Many insurance agent resume drafts fail because they read like policy brochures, listing licenses and duties without clear sales outcomes. That hurts when an ATS filters quickly, recruiters scan in seconds, and competition is high.

A strong resume shows what you delivered and why it mattered. Knowing how to make your resume stand out starts with highlighting premium written, close rate, retention gains, new accounts won, cross-sell results, and revenue from renewals. Add scope like book size, lead volume, and territory growth.

Key takeaways

- Quantify premium growth, retention rates, and close rates instead of listing routine duties.

- Use reverse-chronological format for experienced agents and hybrid format for career changers.

- Tailor every resume to the job posting's specific products, tools, and terminology.

- Place licenses and certifications prominently—they often outweigh your degree.

- Demonstrate skills through measurable outcomes in your experience bullets, not just a skills list.

- Write a three- to four-line summary featuring your domain focus, top metrics, and core tools.

- Use Enhancv to turn vague responsibilities into sharp, results-driven bullet points quickly.

Job market snapshot for insurance agents

We analyzed 1,031 recent insurance agent job ads across major US job boards. These numbers help you understand employer expectations, regional hotspots, industry demand at a glance.

What level of experience employers are looking for insurance agents

| Years of Experience | Percentage found in job ads |

|---|---|

| 1–2 years | 27.0% (278) |

| 10+ years | 16.4% (169) |

| Not specified | 56.6% (584) |

Insurance agent ads by area of specialization (industry)

| Industry (Area) | Percentage found in job ads |

|---|---|

| Finance & Banking | 84.2% (868) |

| Healthcare | 15.5% (160) |

Top companies hiring insurance agents

| Company | Percentage found in job ads |

|---|---|

| Freeway Insurance Services America | 34.7% (358) |

| Country Financial | 25.5% (263) |

| Kemper Corp. | 16.4% (169) |

| AmeriLife and Health Services | 15.5% (160) |

| Shelter Insurance | 1.7% (18) |

| BrightWay | 1.1% (11) |

Role overview stats

These tables show the most common responsibilities and employment types for insurance agent roles. Use them to align your resume with what employers expect and to understand how the role is structured across the market.

Day-to-day activities and top responsibilities for a insurance agent

| Responsibility | Percentage found in job ads |

|---|---|

| Life/health state insurance license | 9.7% (100) |

| Property/casualty state insurance license | 9.7% (100) |

| Financial services | 4.8% (49) |

| Business ownership | 4.7% (48) |

| Sales | 4.5% (46) |

| Customer service | 3.4% (35) |

| Marketing | 2.9% (30) |

| Crm | 2.8% (29) |

| Insurance | 2.1% (22) |

| Life insurance | 2.1% (22) |

| Health insurance | 1.8% (19) |

| Insurance sales | 1.8% (19) |

How to format a insurance agent resume

Recruiters evaluating insurance agent resumes look for sales performance, client retention metrics, licensing credentials, and product knowledge across lines of coverage. A clean, well-structured resume format ensures these signals surface quickly during both human review and applicant tracking system (ATS) scans.

I have significant experience as an insurance agent—which format should I use?

Use a reverse-chronological format to place your strongest, most recent production numbers and book-of-business growth front and center. Do:

- Lead each role entry with scope indicators: territory size, portfolio value, number of accounts managed, and lines of coverage handled.

- Highlight relevant tools and domains—agency management systems (Applied Epic, Hawksoft), CRM platforms, quoting engines, and specific coverage verticals such as commercial P&C, life, or health.

- Quantify outcomes tied to revenue, retention, and growth rather than listing routine duties.

