Crafting a distinct and impactful CV for investment banking roles can be daunting, given the highly competitive nature of the sector and the need to showcase complex financial skills and achievements effectively. Our comprehensive guide will provide you with tailored strategies and examples to enhance your CV, ensuring you stand out in the selection process with a clear demonstration of your expertise and value.

- Answer job requirements with your investment banking CV and experience;

- Curate your academic background and certificates, following industry-leading CV examples;

- Select from +10 niche skills to match the ideal candidate profile

- Write a more succinct experience section that consists of all the right details.

Do you need more specific insights into writing your investment banking CV? Our guides focus on unique insights for each individual role:

CV examples for investment banking

By Experience

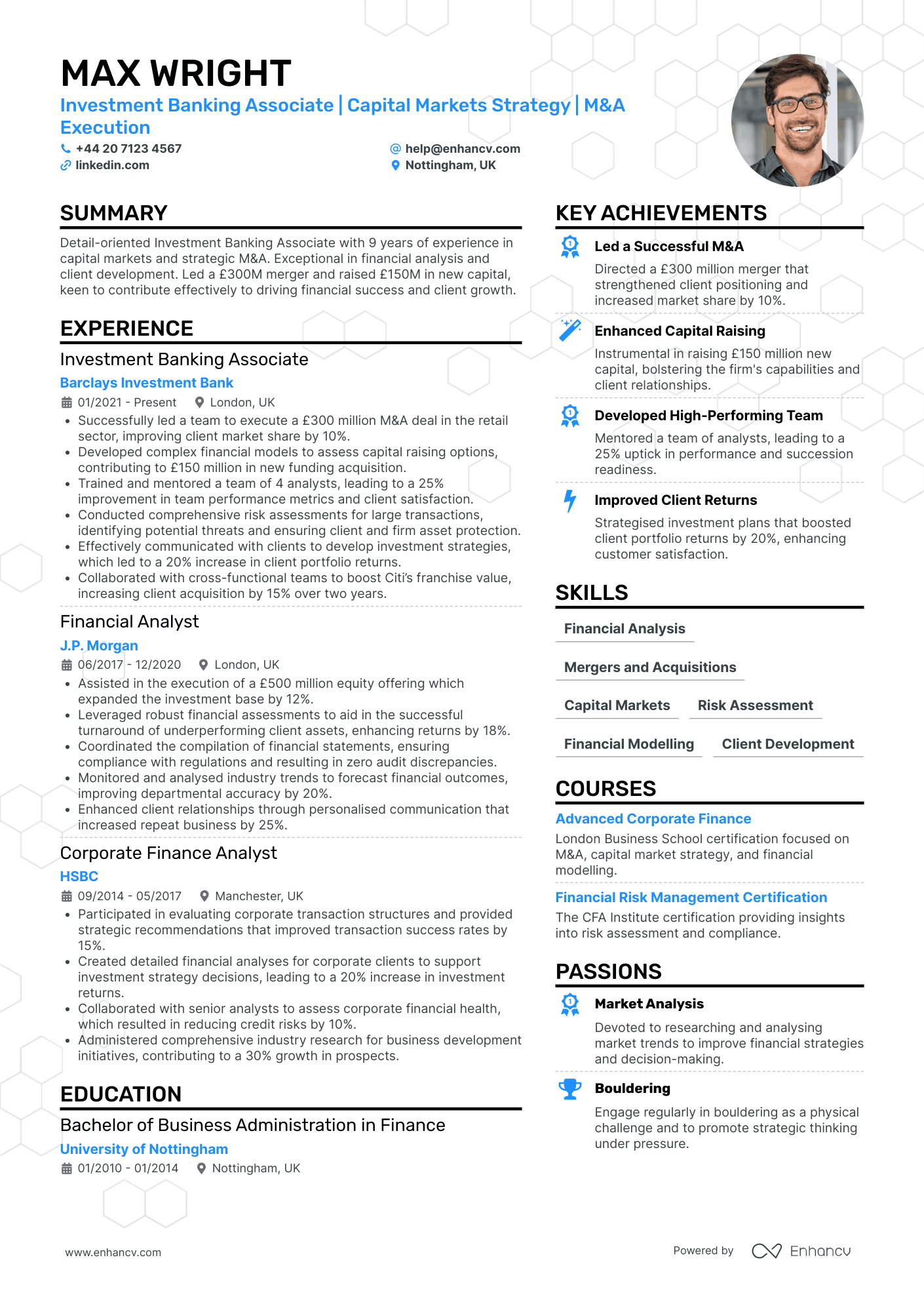

Investment Banking Associate

- Effective Content Presentation - The CV is structured in a clear and concise manner, making it easy to interpret the wealth of experience the candidate offers. Key sections like experience, skills, education, and achievements are well-organized, enabling readers to quickly grasp the candidate's qualifications and career highlights.

- Progressive Career Trajectory - Max Wright's career path demonstrates clear growth and advancement within the finance industry. Starting as a Corporate Finance Analyst at HSBC, his transition to J.P. Morgan as a Financial Analyst, and subsequent promotion to an Investment Banking Associate at Barclays, highlights his progression and increasing responsibility over time.

- Significant Achievements with Broad Impact - The CV details significant achievements with a focus on the practical impact of these accomplishments, not just the monetary figures. For instance, leading a £300 million M&A deal that improved client market share by 10% demonstrates tangible business outcomes, underscoring the candidate's ability to drive growth and contribute to firm success.

Investment Banking Vice President

- Career Progression Reflecting Growth - Sienna West's career trajectory showcases a consistent upward movement, transitioning from an Analyst role at J.P. Morgan to a Vice President position at Goldman Sachs. This progression indicates not only her ability to take on higher responsibilities but also her recognition within the esteemed investment banking industry. Her advancements are marked by increasingly strategic and leadership roles, suggesting adeptness in handling complex projects and teams.

- Clear and Cohesive Presentation - The CV is well-organized, with distinct sections for experience, education, skills, and achievements, allowing for easy navigation and comprehension. Each section is concisely presented, ensuring all relevant information is accessible without overwhelming the reader. The clarity in bullet points and logical structuring of content reflect a professional approach to presentation and communication.

- Specialized Financial Expertise and Innovation - Sienna exhibits deep technical knowledge specific to the investment banking sector, with a focus on technology and financial modeling. Her expertise in creating complex financial models and enhancing due diligence frameworks demonstrates both technical depth and innovative thinking. These skills not only meet industry demands but also provide a competitive edge in advising technology-focused M&A transactions.

Investment Banking Director

- Comprehensive career progression - The CV distinctly outlines William Hall’s steady career advancement, showcasing a move from a Junior Portfolio Manager to a Senior Investment Manager. This trajectory highlights increasing levels of responsibility and expertise, which emphasizes his capability to handle complex investment portfolios and high-level strategic decision-making.

- Impressive achievement highlights - The CV meticulously details various achievements that reflect significant positive impacts on business outcomes. For instance, leading the acquisition of new firms and achieving a sharp increase in client satisfaction scores shows Hall as a proactive leader contributing not just to company growth but also to improved client interactions.

- Distinctive focus on client-centric outcomes - A standout aspect is Hall’s emphasis on increasing client satisfaction and retention, spotlighting his skills in relationship management and personalized service delivery. These customer-related achievements are crucial for client trust and sustaining long-term business relationships, demonstrating his effectiveness beyond mere financial metrics.

By Role

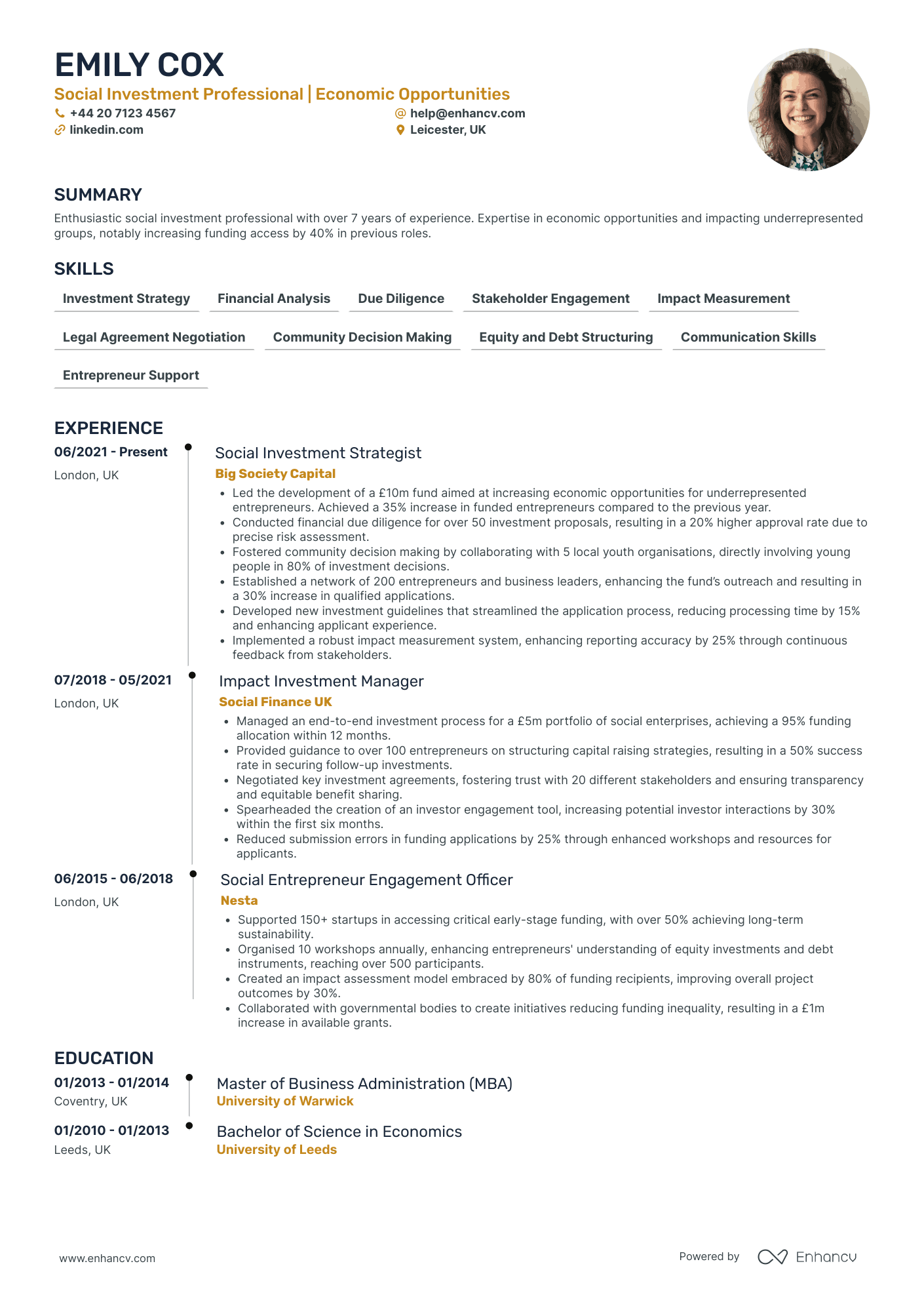

Investment Banking Manager

- Clear and Comprehensive Content Presentation - The CV is structured in a clear and concise manner, featuring distinct sections that are easy to navigate. It maintains a focus on essential information by using bullet points to effectively convey key responsibilities and achievements, making it accessible and efficient for potential employers to assess the candidate’s suitability for the role.

- Impressive Career Trajectory and Growth - Emily Cox's career trajectory showcases a consistent progression in the realm of social investment. Starting as a Social Entrepreneur Engagement Officer and advancing through roles to become a Social Investment Strategist, her journey reflects significant growth and increasing responsibility in the sector, highlighting her dedication to making a substantial impact.

