Crafting a CV that adequately showcases your analytical prowess and experience in financial risk assessment is a specific challenge you might encounter as a credit analyst. Our comprehensive guide is designed to help you navigate through this with tailored advice on articulating your core competencies and accomplishments, ensuring your CV stands out to potential employers.

- Applying best practices from real-world examples to ensure your profile always meets recruiters' expectations;

- What to include in your work experience section, apart from your past roles and responsibilities?

- Why are both hard and soft skills important for your application?

- How do you need to format your CV to pass the Applicant Tracker Software (ATS) assessment?

If you're writing your CV for a niche credit analyst role, make sure to get some inspiration from professionals:

CV examples for credit analyst

By Experience

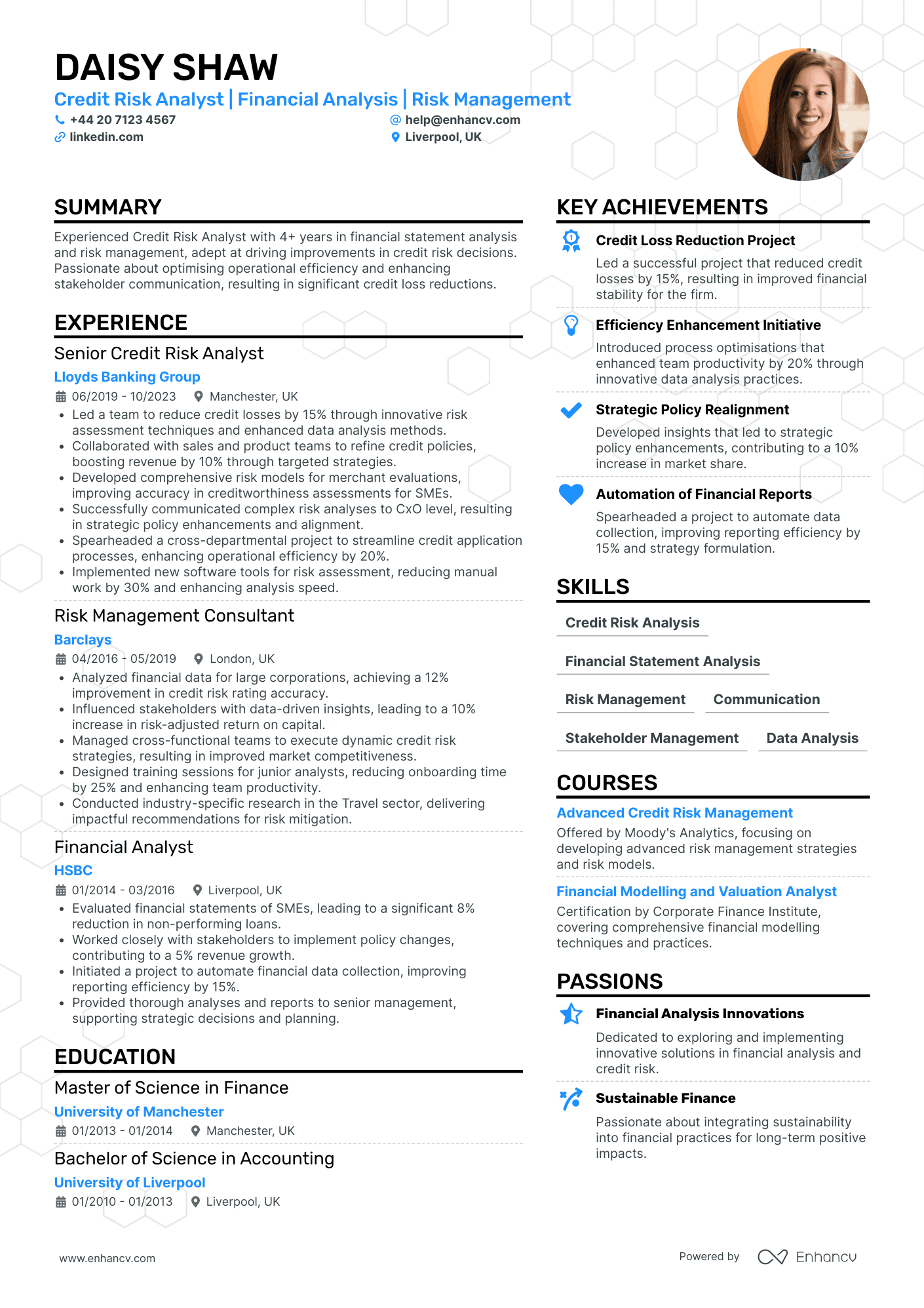

Senior Credit Analyst

- Clearly structured and concise presentation - Daisy Shaw's CV is astutely organized, presenting key information such as experience, education, and skills succinctly, allowing readers to quickly assess her qualifications. The use of bullet points for achievements and responsibilities ensures clarity, while maintaining a professional layout throughout.

- Strong career trajectory with leadership roles - Throughout her career, Daisy has shown remarkable growth, advancing from a Financial Analyst at HSBC to a Senior Credit Risk Analyst at Lloyds Banking Group. This progression highlights her ability to take on increasing responsibilities, reflect growth within the field, and exemplify her leadership qualities such as team management and cross-department collaboration.

- Significant industry-specific achievements impacting business success - Daisy's achievements are impressive, not just in terms of numbers but in the tangible impact on business performance. Her initiatives, such as reducing credit losses by 15% and enhancing operational efficiency by 20%, directly correlate to financial stability and strategic growth, underscoring the business relevance of her contributions.

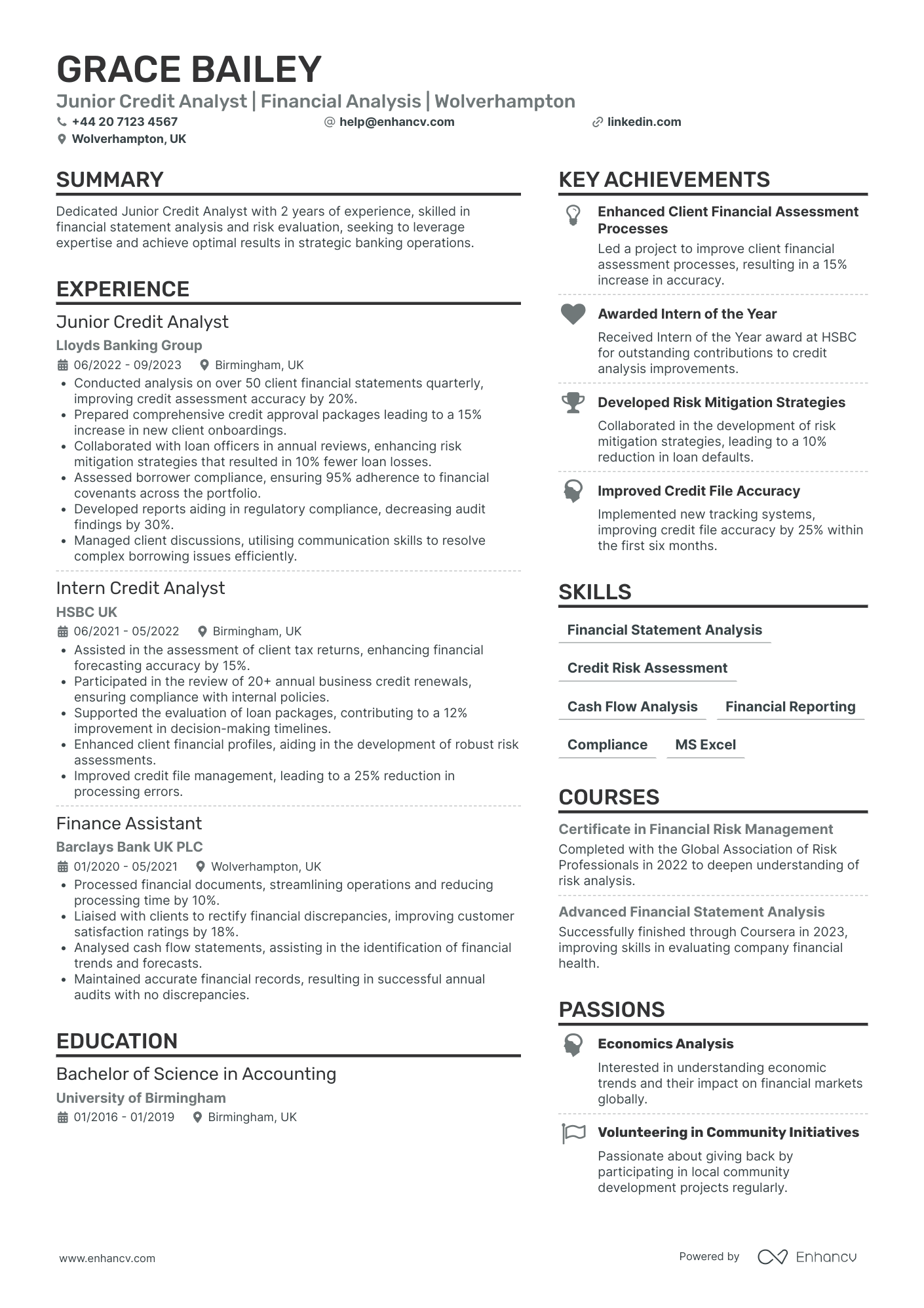

Junior Credit Analyst

- Concise and Effective Content Structure - The CV is well-structured with clear sections that guide the reader through the candidate's qualifications. Each section is concise, maintaining brevity while delivering pertinent information. The effective use of bullet points in the experience section aids in quickly conveying the candidate's achievements and roles, enhancing readability and focus.

- Impressive Career Growth and Development - Grace Bailey demonstrates a clear upward trajectory starting from an intern position at HSBC UK to becoming a Junior Credit Analyst at Lloyds Banking Group. This progression reflects her growing expertise and increasing levels of responsibility within the financial analysis sector. Her career path highlights consistent involvement in financial roles with an industry focus in banking, asserting robust sector-specific experience.

- Significant Achievements with Business Impact - The CV includes several achievements with quantifiable impacts on business performance, such as improving credit assessment accuracy by 20% and reducing loan defaults by 10%. These metrics underscore her ability to contribute effectively to strategic banking operations and reflect her contribution toward enhancing financial decision-making processes and risk mitigation strategies within her roles.

Entry-Level Credit Analyst

- Content Presentation and Clarity - Sienna West's CV is structured with clarity and precision, allowing for easy navigation through sections such as experience, education, and skills. Each segment is well-organized, concise, and highlights the most pertinent information for a Credit Analyst role, making it straightforward for hiring managers to recognize her qualifications and achievements.

- Career Trajectory and Growth - Sienna's career progression is indicative of significant growth and development, moving from a Junior Financial Consultant to a Credit Risk Analyst at Barclays. Her advancement across reputable companies such as Lloyds Banking Group and HSBC reflects her ability to adapt and excel in increasingly complex roles within the financial sector, showcasing a strong trajectory towards leadership.

- Unique Industry-Specific Elements - The inclusion of skills like Bitcoin and the Lightning Network indicates Sienna's forward-thinking approach to financial technologies. Her understanding of these emerging areas not only enhances her profile as a Credit Analyst but also positions her as a valuable asset in organizations looking to innovate in the finance and technology intersection.

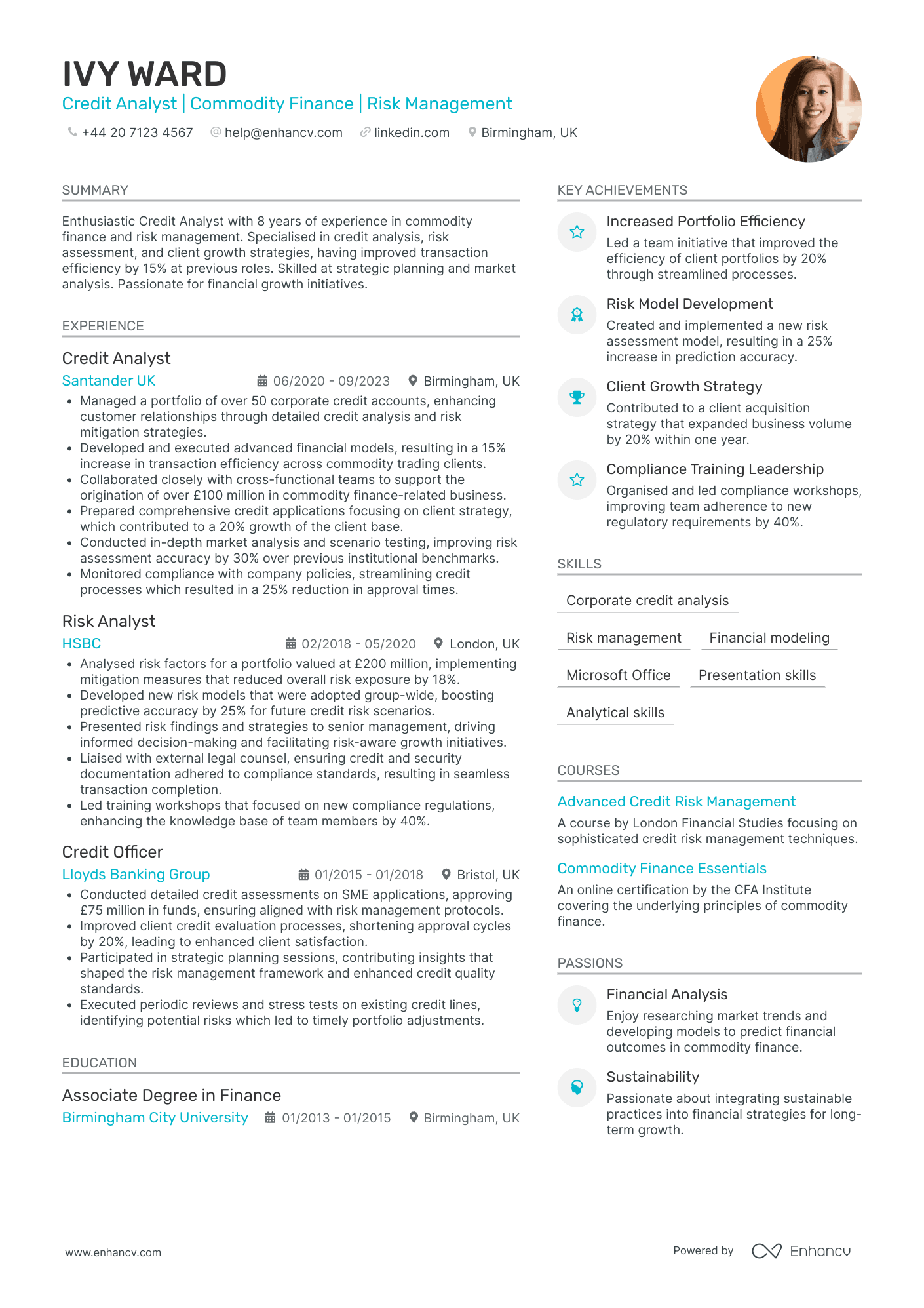

Associate Credit Analyst

- Clear and Concise Content Presentation - The CV is structured with clarity, providing a concise overview of Ivy's career. Each section is well-organized, using bullet points to deliver information effectively, ensuring easy readability and quick access to key details such as experience, skills, and achievements.

- Progressive Career Trajectory - Ivy's career path shows a logical progression within the financial industry, moving from a Credit Officer role to a Credit Analyst position. This upward movement highlights her growth in responsibilities and expertise in credit analysis and risk management within prominent financial institutions.

- Significant Achievements with Business Impact - The CV emphasizes Ivy's accomplishments that have had a meaningful business impact, such as increasing transaction efficiency by 15% and growing the client base by 20%. These achievements demonstrate her ability to drive strategic initiatives that benefit her employers and contribute to overall business success.

By Role

Credit Risk Analyst

- Content presentation with clarity and conciseness - The CV is organized in a clear and structured manner, starting with a concise summary that highlights key skills and achievements, making it easy to navigate. The use of bullet points under each job title further enhances readability by clearly outlining responsibilities and accomplishments.

- Progressive career trajectory in the financial sector - Matilda's career reflects a well-defined growth path, transitioning from a Financial Analyst to a Credit Risk Officer, and ultimately a Credit Risk Analyst. This progression, within well-known companies, demonstrates her increasing expertise and leadership in credit risk management.

- Technical prowess in industry-specific tools and methodologies - Matilda showcases her proficiency with advanced tools—like SAS, Python, and SQL—that are essential for data analysis and credit risk evaluation. Her technical depth is further illustrated by her certification in Advanced SAS Programming, highlighting her commitment to continuous learning.

