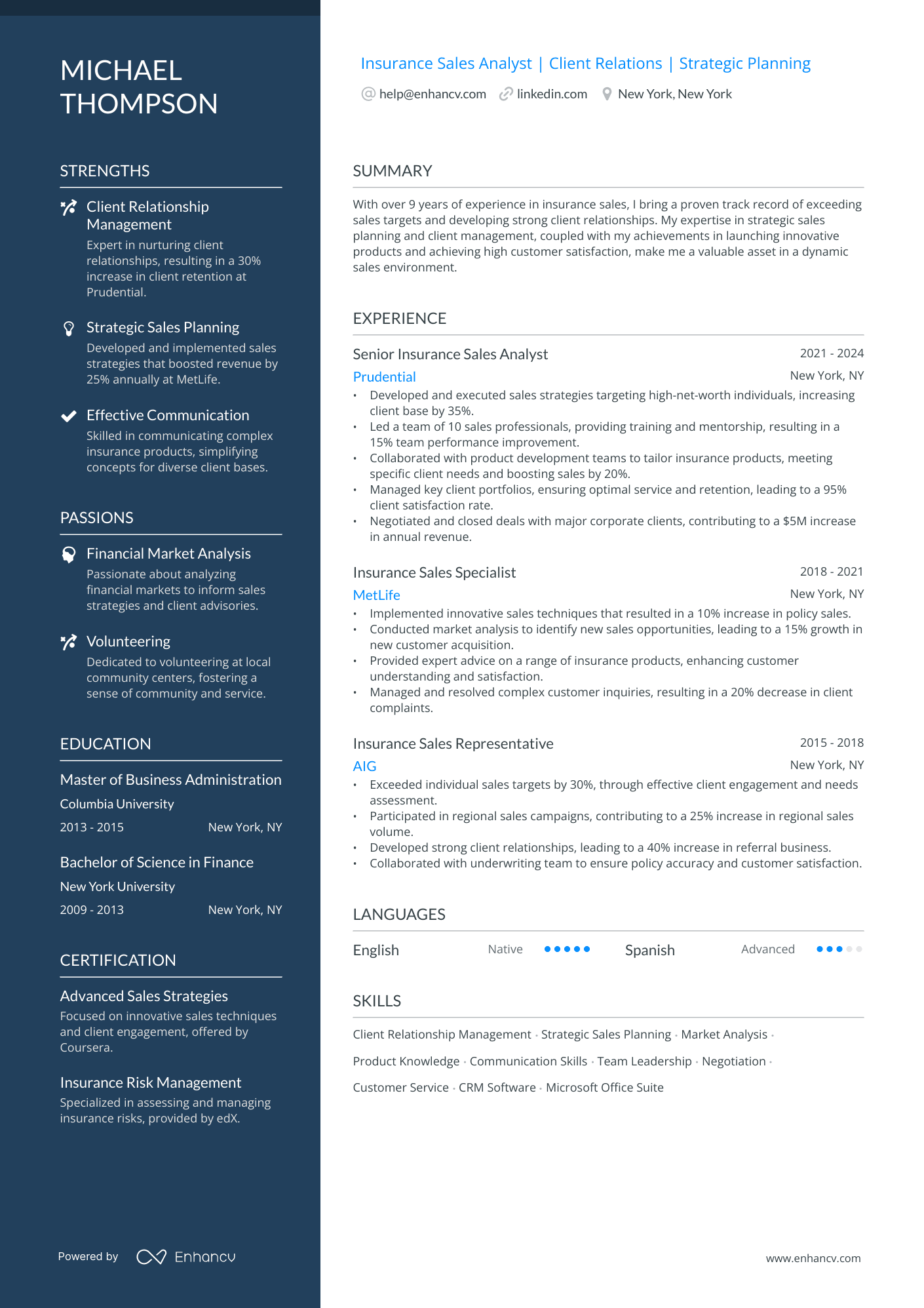

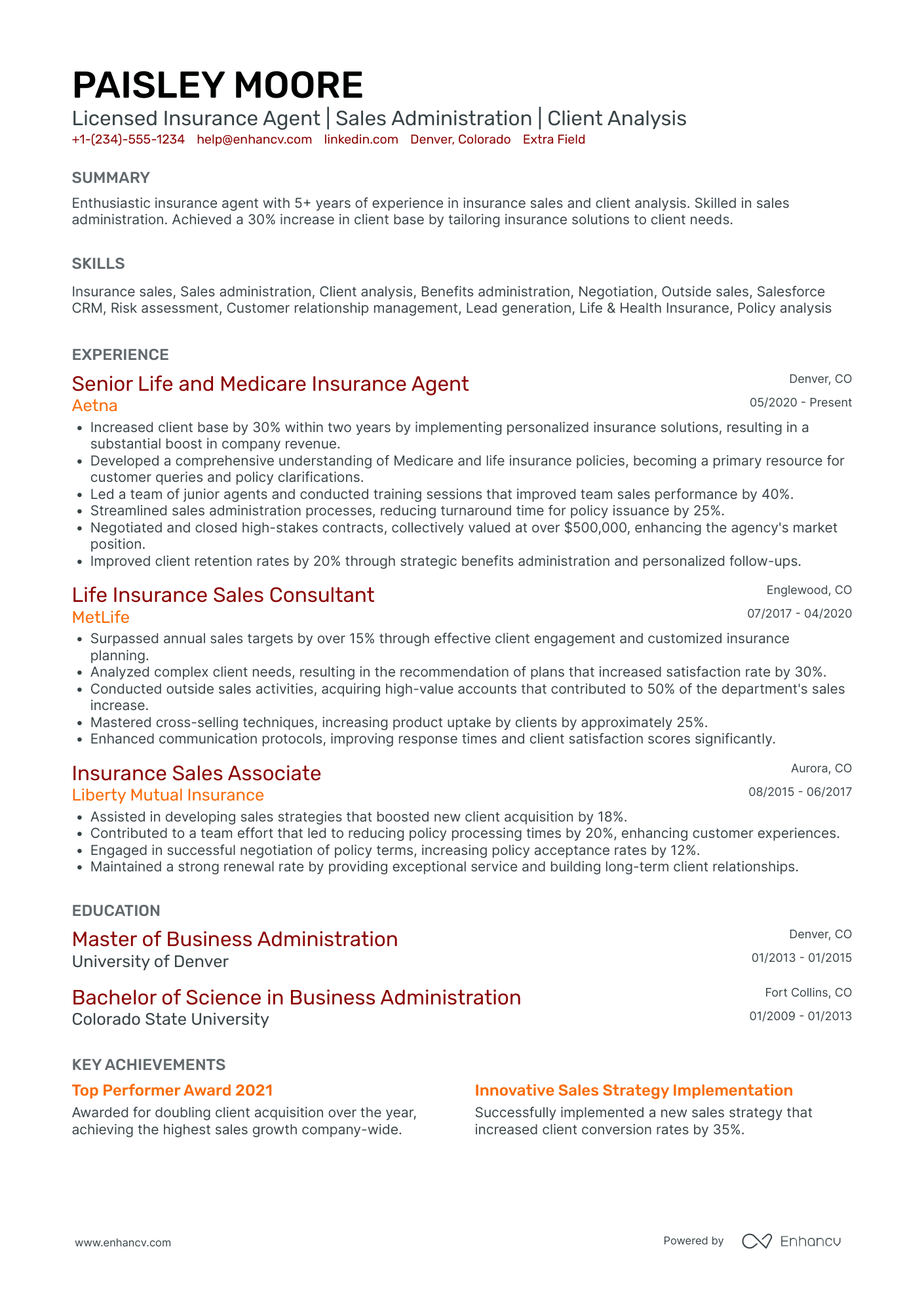