- Focus on Unique Industry-Specific Elements - Emily’s experience includes working with investment funds specifically targeted at underrepresented entrepreneurs, highlighting her specialized knowledge in creating equitable financial opportunities. Her use of impact measurement systems and development of innovative investment guidelines demonstrates technical depth and application of industry-specific methodologies, crucial for achieving sustainable outcomes.

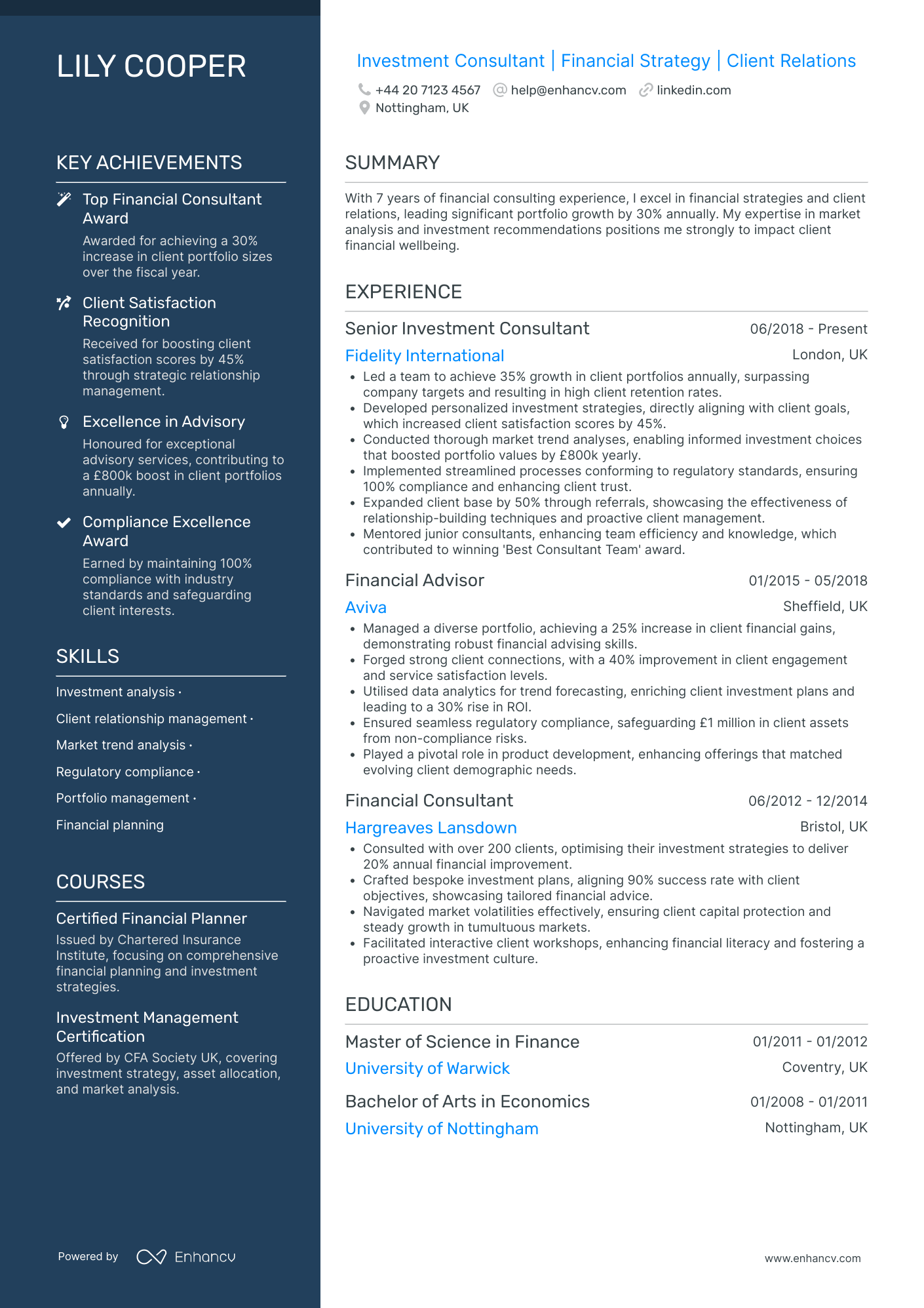

Investment Banking Consultant

- Clear Structure and Presentation - The CV is well-organized, with each section clearly defined and easy to follow. It efficiently uses concise bullet points to convey key achievements and responsibilities, allowing the reader to quickly grasp Lily Cooper's impact and contributions without overwhelming detail.

- Strong Career Progression - Lily's career trajectory is impressive, displaying a steady upward path from a Financial Consultant to a Senior Investment Consultant. This progression highlights her ability to take on more complex roles and responsibilities, reflecting growth and success within reputable companies in the financial industry.

- Data-Driven Achievements with Business Impact - The CV includes quantifiable achievements that demonstrate Lily's influence on business outcomes. By highlighting a 35% growth in client portfolios and a £800k yearly boost in portfolio values, it substantiates her proficiency in driving financial performance and creating lasting client value.

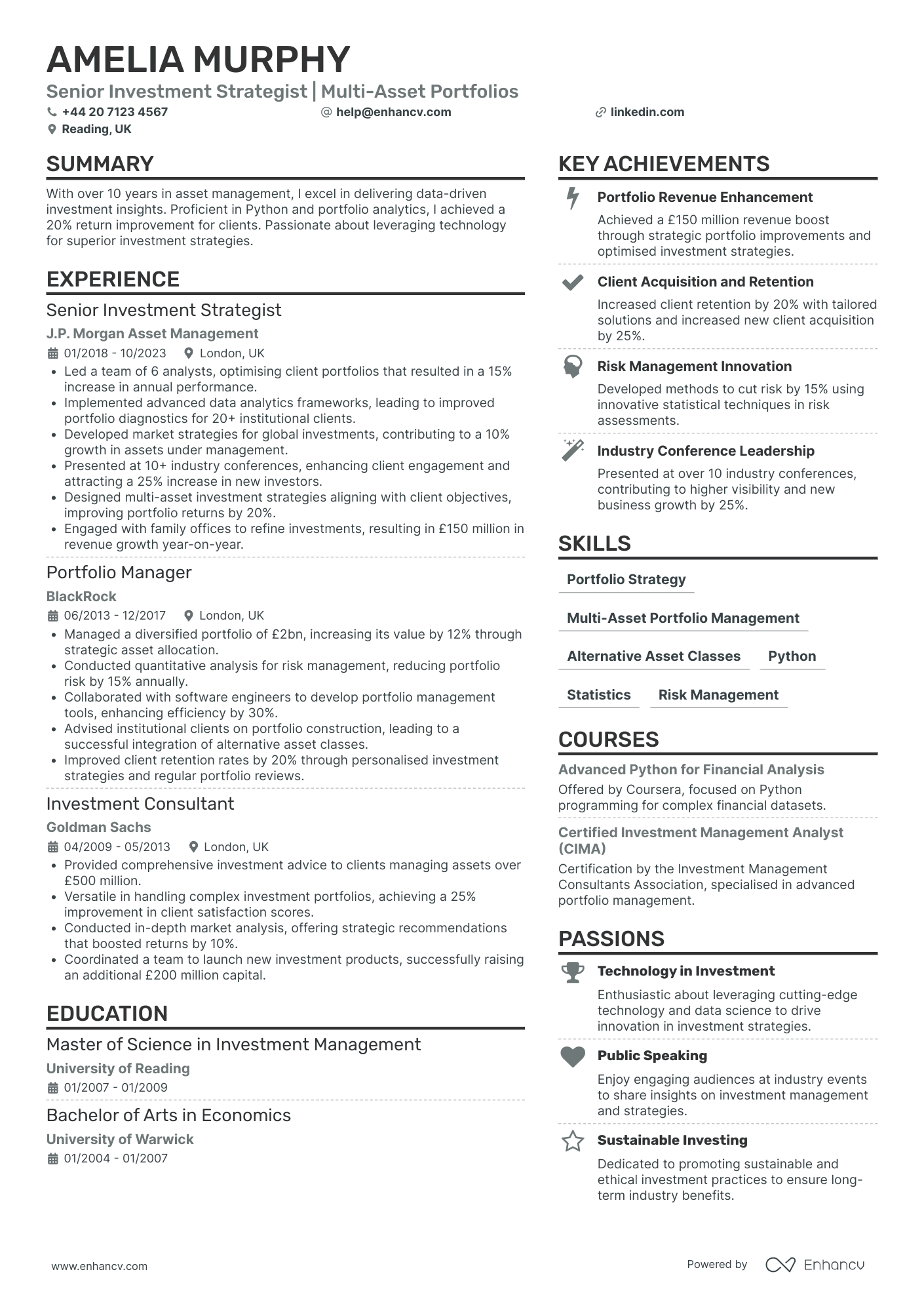

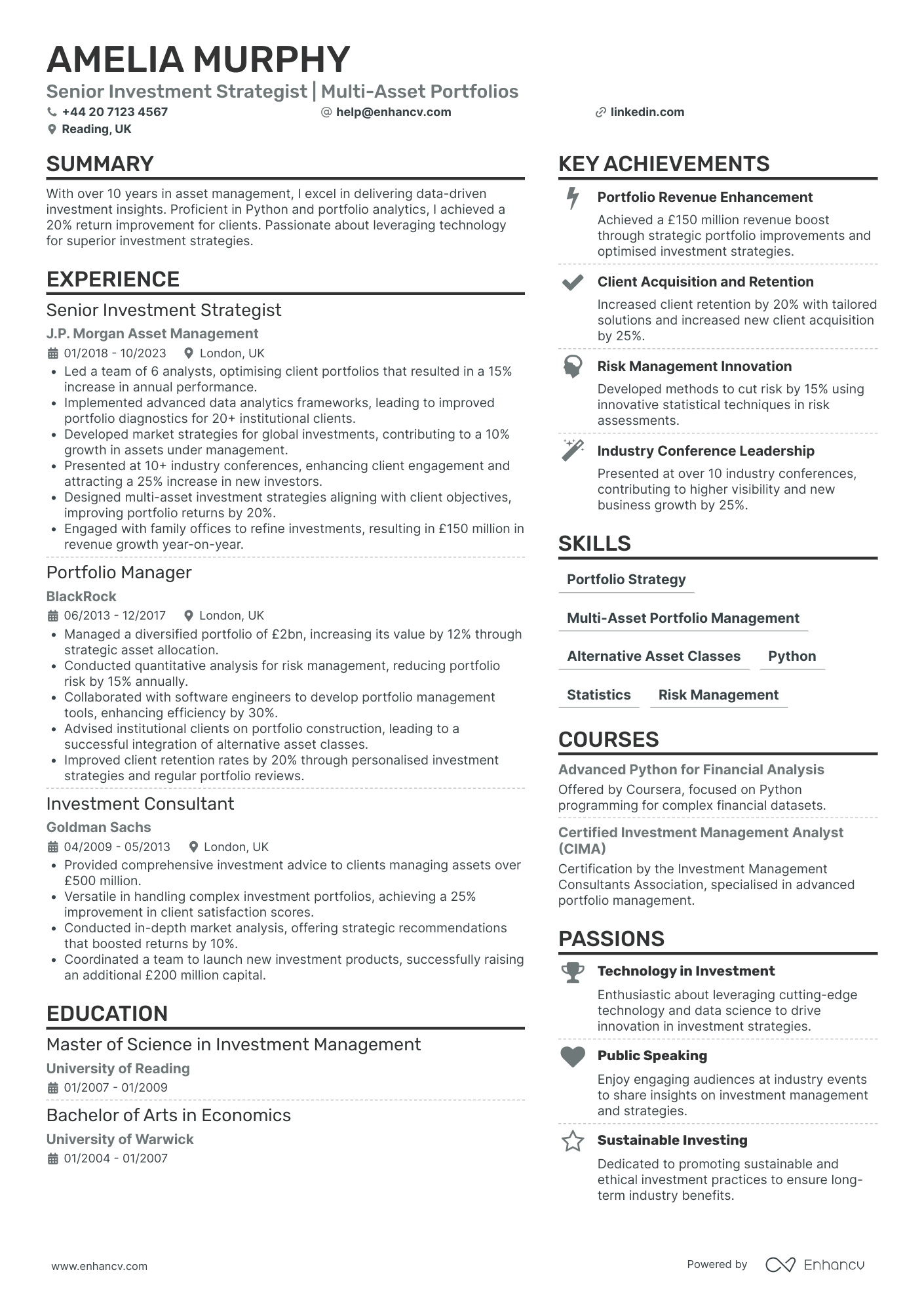

Investment Banking Strategist

- Efficiency in Content Presentation - The CV is structured with clarity and precision, employing concise bullet points to convey key experiences and achievements effectively. The clear segmentation of sections such as education, skills, and experience allows for easy navigation and comprehension, ensuring that the reader can swiftly identify relevant information about Amelia's expertise and career highlights.

