Many fraud investigator resume drafts fail because they read like case logs, not hiring documents, and bury results under tools and tasks. That hurts when an ATS filters keywords and recruiters scan in seconds amid heavy competition. If you need a refresher on the fundamentals, our guide on how to write a resume covers the essentials before you dive into role-specific details.

A strong resume shows how you protect revenue and reduce risk. You should highlight dollars prevented or recovered, false-positive reduction, case volume and cycle time, SAR or chargeback outcomes, audit findings cleared, and cross-team impact.

Key takeaways

- Quantify fraud outcomes using dollars recovered, cases resolved, and cycle time reduced.

- Choose reverse-chronological format for experienced investigators and hybrid format for career changers.

- Mirror exact tools, frameworks, and terminology from each job posting in your bullets.

- Structure every experience bullet with an action verb, specific task, and measurable result.

- Lead your summary with years of experience, domain expertise, and one standout achievement.

- List certifications like CFE or CAMS near education to reinforce specialized credibility fast.

- Use Enhancv to turn vague duties into sharp, recruiter-ready bullets with clear metrics.

Job market snapshot for fraud investigators

We analyzed 75 recent fraud investigator job ads across major US job boards. These numbers help you understand experience requirements, top companies hiring, industry demand at a glance.

What level of experience employers are looking for fraud investigators

| Years of Experience | Percentage found in job ads |

|---|---|

| 1–2 years | 4.0% (3) |

| 3–4 years | 14.7% (11) |

| 5–6 years | 2.7% (2) |

| 7–8 years | 12.0% (9) |

| 9–10 years | 1.3% (1) |

| 10+ years | 2.7% (2) |

| Not specified | 64.0% (48) |

Fraud investigator ads by area of specialization (industry)

| Industry (Area) | Percentage found in job ads |

|---|---|

| Finance & Banking | 58.7% (44) |

| Government | 33.3% (25) |

Top companies hiring fraud investigators

| Company | Percentage found in job ads |

|---|---|

| CONTACT GOVERNMENT SERVICES | 26.7% (20) |

Role overview stats

These tables show the most common responsibilities and employment types for fraud investigator roles. Use them to align your resume with what employers expect and to understand how the role is structured across the market.

Day-to-day activities and top responsibilities for a fraud investigator

| Responsibility | Percentage found in job ads |

|---|---|

| Data analysis | 41.3% (31) |

| Microsoft excel | 30.7% (23) |

| Microsoft word | 30.7% (23) |

| Microsoft powerpoint | 29.3% (22) |

| Microsoft outlook | 28.0% (21) |

| Communication | 12.0% (9) |

| Active directory | 10.7% (8) |

| Amazon web services | 10.7% (8) |

| Artificial intelligence | 10.7% (8) |

| Atlassian jira | 10.7% (8) |

| Authentication management | 10.7% (8) |

| Backup and recovery | 10.7% (8) |

Type of employment (remote vs on-site vs hybrid)