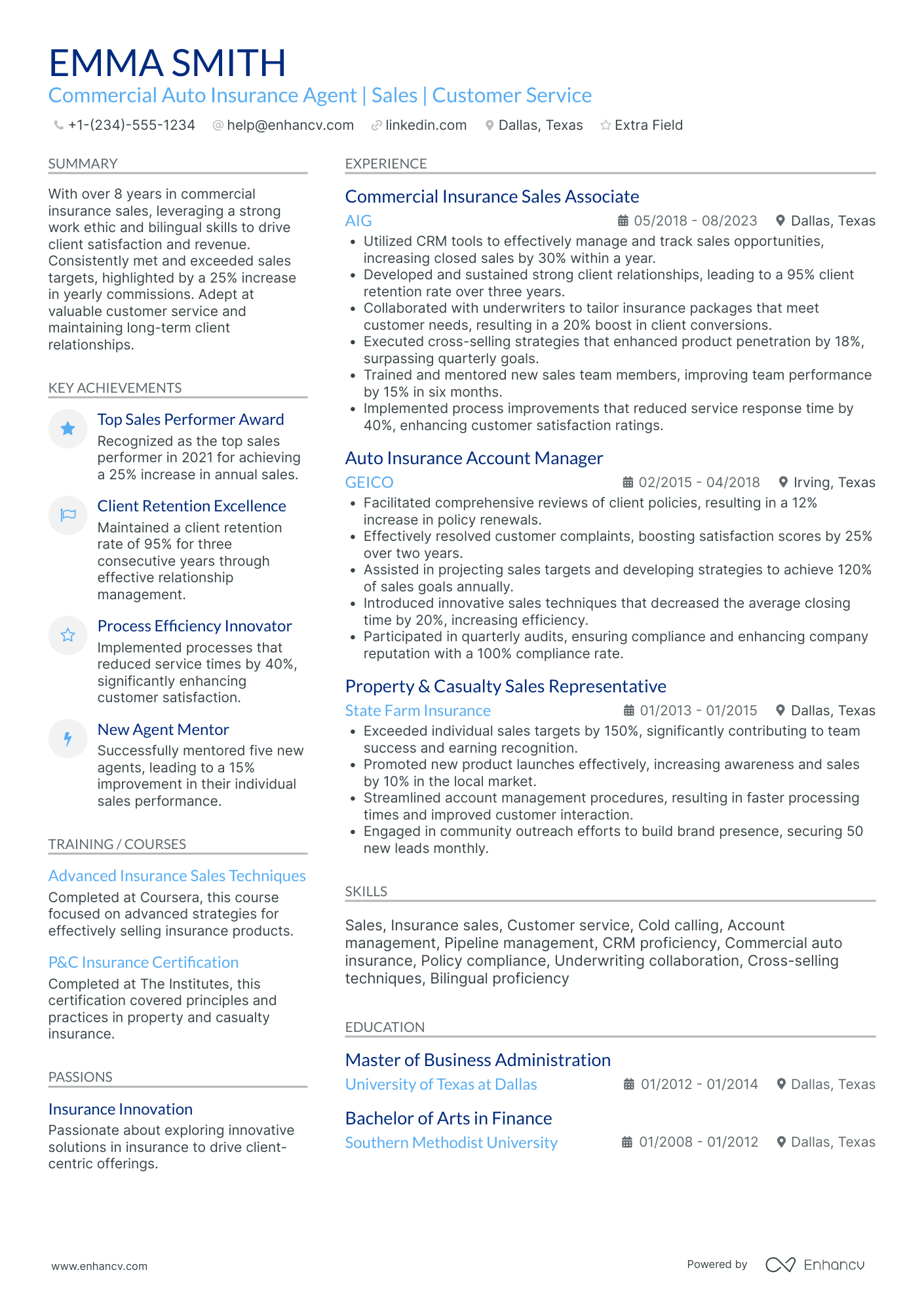

Insurance Sales

Insurance Sales roles are a derivative of sales roles within the broader insurance sector.

