Crafting a standout insurance sales cover letter can be daunting, especially if you've realized its necessity mid-job-hunt. It's not about echoing your resume but spotlighting your proudest professional milestone through an engaging narrative. To capture attention, merge formality with originality, sidestepping overused phrases. And remember, brevity is key; your pitch should fill just one page to make a powerful impression without overwhelming busy hiring managers. Let's guide you through sculpting a cover letter that resonates.

- Personalize the greeting to address the recruiter and your introduction that fits the role;

- Follow good examples for individual roles and industries from job-winning cover letters;

- Decide on your most noteworthy achievement to stand out;

- Format, download, and submit your insurance sales cover letter, following the best HR practices.

Use the power of Enhancv's AI: drag and drop your insurance sales resume, which will swiftly be converted into your job-winning cover letter.

If the insurance sales isn't exactly the one you're looking for we have a plethora of cover letter examples for jobs like this one:

- Insurance Sales resume guide and example

- National Account Manager cover letter example

- Fragrance Sales Associate cover letter example

- Clothing Store Sales Associate cover letter example

- Wholesale Manager cover letter example

- Sales Officer cover letter example

- National Sales Manager cover letter example

- Inside Sales cover letter example

- Senior Sales Executive cover letter example

- Customer Service Coordinator cover letter example

- Walmart Stocker cover letter example

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

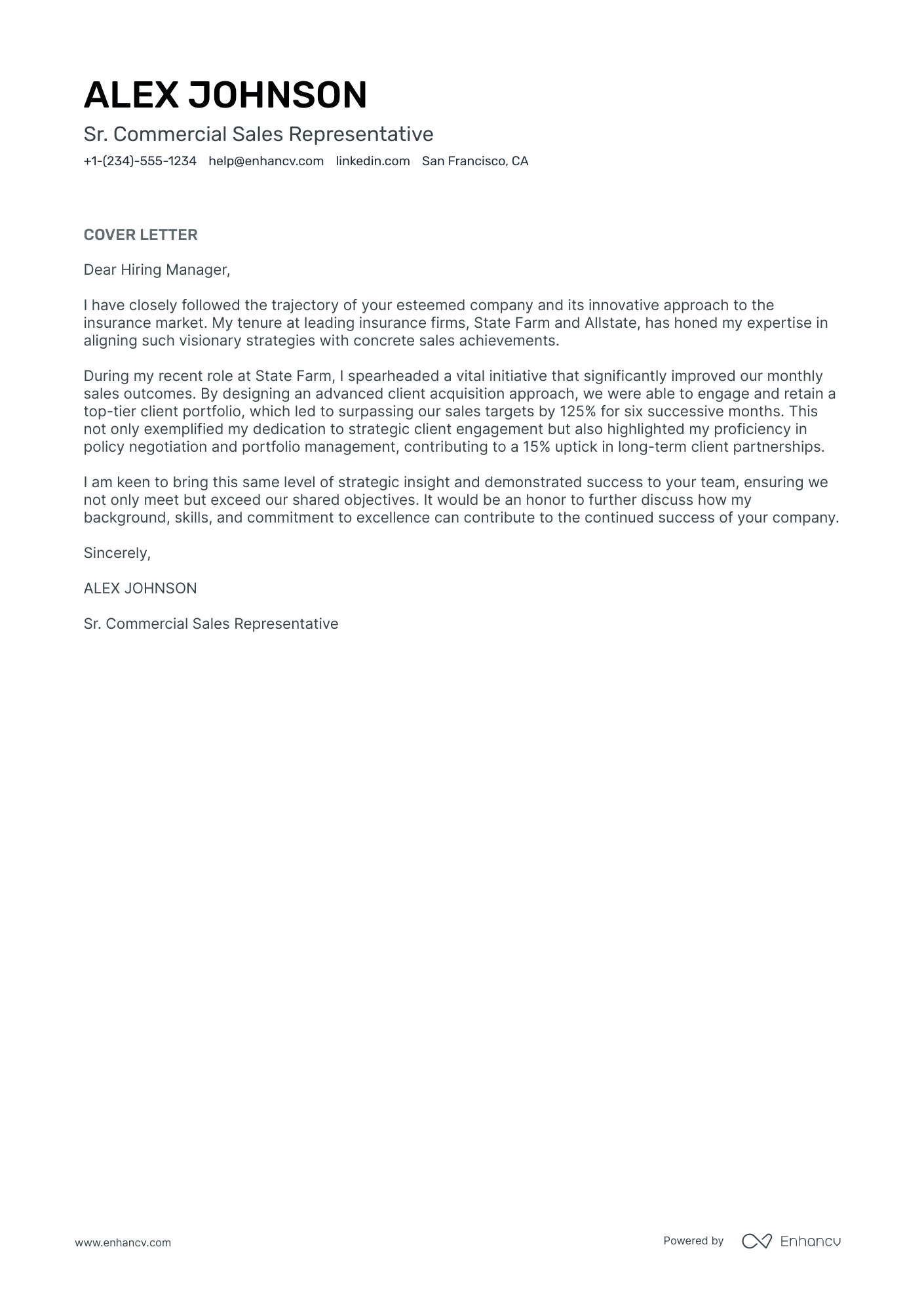

Insurance sales cover letter example

ALEX JOHNSON

San Francisco, CA

+1-(234)-555-1234

help@enhancv.com

- Highlighting proven sales achievements, such as the successful initiative at State Farm that exceeded sales targets, is crucial in portraying a track record of success to potential employers in the sales domain.

- Specifically mentioning experience with renowned insurance firms like State Farm and Allstate lends credibility and shows industry-relevant experience, which reassures the hiring manager of the candidate's familiarity with the field and its challenges.

- Demonstrating strategic skills, like designing a client acquisition approach, directly aligns with the demands of the role, showcasing the ability to innovate and improve sales processes which is key for a senior sales position.

- Expressing eagerness to replicate past successes at the new company, suggests a forward-thinking and results-driven attitude, a desirable trait for driving sales and advancing company objectives.

