You want your cover letter to strike the perfect balance between being professional and showing some personality. But how do you achieve this?

If you write too formally, your tone may come across as stiff. If you're too casual, it may sound overly conversational.

While modesty is always valued, how can you confidently present your skills without sounding arrogant or boastful?

This guide will help you find the right balance, ensuring your cover letter is both professional and personable, while focusing on the key job requirements.

Cover letter examples for accounts receivable

By Experience

Senior Accounts Receivable Specialist

- Emphasise the candidate's expertise in process automation and MS Excel, as these are vital skills for maximising efficiency in accounts receivable management.

- Highlight the candidate's proven track record of improving payment processes, demonstrated by specific percentage improvements in metrics like payment delays and invoice dissemination.

- Underscore the importance of cross-functional collaboration and customer service skills, as evidenced by the candidate's success in improving B2B customer satisfaction scores.

- Include significant achievements in leadership positions, such as spearheading automation projects and leading training initiatives, to show the candidate's ability to drive both process and team improvements.

Junior Accounts Receivable Associate

- Highlighting experience in Deltek Vision ERP, which is crucial for roles in accounts receivable/payable due to its relevance in financial systems and bookkeeping.

- Emphasising a proven track record of improving financial processes, which speaks to the candidate’s ability to enhance department efficiency and resolve billing discrepancies.

- Demonstrating tangible achievements such as reducing overdue accounts by 15% and improving AR collections, which showcase the candidate's results-oriented approach.

- Detailing additional certifications, such as "Excel for Accountants," aligns well with the required skill set for financial roles that demand strong data analysis capabilities.

Accounts Receivable Director

- Highlighting strategic accomplishments: Jacob emphasises his achievements such as improving collection rates by 15% and integrating student information systems effectively. These specific examples demonstrate a proven track record in financial management within educational settings.

- Emphasising leadership and team management skills: Showcasing his role in leading a team of six to implement new payment systems illustrates strong leadership capabilities, which are crucial for a Director position.

- Demonstrating specialised software proficiency: The cover letter underscores proficiency in financial and student management systems like Banner and PeopleSoft, signalling that Jacob is well-equipped to handle the technical demands of the role.

- Including relevant education and certifications: Mentioning his MBA and a course in Financial Management in Education highlights Jacob's robust academic background and ongoing commitment to professional development, which is beneficial for a financial management role in an academic institution.

By Role

Accounts Receivable Manager

- Highlight Relevant Experience: Emphasise roles such as "Senior Revenue Accountant" and "Financial Analyst," where Alice demonstrated leadership in revenue management, project automation, and financial reporting which are essential for advanced finance roles.

- Showcase Technical Proficiency: Mention expertise in specific tools (Excel, Salesforce, Business Central) and advanced financial concepts like multi-currency transactions and revenue recognition which are critical for financial analysis positions.

- Emphasise Certifications and Education: Highlight relevant courses like "Advanced Financial Modelling" and certifications on "Revenue Recognition Principles" that underscore Alice's commitment to continuous learning and expertise in the field.

- Illustrate Achievements with Data: Use quantifiable outcomes like a "25% improvement in receivables turnover" and "40% reduction in processing time" to effectively demonstrate the impact of Alice's work on business operations.

Accounts Receivable Clerk

- Highlight Relevant Experience: The cover letter effectively showcases Isla King’s substantial experience in credit control, emphasising achievements such as reducing outstanding debts by 40% and improving cash flow by 30% at previous roles, which are critical for a Credit Controller position.

- Specific Software Proficiency: Mentioning proficiency with Sage 200 and advanced IT skills demonstrates technical prowess, which is a crucial aspect for roles in finance and credit management.

- Education and Professional Development: The cover letter includes relevant academic credentials like a Master of Science in Finance, along with ongoing professional development through courses such as Advanced Credit Control Techniques and Sage 200 Comprehensive Training, underscoring commitment to the field.

- Professional Achievements: Emphasising competitive achievements such as being awarded Best Credit Controller and implementing systems that significantly boost efficiency positions Isla as a standout candidate for the role.

Accounts Receivable Analyst

- Highlighting Relevant Experience: The cover letter effectively outlines Oscar's career progression in finance, showcasing roles with increasing responsibility and achievements. This highlights the candidate's growth and expertise, important for a finance position.

- Emphasising Process Improvement: Oscar showcases specific achievements such as automating accounting processes and implementing EDI invoicing which resulted in efficiency gains, aligning with the job's focus on enhancing financial systems.

