As a financial consultant, articulating the complexity of your experience while ensuring keyword optimization for automated applicant tracking systems can be challenging. Our comprehensive guide provides tailored strategies to help you effectively translate your financial expertise into engaging, keyword-rich content that will stand out to both algorithms and hiring managers.

- Utilize real-life examples to refine your financial consultant resume;

- Effectively write the experience section of your financial consultant resume, even if you have minimal or no professional experience;

- Incorporate the industry's top 10 essential skills throughout your resume;

- Include your education and certifications to highlight your specific expertise.

If the financial consultant resume isn't the right one for you, take a look at other related guides we have:

- Internal Audit Manager Resume Example

- Staff Auditor Resume Example

- Certified Financial Planner Resume Example

- Corporate Accounting Resume Example

- Hotel Accounting Resume Example

- Forensic Accounting Resume Example

- Actuary Resume Example

- Director of Accounting Resume Example

- Government Accounting Resume Example

- General Ledger Accounting Resume Example

Professional financial consultant resume format advice

Achieving the most suitable resume format can at times seem like a daunting task at hand.

Which elements are most important to recruiters?

In which format should you submit your resume?

How should you list your experience?

Unless specified otherwise, here's how to achieve a professional look and feel for your resume.

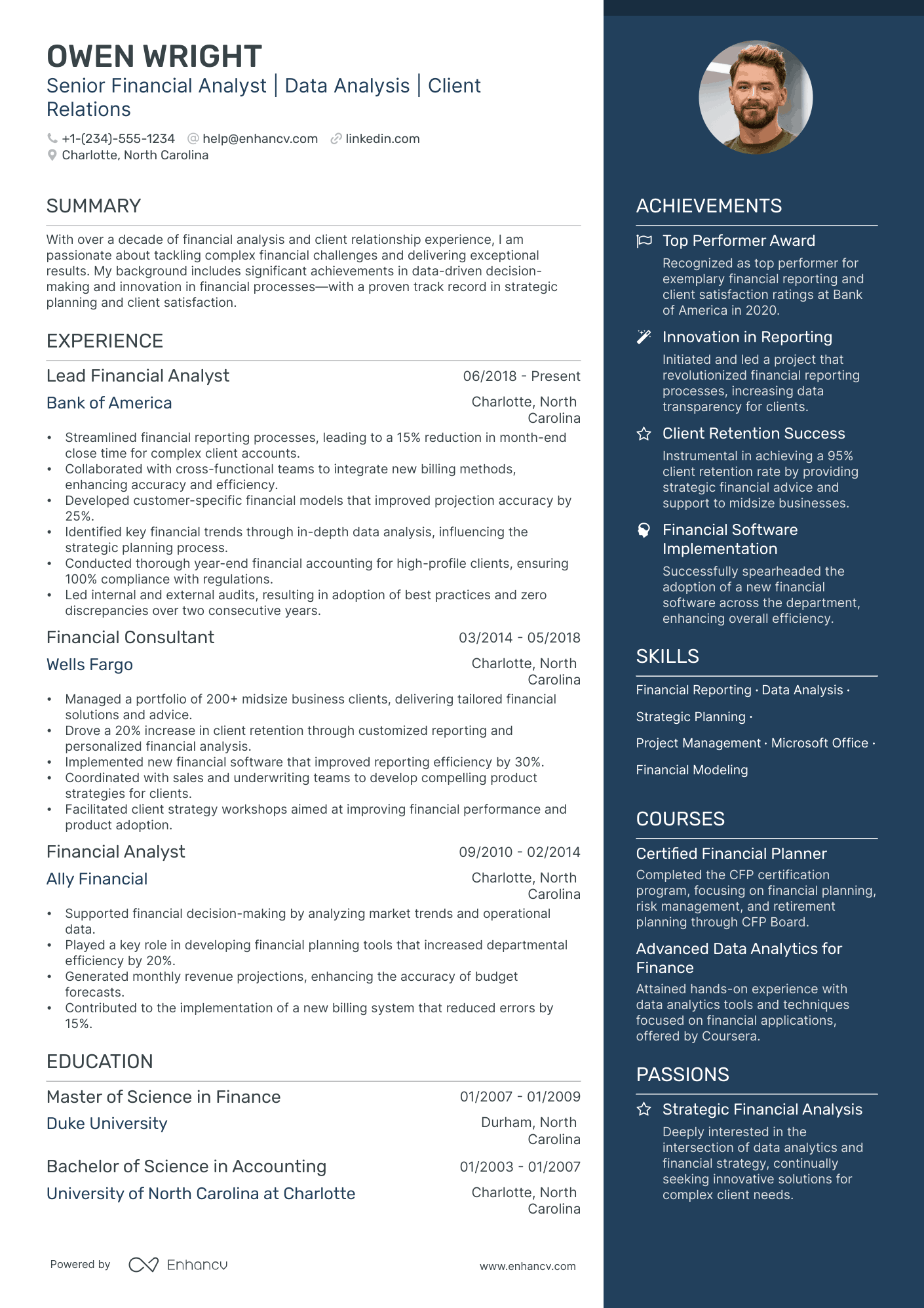

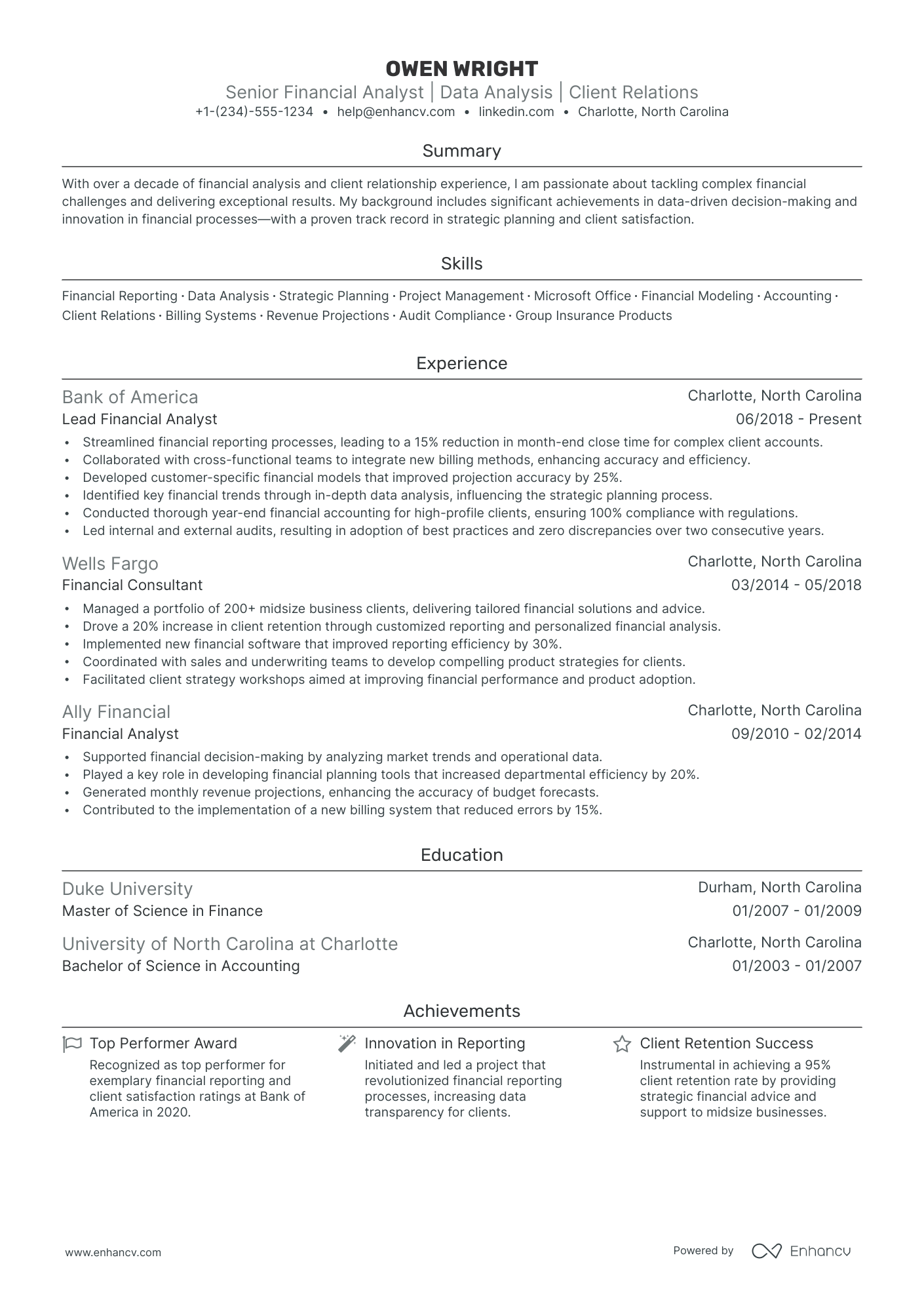

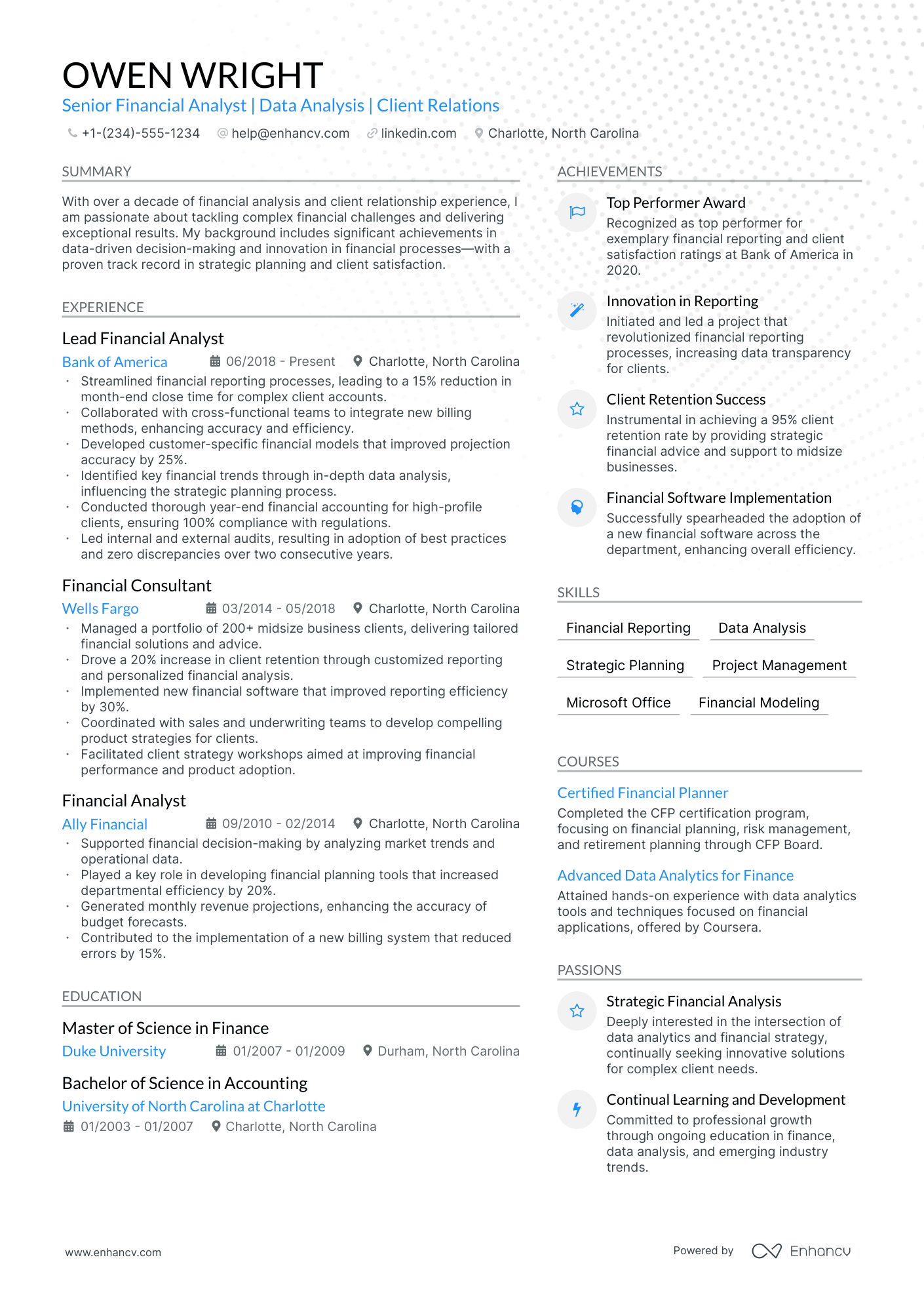

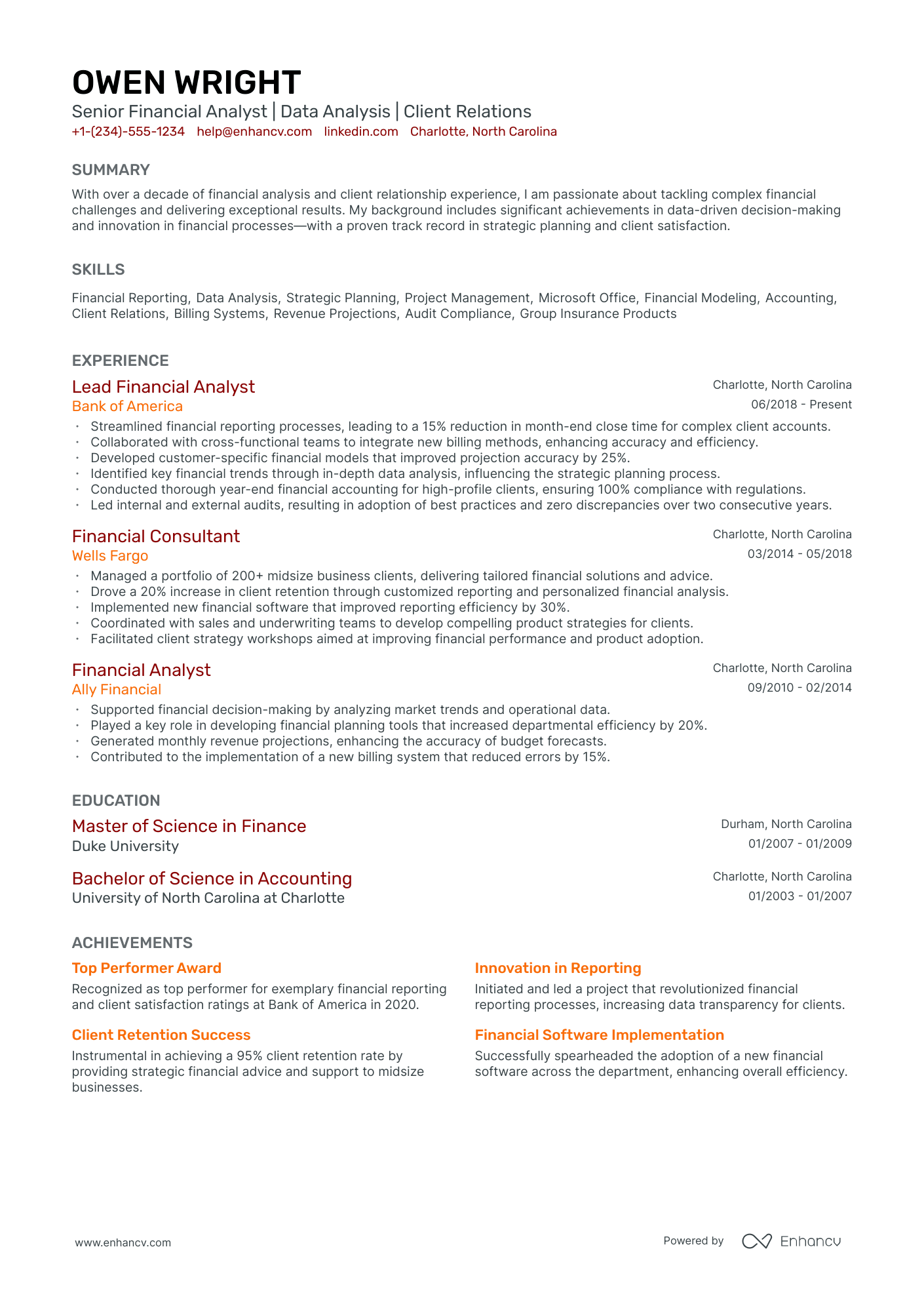

- Present your experience following the reverse-chronological resume format . It showcases your most recent jobs first and can help recruiters attain a quick glance at how your career has progressed.

- The header is the must-have element for your resume. Apart from your contact details, you could also include your portfolio and a headline, that reflects on your current role or a distinguishable achievement.

- Select relevant information to the role, that should encompass no more than two pages of your resume.

- Download your resume in PDF to ensure that its formatting stays intact.