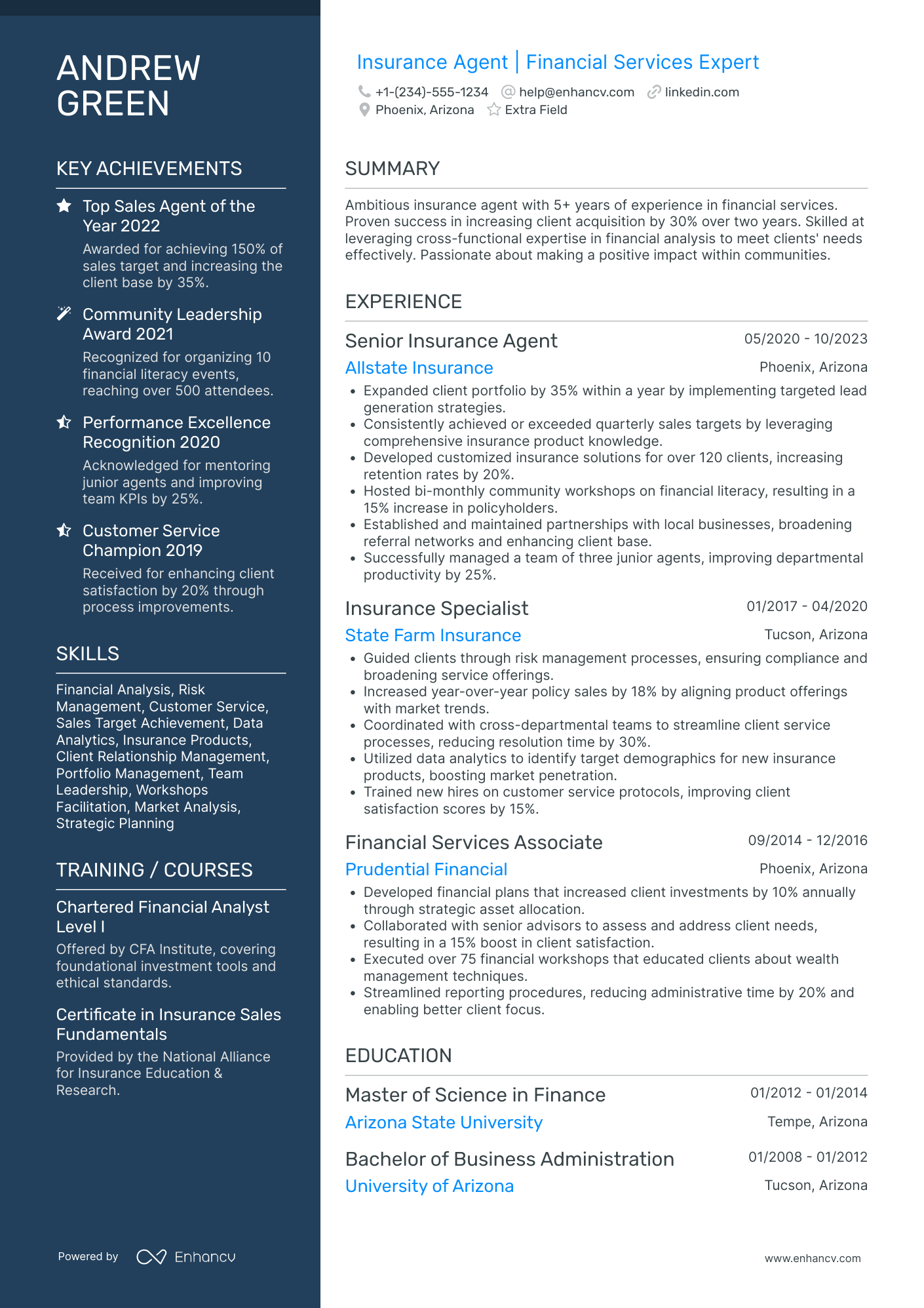

I'm junior or switching into an insurance agent role—what format works best?

A hybrid format lets you lead with relevant skills and certifications while still showing a clear employment timeline underneath. Do:

- Place a dedicated skills section near the top featuring active licenses (Property & Casualty, Life & Health), software proficiency, and sales competencies so ATS filters catch them immediately.

- Include internships, sales roles in adjacent industries, or client-facing project work that demonstrates prospecting, relationship management, or consultative selling ability.

- Connect every listed skill to a specific action and a measurable or observable result so hiring managers see practical application.

Why not use a functional resume?

A functional format strips away the timeline context that hiring managers rely on to verify quota attainment consistency, career progression, and length of client relationships—all critical proof points for an insurance agent.

- Edge-case exception: A functional resume may be acceptable if you're transitioning from a non-insurance sales role, re-entering the workforce after a gap, or have limited formal employment history—but only if every listed skill is tied to a specific project, client outcome, or measurable result rather than presented in isolation.

Once your format establishes a clean, readable structure, the next step is filling it with the right sections to showcase your qualifications effectively.

What sections should go on a insurance agent resume

Recruiters expect to see clear proof you can sell, retain, and grow insurance accounts while staying compliant. Understanding what to put on a resume helps you prioritize the most impactful content.

Use this structure for maximum clarity:

- Header

- Summary

- Experience

- Skills

- Projects

- Education

- Certifications

- Optional sections: Awards, Leadership, Languages

Strong experience bullets should emphasize measurable premium growth, policy volume, retention, cross-sell and upsell results, pipeline performance, and compliance outcomes across a defined book of business.

Is your resume good enough?

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

Once you’ve organized your resume with the right components in place, the next step is to write your insurance agent experience section in a way that fits that structure and supports your application.