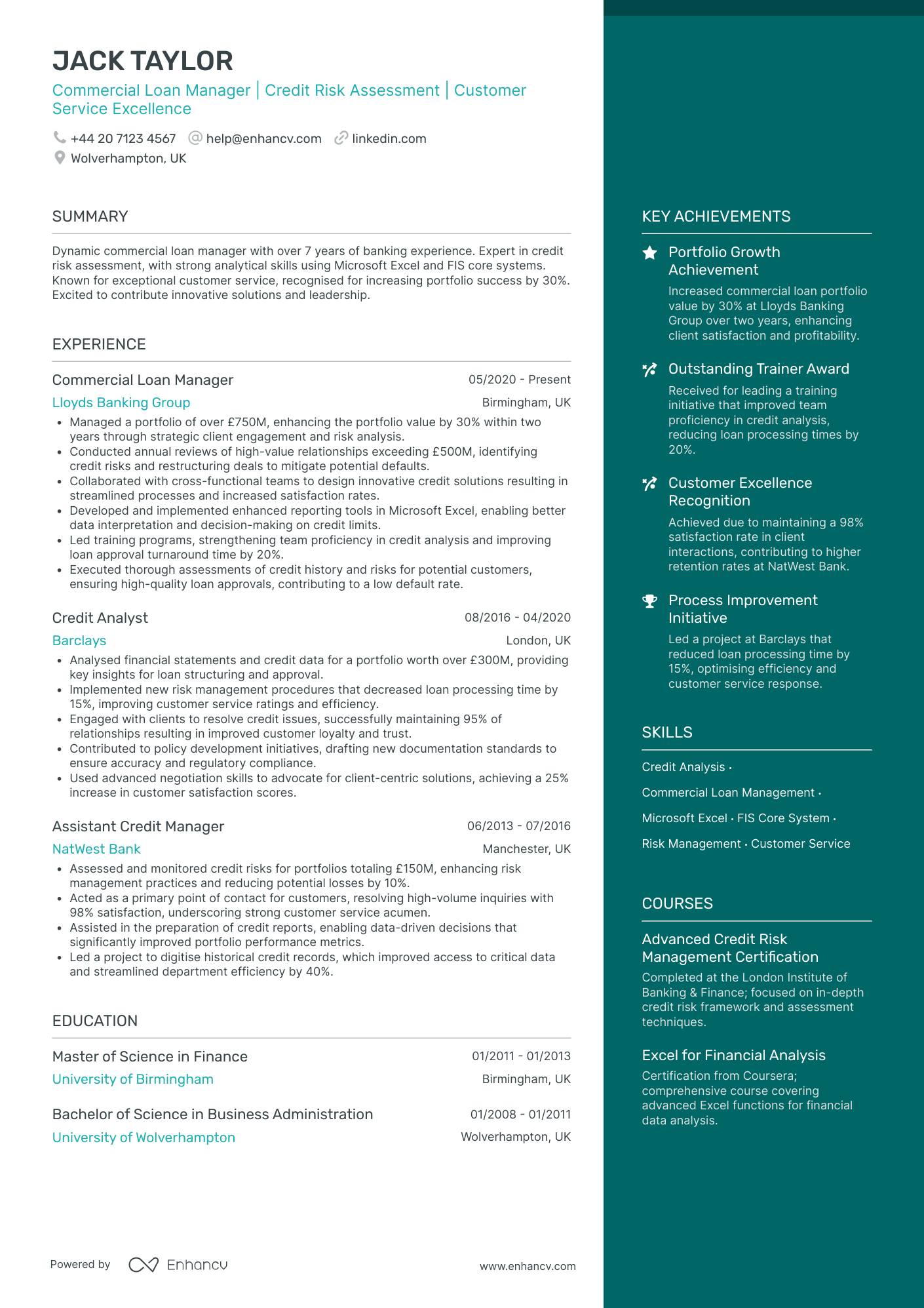

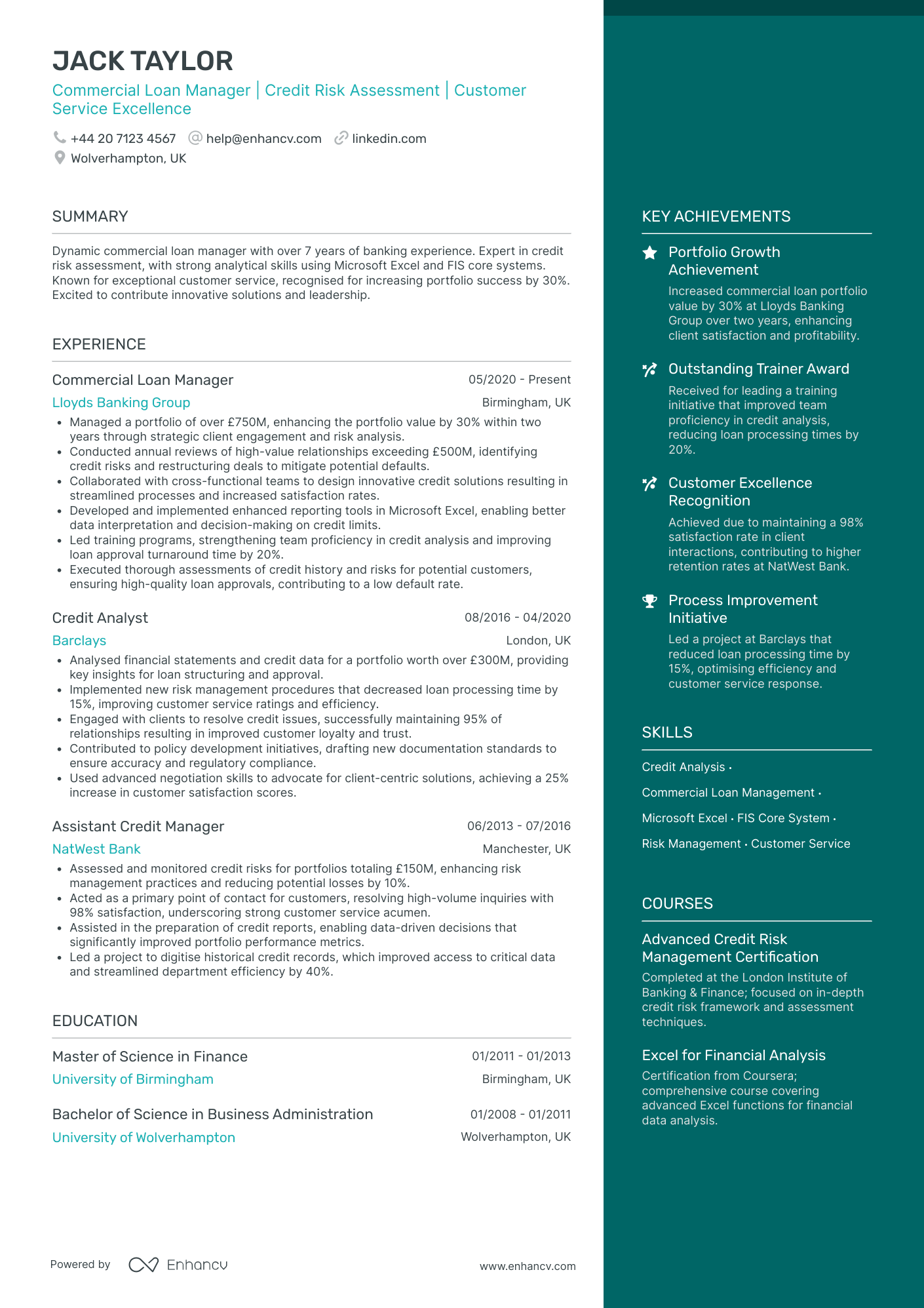

Commercial Credit Analyst

- Impressive Career Advancement - Jack Taylor's career trajectory illustrates significant growth, showcasing advancements from an Assistant Credit Manager to a Commercial Loan Manager within top banking institutions like NatWest, Barclays, and Lloyds Banking Group. This progression demonstrates his ability to manage increasing responsibilities and influence in the financial services sector.

- Emphasis on Cross-Functional Collaboration - The CV highlights Taylor's adaptability and ability to work effectively with cross-functional teams. This is evident from his collaboration with different departments to create innovative credit solutions, enhancing process efficiencies and customer satisfaction, an essential skill for modern financial managers.

- Noteworthy Achievements with Business Impact - Beyond numerical success, the CV demonstrates Taylor's contributions that significantly impact business outcomes, like a 30% portfolio growth at Lloyds and enhanced team proficiency leading to a 20% reduction in loan processing times. These accomplishments show his capability to drive substantial business improvements.

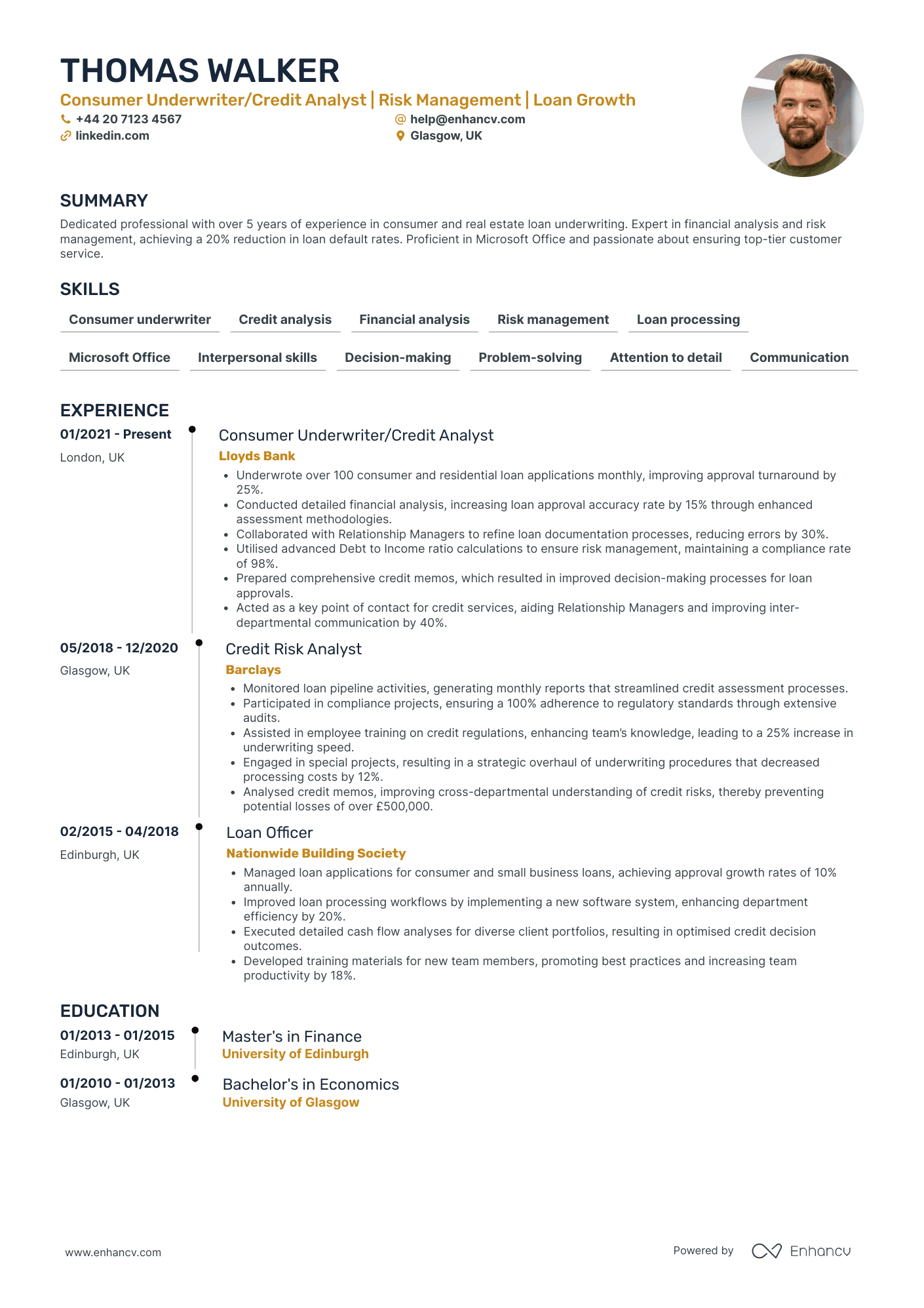

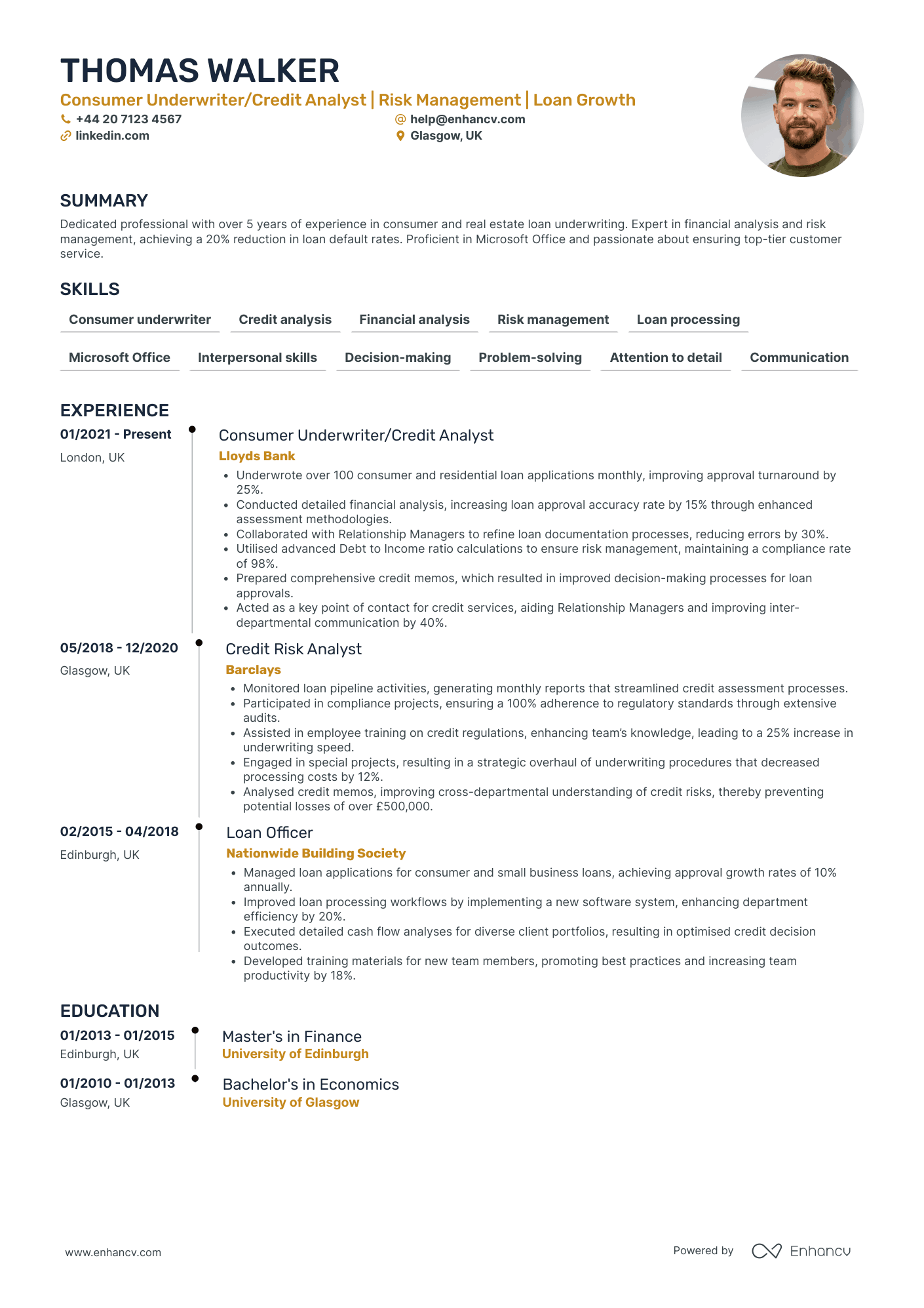

Consumer Credit Analyst

- Effective Content Presentation - The CV stands out for its clear structure and concise language. Each section is well-organized, making it easy for readers to quickly grasp Walker’s professional background, skills, and achievements. The use of bullet points aids in highlighting key information, ensuring that critical data is efficiently communicated.

- Career Trajectory and Growth - Walker’s career trajectory is a testament to his continuous growth and increasing responsibilities in the field of credit and risk management. Starting as a Loan Officer and progressing to a Consumer Underwriter/Credit Analyst showcases his upward movement within the industry, reflecting significant trust and competency in his abilities.

- Achievements and Business Impact - Walker's accomplishments are notable not only for their impressive metrics but also for their broad business impact. For example, implementing policies that reduced loan default rates by 20% directly contributed to a stronger credit portfolio and enhanced organizational efficiency, underlining his role in strategic improvements.