- Demonstrating Technical Skills: Mentioning advanced Excel skills and automated accounting systems experience underlines proficiency in tools crucial for finance roles, making the candidate stand out to potential employers.

- Professional Achievements: The cover letter showcases significant achievements in each role, such as improving payment collection timelines by 30%, which demonstrates tangible impact in previous positions.

Accounts Receivable Coordinator

- Emphasises relevant experience by illustrating past roles and achievements in the field of Accounts Receivable, highlighting expertise in debt reduction, customer communication, and strategic financial improvements.

- Showcases specialist skills such as proficiency in Excel and PeopleSoft, which are critical tools for financial reporting and data analysis within the accounts receivable domain.

- Highlights successful outcomes in key projects, such as implementing streamlined customer query processes and cash flow enhancement initiatives, which demonstrate problem-solving abilities and impact.

- Incorporates certifications and courses like "Advanced Excel for Finance Professionals," demonstrating a continuous pursuit of professional development and expertise in financial analysis for enhancing job performance.

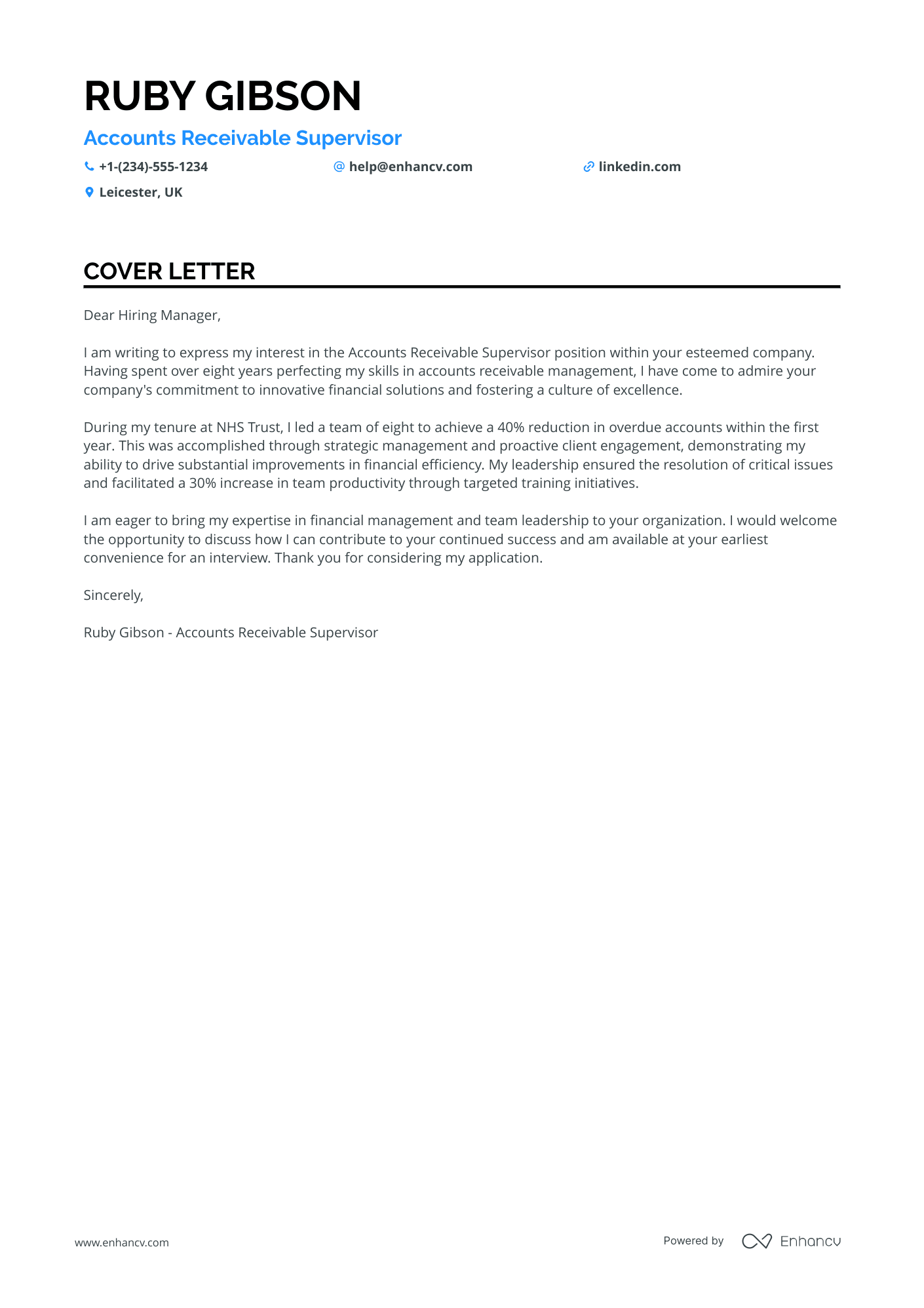

Accounts Receivable Supervisor

- Highlighting measurable achievements such as reducing overdue debts by 20% in one year demonstrates expertise and effectiveness in debt management crucial for an accounts receivable role.

- Emphasising team leadership skills with concrete examples, such as enhancing team productivity by 30%, showcases the candidate's ability to lead and develop a team, which is vital for a supervisory position.

- Detailing technical skills like proficiency in Microsoft Excel, SAP, and Oracle Financials can be critical for showing capability in managing financial systems efficiently.

- Mentioning relevant courses and certifications, such as the Advanced Credit Management certification, reinforces a commitment to staying updated with the latest practices and adds credibility to the candidate’s expertise in strategic credit management.

