Navigating through countless invoices to ensure accurate data entry and timely payments is a complex computer vision challenge in your Accounts Payable process. Our comprehensive guide offers practical solutions, leveraging cutting-edge CV technologies that streamline your invoice management and bolster your financial workflow.

- Applying the simplest CV design, so that recruiters can easily understand your expertise, skills, and professional background;

- Ensuring you stand out with your header, summary or objective statement, and a designated skills section;

- Creating your CV experience section - no matter how much expertise you have;

- Using real life professional CV examples to enhance the structure and outline of your profile.

If you still have no muse to write your professional CV, find some more industry-leading examples.

CV examples for accounts payable

By Experience

Junior Accounts Payable Specialist

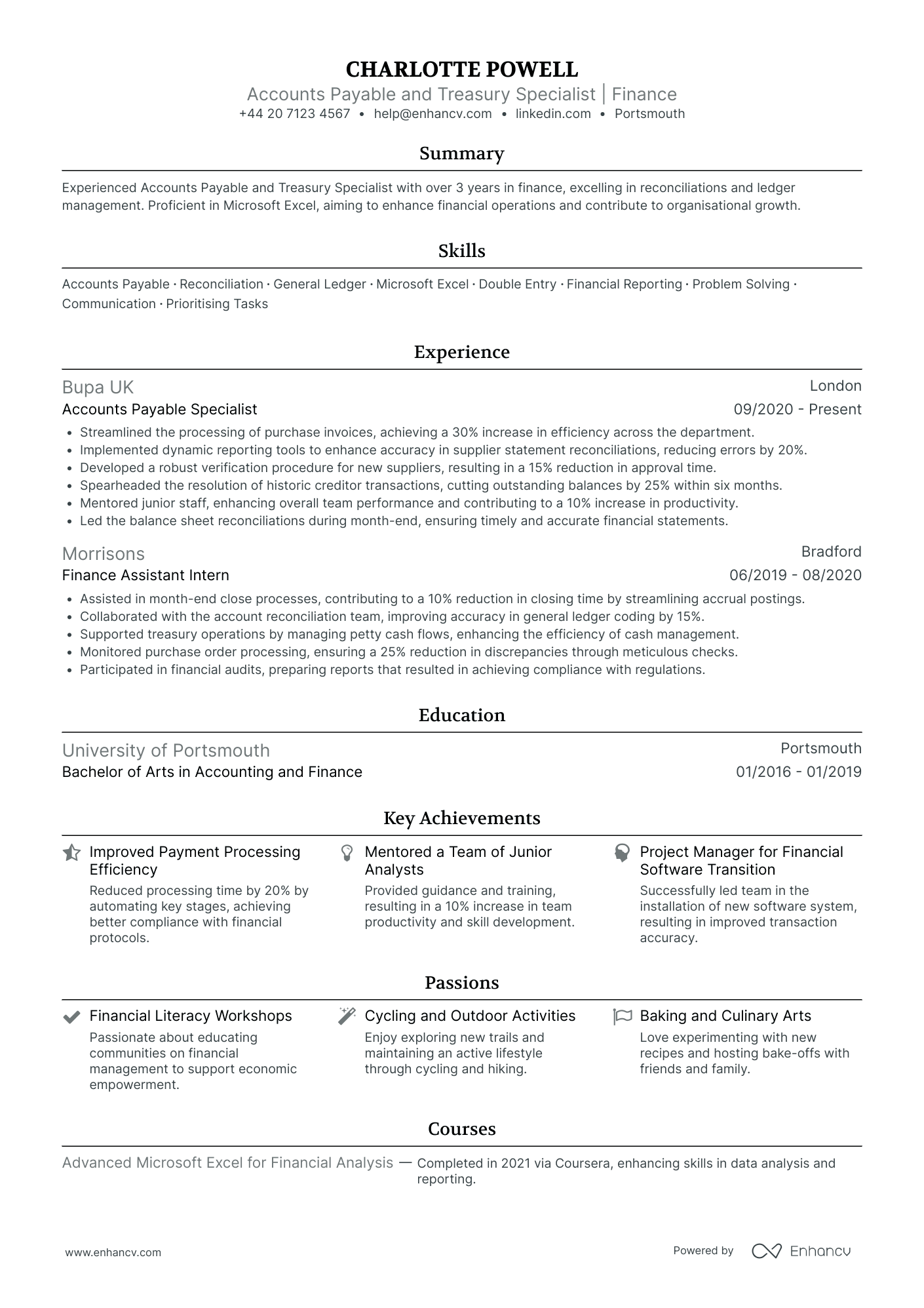

- Depth in Accounts Payable Expertise - Charlotte Powell's CV highlights her proficiency in accounts payable through documented achievements such as streamlining invoice processing and implementing supplier verification processes. These tasks not only demonstrate technical competence but underline her capability to enhance financial operations by reducing errors and processing time.

- Structured Career Development - The career trajectory from a Finance Assistant Intern to an Accounts Payable Specialist shows significant progress in the finance industry, reflecting her growing responsibility and expertise. Such advancement is indicative of her commitment to honing her skills and taking on more complex roles, which is crucial for any finance-oriented position.

- Comprehensive Range of Skills and Leadership - In addition to technical expertise, this CV showcases soft skills such as problem-solving, communication, and team mentorship. By highlighting leadership achievements, such as mentoring junior staff and managing a team during financial software transitions, it further establishes her ability to guide and improve team performance, essential for an accounts payable role that may involve overseeing others.

Senior Accounts Payable Analyst

- Clear and Structured Presentation - The CV is well-organized with clearly defined sections for experience, education, achievements, and skills. This structured approach ensures easy navigation through Edward's professional timeline and qualifications, making it convenient for recruiters to identify his suitability for the Accounts Payable Analyst role.

- Consistent Career Growth and Industry Engagement - Edward's career trajectory displays a clear progression from an Accounting Assistant to an Accounts Payable Analyst, showcasing his commitment to advancing within the finance sector. His experience across renowned companies like PwC, HSBC, and Barclays indicates a robust understanding of different financial settings and expectations.

- Emphasis on Achievements with Business Impact - The CV impressively highlights Edward's concrete achievements, such as implementing a Procure to Pay system that reduced invoice processing time by 30% and saved £50,000 annually by improving cost management. These not only showcase his capability of driving business efficiencies but also underscore his value in financial operations.

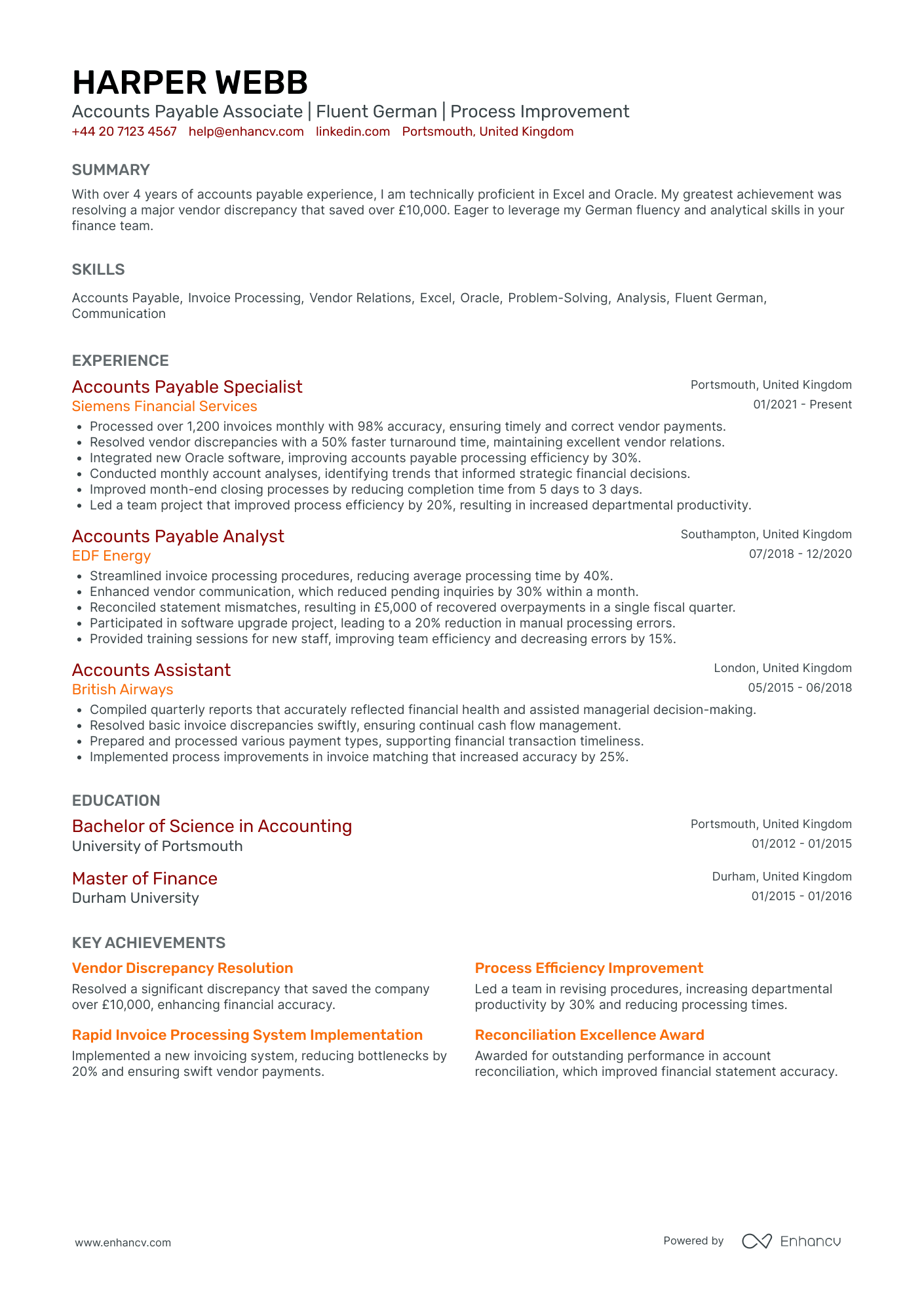

Entry Level Accounts Payable Associate

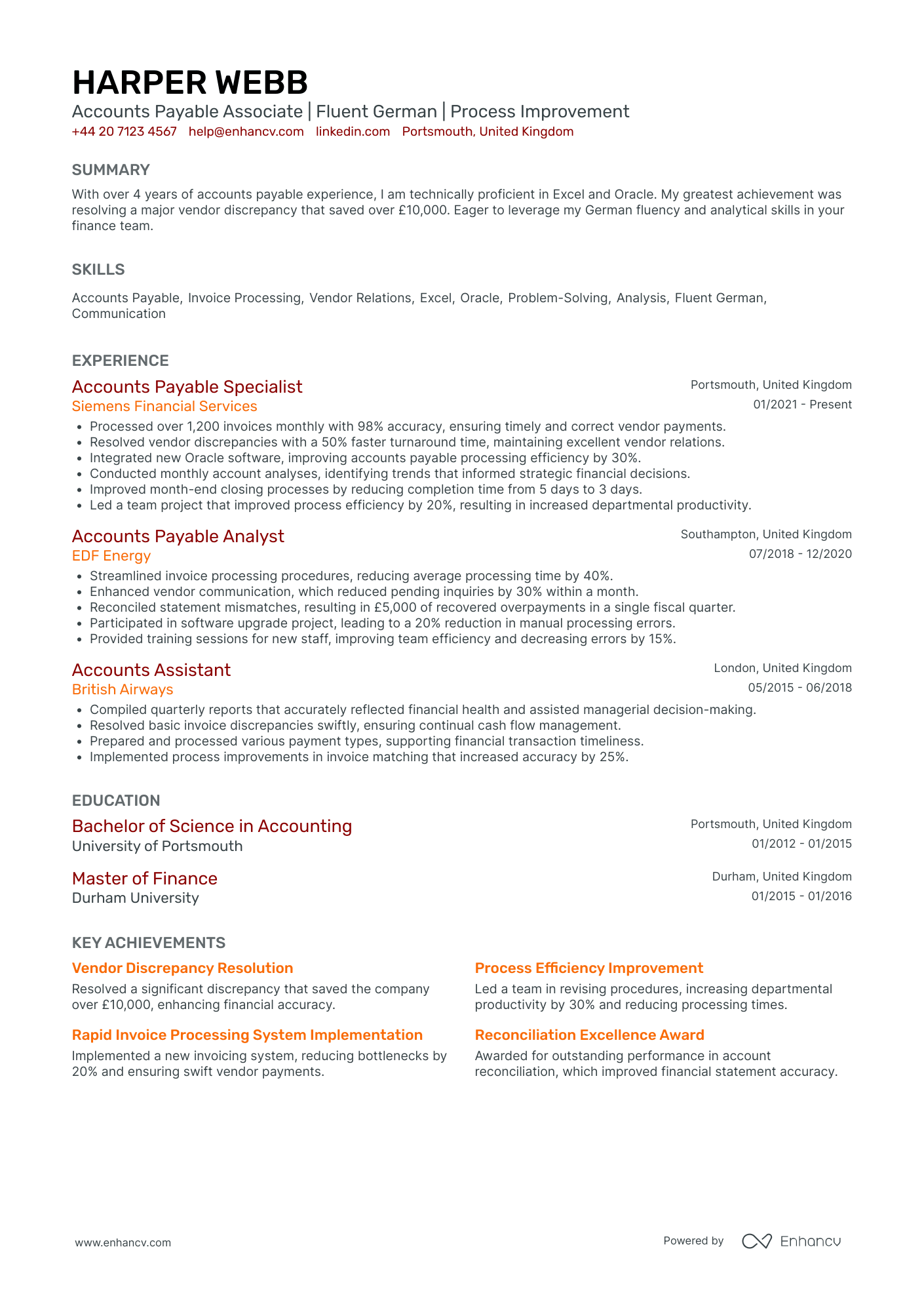

- Effective Content Presentation - The CV is well-structured, providing a clear and concise overview of Harper’s skills and experiences. Each section is meticulously organized with bullet points that aid in quick reading and comprehension. This clarity showcases Harper’s analytical skills and attention to detail, essential for an Accounts Payable Associate role.

- Impressive Career Trajectory - Harper’s career progression is notable, moving from an Accounts Assistant to an Accounts Payable Specialist with increased responsibilities at each stage. This growth trajectory, demonstrated by leadership in process improvement and efficiency, aligns perfectly with ambitions of advancement in the finance industry.

- Industry-Relevant Skills and Tools - Harper’s proficiency with specific tools like Excel and Oracle is well-documented, emphasizing the technical depth required in accounts payable functions. Additionally, their fluency in German and experience with financial software integration highlights their capability to manage complex tasks and communicate effectively in multinational environments.