Mortgage Credit Analyst

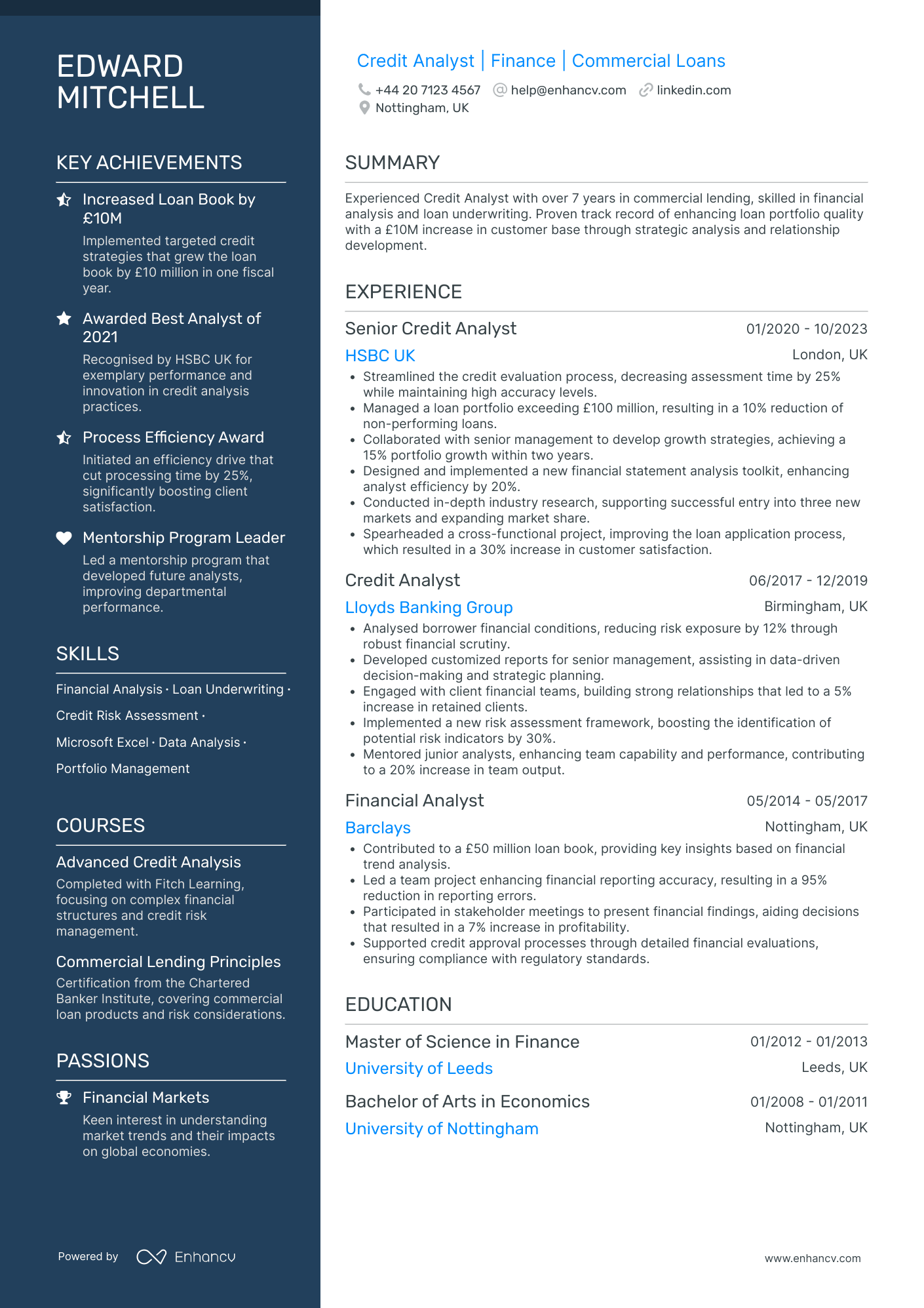

- Structured and Concise Presentation - The CV is well-organized, facilitating easy navigation through clear sections for experience, education, skills, achievements, and more. This clarity enables quick extraction of key information, crucial for hiring managers assessing a candidate's fit for the credit analyst role.

- Proven Career Progression and Leadership - The candidate's rise from a Financial Analyst role at Barclays to a Senior Credit Analyst at HSBC UK illustrates a robust career trajectory marked by growing responsibilities and leadership in financial management, aligning well with the expectations for advanced commercial loan portfolio management.

- Impact-Oriented Achievements - By focusing on achievements with substantial business impact, such as a 10% reduction of non-performing loans and a £10M increase in the loan book, the CV demonstrates the candidate's ability to drive significant financial performance improvements and strategic growth in the banking sector.

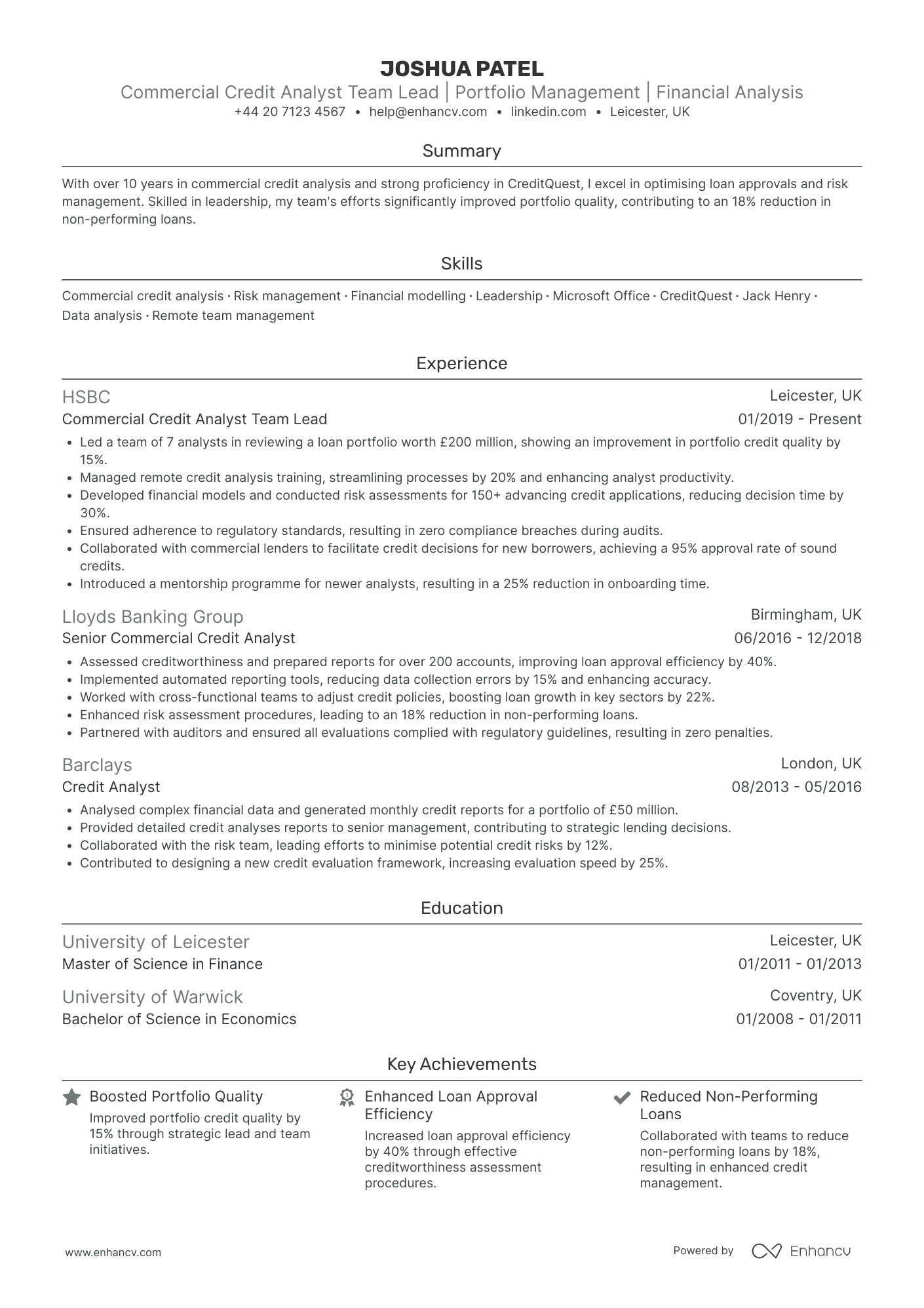

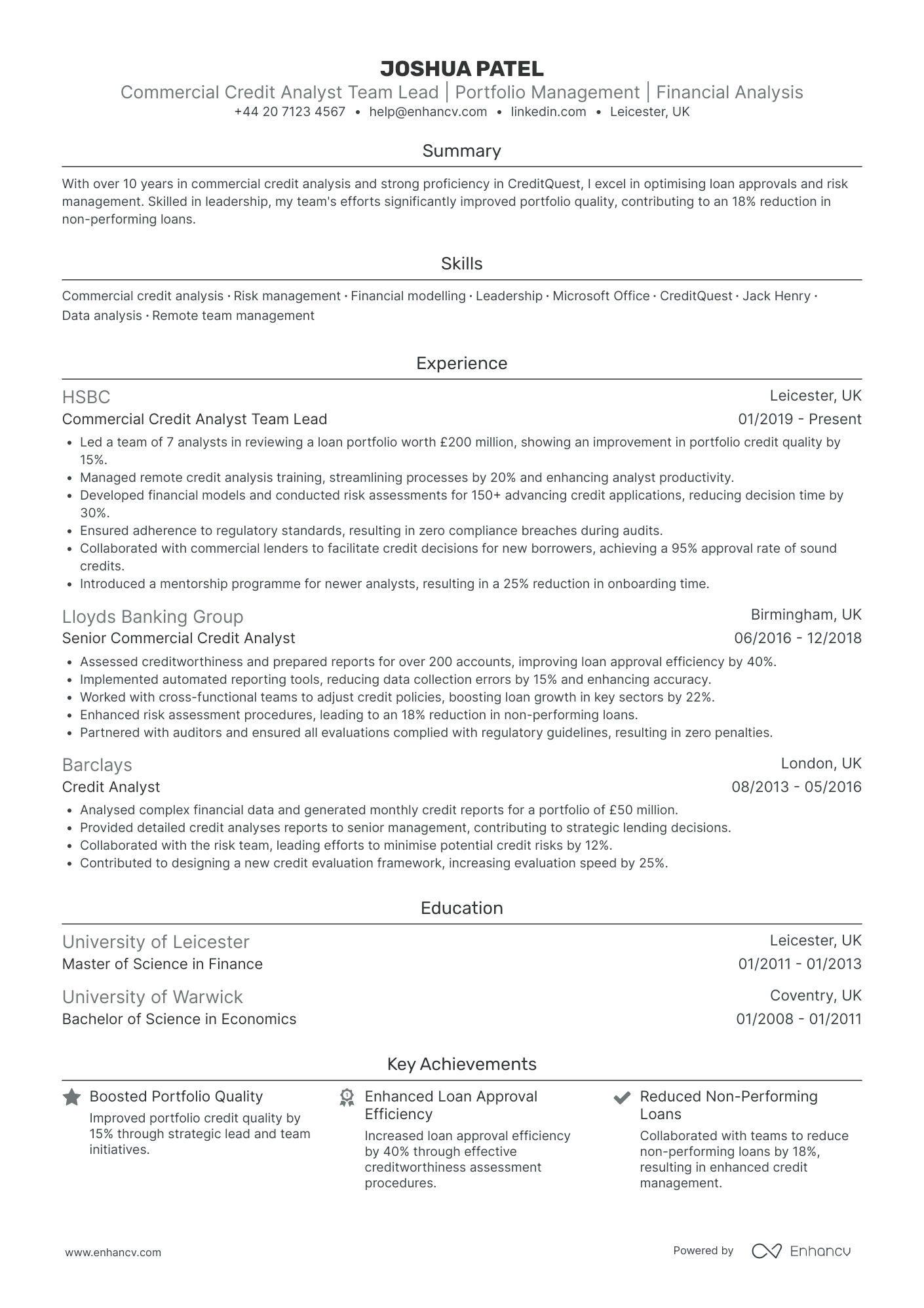

Credit Analyst Team Leader

- Clarity and Structured Presentation - The CV is well-structured, presenting detailed information in a clear, concise manner. Each section is effectively categorized, making it easy for the reader to navigate through work history, skills, education, and achievements. This organization ensures that the most relevant information stands out and is easily accessible.

- Steady Career Growth and Leadership - Joshua's career trajectory illustrates a consistent ascent in the field of commercial credit analysis, culminating in his current role as Team Lead at HSBC. Each role displays increased responsibility and leadership, reflecting his ability to guide teams and enhance operational processes, which is critical for continuing growth in the financial industry.

- Technical Proficiency and Industry Knowledge - The CV highlights Joshua’s expertise with industry-specific tools such as CreditQuest and Jack Henry, which are essential for modern financial analysis and credit management. His experience in developing financial models and conducting risk assessments further emphasizes his technical prowess, showcasing the depth of his industry knowledge.