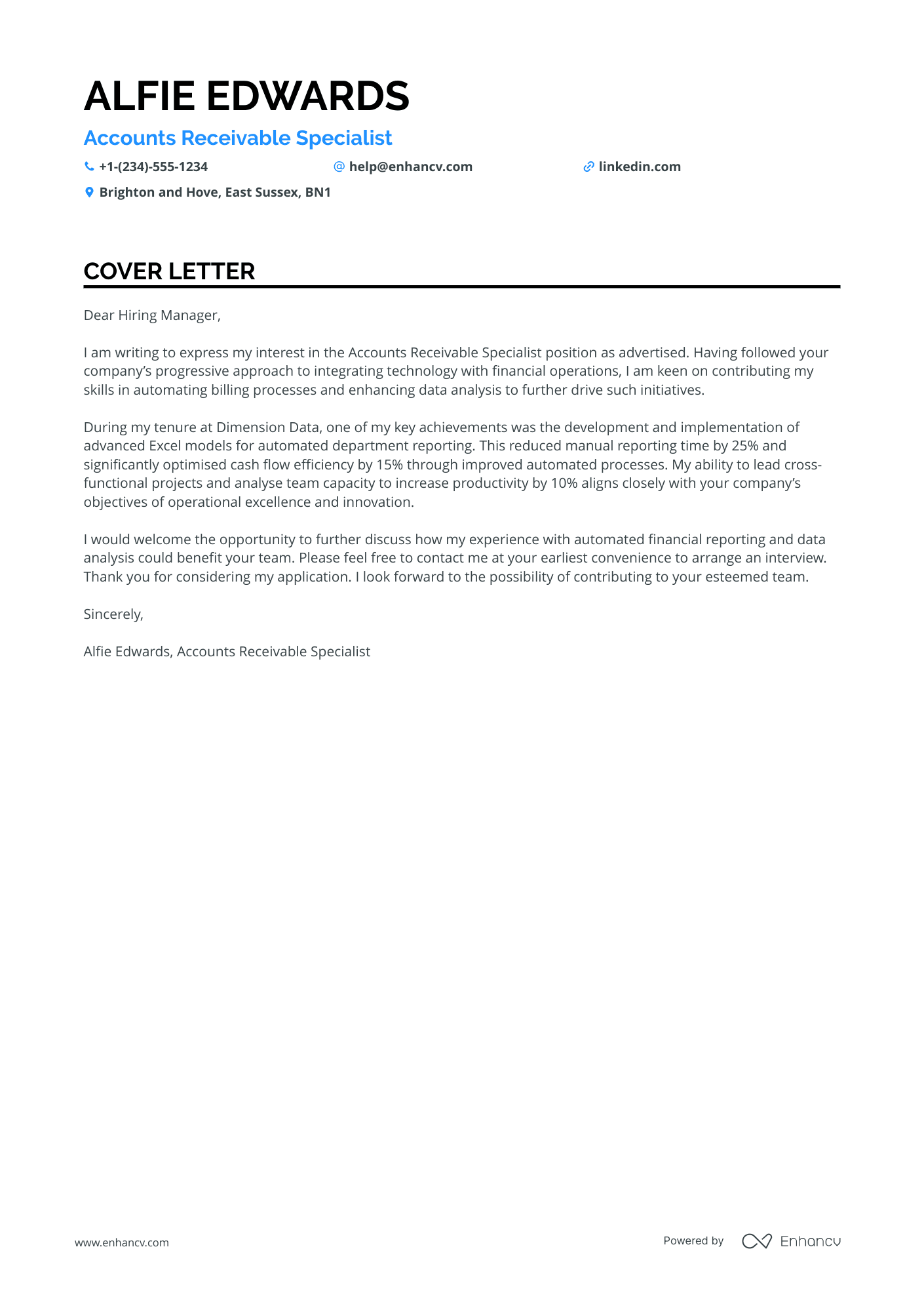

Accounts Receivable Operations Lead

- Highlight Alfie's expertise in automated billing and data analysis, showcasing skills that are crucial for an Accounts Receivable Specialist, particularly in an era where technology automates many financial processes.

- Emphasise successful leadership in improving cash flow efficiency by 15% and managing substantial financial transactions, reflecting significant contributions to organisational financial health.

- Detail the candidate's experience with a diverse set of financial tools, such as Excel and Power BI, as these skills are valuable for data-driven decision-making and reporting in finance roles.

- Include Alfie's educational background in Finance and Accounting, along with relevant courses, to demonstrate a solid foundation in financial principles and continuous learning.

