Navigating the intricate compliance regulations inherent in the finance sector can be a daunting CV challenge, often requiring a delicate balance of showcasing both analytical skills and strict adherence to legal standards. By following our guide, you'll learn the art of effectively highlighting your expertise in regulatory frameworks and risk management, thereby crafting a CV that stands out in the competitive financial job market.

- Applying the simplest CV design, so that recruiters can easily understand your expertise, skills, and professional background;

- Ensuring you stand out with your header, summary or objective statement, and a designated skills section;

- Creating your CV experience section - no matter how much expertise you have;

- Using real life professional CV examples to enhance the structure and outline of your profile.

If you still have no muse to write your professional CV, find some more industry-leading examples.

CV examples for finance

By Experience

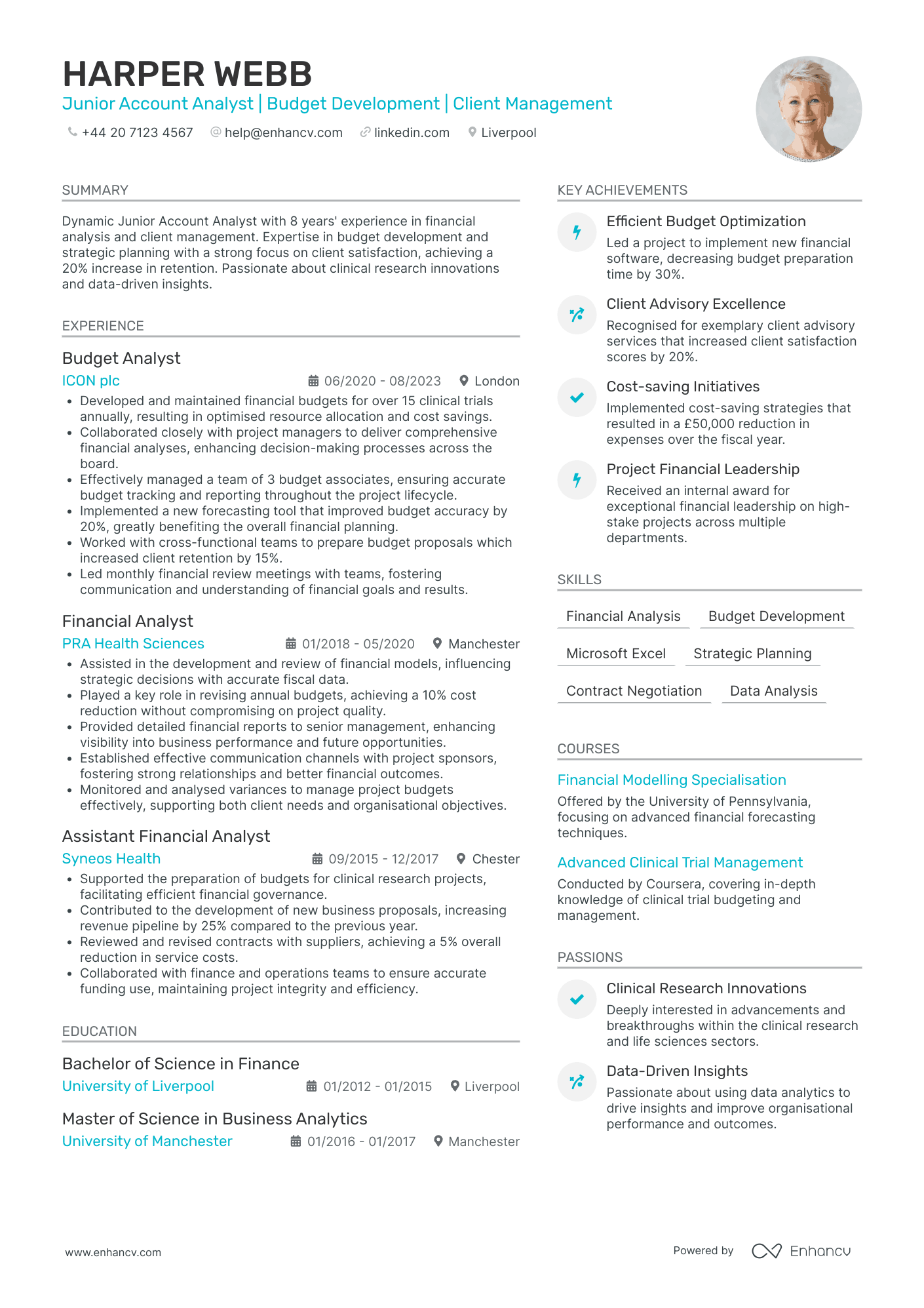

Entry Level Finance Analyst

- Clear Structure Enhancing Readability - Harper Webb's CV is well-structured, with neatly categorized sections such as experience, education, skills, and achievements. This clarity aids in quickly understanding their career journey and expertise in financial analysis and client management, offering a comprehensive view of their professional profile at a glance.

- Significant Career Growth and Industry Experience - The career trajectory shows a progression from Assistant Financial Analyst to Budget Analyst, demonstrating considerable growth and increased responsibility within financial roles across the clinical research sector. This upward movement highlights resilience and commitment to advancing within an industry that aligns with their passions and skills.

- Demonstrates Leadership and Cross-Functional Collaboration - Harper has showcased strength in leadership by managing a team and leading financial review meetings. Their ability to collaborate across cross-functional teams, evident in initiatives that improved client retention and strategic planning, underscores their capability to drive projects toward achieving organizational objectives efficiently.

Senior Finance Manager

- Well-Structured Layout - The CV is presented in a concise and well-organized manner, with distinct sections for experience, education, skills, and achievements. This structure ensures that the reader can easily navigate through Theodore Green's professional history and quickly grasp his qualifications relevant to a Senior Finance Manager position.

- Impressive Career Growth - Over the course of nine years, Theodore has demonstrated significant career progression, moving from a Finance Analyst to a Senior Finance Manager. His career trajectory emphasizes his expanding responsibilities and expertise, specifically within ESG and non-financial reporting sectors, showcasing his continual professional development and alignment with industry demands.

- Impactful Achievements - The CV highlights specific achievements that had substantial business impacts, such as a 90% compliance increase with the Corporate Sustainability Reporting Directive and facilitating a software transition that improved data accessibility. These accomplishments underscore Theodore's ability to drive company-wide improvements and ensure that his contributions directly support strategic goals and operational efficiency.

Mid-Level Finance Administrator

- Structured and Clear Presentation - The CV is organized into distinct sections, each clearly defined, which allows for easy navigation and comprehension. Key elements such as experience, skills, and achievements are concisely presented, ensuring that the reader quickly understands the candidate's qualifications and professional history. The use of bullet points aids in highlighting specific achievements and responsibilities, making it accessible and readable.

- Steady Career Progression - The career trajectory displayed in this CV reflects a logical and impressive growth path, moving from a Financial Analyst position at HSBC to a current role as a Finance Manager at BP Finance Group. This upward trajectory showcases not only promotions and increased responsibilities but also the candidate's ability to make significant contributions at each stage, thereby enhancing their credibility as a seasoned financial professional.

- Impactful Achievements with Business Relevance - Harry Williams' CV underscores its value by detailing achievements with clear business impacts, such as reducing discrepancies by 30% and improving profitability by 15%. These figures are not merely statistics but are framed within the context of strategic improvements and innovations he has led, illustrating his capability to drive meaningful change and efficiency in financial operations.

By Role

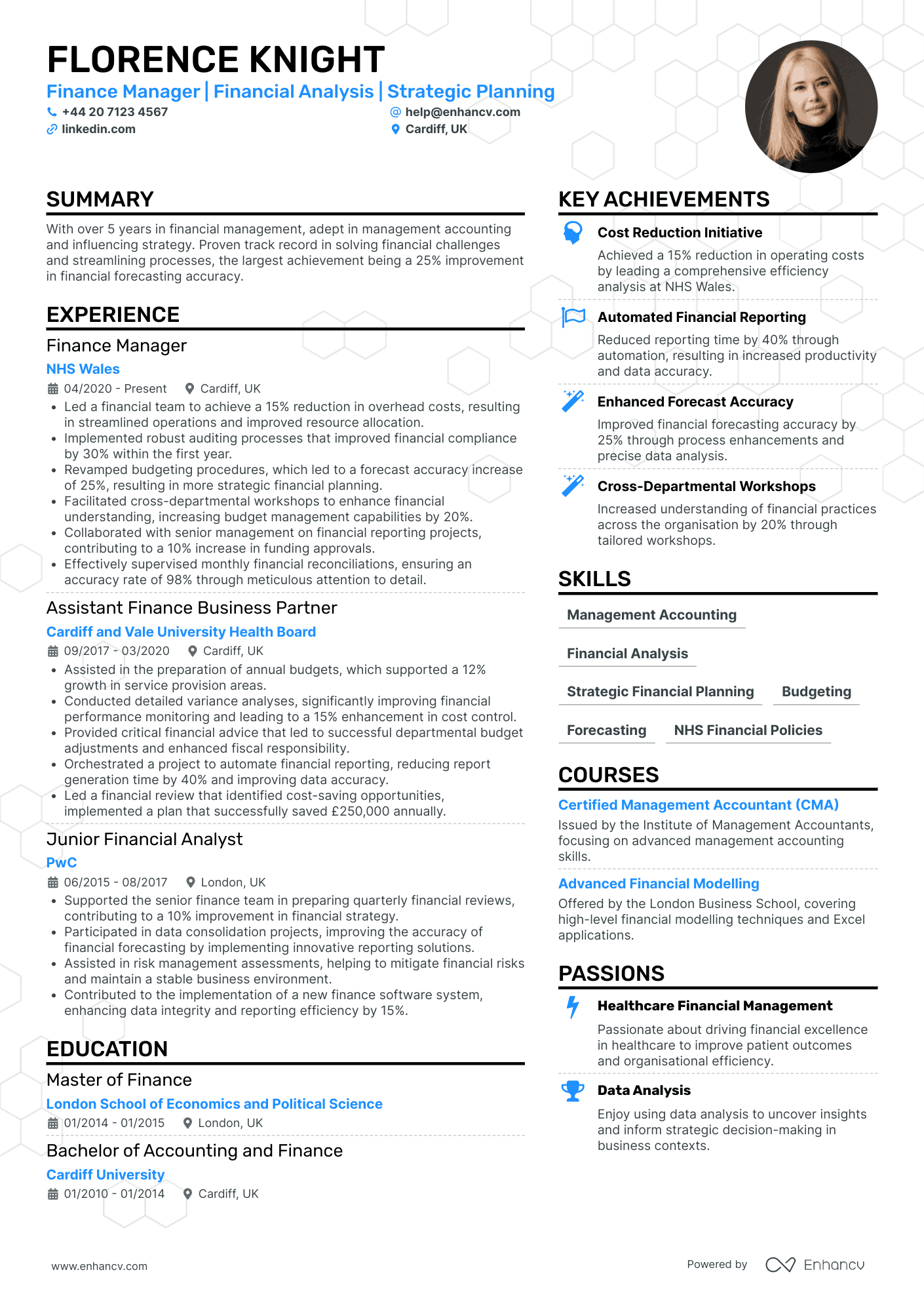

Finance Analyst in Healthcare

- Effective Content Presentation - Florence Knight's CV is structured for clarity and conciseness, ensuring that each section communicates essential details effortlessly. The use of bullet points in the experience section highlights achievements and responsibilities in a digestible format, making it easy for recruiters to quickly ascertain key competencies.