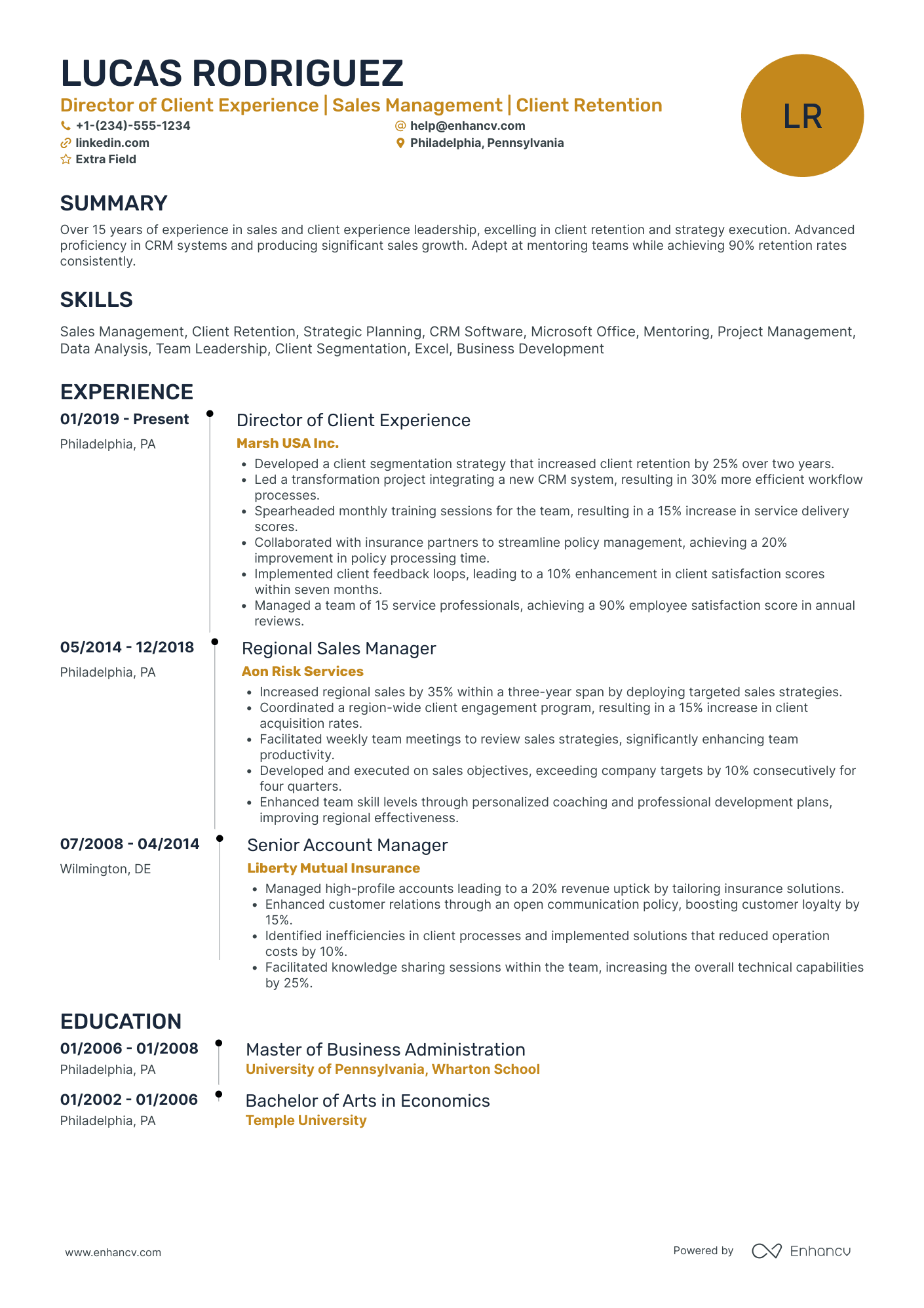

How to write your insurance agent resume experience

Your experience section should highlight the policies you've sold, the client portfolios you've managed, and the measurable results you've driven—whether that's growth in premiums written, client retention rates, or new business development. Hiring managers prioritize demonstrated impact over descriptive task lists, so focus on what you delivered rather than what you were assigned. Building a targeted resume ensures each entry speaks directly to the role you're pursuing.

Each entry should include:

- Job title

- Company and location (or remote)

- Dates of employment (month and year)

Three to five concise bullet points showing what you owned, how you executed, and what outcomes you delivered:

- Ownership scope: the book of business, insurance product lines, client segments, or territory you were directly accountable for as an insurance agent.

- Execution approach: the quoting platforms, CRM systems, underwriting guidelines, needs-analysis frameworks, or lead-generation methods you used to assess risk, recommend coverage, and close policies.

- Value improved: changes to policy retention, claims satisfaction, coverage accuracy, cross-sell rates, or compliance adherence that resulted from your work.

- Collaboration context: how you partnered with underwriters, claims adjusters, carrier representatives, or referral partners to place coverage, resolve disputes, or expand client relationships.

- Impact delivered: outcomes expressed through portfolio growth, revenue contribution, renewal percentages, or client acquisition results rather than routine duties.