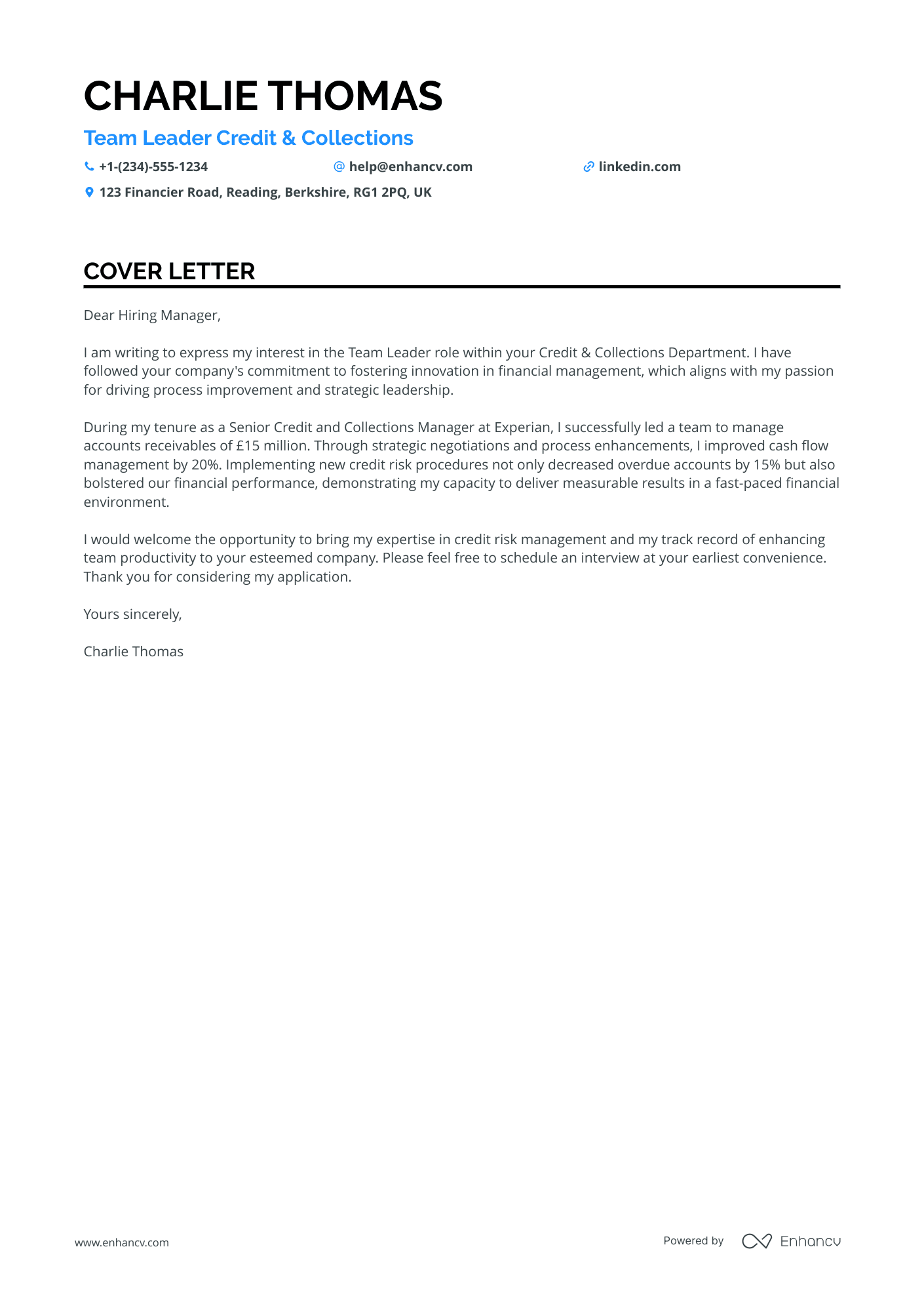

Accounts Receivable Team Leader

- Leadership and Team Management: The cover letter emphasises Charlie's extensive experience in leading and managing credit and collections teams, showcasing their ability to enhance performance and develop talent, which is critical for a Team Leader role.

- Quantifiable Successes: The letter effectively uses quantifiable achievements, such as reducing bad debt by 40% and achieving a 30% revenue collection increase, to highlight Charlie’s impactful contributions in previous roles, making a strong case for their candidacy.

- Problem Solving and Process Improvement: With a strong focus on problem-solving and process enhancements, Charlie’s initiatives that led to significant improvements in team efficiency and credit processes demonstrate their capability to drive operational improvements.

- Educational Background and Courses: The inclusion of a Master of Business Administration from the University of Oxford and relevant courses like Credit Risk Assessment from the London School of Economics underscores Charlie’s solid foundation in financial analysis and credit risk management.