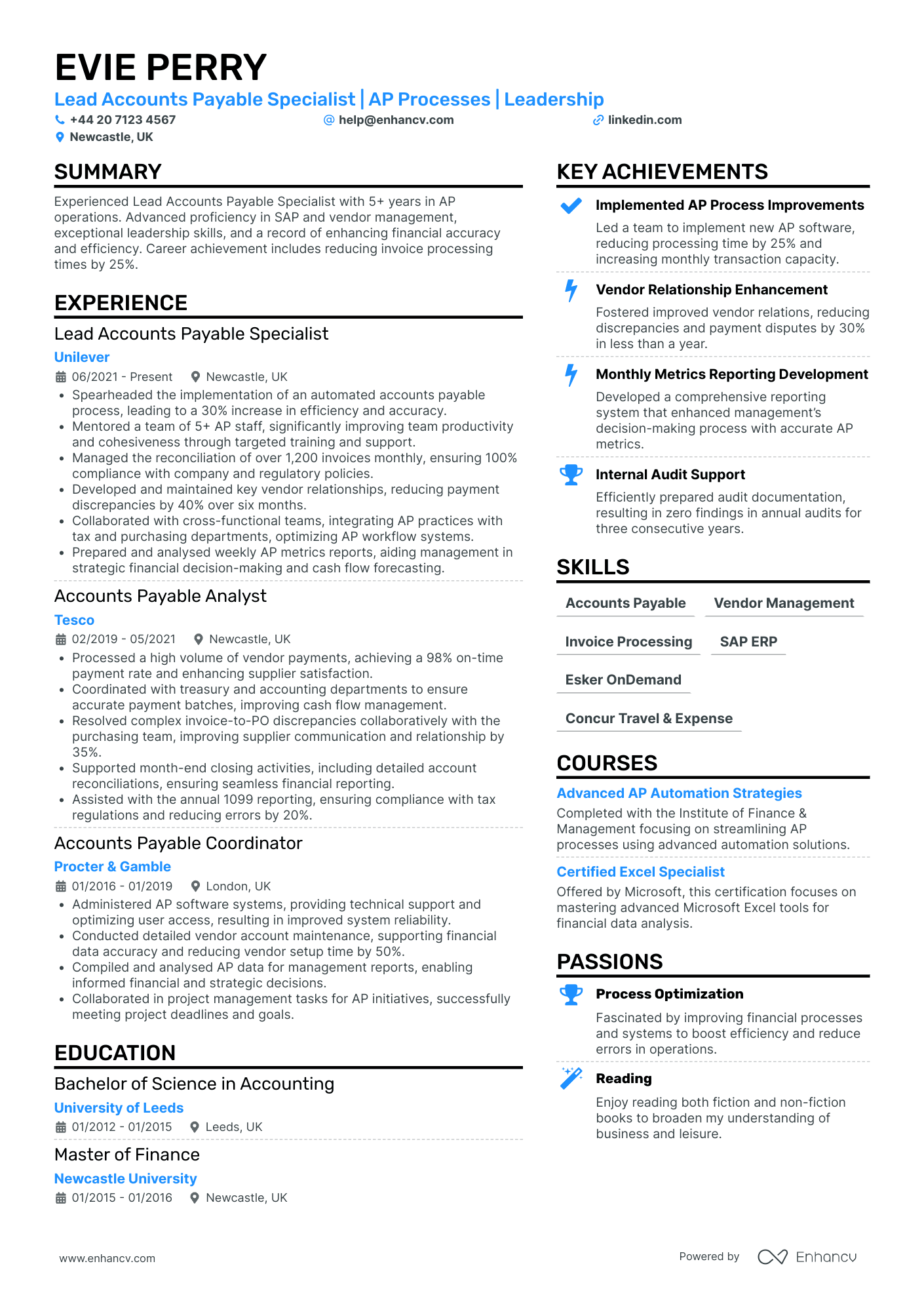

Mid-Level Accounts Payable Consultant

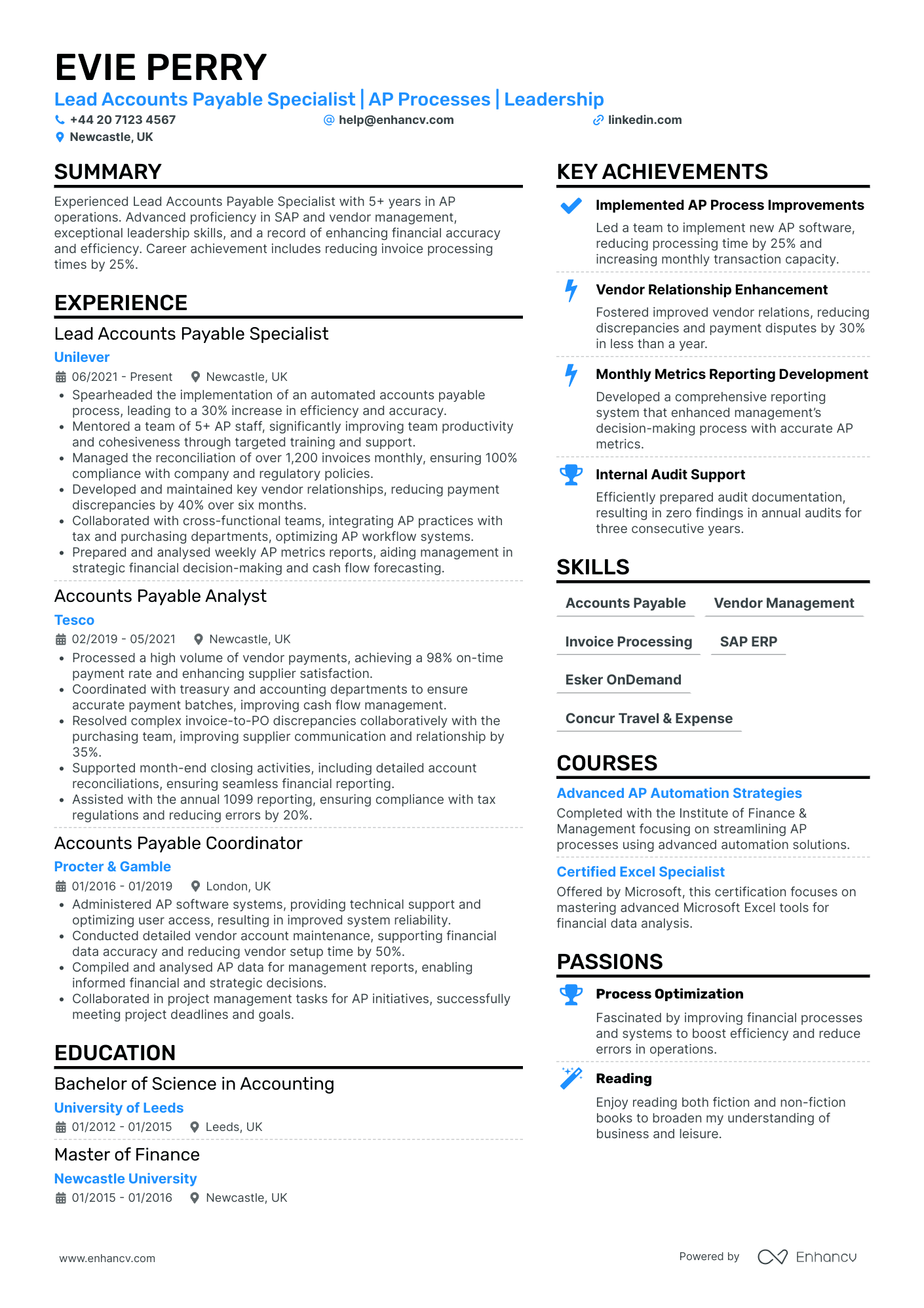

- Comprehensive Experience and Career Progression - Evie's CV illustrates a clear and progressive career trajectory in the accounts payable domain, advancing from an Accounts Payable Coordinator to a Lead Accounts Payable Specialist at renowned companies like Unilever and Tesco. This growth reflects not only her expanding expertise but also her increasing responsibility and contributions to her teams and organizations.

- Emphasis on Leadership and Team Development - Evie showcases her leadership abilities by mentoring a team of over five AP staff members, driving improvements in team productivity and cohesiveness. Her efforts in team training and support highlight her capacity to lead and develop effective teams, which is crucial for a leadership role like Lead Accounts Payable Specialist.

- Technical Proficiency and Industry-Specific Tools - The CV details Evie's advanced proficiency in critical industry tools such as SAP ERP, Esker OnDemand, and Concur Travel & Expense, underscoring her technical depth and capability to implement impactful AP process improvements. Her certification in advanced Microsoft Excel further emphasizes her technical expertise and readiness to handle complex financial data analysis.

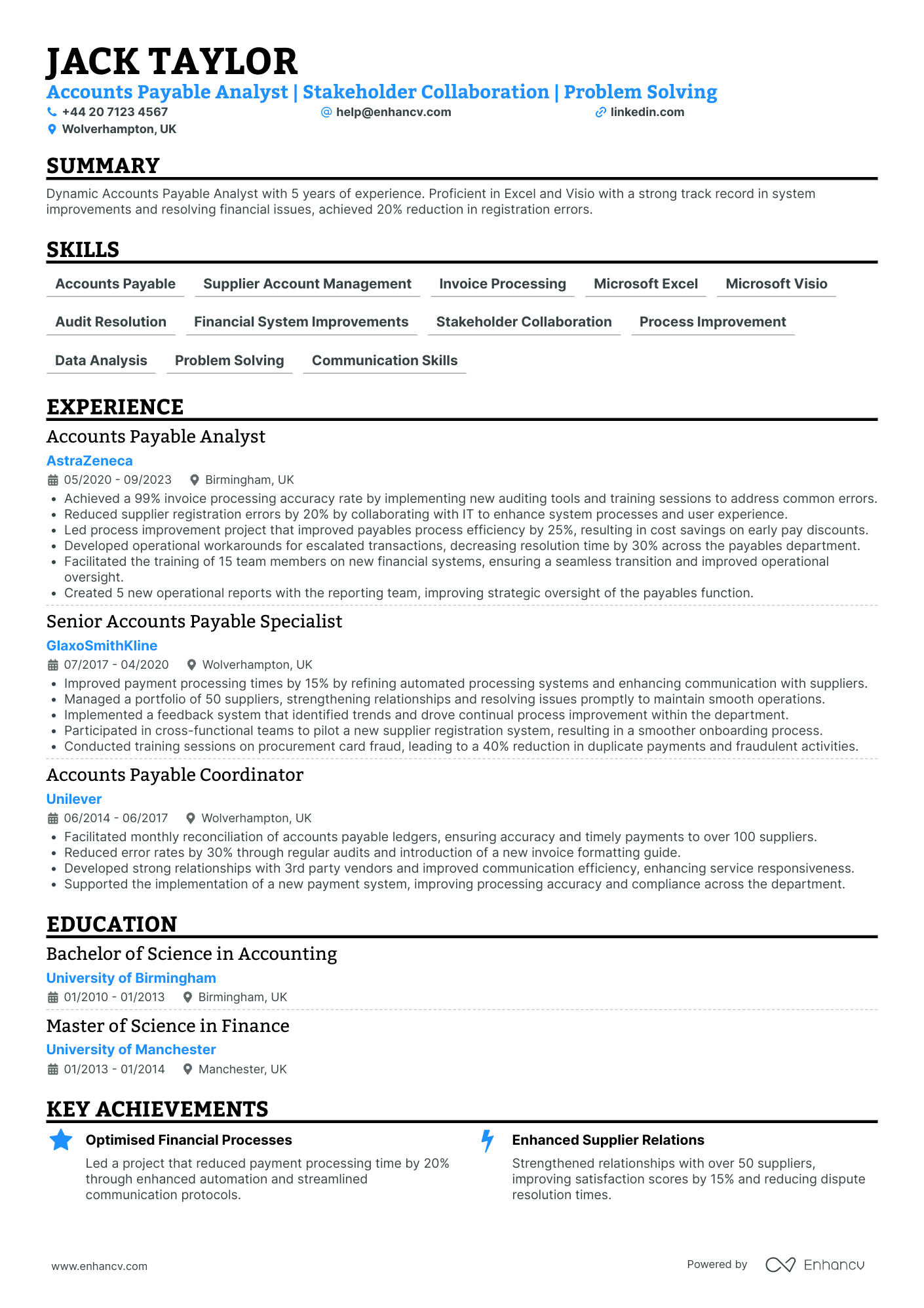

Advanced Accounts Payable Practitioner

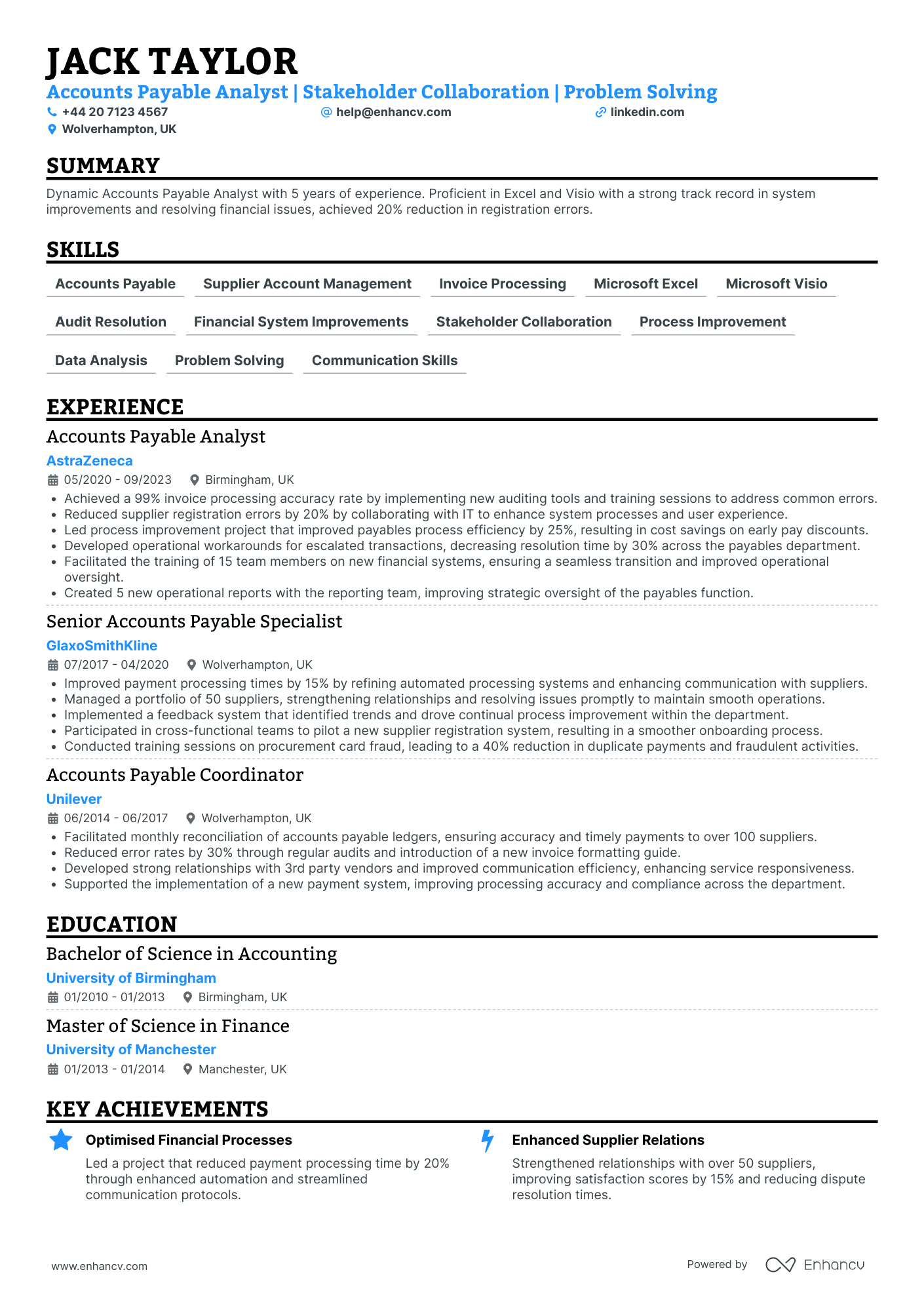

- Effective Content Presentation - The CV is organized with clarity and structure, making it easy to follow Jack Taylor’s career path. Each section is concise and details are neatly sectioned, enhancing readability while emphasizing relevant career highlights.

- Clear Career Trajectory - This CV demonstrates solid growth, showcasing a progression from Accounts Payable Coordinator to Analyst roles with increasing responsibilities and accomplishments at globally recognized firms such as AstraZeneca and GlaxoSmithKline.

- Technical Proficiency and Tools - A standout feature is Jack’s proficiency in industry-specific tools like Excel and Visio, alongside a history of leading financial system improvements. This exhibits technical depth, critical for roles focused on process optimization and error reduction.