- Demonstrated Career Growth - The CV reflects a well-defined career trajectory from a Junior Financial Analyst at PwC to a Finance Manager at NHS Wales, showcasing professional growth within the financial sector. This progression underscores her ability to take on increased responsibilities and to advance in her field through promotions and skill development.

- Industry-Specific Proficiency - Florence's skill set and experience are tailored specifically to the financial management within healthcare, with expertise in NHS financial policies and tools like SAP. The inclusion of certifications such as Certified Management Accountant further attests to her specialized knowledge and technical depth in financial management.

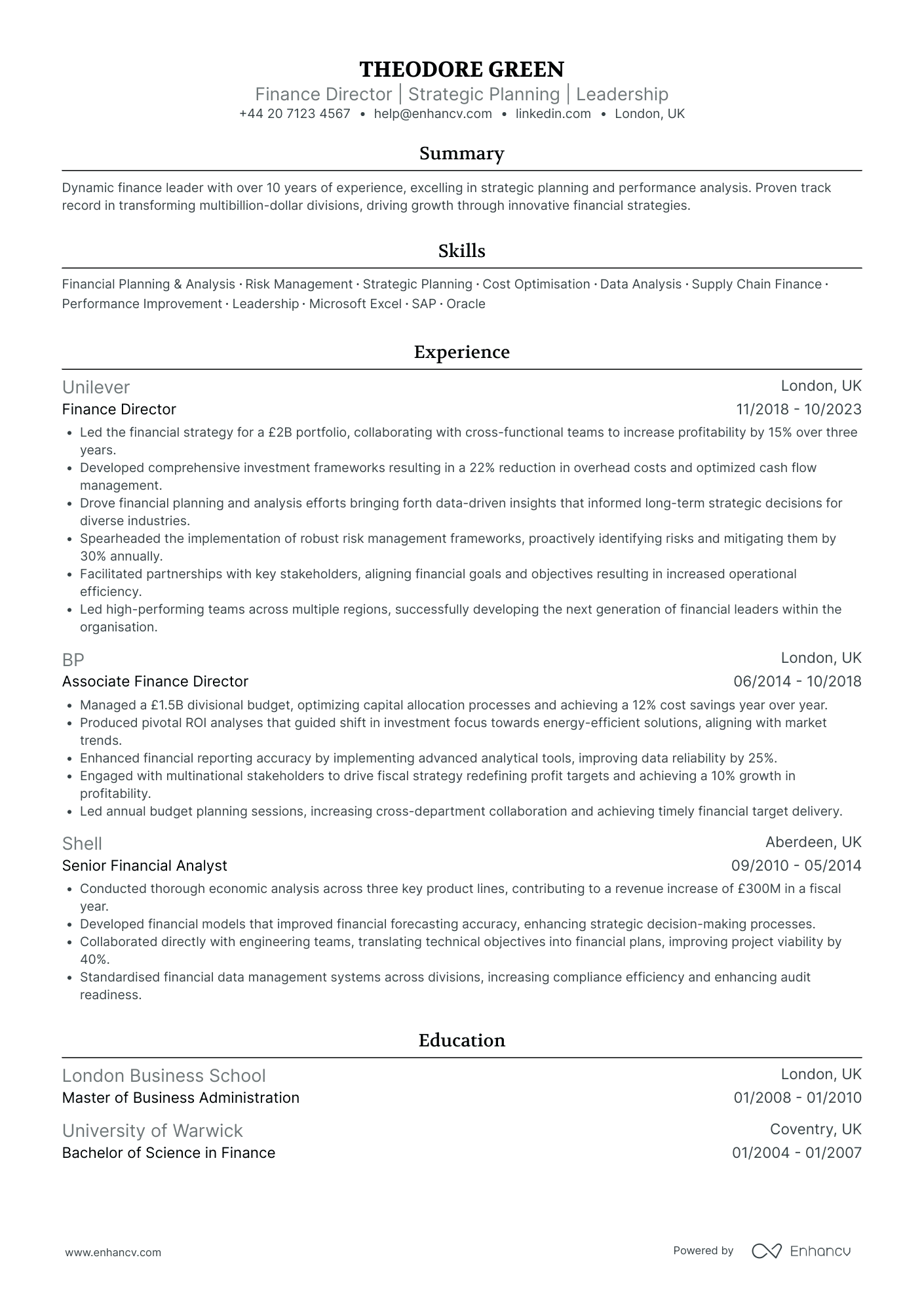

Finance Director in Manufacturing

- Content Presentation - This CV is structured with clarity and precision, focusing on concise bullet points that effectively convey key responsibilities and accomplishments. Each section is clearly demarcated, allowing for easy navigation and quick identification of relevant experiences and skills. The use of bullet points also aids in presenting information in an accessible and reader-friendly format.

- Career Trajectory - The CV outlines a steady career progression from a Senior Financial Analyst role at Shell to a Finance Director position at Unilever. This trajectory highlights the candidate's growth in both responsibility and leadership within the finance industry, demonstrating an upward movement aligned with increasing expertise and impact.

- Soft Skills and Leadership - Highlighted throughout the CV is the candidate's strong leadership capability. They have effectively led cross-functional teams, mentored future leaders, and facilitated partnerships. These soft skills, combined with technical expertise, portray a financial leader who excels in both strategic initiatives and team development.

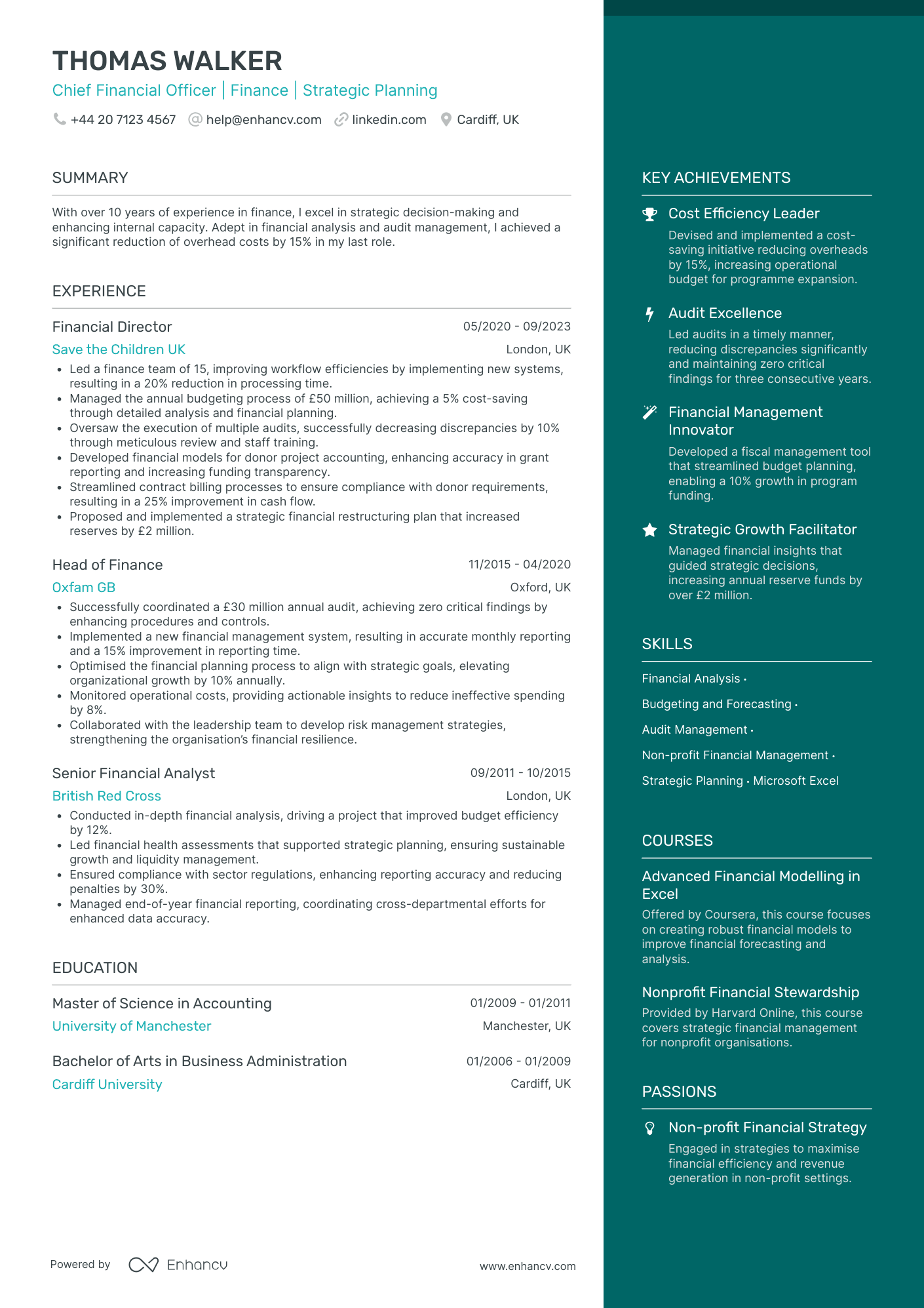

Finance Officer in Non-Profit

- Clear structure and detailed achievements - The CV is organized in a way that clearly outlines the candidate's professional journey and accomplishments. Each position lists specific results, such as reducing overhead costs by 15% and managing the budgeting process of £50 million, giving a concise yet thorough insight into their impact.