Upload & Check Your Resume

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

PRO TIP

Bold the names of educational institutions and certifying bodies for emphasis.

Essential sections that should make up your financial consultant resume include:

- The header - with your contact details (e.g. email and telephone number), link to your portfolio, and headline

- The summary (or objective) - to spotlight the peaks of your professional career, so far

- The experience section - with up to six bullets per role to detail specific outcomes

- The skills list - to provide a healthy mix between your personal and professional talents

- The education and certification - showing your most relevant degrees and certificates to the financial consultant role

What recruiters want to see on your resume:

- Proven success in financial planning and advising with a track record of managing client portfolios effectively.

- Strong understanding and experience with financial software, such as QuickBooks, Microsoft Excel, and advanced financial modeling.

- Relevant financial certifications like CFP (Certified Financial Planner) or CFA (Chartered Financial Analyst).

- Excellent quantitative and analytical skills, with the ability to provide clear financial insights and reports.

- Exceptional communication and interpersonal skills to build trust and maintain strong client relationships.

Adding your relevant experience to your financial consultant resume

If you're looking for a way to show recruiters that your expertise is credible, look no further than the resume experience section.

Your financial consultant resume experience can be best curated in a structured, bulleted list detailing the particulars of your career:

- Always integrate metrics of success - what did you actually achieve in the role?

- Scan the financial consultant advert for your dream role in search of keywords in the job requirements - feature those all through your past/current experience;

- Dedicate a bullet (or two) to spotlight your technical capabilities and how you're able to use the particular software/technology in your day-to-day roles;

- Write simple by including your responsibility, a job advert keyword or skill, and a tangible outcome of your success;

- Use the experience section to also define the unique value of working with you in the form of soft skills, relevant feedback, and the company culture you best thrive in.