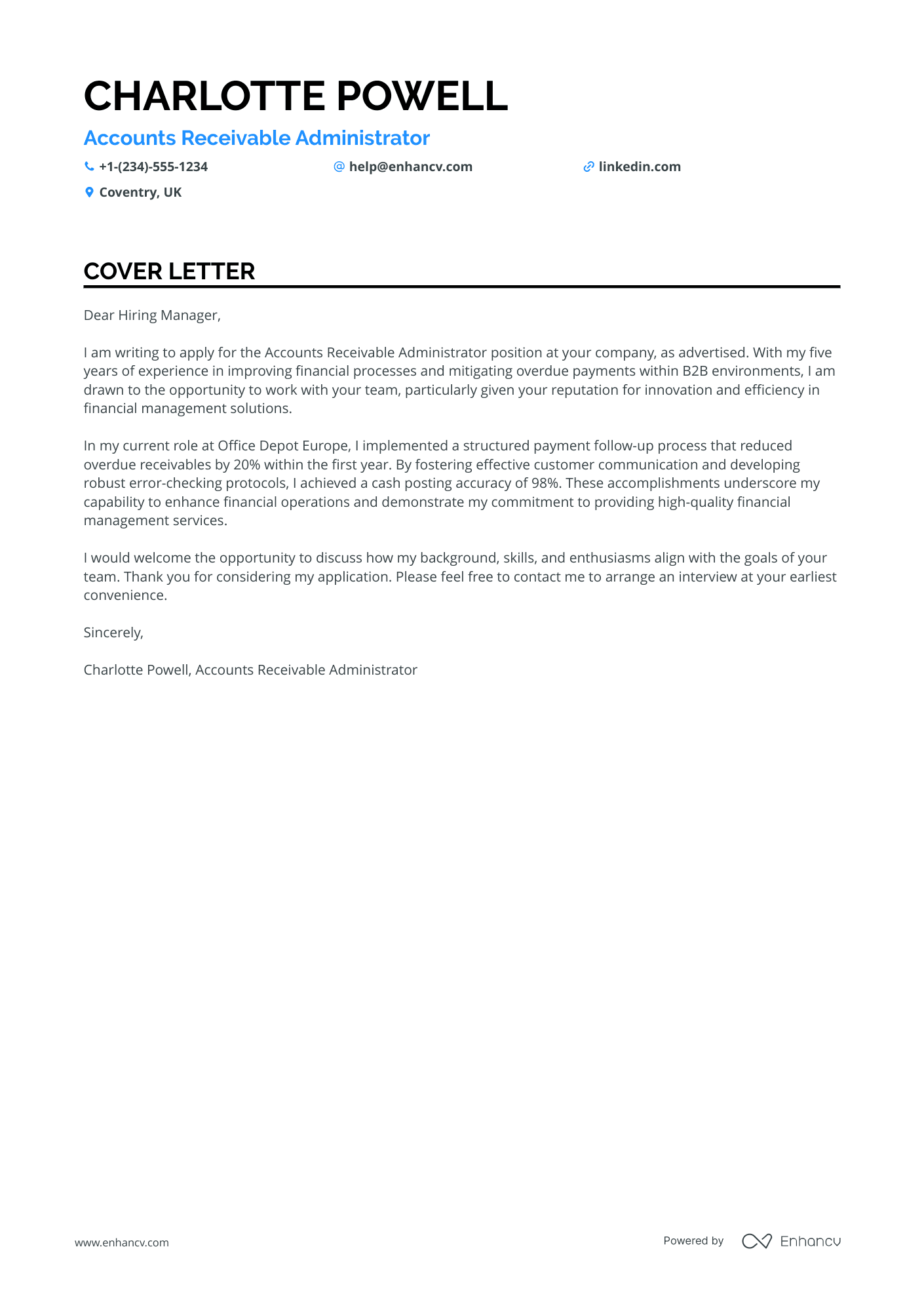

Accounts Receivable Administrator

- Quantifiable Achievements: The cover letter highlights significant achievements such as reducing overdue receivables by 20% and increasing payment rates by 25%, demonstrating the candidate's effectiveness in the role.

- Relevant Certifications: It includes specific certifications such as the Sage X3 Certification and completion of an advanced Excel course, showcasing the candidate's commitment to professional growth and relevance to the financial management field.

- Transferable Skills: The candidate effectively highlights essential skills such as cash posting and allocation, communication, and attention to detail, making a strong case for their suitability as an Accounts Receivable Administrator.

- Supporting Experience: Details on experiences like resolving disputes swiftly and enhancing client communication align with key responsibilities of the Accounts Receivable role, reinforcing the candidate's expertise and track record.

Accounts Receivable Collections Specialist

- Quantifiable Achievements: The cover letter effectively highlights quantifiable achievements, such as reducing outstanding balances by 30% and increasing collections efficiency by 20%, which demonstrate the candidate's ability to deliver tangible results in payments collections.

- Skill Emphasis: It focuses on critical skills for the role, including MS Office, Excel, negotiation, and analytical skills, underscoring their relevance to the Payments Collections Specialist position.

- Client Management Expertise: It emphasises the candidate's experience in managing complex client disputes and improving client satisfaction, an essential aspect for enhancing customer relationships and retention.

- Industry-Specific Experience: The cover letter outlines relevant industry experience across reputable organisations like Barclays Bank and HSBC, conveying the candidate's deep understanding of the financial sector and expertise in collections and dispute resolution.