- Demonstrates growth within the non-profit sector - Thomas Walker’s career trajectory is impressive, showcasing a consistent rise in responsibility and leadership. From beginning as a Senior Financial Analyst to advancing to Chief Financial Officer, he has demonstrated adaptability and capacity for increased decision-making in notable organizations like Save the Children UK and Oxfam GB.

- Strategic innovation in financial management - The CV highlights the candidate’s ability to innovate within the financial domain, particularly for non-profits. Implementing new systems improved workflow efficiencies, achieving a 25% improvement in cash flow, while strategic planning enabled a £2 million increase in reserves, indicating a deep understanding of financial impact.

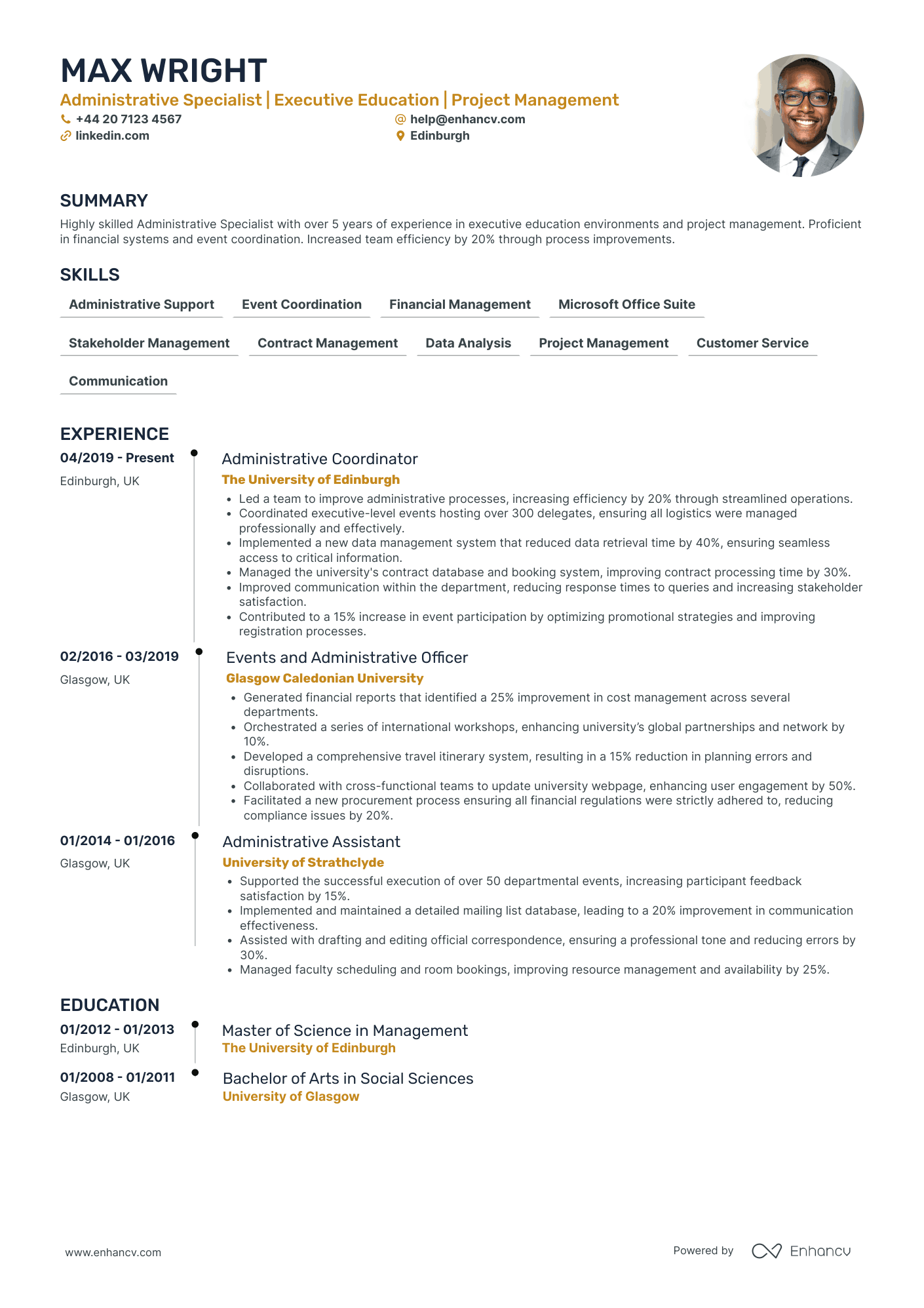

Finance Administrator in Education

- Effective Content Presentation - The CV is presented in a clear and concise manner, beginning with a solid summary that immediately establishes the applicant's expertise in administrative roles. Each section has been organized logically, with bullet points that make the key achievements and responsibilities easy to scan, ensuring that important information stands out quickly to potential employers.

- Demonstrated Career Growth and Competence - Max Wright's career trajectory shows a marked progression from an Administrative Assistant to an Administrative Coordinator in reputable academic institutions. This growth, coupled with specific roles and achievements at each stage, highlights their increasing competence and ability to handle greater responsibilities and complex challenges in the field.

- Substantial Achievements with Business Impact - The CV is rich with quantifiable achievements, such as a 20% increase in efficiency and a 25% improvement in cost management. These metrics are not merely numerical but are tied directly to business outcomes, illustrating Wright's capacity to create value and drive positive changes in their professional environment.

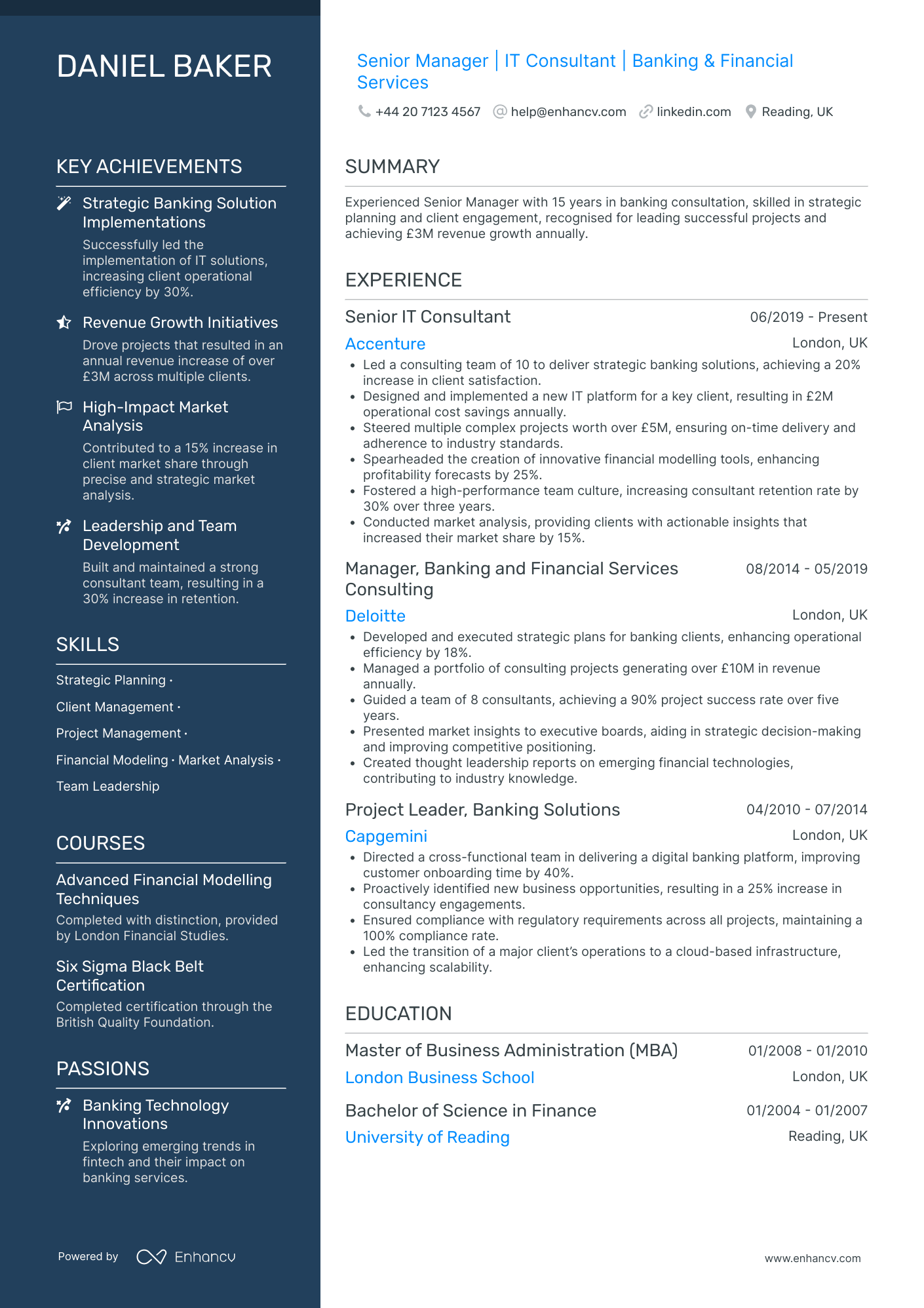

Finance Consultant in Banking

- Career Progression and Industry Expertise - Daniel Baker's CV reflects a well-defined career trajectory, showcasing growth from a Project Leader at Capgemini to a Senior IT Consultant at Accenture. The upward movement within prominent consulting firms in the banking and financial sector highlights both industry loyalty and a steady increase in responsibilities and expertise.