Experience bullet formula

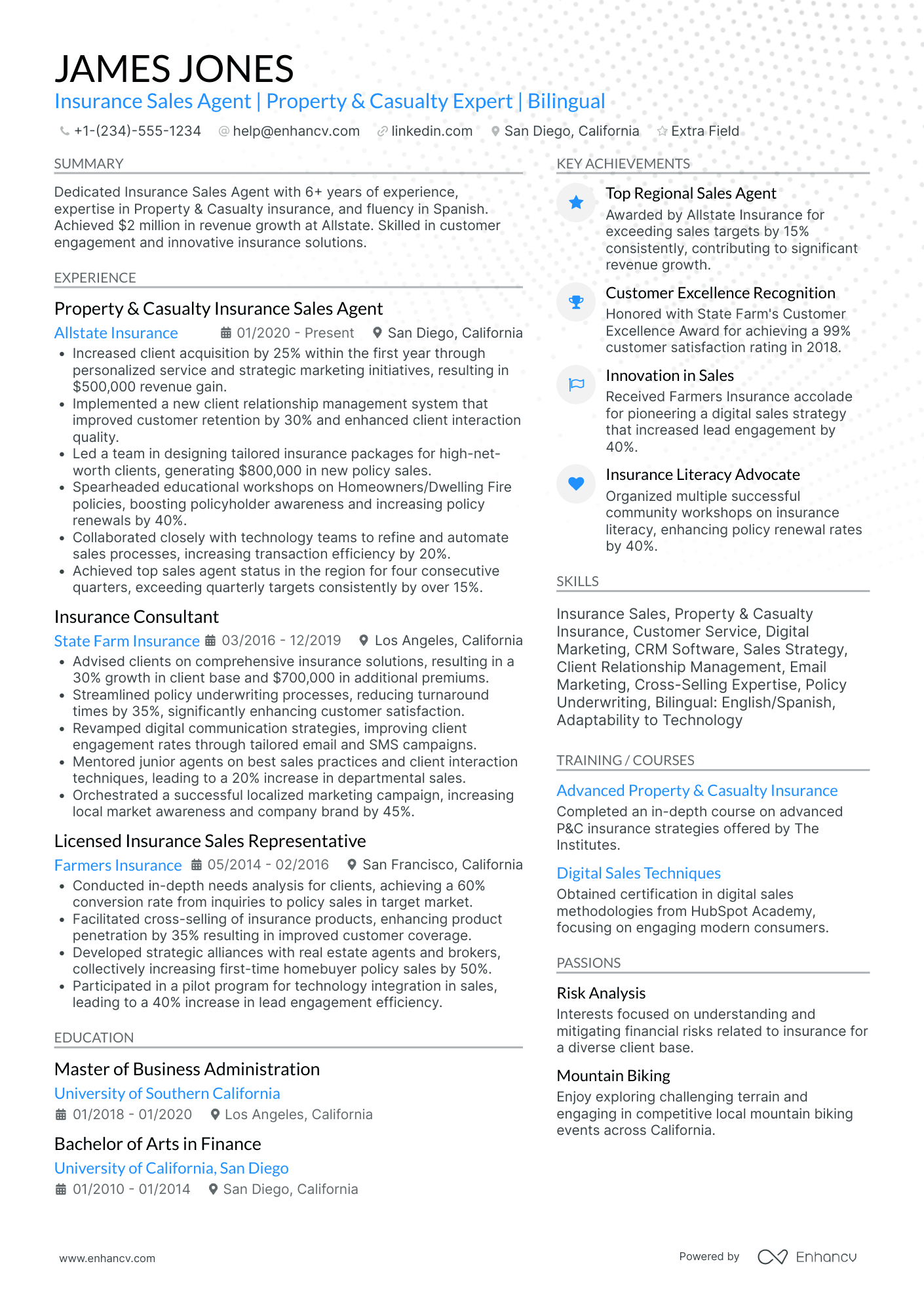

A insurance agent experience example

✅ Right example - modern, quantified, specific.

Insurance Agent

Horizon Mutual Insurance | Phoenix, AZ

2021–Present

Independent agency specializing in personal lines and small business coverage across Arizona, serving over 3,000 active policyholders.

- Grew written premium by 24% year over year by building a referral pipeline in HubSpot and running segmented outreach campaigns that increased quote-to-bind conversion from 18% to 26%.

- Reduced average quote turnaround time from forty-five minutes to twenty-eight minutes by standardizing intake in AgencyZoom and automating carrier submissions through Applied Epic templates.

- Improved retention by 9% by launching a renewal playbook using AMS360 tasks, proactive coverage reviews, and rate-change explanations coordinated with carrier underwriters.

- Increased cross-sell rate by 14% by analyzing policy gaps in Excel and Applied Epic, then bundling auto, homeowners, and umbrella recommendations during annual reviews.

- Cut errors and rework by 32% by implementing an audit checklist for applications and endorsements, collaborating with carrier service teams and clients to resolve documentation issues within two business days.

Now that you've seen how a strong experience section comes together, let's look at how to adapt yours to match the specific job you're targeting.

How to tailor your insurance agent resume experience

Recruiters evaluate your resume through both manual review and applicant tracking systems, so tailoring your resume to the job description is essential. Tailoring ensures your most relevant qualifications stand out immediately.

Ways to tailor your insurance agent experience:

- Match the specific insurance products or policy types listed in the posting.

- Mirror the exact CRM or quoting software the employer names.

- Use the same terminology for underwriting guidelines or claims processes referenced.

- Highlight relevant state licensure or certifications the role requires.

- Emphasize retention or cross-selling strategies if the posting prioritizes growth.

- Include compliance or regulatory experience when the description mentions oversight.

- Reflect the sales methodology or lead generation approach the employer uses.

- Showcase client relationship management workflows described in the job listing.

Tailoring means connecting your real accomplishments to what the employer needs—not forcing keywords where they don't belong.

Resume tailoring examples for insurance agent

| Job description excerpt | Untailored | Tailored |

|---|---|---|

| "Prospect and generate new commercial lines business through cold calling, networking, and referral development with a target of $500K in new annual premiums" | Responsible for finding new clients and selling insurance policies to meet company goals. | Prospected and closed commercial lines accounts through cold calling, networking events, and referral partnerships, generating $620K in new annual premiums and exceeding target by 24%. |

| "Conduct comprehensive needs assessments using Applied Epic to recommend appropriate coverage options across property, casualty, and liability lines" | Helped customers choose the right insurance plans based on their needs. | Performed detailed needs assessments in Applied Epic for 150+ clients annually, recommending tailored property, casualty, and liability coverage packages that reduced coverage gaps by 35%. |

| "Retain book of business with a minimum 90% retention rate by conducting annual policy reviews and proactively communicating renewal options 60 days before expiration" | Maintained relationships with existing clients and handled policy renewals. | Managed a $2.1M book of business at a 94% retention rate by conducting annual policy reviews and initiating renewal outreach 60 days before expiration, reducing lapsed policies by 18% year over year. |

Once you’ve aligned your experience with the role’s priorities, back it up by quantifying your insurance agent achievements to show the impact behind each claim.