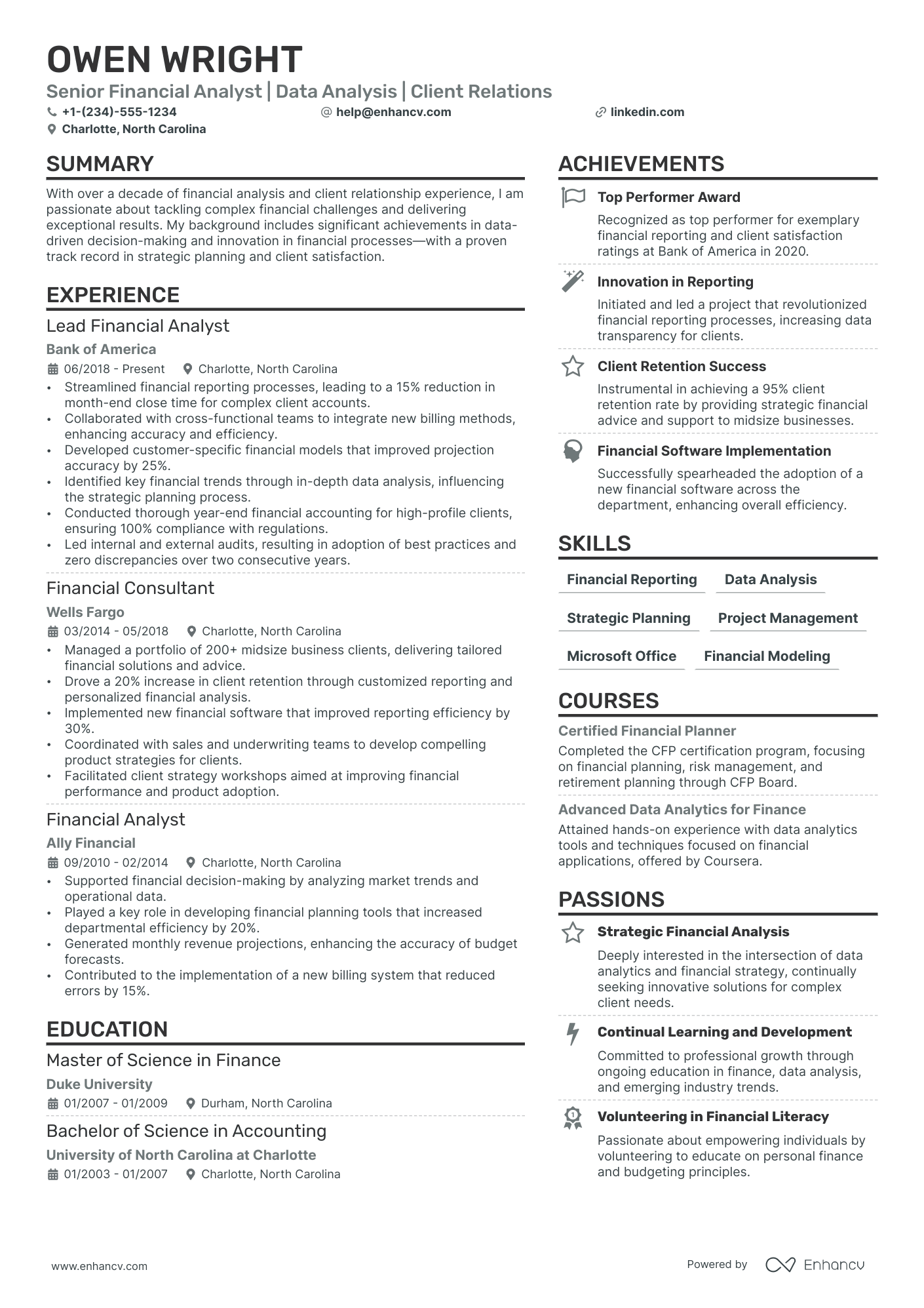

Industry leaders always ensure that their resume experience section offers an enticing glimpse at their expertise, while telling a career narrative. Explore these sample financial consultant resumes on how to best create your resume experience section.

- Developed and executed financial strategies for 50+ high-net-worth clients, consistently achieving a 15% year-over-year portfolio growth.

- Led a team of junior financial advisors on an expansive wealth management project that expanded the firm's assets under management by $30M.

- Orchestrated a comprehensive financial risk assessment model that reduced client exposure to volatile markets by 25%.

- Successfully diversified investment portfolios across emerging markets, resulting in a risk-adjusted return rate improvement of 20%.

- Tailored and presented financial plans to 100+ corporate clients that align with their business models and growth objectives.

- Implemented tax-efficient investment strategies for clients, resulting in an average of 10% reduction in annual tax liabilities.

- Introduced cutting-edge financial modeling techniques that increased forecast accuracy by 35% for our client's strategic investment decisions.

- Collaborated with cross-functional teams to provide comprehensive retirement planning services, increasing customer satisfaction scores by 30%.

- Managed an investment portfolio worth over $50M, outperforming the S&P 500 index by 5% on average per annum.

- Spearheaded the adoption of sustainable investment practices, which increased ESG fund investments by 40% over two years.

- Facilitated the restructuring of debt for small to medium businesses, leading to an average of 20% improvement in their cash flows.

- Executed a strategic partnership with fintech companies to provide innovative financial tools, enhancing client portfolio options by over 50%.

- Pioneered the introduction of a digital advisory platform, resulting in a 60% increase in client engagement and a 15% increase in revenue.

- Provided crisis management financial solutions during downturns, helping clients mitigate potential losses by an average of 30%.

- Authored insightful market analysis reports that guided the investment decisions for a portfolio exceeding $70M in assets.

- Delivered customized estate planning workshops, enhancing client retention by 20% and fostering long-term customer relationships.

- Negotiated with insurance carriers to secure more favorable terms for client policies, which cut costs by an average of 15% annually.

- Increased client portfolio returns by 12% through strategic asset allocation and active management of stocks and bonds.

- Enhanced client acquisition by developing a data-driven marketing strategy, which resulted in a 25% increase in new clients annually.

- Directed the deployment of a personalized investment tracking system, improving the clients' user experience and satisfaction levels.

- Conducted rigorous due diligence on alternative investments, leading to a portfolio diversification that safeguarded assets during market downswings.

- Initiated a mentorship program for junior consultants, increasing team productivity by 40% and enhancing service delivery.

- Developed a proprietary quantitative analysis tool for identifying undervalued securities, significantly outperforming market benchmarks.

- Advised corporate clients on IPO readiness and capital raising strategies, leading to successful listings and an average of $100M in funds raised.

Quantifying impact on your resume

- Highlight the total assets you managed or advised on to demonstrate your experience with large-scale financial portfolios.

- Specify the number of clients you have successfully advised to illustrate your client reach and relationship building skills.