Accounts Receivable Assistant

- Experience and Achievements: The cover letter effectively highlights over 3 years of experience in financial roles, emphasising specific achievements such as a 20% reduction in overdue debts and improving invoice processing time by 30%, which demonstrate relevant accomplishments and impact in similar roles.

- Relevant Skills and Tools: It is beneficial that the cover letter mentions proficiency in Excel and ERP systems which are essential tools for accounts receivable management, thus assuring the employer of the candidate's technical capabilities.

- Industry-Specific Experience: Describing past roles in well-known companies such as DHL Supply Chain and British Steel clearly indicates applicable industry experience, lending credibility and showing a track record of handling significant responsibilities with known brands.

- Soft Skills and Client Relations: Highlighting the ability to maintain a client satisfaction rate above 90% underscores strong communication and client management skills, which are indispensable in any role dealing directly with accounts and customer interactions.

Accounts Receivable Officer

- Tailored Experience: Emily effectively highlights her extensive experience in Accounts Receivable, showcasing a proven track record of managing client accounts and reducing overdue debts, which is crucial for the role.

- Industry-Specific Certification: Emphasising a Certificate in Xero Accounting Software underlines specialisation in a valued industry tool, affirming her proficiency in cloud-based financial management.

- Quantifiable Achievements: Including specific results, such as improving collection rates by 18% and reducing discrepancies by 30%, effectively demonstrates the tangible impact of her efforts.