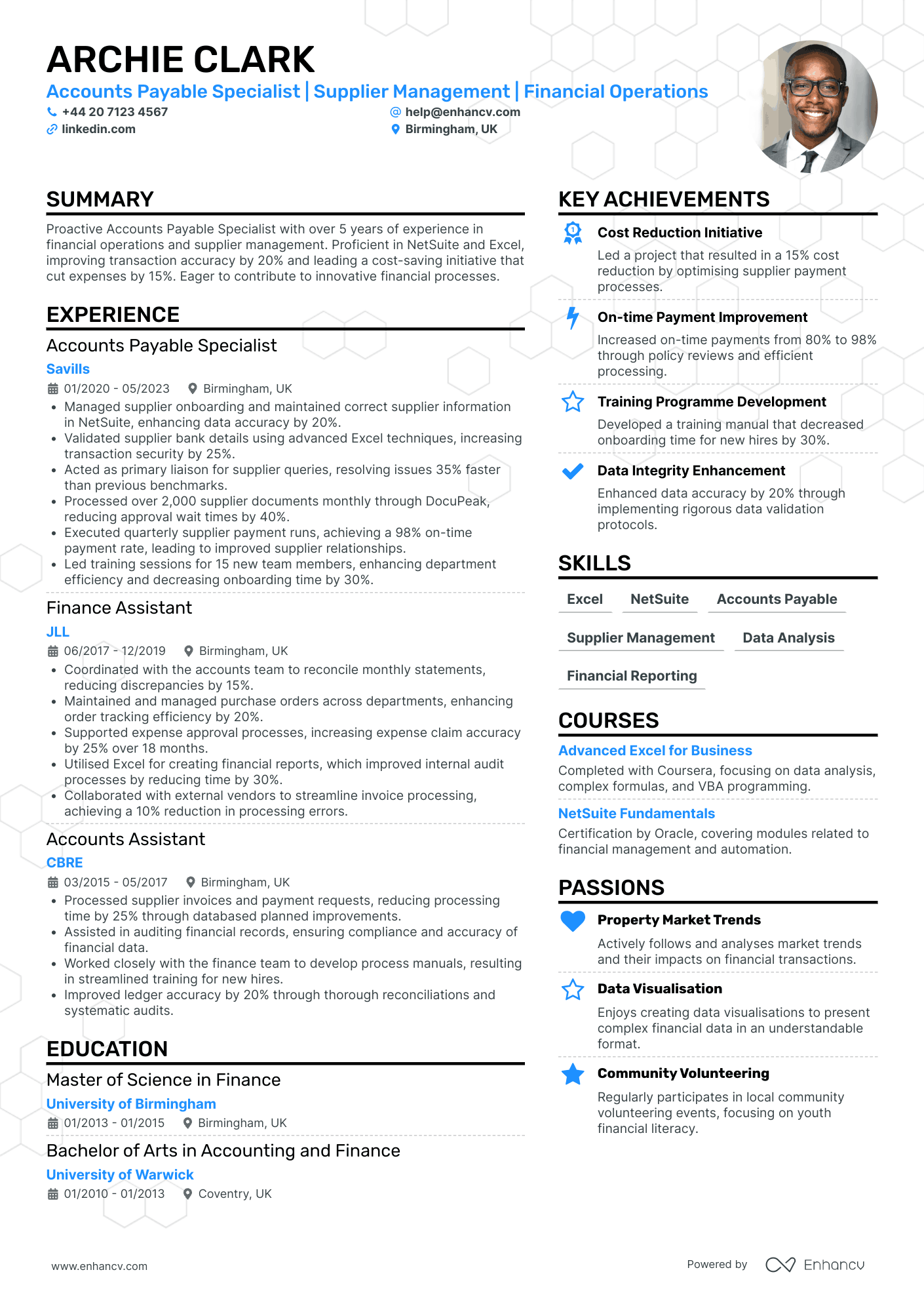

By Role

Accounts Payable Clerk

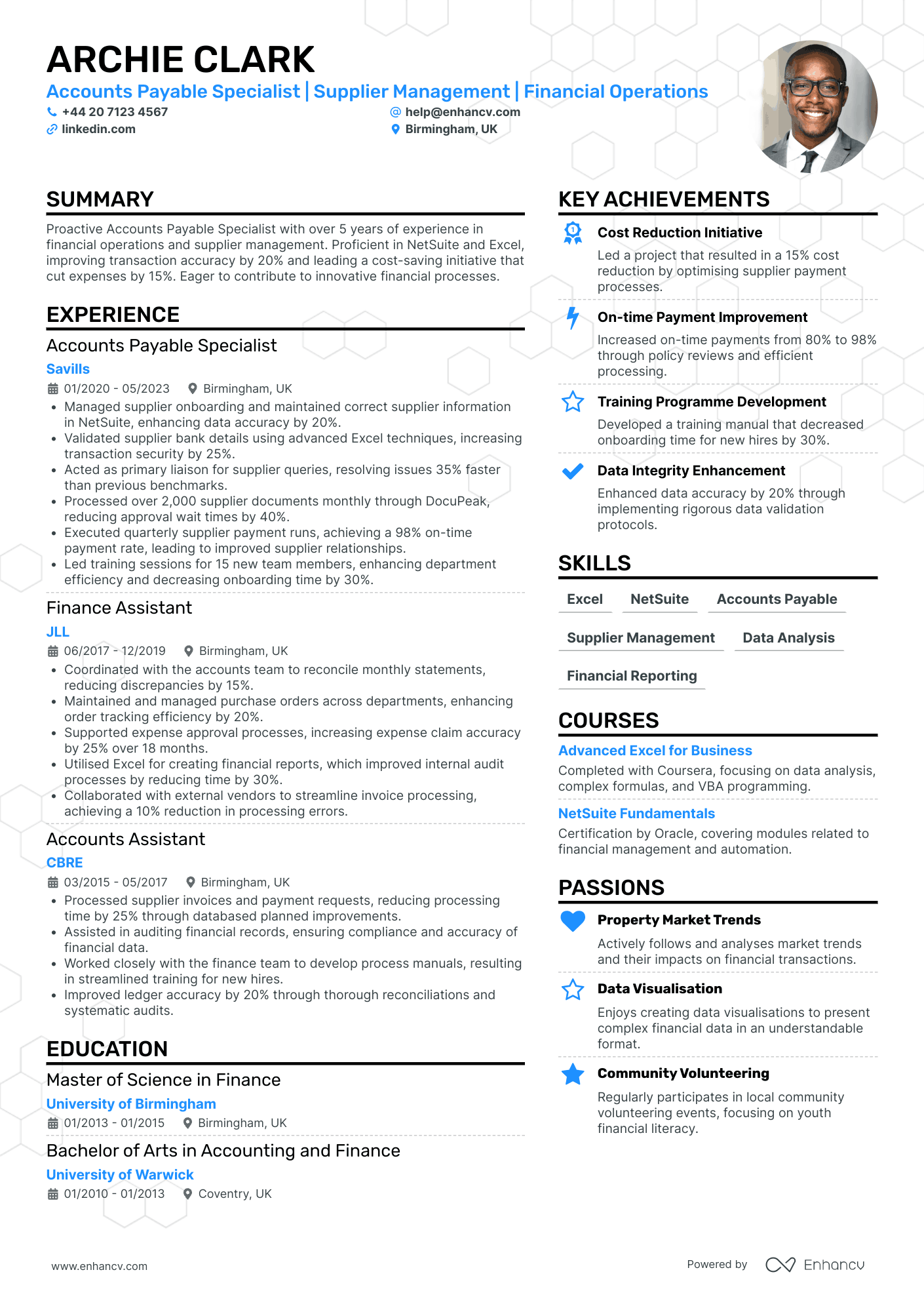

- Effective Content Presentation - Archie’s CV is meticulously structured, presenting information clearly and concisely. Sections are well-organized, with bullet points succinctly summarizing key achievements and responsibilities, making it easy for recruiters to quickly grasp essential details without sifting through unnecessary text.

- Progressive Career Development - The career trajectory detailed in the CV highlights a steady progression through roles in financial operations, showcasing growth in responsibility and expertise. Each role adds a layer of complexity, from Accounts Assistant to Accounts Payable Specialist, reflecting an upward movement within the industry without unnecessary role shifts.

- Technological Proficiency and Industry Tools - Archie’s aptitude for using industry-specific tools like NetSuite and advanced Excel techniques uniquely positions him in the financial operations field. His technical depth in audit support and transaction security, coupled with certifications in advanced Excel and NetSuite, highlights his expertise and commitment to staying current with industry standards.

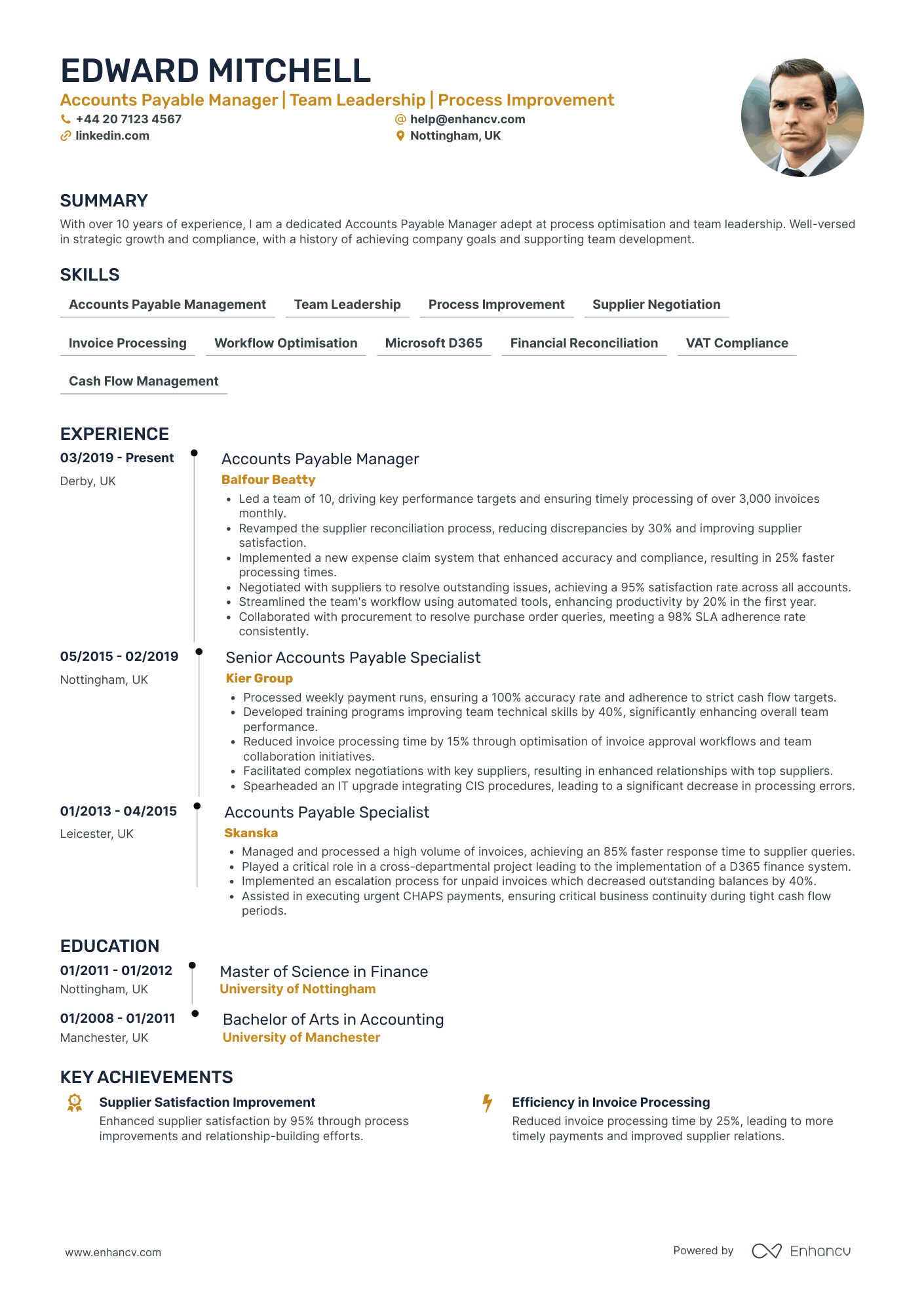

Accounts Payable Manager

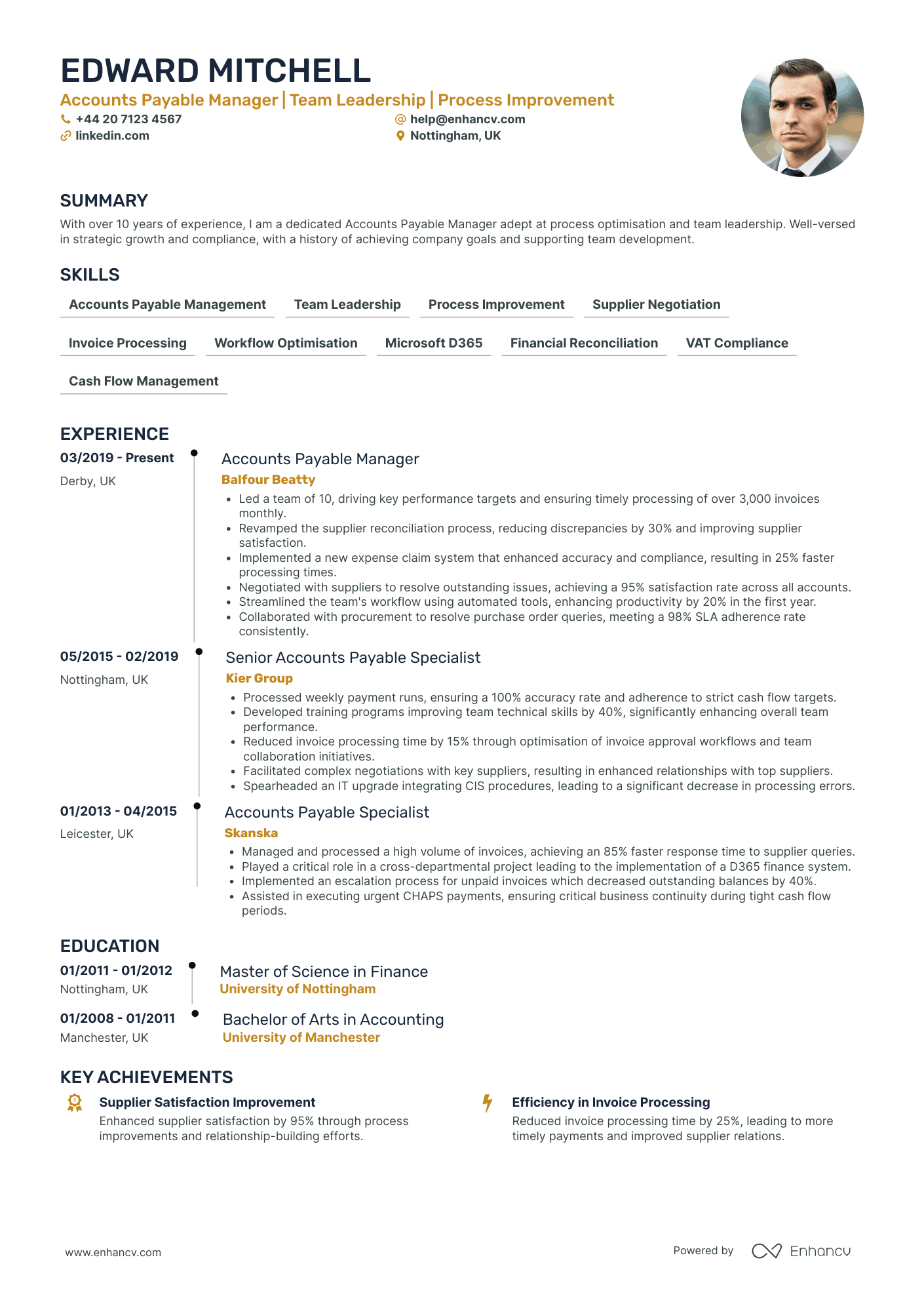

- Structured and Clear Presentation - The CV is well-structured, presenting information in a concise manner that enhances its readability. Each section is clearly delineated, using bullet points to effectively summarize key responsibilities and achievements, making it easy for hiring managers to assess the candidate's qualifications quickly.

- Clear Evidence of Career Progression - Edward's career trajectory shows a natural progression from Accounts Payable Specialist to Manager, highlighting consistent growth and advancement within the field. His upward movement is supported by roles at reputable companies, showing his ability to excel and take on more leadership responsibilities over time.

- Emphasis on Process Improvement - The CV underscores the candidate’s focus on process optimization, a critical factor in accounts payable roles. Achievements in revamping supplier reconciliation processes and implementing new systems reveal Edward's ability to leverage industry-standard tools and methodologies to drive efficiency and improve business operations.

Accounts Payable Coordinator in Manufacturing

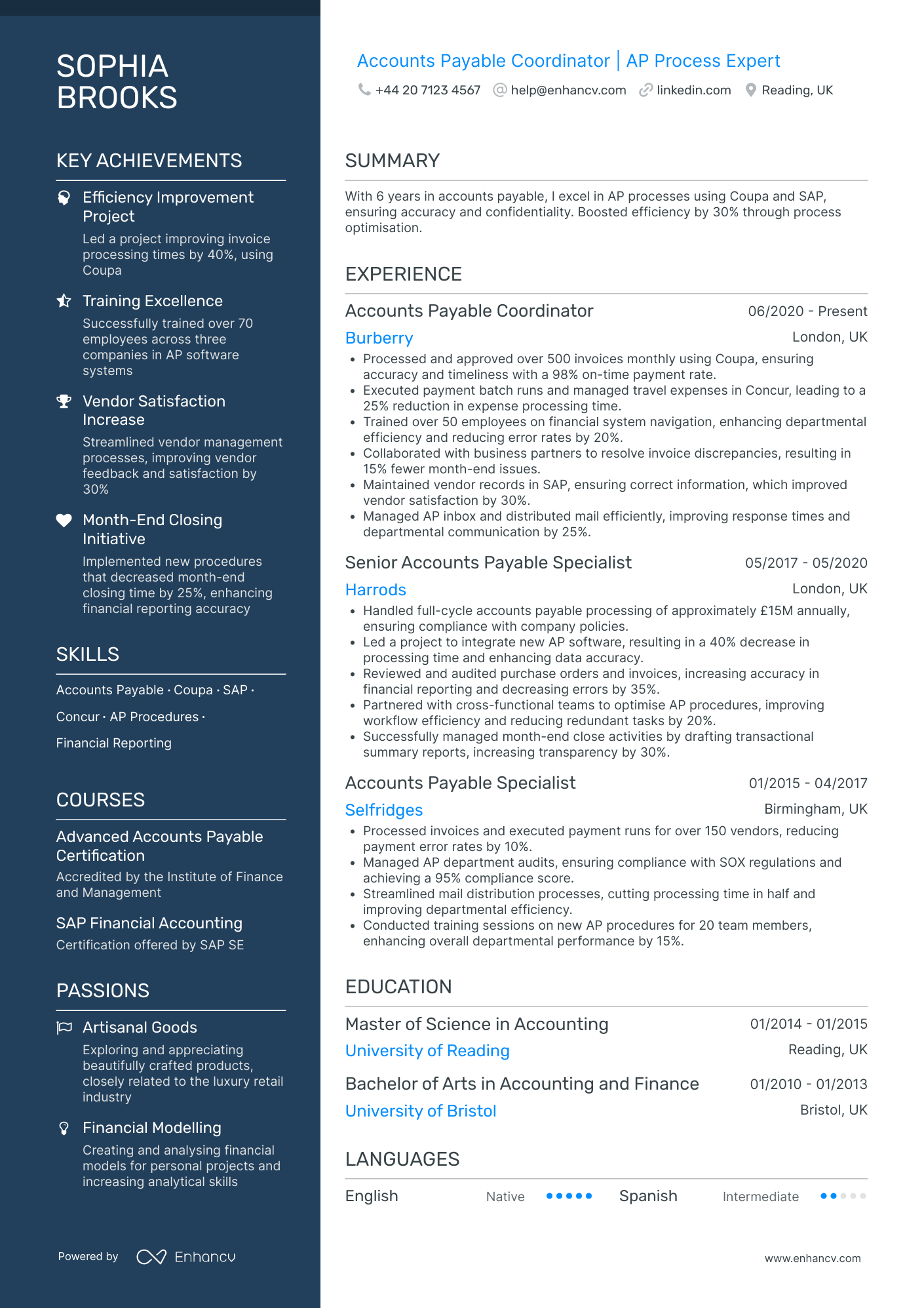

- Concise and Structured Presentation - The CV is organized in a clear and concise manner, with each section crisply detailing relevant information. Bullet points are used effectively to present achievements and responsibilities, making the content easy to digest and ensuring that key accomplishments stand out for the reader.