| Employment type | Percentage found in job ads |

|---|---|

| On-site | 80.0% (60) |

| Hybrid | 16.0% (12) |

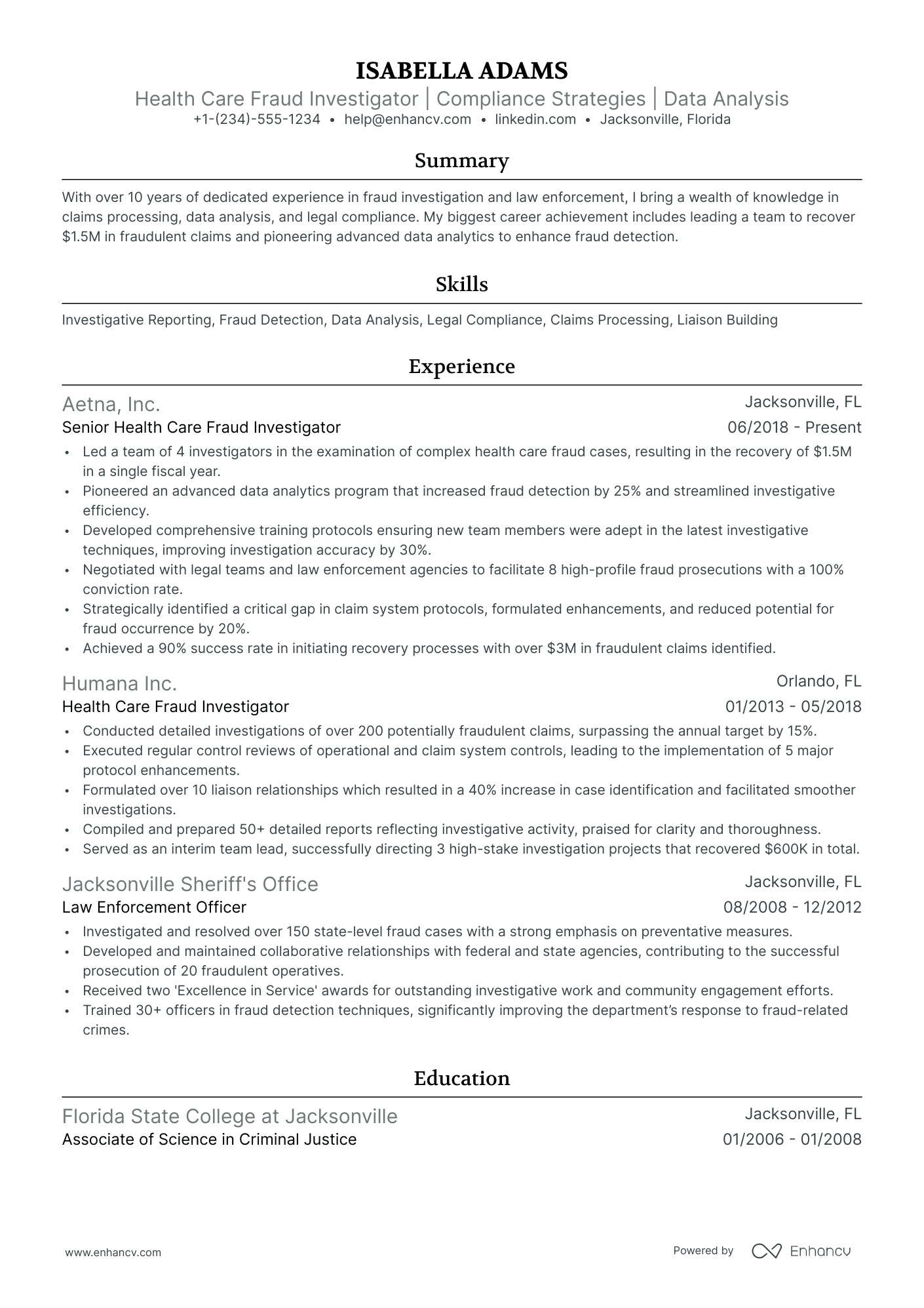

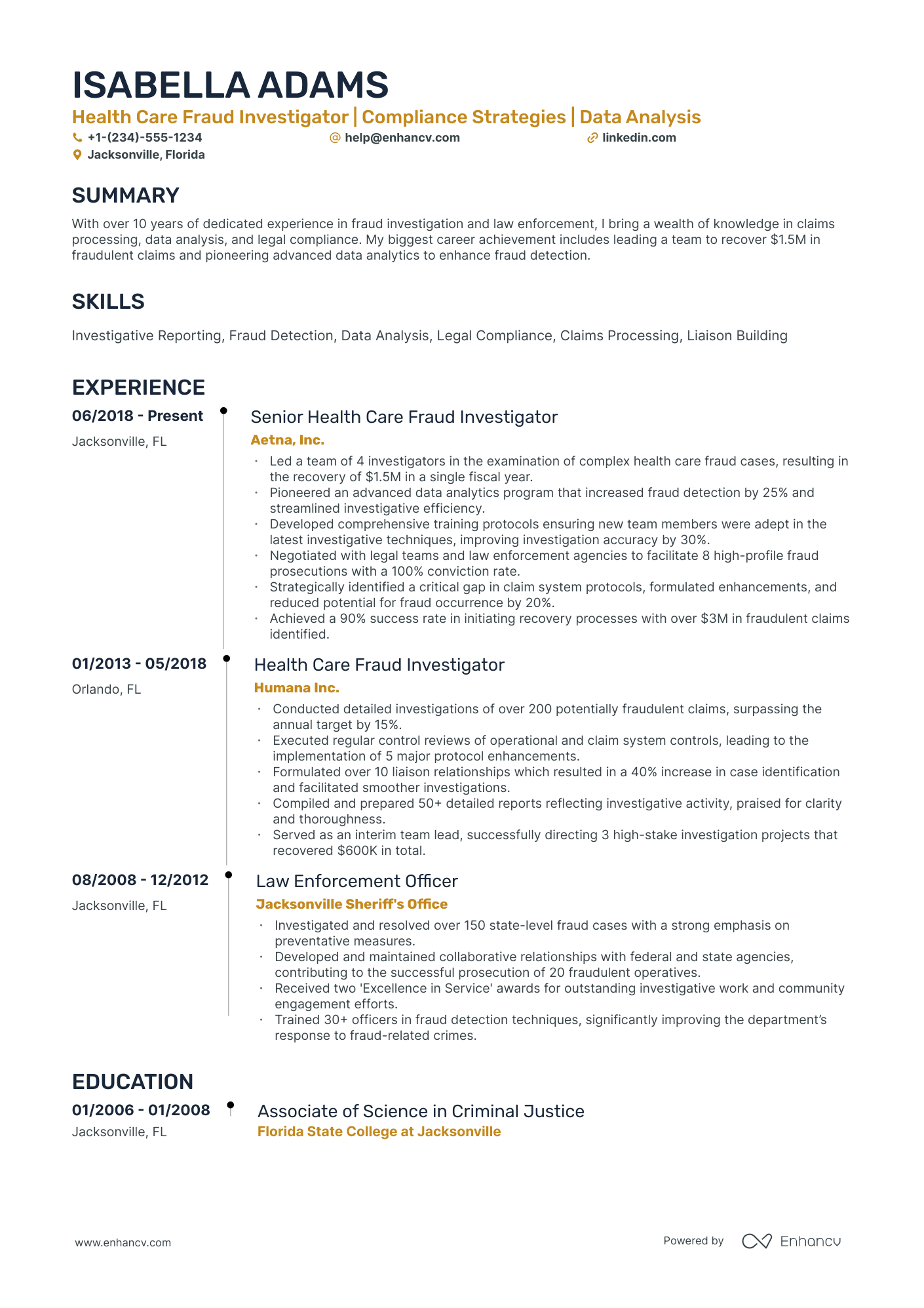

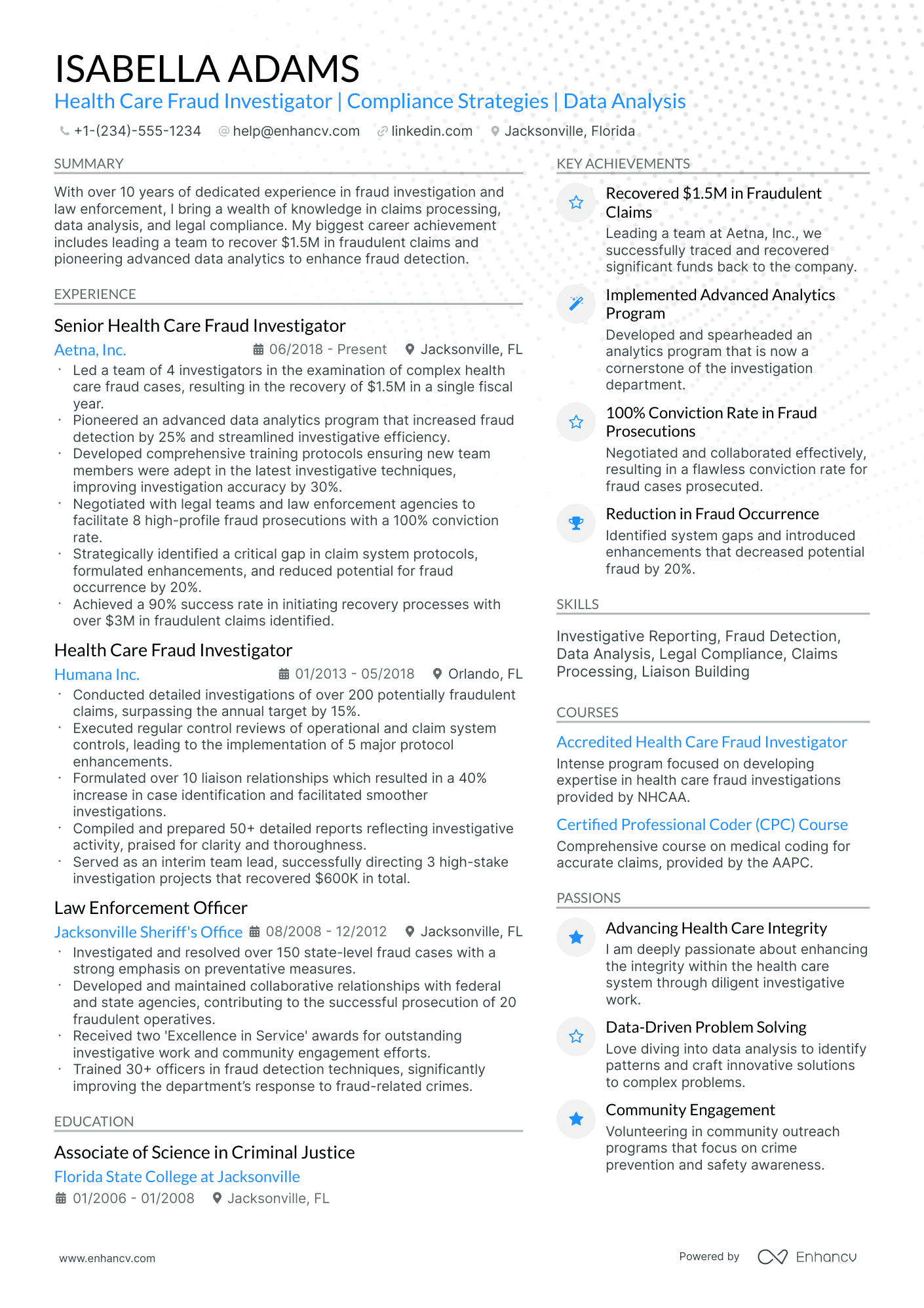

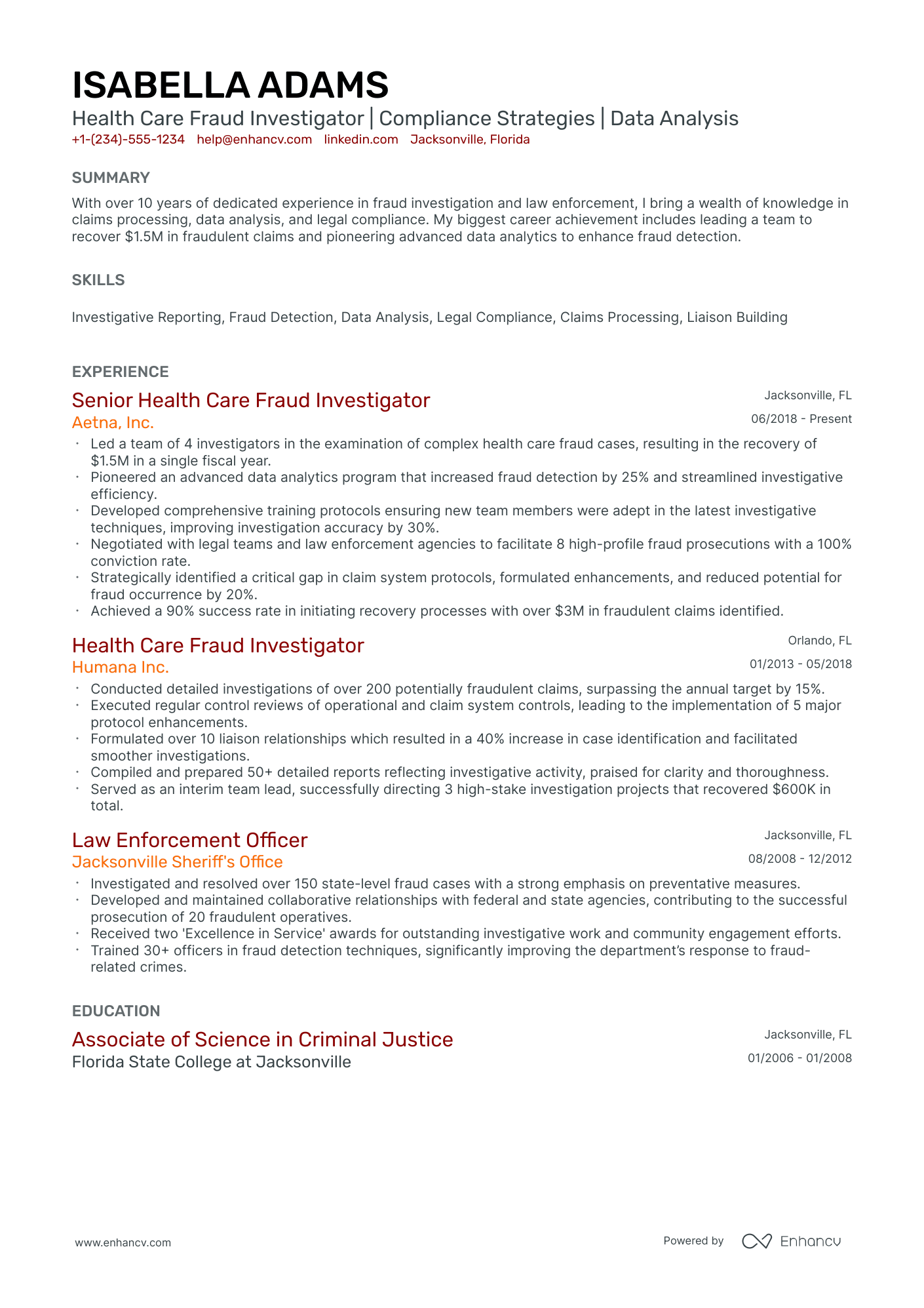

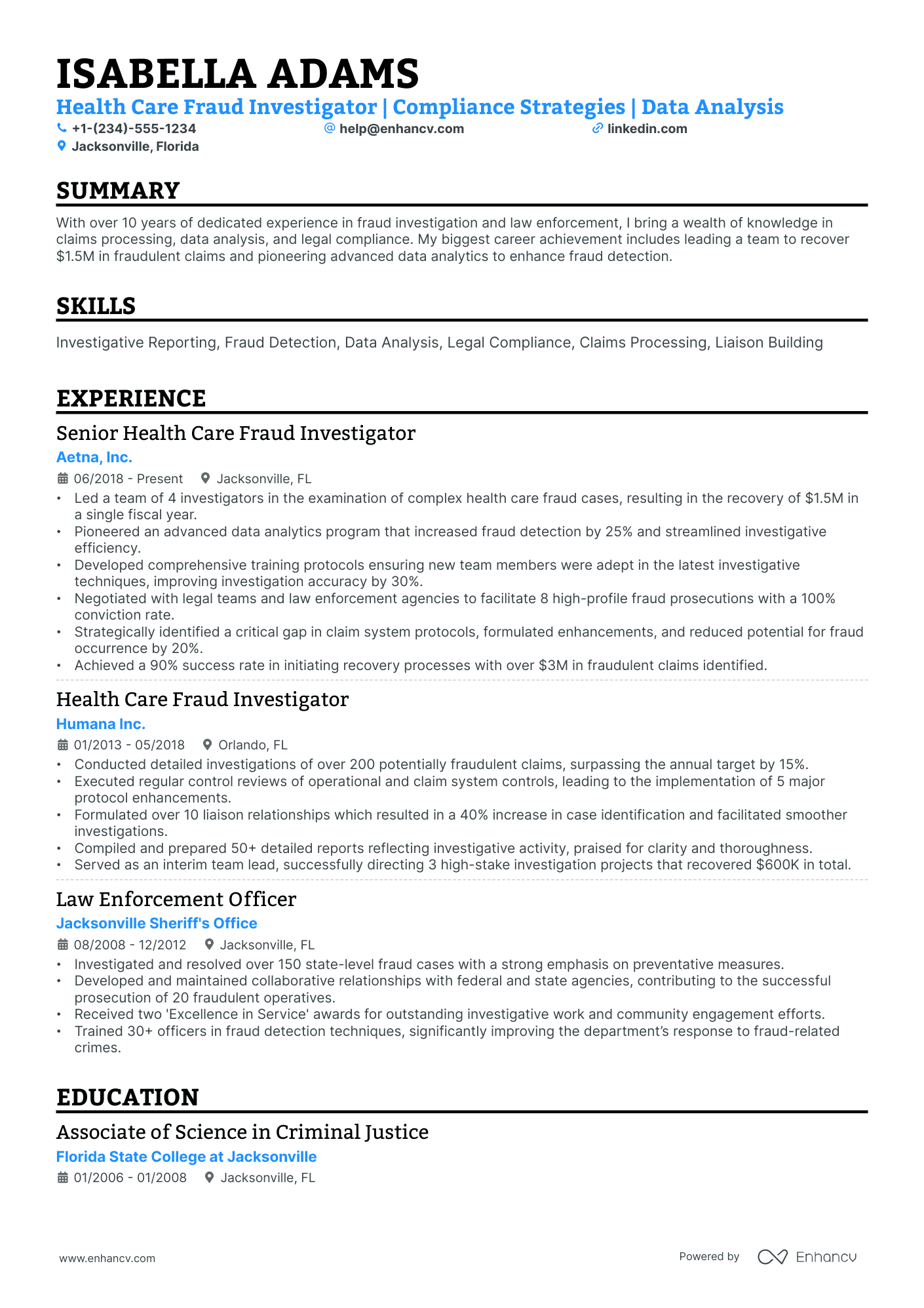

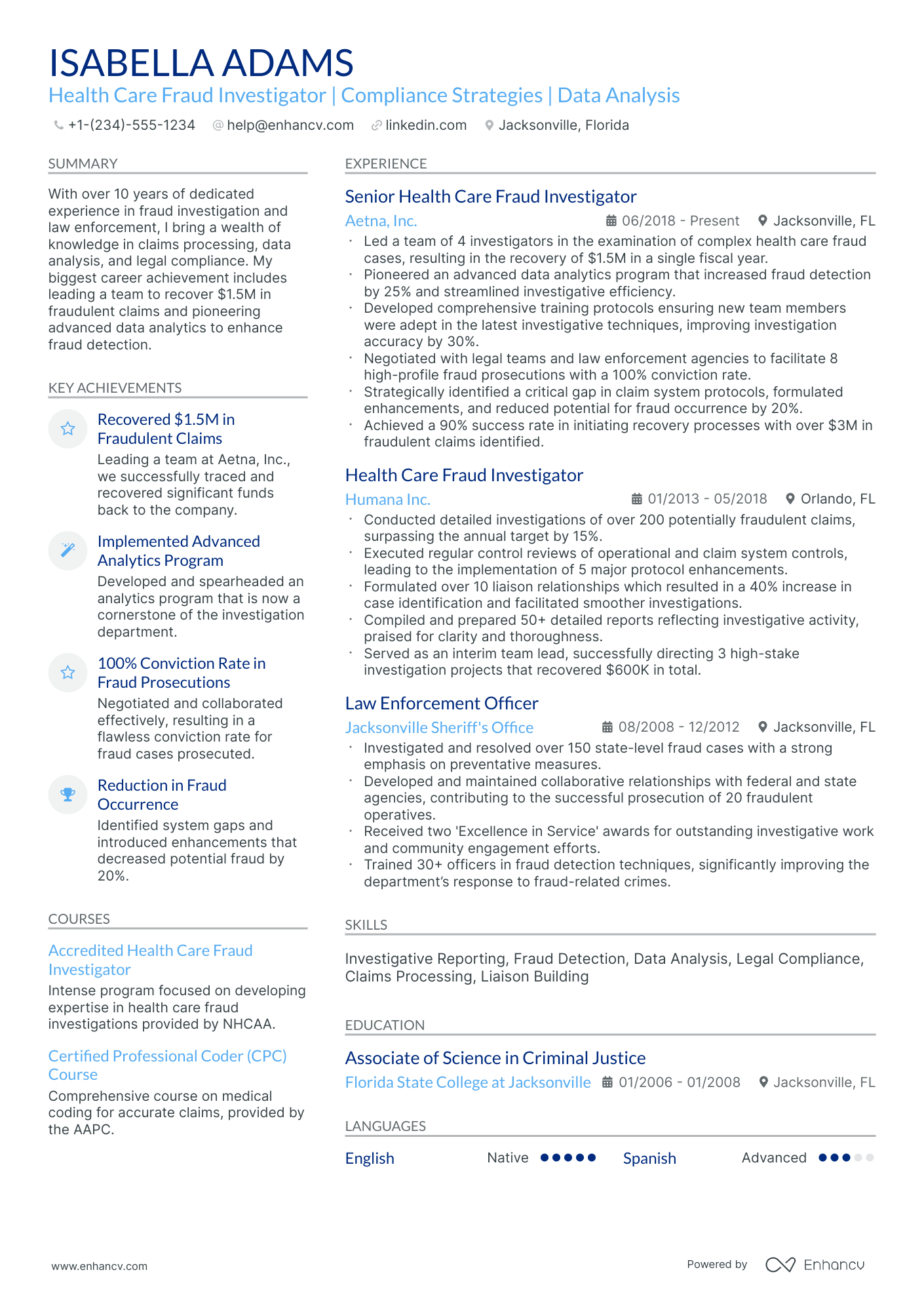

How to format a fraud investigator resume

Recruiters hiring fraud investigators prioritize analytical rigor, familiarity with investigation methodologies, and a track record of resolving cases with measurable outcomes. The right resume format ensures these signals—case volume, recovery figures, tools proficiency, and collaboration with legal or compliance teams—are immediately visible rather than buried beneath formatting choices that obscure your progression.

I have significant experience in this role—which format should I use?

Use a reverse-chronological format to present your investigative career in a clear, linear progression that highlights growing caseload responsibility and domain expertise. Do:

- Lead with your most recent role and emphasize scope: team size, case volume, jurisdictions covered, and cross-functional coordination with law enforcement or compliance units.