How to quantify your insurance agent achievements

Quantifying your achievements proves business impact beyond effort. For insurance agents, focus on premium sold, conversion rate, retention, policy accuracy, compliance results, and claim or service turnaround time.

Quantifying examples for insurance agent

| Metric | Example |

|---|---|

| Revenue growth | "Grew annualized written premium by $1.2M in twelve months by cross-selling auto and homeowners bundles to an existing book of 380 clients." |

| Conversion rate | "Improved quote-to-bind conversion from 18% to 27% by standardizing needs-analysis scripts and tracking follow-ups in Salesforce." |

| Retention | "Raised policy renewal rate from 82% to 89% by launching a ninety-day renewal outreach cadence and resolving coverage gaps before notices." |

| Compliance accuracy | "Cut application errors by 35% and passed two carrier audits with zero findings by using an intake checklist and e-signature workflows in DocuSign." |

| Cycle time | "Reduced average quote turnaround from two days to six hours by templating underwriting submissions and batching carrier requests twice daily." |

Turn vague job duties into measurable, recruiter-ready resume bullets in seconds with Enhancv's Bullet Point Generator.

Once you've crafted strong bullet points to showcase your experience, the next step is ensuring your resume also highlights the right hard and soft skills insurance employers are looking for.

How to list your hard and soft skills on a insurance agent resume

Your skills section shows you can sell, service, and retain policies, and recruiters and an ATS (applicant tracking system) scan this section to confirm role fit; aim for mostly hard skills with a smaller set of job-specific soft skills. insurance agent roles require a blend of:

- Product strategy and discovery skills.

- Data, analytics, and experimentation skills.

- Delivery, execution, and go-to-market discipline.

- Soft skills.

Your skills section should be:

- Scannable (bullet-style grouping).

- Relevant to the job post.

- Backed by proof in experience bullets.

- Updated with current tools.

Place your skills section:

- Above experience if you're junior or switching careers.

- Below experience if you're mid/senior with strong achievements.

Hard skills

- Needs analysis and fact-finding

- Policy quoting and binding

- Underwriting intake and submissions

- Coverage analysis and gap reviews

- Risk assessment and loss control basics

- Customer relationship management (CRM) systems

- Agency management systems

- Comparative rater platforms

- Policy administration systems

- Claims intake, first notice of loss

- Renewal management and retention workflows

- Compliance, licensing, and suitability documentation

Soft skills

- Consultative selling conversations

- Objection handling and negotiation

- Clear coverage explanations

- Active listening and probing questions

- Cross-selling and upselling judgment

- Follow-up cadence and persistence

- Pipeline prioritization and time management

- Accurate documentation habits

- Calm de-escalation during claims

- Collaboration with underwriters and adjusters

- Ownership of renewals and retention

- Ethical decision-making under pressure

How to show your insurance agent skills in context

Skills shouldn't live only in a dedicated skills list. Explore resume skills examples to see how top candidates weave competencies throughout their documents.

They should be demonstrated in:

- Your summary (high-level professional identity)

- Your experience (proof through outcomes)

Here's what that looks like in practice.

Summary example

Senior insurance agent with 12 years in commercial property and casualty coverage. Skilled in risk assessment, Salesforce-driven pipeline management, and consultative selling. Grew portfolio retention to 94% while managing $8M in annual premiums.

- Reflects senior-level expertise clearly

- Names specific tools like Salesforce

- Quantifies retention and portfolio value

- Signals consultative, client-facing strengths

Experience example

Senior Insurance Agent

Lakeview Risk Partners | Chicago, IL

March 2018–Present

- Increased policy renewal rates by 17% over three years using consultative needs assessments and proactive client outreach through Applied Epic.

- Collaborated with underwriting teams to customize commercial coverage packages, reducing claim disputes by 22% across mid-market accounts.

- Mentored four junior agents on cross-selling strategies, contributing to a 30% rise in multi-policy households within the assigned book of business.

- Every bullet includes measurable proof

- Skills surface naturally through outcomes

Once you’ve demonstrated your insurance agent strengths through specific examples, the next step is to apply that approach to structuring an insurance agent resume when you don’t have formal experience.

How do I write a insurance agent resume with no experience

Even without full-time experience, you can demonstrate readiness through:

- State insurance licensing coursework

- Sales or retail quota achievement

- Call center outbound dialing metrics

- Customer service complaint resolution logs

- CRM data entry and follow-up

- Volunteer fundraising and donor outreach

- Insurance agency job shadowing hours

- Personal finance or risk projects

Our guide on writing a resume without work experience covers additional strategies for showcasing your potential.

Focus on:

- Licensing progress and exam dates

- Documented sales or outreach metrics

- CRM proficiency and clean records

- Compliance awareness and accurate documentation

Resume format tip for entry-level insurance agent

Use a combination resume format. It highlights relevant skills and measurable results while still showing your work history, even if it is not insurance agent work. Do:

- Put licensing status near the top.