- Consistent Career Growth - Sophia Brooks demonstrates a clear upward trajectory in her career, starting as an Accounts Payable Specialist and progressing to a Senior position before eventually becoming an Accounts Payable Coordinator. This progression highlights her ability to not only master her current roles but also gain the trust and recognition needed for advancement within top companies.

- Technical Proficiency in Leading Tools - The CV clearly outlines Sophia's expertise with industry-specific tools like Coupa, SAP, and Concur, showcasing her technical depth in accounts payable systems. Her initiatives in software integration and optimization further underscore her ability to leverage technology to drive operational efficiency and accuracy in AP processes.

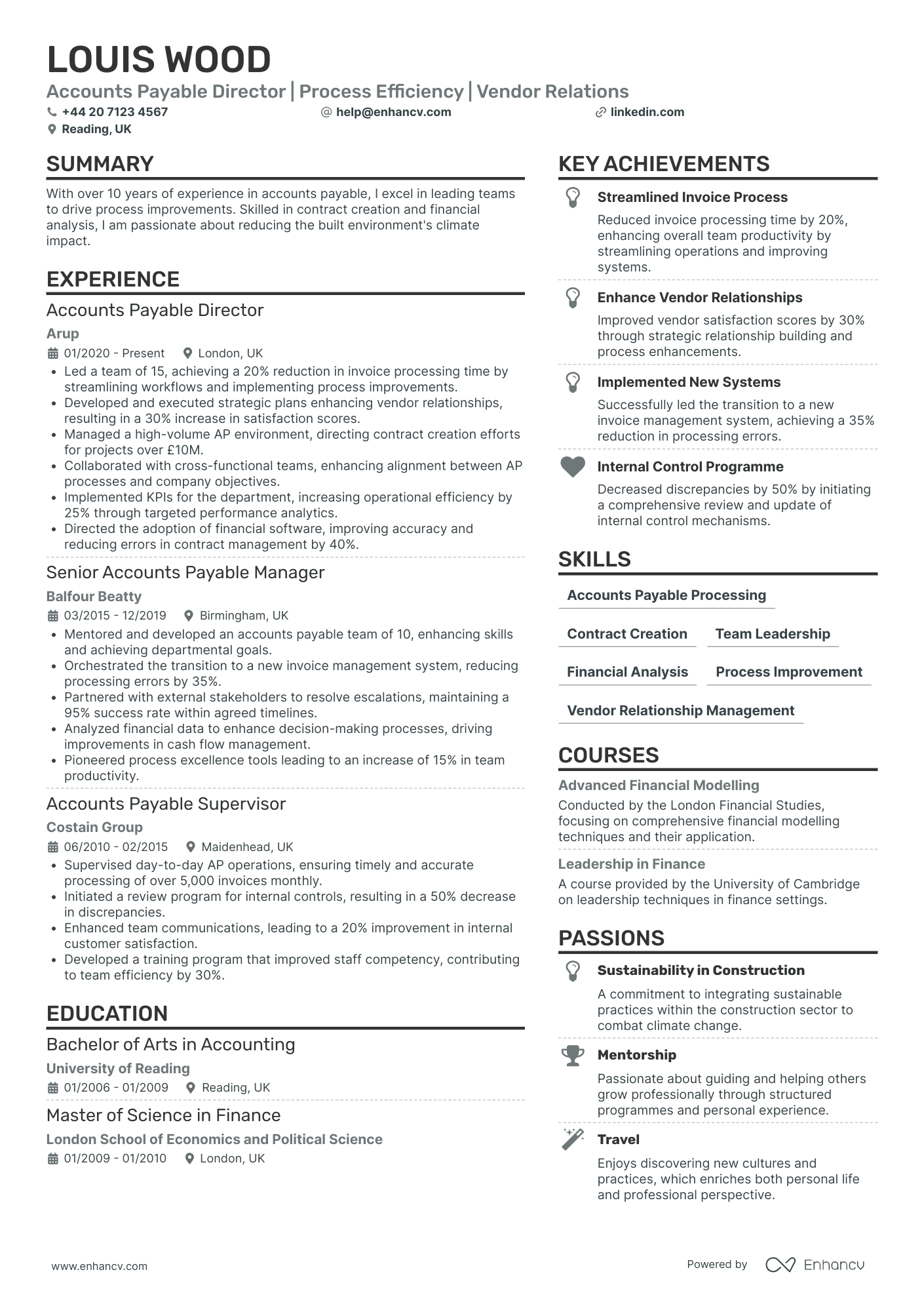

Accounts Payable Director

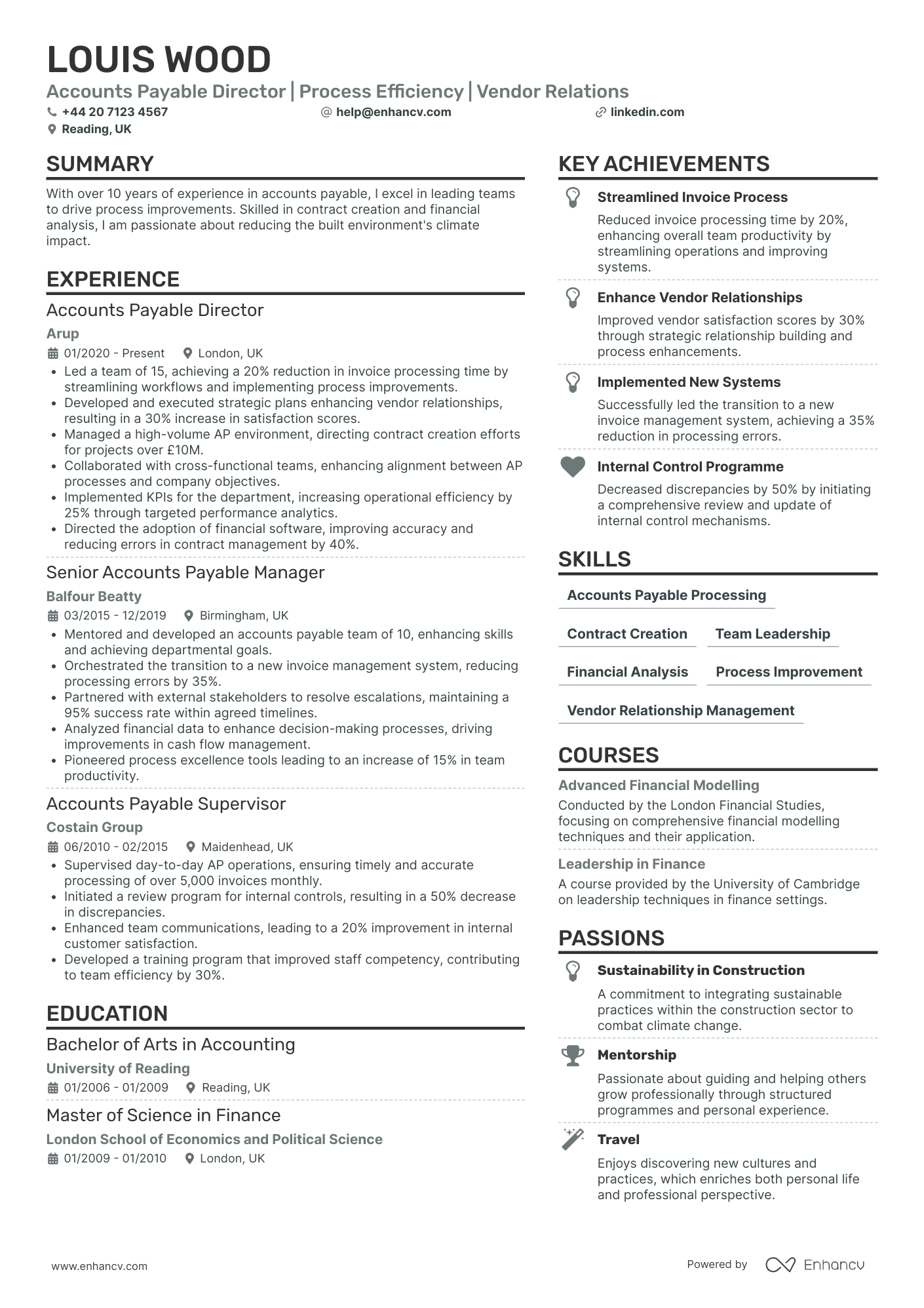

- Strategic Career Growth - Louis Wood's CV showcases a clear upward trajectory in the field of accounts payable, moving from a supervisor role to director, highlighting strategic advancements and increased responsibilities. This demonstrates his ability to consistently grow within the industry, enhancing operational capabilities at each step.

- Cross-functional Collaboration - The CV reflects Louis's ability to collaborate effectively with cross-functional teams, aligning AP processes with broader company objectives. His capacity to integrate various departmental goals indicates strong adaptability and strategic alignment with organizational visions.

- Impactful Leadership and Transformation - Throughout his roles, Louis has implemented significant process improvements and strategic changes, such as reducing invoice processing times and enhancing vendor relationships. These changes have not only improved efficiency but also had a considerable positive impact on business relations and overall operational success.

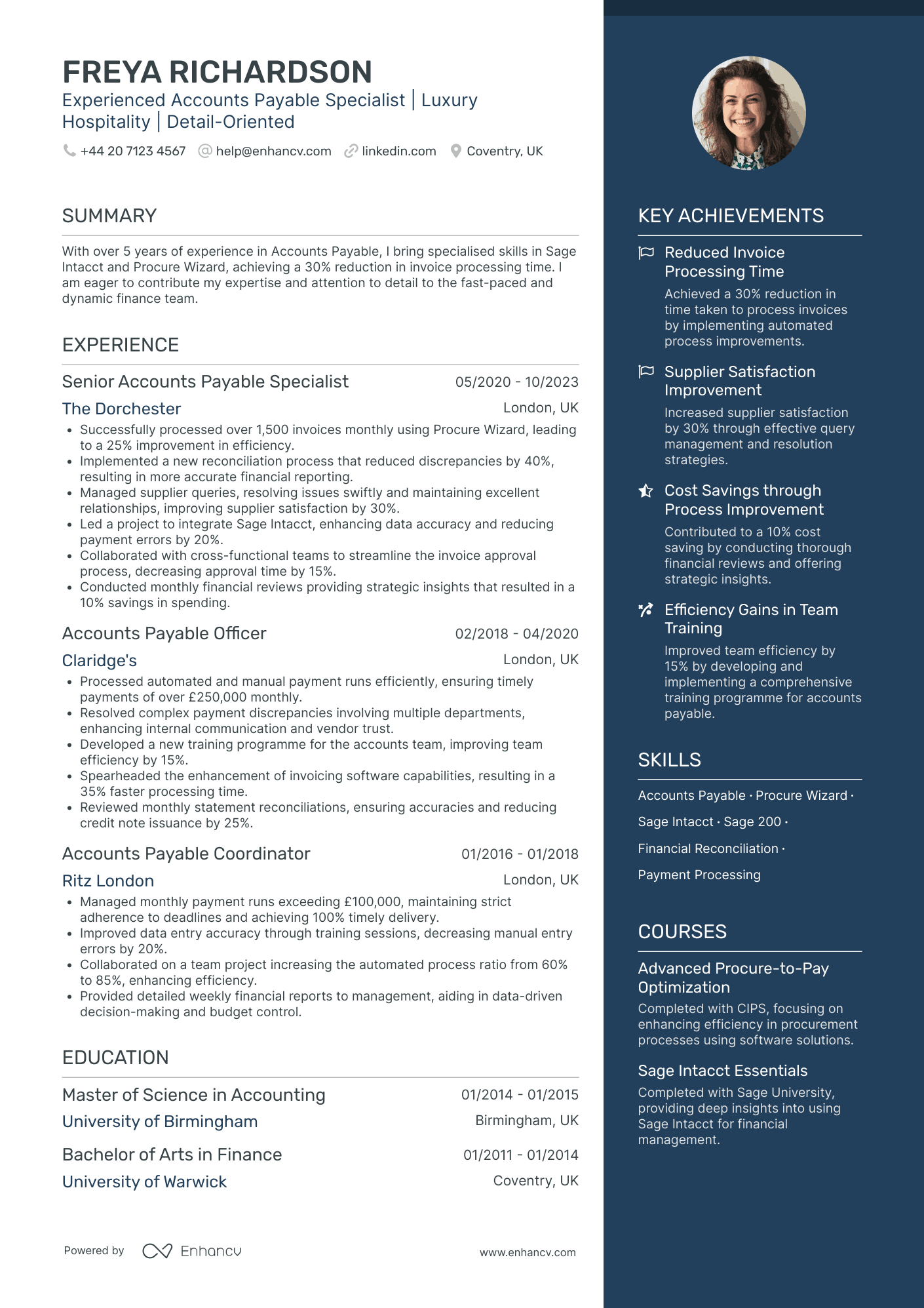

Accounts Payable Supervisor in Retail

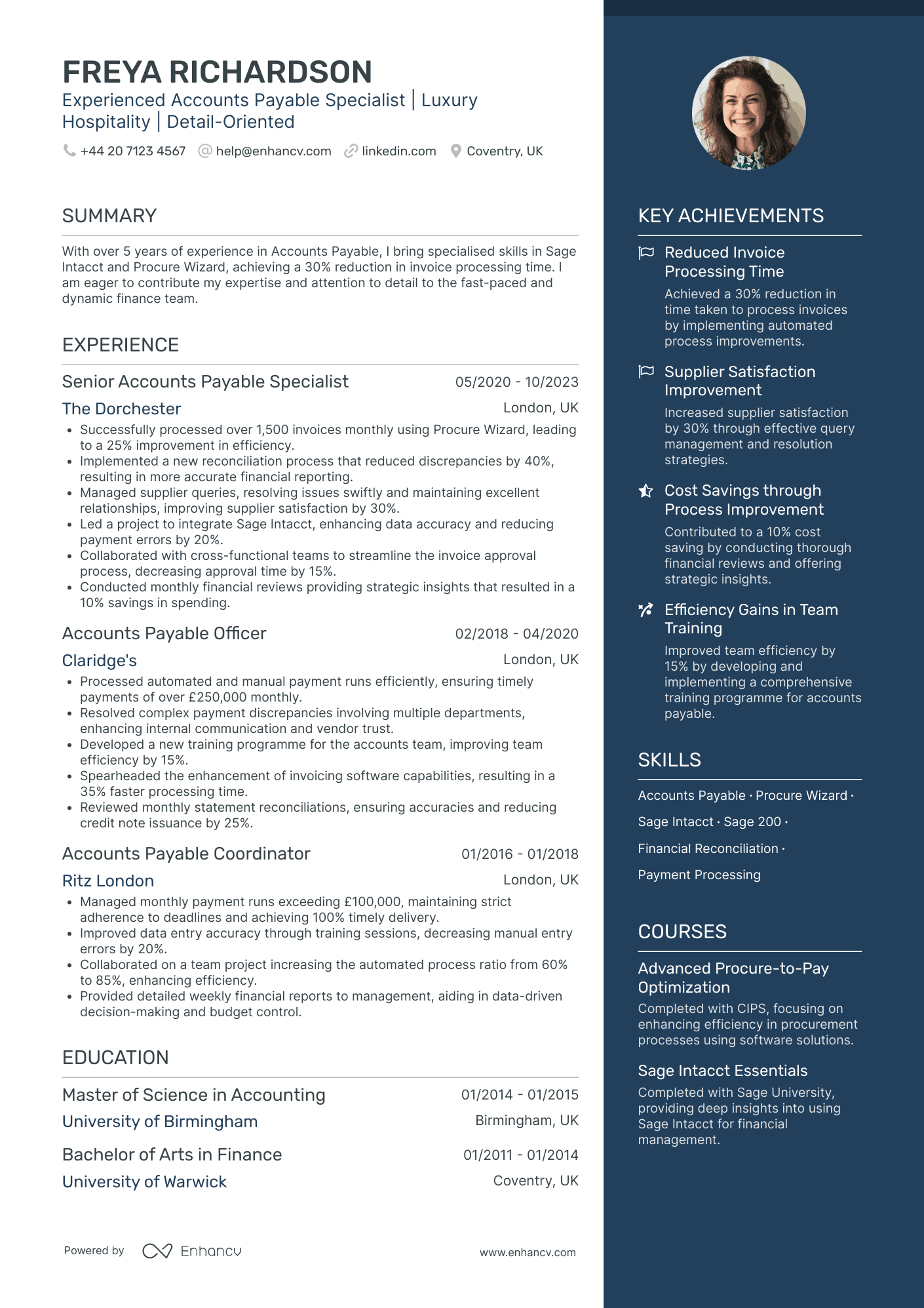

- Structured and Concise Presentation - The CV is well-organized, featuring clear sections that make it easy to navigate through Freya Richardson's professional profile. The use of bullet points and concise language enhances readability and conveys significant information efficiently, ensuring nothing essential is overlooked.