- Feature role-specific tools and domains prominently—SAS, ACL, i2 Analyst's Notebook, Verafin, SAR filing, anti-money laundering frameworks, or insurance fraud detection platforms.

- Quantify outcomes tied to financial recovery, loss prevention, case resolution rates, or policy improvements you directly influenced.

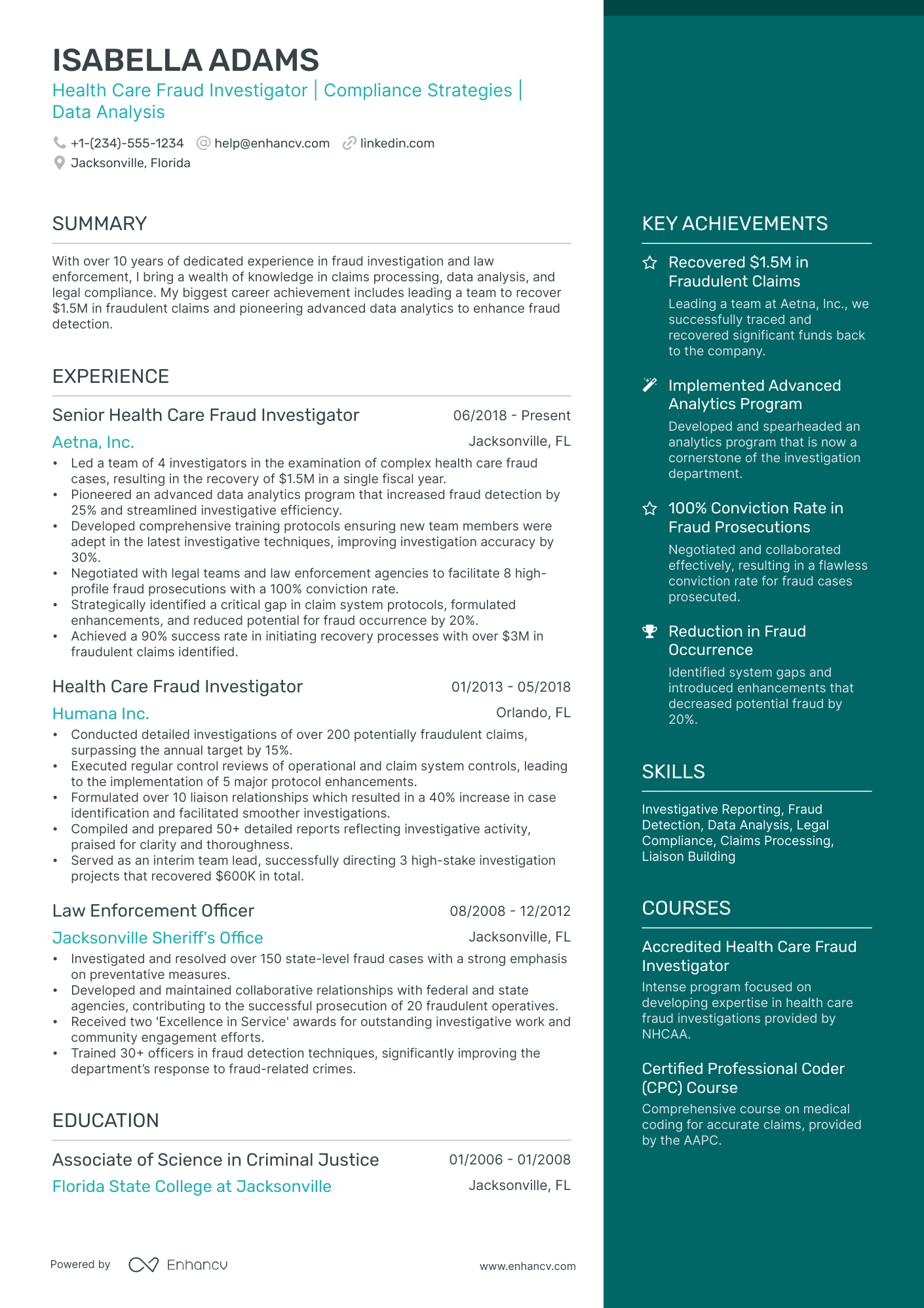

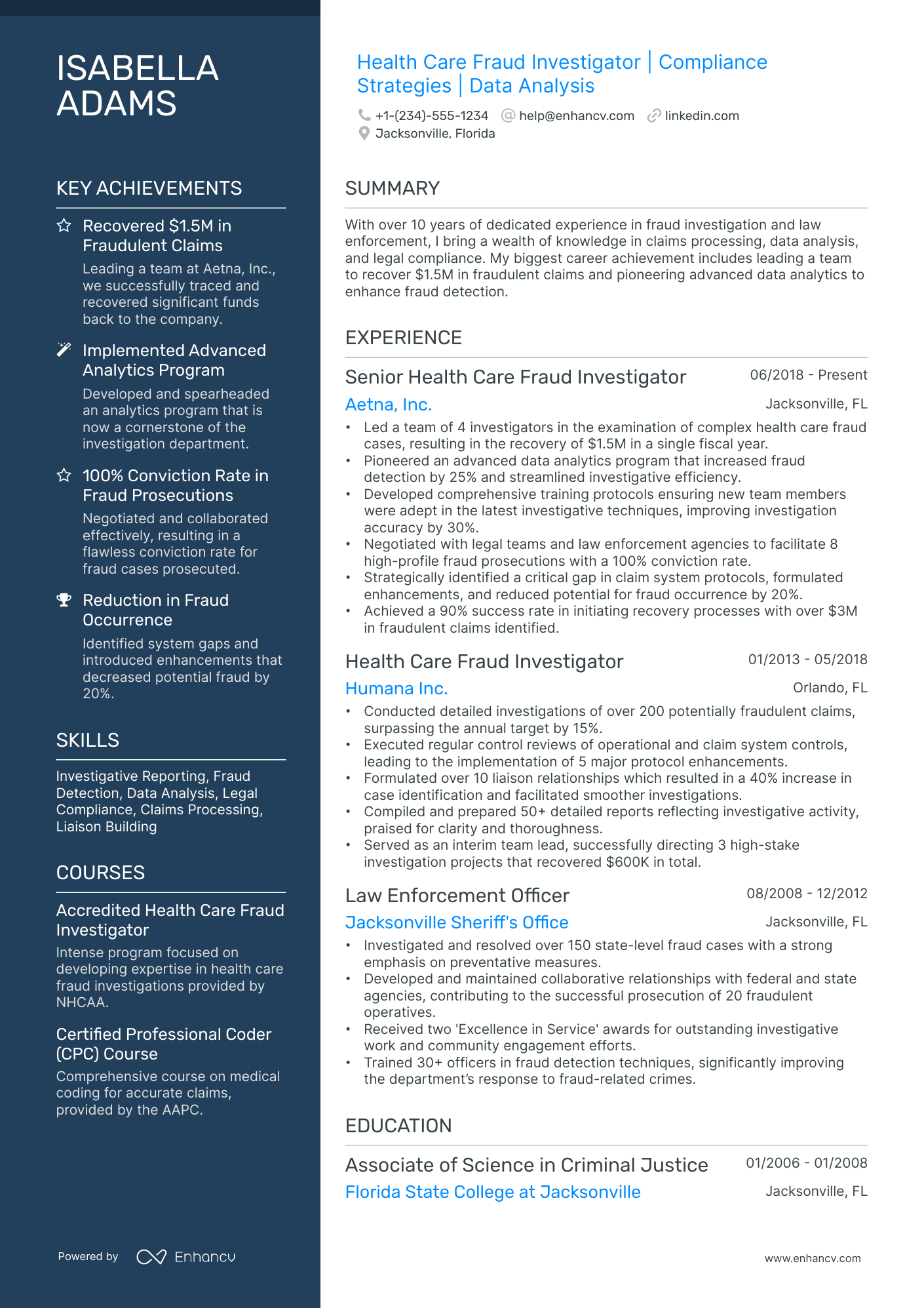

I'm junior or switching into this role—what format works best?

A hybrid format works best because it lets you lead with relevant analytical and investigative skills while still providing a concise work history that shows professional context. Do:

- Place a dedicated skills section near the top of your resume, highlighting fraud detection tools, data analysis platforms, regulatory knowledge, and relevant certifications such as the Certified Fraud Examiner (CFE) designation.

- Include academic projects, internships, or transitional experience—such as compliance auditing, loss prevention, or financial analysis roles—that demonstrate investigative thinking and attention to detail.

- Connect every action to a clear result so recruiters see cause and effect, not just task descriptions.

Why not use a functional resume?

A functional format strips away the timeline and context recruiters need to evaluate how your investigative skills were applied in real workplace settings, making it harder to verify your competence and credibility.

- Career changers from law enforcement, accounting, or compliance who have transferable analytical and investigative skills but no formal fraud investigator title yet.

- Recent graduates with relevant internships or capstone projects in fraud examination, forensic accounting, or criminal justice who lack full-time experience.

- Candidates with extended resume gaps due to personal circumstances or industry transitions who need to foreground certifications and skills.

Once your layout and formatting choices are in place, the next step is deciding which sections to include so each one reinforces your qualifications.

What sections should go on a fraud investigator resume

Recruiters expect a fraud investigator resume to show clear investigative experience, case outcomes, and compliance knowledge at a glance. Knowing what to put on a resume helps you prioritize the right content from the start. Use this structure for maximum clarity:

- Header

- Summary

- Experience

- Skills

- Projects

- Education

- Certifications

- Optional sections: Awards, Publications, Languages

Your strongest experience bullets should emphasize measurable impact, case volume and complexity, dollar amounts prevented or recovered, tools used, and results delivered in audits, referrals, or prosecutions.

Is your resume good enough?

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

Once you’ve organized your resume with the right components, the next step is writing your fraud investigator experience section to show how you applied those elements in real investigations.

How to write your fraud investigator resume experience

Your work experience section is where you prove you've actually caught fraud, recovered losses, and protected organizations—not just monitored alerts. Hiring managers prioritize demonstrated impact over descriptive task lists, so every bullet should highlight delivered outcomes, the investigative tools or methods you applied, and measurable results tied to fraud detection, prevention, or resolution.

Each entry should include:

- Job title

- Company and location (or remote)

- Dates of employment (month and year)

Three to five concise bullet points showing what you owned, how you executed, and what outcomes you delivered:

- Ownership scope: the case portfolios, fraud categories, account populations, monitoring systems, or investigative teams you were directly accountable for as a fraud investigator.

- Execution approach: the tools, frameworks, technologies, or methods you used to investigate and resolve fraud—such as case management platforms, data analytics software, transaction monitoring systems, regulatory databases, evidence preservation protocols, or interview techniques.

- Value improved: changes to detection accuracy, false-positive rates, case resolution speed, loss recovery, compliance posture, or organizational risk exposure that resulted from your investigative work.

- Collaboration context: how you worked with law enforcement agencies, compliance teams, legal counsel, financial institutions, internal audit, or technology partners to advance investigations and strengthen fraud prevention controls.

- Impact delivered: outcomes expressed through recovered funds, reduced fraud losses, successful prosecutions, strengthened controls, or risk mitigation at scale—framed as results rather than activities.

Experience bullet formula

A fraud investigator experience example

✅ Right example - modern, quantified, specific.

Fraud Investigator

PayWave Financial | Austin, TX

2022–Present

Digital payments platform supporting five million customers and mid-market merchants across the US.

- Led end-to-end investigations across card-not-present, account takeover, and synthetic identity cases using SQL, Excel, and Splunk; reduced fraud loss rate by 18% year over year while maintaining a 0.6% false-positive rate.

- Built and tuned rules in Actimize and internal risk engines using device fingerprinting, IP intelligence, and velocity checks; cut high-risk transaction approval time from twenty-four hours to four hours and prevented $1.3M in confirmed losses.

- Partnered with product managers and engineers to ship step-up authentication and KYC (know your customer) flow changes; increased verified-user conversion by 6% while lowering new-account fraud by 22%.

- Produced and presented weekly fraud trend reporting in Tableau and Jira to operations and leadership; improved case triage accuracy by 15% and reduced backlog from nine days to three days.

- Coordinated with bank partners, legal, and customer support to file SARs (Suspicious Activity Reports) and support chargeback disputes; improved representment win rate by 11% and recovered $420K in revenue.

Now that you've seen how a strong experience section comes together, let's look at how to adjust yours to match the specific job you're targeting.

How to tailor your fraud investigator resume experience

Recruiters evaluate your fraud investigator resume through applicant tracking systems and manual review, so tailoring your resume to the job description is critical. Tailoring your experience section ensures your qualifications match the specific language, tools, and priorities each employer outlines.

Ways to tailor your fraud investigator experience:

- Mirror the exact fraud detection software or platforms listed in the posting.

- Match terminology for investigative methodologies like SARs or link analysis.

- Reflect the compliance frameworks or regulatory standards the employer references.

- Highlight experience in the specific industry domain the role targets.

- Use the same KPIs or case resolution metrics the job description prioritizes.

- Emphasize collaboration with law enforcement or legal teams when mentioned.

- Align your experience with referenced anti-money laundering or BSA requirements.