Standard formatting for your insurance sales cover letter

Structure your insurance sales cover letter, following industry-leading advice, to include:

- Header - with your name, the role you're applying for, the date, and contact details;

- Greeting - make sure it's personalized to the organization;

- Introduction paragraph - no more than two sentences;

- Body paragraph - answering why you're the best candidate for the role;

- Closing paragraph - ending with a promise or a call to action;

- Signature - now that's optional.

Set up your insurance sales cover letter for success with our templates that are all single-spaced and have a one-inch margin all around.

Use the same font for your insurance sales cover as the one in your resume(remember to select a modern, Applicant Tracker System or ATS favorites, like Raleway, Volkhov, or Chivo instead of the worn-out Times New Roman).

Speaking of the ATS, did you know that it doesn't scan or assess your cover letter? This document is solely for the recruiters.

Our builder allows you to export your insurance sales cover letter in the best format out there: that is, PDF (this format keeps your information intact).

Don’t stress about writing your cover letter. Use our free cover letter generator to make one in seconds.

The top sections on a insurance sales cover letter

- Header: This includes your contact information, the date, and the employer's contact information, which is essential for professionalism and to ensure the hiring manager can easily reach out to you.

- Greeting: A personalized salutation demonstrates your detail-oriented nature and that you have done your research to address the letter to the specific hiring manager or team.

- Introduction: Quickly captivate the recruiter's attention by outlining your understanding of the insurance industry and your passion for helping clients navigate complex insurance decisions.

- Body: This should highlight your sales achievements, expertise in insurance products, and client relationship management skills, all of which are critical in showing you can meet and exceed sales targets.

- Closing: Reaffirm your enthusiasm for the role, express your desire for a personal interview, and include a call to action, reflecting your sales skills by effectively closing the "deal" with your cover letter.

Key qualities recruiters search for in a candidate’s cover letter

- Strong interpersonal and communication skills: Essential for building relationships with clients and effectively explaining complex insurance policies.

- Sales acumen and persuasiveness: Key to convincing potential clients of the value of various insurance products and closing deals.