- Impactful Leadership and Team Development - The CV emphasizes Daniel's strong leadership skills, as demonstrated by his ability to lead and maintain high-performance teams. His focus on team retention, increasing it by 30% at Accenture, and achieving a 90% project success rate at Deloitte emphasize his effectiveness in fostering a productive work culture.

- Strategic Achievements with Tangible Outcomes - The document is rich with specific achievements that align with business growth and strategic goals. Clear examples include generating over £3M in annual revenue growth and spearheading projects that led to significant operational cost savings and efficiency improvements, illustrating his ability to drive substantial organizational value beyond just figures.

Finance Specialist in Technology

- Content Presentation and Conciseness - The CV demonstrates clarity and structure by presenting information in a concise manner, allowing each section to highlight critical aspects of Archie's career with precision. The bullet-point format efficiently outlines achievements and responsibilities, maximizing readability and retention for the reader.

- Career Trajectory and Growth - Archie's career progression is clearly outlined, showing a steady rise from a Finance Assistant to Senior Finance Manager. This trajectory demonstrates his ability to take on increased responsibilities and showcases his growth within the non-profit sector while working for globally recognized organizations like WWF UK and Greenpeace UK.

- Achievements and Their Business Relevance - The CV highlights significant accomplishments with quantifiable outcomes, such as improving forecast accuracy by 15% and reducing audit adjustments by 40%, illustrating Archie’s impactful contributions to organizational effectiveness. These achievements underscore his ability to deliver meaningful business results in the non-profit sector.

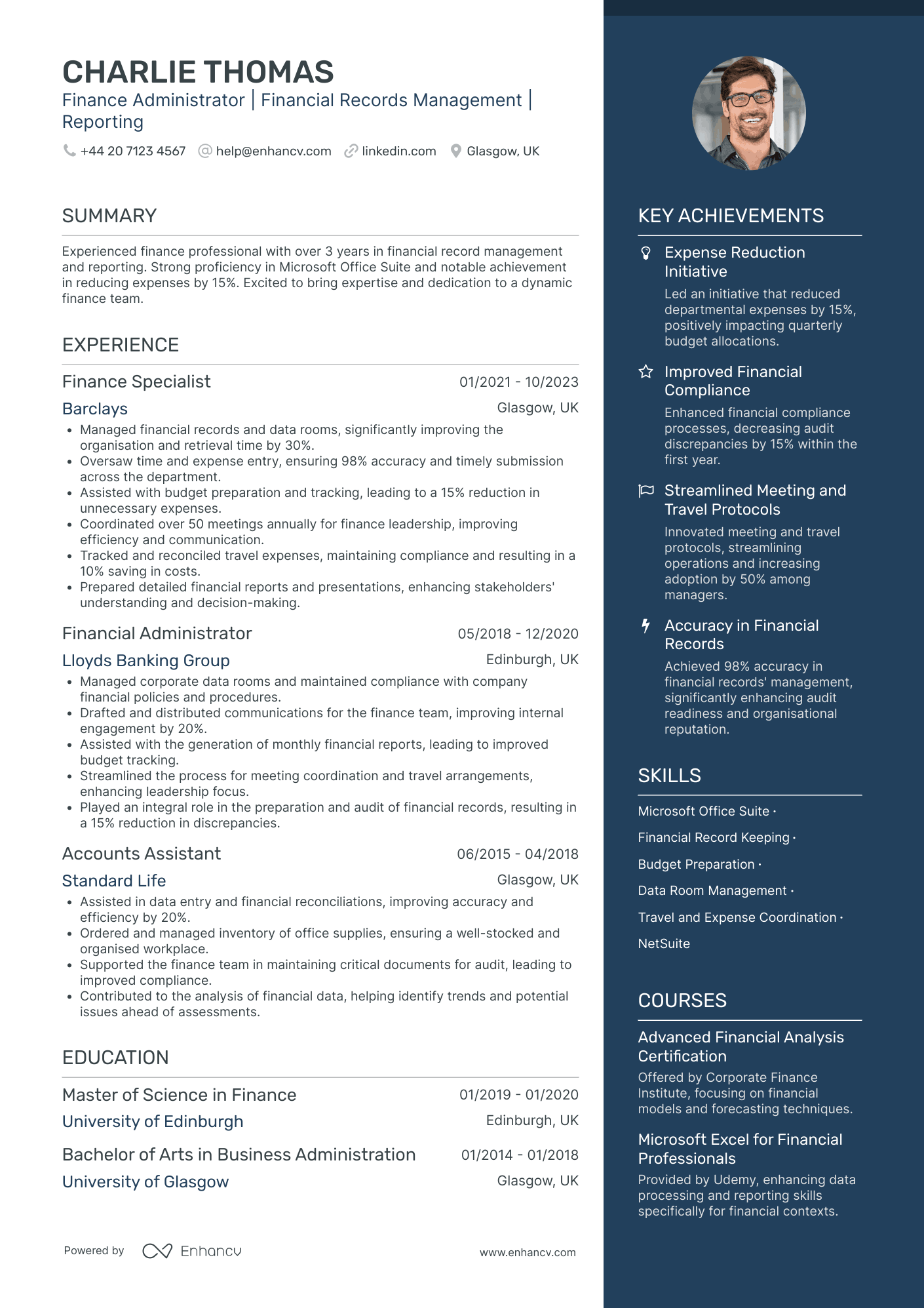

Finance Coordinator in Hospitality

- Structured and Focused Content Presentation - The CV employs a clear and logical structure, with neatly sectioned categories that enhance readability and effectively highlight Charlie's professional journey. It succinctly communicates the candidate's expertise and experience through concise bullet points, making it easy for employers to grasp key accomplishments and skills at a glance.

- Progressive Career Trajectory - Charlie's career progression from an Accounts Assistant to a Finance Specialist showcases a commendable growth path within the financial industry. This evolution reflects not only an expansion in responsibilities but also a deepening of industry expertise, as evidenced by the transition to roles that require greater leadership and analytical capabilities.

- Achievements with Business Impact - The CV effectively highlights achievements that have delivered tangible business outcomes, such as reducing expenses by 15% and achieving 98% accuracy in financial records management. These accomplishments not only speak to Charlie's capability in enhancing operational efficiency but also underscore the candidate's proactive approach to driving cost savings and improving organizational processes.

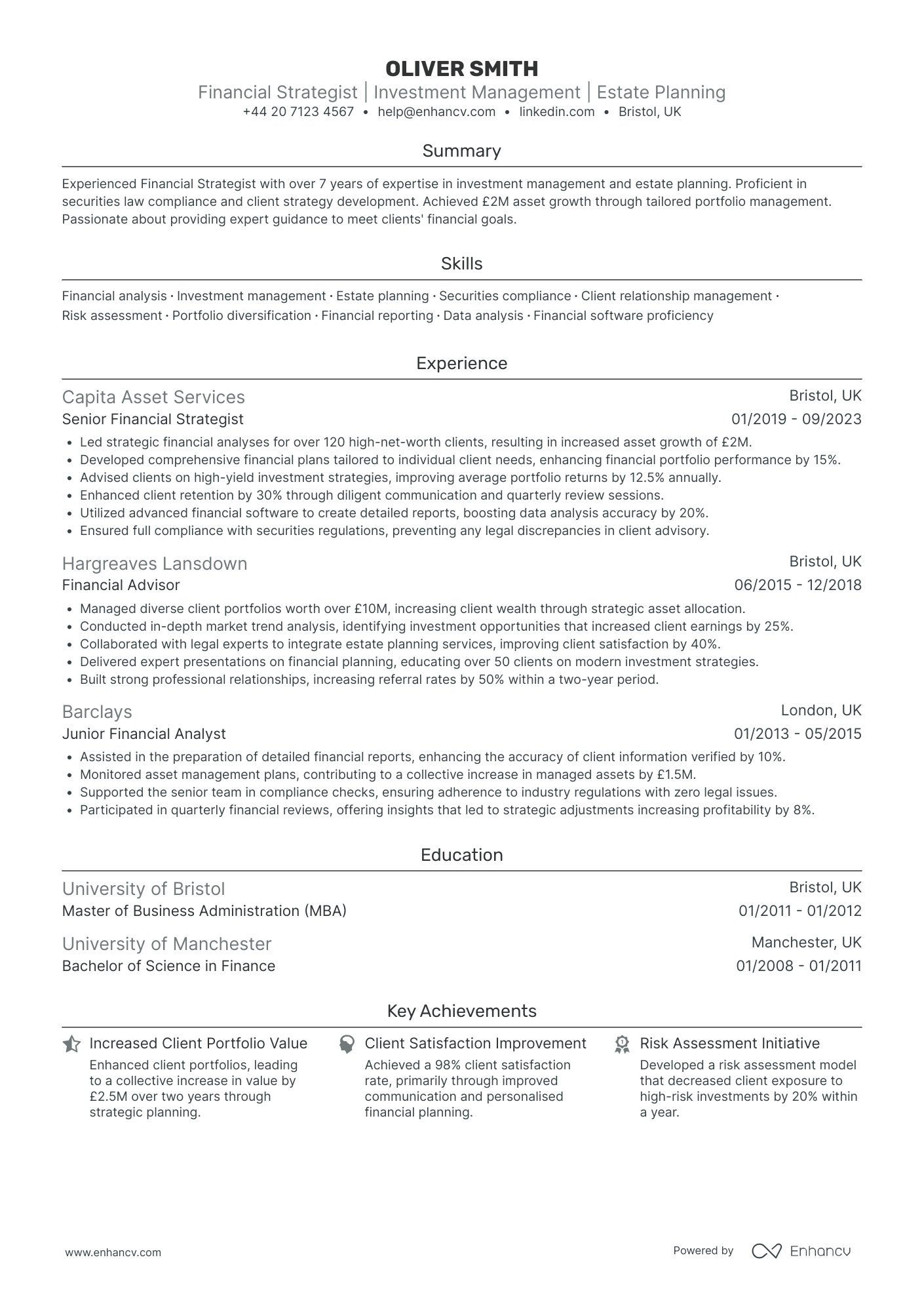

Finance Partner in Law

- Strongly Structured and Clear Presentation - The CV is structured for clarity and conciseness, featuring distinct sections that cover personal information, experience, education, and skills in a logical flow. Every section addresses specific elements relevant to financial strategy roles, ensuring easy navigation for potential employers.