- Quantify outreach, sales, or service results.

- Add a tools section with CRMs.

- Tailor bullets to the job posting.

- Include compliance-related coursework or training.

- Built a HubSpot follow-up tracker for donor outreach, logged one hundred twenty calls, scheduled eighteen appointments, and improved contact-to-appointment rate by fifteen percent.

Even without hands-on experience, your education section can demonstrate the foundational knowledge and qualifications that make you a strong candidate—here's how to present it effectively.

How to list your education on a insurance agent resume

Your education section helps hiring teams confirm you have the foundational knowledge needed for an insurance agent role. It signals relevant training in finance, risk, or business.

Include:

- Degree name

- Institution

- Location

- Graduation year

- Relevant coursework (for juniors or entry-level candidates)

- Honors & GPA (if 3.5 or higher)

Skip month and day details—list the graduation year only.

Here's a strong education entry tailored for an insurance agent resume.

Example education entry

Bachelor of Science in Finance

University of Georgia, Athens, GA

Graduated 2021

GPA: 3.7/4.0

- Relevant Coursework: Risk Management, Insurance Principles, Business Law, Financial Planning

- Honors: Magna Cum Laude, Dean's List (six semesters)

How to list your certifications on a insurance agent resume

Certifications on a resume show an insurance agent's commitment to learning, proficiency with industry tools, and relevance to current regulations, products, and sales practices.

Include:

- Certificate name

- Issuing organization

- Year

- Optional: credential ID or URL

- Place certifications below education when your education is recent and directly relevant, and your certifications are older or secondary.

- Place certifications above education when they are recent, role-relevant, or required for your target insurance agent role.

Best certifications for your insurance agent resume

- Licensed Insurance Agent (Life, Accident, and Health)

- Property and Casualty Insurance License

- Chartered Property Casualty Underwriter (CPCU)

- Certified Insurance Counselor (CIC)

- Associate in Risk Management (ARM)

- Chartered Life Underwriter (CLU)

- Certified Financial Planner (CFP)

Once you’ve positioned your credentials where hiring managers can quickly verify them, use that same credibility to shape a resume summary that highlights your fit upfront.