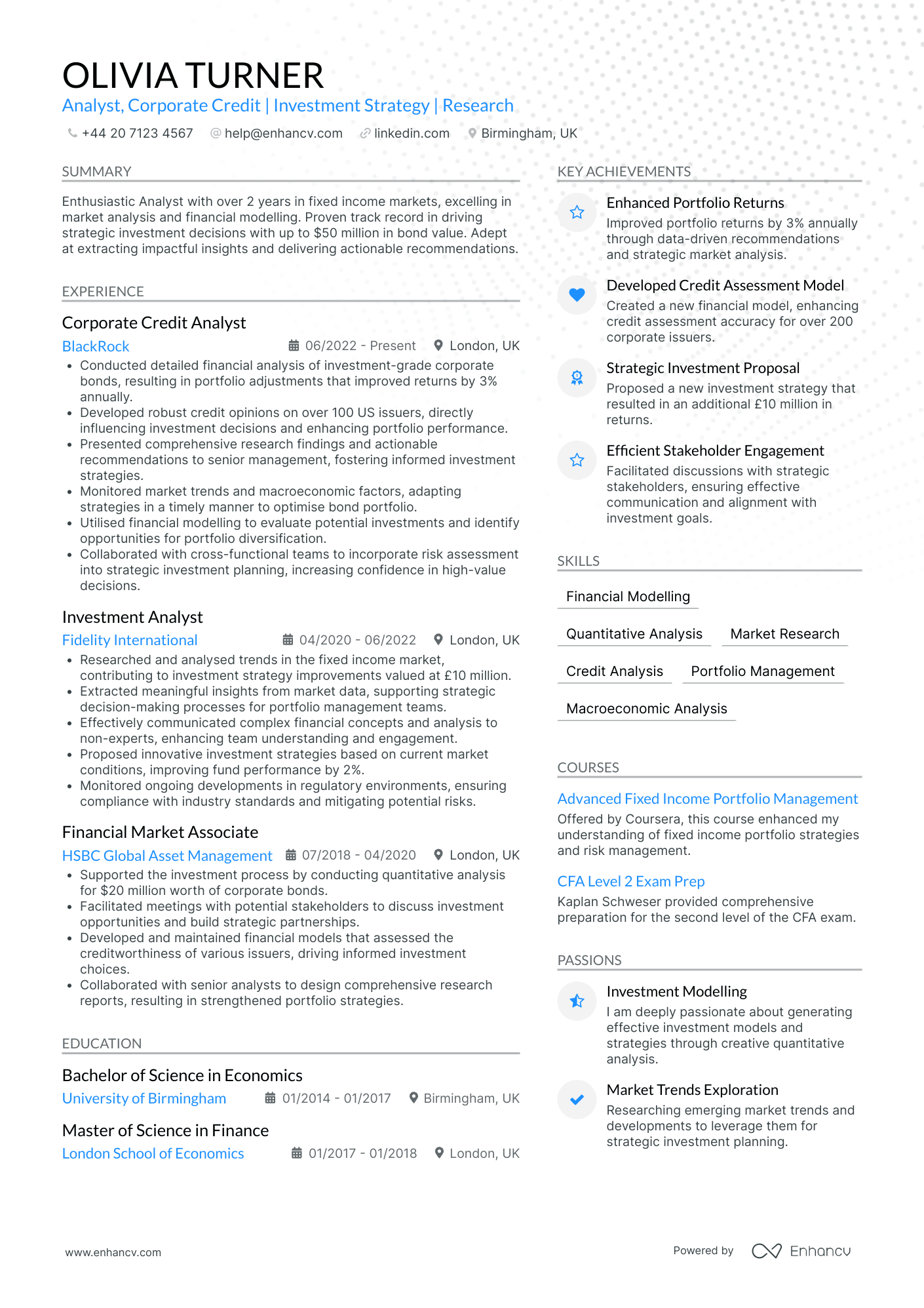

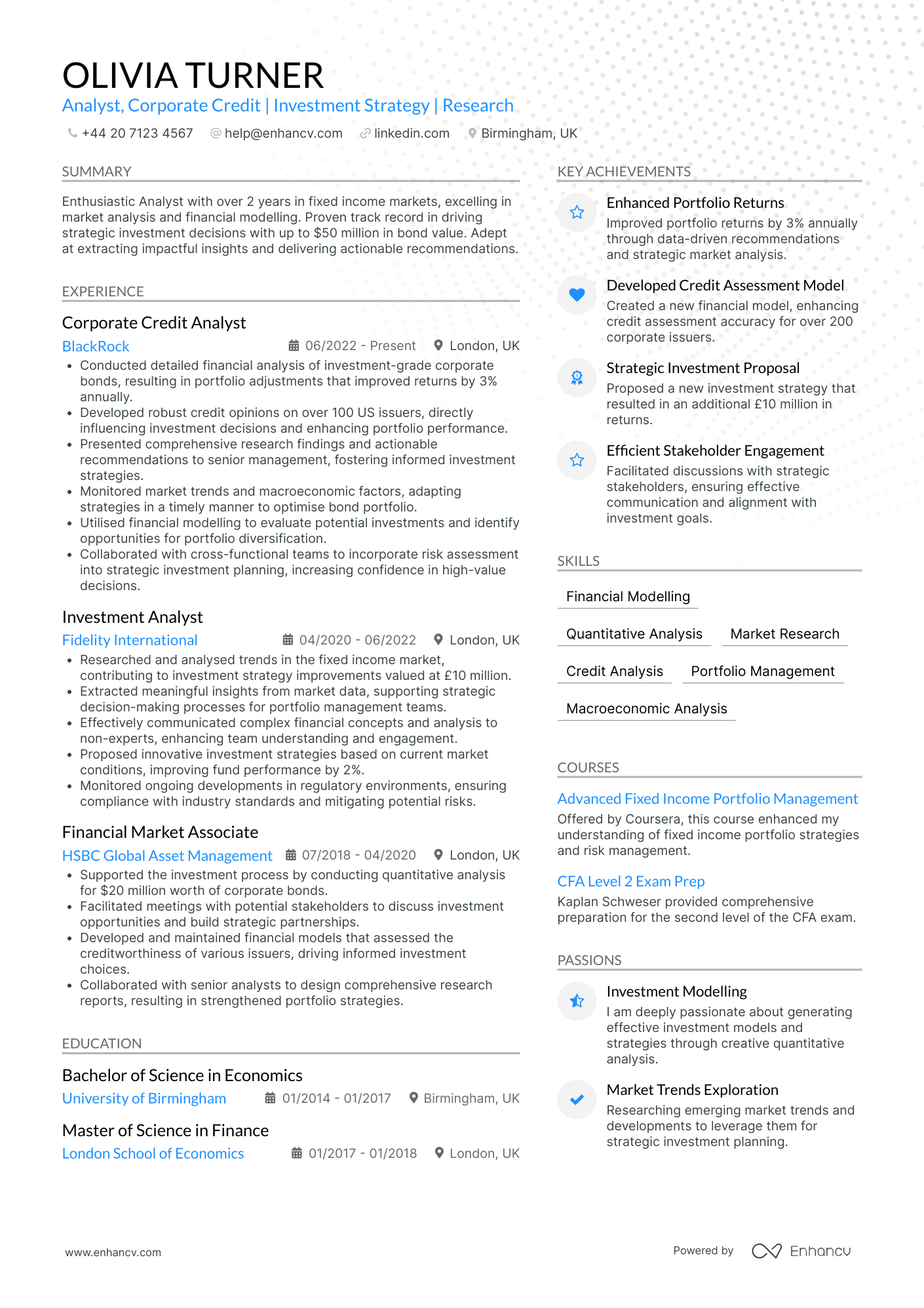

Corporate Credit Analyst

- Strategic Focus on Investment Decisions - Olivia Turner's CV clearly illustrates her strategic approach by detailing her impact on investment decisions at organizations such as BlackRock and Fidelity International. Her work led to portfolio adjustments that improved returns notably, demonstrating her ability to influence high-value outcomes effectively.

- Depth of Financial Analytical Skills - The document highlights Olivia's proficiency in financial modeling and credit analysis, with specific achievements such as developing a new credit assessment model that improved accuracy for over 200 issuers. This technical expertise underpins her capability to drive informed investment strategies and deliver impactful recommendations.

- Cross-Functional Collaboration and Soft Skills - Olivia's cross-functional experience is emphasized by her ability to collaborate with various teams, conduct stakeholder meetings, and present findings to senior management. Her effective communication skills are particularly noted in her ability to translate complex financial concepts to non-experts, ensuring alignment and understanding across different functions.

Credit Analyst Trainer

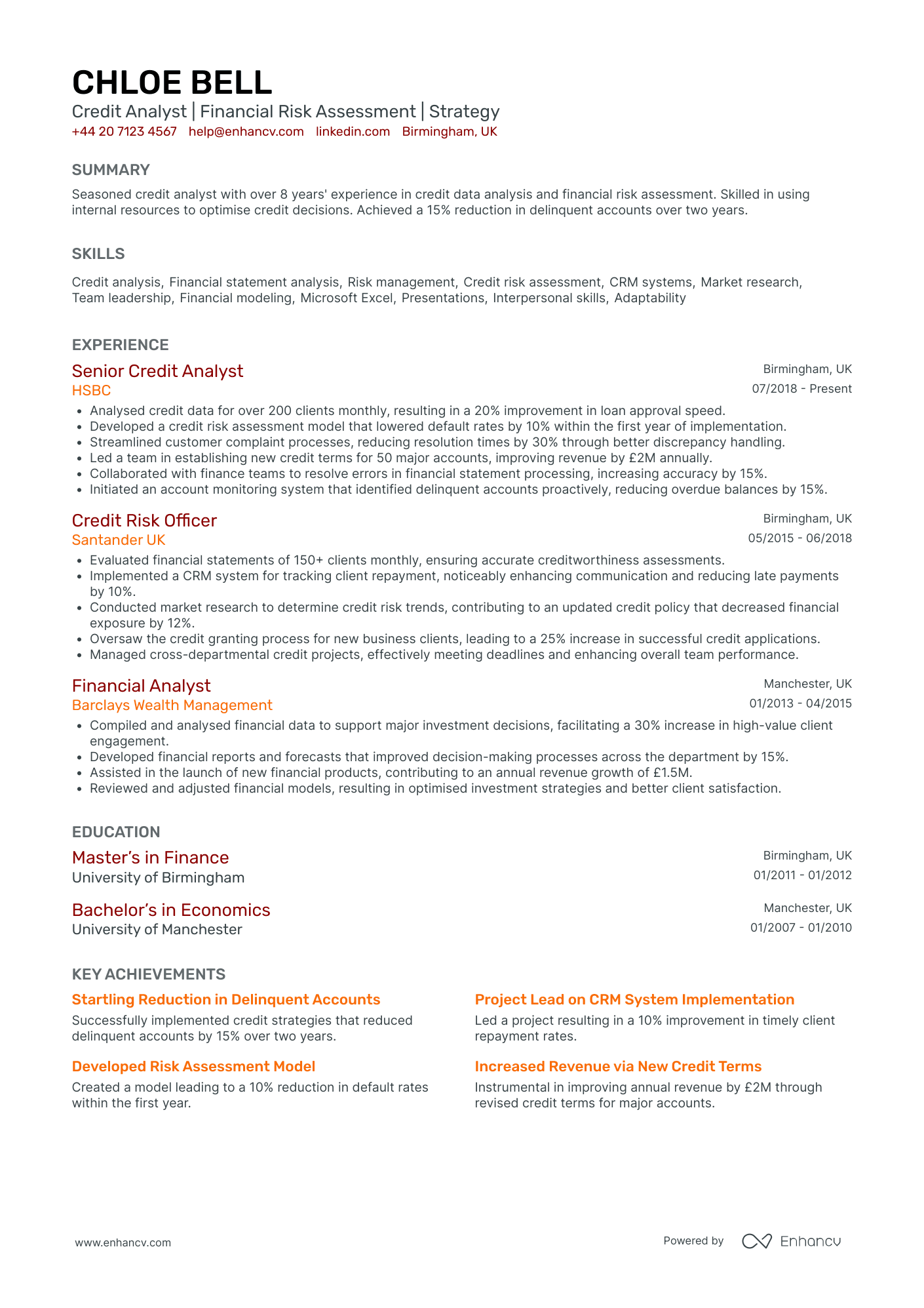

- Impressive Career Trajectory and Growth - Chloe Bell's professional journey evidences remarkable advancement, transitioning from a Financial Analyst role at Barclays Wealth Management to a Senior Credit Analyst at HSBC. Each career step represents significant skill development and responsibility increase, signifying her dedication to growth within the financial analysis and risk management fields.

- Strong Adaptability and Cross-Functional Experience - The CV highlights Chloe's ability to seamlessly work across various departments and projects. Her roles often involve collaboration with finance teams to enhance accuracy and streamline processes, suggesting a high level of adaptability and the capacity to function effectively in collaborative environments.

- Exceptional Achievements with Business Impact - Achievements listed are not merely numbers but demonstrate meaningful business impact, such as a 15% reduction in delinquent accounts and a £2M annual revenue boost through revised credit terms. These achievements prove Chloe’s effective strategic implementation and her vital role in financial decision-making contributions.

Chief Credit Analyst

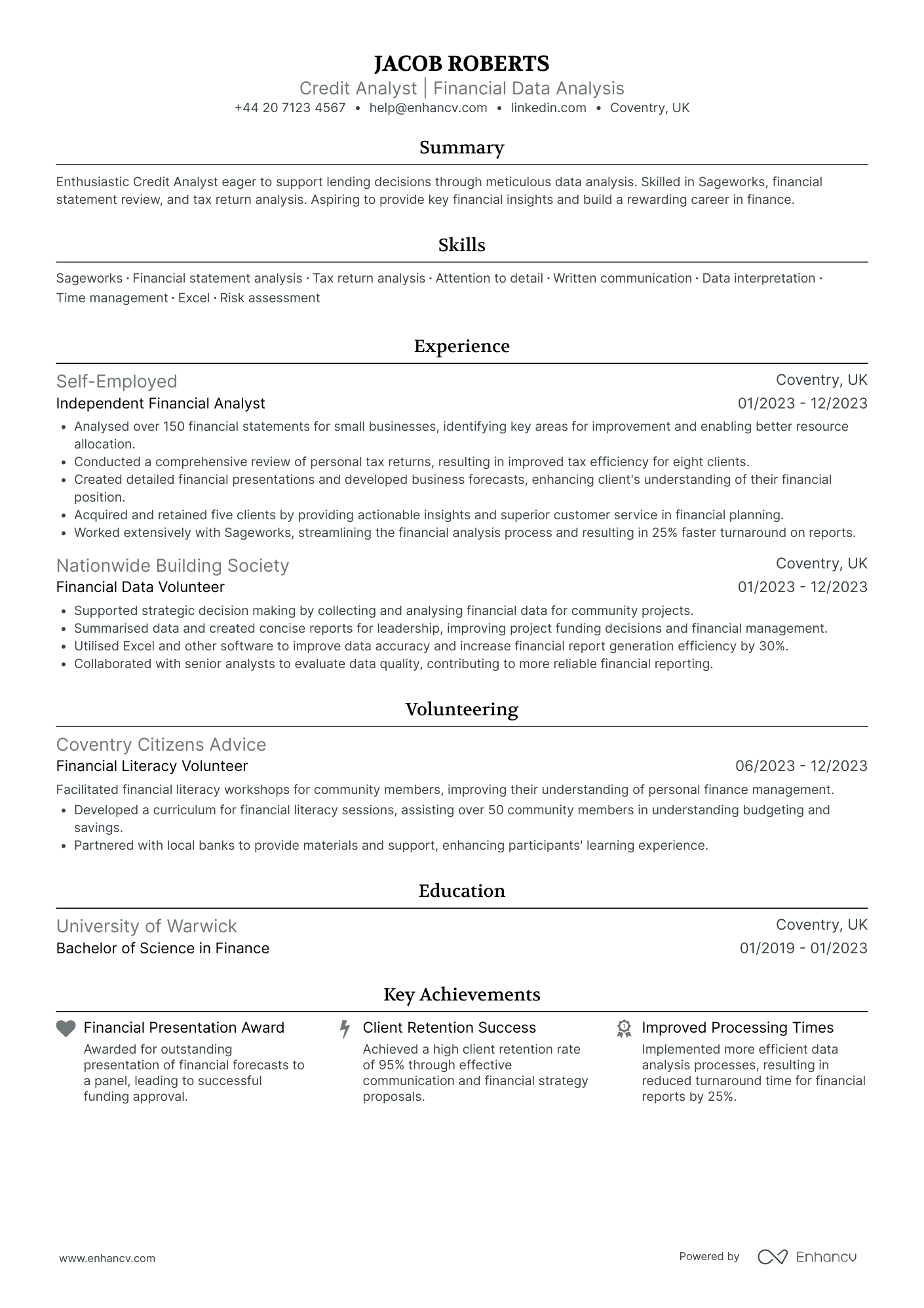

- Clear and Engaging Structure - The CV is structured in a way that presents Jacob Roberts' career accomplishments and skills with clarity and conciseness. Each section flows logically, helping the reader easily follow his impressive career path from educational background through to current executive-level achievements, emphasizing his strategic leadership abilities.

- Strategic Career Progression - Jacob’s career trajectory highlights a steady climb up the corporate ladder within the credit risk management industry. Beginning as a Credit Risk Manager and advancing to Chief Credit Officer, his promotions and roles in various prestigious banks exhibit a clear dedication to his field and an ability to adapt and excel in different environments.

- Depth in Technical and Strategic Elements - The CV showcases Jacob’s proficiency in industry-specific methodologies and tools. His expertise in risk analytics, model risk management, and cross-functional collaboration underline his technical depth and capacity to innovate within credit risk frameworks, providing significant business value and measurable improvements across his roles.