- Include data analytics tools or forensic technologies the posting names directly.

Tailoring means aligning your real accomplishments with each job's stated requirements, not forcing disconnected keywords into your experience bullets.

Resume tailoring examples for fraud investigator

| Job description excerpt | Untailored | Tailored |

|---|---|---|

| Conduct detailed investigations of suspected fraudulent insurance claims using SIU protocols, including recorded statements, scene inspections, and database cross-referencing through ISO ClaimSearch. | Investigated fraud cases and reported findings to management. | Conducted 40+ SIU investigations annually into suspected fraudulent insurance claims, performing recorded statements, coordinating scene inspections, and cross-referencing claimant data through ISO ClaimSearch to identify inconsistencies. |

| Analyze transactional data in SQL and SAS to detect patterns of internal and external fraud across banking operations, escalating confirmed cases to BSA/AML compliance teams. | Reviewed data to find fraud and worked with compliance. | Analyzed over 500,000 monthly transactions using SQL and SAS to detect internal and external fraud patterns across retail banking operations, escalating 15–20 confirmed cases per quarter to BSA/AML compliance teams. |

| Lead end-to-end healthcare fraud investigations involving Medicare and Medicaid billing irregularities, prepare case documentation for referral to the OIG, and testify as a subject matter expert when required. | Managed fraud investigations and prepared documentation for leadership review. | Led end-to-end investigations into Medicare and Medicaid billing irregularities, preparing detailed case documentation that resulted in 12 successful referrals to the OIG over two years and testifying as a subject matter expert in three federal proceedings. |

Once you’ve aligned your experience with the role’s requirements, quantify your fraud investigator achievements to show the measurable impact of that work.

How to quantify your fraud investigator achievements

Quantifying your achievements proves you reduce fraud risk, protect revenue, and improve investigation efficiency. Focus on case volume, cycle time, accuracy, loss prevented, chargeback reduction, compliance results, and tool-driven productivity gains.

Quantifying examples for fraud investigator

| Metric | Example |

|---|---|

| Cycle time | "Cut average investigation turnaround from 3.2 days to 1.4 days by standardizing evidence checklists and prioritizing queues in ServiceNow." |

| Accuracy rate | "Improved true-positive rate from 62% to 78% by tuning rules in SAS and validating alerts against chargeback outcomes." |

| Loss prevented | "Prevented $420K in confirmed fraud losses in one quarter by escalating high-risk rings and coordinating account freezes with operations." |

| Case throughput | "Resolved 145 cases per week on average—up from 95—by batching data pulls in SQL and automating report templates in Excel." |

| Compliance quality | "Achieved 98% audit pass rate across 60 sampled cases by tightening documentation standards and meeting all suspicious activity report deadlines." |

Turn vague job duties into measurable, recruiter-ready resume bullets in seconds with Enhancv's Bullet Point Generator.

Once you've crafted strong bullet points for your experience section, it's equally important to highlight the specific hard and soft skills that qualify you for a fraud investigator role.

How to list your hard and soft skills on a fraud investigator resume

Your skills section shows you can detect, investigate, and stop fraud—recruiters and an ATS (applicant tracking system) scan this section for job-match keywords—so aim for a balanced mix of hard skills like investigation tools and role-specific soft skills. Fraud investigator roles require a blend of:

- Product strategy and discovery skills.

- Data, analytics, and experimentation skills.

- Delivery, execution, and go-to-market discipline.

- Soft skills.

Your skills section should be:

- Scannable (bullet-style grouping).

- Relevant to the job post.

- Backed by proof in experience bullets.

- Updated with current tools.

Place your skills section:

- Above experience if you're junior or switching careers.

- Below experience if you're mid/senior with strong achievements.

Hard skills

- Fraud case management systems

- Suspicious activity investigations

- Transaction monitoring rules tuning

- Anti-money laundering investigations

- Know your customer verification

- Sanctions screening workflows

- Chargeback and dispute analysis

- Link analysis and entity resolution

- SQL, Excel, Python

- Tableau, Power BI

- OSINT and digital forensics

- SAR drafting and filing

Soft skills

- Write clear investigative narratives

- Interview customers and staff

- Challenge assumptions with evidence

- Prioritize cases by risk

- Escalate issues with context

- Coordinate with legal and HR

- Communicate findings to stakeholders

- Maintain chain of custody

- Make decisions under time pressure

- Document work for audit readiness

- Protect sensitive information

- Resolve cross-team blockers

How to show your fraud investigator skills in context

Skills shouldn't live only in a bulleted list on your resume. Browse our curated resume skills examples to see how other professionals present their capabilities effectively.

They should be demonstrated in:

- Your summary (high-level professional identity)

- Your experience (proof through outcomes)

Here's what strong, contextual skill placement looks like in practice.

Summary example

Senior fraud investigator with 10+ years in financial services, specializing in anti-money laundering and forensic data analysis. Proficient in SAS, Actimize, and link analysis. Led a cross-functional team that reduced false positives by 37%.

- Reflects senior-level experience clearly

- Names industry-standard tools directly

- Quantifies a meaningful outcome

- Highlights cross-functional leadership ability

Experience example

Senior Fraud Investigator

Meridian Financial Group | Remote

March 2019–Present

- Investigated 200+ complex fraud cases annually using Actimize and i2 Analyst's Notebook, recovering $4.2M in losses.

- Partnered with compliance, legal, and law enforcement teams to build case referrals, improving prosecution rates by 28%.

- Designed a transaction-monitoring rule set that cut false-positive alerts by 34%, saving analysts 15 hours weekly.

- Every bullet includes measurable proof

- Skills surface naturally through outcomes

Once you’ve grounded your capabilities in real examples and outcomes, the next step is learning how to write a fraud investigator resume with no experience so you can present that evidence effectively even without a formal fraud title.

How do I write a fraud investigator resume with no experience

Even without full-time experience, you can demonstrate readiness through:

- Fraud case study capstone project

- AML (anti-money laundering) coursework

- Chargeback and dispute analysis project

- SQL and Excel data audits

- KYC (know your customer) mock reviews

- Internship in compliance or risk

- Volunteer role handling sensitive data

Our guide on writing a resume without work experience walks you through how to position these strengths effectively.

Focus on:

- Evidence-based investigations and documentation

- Data analysis tools and queries

- Compliance frameworks and reporting standards

- Clear, quantified impact and accuracy

Resume format tip for entry-level fraud investigator

Use a skills-based resume format because it highlights investigations, analytics, and compliance work when your work history is limited. Do:

- Lead with a summary of fraud investigator skills.

- Add a projects section with measurable results.

- List tools: SQL, Excel, and Tableau.

- Include compliance exposure: KYC and AML.

- Use action verbs and metrics.