- Impressive Career Progression and Growth - The candidate displays a clear upward trajectory in their career, progressing from a Junior Financial Analyst to a Senior Financial Strategist position. This progression is indicative of their growing expertise and capacity to handle more complex financial strategies over the years.

- Impressive Achievements with Tangible Business Impact - The CV effectively communicates achievements beyond numbers, illustrating tangible impacts like enhanced client satisfaction and significant asset growth. Such accomplishments are not just quantified by percentage increases but contextualized with clear business relevance, making them highly impressive to prospective employers.

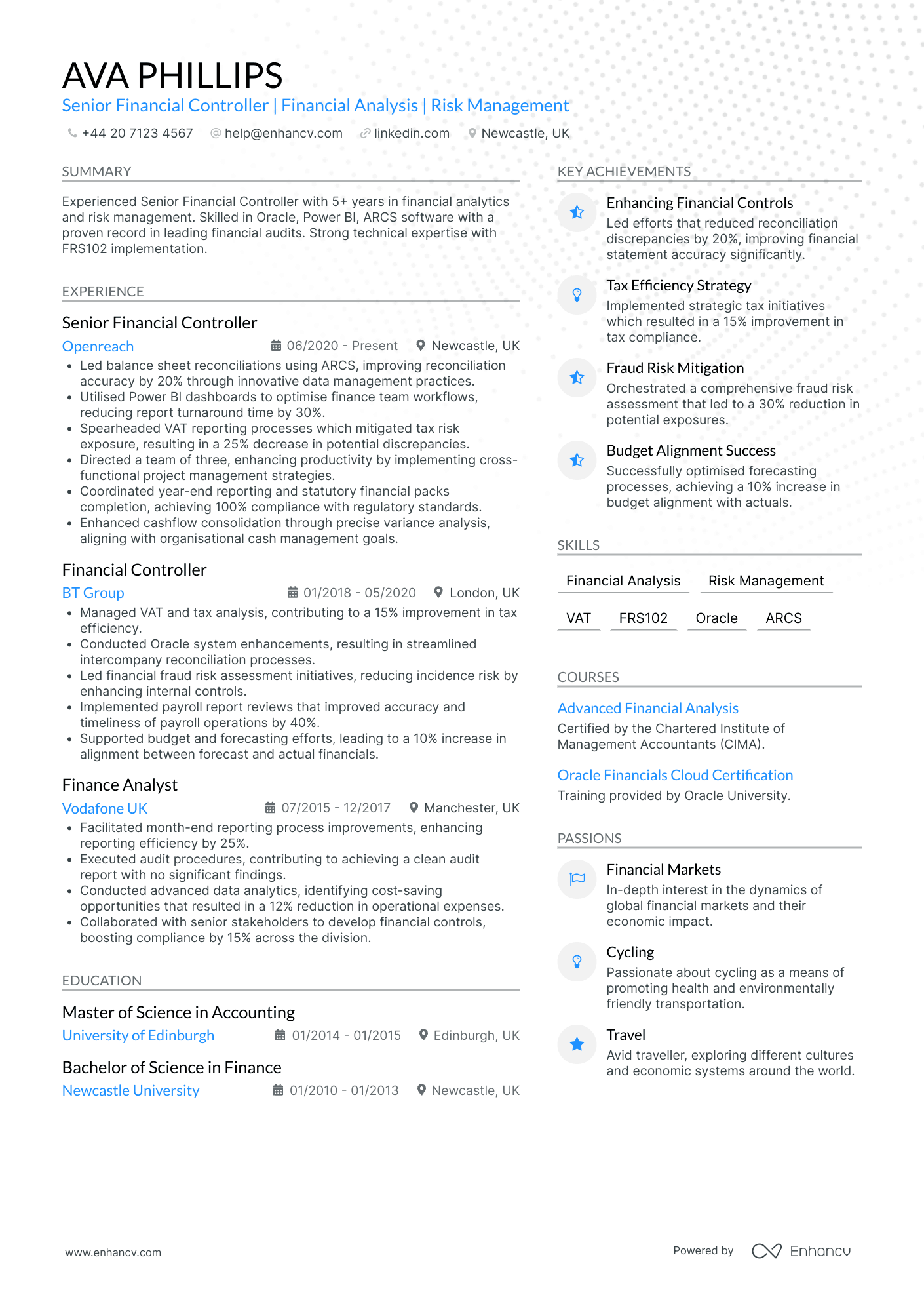

Finance Controller in Construction

- Comprehensive experience in financial leadership - Ava Phillips' CV demonstrates a clear career progression with roles that increasingly emphasize leadership and strategic financial oversight. Starting as a Finance Analyst and rising to a Senior Financial Controller role, her experience at prestigious companies like Vodafone, BT Group, and Openreach indicates steady professional growth aligned with deeper responsibilities in financial management.

- Effective use of specialized financial tools - Ava's proficiency with industry-specific tools such as Oracle, Power BI, and ARCS underscores her technical depth in handling complex financial processes. Her ability to innovate within these frameworks—as evidenced by improved reconciliation accuracy and streamlined reporting—illustrates her command of the digital tools crucial for modern financial analysis and risk management.

- Business-oriented achievements with tangible results - The CV effectively conveys the business impact of Ava's achievements. For example, her leadership led to a 20% improvement in reconciliation accuracy and a 25% decrease in tax discrepancies, highlighting her proficiency in reducing financial risks. These metrics not only underline her strategic problem-solving capabilities but also her significant contribution to the financial health and efficiency of her organizations.

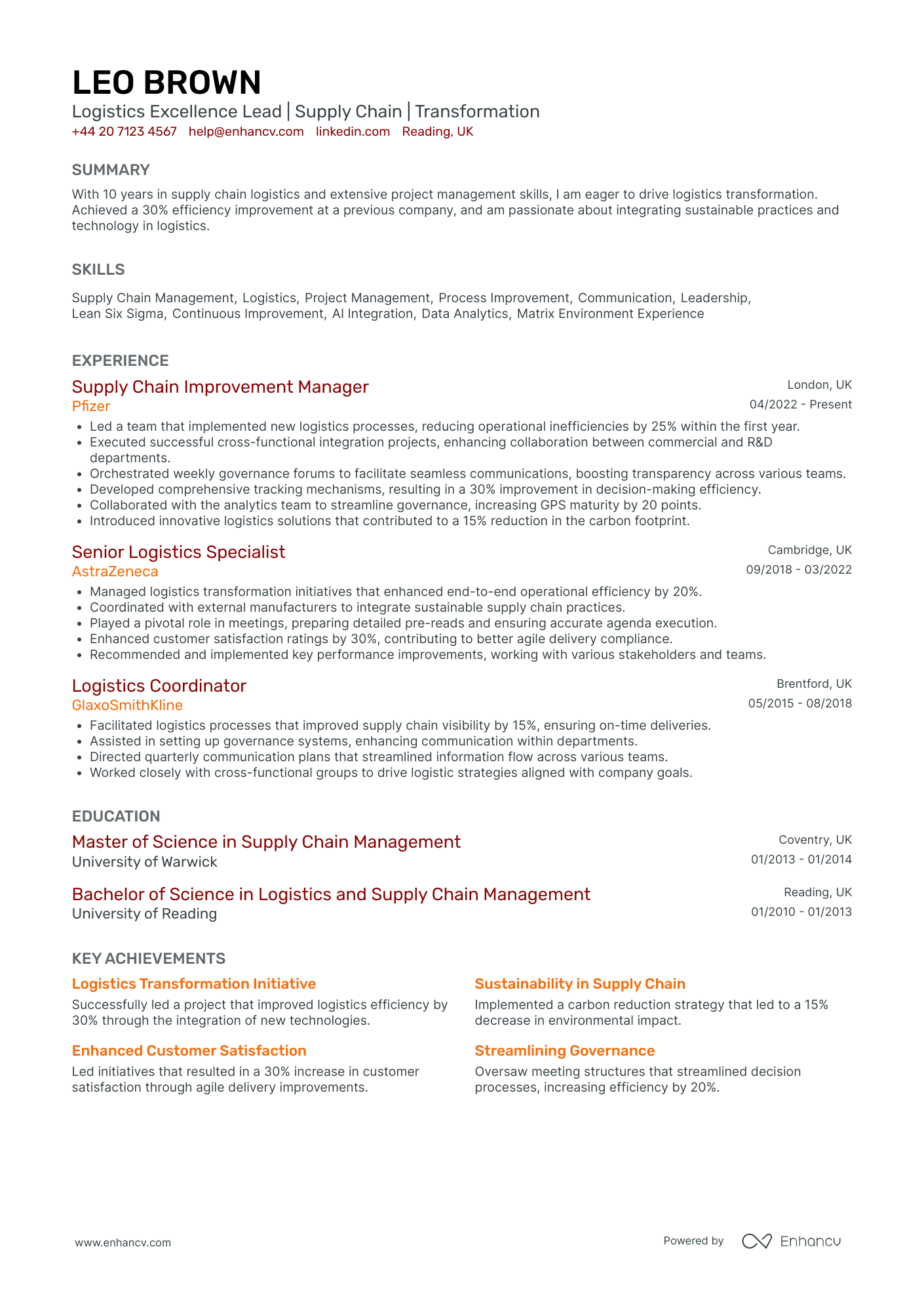

Finance Operations Lead in Logistics

- Clear Structure and Impactful Presentation - The CV is well-structured, facilitating ease of reading and comprehension. The use of concise bullet points in the experience section allows for quick assimilation of key achievements and responsibilities, making the content accessible and engaging.

