Crafting a credit manager cover letter can seem as daunting as crunching complex financial data. You've polished your resume and you're ready to apply, but now you face the challenge of discussing your achievements without echoing your resume. It's crucial to weave a compelling narrative around your proudest professional moment in a formal yet original tone, steering clear of tired clichés. Remember, brevity is key—a powerful story fits neatly in a single page. Let's begin your cover letter journey.

- Including all the must-have paragraphs in your structure for an excellent first impression;

- Learning how to write individual sections from industry-leading cover letter examples;

- Selecting the best accomplishment to tell an interesting and authority-building professional story;

- Introducing your profile with personality, while meeting industry standards.

And, if you want to save some time, drag and drop your credit manager resume into Enhancv's AI, which will assess your profile and write your job-winning cover letter for you.

If the credit manager isn't exactly the one you're looking for we have a plethora of cover letter examples for jobs like this one:

Drop your resume here or choose a file.

PDF & DOCX only. Max 2MB file size.

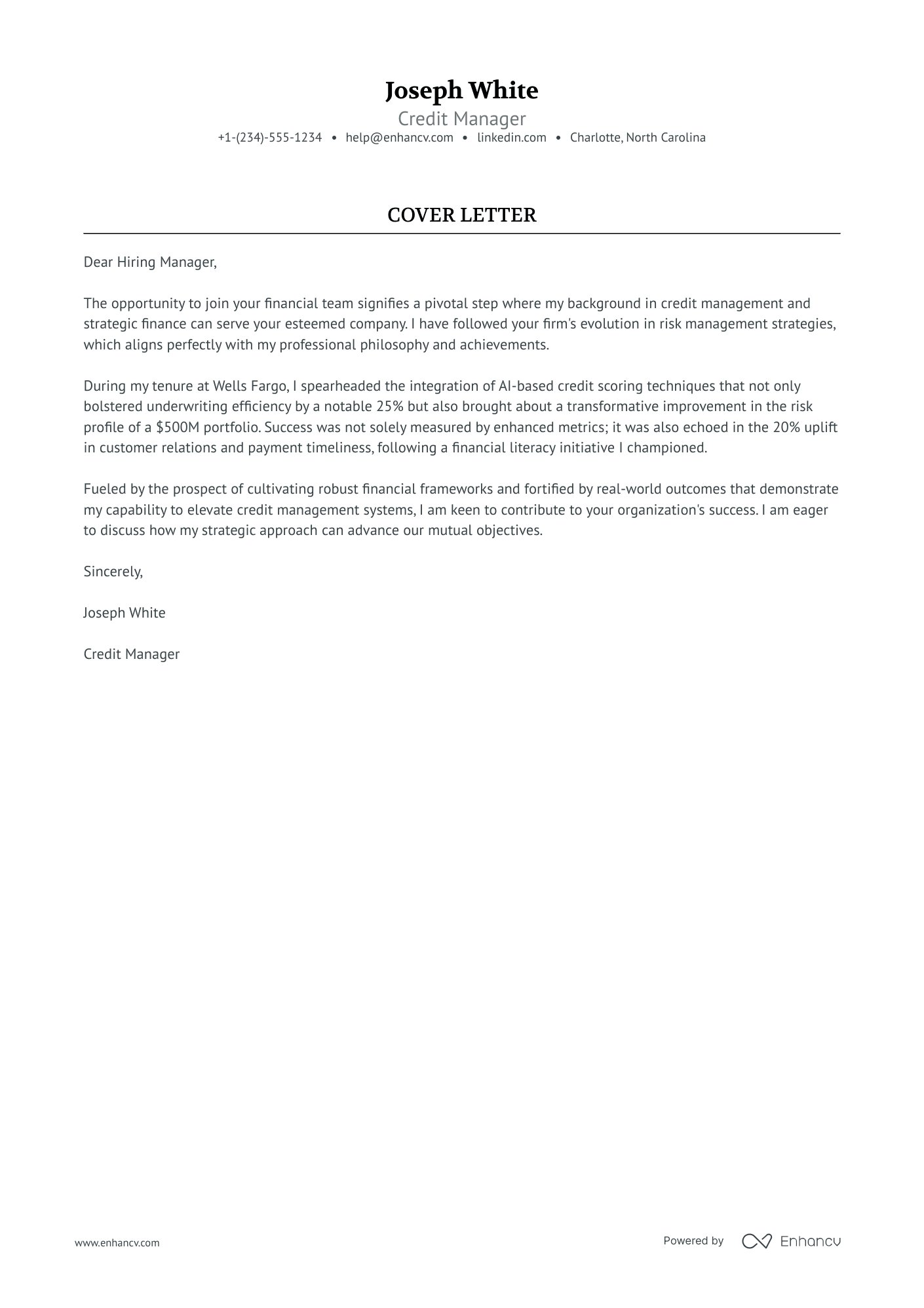

Credit manager cover letter example

Joseph White

Charlotte, North Carolina

+1-(234)-555-1234

help@enhancv.com

- Highlighting specific contributions such as the "integration of AI-based credit scoring techniques" showcases an ability to implement innovative solutions and improve operational efficiency, which is key for a Credit Manager role.

- Demonstrating measurable success through metrics such as "enhancing underwriting efficiency by 25%" and improving "the risk profile of a $500M portfolio" provides evidence of past success and implies potential future benefits for the hiring company.

- Including an initiative that led to improved customer relations ("20% uplift in customer relations and payment timeliness") illustrates not only strategic competence but also an understanding of the importance of customer service in credit management.

What about your credit manager cover letter format: organizing and structuring your information

Here is one secret you should know about your credit manager cover letter assessment. The Applicant Tracker System (or ATS) won't analyze your cover letter.

You should thus focus on making an excellent impression on recruiters by writing consistent:

- Header

- Greeting

- Introduction

- Body paragraphs (and explanation)

- Promise or Call to action