- Progression and Specialization in Career Trajectory - Amelia's career progression reflects a consistent climb up the professional ladder within the investment management industry. Starting as an Investment Consultant at Goldman Sachs, advancing to Portfolio Manager at BlackRock, and then excelling as a Senior Investment Strategist at J.P. Morgan Asset Management demonstrates her growth and increasing specialisation in multi-asset portfolios, denoting a strong career trajectory within top-tier financial institutions.

- Emphasis on Technology and Data Analytics - Unique to Amelia's profile is her integration of technical expertise, particularly her proficiency in Python and advanced data analytics. Her ability to apply these skills to enhance portfolio strategies and risk management processes sets her apart in an industry that increasingly values data-driven approaches. This technical depth supports her adeptness in developing market strategies and optimizing investment portfolios.

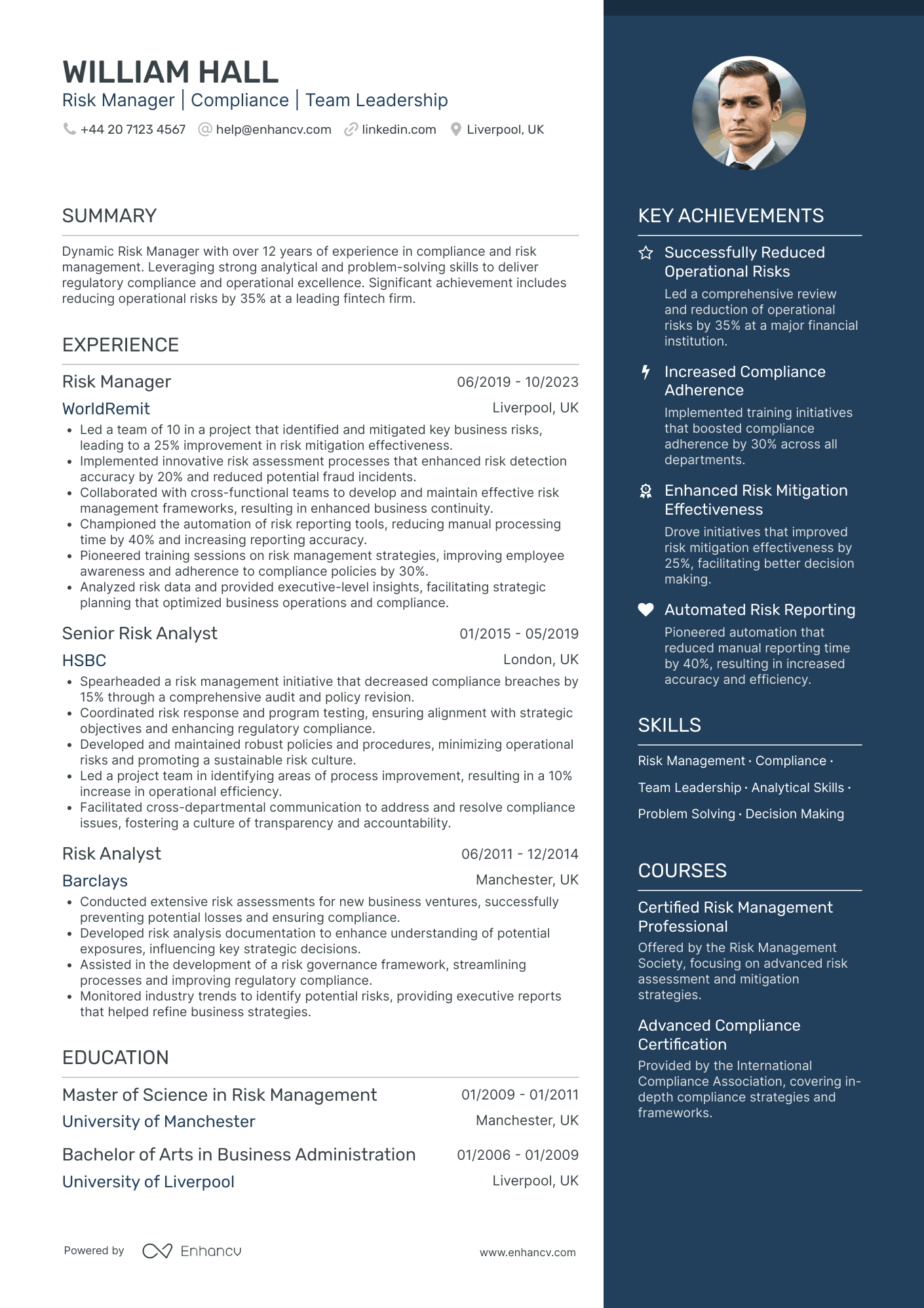

Investment Banking Risk Manager

- Comprehensive Risk Management Acumen - The CV excellently outlines the candidate’s depth in risk management, showcasing significant accomplishments like a 35% reduction in operational risks, which underscores their ability to understand and implement complex risk frameworks efficiently.

- Clear Career Progression in the Financial Sector - The candidate's career path demonstrates a clear trajectory from a Risk Analyst at Barclays, advancing to a Senior Risk Analyst at HSBC, and ultimately to a Risk Manager at WorldRemit. This progression reflects their growing expertise and leadership capabilities in the financial sector.

- Strong Leadership and Team Building - Through multiple experiences, the CV highlights the candidate's leadership skills, such as leading a team of 10 to improve risk mitigation at WorldRemit by 25%. This indicates not only their managerial prowess but also their ability to enhance team performance significantly.

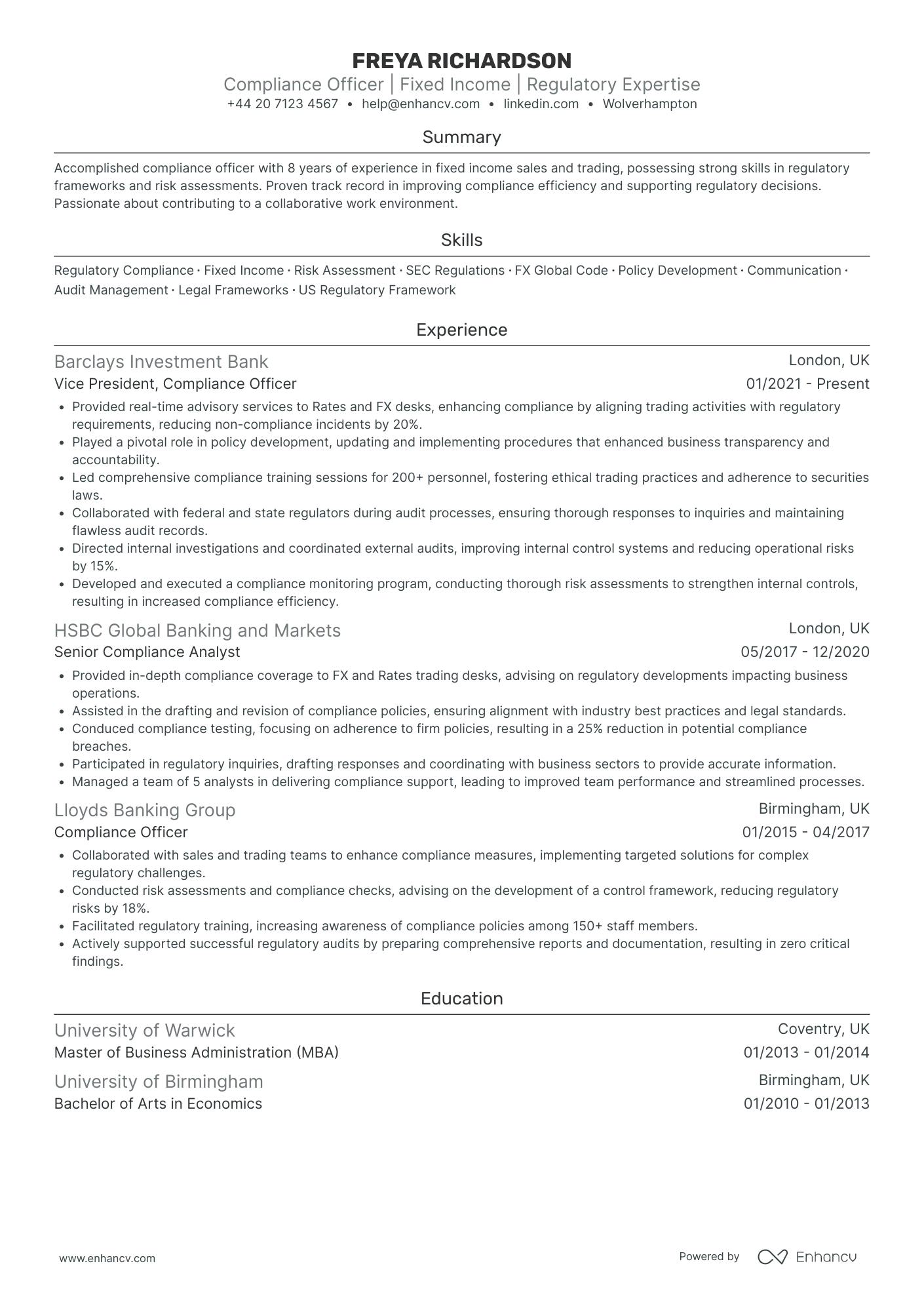

Investment Banking Compliance Officer

- Logical Career Progression - Freya Richardson's CV illustrates a clear career trajectory with consistent growth in roles and responsibilities. Starting as a Compliance Officer and advancing to a Vice President position at Barclays Investment Bank, her progression indicates a strong performance and effectiveness in her field.

- Industry-Specific Expertise - The CV showcases Freya's deep understanding of fixed income and regulatory compliance. Her experience with prominent banks highlights her proficiency in navigating complex regulatory frameworks and her strategic input into policy development and risk assessments.

- Impactful Achievements - Freya's accomplishments are not just listed as numbers but demonstrate genuine contributions to business goals. Whether it's reducing non-compliance incidents by 20% or improving internal control systems, each achievement underlines her ability to enhance compliance efficiency and support organizational success.