- Progressive Career Trajectory in Luxury Hospitality - Freya's career path demonstrates clear growth within the luxury hospitality sector, advancing from an Accounts Payable Coordinator to a Senior Specialist position at prestigious establishments like Ritz London and The Dorchester. This trajectory reflects her expanding expertise and increased responsibility over time.

- Advanced Industry-Specific Tools and Methodologies - The CV reveals Freya's specialized technical proficiency with tools such as Sage Intacct and Procure Wizard, central to luxury hospitality finance management. Her implementation of these tools shows a deep understanding of leveraging technology for financial process optimization, underscoring her value in the field.

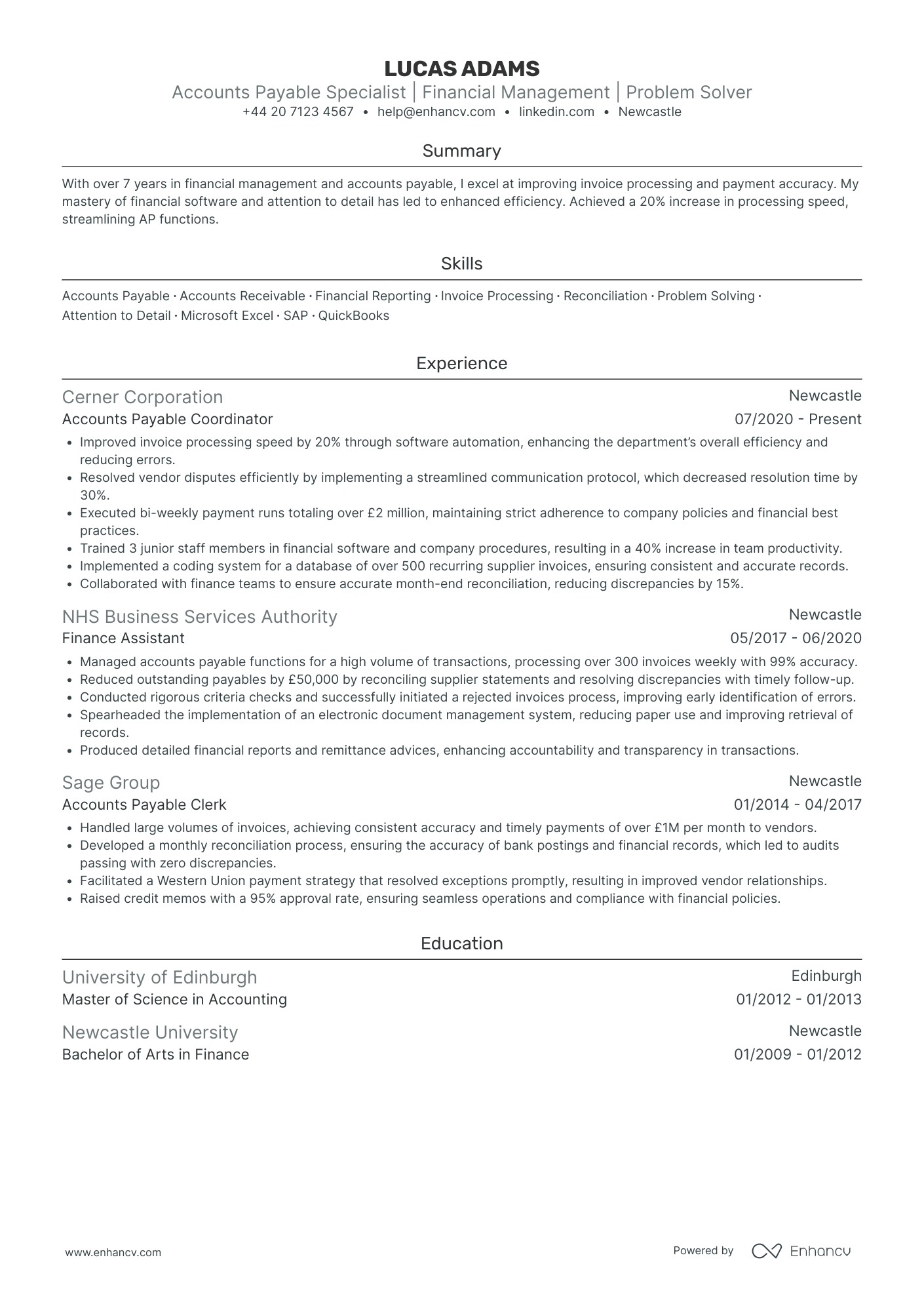

Accounts Payable Administrator in Healthcare

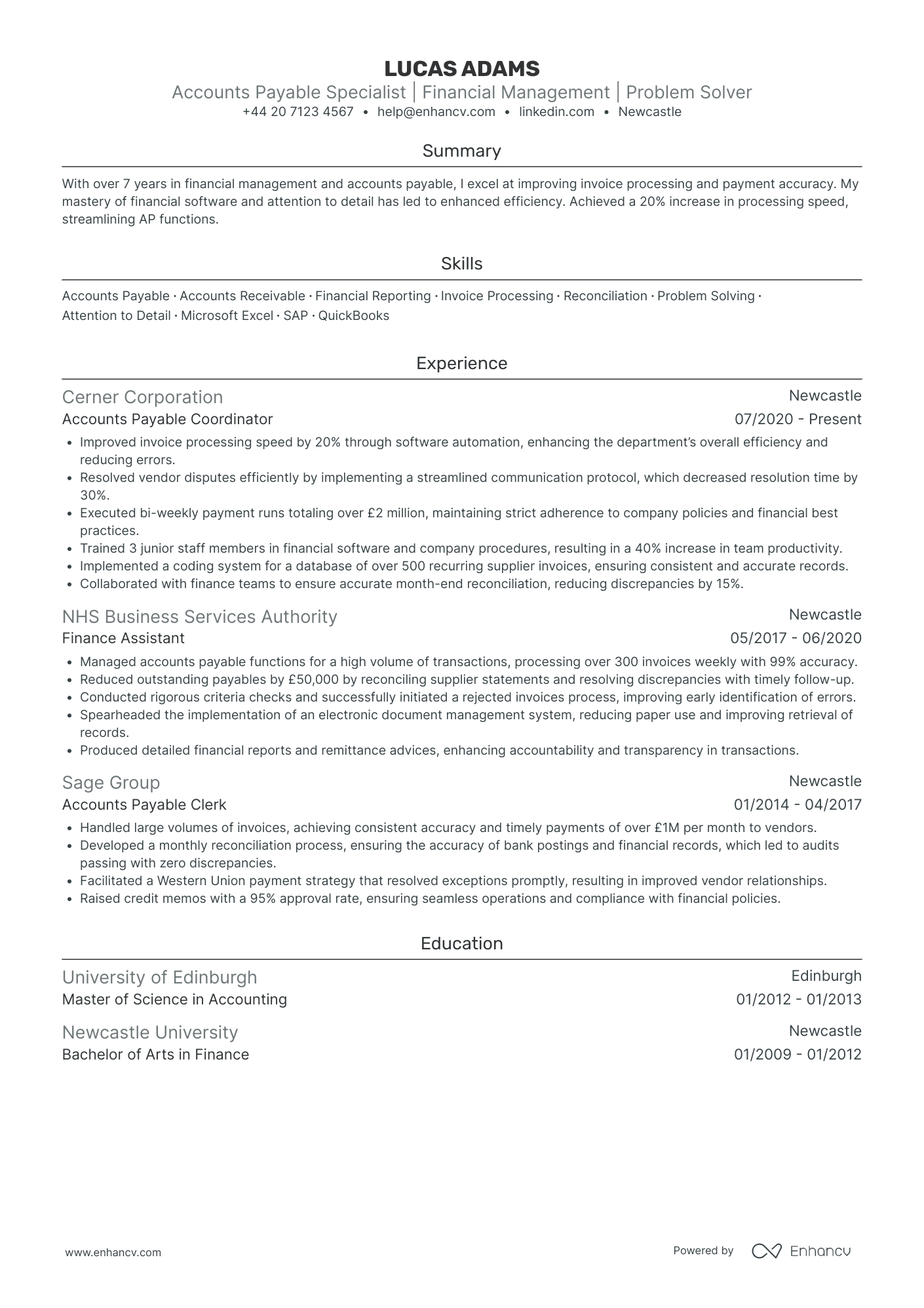

- Comprehensive Career Progression - Lucas Adams’ CV outlines a steady career trajectory within the financial management sector. Over the years, he ascended from an Accounts Payable Clerk to an Accounts Payable Coordinator, demonstrating growth in responsibility and expertise. This well-documented advancement reflects his ability to adapt and excel in increasingly complex roles, particularly in reputed organizations like Cerner Corporation and the NHS Business Services Authority.

- Technical Proficiency and Industry Tools - The CV highlights Lucas’s familiarity with critical industry tools, such as Microsoft Excel, SAP, and QuickBooks, which are essential for financial analysis and invoice processing. His completion of advanced courses like "Advanced Excel for Finance" further emphasizes his technical depth, ensuring he is well-equipped to handle accounting software and financial reporting tasks efficiently.

- Achievements with Strategic Impact - Lucas’s achievements are not just about numbers but signify strategic improvements within his roles. For example, achieving a 20% increase in processing speed through software automation signifies a direct positive impact on operational efficiency. Similarly, implementing a new ERP system with a 96% accuracy rate in invoice processing is a testament to his ability to lead significant projects with precision and positive business outcomes.

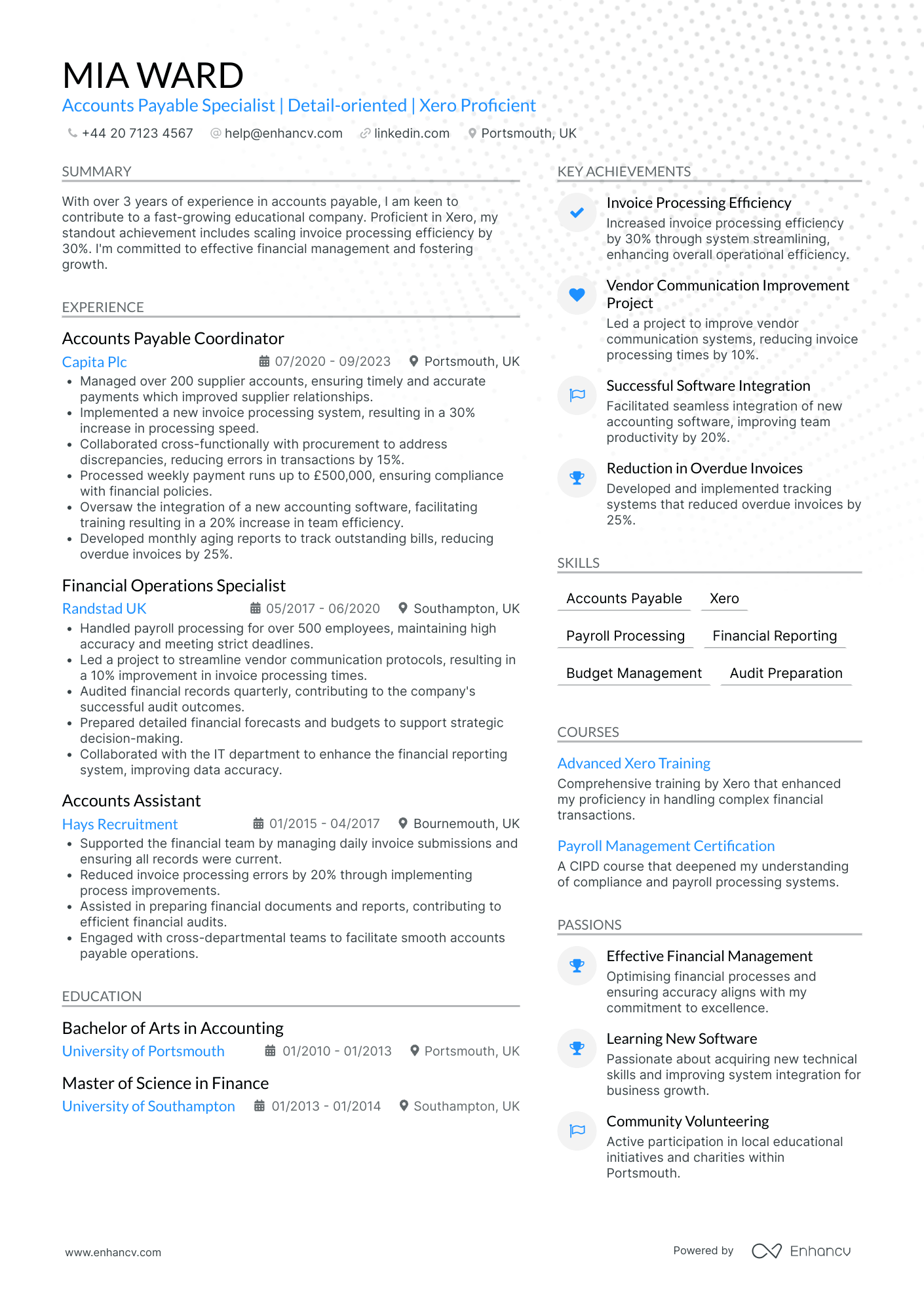

Accounts Payable Officer in Education

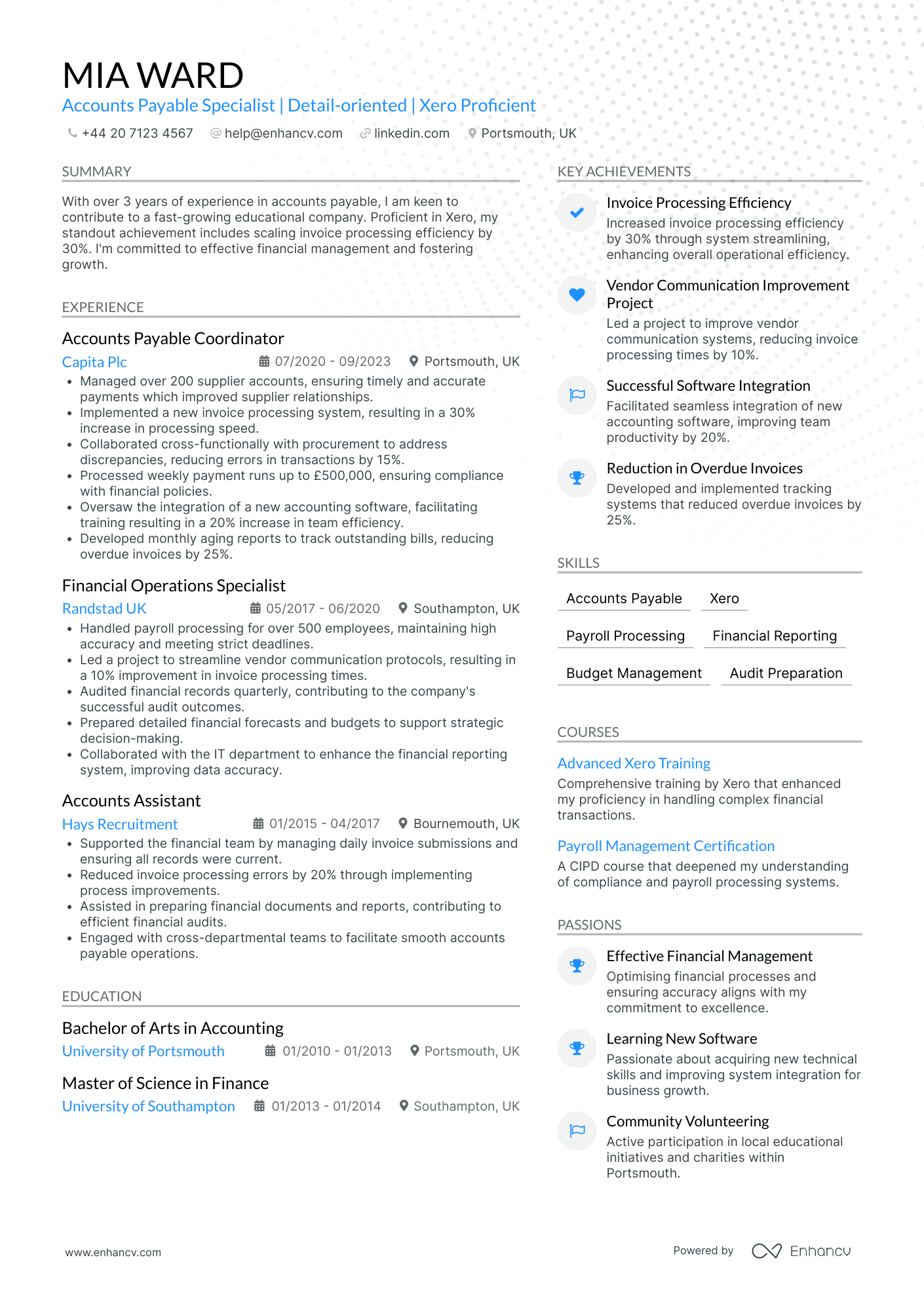

- Structured and Clear Content Presentation - The CV is meticulously organized into sections such as experience, education, skills, and achievements, which makes it easy to read and follow. Each section is concise yet informative, ensuring the reader can quickly grasp key information. The use of bullet points in the experience section highlights key achievements and responsibilities efficiently.

- Demonstrated Career Growth and Industry Expertise - Mia Ward's career trajectory showcases a clear path of progression from Accounts Assistant to Accounts Payable Coordinator, with experience spanning different roles in reputable companies like Capita Plc and Randstad UK. This growth illustrates her increasing responsibilities and expertise in the accounts payable domain, underscoring her adaptability and commitment to professional development.