- Signature (that's optional)

Now, let's talk about the design of your credit manager cover letter.

Ensure all of your paragraphs are single-spaced and have a one-inch margins on all sides (like in our cover letter templates).

Also, our cover letter builder automatically takes care of the format and comes along with some of the most popular (and modern) fonts like Volkhov, Chivo, and Bitter.

Speaking of fonts, professionals advise you to keep your credit manager cover letter and resume in the same typography and avoid the over-used Arial or Times New Roman.

When wondering whether you should submit your credit manager cover letter in Doc or PDF, select the second, as PDF keeps all of your information and design consistent.

Writing a cover letter can take time. Skip the hassle with our free cover letter generator and make one in seconds.

The top sections on a credit manager cover letter

Header: This section includes the candidate's contact information, the date, and the employer's contact information, essential for establishing a professional layout and ensuring the cover letter reaches the intended recipient.

Introduction: In this section, the credit manager candidate should clearly state the position they're applying for and briefly mention how their background makes them a strong fit for managing credit analysis and risk assessment functions.

Professional Experience: This section highlights specific past roles and responsibilities, such as credit policy development or debt management, demonstrating the candidate's relevant experience in credit and financial management.

Accomplishments in Credit Management: Candidates should detail how they've improved credit processes or risk mitigation strategies, quantifying achievements if possible to give recruiters clear evidence of their expertise and impact in previous positions.

Closing and Call-to-Action: This is where the prospective credit manager reiterates their enthusiasm for the role, invites the recruiter to review their attached resume for detailed professional history, and suggests setting up an interview to discuss how they can contribute to the company's financial stability.

Key qualities recruiters search for in a candidate’s cover letter

- Proven experience in credit analysis: Recruiters look for candidates who have hands-on experience in analyzing credit data and financial statements to assess the creditworthiness of individuals or companies.

- Strong understanding of credit risk management: Credit managers must be adept at identifying, measuring, and mitigating credit risk to minimize potential losses.