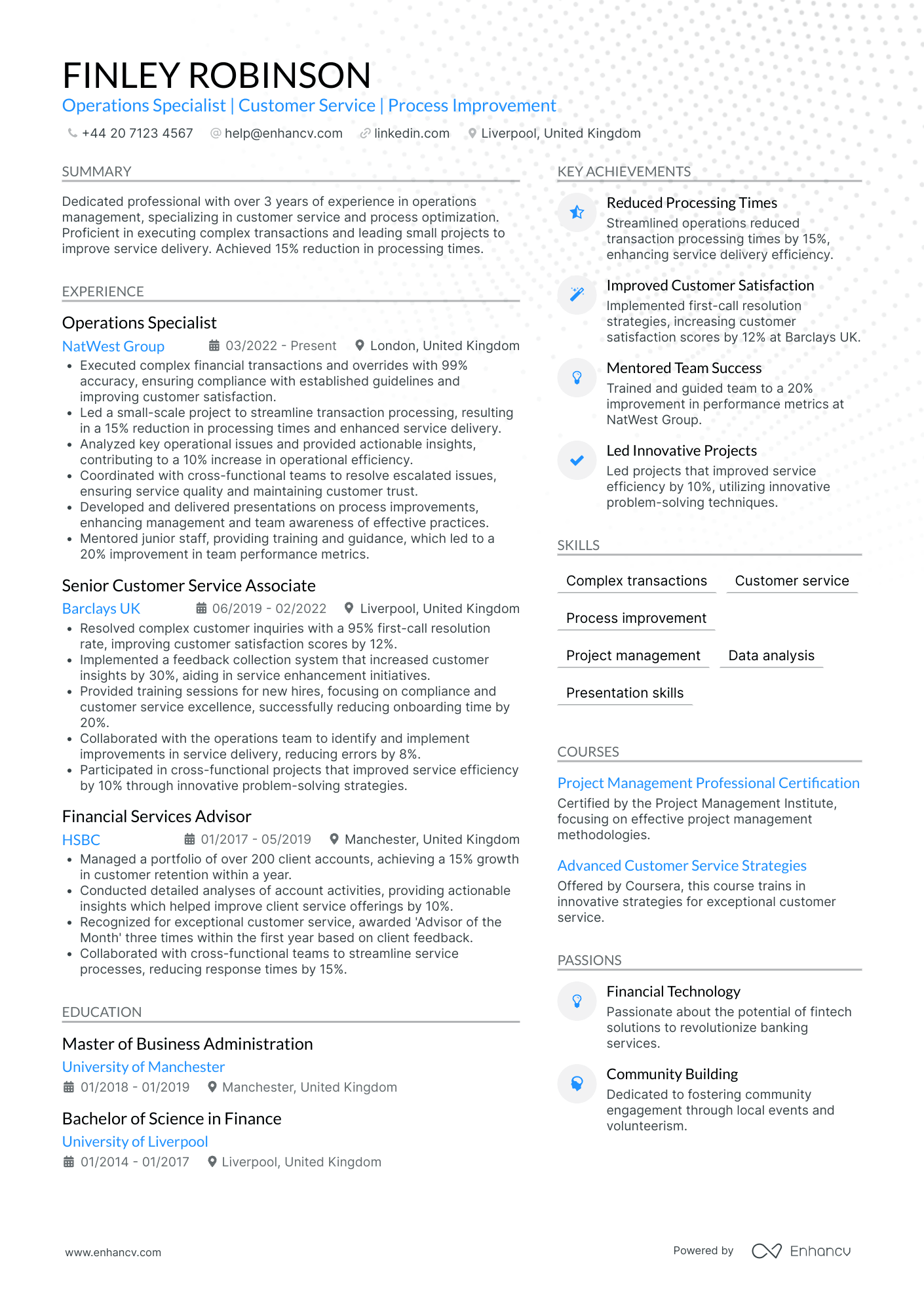

Investment Banking Operations Analyst

- Exemplary Content Structure - This CV effectively manages clarity and conciseness, presenting information in a structured format that immediately highlights the candidate’s key strengths. The use of bullet points for achievements and responsibilities allows for quick digestion of information, making it easy for potential employers to assess the candidate's qualifications at a glance.

- Consistent Career Advancement - Finley Robinson's career trajectory demonstrates a clear path of growth and increased responsibility, moving from a Financial Services Advisor to an Operations Specialist. Progression through reputable financial institutions like HSBC, Barclays, and NatWest showcases steady professional development and an ability to adapt to increasing levels of operational complexity.

- Significant Achievements with Real Business Impact - The achievements listed in the CV are not mere statistics but reflect meaningful business improvements. For instance, a 15% reduction in processing times and a 12% increase in customer satisfaction scores are indicative of Robinson’s ability to implement changes that directly enhance service delivery and customer experiences, thereby contributing to the broader organizational goals.

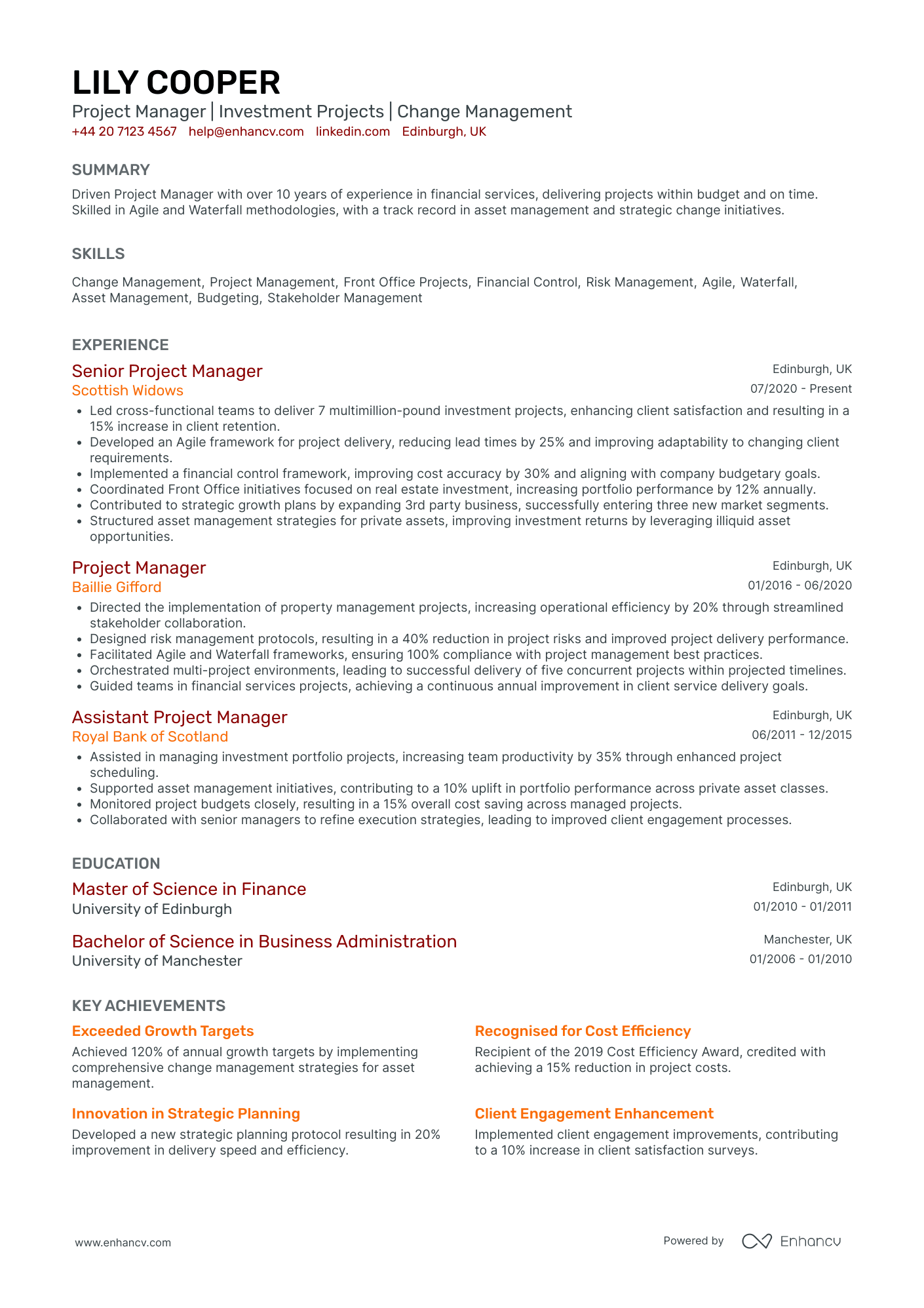

Investment Banking Project Manager

- Strong Career Progression and Industry Focus - Lily Cooper's CV reflects a clear career trajectory, moving from an Assistant Project Manager at Royal Bank of Scotland to a Senior Project Manager at Scottish Widows. This progression highlights her ability to take on increasing responsibilities within the financial services industry, demonstrating her capability to grow and lead within asset management and strategic change initiatives.

- Comprehensive Skills in Project Management Frameworks - The CV showcases a profound expertise in both Agile and Waterfall methodologies, emphasizing her ability to apply these frameworks effectively within financial projects. Her proficiency in implementing frameworks that meet compliance and improve delivery efficiency is a valuable asset for her field, showcasing technical depth and adaptability.

- Achievements with Quantifiable Business Impact - The CV effectively links achievements to business outcomes, such as a 15% increase in client retention and 20% improvement in delivery speed through strategic planning protocols. These accomplishments highlight her impact on business growth and operational efficiency, reinforcing her value as a Project Manager capable of driving tangible improvements.

Investment Banking Relationship Manager

- Effective Content Presentation - The CV is structured clearly with a logical flow, allowing the reader to easily comprehend the candidate's qualifications. It concisely presents eight years of experience across well-organized sections, providing a strong first impression by highlighting Ivy Ward's achievements and skill set relevant to corporate banking.

- Advancement in Career Trajectory - Ivy Ward's career progression showcases notable growth from a Corporate Banking Analyst at Lloyds to a Relationship Manager at HSBC. The CV highlights impactful promotions, illustrating a consistent career trajectory marked by increased responsibilities and leadership capabilities within renowned financial institutions.

- Strategic Soft Skills and Leadership - The CV emphasizes Ward's proficiency in relationship management and team leadership, areas crucial to corporate banking. Notably, her ability to mentor analysts and spearhead client satisfaction initiatives reflects her capability to enhance team efficiency and drive client-oriented results.