- Quantifiable Achievements with Business Impact - The CV effectively ties personal achievements to broader business outcomes. For example, the implementation of a new invoice processing system that increased efficiency by 30% not only showcases Mia's ability to streamline operations but also highlights her impact on enhancing overall operational efficiency. Her efforts in reducing overdue invoices by 25% demonstrate practical contributions to improved financial management.

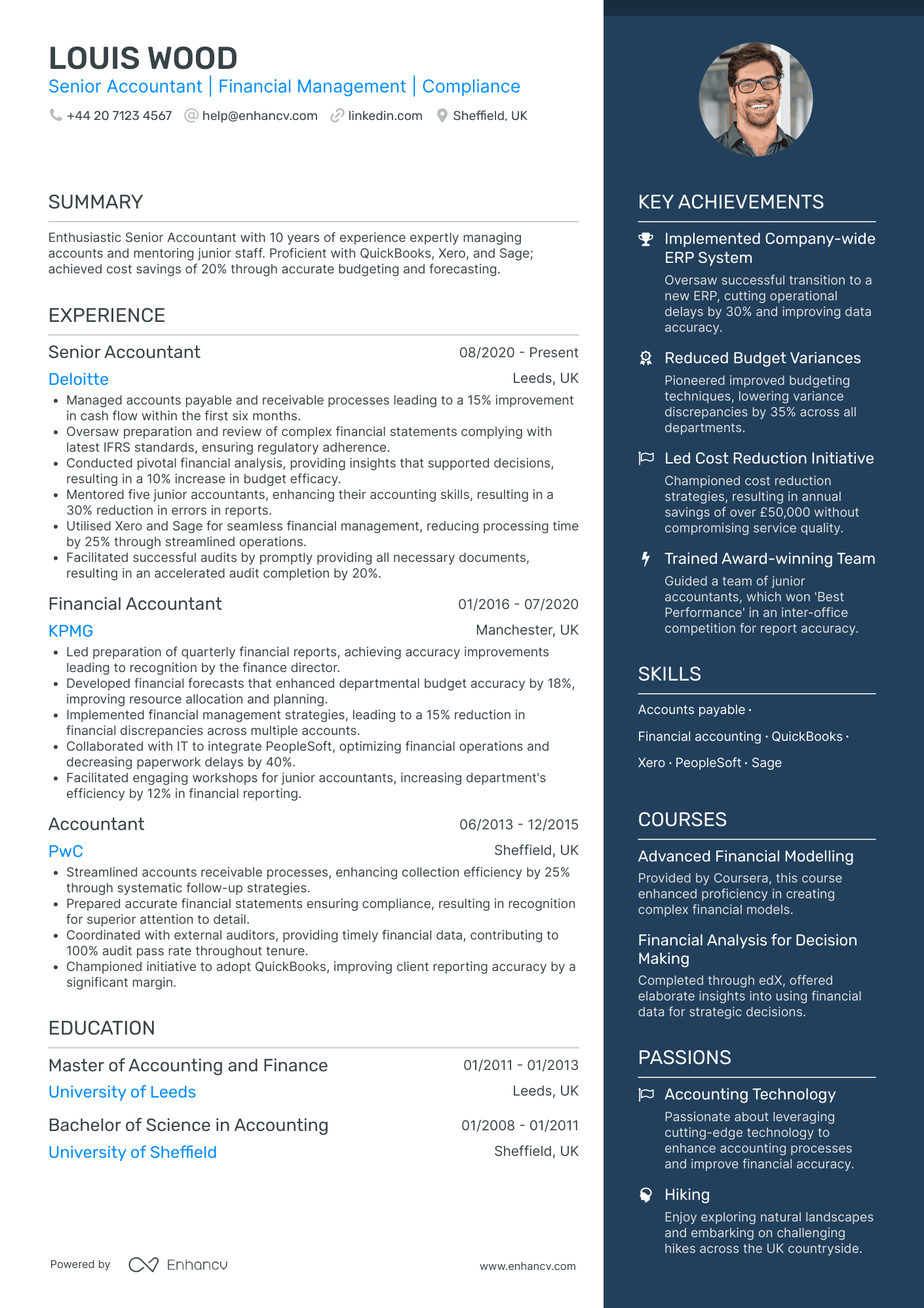

Senior Accounts Payable Auditor in Finance

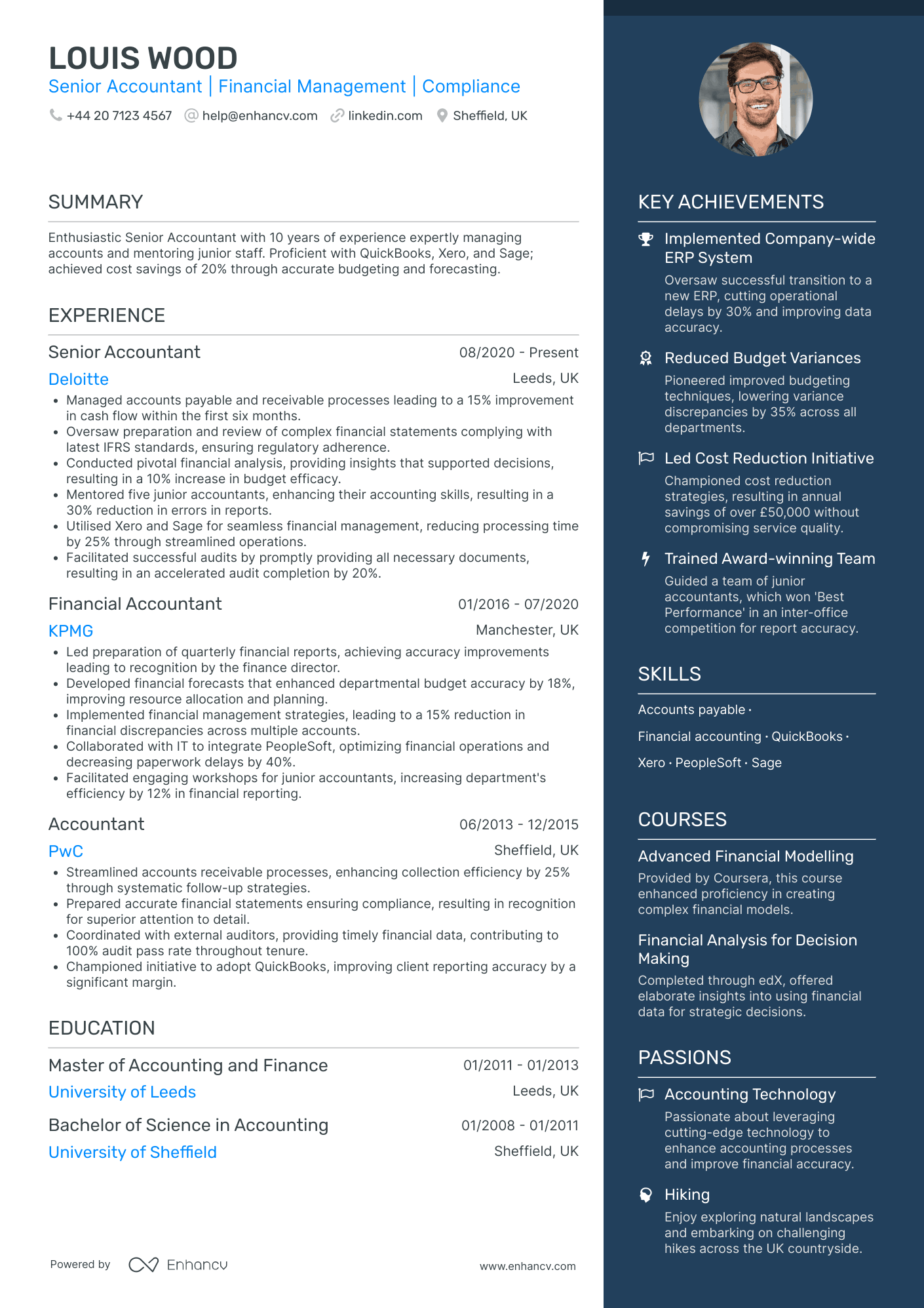

- Structured and Concise Presentation - The CV is organized with a clear structure that segments information into distinct sections, enhancing readability. Each section is concise, focusing on key achievements and important details, benefiting those who quickly scan documents for crucial information.

- Progressive Career Trajectory - Louis Wood has a well-defined career path, showcasing growth within top accounting firms like Deloitte, KPMG, and PwC. His upward mobility from an Accountant to Senior Accountant demonstrates strong professional development and increased responsibilities over time.

- Technical Proficiency and Methodological Depth - The CV highlights expertise with modern accounting tools like QuickBooks, Xero, and Sage, showing Louis' capability to handle comprehensive financial systems. The mention of implementing an ERP system attests to his ability to integrate advanced methodologies into business processes.

Accounts Payable Team Lead in Technology

- Comprehensive Experience in Accounts Management - Alexander Jackson's CV clearly outlines a robust career trajectory in accounts management. Each role builds on the previous one, showcasing continuous growth from an Accounts Payable Analyst to a Manager role in a relatively short time span. This demonstrates his ability to consistently take on more responsibility and drive significant improvements in the accounts payable process.

- Effective Use of SAP for Enhanced Efficiency - The CV highlights the use of SAP as a key tool in Alexander's industry-specific skill set, which has significantly boosted process efficiency and compliance. Implementing SAP not only reduced errors by 20% but also led to a 20% improvement in invoice accuracy, showcasing his technical depth and ability to leverage industry-standard software to achieve business objectives.

- Leadership and Mentorship Impact - The inclusion of mentoring achievements emphasizes Alexander's capability to lead, engage, and enhance team performance. By fostering professional growth within his team, which led to promotions and increased engagement, Alexander's leadership extends beyond process improvements to developing a motivated and competent workforce.

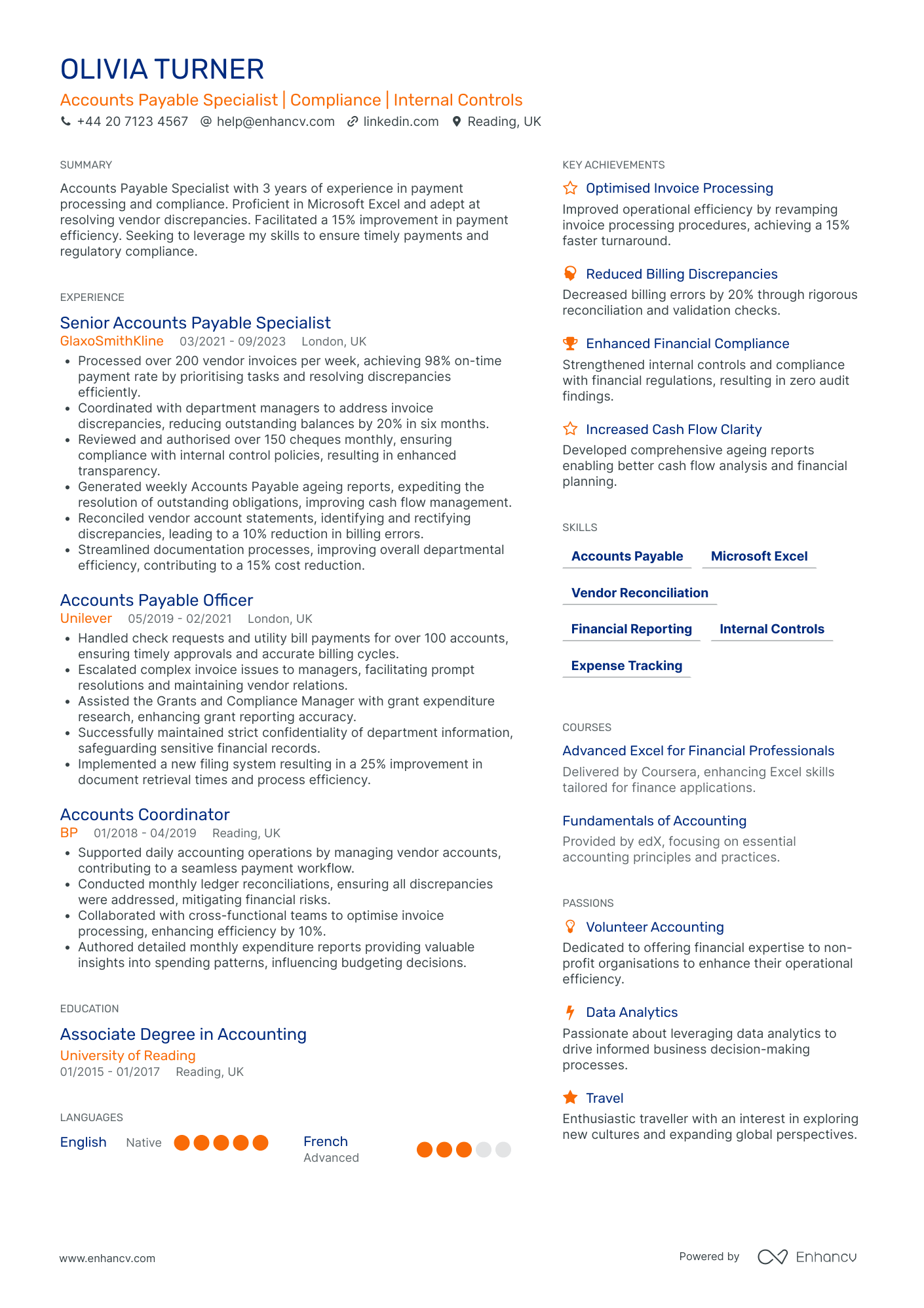

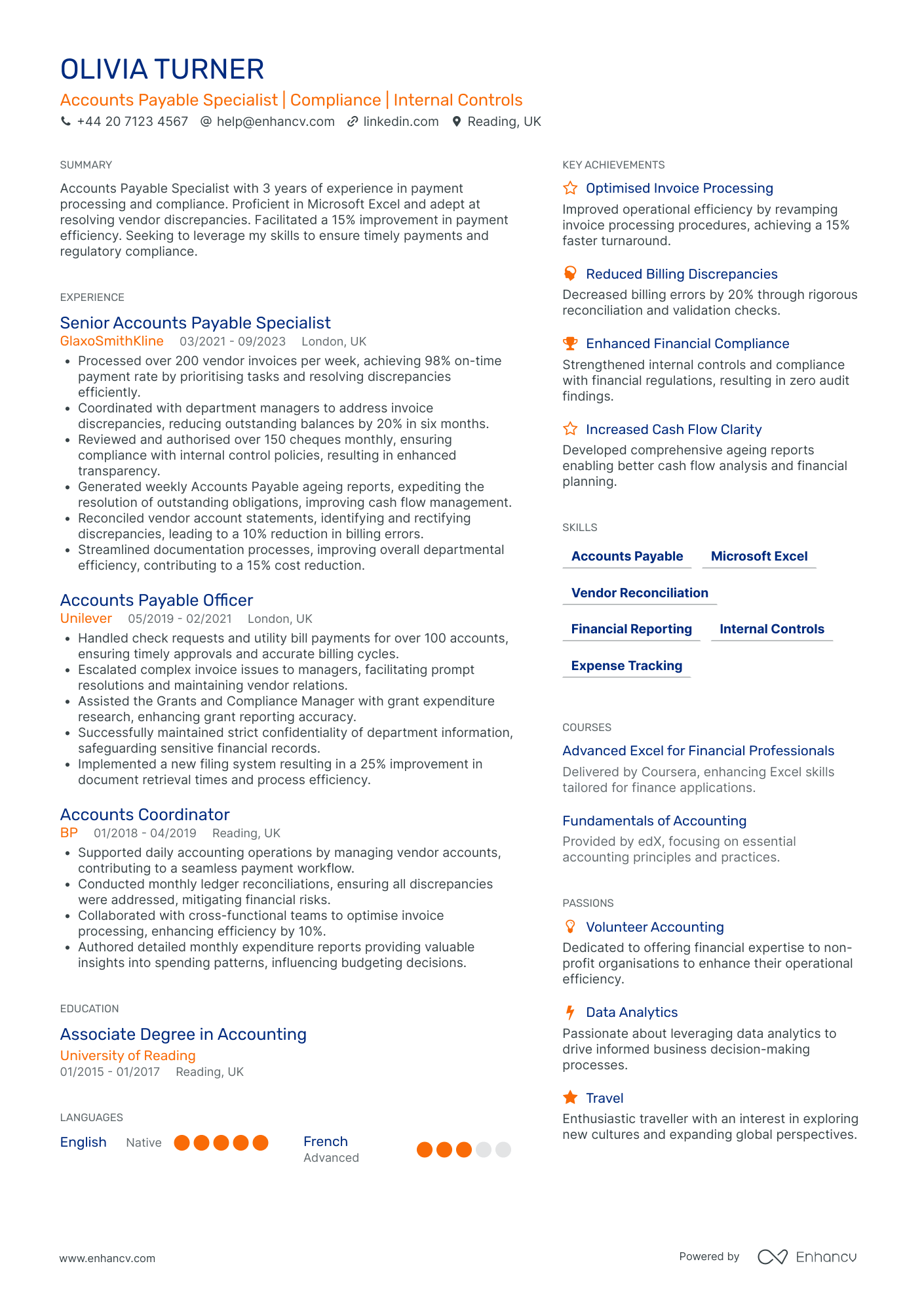

Accounts Payable Specialist in Non-Profit

- Concise and Structured Presentation - The CV employs a clear and concise structure, which aids in easy navigation. Sections are well-defined, helping an employer promptly identify key qualifications, experiences, and achievements that align with the role of an Accounts Payable Specialist.