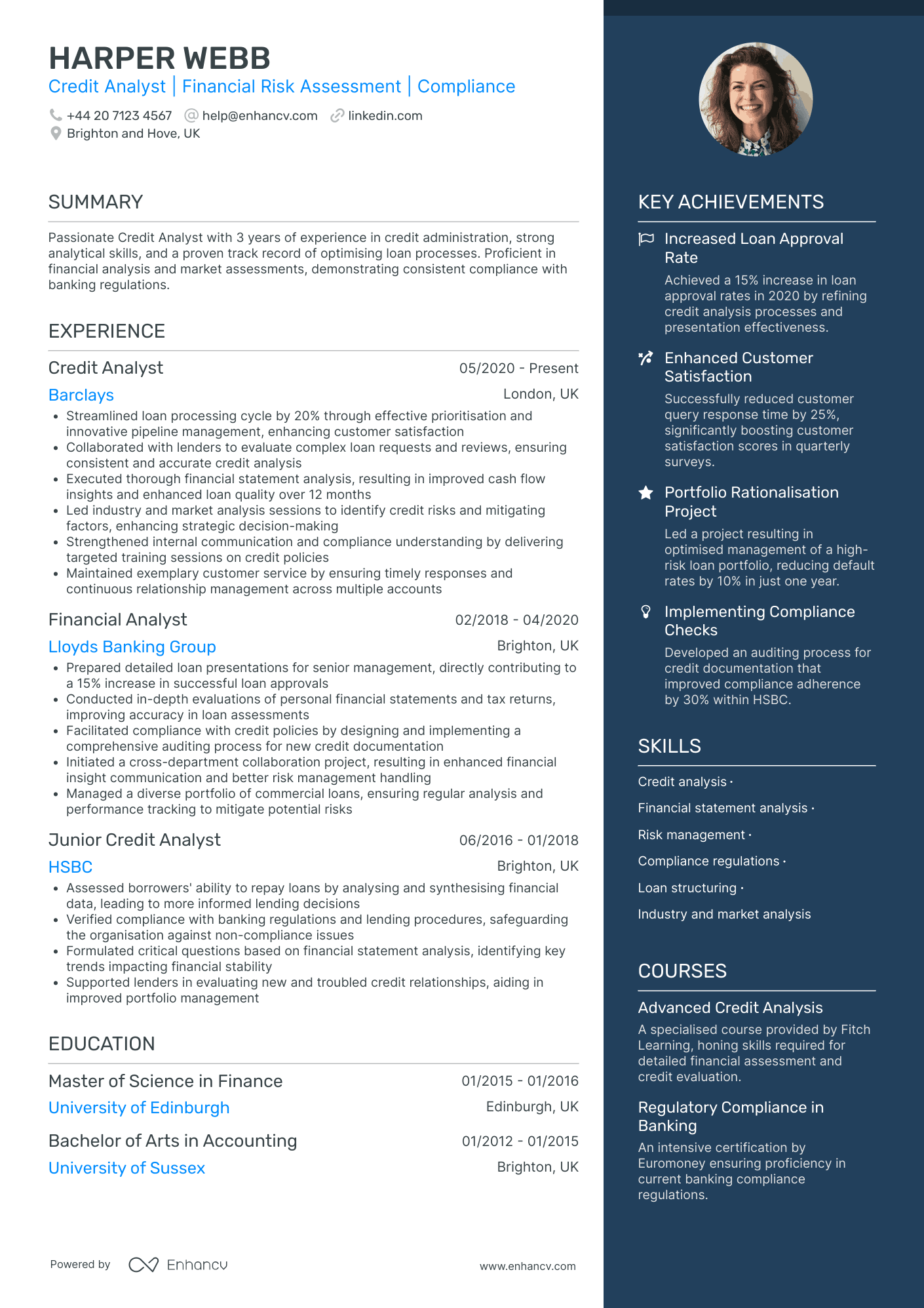

Credit Analyst Supervisor

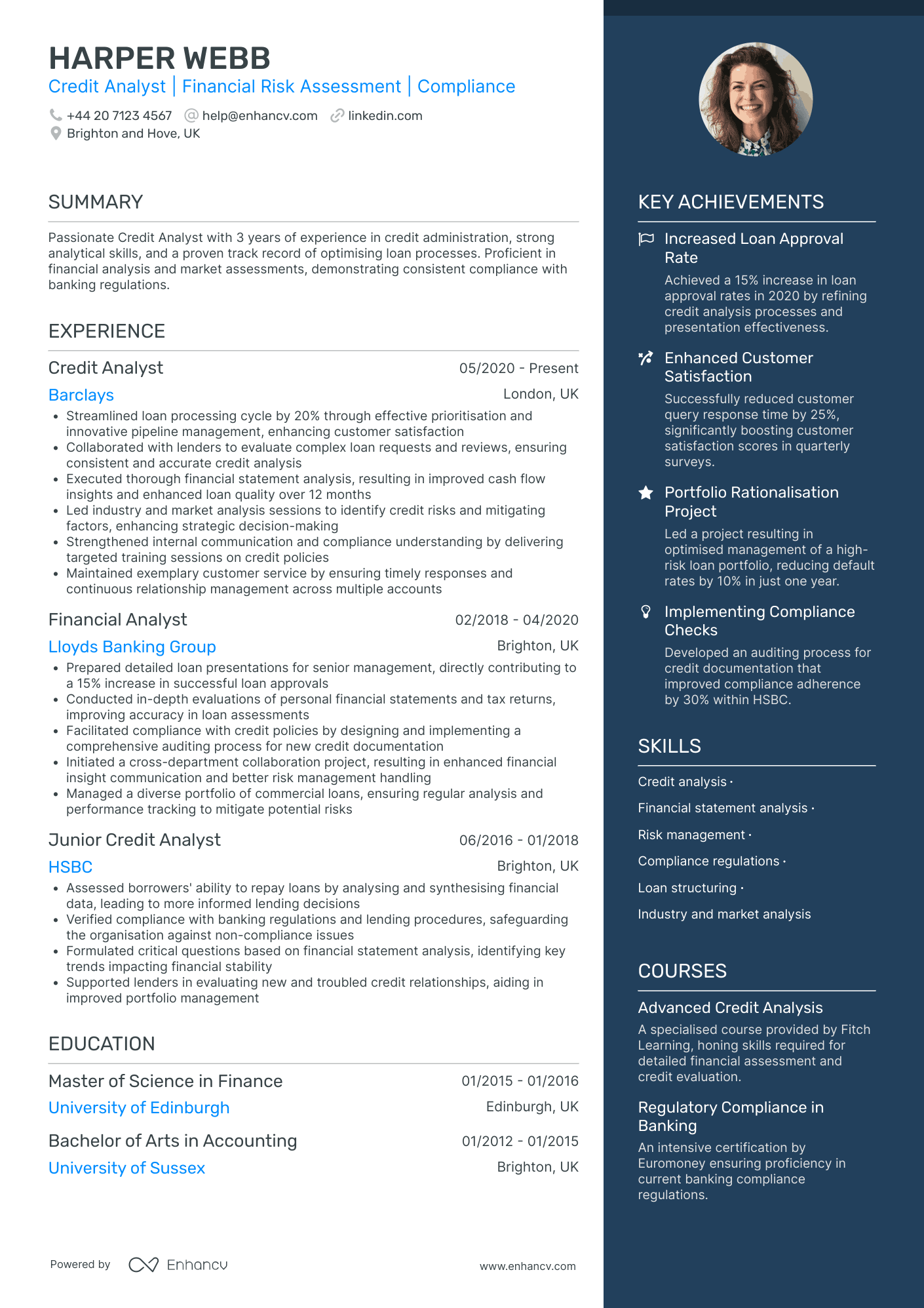

- Structured career progression with increasing responsibility - Harper Webb's career trajectory shows a clear path of advancement from a Junior Credit Analyst at HSBC to a Credit Analyst position at Barclays. This progression highlights Harper's growing expertise and leadership in credit analysis and financial risk management, underscoring their capability to take on more significant roles within the industry.

- Emphasis on compliance and regulatory acumen - The CV repeatedly showcases Harper's proficiency in compliance regulations, which is critical in the banking and finance sector. By demonstrating the implementation of auditing processes and involvement in compliance training sessions, Harper proves their dedication to safeguarding financial institutions against compliance issues, enhancing the reliability of their role.

- Significant achievement-driven impact on business outcomes - Harper Webb has achieved substantial business results, such as a 15% increase in loan approval rates and a 25% reduction in customer query response time. These achievements not only highlight Harper's ability to refine processes but also underscore their potential for enhancing customer satisfaction and operational efficiency within their teams and organizations.

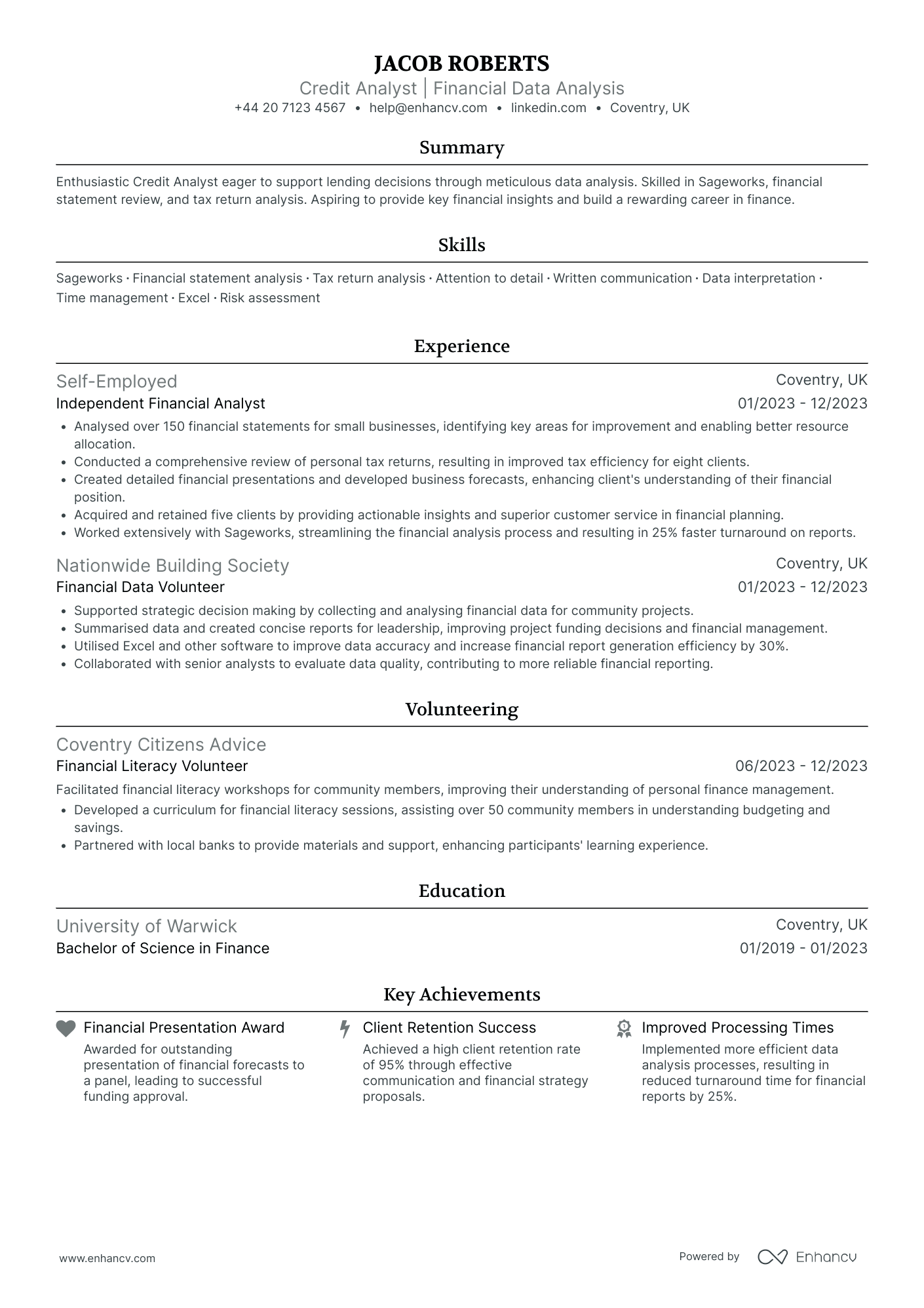

International Credit Analyst

- Concise and methodically structured presentation - The CV presents information in a clear and orderly fashion, allowing readers to easily navigate through sections such as experience, education, skills, and volunteering. Each section is concise, making it straightforward for hiring managers to quickly evaluate the candidate's qualifications and relevance for the role.

- Strong emphasis on adaptability and cross-functional experience - Jacob has demonstrated adaptability and the ability to work cross-functionally through varied experiences such as volunteering at Nationwide Building Society and working independently as a financial analyst. This showcases his capacity to adjust to different organizational environments and contribute effectively across projects.

- Highlighting industry-specific tools and technical acumen - The CV effectively showcases Jacob’s proficiency in industry-specific tools like Sageworks and Excel, essential for data interpretation and financial analysis. The inclusion of specialized courses in Sageworks Credit Analysis and Advanced Financial Modelling further underscores his technical depth and preparedness for a credit analyst role.

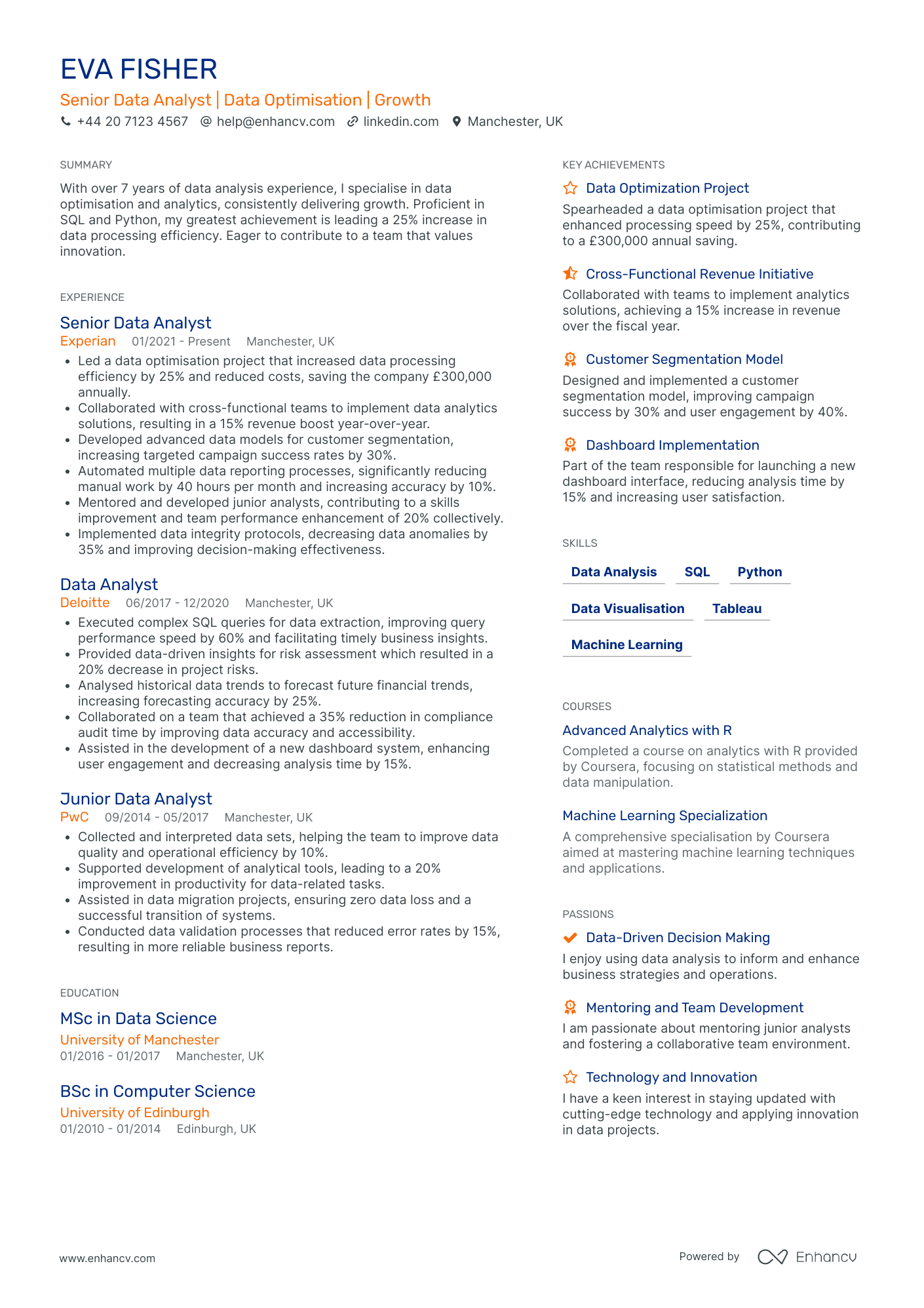

Credit Analyst Consultant

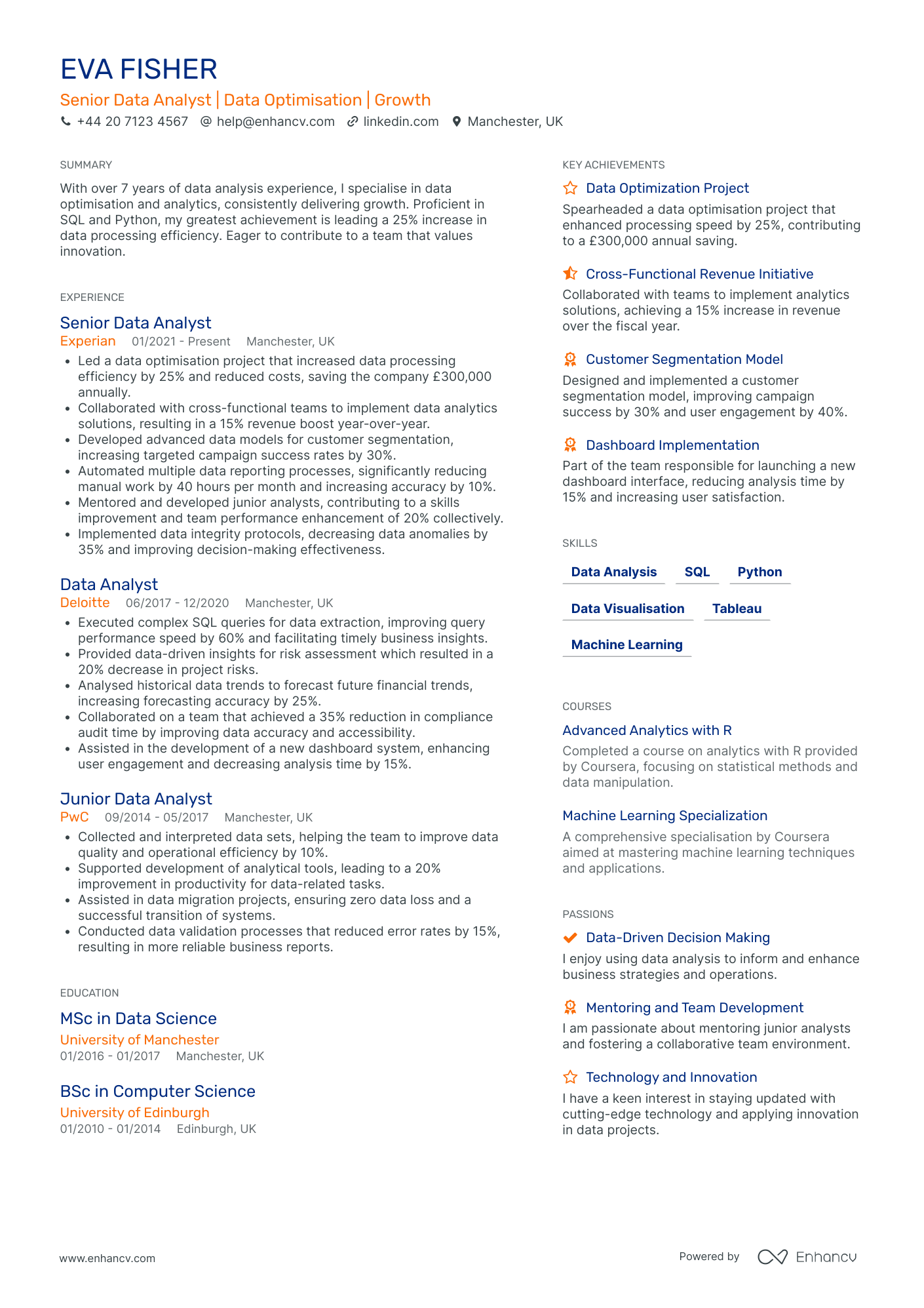

- Structured and Clear Presentation - Eva Fisher's CV is well-structured and presented with clarity. Each section is neatly organized, making it easy to navigate through her professional journey. The use of concise bullet points and quantified achievements offers a quick yet comprehensive understanding of her capabilities and contributions.