- Detail the percentage growth of investments you've managed to show your success in maximizing client returns.

- Quantify the amount of risk reduced through strategic financial planning to underscore your risk management capabilities.

- Present the size of budgets you have planned or overseen to exhibit your prowess in fiscal management.

- Mention the number of financial models developed to highlight your analytical abilities and contribution to decision-making processes.

- Outline the percentage increase in efficiency or cost savings you achieved for your clients to display your ability to optimize financial performance.

- Report the number of cross-functional teams you've collaborated with to demonstrate your teamwork and interdisciplinary coordination skills.

Action verbs for your financial consultant resume

Experience section for candidates with zero-to-none experience

While you may have less professional experience in the field, that doesn't mean you should leave this section of your resume empty or blank.

Consider these four strategies on how to substitute the lack of experience with:

- Volunteer roles - as part of the community, you've probably gained valuable people (and sometimes even technological capabilities) that could answer the job requirements

- Research projects - while in your university days, you may have been part of some cutting-edge project to benefit the field. Curate this within your experience section as a substitute for real-world experience

- Internships - while you may consider that that summer internship in New York was solely mandatory to your degree, make sure to include it as part of your experience, if it's relevant to the role

- Irrelevant previous jobs - instead of detailing the technologies you've learned, think about the transferable skills you've gained.

Recommended reads:

PRO TIP

If you failed to obtain one of the certificates, as listed in the requirements, but decide to include it on your resume, make sure to include a note somewhere that you have the "relevant training, but are planning to re-take the exams". Support this statement with the actual date you're planning to be re-examined. Always be honest on your resume.

Shining a light on your financial consultant hard skills and soft skills

To win recruiters over, you must really have a breadth of skill set presented and supported within your financial consultant resume.

On hiring managers' checklists, you'd initially discover hard or technical skills. Those are the technology (and software) that help you perform on the job. Hard skills are easy to quantify via your education, certificates, and on-the-job success.

Another main criterion recruiters are always assessing your financial consultant resume on is soft skills. That is your ability to communicate, adapt, and grow in new environments. Soft skills are a bit harder to measure, as they are gained both thanks to your personal and professional experience.

Showcase you have the ideal skill set for the role by:

- Dedicating both a skills box (for your technical capabilities) and an achievements or strengths section (to detail your personal skills).

- When listing your skills, be specific about your hard skills (name the precise technology you're able to use) and soft skills (aim to always demonstrate what the outcomes were).

- Avoid listing overused cliches in the skills section (e.g. Microsoft Office and Communication), unless they're otherwise specified as prominent for the role.

- Select up to ten skills which should be defined via various sections in your resume skills sidebar (e.g. a technical skills box, industry expertise box with sliders, strengths section with bullets).

Spice up your resume with leading technical and people skills, that'd help you get noticed by recruiters.

Top skills for your financial consultant resume:

Financial Modeling

Portfolio Management

Investment Strategies

Risk Assessment

Financial Analysis

Tax Planning

Retirement Planning

Wealth Management

Insurance Analysis

Regulatory Compliance

Analytical Thinking

Problem Solving

Interpersonal Communication

Client Relations

Time Management

Adaptability

Attention to Detail

Negotiation

Persuasion

Sales Skills

PRO TIP

Always remember that your financial consultant certifications can be quantified across different resume sections, like your experience, summary, or objective. For example, you could include concise details within the expertise bullets of how the specific certificate has improved your on-the-job performance.

Financial Consultant-specific certifications and education for your resume

Place emphasis on your resume education section . It can suggest a plethora of skills and experiences that are apt for the role.

- Feature only higher-level qualifications, with details about the institution and tenure.

- If your degree is in progress, state your projected graduation date.

- Think about excluding degrees that don't fit the job's context.

- Elaborate on your education if it accentuates your accomplishments in a research-driven setting.

On the other hand, showcasing your unique and applicable industry know-how can be a literal walk in the park, even if you don't have a lot of work experience.

Include your accreditation in the certification and education sections as so:

- Important industry certificates should be listed towards the top of your resume in a separate section

- If your accreditation is really noteworthy, you could include it in the top one-third of your resume following your name or in the header, summary, or objective

- Potentially include details about your certificates or degrees (within the description) to show further alignment to the role with the skills you've attained

- The more recent your professional certificate is, the more prominence it should have within your certification sections. This shows recruiters you have recent knowledge and expertise

At the end of the day, both the education and certification sections hint at the initial and continuous progress you've made in the field.