- Progressive Career Trajectory in Leading Pharma Companies - Leo Brown’s career shows consistent growth, moving from a Logistics Coordinator to a Logistics Excellence Lead within top pharmaceutical companies like Pfizer and AstraZeneca, highlighting strategic advancement and increasing responsibility.

- Strong Focus on Sustainability and Innovation - The CV distinguishes itself by emphasizing the integration of sustainable practices and advanced technologies in the logistics sector, showcasing the candidate’s forward-thinking approach and adaptability to industry innovations.

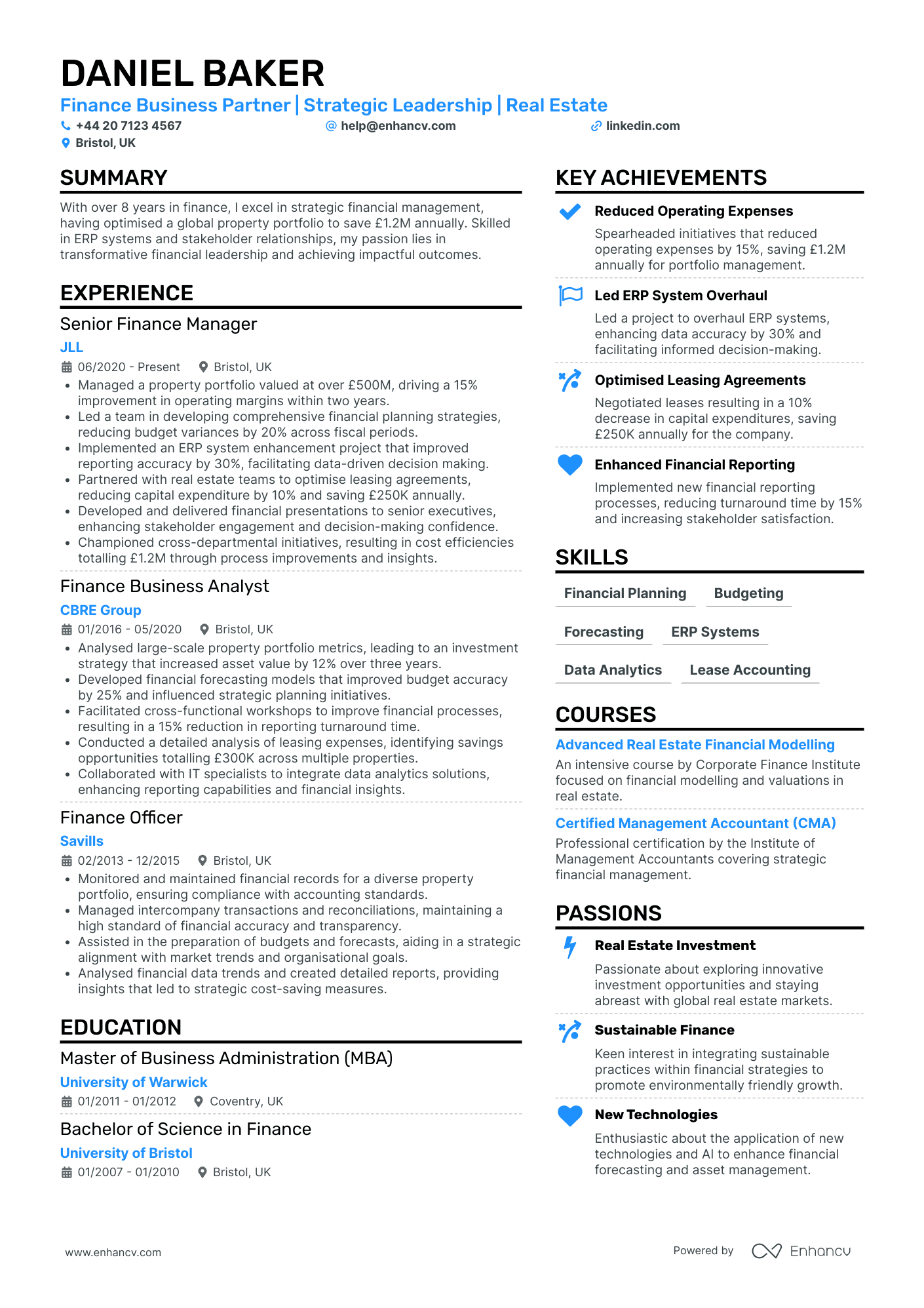

Finance Business Partner in Real Estate

- Structured and Easily Navigable - The CV is thoughtfully organized, with distinct sections that allow for quick navigation and understanding. Key information, such as contact details, skills, and experience, is presented concisely, enabling a clear overview of Daniel Baker's professional profile. This structure is particularly effective for a senior finance position, where clarity is paramount.

- Progressive and Strategic Career Growth - Daniel Baker's career pathway demonstrates consistent progression within the finance and real estate sectors. Starting as a Finance Officer and advancing to a Senior Finance Manager, the trajectory shows a strategic mindset and leadership capabilities. The roles highlight an increasing level of responsibility, notably managing significant portfolios and leading major financial projects, reflecting growth and ambition in his career.

- Impactful Achievements with Real-World Business Relevance - The CV effectively showcases achievements that directly correlate to significant business improvements. For instance, savings of £1.2M annually through operating expense reductions, and enhancing reporting accuracy by 30% via an ERP system. These accomplishments not only emphasize technical proficiency but also demonstrate Baker's ability to deliver transformative and impactful financial solutions within the real estate industry.

Finance Systems Manager in IT

- Impressive Career Trajectory - Harper Webb's career progression is well-highlighted, showing a clear path of growth and increased responsibility in the finance and gaming industries. From a Financial Analyst at Sony Interactive Entertainment to a Finance Systems Manager at Electronic Arts, every step denotes an enhancement in skills and leadership roles, reflecting a robust career trajectory aimed at process optimization and system management.

- Deep Technical Expertise in D365 - The CV effectively underscores Webb's technical depth with Microsoft D365, a crucial component for a Finance Systems Manager. It showcases their specialized skills in implementing finance modules and leading process automation initiatives, thereby emphasizing their capability to handle complex financial infrastructures in a dynamic gaming environment.

- Impactful Achievements and Business Relevance - Harper Webb's CV shines with quantified achievements that highlight significant business value. Improvements such as reducing processing time by 20% and saving over £300,000 annually demonstrate the tangible positive impact on profit margins and operational efficiencies, enhancing the CV’s appeal to prospective employers in the gaming industry.

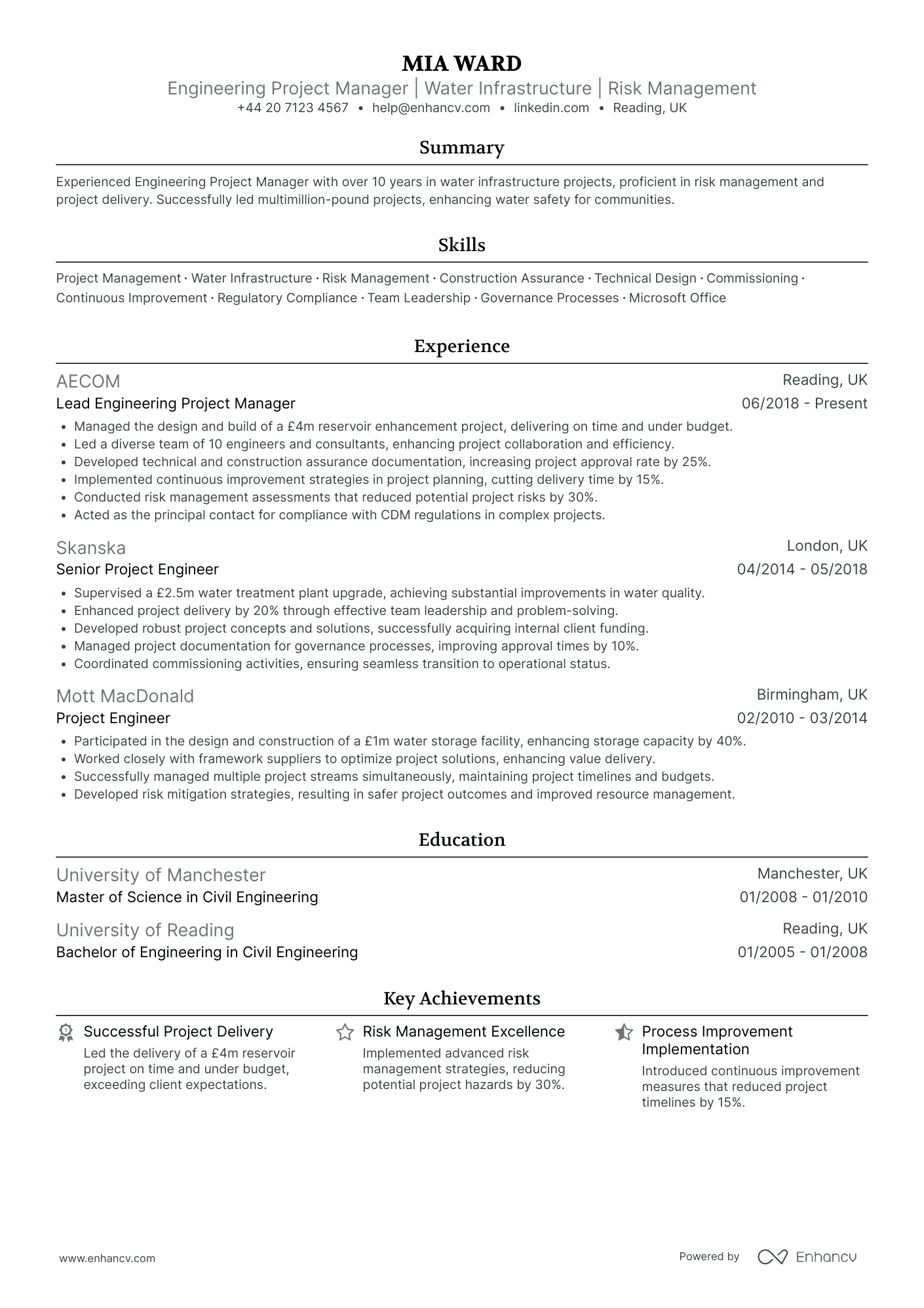

Finance Project Manager in Engineering

- Comprehensive Project Management Record - The CV is neatly structured with a clear focus on Mia's project management expertise in water infrastructure encompassing over a decade. It spans from managing multimillion-pound projects to improving water safety, providing a detailed snapshot of her successful leadership delivery in the industry.