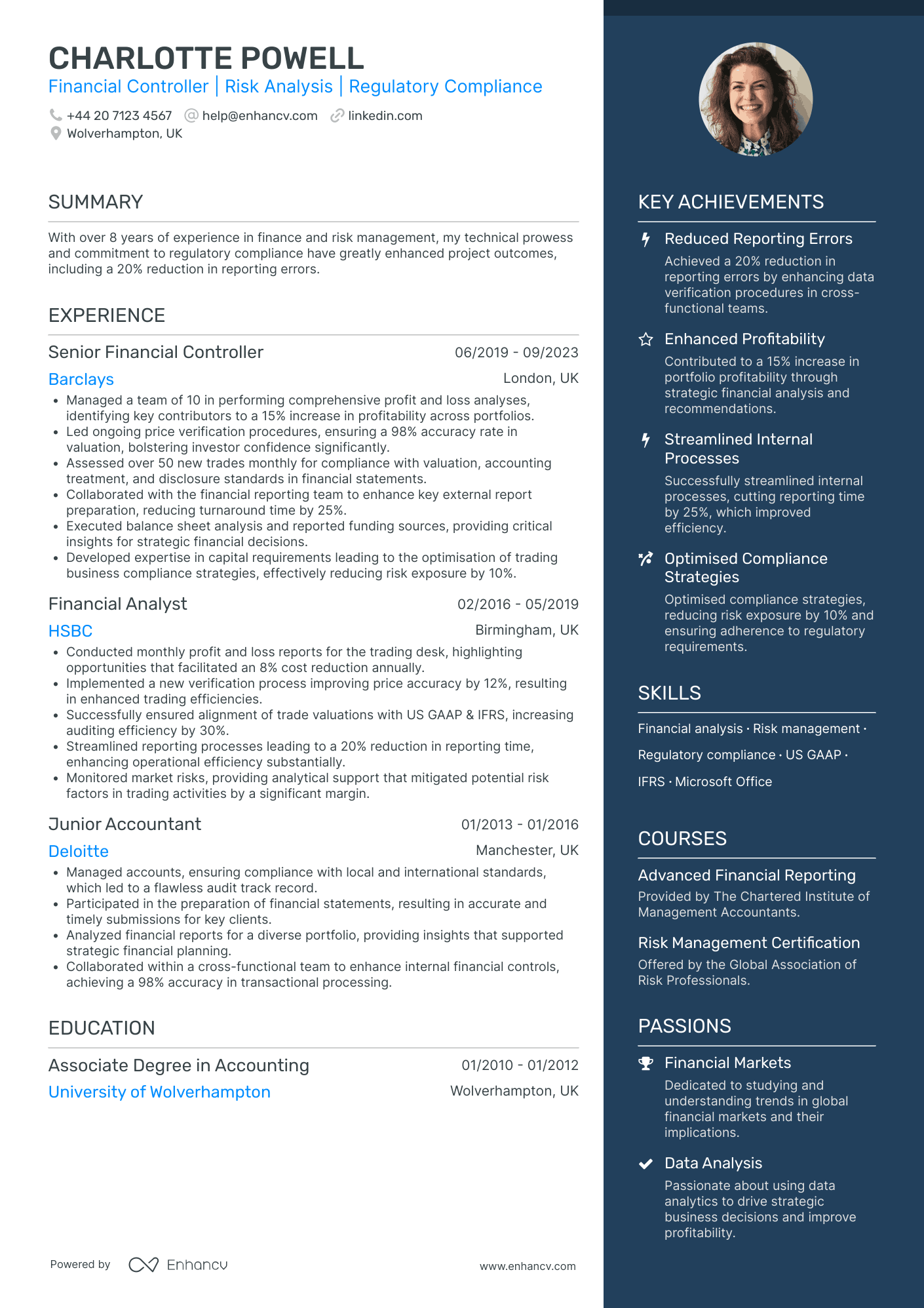

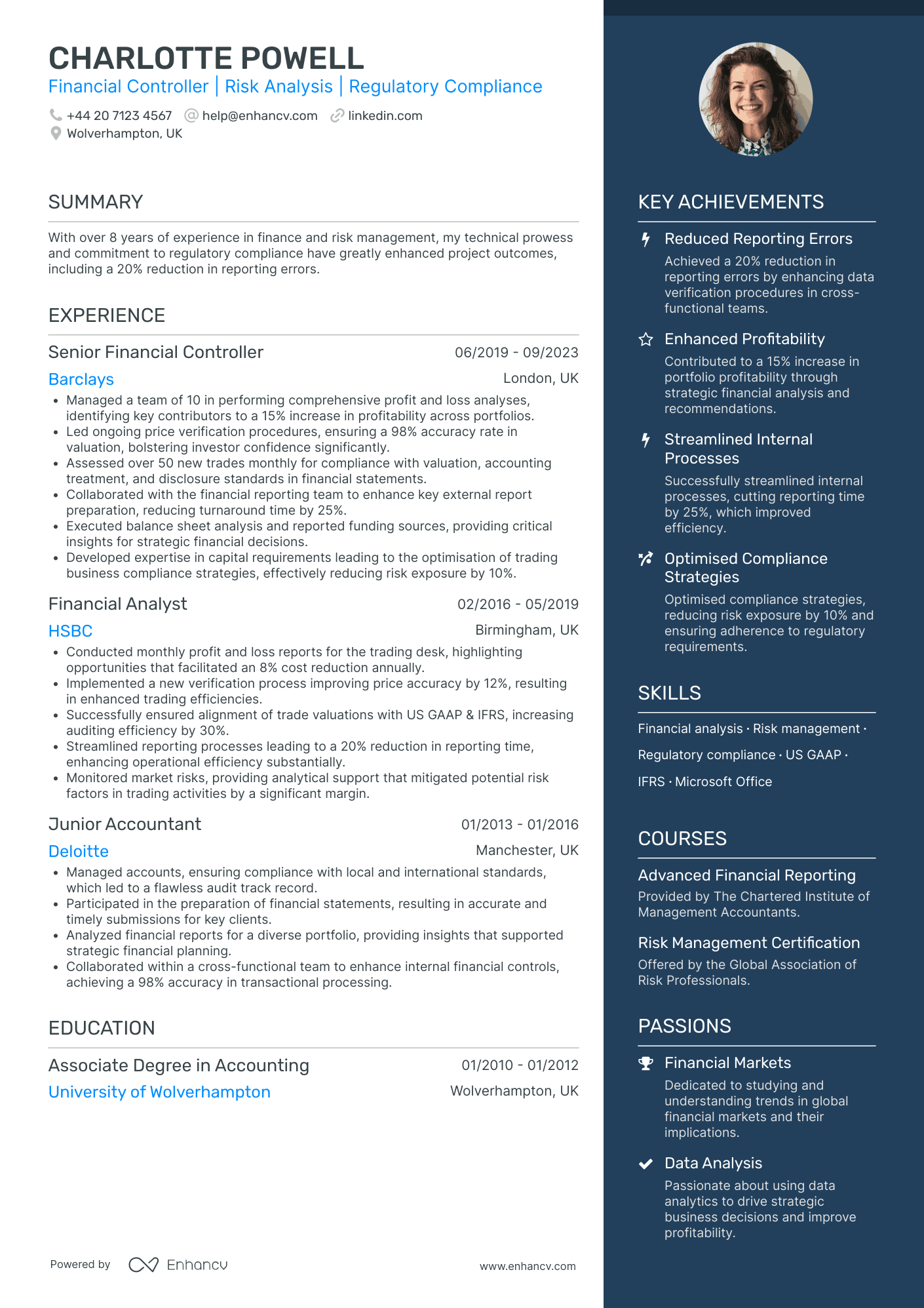

Investment Banking Product Control Specialist

- Strategic Presentation of Achievements - The CV effectively highlights Charlotte's ability to drive significant improvements in financial processes through detailed achievements, such as reducing reporting errors by 20% and optimizing compliance strategies to decrease risk exposure by 10%. This demonstrates her impact not only through numerical improvements but also in bolstering confidence and optimizing industry standards.

- Progression in Financial Roles - Charlotte’s career trajectory reflects a strong and steady growth within the financial sector, advancing from a Junior Accountant at Deloitte to a Senior Financial Controller at Barclays. This progression underscores her capability to take on more complex roles and leadership positions, highlighting her competence and adaptability in evolving financial environments.

- Integration of Technical and Soft Skills - The CV clearly articulates a blend of necessary financial analytical skills and essential soft skills such as attention to detail and communication. As a leader managing a team, her ability to convey complex information and collaborate with cross-functional teams is crucial, establishing her as a well-rounded professional capable of driving strategic decisions and enhancing operational efficiencies.