And, honestly - that's important for any company.

Below, discover some of the most recent and popular Financial Consultant certificates to make your resume even more prominent in the applicant pool:

The top 5 certifications for your financial consultant resume:

- Certified Financial Planner (CFP) - Certified Financial Planner Board of Standards, Inc.

- Chartered Financial Analyst (CFA) - CFA Institute

- Chartered Financial Consultant (ChFC) - The American College of Financial Services

- Certified Public Accountant (CPA) - American Institute of CPAs

- Financial Risk Manager (FRM) - Global Association of Risk Professionals

PRO TIP

Showcase any ongoing or recent educational efforts to stay updated in your field.

Recommended reads:

The summary or objective: focusing on the top one-third of your resume

It's a well-known fact that the top one-third of your financial consultant resume is the make-it-or-break-it moment of your application. The resume summary and objective could help you further build up your professional profile.

- If you have plenty of career highlights behind your back, use the resume summary . The financial consultant summary immediately focuses recruiters' attention on what matters most within your experience.

- The resume objective is the perfect choice for balancing your career achievements with your vision. Use it to state precisely how you see yourself in a couple of years' time - as part of the company you're applying for.

Both the resume summary and resume objective can be your value pitch to potential employers: answering what makes your application unique and the top choice for the financial consultant role. They both have to be specific and tailored - as there's no one-size-fits-all approach to writing your financial consultant summary or objective. Use the financial consultant examples below as a starting point:

Resume summaries for a financial consultant job

- Seasoned Financial Consultant with over 10 years of proven expertise in wealth management, portfolio optimization, and tailored financial planning for high-net-worth individuals at a top-tier investment firm. Recognized for surpassing client retention goals by 25% through exceptional advisory services and strategic investment decisions.

- Former Senior Accountant transitioning into financial consultancy, bringing along a robust 8-year background in corporate finance, budget analysis, and fiscal audits from a Fortune 500 company. Award-winning strategist commended for identifying 15% cost-saving opportunities, seamlessly integrating financial acumen into consultancy potential.

- Ex-Marketing Executive pivoting to finance with a deep understanding of market dynamics and customer engagement strategies garnered over 7 years. Leveraged data-driven decision-making to boost ROI by 30% across multiple campaigns, aiming to apply analytical skills to optimize client financial portfolios.

- Dedicated professional with a Master's degree in Finance and certification as a Chartered Financial Analyst (CFA). Possesses 12 years of experience in developing comprehensive investment strategies, risk management, and market analysis, resulting in a track record of outperforming benchmark indices by an average of 10% annually.

- Aspiring to launch a career in financial consultancy, my objective is to leverage a fresh MBA in Finance and an internship experience at a regional investment bank, where I contributed to a 20% growth in the SME portfolio, to deliver meticulous financial solutions and foster clients' financial prosperity.

- Eager to commence my journey as a Financial Consultant, I am armed with a B.S. in Economics and a passion for financial markets. Although new to the field, my objective is to apply strong analytical skills and an internship with a local financial advisor, where I assisted in increasing customer satisfaction by 40% through personalization of service.

Showcasing your personality with these four financial consultant resume sections

Enhance your financial consultant expertise with additional resume sections that spotlight both your professional skills and personal traits. Choose options that not only present you in a professional light but also reveal why colleagues enjoy working with you:

- My time - a pie chart infographic detailing your daily personal and professional priorities, showcasing a blend of hard and soft skills;

- Hobbies and interests - share your engagement in sports, fandoms, or other interests, whether in your local community or during personal time;

- Quotes - what motivates and inspires you as a professional;

- Books - indicating your reading and comprehension skills, a definite plus for employers, particularly when your reading interests align with your professional field.

Key takeaways

- Your financial consultant resume is formatted professionally and creates an easy-to-read (and -understand) experience for recruiters;

- You have included all pertinent sections (header, summary/objective, experience, skills, certifications) within your financial consultant resume;

- Instead of just listing your responsibilities, you've qualified them with skills and the results of your actions;

- Within your financial consultant resume, you've taken the time to align specific job requirements with your unique expertise, showcasing the value you can provide as a professional;

- Technologies and personal skills are featured across different sections of your financial consultant resume to achieve the perfect balance.