- Industry knowledge: Understanding of insurance products, terms, and market trends is crucial to providing accurate information and advice to clients.

- Resilience and tenacity: Insurance sales often involve rejection; the ability to persist in the face of challenges is important.

- Customer service orientation: Commitment to addressing client needs and ensuring satisfaction to foster loyalty and referrals.

- Attention to detail: Accuracy is imperative when handling insurance applications and policy documentation to avoid errors that could impact coverage.

Greeting recruiters with your insurance sales cover letter salutation

What better way to start your conversation with the hiring manager, than by greeting them?

Take the time to find out who the professional, recruiting for the role, is.

Search on LinkedIn, the company website. And for those still keen on making a fantastic first impression, you could even contact the organization, asking for the recruiter's name and more details about the job.

Address recruiters in the insurance sales greeting by either their first name or last name. (e.g. "Dear Anthony" or "Dear Ms. Smarts").

If you're unable to discover the recruiter's name - don't go for the impersonal "To whom it may concern", but instead use "Dear HR team".

List of salutations you can use

- Dear Hiring Manager,

- Dear [Company Name] Recruitment Team,

- Dear [Department Name] Director,

- Dear Mr./Ms. [Last Name],

- Respected [Job Title],

- Attention: [Job Title or Hiring Committee],

Your insurance sales cover letter intro: showing your interest in the role

On to the actual content of your insurance sales cover letter and the introductory paragraph.

The intro should be no more than two sentences long and presents you in the best light possible.

Use your insurance sales cover letter introduction to prove exactly what interests you in the role or organization. Is it the:

- Company culture;

- Growth opportunities;

- Projects and awards the team worked on/won in the past year;

- Specific technologies the department uses.

When writing your insurance sales cover letter intro, be precise and sound enthusiastic about the role.

Your introduction should hint to recruiters that you're excited about the opportunity and that you possess an array of soft skills, e.g. motivation, determination, work ethic, etc.

How to write an achievement-focused insurance sales cover letter body

We've got the intro and greeting covered. Now, comes the most definitive part of your insurance sales cover letter - the body.

In the next three to six paragraphs, you'd have to answer why should recruiters hire you.

What better way to do this than by storytelling?

And, no, you don't need a "Once upon a time" or "I started from the bottom and made it to the top" career-climbing format to tell a compelling narrative.

Instead, select up to three most relevant skills for the job and look back on your resume.

Find an achievement, that you're proud of, which has taught you these three job-crucial skills.

Quantify your accomplishment, using metrics, and be succinct in the way you describe it.

The ultimate aim would be to show recruiters how this particular success has built up your experience to become an invaluable candidate.

Thinking about the closing paragraph of your insurance sales cover letter

Before your signature, you have extra space to close off your insurance sales cover letter.

Use it to either make a promise or look to the future.

Remind recruiters how invaluable of a candidate you are by showing what you plan to achieve in the role.

Also, note your availability for a potential next meeting (in person or over the telephone).

By showing recruiters that you're thinking about the future, you'd come off as both interested in the opportunity and responsible.

No experience insurance sales cover letter: making the most out of your profile

Candidates who happen to have no professional experience use their insurance sales cover letter to stand out.

Instead of focusing on a professional achievement, aim to quantify all the relevant, transferrable skills from your life experience.

Once again, the best practice to do so would be to select an accomplishment - from your whole career history.

Another option would be to plan out your career goals and objectives: how do you see yourself growing, as a professional, in the next five years, thanks to this opportunity?

Be precise and concise about your dreams, and align them with the company vision.

Key takeaways

Winning at your job application game starts with a clear and concise insurance sales cover letter that:

- Has single-spaced paragraphs, is wrapped in a one-inch margin, and uses the same font as the insurance sales resume;

- Is personalized to the recruiter (using their name in the greeting) and the role (focusing on your one key achievement that answers job requirements);

- Includes an introduction that helps you stand out and show what value you'd bring to the company;

- Substitutes your lack of experience with an outside-of-work success, that has taught you valuable skills;

- Ends with a call for follow-up or hints at how you'd improve the organization, team, or role.