- Proven Career Progression and Industry Focus - Mia's career shows a clear trajectory from Project Engineer to Lead Engineering Project Manager, demonstrating her growth and adaptability within renowned companies like AECOM, Skanska, and Mott MacDonald. Her consistent focus on water infrastructure highlights her commitment and specialization in this critical sector.

- Robust Risk Management Skills and Impact - The CV spotlights Mia’s proficiency in risk management, underpinning her technical depth by detailing methodologies that significantly reduced potential project risks by 30%. These measures go beyond just statistics, showing their profound impact on enhancing project safety and resource management.

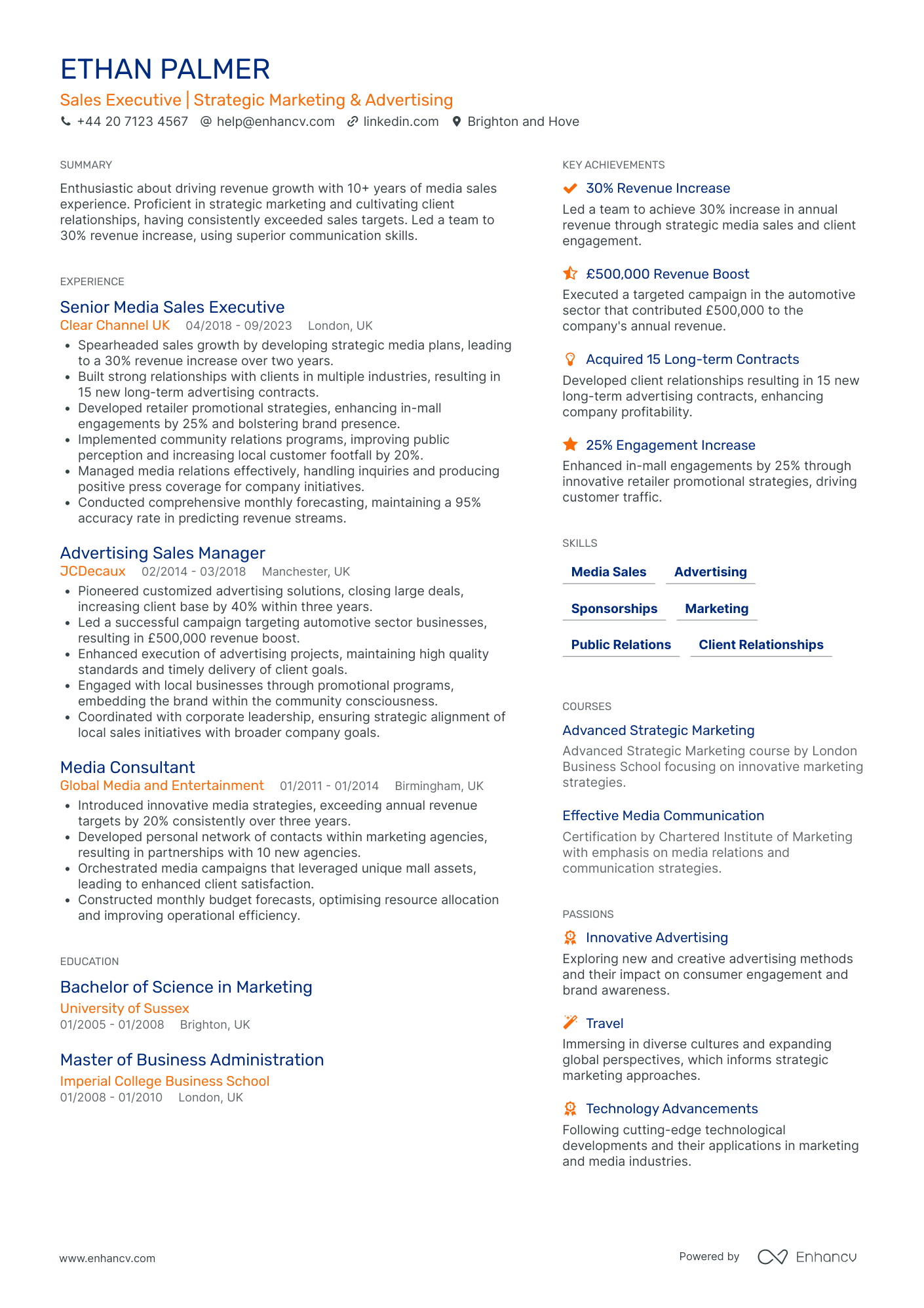

Finance Executive in Advertising

- Clear and Structured Presentation - Ethan Palmer’s CV is impeccably structured, providing clarity and conciseness in how his information is presented. Each section is well-organized, making it easy to navigate. This systematic approach ensures that key details like his professional experience, education, and achievements are readily accessible and comprehensible, enhancing the overall readability of the document for potential employers.

- Impressive Career Progression - The progression in Ethan's career from a Media Consultant to a Senior Media Sales Executive demonstrates a clear trajectory of growth and increased responsibility. His career path shows a consistent climb in the media and advertising field, transitioning through progressively senior roles across different cities in the UK. This upward movement highlights his dedication and capacity to adapt and expand his expertise in various environments.

- Strategic and Impactful Achievements - Ethan's CV doesn't just focus on numbers, but emphasizes the broader impact of his work, such as achieving a 30% revenue increase and securing 15 long-term contracts. Each achievement outlines not just the quantitative success but also the strategic methodologies employed to reach these targets, portraying Ethan as someone who is not only effective in execution but also in strategic planning and business development.

How complex should the format of your finance CV be?

Perhaps, you decided to use a fancy font and plenty of colours to ensure your finance CV stands out amongst the pile of other candidate profiles. Alas - this may confuse recruiters. By keeping your format simple and organising your information coherently, you'll ultimately make a better impression. What matters most is your experience, while your CV format should act as complementary thing by:

- Presenting the information in a reverse chronological order with the most recent of your jobs first. This is done so that your career history stays organised and is aligned to the role;

- Making it easy for recruiters to get in touch with you by including your contact details in the CV header. Regarding the design of your CV header, include plenty of white space and icons to draw attention to your information. If you're applying for roles in the UK, don't include a photo, as this is considered a bad practice;

- Organising your most important CV sections with consistent colours, plenty of white space, and appropriate margins (2.54 cm). Remember that your CV design should always aim at legibility and to spotlight your key information;

- Writing no more than two pages of your relevant experience. For candidates who are just starting out in the field, we recommend to have an one-page CV.

One more thing about your CV format - you may be worried if your double column CV is Applicant Tracker System (ATS) complaint. In our recent study, we discovered that both single and double-column CVs are ATS-friendly . Most ATSes out there can also read all serif and sans serif fonts. We suggest you go with modern, yet simple, fonts (e.g. Rubik, Lato, Raleway) instead of the classic Times New Roman. You'll want your application to stand out, and many candidates still go for the classics. Finally, you'll have to export your CV. If you're wondering if you should select Doc or PDF, we always advise going with PDF. Your CV in PDF will stay intact and opens easily on every OS, including Mac OS.

PRO TIP

Use bold or italics sparingly to draw attention to key points, such as job titles, company names, or significant achievements. Overusing these formatting options can dilute their impact.

The top sections on a finance CV

- Professional Summary highlights your finance expertise and objectives.

- Work Experience shows your relevant finance career progression.

- Education and Certifications demonstrate your foundational finance knowledge.

- Key Skills section showcases your finance-related abilities and proficiencies.

- Achievements in Finance underscores your contributions and successes in finance roles.

What recruiters value on your CV:

- Highlight your quantifiable achievements in finance, such as assets you managed, percentages by which you increased revenue or reduced costs, or how you outperformed market benchmarks.

- Demonstrate your financial modelling and analytical skills, ensuring to include any proficiency with industry-standard software like Excel, Bloomberg Terminal, or specific financial platforms relevant to the role.

- Emphasise your understanding of financial regulations and compliance, and if applicable, any experience you have in navigating the complex regulatory environment effectively.

- Include industry-specific certifications such as CFA, ACCA, or CIMA, as these are often required or favoured for finance roles and exhibit a strong professional dedication.

- Use finance-specific language and acronyms only where appropriate and ensure they’re widely recognised within the industry to show your insider knowledge and effective communication skills.

Recommended reads:

What information should you include in your finance CV header?

The CV header is potentially the section that recruiters would refer to the most, as it should include your:

- Contact details - your professional (non-work) email address and phone number;

- Professional photograph - if you're applying hinting at the value you bring as a professional.

Many professionals often struggle with writing their finance CV headline. That's why in the next section of this guide, we've curated examples of how you can optimise this space to pass any form of assessment.

Examples of good CV headlines for finance:

- Financial Analyst | CFA Level II Candidate | Data Modelling Expertise | 5+ Years in Investment Analysis

- Senior Accountant | ACCA Qualified | Tax Compliance Specialist | Financial Reporting | 10 Years’ Experience

- Risk Management Officer | FRM Holder | Strategic Risk Assessment | Capital Markets | 7 Years in Banking

- Treasurer | CPA Certified | Cash Flow Optimisation | Corporate Finance | Over 12 Years’ Seniority

- Junior Portfolio Manager | Investment Strategy | Equity Research | FINRA Series 7 & 63 | 3 Years’ Practice

- Chief Financial Officer | MBA Finance | Corporate Governance | Mergers & Acquisitions | 15+ Years’ Leadership

Your finance CV introduction: selecting between a summary and an objective

finance candidates often wonder how to start writing their resumes. More specifically, how exactly can they use their opening statements to build a connection with recruiters, showcase their relevant skills, and spotlight job alignment. A tricky situation, we know. When crafting you finance CV select between:

- A summary - to show an overview of your career so far, including your most significant achievements.