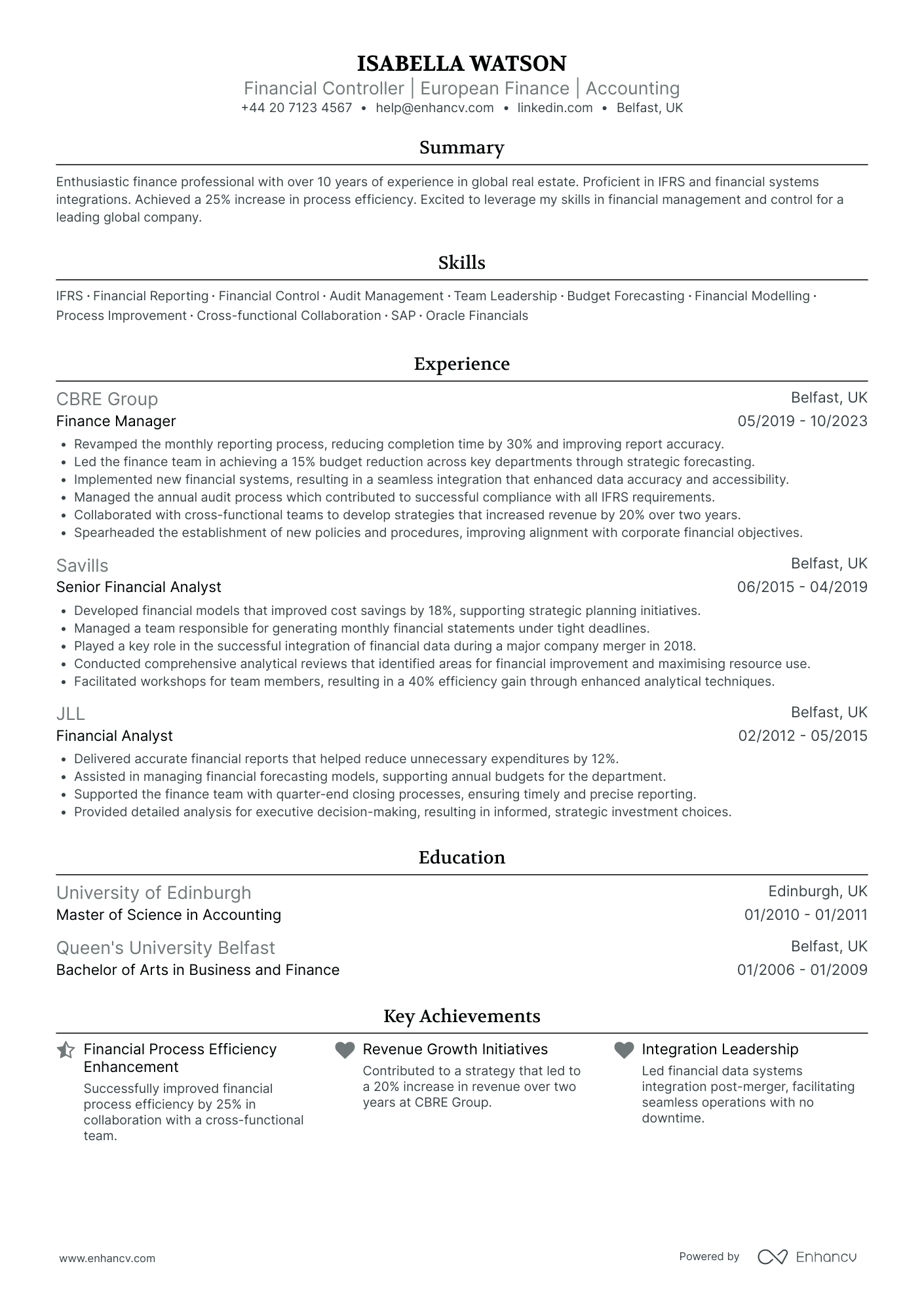

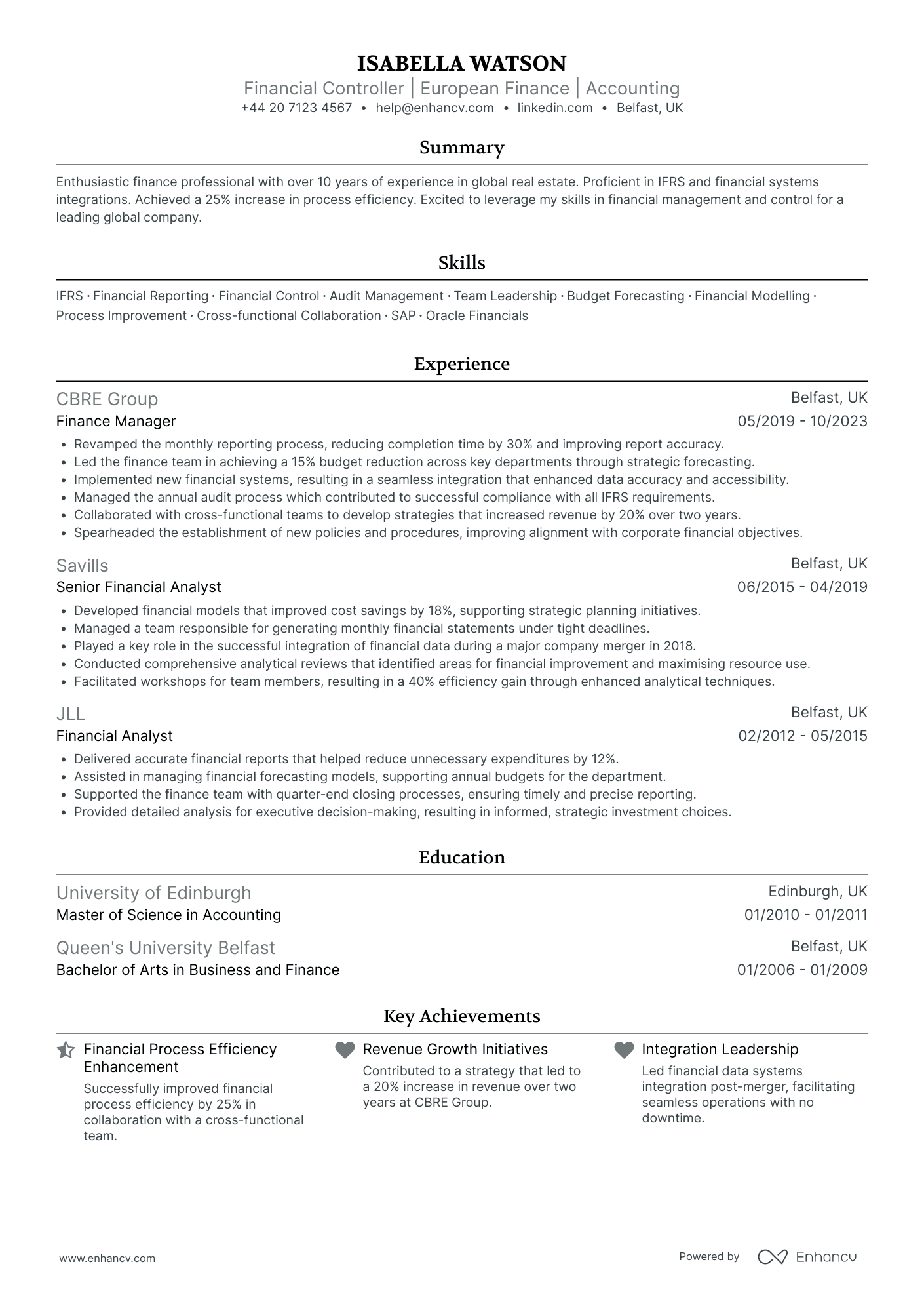

Investment Banking Financial Controller

- Clear Structure and Conciseness in Presentation - Isabella's CV is structured logically, making it easy to follow her career timeline, key skills, and achievements. Each section is presented with clarity, minimizing unnecessary jargon, and focusing on essential information that effectively communicates her credentials and career story. The bullet points are concise, directing attention to quantifiable results and responsibilities.

- Progressive Career Trajectory - The CV outlines a clear path of upward mobility in Isabella's career, marked by consistent promotions from Financial Analyst to Senior Financial Analyst, and then to Finance Manager. This progression highlights her growth potential and ability to handle increased responsibilities and challenges in the financial sector, specifically within the real estate industry.

- Significant Achievements with Business Impact - The CV does a commendable job of linking achievements directly to business outcomes, such as a 25% improvement in process efficiency and a 20% revenue increase. These metrics are not only impressive but also speak to Isabella’s capacity to drive tangible results that align with overall organizational goals. Each listed accomplishment is backed by data, making her contributions both visible and valuable to potential employers.

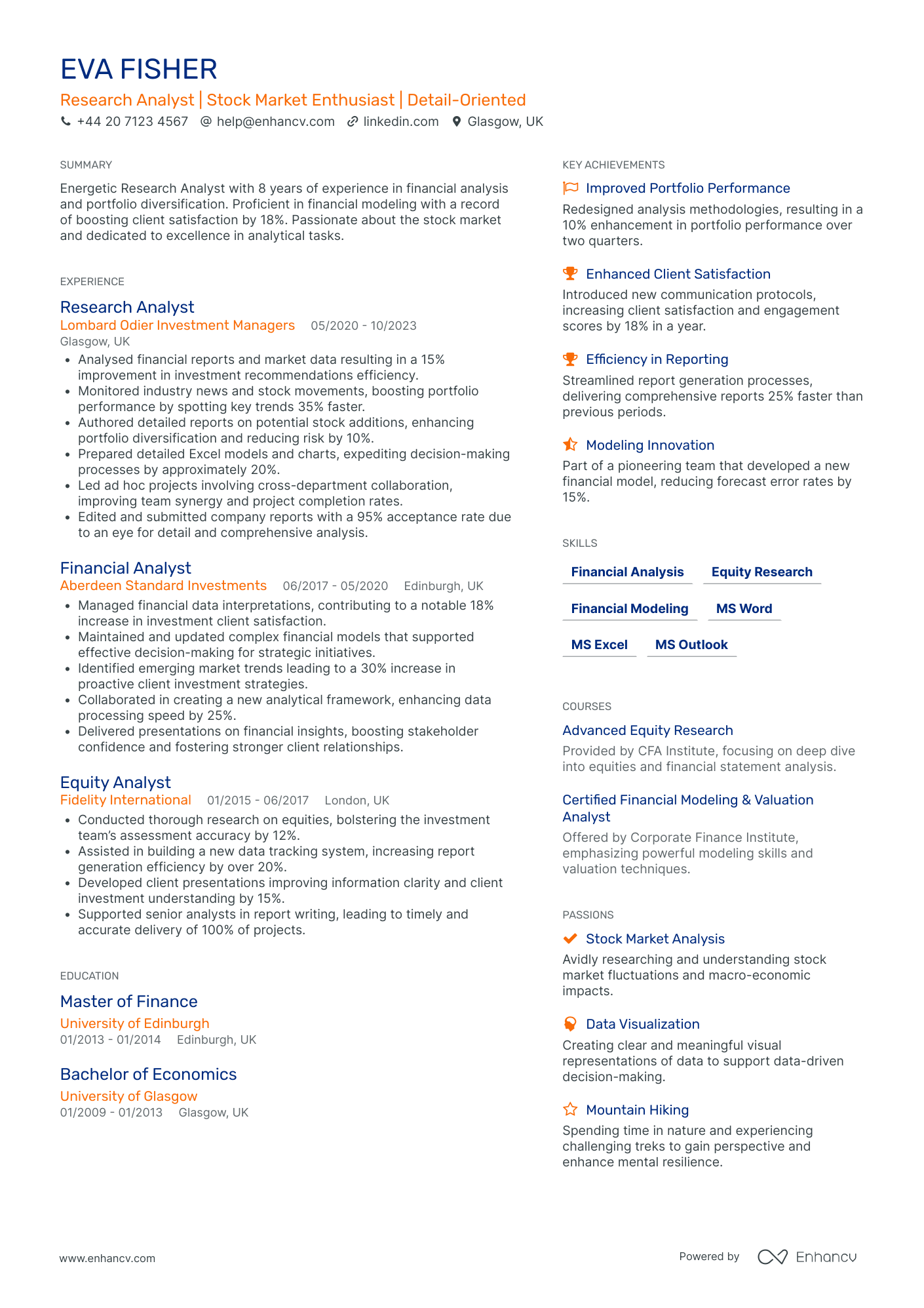

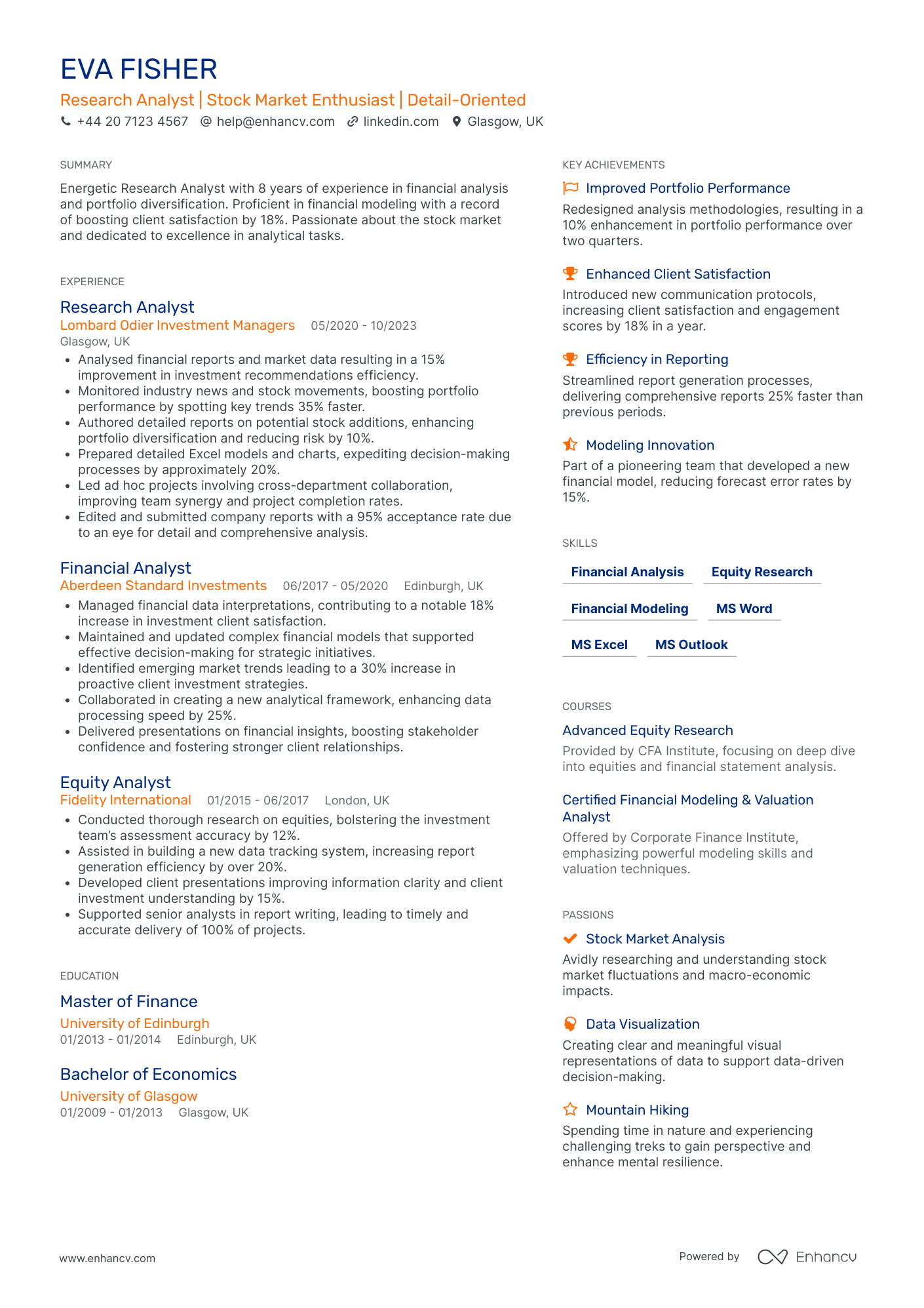

Investment Banking Research Analyst

- Methodical Content Presentation - The CV showcases an organized and structured layout, with each section clearly defined and concise. Eva Fisher's core competencies and career details are presented logically, making it easy for a recruiter to scan and identify key qualifications. The bulleted lists in the experience section effectively prioritize clarity and brevity, ensuring the most critical information is communicated efficiently.

- Robust Career Trajectory and Growth - Eva's career path demonstrates significant growth and depth in the financial sector, transitioning from an Equity Analyst to an accomplished Research Analyst. Her experience spans across reputable firms like Fidelity International and Lombard Odier Investment Managers, indicating a steady progression in roles with increasing responsibility. This trajectory highlights her expertise in the investment management field and commitment to professional development.