- Excellent negotiation and decision-making skills: In the credit manager role, making informed decisions and negotiating payment terms with clients is crucial.

- Knowledge of relevant laws and regulations: Understanding the legal framework surrounding credit, including fair lending practices and debt collection laws, is essential for compliance and ethical management.

- Experience with credit scoring models and software: Familiarity with the tools and technologies used to evaluate credit risk is important for efficiency and accuracy in credit decisions.

- Leadership and team management ability: Credit managers often lead a team of credit analysts or specialists, so strong leadership skills are important for maintaining team performance and morale.

Personalizing your credit manager cover letter salutation

Always aim to address the recruiter from the get-go of your credit manager cover letter.

Use:

- the friendly tone (e.g. "Dear Paul" or "Dear Caroline") - if you've previously chatted up with them on social media and are on a first-name basis;

- the formal tone (e.g. "Dear Ms. Gibbs" or "Dear Ms. Swift") - if you haven't had any previous conversation with them and have discovered the name of the recruiter on LinkedIn or the company website;

- the polite tone (e.g. "Dear Hiring Manager" or "Dear HR Team") - at all costs aim to avoid the "To whom it may concern" or "Dear Sir/Madam", as both greetings are very old-school and vague.

List of salutations you can use

- Dear Hiring Manager,

- Dear [Company Name] Team,

- Dear [Department Name] Director,

- Dear Mr./Ms. [Last Name],

- Dear [Professional Title] [Last Name],

- Good day [Last Name],

Get creative with your credit manager cover letter introduction

Recruiters are going to assess plenty of candidate profiles for the role. Thus, anything you do to stand out will win you brownie points.

Use your credit manager cover letter introduction to share something memorable about your experience.

But before you go down the rabbit hole of creativity and humor, align your message with the company culture.

For example, if you are applying for a role in some startup, use those first two sentences to tell a funny story (about your experience) to quickly connect with the recruiter.

Choosing your best achievement for the middle or body of your credit manager cover letter

Now that you have the recruiters' attention, it's time to write the chunkiest bit of your credit manager cover letter.

The body consists of three to six paragraphs that focus on one of your achievements.

Use your past success to tell a story of how you obtained your most job-crucial skills and know-how (make sure to back these up with tangible metrics).

Another excellent idea for your credit manager cover letter's middle paragraphs is to shine a light on your unique professional value.

Write consistently and make sure to present information that is relevant to the role.

Final words: writing your credit manager cover letter closing paragraph

The final paragraph of your credit manager cover letter allows you that one final chance to make a great first impression.

Instead of going straight to the "sincerely yours" ending, you can back up your skills with a promise of:

- how you see yourself growing into the role;

- the unique skills you'd bring to the organization.

Whatever you choose, always be specific (and remember to uphold your promise, once you land the role).

If this option doesn't seem that appealing to you, close off your credit manager cover letter with a follow-up request.

You could even provide your availability for interviews so that the recruiters would be able to easily arrange your first meeting.

Keep this in mind when writing your zero experience credit manager cover letter

Even though you may not have any professional experience, your credit manager cover letter should focus on your value.

As a candidate for the particular role, what sort of skills do you bring about? Perhaps you're an apt leader and communicator, or have the ability to analyze situations from different perspectives.

Select one key achievement from your life, outside work, and narrate a story that sells your abilities in the best light.

If you really can't think of any relevant success, you could also paint the picture of how you see your professional future developing in the next five years, as part of the company.

Key takeaways

Winning at your job application game starts with a clear and concise credit manager cover letter that:

- Has single-spaced paragraphs, is wrapped in a one-inch margin, and uses the same font as the credit manager resume;

- Is personalized to the recruiter (using their name in the greeting) and the role (focusing on your one key achievement that answers job requirements);

- Includes an introduction that helps you stand out and show what value you'd bring to the company;

- Substitutes your lack of experience with an outside-of-work success, that has taught you valuable skills;

- Ends with a call for follow-up or hints at how you'd improve the organization, team, or role.