- An objective - to show a conscise overview of your career dreams and aspirations.

Find out more examples and ultimately, decide which type of opening statement will fit your profile in the next section of our guide:

CV summaries for a finance job:

- With over 10 years of progressive experience in investment banking, a masterful command of mergers and acquisitions, and a proven track record of growing a client portfolio by 200% over five years, I am poised to deliver exceptional financial analysis and strategic planning services.

- Eager to bring seven years of equity trading expertise, including a deep understanding of Asian markets and a history of surpassing trading targets by 30%, to a thriving financial team seeking deep market insights and risk management acumen.

- Accomplished sales professional with a decade's tenure transitioning to asset management, wielding expert analytical skills, comprehensive knowledge in portfolio diversification, and a dedication to achieving rigorous financial objectives in a new industry vertical.

- Highly successful IT project manager seeking to leverage extensive background in project budgeting and cost control to transition into a dynamic finance career, backed by a strong acumen for numbers and unparalleled organizational skills.

- As a recent finance graduate, I aim to apply my academic knowledge of financial modeling and my passion for stock market analysis to a career that allows for continued learning and growth within the financial sector.

- Seeking an entry-level position in the finance industry, I am keen to utilise my recent Master's degree in Finance, strong analytical skills, and enthusiasm for understanding market trends to contribute effectively to a team committed to financial excellence.

Best practices for writing your finance CV experience section

If your profile matches the job requirements, the CV experience is the section which recruiters will spend the most time studying. Within your experience bullets, include not merely your career history, but, rather, your skills and outcomes from each individual role. Your best experience section should promote your profile by:

- including specific details and hard numbers as proof of your past success;

- listing your experience in the functional-based or hybrid format (by focusing on the skills), if you happen to have less professional, relevant expertise;

- showcasing your growth by organising your roles, starting with the latest and (hopefully) most senior one;

- staring off each experience bullet with a verb, following up with skills that match the job description, and the outcomes of your responsibility.

Add keywords from the job advert in your experience section, like the professional CV examples:

Best practices for your CV's work experience section

- Quantified achievements with figures and percentages to illustrate the impact of your financial strategies and decisions, showcasing your ability to add value.

- Detailed knowledge of financial regulations and compliance achievements to demonstrate your adherence to industry standards and legal requirements.

- Highlighted proficiency in financial software and analytical tools, specifying your expertise in platforms like Excel, QuickBooks, or specialised finance industry software.

- Listed experience with budget development and forecasting, providing examples where you've successfully managed and optimised financial resources.

- Emphasised strong attention to detail through the successful identification and rectification of financial discrepancies or errors in accounting records.

- Described instances of cross-functional team collaboration, demonstrating your ability to work with other departments to achieve financial objectives.

- Included examples of custom financial modelling or reports you've created to support management decision-making or investor relations.

- Outlined contributions to financial strategy planning, including any involvement in mergers, acquisitions, or fundraising activities.

- Presented any successful negotiations of terms with banks, investors, or clients that have resulted in favourable financial outcomes for the company.

- Spearheaded the restructuring of the financial planning process, incorporating more robust forecasting tools which increased forecasting accuracy by 25%.

- Led a team in the successful roll-out of a company-wide expense reduction initiative, resulting in a 15% reduction in operating expenses.

- Managed a multi-million dollar portfolio, achieving an average annual return of 10% while mitigating risks through strategic diversification.

- Streamlined internal audit procedures to improve financial controls, which decreased discrepancies by 40% and enhanced compliance with regulatory standards.

- Oversaw the successful negotiation and integration of a $50M acquisition, expanding the company's market share and product offerings.

- Implemented a new ERP system to better manage financial transactions, which improved reporting time by 30% and reduced errors.

- Led a cross-functional team in a company-wide budget overhaul which trimmed departmental budgets by 20% without compromising on key deliverables.

- Collaborated on the development of a new financial model for predicting revenue streams, which has since become the standard across the company.

- Chaired monthly financial review meetings presenting analytics and recommendations to executive leadership, influencing decision-making processes.

- Managed financial operations for international projects worth over $200M, optimizing spending and saving the company 5% in projected costs.

- Developed and trained a team of 15 financial analysts, creating a more efficient workflow and increasing department productivity by 35%.

- Established a risk management plan that insulated the company from volatile market shifts and protected profits in a tough economic climate.

- Authored detailed financial reports for stakeholders that presented insights on key performance indicators, leading to more informed strategic decisions.

- Pioneered the use of advanced analytical tools which increased data analysis efficiency and provided deeper insights into market trends.

- Orchestrated a debt refinancing strategy that cut interest expenses by 8% annually, freeing up capital for investment in growth opportunities.

- Enhanced the company's cash flow management procedures, which stabilized cash reserves and reduced the need for external financing.

- Initiated a partnership with IT to develop a custom financial dashboard, improving real-time decision making with up-to-date metrics.

- Played a crucial role in the quarterly financial forecasting, aligning company resources with projected revenue and market conditions.

- Served as a key member of the strategic planning committee, directly contributing to a 12% year-over-year increase in company profitability.

- Initiated process improvements in the procure-to-pay cycle, which shortened the cycle time by 20% and improved supplier relationships.

- Negotiated a major credit line with a consortium of banks, enhancing the company's liquidity and enabling the launch of a new product line.

- Oversaw financial due diligence for mergers and acquisitions, enabling the company to expand its portfolio while maintaining a strong financial position.

- Managed quarterly earnings reporting, conveying complex financial information in an accessible manner that increased investor confidence.

- Implemented a company-wide cost control plan that reduced unnecessary expenditures by 18%, bolstering the bottom line.

- Supervised and mentored a finance team, enhancing their professional development which led to a 50% reduction in staff turnover.

- Conducted in-depth market analysis resulting in the divestiture of underperforming assets and reinvestment in high-growth opportunities.

- Improved the month-end financial close process, reducing the timeline from 10 to 6 days, thereby enabling faster strategic adjustments.

- Managed the investment strategy for a portfolio exceeding $1B in assets, consistently outperforming benchmarks by 5%.

- Developed a risk assessment protocol that improved the identification of financial risks associated with new initiatives.

- Introduced sustainability and social responsibility metrics into the financial evaluation process, which attracted a new segment of socially conscious investors.

What to add in your finance CV experience section with no professional experience

If you don't have the standard nine-to-five professional experience, yet are still keen on applying for the job, here's what you can do:

- List any internships, part-time roles, volunteer experience, or basically any work you've done that meets the job requirements and is in the same industry;

- Showcase any project you've done in your free time (even if you completed them with family and friends) that will hint at your experience and skill set;

- Replace the standard, CV experience section with a strengths or achievements one. This will help you spotlight your transferrable skills that apply to the role.

Recommended reads:

PRO TIP

If you have experience in diverse fields, highlight how this has broadened your perspective and skill set, making you a more versatile candidate.

Mix and match hard and soft skills across your finance CV

Your skill set play an equally valid role as your experience to your application. That is because recruiters are looking for both:

- hard skills or your aptitude in applying particular technologies

- soft skills or your ability to work in a team using your personal skills, e.g. leadership, time management, etc.

Are you wondering how you should include both hard and soft skills across your finance CV? Use the:

- skills section to list between ten and twelve technologies that are part of the job requirement (and that you're capable to use);

- strengths and achievements section to detail how you've used particular hard and soft skills that led to great results for you at work;

- summary or objective to spotlight up to three skills that are crucial for the role and how they've helped you optimise your work processes.

One final note - when writing about the skills you have, make sure to match them exactly as they are written in the job ad. Take this precautionary measure to ensure your CV passes the Applicant Tracker System (ATS) assessment.

Top skills for your finance CV:

Financial Analysis

Financial Reporting

Budgeting

Accounting

Corporate Finance

Financial Modelling

Risk Management

Tax Planning

Data Analysis

Strategic Planning

Analytical Thinking

Problem Solving

Attention to Detail

Leadership

Communication

Time Management

Adaptability

Teamwork

Initiative

Integrity

PRO TIP

If there's a noticeable gap in your skillset for the role you're applying for, mention any steps you're taking to acquire these skills, such as online courses or self-study.

Education and more professional qualifications to include in your finance CV

If you want to showcase to recruiters that you're further qualified for the role, ensure you've included your relevant university diplomas. Within your education section:

- Describe your degree with your university name(-s) and start-graduation dates;

- List any awards you've received, if you deem they would be impressive or are relevant to the industry;

- Include your projects and publications, if you need to further showcase how you've used your technical know-how;

- Avoid listing your A-level marks, as your potential employers care to learn more about your university background.

Apart from your higher education, ensure that you've curated your relevant certificates or courses by listing the:

- name of the certificate or course;

- name of the institution within which you received your training;

- the date(-s) when you obtained your accreditation.

In the next section, discover some of the most relevant certificates for your finance CV:

PRO TIP

Use mini case studies or success stories in your CV to demonstrate how your skills have positively impacted previous roles or projects.

Recommended reads:

Key takeaways

What matters most in your finance CV-writing process is for you to create a personalised application. One that matches the role and also showcases your unique qualities and talents.

- Use the format to supplement the actual content, to stand out, and to ensure your CV experience is easy to comprehend and follows a logic;

- Invest time in building a succinct CV top one third. One that includes a header (with your contact details and headline), a summary or an objective statement (select the one that best fits your experience), and - potentially - a dedicated skills section or achievements (to fit both hard skills and soft skills requirements);

- Prioritise your most relevant (and senior) experience closer to the top of your CV. Always ensure you're following the "power verb, skill, and achievement" format for your bullets;

- Integrate both your technical and communication background across different sections of your CV to meet the job requirements;

- List your relevant education and certificates to fill in gaps in your CV history and prove to recrutiers you have relevant technical know-how.