- Notable Career Growth and Specialization - The CV illustrates Eva's steady career progression, from a Junior Data Analyst to a Senior Data Analyst. Her continuous growth within reputable companies like PwC, Deloitte, and Experian shows her ability to thrive and excel in her field. It is evident that her expertise in data optimization and strategic analysis has been honed over time, reflecting both dedication and skill enhancement.

- Impactful Achievements with Significant Business Relevance - Eva's achievements are not just presented as numbers but encapsulate significant business impact. Her leadership in projects that resulted in substantial cost savings, revenue growth, and efficiency improvements underlines her strategic influence. These accomplishments are directly aligned with business goals, showcasing her ability to drive meaningful results that contribute to organizational success.

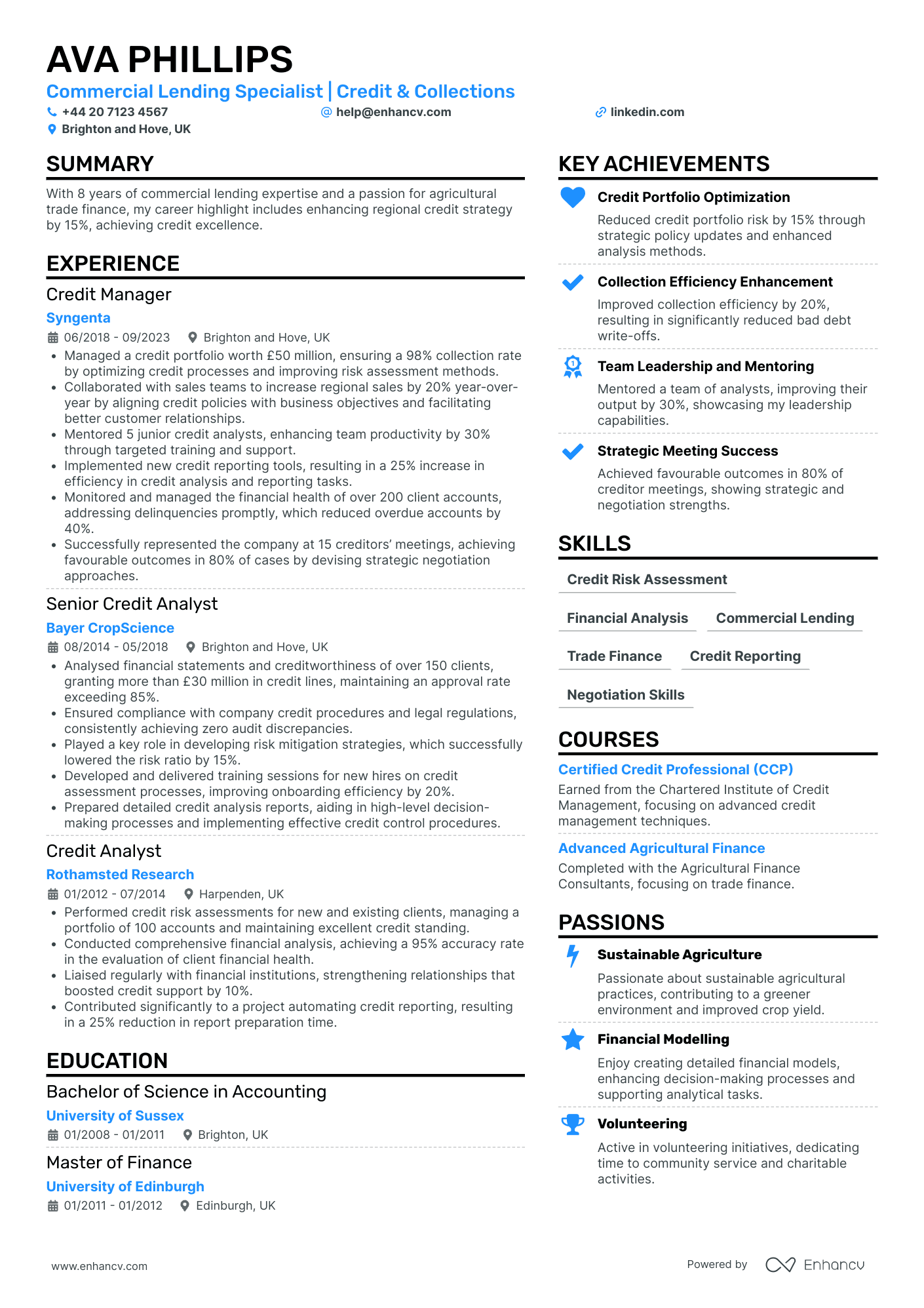

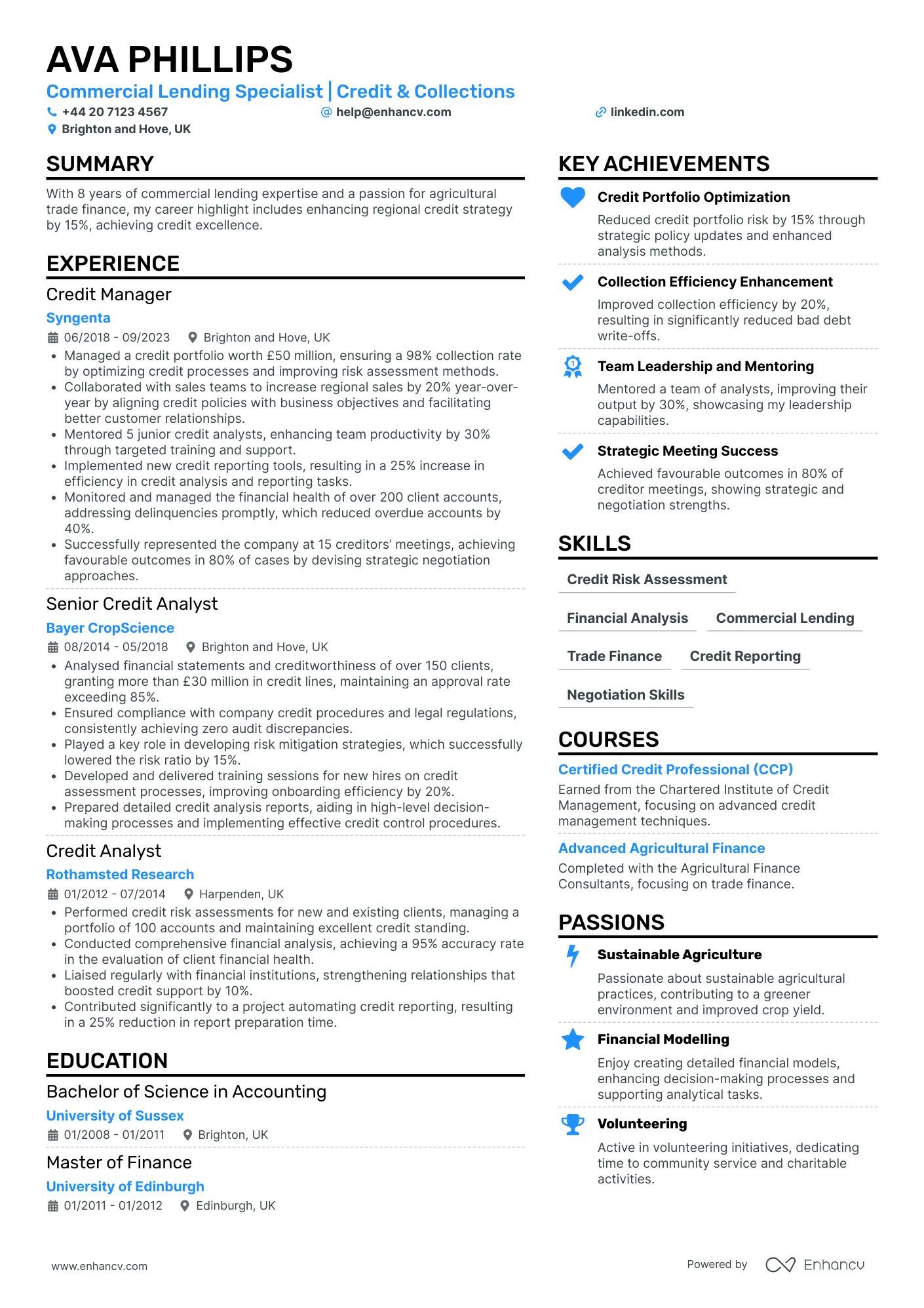

Credit Analyst Manager

- Clear and Concise Content Presentation - The CV is structured logically, presenting information in a way that is easy to follow. Each section is clearly marked and concisely written, ensuring that even complex career details are easily digestible. This enhances accessibility and allows hiring managers to quickly identify key qualifications and achievements.

- Strong Career Trajectory and Progression - Ava Phillips' career demonstrates consistent growth, moving from a Credit Analyst to a Credit Manager role over a span of eight years. This progression within reputable companies such as Syngenta and Bayer CropScience showcases her ability to adapt and excel within the commercial lending and finance industry.

- Industry-Specific Expertise and Tools - The CV highlights Ava's proficiency with credit reporting tools and methodologies that have directly contributed to efficiencies. Her involvement in automating credit reporting processes and implementing new credit reporting tools sets her apart by emphasizing her technical depth and forward-thinking approach in financial analysis.

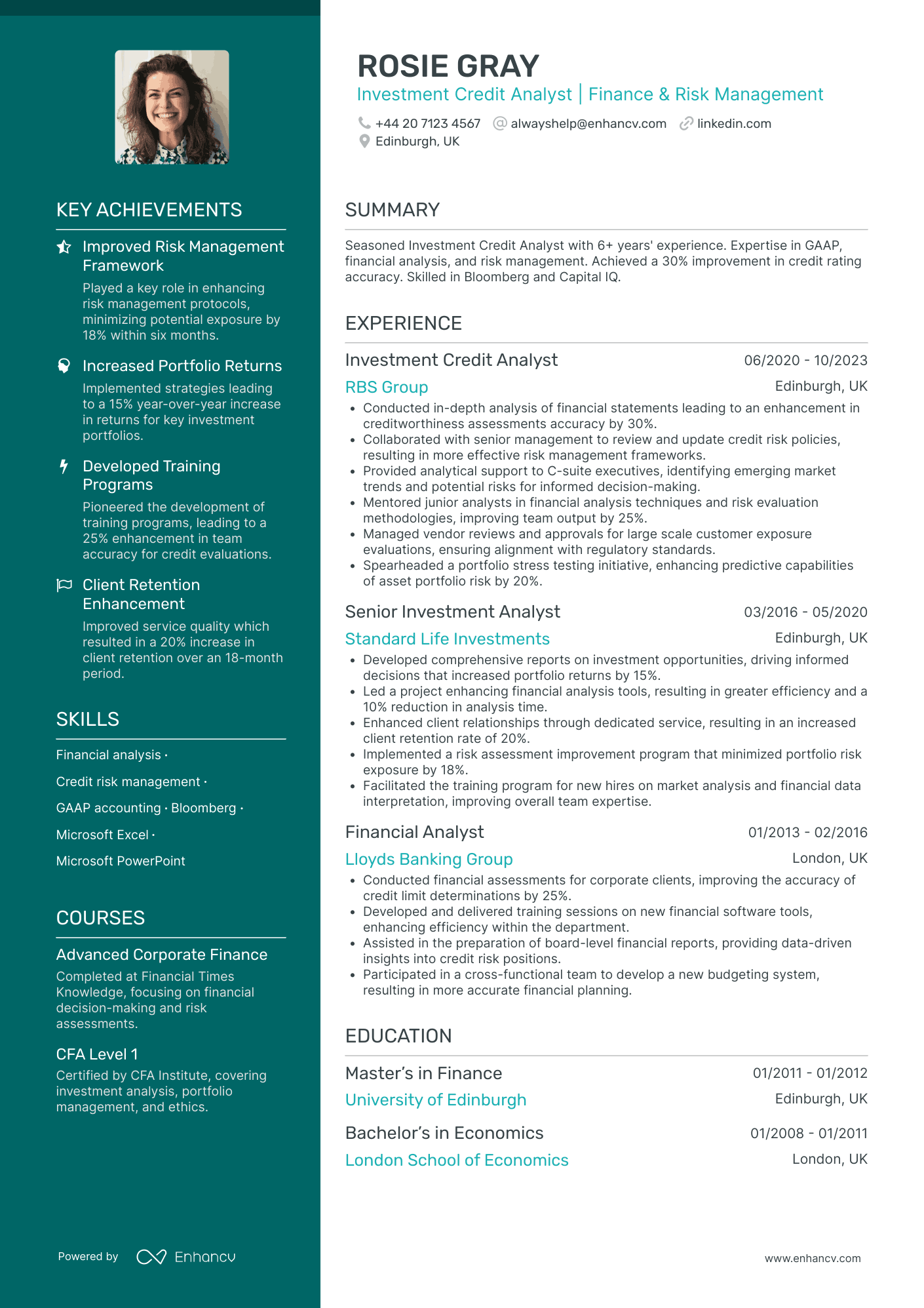

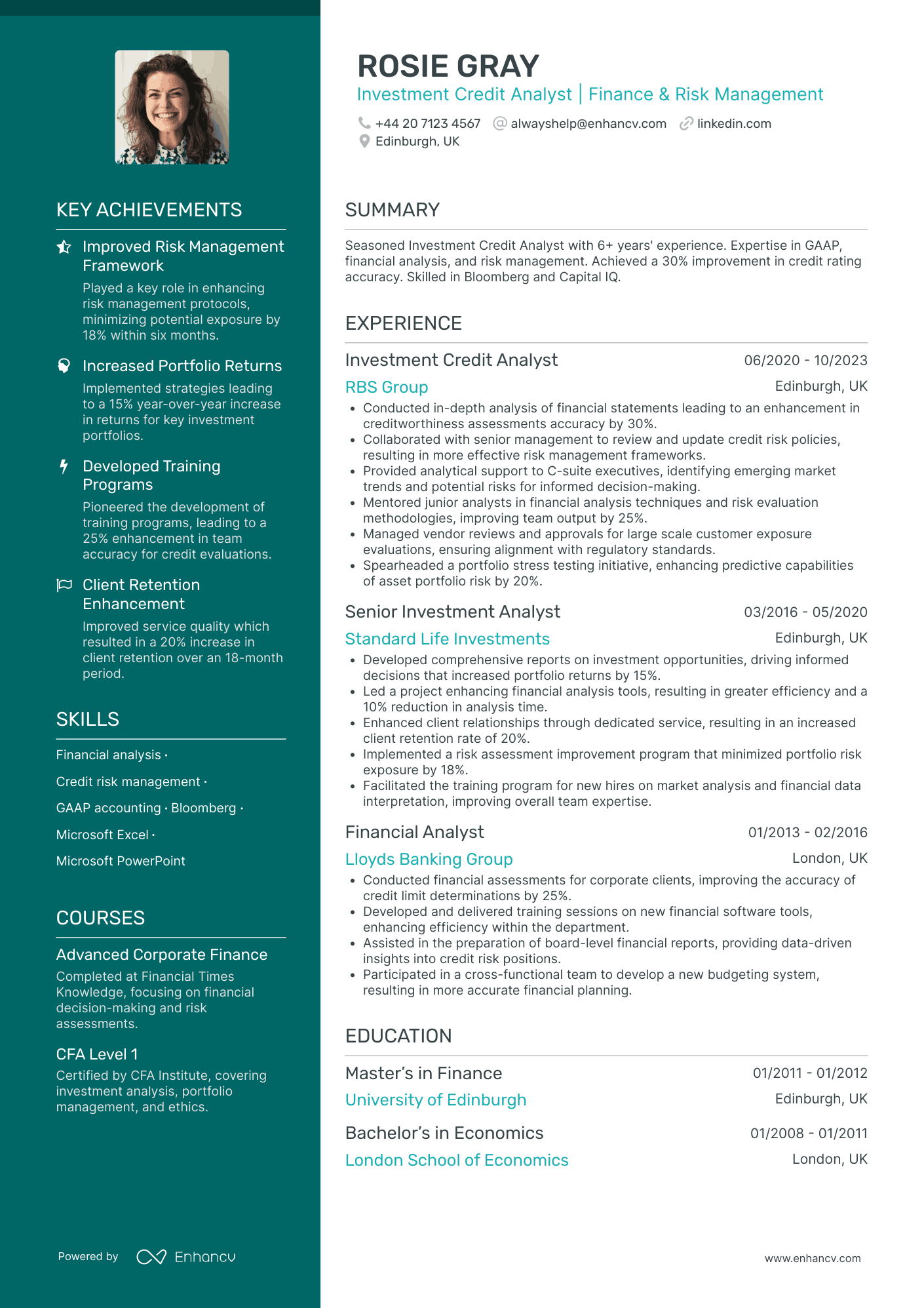

Investment Credit Analyst

- Clarity and Strategic Structure - The CV is expertly structured to deliver key information succinctly. Each section is organized to highlight important aspects of the candidate's career in a seamless flow—from a compelling summary to detailed experience entries, swiftly conveying expertise and relevant skills.