- Steady Career Progression - Olivia's career trajectory shows a consistent upward movement, evidenced by her advancing from an Accounts Coordinator to a Senior Accounts Payable Specialist. This progression signifies her growth and her ability to adapt and excel in the competitive finance industry.

- Market-Relevant Achievements - Noteworthy is her tangible impact on business operations, such as facilitating a 15% improvement in payment efficiency and a 20% reduction in billing errors. These achievements highlight her ability to identify areas for improvement and implement strategies that enhance the company's financial operations.

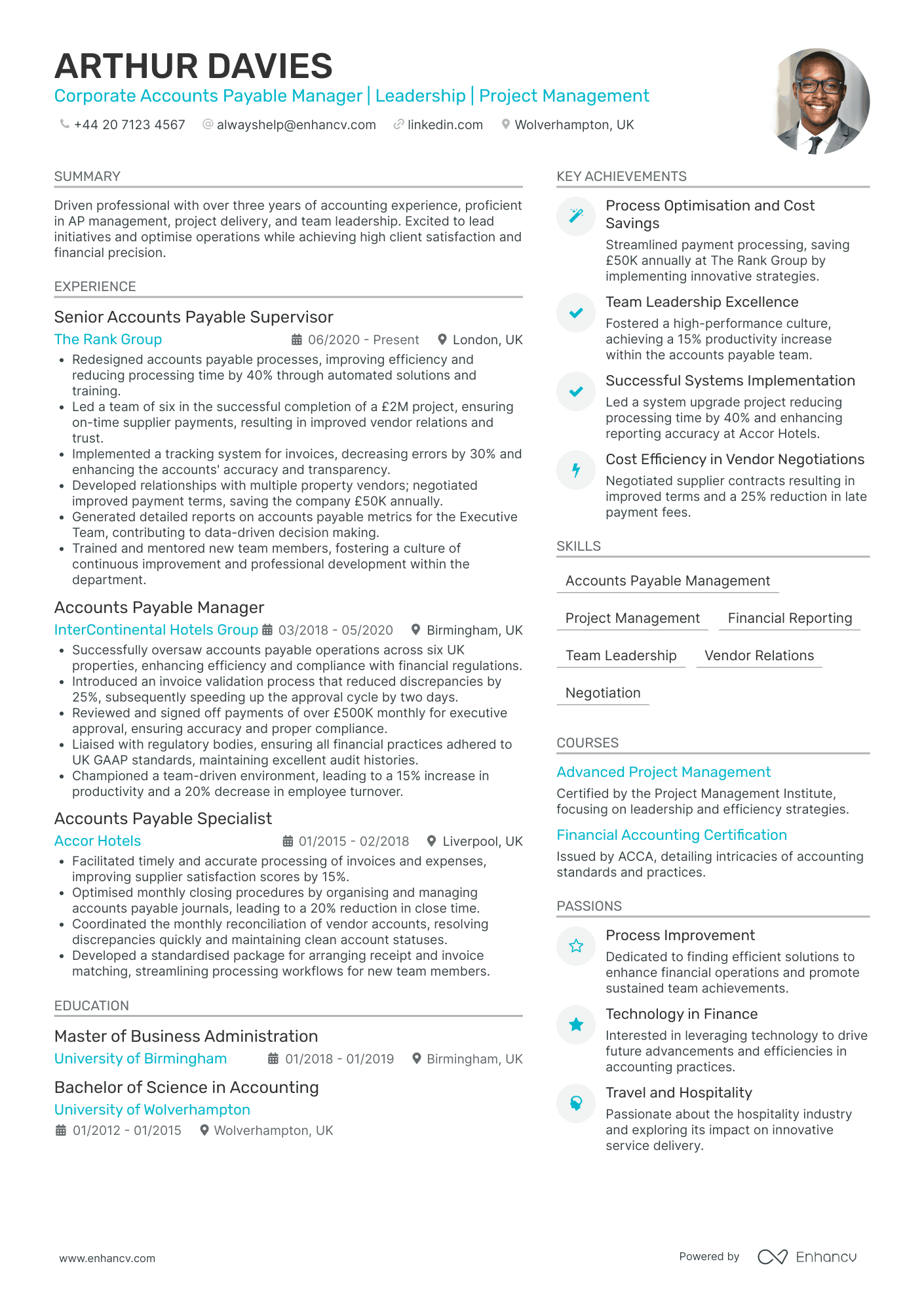

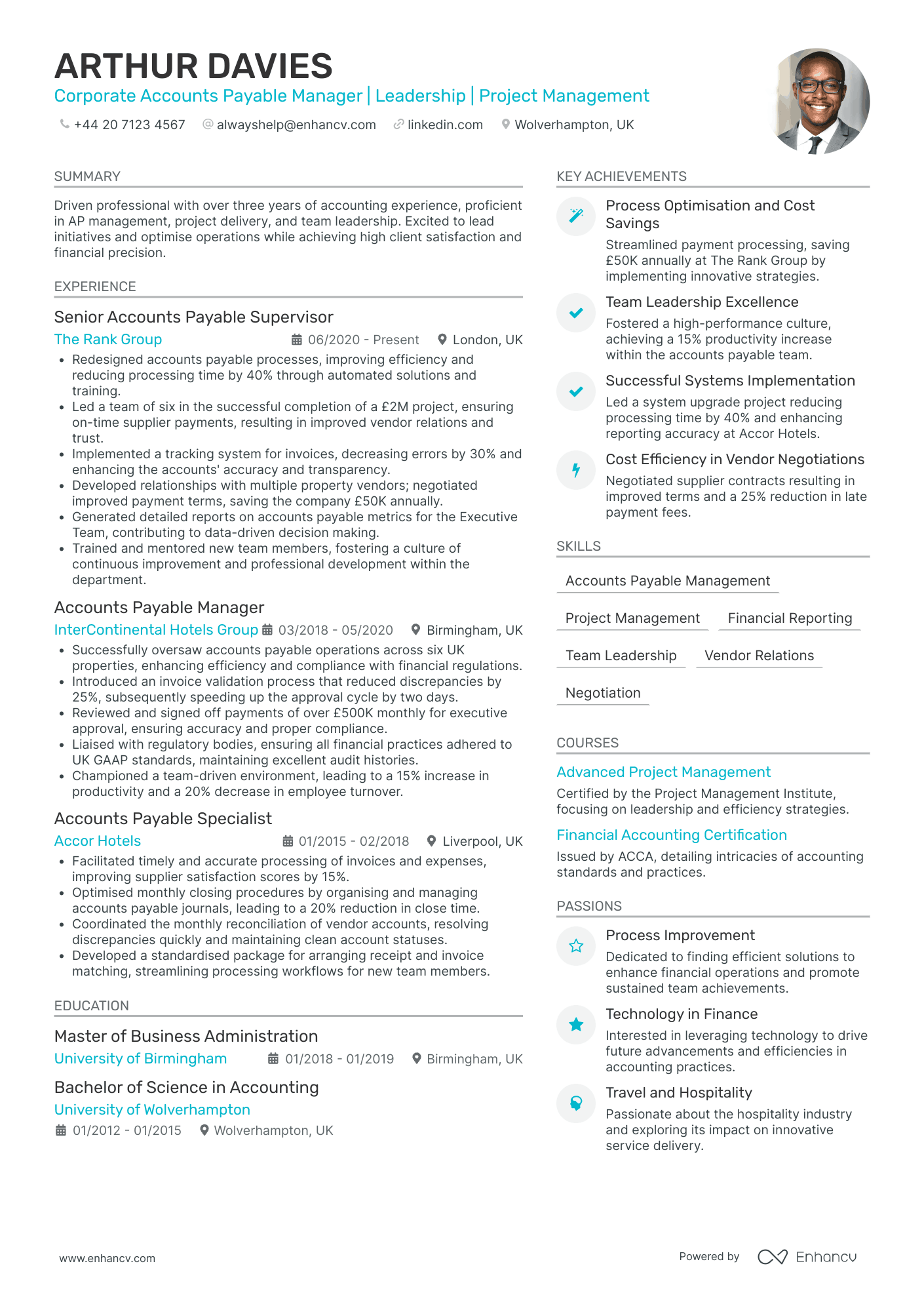

Accounts Payable Representative in Hospitality

- Strategic Presentation and Structure - The CV is clearly structured, allowing quick access to key information, such as Arthur Davies’ expertise in accounts payable and project management. It uses concise bullet points to highlight achievements and responsibilities, efficiently communicating his professional journey and contributions.

- Progressive Career Path - Arthur demonstrates a consistent career trajectory from an Accounts Payable Specialist to a Senior Accounts Payable Supervisor. This growth, coupled with his roles at major hospitality companies, highlights his expanding responsibilities and expertise in financial operations and team leadership.

- Significant Achievements and Business Impact - The CV effectively uses numbers to underline Arthur’s achievements, such as reducing processing time by 40% and negotiating savings of £50K annually. These accomplishments underscore his ability to deliver business-relevant improvements through strategic initiatives.

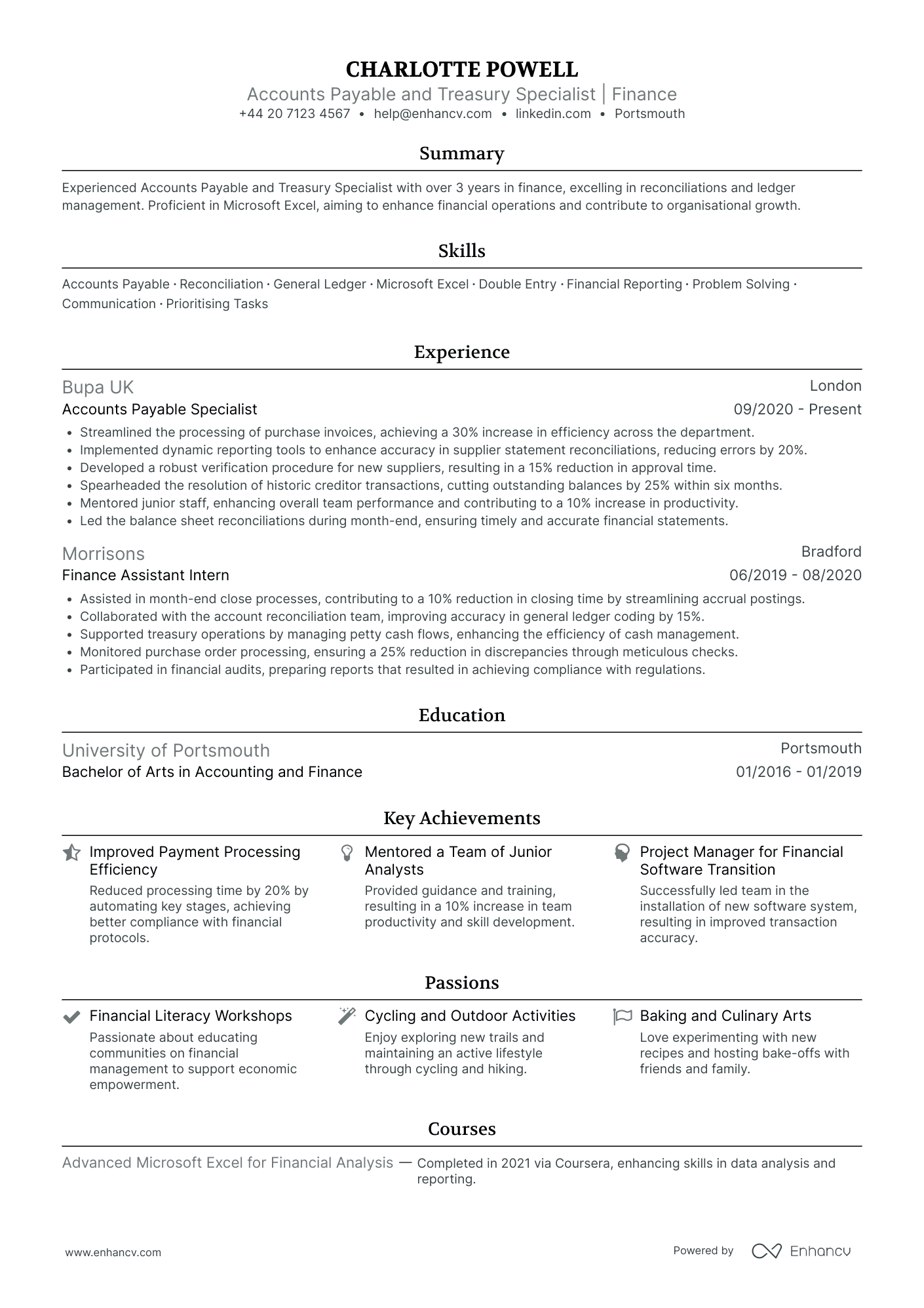

Accounts Payable Assistant in Construction

- Well-Structured and Concise Presentation - The CV of Charlotte Powell is organized in a manner that facilitates easy navigation. Sections are clearly delineated, allowing a recruiter to quickly grasp her qualifications, experience, and skills. Each bullet point in the roles she’s held is precise and focuses on key outcomes rather than extended narratives, ensuring that her contributions are swiftly understood.

- Demonstrated Career Progression - Charlotte’s career trajectory illustrates a clear path of upward growth. Starting as an Accounts Payable Clerk, she has advanced to a Senior Accounts Payable Analyst within four years. This progression reflects her expanding responsibilities and the increasing complexity of her roles, showcasing her development within the field of accounts payable in well-regarded companies.

- Implementation of Industry-Specific Tools and Processes - Powell’s CV highlights her proficiency with ERP systems and industry-specific software like COINS, which are crucial in finance roles. Her ability to implement new reconciliation systems and lead system migrations demonstrates a depth of technical knowledge that enhances operational efficiencies, proving her capability to innovate and solve complex problems within her field.

Accounts Payable Executive in Publishing

- Structured and Insightful Presentation - The CV is expertly structured, offering a clear narrative that guides readers through the candidate’s comprehensive experience in accounts payable within the real estate sector. The noteworthy utilization of bullet points in the experience section ensures that achievements and responsibilities are easily digestible, showcasing attention to detail and effective communication skills.

- Impressive Career Advancement - Louis Wood's career trajectory showcases progressive growth, transitioning from an Accounts Payable Analyst to an Accounts Payable Manager. This trajectory not only highlights his professional development within reputable real estate firms but also underscores his capability to handle increased responsibilities and lead teams to success in a competitive industry.

- Implemented Innovative Solutions - The CV highlights industry-specific initiatives such as the implementation of ERP systems and AP automation systems, demonstrating deep technical expertise and the ability to drive meaningful process improvements. This adeptness with specialized tools is crucial for enhancing efficiency and accuracy in financial operations, addressing a key aspect of his role as an AP specialist.

Accounts Payable Professional in Logistics

- Clear and structured presentation - The CV is organized into well-defined sections, such as experience, education, and skills, contributing to a seamless reading experience. The use of bullet points for job descriptions ensures clarity and conciseness, allowing potential employers to quickly grasp the key points of Alfie's expertise and accomplishments.

- Strong career progression in finance - Alfie's career trajectory showcases consistent growth within the finance sector. Starting as a Junior Financial Advisor and advancing to an Accounts Payable Associate, each role demonstrates increased responsibilities and contributions, such as leading cross-departmental teams and implementing cost-saving initiatives.

- Demonstrated expertise in process improvement - The CV reflects Alfie's adeptness in improving financial processes, highlighted by achievements like a 30% reduction in invoice processing time and a 20% improvement in month-end closing times. These accomplishments are not just numerical but have significant business relevance, enhancing productivity and compliance.