- Built SQL queries to flag duplicate refunds, reviewed 200 transactions, and documented ten high-risk cases with a 95% match rate against test labels.

Once you've positioned your transferable skills and relevant strengths to compensate for limited experience, highlighting your educational background becomes the next essential step in building credibility.

How to list your education on a fraud investigator resume

Your education section helps hiring teams confirm you have the foundational knowledge needed for fraud investigation. It validates your analytical training and relevant academic background quickly.

Include:

- Degree name

- Institution

- Location

- Graduation year

- Relevant coursework (for juniors or entry-level candidates)

- Honors & GPA (if 3.5 or higher)

Skip month and day details—list the graduation year only.

Here's a strong education entry tailored to a fraud investigator resume.

Example education entry

Bachelor of Science in Criminal Justice

George Mason University, Fairfax, VA

Graduated 2021

GPA: 3.7/4.0

- Relevant coursework: Financial Crime Analysis, Forensic Accounting, White-Collar Crime, and Data Analytics

- Honors: Magna Cum Laude, Dean's List (six consecutive semesters)

How to list your certifications on a fraud investigator resume

Certifications show your commitment to learning, confirm tool proficiency, and signal industry relevance as a fraud investigator. They also help recruiters trust your judgment, methods, and compliance knowledge.

Include:

- Certificate name

- Issuing organization

- Year

- Optional: credential ID or URL

- Place certifications below education when they're older, less relevant, or you want your degree to lead your qualifications.

- Place certifications above education when they're recent, highly relevant, or required for the fraud investigator roles you target.

Best certifications for your fraud investigator resume

- Certified Fraud Examiner (CFE)

- Certified Anti-Money Laundering Specialist (CAMS)

- Certified Financial Crime Specialist (CFCS)

- Certified in Financial Forensics (CFF)

- Accredited Financial Investigator (AFI)

- Certified Forensic Interviewer (CFI)

Once you’ve positioned your credentials where hiring managers will see them, use your fraud investigator resume summary to reinforce that expertise upfront and align it with the role.

How to write your fraud investigator resume summary

Your resume summary is the first thing a recruiter reads, so it needs to earn their attention fast. A strong opening tied to fraud investigation signals you understand the role and belong in the candidate pool.

Keep it to three to four lines, with:

- Your title and total years of fraud investigation experience.

- The domain you work in, such as financial services, insurance, or healthcare.

- Core tools and skills like SAS, SQL, case management systems, or data analytics.

- One or two measurable achievements, such as cases resolved or losses recovered.

- Soft skills tied to real outcomes, like attention to detail that reduced false positives.

PRO TIP

At this level, lead with relevant skills, tools, and concrete early wins rather than vague career goals. Recruiters want to see you can investigate cases, use fraud detection platforms, and deliver results. Avoid phrases like "passionate professional" or "eager learner." Replace them with evidence of what you've already accomplished.

Example summary for a fraud investigator

Fraud investigator with three years of experience in financial services. Skilled in SAS, SQL, and i-Sight case management. Resolved 200+ cases annually, recovering $1.2M in losses through detailed transaction analysis.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Now that you've crafted a summary that highlights your investigative expertise, make sure the header above it presents your contact details clearly so hiring managers can reach you without effort.

What to include in a fraud investigator resume header

A resume header lists your key identifiers and contact details, helping fraud investigator candidates stay visible, credible, and easy to screen quickly.

Essential resume header elements

- Full name

- Tailored job title and headline

- Location

- Phone number

- Professional email

- GitHub link

- Portfolio link

A LinkedIn link helps recruiters verify your experience quickly and supports fast screening.

Don't include a photo on a fraud investigator resume unless the role is explicitly front-facing or appearance-dependent.

Match your header title to the posting and mirror key fraud investigator keywords to improve recruiter searches and applicant tracking system sorting.

Example

Fraud investigator resume header

Jordan Lee

Fraud Investigator | Transaction Monitoring and Case Management

Chicago, IL

(312) 555-01XX

jordan.lee@enhancv.com

github.com/jordanlee

jordanlee.com

linkedin.com/in/jordanlee

Once your contact details and role information are clearly presented at the top, add optional sections to highlight relevant strengths that don’t fit in the main resume content.

Additional sections for fraud investigator resumes

Beyond core sections, additional resume sections help you stand out by showcasing specialized credentials and interests that reinforce your fraud investigator expertise. For example, listing language skills can be especially valuable if you investigate cross-border fraud or work with international compliance teams.

- Certifications (CFE, CAMS, CPA)

- Languages

- Professional affiliations (ACFE, ACAMS)

- Publications and case studies

- Continuing education and training

- Hobbies and interests

- Awards and recognitions

Once you've rounded out your resume with relevant additional sections, it's worth pairing it with a strong cover letter to maximize your impact.

Do fraud investigator resumes need a cover letter

A cover letter isn't required for a fraud investigator, but it helps in competitive searches or when hiring teams expect one. If you're unsure where to start, learn what a cover letter is and how it complements your resume. It can make a difference when your resume doesn't fully show fit, impact, or context.

Use these pointers to decide when to include one and what to say:

- Explain role or team fit by matching your casework, tools, and risk approach to the job's fraud types and workflows.

- Highlight one or two projects or outcomes, such as reducing chargebacks, improving alert precision, or shortening investigation time.

- Show understanding of the product, users, and business context, including where fraud shows up in the customer journey and how decisions affect losses.

- Address career transitions or non-obvious experience by translating adjacent work into fraud investigator skills, such as evidence handling, pattern analysis, and reporting.

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Whether you include a cover letter or rely on your resume alone, the next step is using AI to improve your fraud investigator resume so it aligns more closely with the role.

Using AI to improve your fraud investigator resume

AI can sharpen your resume's clarity, structure, and impact. It helps tighten language and highlight relevant achievements. But overuse kills authenticity. If you're exploring AI tools, our comparison of which AI is best for writing resumes can help you choose the right one. Once your content is clear and role-aligned, step away from AI.

Here are 10 practical prompts to strengthen specific sections of your fraud investigator resume:

Strengthen your summary

Quantify experience bullets

Tighten action verbs

Align skills strategically

Clarify certification relevance

Refine project descriptions

Remove redundant phrasing

Improve education section

Target industry language

Sharpen bullet structure

Conclusion

A strong fraud investigator resume proves impact with measurable outcomes, like dollars recovered, cases closed, and cycle time reduced. It highlights role-specific skills, including case management, interviews, evidence handling, and report writing. Keep the structure clear, with focused sections and clean formatting.

Today’s hiring market rewards fraud investigators who show results, sound judgment, and consistent documentation. Use precise metrics, relevant skills, and a logical layout to make your qualifications easy to scan. This approach shows you’re ready to deliver on day one.