- Solid Career Progression - Rosie Gray's career trajectory demonstrates a steady advancement in the field of financial analysis and risk management. Moving from a Financial Analyst at Lloyds Banking Group to a prominent role as an Investment Credit Analyst at RBS Group indicates increasing responsibility and specialization in credit analysis.

- Technical Expertise and Industry Tools - The CV highlights Rosie’s proficiency in industry-standard tools such as Bloomberg and Capital IQ, essential for an investment credit analyst. Her knowledge of these platforms, coupled with risks assessment techniques and GAAP accounting, solidifies her technical competence in the finance field.

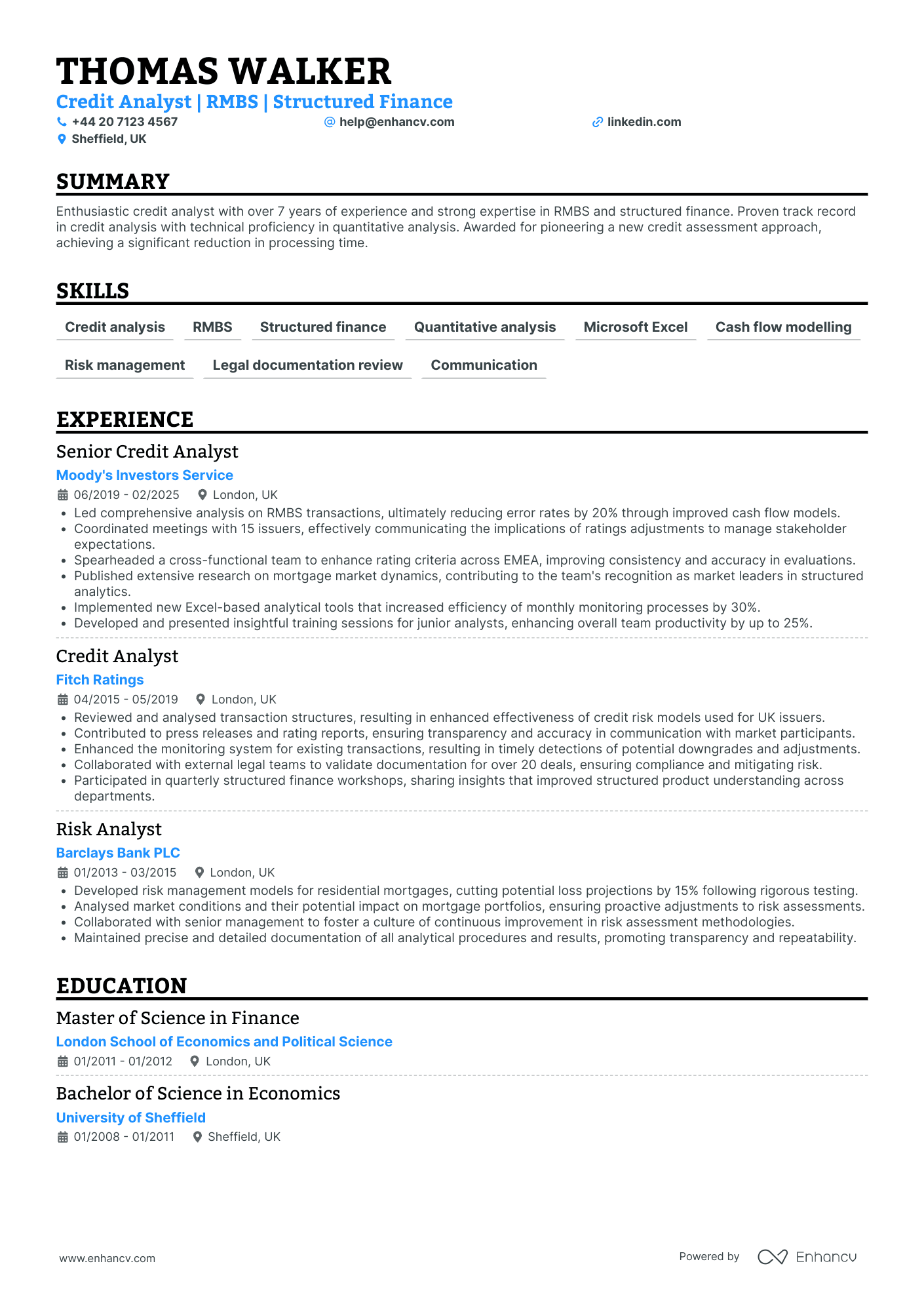

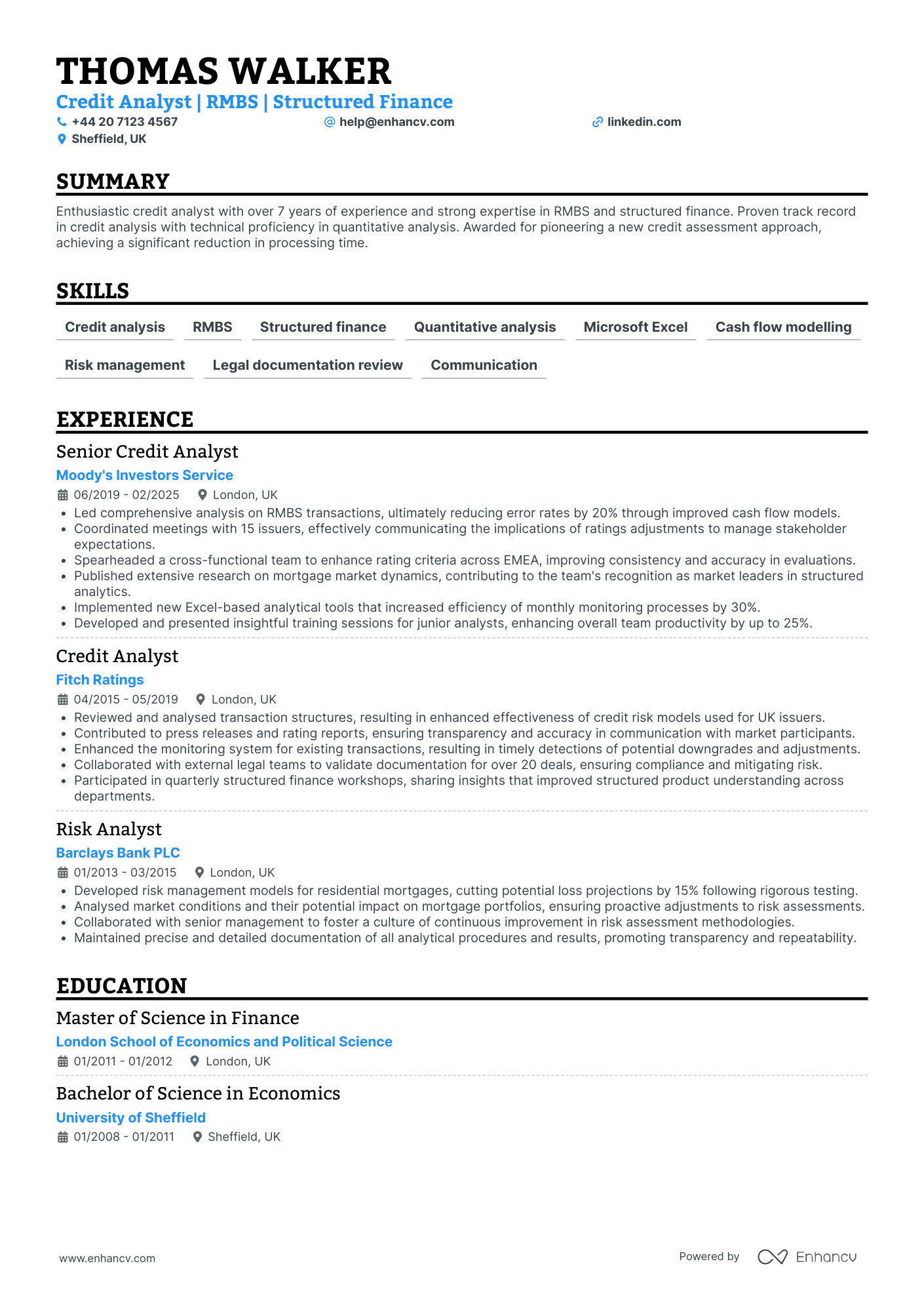

Credit Analyst Director

- Clear and Structured Presentation - The CV is well-organized with distinct sections such as summary, experience, education, skills, and achievements. This structure helps the reader quickly ascertain key information and chronological career progressions, ensuring clarity and conciseness in conveying the candidate’s qualifications.

- Demonstrated Career Growth - Thomas Walker’s career trajectory shows a clear progression from Risk Analyst to Senior Credit Analyst, highlighting his advancement and increasing responsibility in the field of structured finance. This upward mobility indicates strong performance and a commitment to professional development within the industry.

- Innovative Methodologies and Technical Competence - The CV emphasizes Thomas's pioneering approach to credit assessments and his expertise in RMBS, showcasing the candidate's ability to innovate and apply advanced quantitative analysis techniques. His proficiency with tools like Microsoft Excel for cash flow modeling further highlights his technical skills within structured finance.

Credit Operations Analyst

- Structured Presentation of Experience and Achievements - The CV is well-organized with clearly delineated sections for work experience, education, and skills. Each bullet point under the experience section outlines specific actions and impacts, making it straightforward to grasp the candidate's contributions and successes. There's no unnecessary information, ensuring the content is concise and targeted.

- Strong Demonstrations of Cross-Functional Experience and Adaptability - The candidate has shown adaptability by handling different roles and responsibilities, from credit operations to treasury functions and investment research. This cross-functional experience indicates their ability to work in various financial environments and collaborate effectively with different teams to achieve organizational goals.

- Technical Proficiency and Industry-Specific Knowledge - The CV highlights proficiency in Microsoft Office and Excel, along with specialized courses in credit risk analysis and financial analysis. These elements suggest not just a surface-level understanding but an in-depth grasp of industry-specific tools and methodologies that are crucial for roles in credit operations and financial analysis. This technical depth complements their analytical skills and understanding of complex financial markets.