- Sector-Specific Achievements and Impact - Eva's CV details achievements with substantial business relevance, such as enhancing portfolio performance, improving investment recommendations efficiency, and boosting client satisfaction. These accomplishments are underscored by quantifiable metrics, such as a 10% improvement in portfolio performance and an 18% increase in client satisfaction, effectively illustrating her ability to drive significant results and add value to her employers in the financial industry.

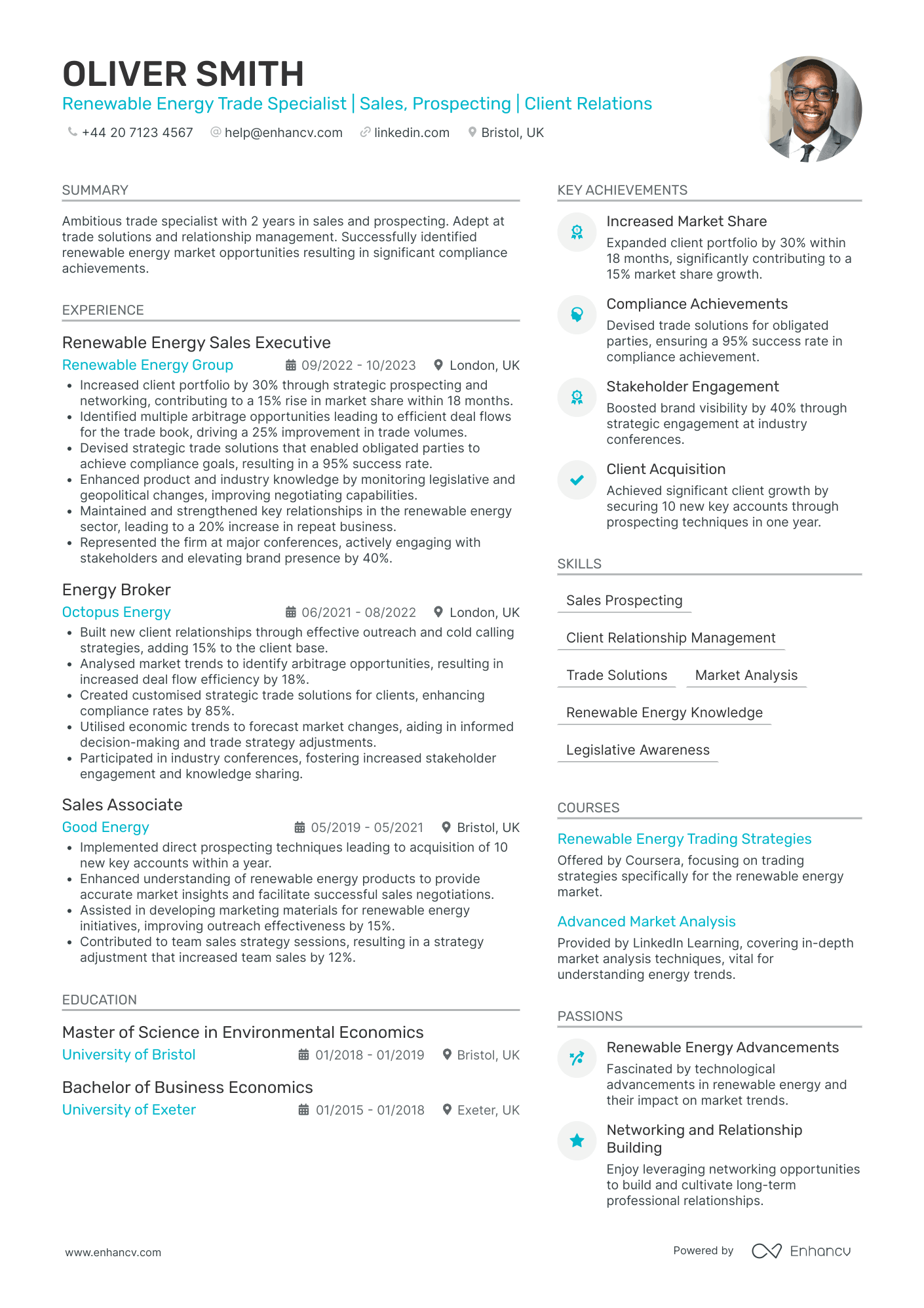

Investment Banking Sales Trader

- Structured for Impact - The CV is clearly and logically structured, starting with a concise summary that outlines the candidate's qualifications and skills. Each section is distinct, allowing for easy navigation and quick identification of relevant information. This clarity ensures that important details are immediately accessible, highlighting expertise in renewable energy trade.

- Progressive Career Development - Oliver Smith's career trajectory showcases a steady progression in the renewable energy industry, moving from a Sales Associate to a Renewable Energy Sales Executive. This growth is underpinned by significant contributions in each role, demonstrating an increase in responsibilities and accomplishments, making him well-suited for strategic positions in the sector.

- Industry-Specific Expertise - The CV reveals a deep technical understanding of the renewable energy market, as evidenced by the development of strategic trade solutions and legislative awareness. These industry-specific skills are essential for negotiating and closing deals in a complex and regulated market, highlighting the candidate's ability to drive compliance and market share growth in a specialized field.

Investment Banking Mergers and Acquisitions Advisor

- Effective Content Presentation - The CV is structured for clarity and conciseness, with distinct sections for each role and achievements highlighted in bullet points. This format ensures key information is easily accessible and emphasizes Isla King's strong communication skills. Each section clearly delineates roles, responsibilities, and accomplishments, making it straightforward to assess her qualifications and experience at a glance.

- Impressive Career Trajectory - A seamless progression from Analyst at J.P. Morgan to Vice President at Barclays illustrates Isla's rapid career advancement in the banking industry. Her trajectory reflects both deepening expertise in capital markets and increasing leadership responsibilities, positioning her as a seasoned professional in strategic advisory roles. Each promotion aligns with significant milestones and accomplishments in her career.

- Valuable Achievements and Business Impact - The CV articulates achievements with concrete business outcomes, such as leading capital market transactions that resulted in significant portfolio growth and revenue increases. Isla's strategic influence is further highlighted by industry recognition and successful client engagements, indicating her ability to drive substantial business results in competitive financial environments.

Investment Banking Equity Capital Markets Specialist

- Structured presentation with clear achievements - The CV is well-organized, showcasing accomplishments in a structured format that highlights the candidate's impact, such as raising over £500 million in ECM transactions. The use of clear bullet points maintains conciseness and allows the reader to grasp key achievements quickly.

- Strong career trajectory in prestigious firms - Isaac Scott demonstrates a progressive career path through reputable companies like Barclays, Morgan Stanley, and Goldman Sachs. The trajectory shows growth and increased responsibilities, reflecting expertise and credibility within the highly competitive field of investment banking.

- Combination of technical depth and mentorship skills - The CV highlights Isaac's proficiency in financial modeling and analysis, underscored by leading ECM transactions and introducing process optimizations. Additionally, the experience section points to his leadership skills through mentorship initiatives, which bolstered team performance and efficiency by 15%.

Investment Banking Debt Capital Markets Specialist

- Proven Track Record in Debt Capital Markets - The CV stands out by highlighting a strong career trajectory in debt capital markets with a focus on Latin America, demonstrated by a successful $100M bond issuance process. The candidate's past roles and responsibilities align with this area, showcasing a deep understanding and experience in managing high-profile financial transactions.

- Comprehensive Financial Skills and Methodologies - Lily showcases an extensive set of financial skills, from advanced quantitative analysis and financial modelling to strategic market analysis. The CV demonstrates her proficiency in tools such as spreadsheet modelling and industry-recognized certifications, which are directly relevant to her specialized focus in capital markets.

- Emphasis on Achievements and Their Business Impact - The candidate's achievements section is particularly impressive, with concrete examples of business impact. Noteworthy accomplishments include leading a complex bond issuance that surpassed market benchmarks by 15% and increasing client satisfaction scores by 25%, which underscores her ability to drive not just results but also substantial business improvements.

Investment Banking Derivatives Trader

- Career Trajectory and Professional Growth - Theodore Green's CV offers a compelling narrative of upward mobility and expertise enhancement, transitioning seamlessly from an Interest Rates Derivatives Trader at J.P. Morgan, through a crucial role at HSBC Asset Management, to a senior position at BlackRock. This career progression highlights not only his expanding responsibilities but also a deepening specialization in fixed income, derivatives, and FX markets.

- Achievements and Business Impact - The CV effectively highlights Theodore's measurable contributions to his employers, such as increasing trade execution efficiency by 25% and boosting portfolio revenues by 15% annually. These achievements underscore his ability to deliver significant business outcomes through innovative technologies and strategic market insights, cementing his reputation as a high-impact professional in the financial trading arena.

- Industry-Specific Tools and Methodologies - Theodore's proficiency in cutting-edge technological tools like Aladdin OMS and algorithm-driven trading solutions distinguishes him in the competitive field of macro trading. His implementation of innovative, tech-driven strategies for trade workflow automation and market analysis not only underscores his technical depth but also demonstrates his proactive approach to enhancing operational efficiencies and reducing costs.

How to ensure your profile stands out with your investment banking CV format

It's sort of a Catch 22. You want your investment banking CV to stand out amongst a pile of candidate profiles, yet you don't want it to be too over the top that it's unreadable. Where is the perfect balance between your CV format simple, while using it to shift the focus to what matters most. That is - your expertise. When creating your investment banking CV:

- list your experience in the reverse chronological order - starting with your latest roles;

- include a header with your professional contact information and - optionally - your photograph;

- organise vital and relevant CV sections - e.g. your experience, skills, summary/ objective, education - closer to the top;

- use no more than two pages to illustrate your professional expertise;

- format your information using plenty of white space and standard (2.54 cm) margins, with colours to accent key information.

Once you've completed your information, export your investment banking CV in PDF, as this format is more likely to stay intact when read by the Applicant Tracker System or the ATS. A few words of advice about the ATS - or the software used to assess your profile:

- Generic fonts, e.g. Arial and Times New Roman, are ATS-compliant, yet many candidates stick with these safe choices. Ensure your CV stands out by using a more modern, and simple, fonts like Lato, Exo 2, Volkhov;

- All serif and sans-serif fonts are ATS-friendly. Avoid the likes of fancy decorative or script typography, as this may render your information to be illegible;

- Both single- and double-column formatted CVs could be assessed by the ATS;

- Integrating simple infographics, icons, and charts across your CV won't hurt your chances during the ATS assessment.

PRO TIP

Be mindful of white space; too much can make the CV look sparse, too little can make it look cluttered. Strive for a balance that makes the document easy on the eyes.

The top sections on a investment banking CV

- Personal Summary offers a concise intro to one's skills and goals.

- Work Experience showcases relevant banking or financial roles.

- Education and Qualifications highlight top-tier university and degrees.

- Relevant Skills section emphasises analytical and quantitative abilities.

- Additional Certifications underscore commitment to finance profession.

What recruiters value on your CV:

- Highlight your numerical proficiency by detailing your experience with financial modelling, valuation, and experience with Excel or any other financial software to showcase your technical skills critical for investment banking.

- Emphasise any previous investment banking internships, finance-related experience, or deals you have worked on, demonstrating direct industry relevance and familiarity with the banking environment.

- Focus on your ability to work under pressure by citing examples of tight deadlines or high-stress situations you have successfully navigated, as stamina and resilience are prized in the investment banking sector.

- Demonstrate your team-working skills and leadership potential with examples of collaborative projects, especially where you took initiative or drove results, as teamwork is indispensable in deal-making and client projects.

- Illustrate your understanding of current economic and financial trends, as well as regulatory knowledge, by mentioning any relevant coursework, certifications (such as the CFA), or personal investments to reflect a solid grasp of market dynamics.