- Leadership Skills: Highlighting her role in training junior officers illustrates her capability to lead and enhance team performance, an asset for driving team success in finance.

Accounts Receivable Consultant

- Emphasising expertise in process improvement, particularly highlighting a significant reduction in billing errors and improvement in payment accuracy, demonstrates capability in enhancing efficiency, which is crucial for an Accounts Receivable Analyst position.

- Incorporating specific achievements, such as recovering lost revenue and enhancing customer satisfaction, underscores the candidate's ability to positively impact the company's financial health and customer relations.

- Highlighting soft skills, like customer service and problem-solving, alongside technical skills such as Microsoft Excel and financial reporting, provides a balanced view of competencies beneficial for managing complex billing scenarios.

- Mentioning a Master of Business Administration supports the candidate's readiness for complex operational challenges and showcases a commitment to further education relevant to the business aspect of the role.

Accounts Receivable Operations Manager

- Experience Alignment: The cover letter effectively highlights Oliver's extensive experience in accounts receivable management, showcasing his tenure and expertise, crucial for leadership roles in financial operations.

- Achievements and Impact: Oliver's accomplishments, such as reducing collection days and implementing cost-effective measures, are quantitatively detailed, demonstrating his ability to drive financial improvements.

- Process Improvement Focus: The cover letter emphasises Oliver's proficiency in process optimisation, a critical skill for enhancing efficiency and consistency in accounts receivable roles.

- Certification and Education: Relevant qualifications, like the Certified Accounts Receivable Specialist credential, underscore Oliver's dedication to maintaining industry best practices and keeping updated with the latest developments in the field.

Accounts Receivable and Payable Specialist

- Highlighting the successful reconciliation project led by the candidate, which improved accuracy by 30%, is key for showcasing problem-solving skills and attention to detail crucial for finance roles.

- Emphasising the 25% reduction in invoicing process times demonstrates the candidate's ability to enhance operational efficiency, a vital capability for streamlining financial operations.

- Mentioning the AAT Level 3 Diploma in Accounting from Newcastle College underscores a solid educational foundation in accounting, aligning with industry expectations for specialised financial roles.

- Including skills in advanced tools like MRI Qube and Excel shows technological proficiency that is increasingly important for modern financial and accounts management positions.

Accounts Receivable and Collections Analyst

- Proven Track Record in Cash Flow Optimisation: Demonstrates significant improvements such as an 18% reduction in days sales outstanding at Barclays, showcasing tangible results in enhancing cash flow efficiency.

- Expertise in Microsoft Office Excel: Highlighted proficiency in Excel is crucial for handling financial data, evidenced by completion of an advanced Excel course tailored for financial professionals.

- Communication and Client Management Skills: Increased client satisfaction by 28% through effective communication and resolution strategies, which is vital for maintaining strong client relationships and negotiation capabilities in collections.

- Leadership and Team Development Abilities: Experience in training and developing junior staff, improving team productivity by 30%, underscores the ability to lead and mentor others within financial operations.

Accounts Receivable and Billing Specialist

- Emphasising Industry-Specific Experience: Highlight your extensive experience in accounts receivable and billing operations, showcasing how it directly correlates to the role.

- Demonstrating Process Improvement Skills: Provide specific examples of how you have implemented process optimisation techniques, leading to enhanced efficiency and reduced discrepancies.

- Showcasing Customer Service Acumen: Share achievements that demonstrate your ability to quickly resolve disputes and improve customer satisfaction, indicating your dedication to excellent customer service.

- Displaying Strong Interpersonal Skills: Mention your experience in mentoring and training team members, which suggests strong leadership, communication, and organisational skills necessary for the role.

Accounts Receivable and Credit Control Manager

- Highlighting over 10 years of experience in debt collection and credit control sets a strong foundation for the role, suggesting a deep understanding of the industry's nuances.

- Emphasising expertise in SAP and regulatory compliance is crucial, as these are likely essential tools and requirements in managing group receivables efficiently.

- Showcasing leadership abilities through examples such as leading a team and executing a 30% reduction in overdue payments reflects effective managerial skills and capability for strategic transformations.

- Mentioning specific achievements, like resolving £1 million in outstanding debts and maintaining a high client retention rate, demonstrates tangible results and successful handling of significant responsibilities.

Accounts Receivable cover letter example

Ava Phillips

Nottingham, UK

+44 1234 567890

help@enhancv.com

- Highlight Specialized Skills: Clearly mention skills related to the role, such as experience with financial risk management and process improvement, underscoring expertise in areas critical to the Accounts Receivable Specialist position.