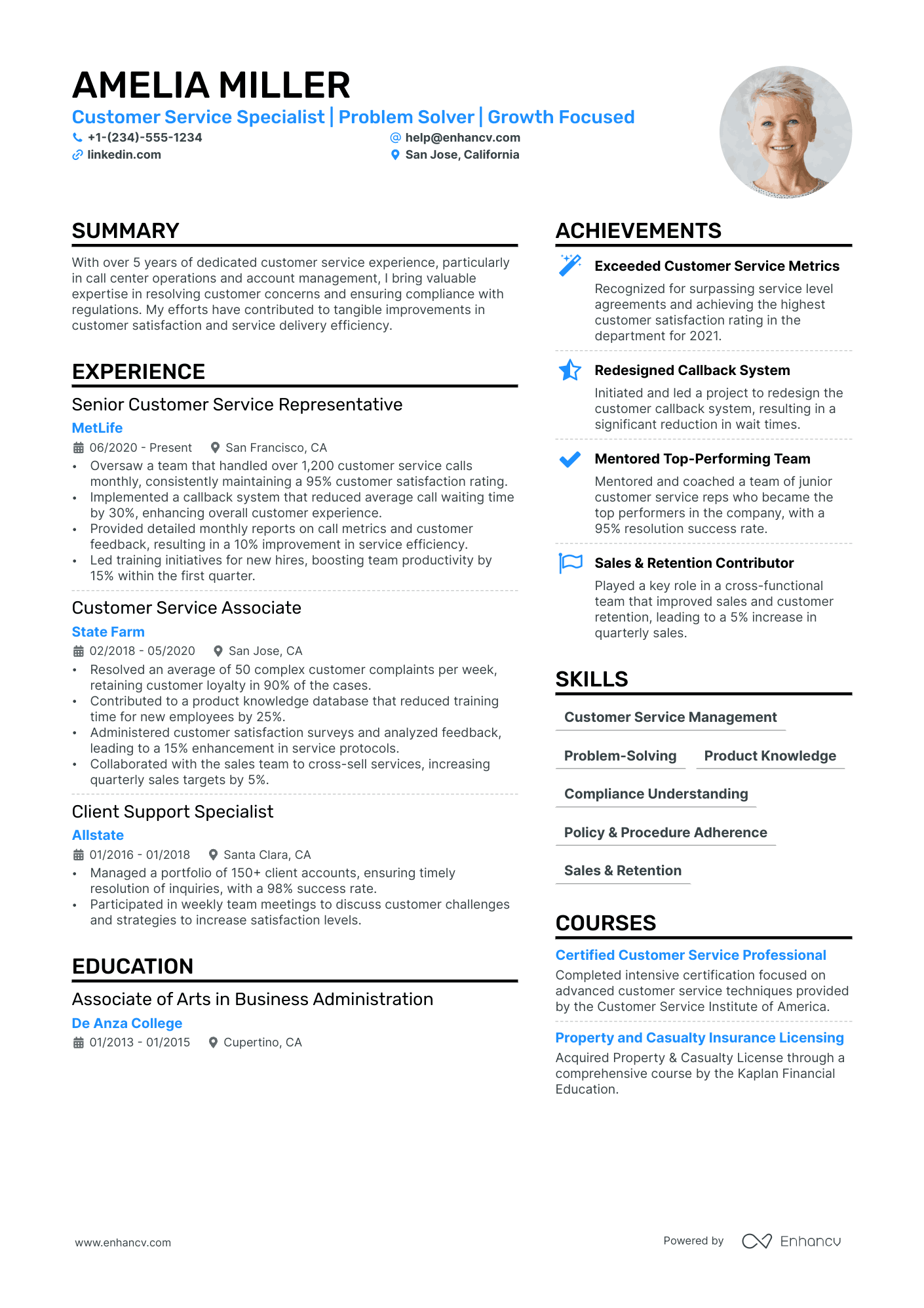

How to write your insurance agent resume summary

Your resume summary is the first thing a recruiter reads. A sharp, focused opening can set you apart from dozens of other insurance agent applicants.

Keep it to three to four lines, with:

- Your title and total years of insurance industry experience.

- Domain focus, such as property and casualty, life, health, or commercial lines.

- Core skills like policy analysis, risk assessment, CRM platforms, or claims processing.

- One or two measurable wins, such as retention rates, revenue growth, or book size.

- Soft skills tied to outcomes, like client relationship building that drove renewals.

PRO TIP

At this level, emphasize relevant skills, licensing, and early client-facing results. Highlight specific insurance products you've worked with and tools you've used daily. Avoid vague phrases like "passionate self-starter" or "goal-oriented team player." Recruiters want proof, not personality descriptors.

Example summary for a insurance agent

Licensed insurance agent with two years of experience in property and casualty lines. Grew a personal book of business to $1.2M in annual premiums while maintaining a 94% client retention rate using Salesforce CRM.

Optimize your resume summary and objective for ATS

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Now that your summary is ready to hook recruiters with your top qualifications, make sure the header above it presents your contact details correctly so they can actually reach you.

What to include in a insurance agent resume header

A resume header is the top section with your key contact details, helping insurance agent candidates boost visibility, credibility, and pass recruiter screening fast.

Essential resume header elements

- Full name

- Tailored job title and headline

- Location

- Phone number

- Professional email

- GitHub link

- Portfolio link

A LinkedIn link helps recruiters verify your work history quickly and supports screening.

Do not include photos on a insurance agent resume unless the role is explicitly front-facing or appearance-dependent.

Match your header title to the job posting and keep your contact line consistent across your resume and online profiles.

Insurance agent resume header

Jordan Taylor

Insurance agent | Personal Lines Sales & Client Service

Austin, TX

(512) 555-01XX

jordan.taylor@enhancv.com

github.com/jordantaylor yourwebsite.com linkedin.com/in/jordantaylor

Once your contact details and role information are clear and easy to find at the top, add optional sections to highlight relevant strengths that don’t fit in the main resume content.