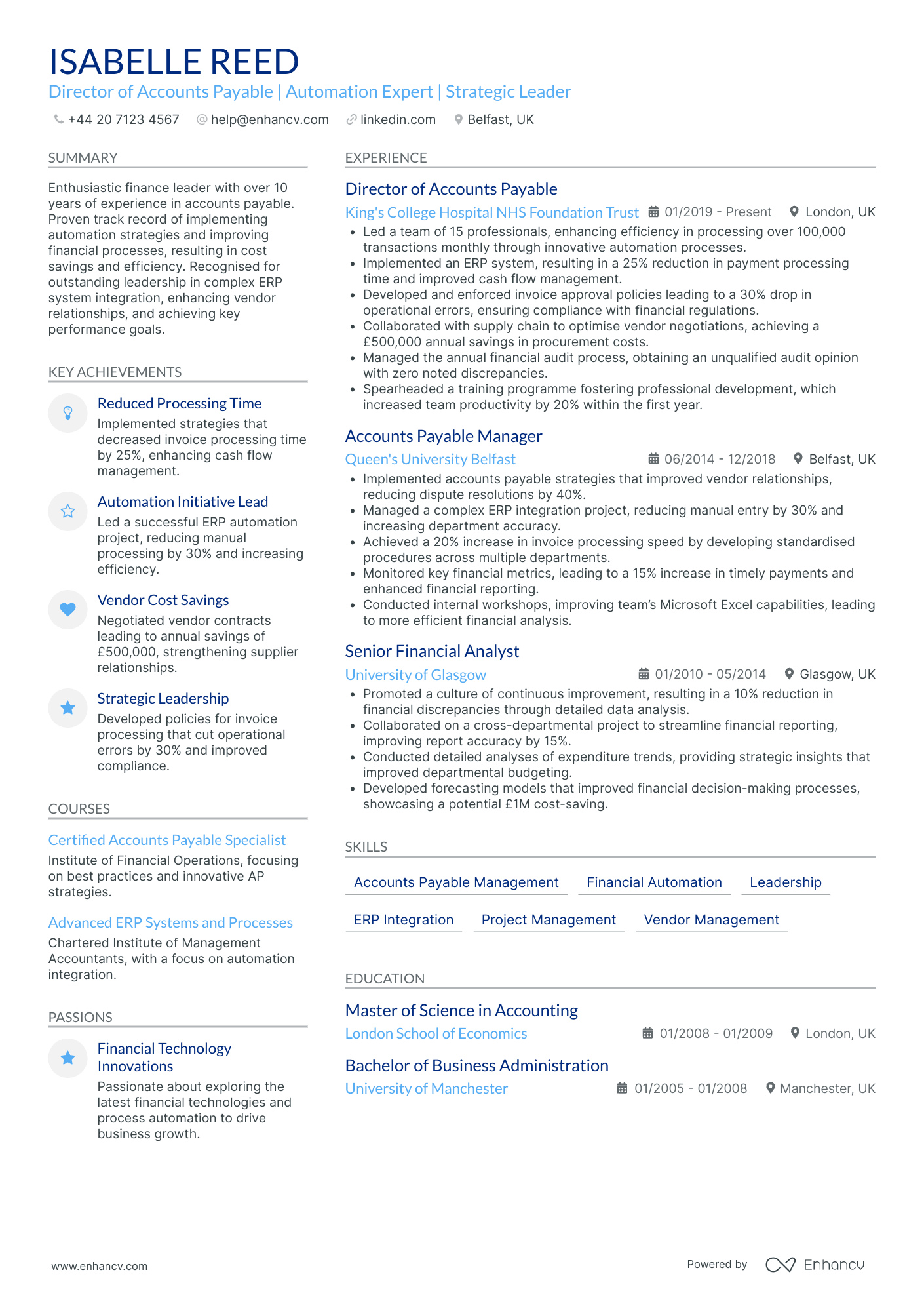

Chief Accounts Payable Officer

- Strategic Leadership and Adaptability - The CV highlights Isabelle Reed's strategic leadership skills, evident from her roles involving significant process enhancements and ERP system integration. Her adaptability is showcased through several successful cross-functional projects, which required collaboration with diverse teams to optimize vendor negotiations and improve financial processes.

- Comprehensive Career Progression - Isabelle’s career trajectory suggests a steady and focused ascent within the accounts payable domain, transitioning from a Senior Financial Analyst to Director of Accounts Payable. Each position reflects a step up in responsibilities, showcasing her growth and expertise in financial management and process automation.

- Emphasis on Automation and Innovation - Unique to her industry-specific profile is Isabelle’s emphasis on financial technology innovations and automation. Her achievements in ERP automation projects that reduced manual processes demonstrate her technical depth and commitment to driving efficiency through technology, an invaluable skill in today's fast-paced financial environments.

Structuring your accounts payable CV layout: four factors to keep in mind

There are plenty of best practices out there for your CV layout and design. At the end of the day, a clear format and concise CV message should be your top priority. Use your CV design to enhance separate sections, bringing them to the forefront of recruiters' attention. At the same time, you can write content that:

- Follows the reverse chronological order in the experience section by first listing your most recent jobs;

- Incorporates your contact information in the header, but do skip out on the CV photo for roles in the UK;

- Is spotlighted in the most important sections of your CV, e.g. the summary or objective, experience, education, etc. to show just how you meet the job requirements;

- Is no longer than two-pages. Often, the one-page format can be optimal for your accounts payable CV.

Before submitting your CV, you may wonder whether to export it in Doc or PDF. With the PDF format, your information and layout stay intact. This is quite useful when your CV is assessed by the Applicant Tracker System (or the ATS) . The ATS is a software that scans your profile for all relevant information and can easily understand latest study on the ATS , which looks at your CV columns, design, and so much more.

PRO TIP

Use font size and style strategically to create a visual hierarchy, drawing the reader's eye to the most important information first (like your name and most recent job title).

The top sections on a accounts payable CV

- Professional Summary highlights your key achievements and expertise in managing payables.

- Core Competencies section lists your specific skills in accounts payable, such as invoice processing and payment reconciliations.

- Work Experience details your past roles and successes in managing vendor accounts and improving financial processes.

- Education and Certifications showcase your relevant qualifications and any specialised training in finance or accountancy.

- Technical Proficiencies indicate your familiarity with accounting software and tools essential for accounts payable tasks.

What recruiters value on your CV:

- Emphasize your experience with accounting software and systems such as SAP, QuickBooks, or Xero, and describe your proficiency in automating and streamlining accounts payable processes.

- Highlight your ability to meticulously manage invoices, purchase orders, and payment transactions, showcasing your track record of maintaining accurate financial records and reports.

- Demonstrate your understanding of regulatory compliance, including knowledge of tax laws and experience with audit support, which are crucial in accounts payable management.

- Showcase your strong analytical skills and attention to detail by mentioning any previous roles where you successfully resolved discrepancies in vendor payments or reconciled financial statements.

- Include examples of collaborations with other departments such as procurement or budgeting, to exhibit your ability to work cross-functionally and contribute to broader financial goals and cost-saving initiatives.

Recommended reads:

Our checklist for the must-have information in your accounts payable CV header

Right at the very top of your accounts payable CV is where you'd find the header section or the space for your contact details, headline, and professional photo. Wondering how to present your the name of the city you live in and the country abbreviation as your address;

- are tailored to the role you're applying for by integrating key job skills and requirements;

- showcase what your unique value is, most often in the form of your most noteworthy accomplishment;

- select your relevant qualifications, skills, or current role to pass the Applicant Tracker System (ATS) assessment. Still not sure how to write your CV headline? Our examples below showcase best practices on creating effective headlines:

Examples of good CV headlines for accounts payable:

Accounts Payable Specialist | AAT Qualified | Expert in Invoice Management | 5+ Years of Experience

Senior Accounts Payable Coordinator | Vendor Relations | Efficiency Improvement | ACCA Part-Qualified

Accounts Payable Analyst | Financial Reporting | Compliance Oversight | 8 Years in Finance Sector

Lead Accounts Payable Clerk | BSc in Accounting | Process Optimisation | Multi-Currency Transactions

Accounts Payable Manager | Strategic Planning | Staff Leadership | CIMA Certified | 10+ Years' Expertise

Junior Accounts Payable Assistant | Entry-Level | Reconciliation Pro | Proficient in SAP | Pursuing ACCA

Your accounts payable CV introduction: selecting between a summary and an objective

accounts payable candidates often wonder how to start writing their resumes. More specifically, how exactly can they use their opening statements to build a connection with recruiters, showcase their relevant skills, and spotlight job alignment. A tricky situation, we know. When crafting you accounts payable CV select between:

- A summary - to show an overview of your career so far, including your most significant achievements.

- An objective - to show a conscise overview of your career dreams and aspirations.

Find out more examples and ultimately, decide which type of opening statement will fit your profile in the next section of our guide:

CV summaries for a accounts payable job:

- With over 8 years of dedicated experience in high-volume accounts payable management for leading retail chains, I possess deep expertise in automated invoice processing systems, a track record of reducing outstanding payables by 30%, and a strong suite of negotiation and reconciliation skills.

- As a seasoned financial professional with 10 years of robust experience in accounting and budgeting within the manufacturing sector, my capabilities include streamlining payment processes, leveraging ERP software for efficiency gains, and a notable achievement of enhancing vendor relationships while slashing payment delays by 25%.

- Transitioning from a career in hospitality management, my 5 years of experience in overseeing operational finances have equipped me with a solid foundation in vendor management, keen attention to detail, and a commitment to adopting stringent cost control measures, which I aim to apply in the accounts payable domain.

- Eager to transfer strong analytical and project management skills from a 7-year tenure in software development, I am well-versed in quantitative analysis and possess a consistent record of implementing process improvements, aspiring to bring a fresh technological perspective to streamline the accounts payable function.

- Seeking to advance my career in a dynamic accounts payable environment where I can apply my recent degree in finance combined with my passion for analytics and proficiency in Excel. Driven to develop my expertise through hands-on experience, with a goal to contribute to the fiscal health and effective payment strategies of the team.

- Gearing up for a challenging first step into the financial sector, I bring a degree in business administration, enthusiasm for number crunching, and an eagerness to learn and excel. I am determined to harness my strong organisational skills and attention to detail to support the accounts payable department in achieving its objectives.

Best practices for writing your accounts payable CV experience section

If your profile matches the job requirements, the CV experience is the section which recruiters will spend the most time studying. Within your experience bullets, include not merely your career history, but, rather, your skills and outcomes from each individual role. Your best experience section should promote your profile by:

- including specific details and hard numbers as proof of your past success;

- listing your experience in the functional-based or hybrid format (by focusing on the skills), if you happen to have less professional, relevant expertise;

- showcasing your growth by organising your roles, starting with the latest and (hopefully) most senior one;

- staring off each experience bullet with a verb, following up with skills that match the job description, and the outcomes of your responsibility.

Add keywords from the job advert in your experience section, like the professional CV examples:

Best practices for your CV's work experience section

- Managed the timely and accurate processing of up to 1,000 invoices per month, utilising accounting software such as SAP and Oracle to enhance efficiency.

- Conducted monthly reconciliation of supplier statements to ensure all accounts were up-to-date and discrepancies promptly addressed, mitigating risk of overpayment.

- Negotiated payment terms with suppliers to improve cash flow, successfully extending average payment terms by 15 days without compromising supplier relationships.

- Liaised with procurement and received teams to resolve price and quantity discrepancies, ensuring accurate billing and maintaining a 98% invoice accuracy rate.

- Implemented a new electronic approval workflow for invoices, reducing the average invoice approval time by 25% and supporting timely payment cycles.

- Assisted with month-end closing procedures, including accruals and prepayments, which contributed to a 15% reduction in closing timeframes.

- Processed employee expense reports and managed reimbursement process, ensuring all expenses were verified and compliant with company policies.

- Regularly reviewed and updated accounts payable policies and procedures to ensure alignment with current regulatory standards, achieving a 10% increase in audit compliance.

- Utilised data analytics to report on key accounts payable metrics, such as average invoice processing time and cost-per-invoice, helping to identify areas for process improvement.

- Streamlined invoice processing using SAP, resulting in a 25% increase in process efficiency for a monthly volume of approximately 2000 invoices.

- Managed a team of 4 AP clerks, enhancing team accuracy to 98% and consistently maintaining performance metrics above departmental targets.

- Led the project for transitioning to automated electronic payments, reducing manual payment processing time by 40% and cutting company costs by £15,000 annually.

- Reduced the monthly financial close cycle by three days through improved reconciliation processes and strategic overtime scheduling during peak periods.

- Negotiated with suppliers to extend payment terms from 30 to 60 days, improving the company's cash flow and working capital by £50,000 per quarter.

- Introduced a new expense reporting system which cut down on employee reimbursement time from two weeks to three days, enhancing employee satisfaction.

- Oversaw the implementation of a cloud-based accounts payable system, coordinating with IT and finance teams to ensure a smooth transition.

- Developed and conducted training sessions for 20 staff members to ensure adherence to updated invoice processing procedures that comply with internal controls.

- Cultivated relationships with key suppliers, reducing the average number of invoice disputes by 70% and maintaining a 99% on-time payment record.

- Headed the quarterly AP audit and coordinated with auditors, resulting in zero compliance issues over the 3-year period.

- Successfully migrated the accounts payable data to a new software platform with zero downtime or disruption to the payment cycle.

- Implemented regular vendor statement reconciliations, uncovering and rectifying £10,000 in historical invoice discrepancies.

- Facilitated the merger of accounts payable functions from two legacy companies, integrating systems and aligning policies without any delays in payment schedules.

- Identified and resolved a recurring error in VAT processing, recovering £6,000 and improving overall tax reporting accuracy.

- Pioneered a supplier self-service portal that reduced inbound payment status inquiries by 50%, allowing for more strategic use of the finance team's time.

- Performed detailed spend analysis reports on a bimonthly basis which informed department budget cuts of 10%, saving £20,000 annually.

- Collaborated with procurement to implement just-in-time inventory practices, reducing stock holding costs by 15%.

- Desgined and rolled out a new approval workflow for expense claims that cut processing times by a full day.

- Liaised with IT to automate data entry tasks using AI software, resulting in an annual reduction of 500 man-hours dedicated to manual entry.

- Championed a monthly cross-departmental reconciliation meeting, which drastically reduced the recurrence of inter-company billing errors.

- Conducted half-yearly supplier reviews and successfully renegotiated contract terms which led to a 5% cost saving across all major supply contracts.

- Revived a lagging accounts payable department by improving document management, resulting in a 20% increase in the speed of invoice turnaround.

- Provided comprehensive monthly AP aging reports to management that directly influenced strategic financial planning.

- Executed a successful credit recovery campaign for late payments, amassing over £8,000 in overdue funds within the first fiscal quarter of implementation.

Swapping your professional experience (when you have none) with skills and more

Never underestimate the importance of relevancе when it comes to your accounts payable CV. Even if you don't happen to have much or any standard (full-time contract) professional experience, this doesn't mean you shouldn't apply for the role. Instead of a bespoke CV experience section:

- Showcase more prominently any internships, part-time roles, and volunteer experience that are applicable to the role and have taught you job-crucial skills;

- Feature a strengths or achievements section with your transferrable skills or talents you've obtained thanks to your work or life experience;

- Write an objective statement that clearly outlines your values as a candidate and defines your career ambitions;

- List your education or certificates that match the job profile closer to the top of your CV.

Recommended reads:

PRO TIP

Include examples of how you adapted to new tools, environments, or work cultures, showing your flexibility.

Describing your unique skill set using both hard skills and soft skills

Your accounts payable CV provides you with the perfect opportunity to spotlight your talents, and at the same time - to pass any form of assessment. Focusing on your skill set across different CV sections is the way to go, as this would provide you with an opportunity to quantify your achievements and successes. There's one common, very simple mistake, which candidates tend to make at this stage. Short on time, they tend to hurry and mess up the spelling of some of the key technologies, skills, and keywords. Copy and paste the particular skill directly from the job requirement to your CV to pass the Applicant Tracker System (ATS) assessment. Now, your CV skills are divided into:

- Technical or hard skills, describing your comfort level with technologies (software and hardware). List your aptitude by curating your certifications, on the work success in the experience section, and technical projects. Use the dedicated skills section to provide recruiters with up to twelve technologies, that match the job requirements, and you're capable of using.

- People or soft skills provide you with an excellent background to communicate, work within a team, solve problems. Don't just copy-paste that you're a "leader" or excel at "analysis". Instead, provide tangible metrics that define your success inusing the particular skill within the strengths, achievements, summary/ objective sections.

Top skills for your accounts payable CV:

Invoice Processing

Accounts Payable Software

Data Entry

Financial Reporting

Reconciliation

General Ledger Management

Tax Compliance

ERP Systems

Payment Processing

Spreadsheet Proficiency

Attention to Detail

Organisation

Time Management

Communication

Problem-Solving

Teamwork

Adaptability

Integrity

Critical Thinking

Customer Service Orientation

PRO TIP

Order your skills based on the relevance to the role you're applying for, ensuring the most pertinent skills catch the employer's attention first.

CV education and certificates: your academic background as proof of your skill set

A common misconception about your accounts payable CV education is that you only need it, if you have less professional experience. That is completely false. The CV education section serves to back up your technical (and sometimes personal) capabilities, fill in gaps in your work history, and show you have the initial industry background and know-how. When creating your education section:

- List your degrees in the reverse chronological order, starting with the most recent (and relevant) ones first;

- Include your degree and university names, start and graduation dates. It's optional to also denote you received a "First-Class Honours" for diplomas that are more relevant to the role;

- Curate your relevant university coursework, projects, or thesis work if you happen to have less professional expertise and need to integrate more job keywords and skills.

Your professional qualifications don't need to stop at your academic background. It's advisable to also select up to three of your most noteworthy (and relevant) industry certificates and feature them in a dedicated section. Once more, include the certificate name, the institution that issued it out, and the date you obtained it on. You could feature both hard skills and soft skills certificates, as in the examples below:

PRO TIP

Use mini case studies or success stories in your CV to demonstrate how your skills have positively impacted previous roles or projects.

Recommended reads:

Key takeaways

What matters most in your accounts payable CV-writing process is for you to create a personalised application. One that matches the role and also showcases your unique qualities and talents.

- Use the format to supplement the actual content, to stand out, and to ensure your CV experience is easy to comprehend and follows a logic;

- Invest time in building a succinct CV top one third. One that includes a header (with your contact details and headline), a summary or an objective statement (select the one that best fits your experience), and - potentially - a dedicated skills section or achievements (to fit both hard skills and soft skills requirements);

- Prioritise your most relevant (and senior) experience closer to the top of your CV. Always ensure you're following the "power verb, skill, and achievement" format for your bullets;

- Integrate both your technical and communication background across different sections of your CV to meet the job requirements;

- List your relevant education and certificates to fill in gaps in your CV history and prove to recrutiers you have relevant technical know-how.