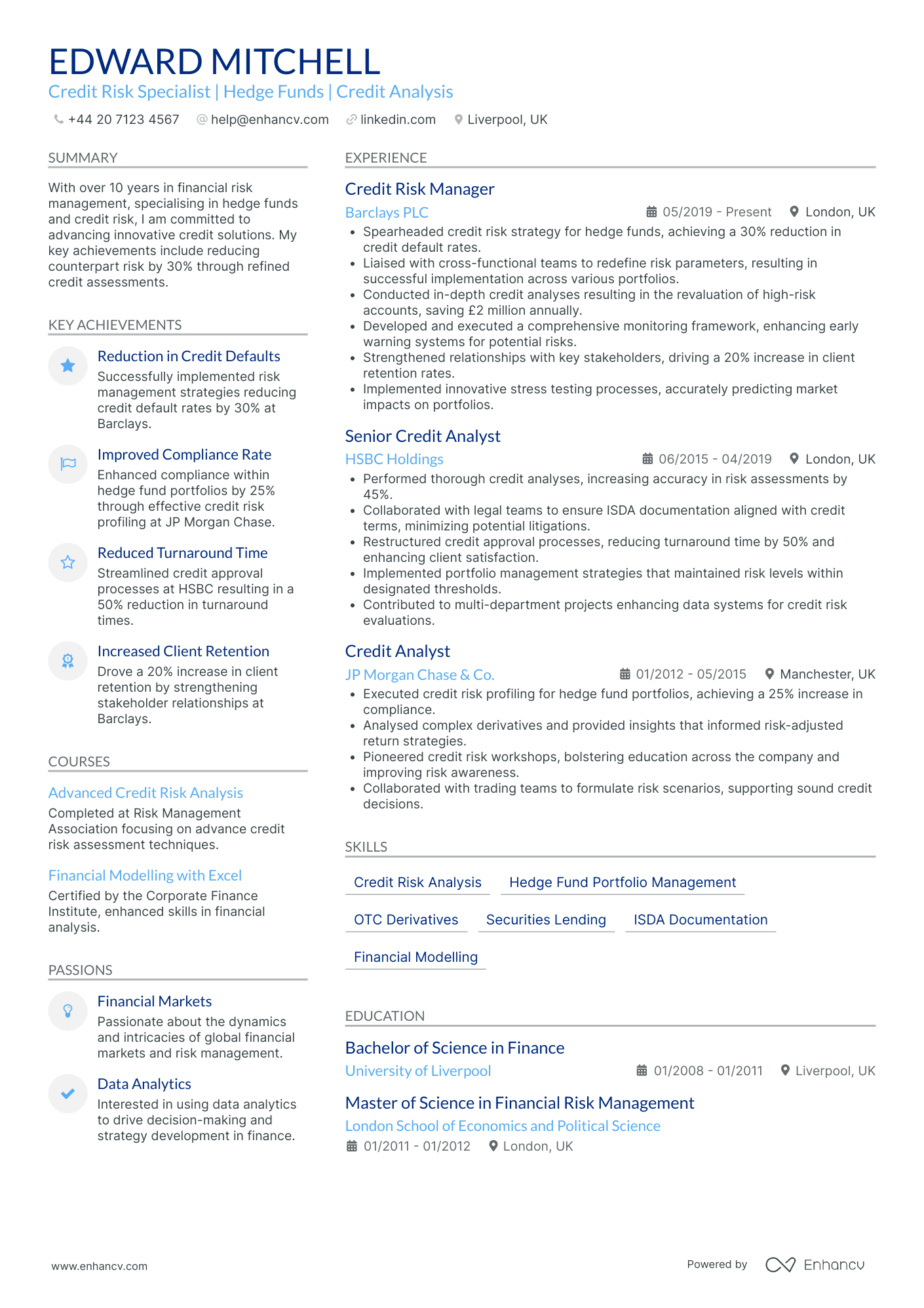

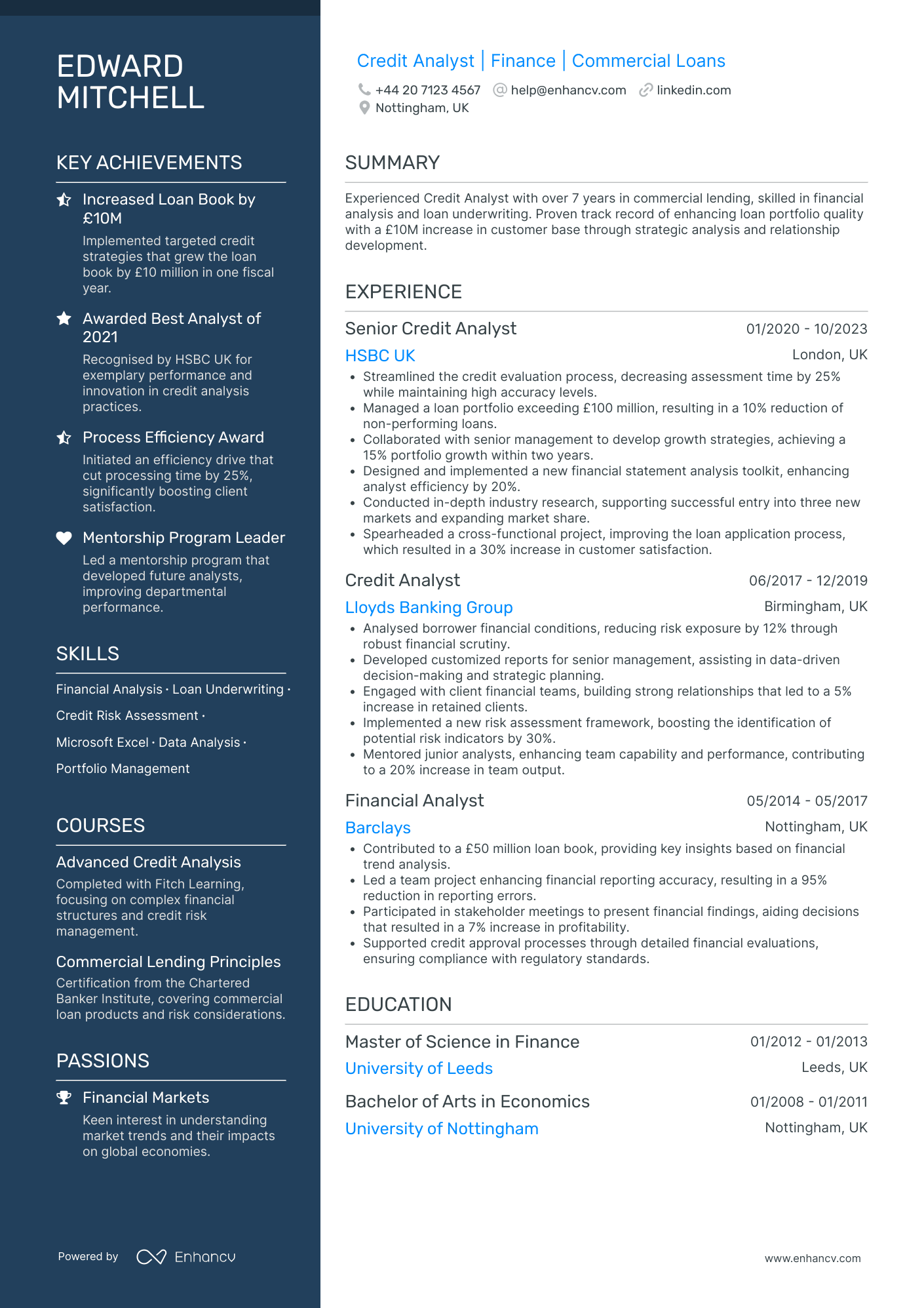

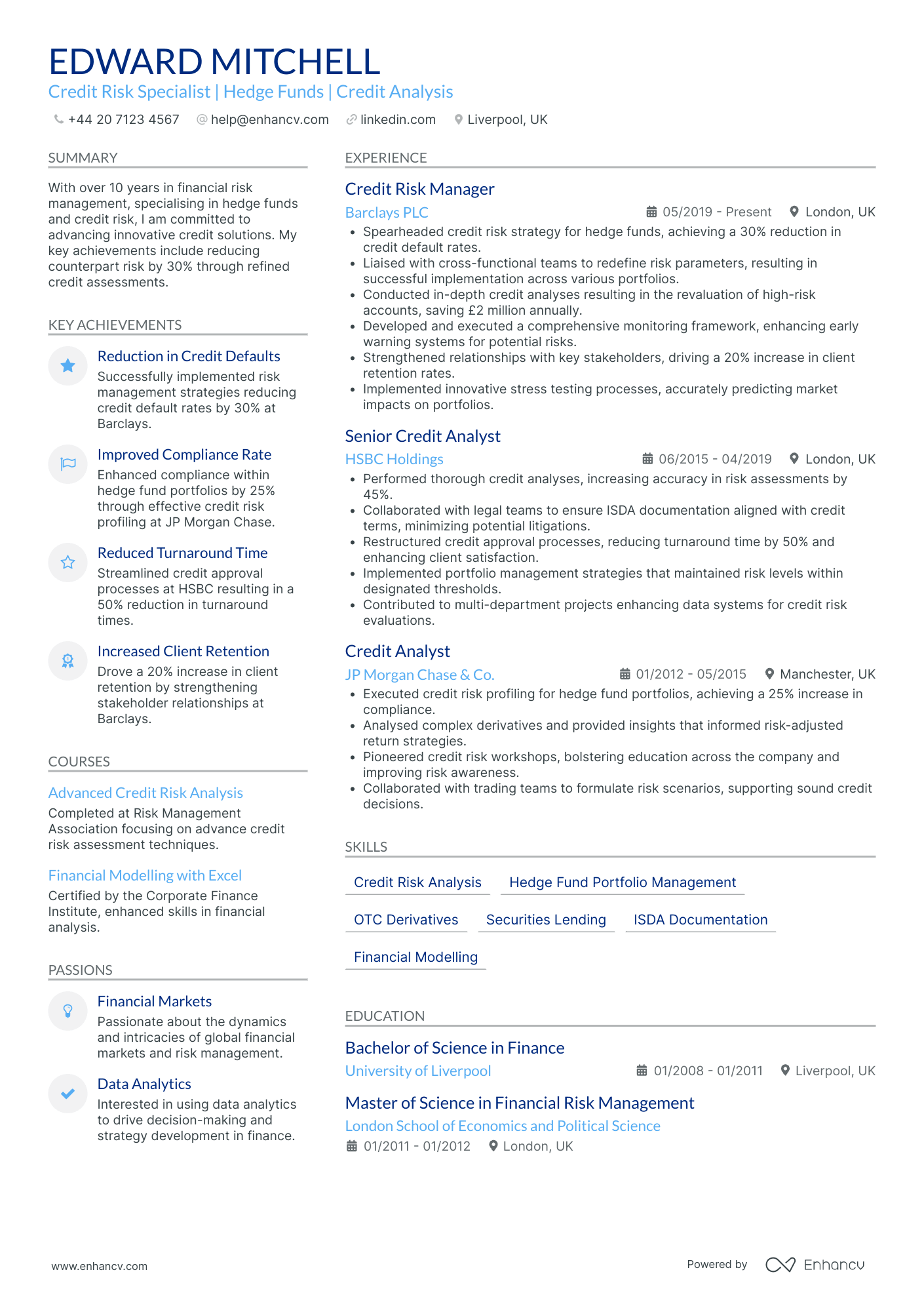

Credit Analyst Vice President

- Structured educational and professional journey - The CV guides the reader smoothly through Edward Mitchell's educational accomplishments leading to a field-specific master's degree, accentuating the academic preparation that supports his specialized career in credit risk management.

- Progressive career advancement - Edward’s career illustrates notable upward mobility, transitioning from Credit Analyst roles to a management position, reflecting a trajectory of growing responsibilities and influence in esteemed financial institutions like JP Morgan Chase, HSBC, and Barclays.

- Strategic risk management achievements - The CV succinctly demonstrates Edward’s remarkable contributions to reducing credit default rates by 30% at Barclays, not only presenting numbers but also framing them as impactful strategic initiatives that improved the company’s overall risk profile.

Structuring your credit analyst CV layout: four factors to keep in mind

There are plenty of best practices out there for your CV layout and design. At the end of the day, a clear format and concise CV message should be your top priority. Use your CV design to enhance separate sections, bringing them to the forefront of recruiters' attention. At the same time, you can write content that:

- Follows the reverse chronological order in the experience section by first listing your most recent jobs;

- Incorporates your contact information in the header, but do skip out on the CV photo for roles in the UK;

- Is spotlighted in the most important sections of your CV, e.g. the summary or objective, experience, education, etc. to show just how you meet the job requirements;

- Is no longer than two-pages. Often, the one-page format can be optimal for your credit analyst CV.

Before submitting your CV, you may wonder whether to export it in Doc or PDF. With the PDF format, your information and layout stay intact. This is quite useful when your CV is assessed by the Applicant Tracker System (or the ATS) . The ATS is a software that scans your profile for all relevant information and can easily understand latest study on the ATS , which looks at your CV columns, design, and so much more.

PRO TIP

For certain fields, consider including infographics or visual elements to represent skills or achievements, but ensure they are simple, professional, and enhance rather than clutter the information.

The top sections on a credit analyst CV

Contact Information is crucial for communication. It includes name, phone number, email, and LinkedIn profile.

Professional Summary highlights experience and skills. It gives a quick overview of the credit analyst's qualifications.

Work Experience details past roles and achievements. This section outlines relevant job history and accomplishments in finance.

Education reflects academic background. It lists degrees and certifications pertinent to credit analysis and finance.

Key Skills showcase relevant abilities. This section includes financial analysis, risk assessment, and software proficiency.

What recruiters value on your CV:

- Highlight your proficiency in financial analysis by showcasing experience with financial modelling, credit risk assessments, and usage of analytical software pertinent to credit analysis roles such as Moody's Analytics or Bloomberg.

- Emphasise your understanding of credit instruments and markets, including bonds, loans, and credit derivatives, and detail your ability to perform in-depth sector or company-specific research.

- Demonstrate your attention to detail and accuracy by mentioning any past work where you successfully identified risks that led to improved lending decisions or risk mitigation strategies.

- Showcase your communication skills by describing instances where you clearly conveyed credit recommendations or risk assessments to senior management, credit committees, or clients.

- Include any relevant certifications such as the CFA or FRM, and continuous professional development courses that are related to credit analysis, financial markets, or risk management.

Recommended reads:

Our checklist for the must-have information in your credit analyst CV header

Right at the very top of your credit analyst CV is where you'd find the header section or the space for your contact details, headline, and professional photo. Wondering how to present your the name of the city you live in and the country abbreviation as your address;

- are tailored to the role you're applying for by integrating key job skills and requirements;

- showcase what your unique value is, most often in the form of your most noteworthy accomplishment;

- select your relevant qualifications, skills, or current role to pass the Applicant Tracker System (ATS) assessment. Still not sure how to write your CV headline? Our examples below showcase best practices on creating effective headlines:

Examples of good CV headlines for credit analyst:

- Credit Risk Analyst | Certified FRM | Financial Modelling & Analysis | 5+ Years' Experience

- Senior Credit Analyst | Portfolio Management Specialist | CFA Level II | 10 Years in Banking

- Credit Underwriter | SME Lending Expert | Credit Risk Mitigation | 8 Years' Sector Experience

- Credit Risk Officer | Data Analytics & Reporting | Basel III Proficient | 6 Years' Professional Insight

- Lead Credit Strategy Analyst | MSc in Finance | Regulatory Compliance | 12 Years' Industry Leadership

- Junior Credit Risk Assessor | Graduate Diploma in Risk Management | Emerging Markets Interest | 2 Years Dedicated Service

Choosing your opening statement: a credit analyst CV summary or objective

At the top one third of your CV, you have the chance to make a more personable impression on recruiters by selecting between:

- Summary - or those three to five sentences that you use to show your greatest achievements. Use the CV summary if you happen to have plenty of relevant experience and wish to highlight your greatest successes;

- Objective - provides you with up to five sentences to state your professional aims and mission in the company you're applying for

CV summaries for a credit analyst job:

Narrating the details of your credit analyst CV experience section

Perhaps you've heard it time and time again, but, how you present your experience is what matters the most. Your CV experience section - that details your work history alongside your accomplishments - is the space to spotlight your unqiue expertise and talents. So, avoid solely listing your responsibilities, but instead:

- adverts' keywords and integrate those in your experience section;

- Use your CV to detail how you've been promoted in the past by including experience in the reverse chronological order.

Before you start writing your credit analyst CV experience section, dive into some industry-leading examples on how to structure your bullets.

Best practices for your CV's work experience section

- Analytically reviewed borrowers' financial statements and credit history to assess creditworthiness and recommend limits based on risk assessments and credit policy guidelines.

- Developed complex financial models to simulate various economic scenarios and forecast future financial performance, aiding in the structured credit decision-making process.

- Successfully managed credit portfolios comprising SMEs and corporate accounts, consistently monitoring for signs of credit deterioration and taking proactive measures to mitigate potential losses.

- Collaborated effectively with cross-functional teams, including risk management, sales, and operations, to align credit strategies with business objectives and operational capabilities.

- Prepared and presented detailed credit reports and loan proposals to senior management and credit committees, articulating the risks and merits of lending propositions.

- Led due diligence efforts to verify the accuracy of financial information provided by potential borrowers, unearthing critical findings that influenced credit conclusions.

- Regularly updated credit and loan documentation, ensuring compliance with regulatory standards and internal policies, thereby minimising operational risks and improving audit results.

- Actively monitored market trends and economic indicators to adjust loan pricing strategies and competitive positioning within the credit market.

- Designed and implemented credit policies and procedures that streamlined the approval process, reduced inefficiencies, and contributed to a culture of credit excellence within the organisation.

- Conducted rigorous financial analyses on mid-market companies, performing cash flow modeling and creating detailed projections to assess creditworthiness.

- Collaborated with senior analysts on a $500-million corporate debt offering, contributing to due diligence efforts and the development of investment theses.

- Improved efficiency by spearheading the implementation of a new risk assessment software that reduced analysis time by 25%.

- Design and maintain complex credit risk models for high-profile client portfolios, helping to manage a portfolio exceeding $3 billion in revolving credit lines.

- Lead a team of junior analysts, fostering professional development through mentorship, resulting in a 15% increase in team productivity.

- Conduct in-depth sector risk reviews quarterly, enabling the organization to adjust credit strategies ahead of market trends and minimize exposure in volatile sectors.

- Completed comprehensive credit analyses on a range of SMEs leading to the identification of 20% more viable lending opportunities compared to the previous year.

- Developed and implemented a new analytical framework for evaluating the creditworthiness of startups, enhancing portfolio diversity.

- Regularly presented findings and recommendations to executive management that directly influenced credit decision-making processes.

- Effectively managed a credit portfolio of over $200 million, ensuring compliance with internal and regulatory standards.

- Created a streamlined underwriting process for small business loans which increased processing speed by 30%.

- Acted as the key point of contact for interdepartmental communications regarding clients' financial status and risks.

- Developed expertise in financial statement analysis and applied this to evaluating the creditworthiness of potential borrowers in the retail industry.

- Rolled out a risk-rating system tailored to the agricultural sector that optimized the lender's portfolio for seasonal fluctuations.

- Provided training to new hires on credit analysis tools and methodologies, leading to standardized reporting practices across the team.

- Directed a project to integrate AI into credit scoring models which enhanced predictive accuracy by 20%.

- Pioneered a behavioral analytics program that identified early signs of default among existing borrowers, reducing bad debt by 10%.

- Actively engaged with cross-functional teams to fine-tune lending criteria and risk parameters for the bank's fintech partnerships.

- Assisted with the analysis and credit review of a $100 million commercial loan portfolio, ensuring a delinquency rate below industry average.

- Implemented a revised set of financial covenants for medium-term loans that improved the bank's position on collateral recovery.

- Played a pivotal role in the restructuring of credit terms for struggling business accounts, aiding in their financial recovery and retaining them as clients.

- Mastered various financial modeling techniques to evaluate different types of debt structures and their impact on company valuations.

- Instrumental in the development of an early warning system identifying credit deterioration, which reduced provision for loan losses by 5%.

- Chaired the quarterly credit committee meetings, consolidating cross-departmental insights and aligning credit policies with market conditions.

- Led the credit evaluation for a portfolio transition involving over 1,000 individual credit facilities during a major acquisition.

- Provided detailed investment-grade and high-yield credit research that supported the firm's participation in syndicated loan facilities.

- Engaged with institutional investors on credit positioning, offering insights that shaped investment strategies in alignment with economic cycles.

Writing your CV without professional experience for your first job or when switching industries

There comes a day, when applying for a job, you happen to have no relevant experience, whatsoever. Yet, you're keen on putting your name in the hat. What should you do? Candidates who part-time experience , internships, and volunteer work.

Recommended reads:

PRO TIP

Talk about any positive changes you helped bring about in your previous jobs, like improving a process or helping increase efficiency.

Describing your unique skill set using both hard skills and soft skills

Your credit analyst CV provides you with the perfect opportunity to spotlight your talents, and at the same time - to pass any form of assessment. Focusing on your skill set across different CV sections is the way to go, as this would provide you with an opportunity to quantify your achievements and successes. There's one common, very simple mistake, which candidates tend to make at this stage. Short on time, they tend to hurry and mess up the spelling of some of the key technologies, skills, and keywords. Copy and paste the particular skill directly from the job requirement to your CV to pass the Applicant Tracker System (ATS) assessment. Now, your CV skills are divided into:

- Technical or hard skills, describing your comfort level with technologies (software and hardware). List your aptitude by curating your certifications, on the work success in the experience section, and technical projects. Use the dedicated skills section to provide recruiters with up to twelve technologies, that match the job requirements, and you're capable of using.

- People or soft skills provide you with an excellent background to communicate, work within a team, solve problems. Don't just copy-paste that you're a "leader" or excel at "analysis". Instead, provide tangible metrics that define your success inusing the particular skill within the strengths, achievements, summary/ objective sections.

Top skills for your credit analyst CV:

Financial Analysis

Credit Risk Assessment

Accounting Principles

Financial Modelling

Loan Structuring

Analytical Software Proficiency

Data Analysis

Statistical Analysis

Regulatory Compliance

Report Writing

Attention to Detail

Problem-Solving

Decision-Making

Communication Skills

Time Management

Critical Thinking

Adaptability

Negotiation

Teamwork

Interpersonal Skills

PRO TIP

Order your skills based on the relevance to the role you're applying for, ensuring the most pertinent skills catch the employer's attention first.

Your university degree and certificates: an integral part of your credit analyst CV

Let's take you back to your uni days and decide what information will be relevant for your credit analyst CV. Once more, when discussing your higher education, select only information that is pertinent to the job (e.g. degrees and projects in the same industry, etc.). Ultimately, you should:

- List only your higher education degrees, alongside start and graduation dates, and the university name;

- Include that you obtained a first degree for diplomas that are relevant to the role, and you believe will impress recruiters;

- Showcase relevant coursework, projects, or publications, if you happen to have less experience or will need to fill in gaps in your professional history.

PRO TIP

If you have received professional endorsements or recommendations for certain skills, especially on platforms like LinkedIn, mention these to add credibility.

Recommended reads:

Key takeaways

What matters most in your credit analyst CV-writing process is for you to create a personalised application. One that matches the role and also showcases your unique qualities and talents.

- Use the format to supplement the actual content, to stand out, and to ensure your CV experience is easy to comprehend and follows a logic;

- Invest time in building a succinct CV top one third. One that includes a header (with your contact details and headline), a summary or an objective statement (select the one that best fits your experience), and - potentially - a dedicated skills section or achievements (to fit both hard skills and soft skills requirements);

- Prioritise your most relevant (and senior) experience closer to the top of your CV. Always ensure you're following the "power verb, skill, and achievement" format for your bullets;

- Integrate both your technical and communication background across different sections of your CV to meet the job requirements;

- List your relevant education and certificates to fill in gaps in your CV history and prove to recrutiers you have relevant technical know-how.