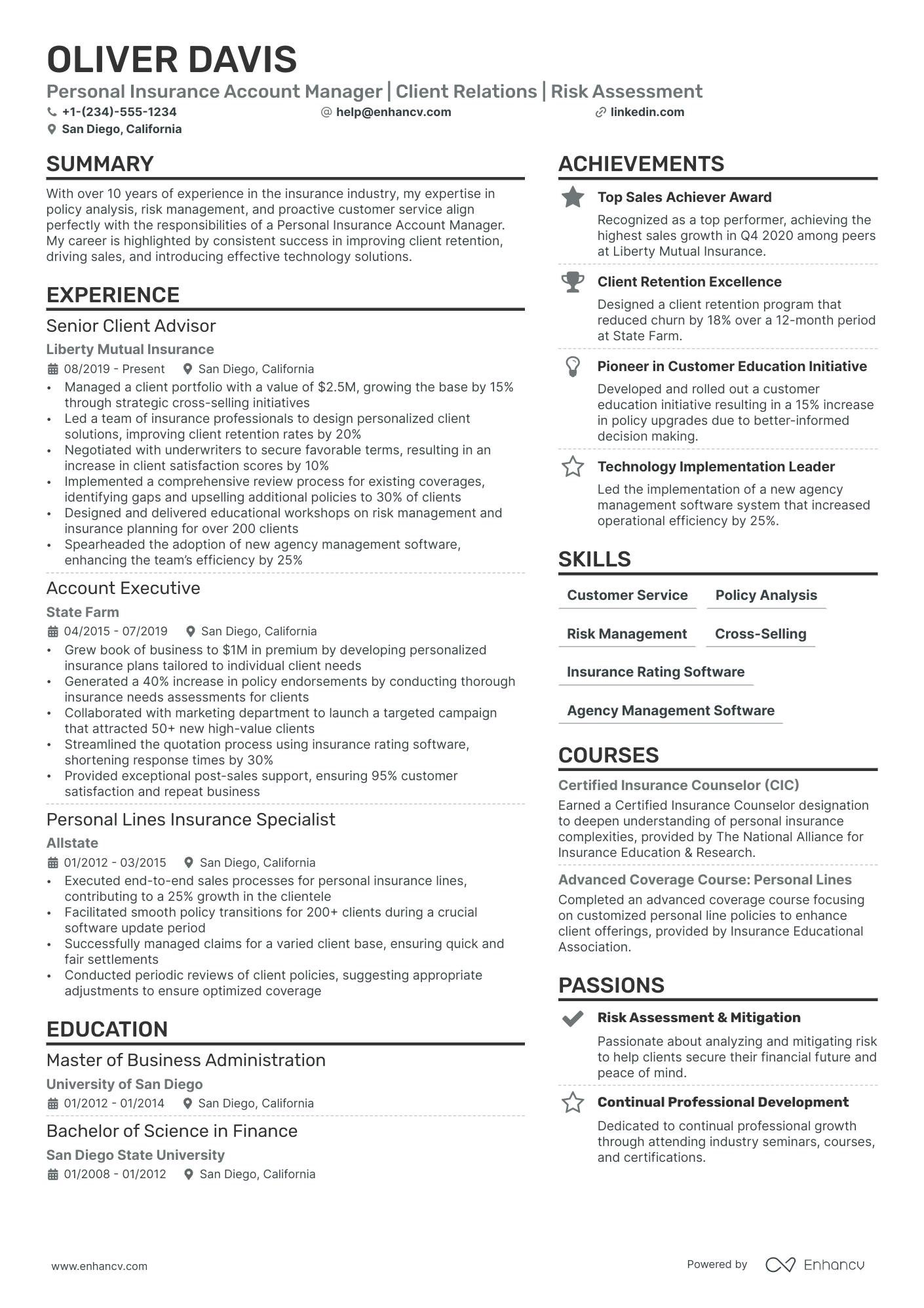

Additional sections for insurance agent resumes

Standing out means showcasing credentials beyond standard work experience and education. Extra sections help demonstrate industry commitment and specialized expertise.

Consider adding these sections to strengthen your insurance agent resume:

- Licenses and certifications

- Professional affiliations

- Languages — listing language skills on your resume can be especially valuable when serving diverse client communities

- Awards and achievements

- Continuing education

- Volunteer experience

- Industry publications

Once you've rounded out your resume with the right supplementary sections, it's worth pairing it with a strong cover letter to maximize your impact.

Do insurance agent resumes need a cover letter

A cover letter isn't required for an insurance agent, but it often helps. If you're unsure what a cover letter is and when it adds value, it matters most in competitive markets, for captive agencies, or when hiring managers expect a short narrative. It can also help when your resume doesn't show fit at a glance.

Use a cover letter to add context your resume can't:

- Explain role or team fit: Match your sales style to the agency's model, such as captive, independent, inbound, or outbound.

- Highlight one or two outcomes: Share a specific result, like improved retention, higher close rates, or stronger cross-sell performance.

- Show product and customer understanding: Reference the agency's lines, target customers, and how you handle compliance, underwriting basics, and objections.

- Address transitions or non-obvious experience: Connect prior roles to insurance agent skills, such as prospecting, account management, or regulated sales.

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

Even when you choose to skip a separate letter and rely on your resume to carry the full message, AI can help you strengthen your insurance agent resume by sharpening its content and alignment.

Using AI to improve your insurance agent resume

AI can sharpen your resume's clarity, structure, and overall impact. It helps tighten language and highlight measurable results. But overuse strips authenticity. Once your content reads clearly and fits the role, step away from AI. For practical prompts and workflows, see our guide on ChatGPT resume writing.

Here are 10 practical prompts you can copy and paste to strengthen specific sections of your insurance agent resume:

- Strengthen your summary: "Rewrite my insurance agent resume summary to highlight my top three achievements and core value proposition in under four sentences."

- Quantify experience bullets: "Add specific metrics like policy counts, retention rates, or revenue figures to each of my insurance agent experience bullet points."

- Tighten bullet language: "Remove filler words and passive voice from my insurance agent experience section while keeping each bullet under 20 words."

- Align skills strategically: "Compare my insurance agent skills section against this job description and suggest missing keywords I should add."

- Improve certification clarity: "Reformat my insurance agent certifications section so each entry includes the credential name, issuing body, and year earned."

- Refine education details: "Review my insurance agent education section and suggest ways to highlight relevant coursework, honors, or insurance-related training."

- Target a specific role: "Tailor my insurance agent resume summary and experience bullets to match this specific job posting I'm applying for."

- Eliminate redundancy: "Identify and remove any repeated ideas or overlapping bullet points across my entire insurance agent resume."

- Boost action verbs: "Replace weak or generic verbs in my insurance agent experience bullets with stronger, results-oriented alternatives."

- Clarify project contributions: "Rewrite my insurance agent project descriptions to clearly state my role, actions taken, and measurable outcomes achieved."

Stop using AI once your resume sounds accurate, specific, and aligned with real experience. AI should never invent experience or inflate claims—if it didn't happen, it doesn't belong here.

Conclusion

A strong insurance agent resume proves results with numbers, highlights role-specific skills, and stays easy to scan. Lead with measurable outcomes like policies sold, retention rates, premium volume, and close rates. Support them with licensing, compliance, product knowledge, and consultative selling.

Keep the structure clean with clear headings, consistent formatting, and focused bullet points. Show you can build trust, manage a book of business, and meet targets in today’s market. This approach signals you’re ready for current hiring needs and near-future expectations.