Recommended reads:

Making a good first impression with your investment banking CV header

Your typical CV header consists of Your typical CV header consists of contact details and a headline. Make sure to list your professional phone number, email address, and a link to your professional portfolio (or, alternatively, your LinkedIn profile). When writing your CV headline , ensure it's:

- tailored to the job you're applying for;

- highlights your unique value as a professional;

- concise, yet matches relevant job ad keywords.

You can, for examples, list your current job title or a particular skill as part of your headline. Now, if you decide on including your photo in your CV header, ensure it's a professional one, rather than one from your graduation or night out. You may happen to have plenty more questions on how to make best the use of your CV headline. We'll help you with some real-world examples, below.

Examples of good CV headlines for investment banking:

- Associate Director, M&A Execution | Equities Specialist | CFA Charterholder | 10 Years' Experience

- Investment Banking Analyst | Debt Capital Markets | MSc Finance | 2+ Years' Frontline Exposure

- Senior Vice President, Corporate Financing | IPO Strategist | ACCA Certified | 15+ Years in Advisory

- VP, Leveraged Finance | High-Yield Bonds Expert | MBA Graduate | 8 Years of Deal Structuring

- Graduate Analyst | Emerging Markets Enthusiast | BSc Economics | Recent Top-Tier University Graduate

- Director, Private Equity Placements | Venture Capital Insight | CAIA Member | 12 Years' Industry Leadership

Choosing your opening statement: a investment banking CV summary or objective

At the top one third of your CV, you have the chance to make a more personable impression on recruiters by selecting between:

- Summary - or those three to five sentences that you use to show your greatest achievements. Use the CV summary if you happen to have plenty of relevant experience and wish to highlight your greatest successes;

- Objective - provides you with up to five sentences to state your professional aims and mission in the company you're applying for

CV summaries for a investment banking job:

- With a robust 10-year background in structured finance and mergers & acquisitions at leading global investment firms, including spearheading a $2 billion industry merger, I possess in-depth experience in equity research, risk management, and complex financial modelling, striving to leverage these skills to execute high-profile transactions.

- A seasoned professional acclaimed for managing multi-million-dollar portfolios and driving strategic investments over a 12-year tenure, proficient in capital raising, and due diligence, with a keen analytical aptitude for market trends and a record of consistently surpassing client investment targets.

- Transitioning from a 15-year career as a senior software engineer at top-tier tech companies, with extensive project management expertise and advanced analytical skills, my aim is to apply my strategic thinking and technological insights to offer a unique perspective in financial structuring and investment analysis.

- Former Head of Strategic Development with 8 years of experiencing driving innovation and operational efficiencies in the manufacturing sector, now eager to transition to investment banking to employ robust quantitative analysis and client relations skills in facilitating high-impact financial solutions.

- As a recent finance graduate with top honours, my objective is to deploy my academic knowledge of market analysis and a fervent commitment to learn and grow within the investment banking sector, aiming to contribute to high-stake projects through diligent research and a data-driven approach.

- Eager to enter the challenging world of investment banking, I am committed to building a foundation in financial analysis, client portfolio management, and strategic investment. My objective is to work diligently, maximising comprehensive training opportunities to become a proficient banking professional.

Best practices for writing your investment banking CV experience section

If your profile matches the job requirements, the CV experience is the section which recruiters will spend the most time studying. Within your experience bullets, include not merely your career history, but, rather, your skills and outcomes from each individual role. Your best experience section should promote your profile by:

- including specific details and hard numbers as proof of your past success;

- listing your experience in the functional-based or hybrid format (by focusing on the skills), if you happen to have less professional, relevant expertise;

- showcasing your growth by organising your roles, starting with the latest and (hopefully) most senior one;

- staring off each experience bullet with a verb, following up with skills that match the job description, and the outcomes of your responsibility.

Add keywords from the job advert in your experience section, like the professional CV examples:

Best practices for your CV's work experience section

- Demonstrated analytical skills through detailed financial modelling and valuation analyses, including DCF, LBO, and comparable company and transaction benchmarking.

- Exhibited strong deal execution capabilities by effectively managing due diligence processes, including coordinating with lawyers, accountants, and other advisers.

- Quantified the impact of my work by highlighting the size and scope of transactions (e.g., "Assisted in the execution of a £300 million IPO").

- Illustrated excellent teamwork and project management by leading deal teams comprised of analysts and associates to meet critical deadlines.

- Articulated my role in client relationship management and business development by showcasing how I regularly presented pitch books and participated in client meetings.

- Emphasised technical knowledge by describing experience with financial software and databases such as Bloomberg, Capital IQ, and advanced Excel functionality.

- Portrayed ability to work under pressure through involvement in multiple, concurrent projects while maintaining attention to detail and accuracy.

- Showcased communication and interpersonal skills with examples of reports and presentations prepared for senior management, outlining investment opportunities and risks.

- Conveyed commitment to professional development by mentioning any certifications such as CFA or relevant training programmes completed during my tenure.

- Led the structuring and execution of mergers and acquisitions worth over $2 billion, contributing to a 20% increase in firm's market presence.

- Developed comprehensive financial models for complex investment strategies that assisted clients in understanding potential risks and rewards.

- Managed relationships with key institutional investors, which enhanced capital sourcing efforts by 35% through strategic partnerships.

- Orchestrated the underwriting process for high-profile Initial Public Offerings (IPOs), successfully leading four companies to market with a combined capital of $1.5 billion.

- Drove cross-border transactions by advising on regulatory compliance and market entry strategy, resulting in a 25% uptick in firm's international deals pipeline.

- Cultivated a robust client portfolio by executing strategic outreach, increasing deal flow by 30% through lead generation and networking.

- Implemented innovative financial structuring for mid-cap transactions, which increased transaction completion rate by 22% year-over-year.

- Played a pivotal role in advising on a $750 million acquisition, conducting due diligence and financial analysis that informed the successful negotiation strategy.

- Spearheaded the creation of pitch books and marketing materials that effectively communicated value propositions to potential investors, boosting capital raised by 18%.

- Facilitated the execution of debt and equity financing transactions, raising over $600 million for clients in the technology sector.

- Expanded the investment banking division's client base by 40% through strategic networking and a targeted business development plan.

- Implemented process improvements in the deal execution phase that reduced average transaction turnaround time by 15%.

- Crafted and executed complex financial models for valuation analysis, which played a crucial role in a $300 million merger agreement.

- Enhanced the firm’s deal sourcing efficiency by leveraging advanced data analytics, leading to a 20% increase in qualified leads.

- Mentored a team of junior analysts, improving their financial reporting skills and reducing errors in client deliverables by 25%.

- Directed sector-specific research analyses to support investment banking transactions in the healthcare industry, involving deals of up to $900 million.

- Optimized the transactional workflow by leveraging emerging fintech solutions, improving deal execution speed by 30%.

- Contributed to the development of an investor relations framework that augmented post-deal communication and improved client satisfaction scores by 15%.

- Coordinated with cross-functional teams to ensure meticulous due diligence for a portfolio of assets exceeding $400 million, greatly mitigating investment risk.

- Led client presentations and discussions that assisted in securing a strategic partnership with a major industry player, increasing AUM by $200 million.

- Drove the adoption of sustainable investment principles in deal structuring, aligning with client ESG goals and attracting $150 million in green bonds investments.

- Played an instrumental role in the expansion of the firm's real estate investment banking sector by advising on deals totaling over $500 million.

- Successfully led the negotiation and closing of a high-stakes restructuring deal for a distressed asset portfolio, securing an above-market recovery rate of 90%.

- Initiated and fostered strategic relationships with key real estate investment trusts, culminating in a 25% increase in sector deal flow.

- Championed the strategic planning and execution of a fintech startup's Series B funding round, raising $120 million and valuing the company at $600 million.

- Led the digital transformation initiative within the investment banking team, resulting in a 40% efficiency gain in deal analysis and origination.

- Formed strategic alliances with top venture capital firms that resulted in a diversified investment portfolio and a robust pipeline of innovative tech deals.

- Spearheaded a strategic review process for underperforming assets that enabled a pivot towards more lucrative market segments, locking in a 15% higher ROI.

- Facilitated a landmark partnership between a client and a leading industry conglomerate, boosting the client's market share by 10% within a year.

- Executed risk assessment and management for portfolio investments, reducing financial exposure by 20% through diligent analysis and timely recommendations.

How to ensure your investment banking CV stands out when you have no experience

This part of our step-by-step guide will help you substitute your experience section by helping you spotlight your skill set. First off, your ability to land your first job will depend on the time you take to assess precisely how you match the job requirements. Whether that's via your relevant education and courses, skill set, or any potential extracurricular activities. Next:

- Systematise your CV so that it spotlights your most relevant experience (whether that's your education or volunteer work) towards the top;

- Focus recruiters' attention to your transferrable skill set and in particular how your personality would be the perfect fit for the role;

- Consider how your current background has helped you build your technological understanding - whether you've created projects in your free time or as part of your uni degree;

- Ensure you've expanded on your teamwork capabilities with any relevant internships, part-time roles, or projects you've participated in the past.

Recommended reads:

PRO TIP

Talk about any positive changes you helped bring about in your previous jobs, like improving a process or helping increase efficiency.

Mix and match hard and soft skills across your investment banking CV

Your skill set play an equally valid role as your experience to your application. That is because recruiters are looking for both:

- hard skills or your aptitude in applying particular technologies

- soft skills or your ability to work in a team using your personal skills, e.g. leadership, time management, etc.

Are you wondering how you should include both hard and soft skills across your investment banking CV? Use the:

- skills section to list between ten and twelve technologies that are part of the job requirement (and that you're capable to use);

- strengths and achievements section to detail how you've used particular hard and soft skills that led to great results for you at work;

- summary or objective to spotlight up to three skills that are crucial for the role and how they've helped you optimise your work processes.

One final note - when writing about the skills you have, make sure to match them exactly as they are written in the job ad. Take this precautionary measure to ensure your CV passes the Applicant Tracker System (ATS) assessment.

Top skills for your investment banking CV:

Financial Modelling

Valuation Techniques

Mergers & Acquisitions (M&A)

Initial Public Offerings (IPOs)

Financial Analysis

Due Diligence

Corporate Finance

Capital Markets Knowledge

Excel Proficiency

Quantitative Analysis

Analytical Thinking

Problem Solving

Attention to Detail

Teamwork

Communication

Time Management

Client Relationship Management

Adaptability

Initiative

Leadership

PRO TIP

If you have received professional endorsements or recommendations for certain skills, especially on platforms like LinkedIn, mention these to add credibility.

Listing your university education and certificates on your investment banking CV

The best proof of your technical capabilities would be your education and certifications sections. Your education should list all of your relevant university degrees, followed up by their start and completion dates. Make sure to also include the name of the university/-ies you graduated from. If you happen to have less professional experience (or you deem it would be impressive and relevant to your application), spotlight in the education section:

- that you were awarded a "First" degree;

- industry-specific coursework and projects;

- extracurricular clubs, societies, and activities.

When selecting your certificates, first ask yourself how applicable they'd be to the role. Ater your initial assessment, write the certificate and institution name. Don't miss out on including the completion date. In the below panel, we've curated relevant examples of industry-leading certificates.

PRO TIP

Order your skills based on the relevance to the role you're applying for, ensuring the most pertinent skills catch the employer's attention first.

Recommended reads:

Key takeaways

Write your professional investment banking CV by studying and understanding what the role expectations are. You should next:

- Focus on tailoring your content to answer specific requirements by integrating advert keywords through various CV sections;

- Balance your technical know-how with your personal skills to showcase what the unique value would be of working with you;

- Ensure your CV grammar and spelling (especially of your key information and contact details) is correct;

- Write a CV summary, if your experience is relevant, and an objective, if your career ambitions are more impressive;

- Use active language by including strong, action verbs across your experience, summary/objective, achievements sections.