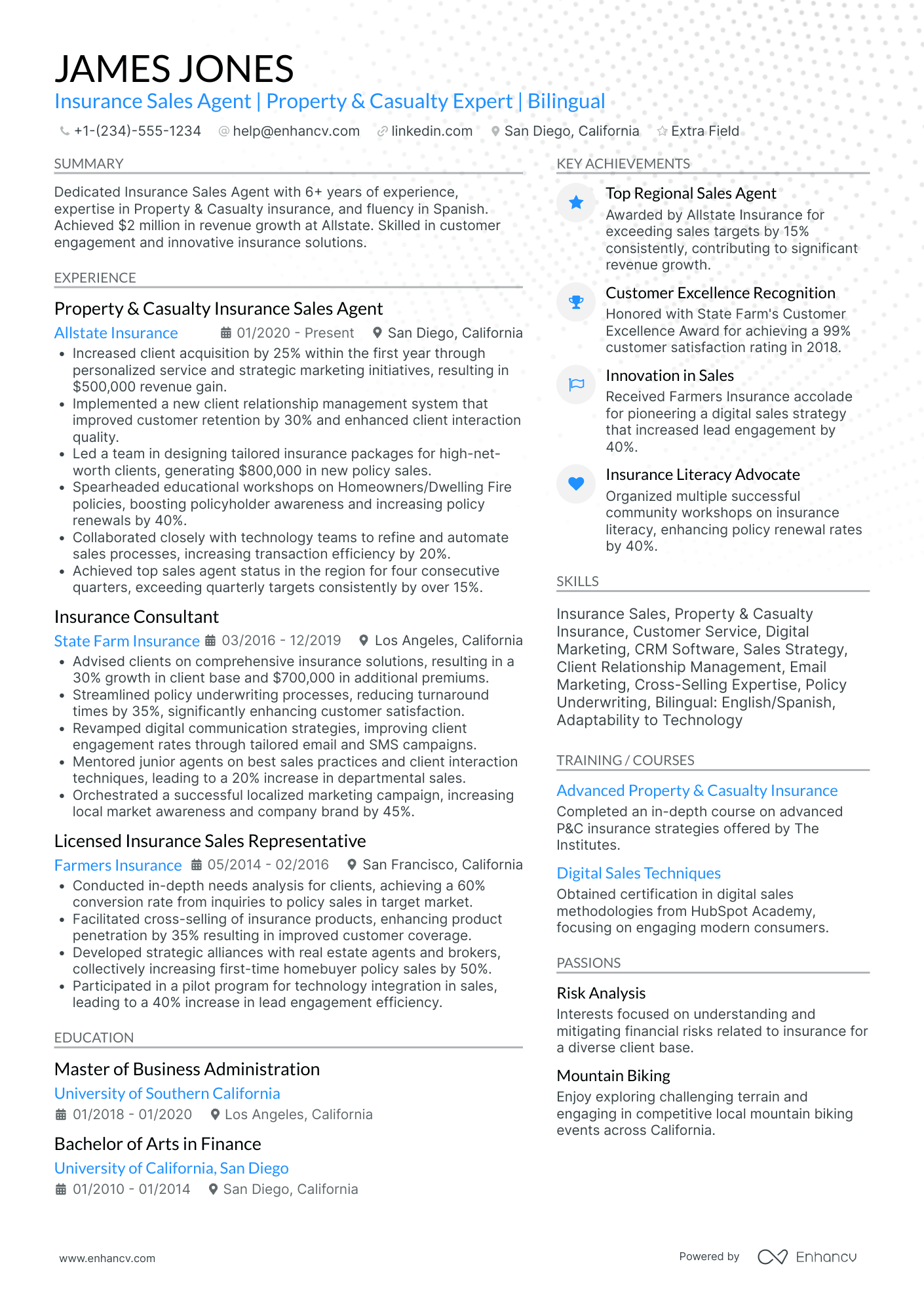

In order to increase your chances when applying for Insurance Sales roles, consider these tips:

- Having a robust understanding of different types of insurance products is vital. Ensure to include your knowledge and experiences dealing with various insurance products.

- Highlight your competencies in lead generation and client onboarding. These are essential sales tasks in the insurance field.

- Demonstrate your expertise in sales presentations and negotiations. Your ability to secure sales deals is fundamental to this role.

- Don’t just list skills, demonstrate how they led to positive results, for instance 'increased sales by...', 'achieved higher customer acquisition by...'. Present your achievements in a 'skill-action-results' method in your resume.