- Emphasize Relevant Achievements: Use specific examples, such as leading a team to reduce variance in accounts receivable by 30%, to illustrate past successes and demonstrate the ability to contribute positively to the organization.

- Align with Company Values: Connect the company’s commitment to innovation and proactive financial health management with personal professional values and experiences, showing alignment with the organization’s culture.

- Express Enthusiasm: End the cover letter with an eagerness to contribute to the company’s objectives and a desire for further discussion, showing genuine interest in the position.

Importance of cover letters in the United Kingdom

Cover letters are a vital part of professional job applications, helping shape recruiters' first impression of your profile.

Here’s why they’re important:

- Indicates your genuine interest: A well-researched cover letter reflects your knowledge of the company and role.

- Professionalism from the outset: Employers expect your cover letter to be structured, polite, and formal. If you wish to add a more personalised touch, be sure to address your recipient directly.

- Capture the recruiters' attention: For most roles, candidates tend to have rather similar experience, which is why you should use your cover letter to explain what is unique about your profile.

What UK employers expect from a cover letter

When writing your cover letter for a UK employer, it’s important to keep several things in mind. First, you need to conduct a thorough research, which includes reading up on the company’s website, recent news, and their presence on social media. Understanding the company’s latest achievements and its overall mission will allow you to tailor your letter to their specific needs.

Next, focus on the company’s core values. Whether they value teamwork, innovation, or community involvement, highlighting how your own experience aligns with these principles is essential.

Finally, don’t forget to match your skills to the job’s requirements. Study the job description carefully and pick out the most important qualifications or competencies. Then, provide evidence of how you meet those criteria with concrete examples from your past work experience.

How to format a accounts receivable cover letter

Before diving into the content, the structure of your cover letter should include the following elements:

- Your address and contact details

- The employer’s name and address

- Date

- Salutation or greeting

- Opening or introductory paragraph

- Middle or body paragraphs

- Closing paragraph

- Sign-off and signature

When it comes to the best font choice, consider modern options like Lato, Rubik, Raleway, Volkhov, Chivo, or Bitter as alternatives to Arial or Times New Roman.

Your cover letter should be single-spaced, with approximately 1-inch (2.5 cm) margins all around (our templates are set up automatically with this spacing in mind).

Ensure your CV and cover letter use the same font for consistency, and always send them as a PDF to prevent edits and maintian formatting.

Lastly, while Applicant Tracking Systems (ATS—the software used to match your application to set requirements) won't read your cover letter, recruiters certainly will, so make sure it stands out.

How to write your accounts receivable cover letter salutation

Imagine you're a hiring manager reading through countless cover letters—which would catch your attention: being addressed directly by name, or reading 'Dear Sir or Madam'?

The first option shows you've made the effort to learn about the company and the role.

To find the hiring manager's name, try LinkedIn, check the company's website, or even reach out to the organisation on social media.

How to write your accounts receivable cover letter intro

A great option to begin your cover letter is by showing recruiters you've done your homework or research.

If the company has won an award or made headlines, congratulate them in your opening sentence, or express how impressed you are.

Provide this achievement as a reason why you admire the company, ensuring your tone remains genuine, sincere, and authentic.

How to write your accounts receivable cover letter body

Which makes for a stronger cover letter body: a long-winded account of everything you’ve ever done, or a focused achievement that’s directly relevant to the job?

Hint: recruiters prefer the second.

When writing your cover letter, select your most impressive achievement that:

- Directly aligns with the job description and role.

- Is quantifiable with tangible metrics like numbers or percentages.

- Maps out your hard and soft skills, showcasing what makes you unique.

- Tells the story of the impact you could have on the organisation.

How to write a closing paragraph

Looking to leave a lasting impression with your cover letter closing?

Then, you should certainly end with a promise—one that outlines what you aim to achieve in the role. Ensure your goals are realistic and align with the company’s needs.

You might also include a call to action, enquiring when you can expect to hear back and what the next steps in the hiring process will be.

Conclusion

A standout cover letter is crucial for making an strong impression in your job search in the UK market. Personalise your letter by addressing it to the hiring manager and aligning your skills with the job description.

Use concrete examples to highlight your greatest achievement and convey your enthusiasm for the position. Finally, ensure that both your cover letter and CV are presented professionally for a consistent application.